Académique Documents

Professionnel Documents

Culture Documents

Pay Slip

Transféré par

VISHESH JAISWALDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Pay Slip

Transféré par

VISHESH JAISWALDroits d'auteur :

Formats disponibles

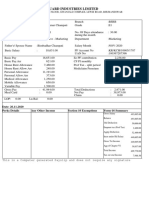

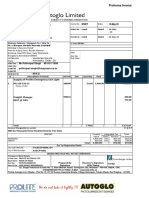

Caliber Outsourcing Services

D-51,Greater Kailash Part II Enclave, ,New Delhi

DELHI – 110048

PAY SLIP MAY 2019

Print Date : 04/06/2019 11:59:36 AM

Emp Code :9056 State :DELHI

Emp Name :VISHESH JAISWAL Region :DELHI

Department:- CDTS Leave Encash Days : 0.00 Bank/MICR : EMSD

Designation:ASTT. ENGINEER DOJ :21 Aug 2017 Notice Recovery Days: 0.00 Bank A/c No.:CHEQUE

Arrear Days : 0.00 Cost Center :G&D India Pvt. Ltd.

DOB :16 Aug 1994 Payable Days : 31 PAN :PANNOTAVBL

PF UAN :101169945530

Earnings Deductions

Description Rate Monthly Arrear Total Description Amount

Basic 20000.00 20000.00 PF 1790.00

HRA 9780.00 9780.00

Total 29780.00 29780.00 GROSS DEDUCTION 1790.00

Net Pay : 27990.00 (TWENTY SEVEN THOUSAND NINE HUNDRED NINETY ONLY)

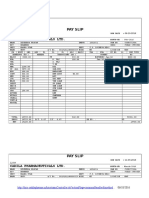

Income Tax Worksheet for the Period April 2019 - March 2020

Description Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA Calculation

Basic 40000.00 0.00 2000.00 Investments u/s 80C

Provident Fund 01/04/2019

From

3580.00 31/05/2019

To

9780.00

1. Actual HRA

2. 40% or 50% of Basic 9780.00

3. Rent - 10% Basic Amount

Least of above is exempt 0.00

Taxable HRA 992.00

Gross 29780.00 0.0 2992.00 0.00

Total of Investments u/s 80C 0.00

Deductions 3580.00

Total of Ded Under Chapter VI-A TDS Deducted Mont . 0.00

Standard Deduction 40000.00 Month May-2019 May-

Previous Employer Taxable Income 0.00 2019

Previous Employer Professional Tax 0.00

Professional Tax 0.00

Under Chapter VI-A 4440.00 Tax Deducted on Perq.

Any Other Income 0.00 Total

Taxable Income 2992.00

Total Tax 0.00

Tax Rebate u/s 87a 0.00

Surcharge 0.00

Tax Due 0.00

Health and Education Cess 0.00

Net Tax 0.00

Tax Deducted (Previous Employer) 0.00

Tax Deducted on Perq. 0.00

Tax Deducted Till Date 0.00

Tax Deducted on Any Other Income 0.00

Tax to be Deducted 0.00

Tax/Month 0.00

Tax on Non-Recurring Earnings 0.00 Total of Income from Other 0.00

Sources 0.00

Tax Deduction for this month 0.00

Printed By : Mr Admin

Printed Date : 04 June 2019

BBSPL

Vous aimerez peut-être aussi

- Salary SlipDocument1 pageSalary SlipPhagun BehlPas encore d'évaluation

- PaySlip FS-04202 October'19Document1 pagePaySlip FS-04202 October'19sonu singhPas encore d'évaluation

- Payslip Jun 2022Document1 pagePayslip Jun 2022Ramesh MishraPas encore d'évaluation

- Salary Slip Amars Aug 09Document1 pageSalary Slip Amars Aug 09Jonathan MendozaPas encore d'évaluation

- Shankesh NARAYAN MANDAVAKAR 5071 Payslip DecemberDocument1 pageShankesh NARAYAN MANDAVAKAR 5071 Payslip DecemberZeenatPas encore d'évaluation

- Zamil Information Technology Global Private Limited Pay Slip For The Month of SEP-2018Document1 pageZamil Information Technology Global Private Limited Pay Slip For The Month of SEP-2018vishalPas encore d'évaluation

- Payslip Aug 2023Document1 pagePayslip Aug 2023paras rawatPas encore d'évaluation

- India Local Monthly130122210312905Document1 pageIndia Local Monthly130122210312905NAGARJUNAPas encore d'évaluation

- Ixfaekuh 1 TNHPN 552 C 1 Oyh 454637235978572027924091013Document1 pageIxfaekuh 1 TNHPN 552 C 1 Oyh 454637235978572027924091013Anonymous NoxtOPCWPas encore d'évaluation

- Sum A 1589Document1 pageSum A 1589Suma KishorePas encore d'évaluation

- Worldwide SolutionsDocument1 pageWorldwide SolutionsKamlesh NandanwarPas encore d'évaluation

- Accretive Health Services Private Limited: Pay Slip For The Month of July 2022Document1 pageAccretive Health Services Private Limited: Pay Slip For The Month of July 2022Santosh Kumar GuptaPas encore d'évaluation

- Pay Slip November 22Document1 pagePay Slip November 22JAGDISH KUMARPas encore d'évaluation

- Chandan Cy Feb Payslip 2021Document1 pageChandan Cy Feb Payslip 2021x foxPas encore d'évaluation

- Syntel Private Limited: Mumbai Maharashtra IndiaDocument1 pageSyntel Private Limited: Mumbai Maharashtra IndiagssPas encore d'évaluation

- Payslip For BeginnerDocument1 pagePayslip For BeginnerKhan SahbPas encore d'évaluation

- Payslip Feb 2023Document1 pagePayslip Feb 2023love entertainmentPas encore d'évaluation

- FormDocument1 pageFormKaushik KumarPas encore d'évaluation

- PayslipSalary Slips - 11-2020-1 PDFDocument1 pagePayslipSalary Slips - 11-2020-1 PDFSukant ChampatiPas encore d'évaluation

- UpdhayDocument1 pageUpdhaySTAR POWERZ LUCKNOW MANISHPas encore d'évaluation

- Kirandeep September SalaryDocument1 pageKirandeep September Salaryprince.gill07Pas encore d'évaluation

- Pay Slip 124Document4 pagesPay Slip 1249125103046100% (1)

- Pay Slip April-22Document1 pagePay Slip April-22B RameshPas encore d'évaluation

- Salary Slip FormatDocument2 pagesSalary Slip FormatManu SenPas encore d'évaluation

- Offer Letter Parag Chandak App3414742504503388 Version 2Document3 pagesOffer Letter Parag Chandak App3414742504503388 Version 2Parag ChandakPas encore d'évaluation

- Salary Slip MayDocument1 pageSalary Slip MayselvaPas encore d'évaluation

- Noraini June 2023 Pay Slip PDFDocument2 pagesNoraini June 2023 Pay Slip PDFNoraini NasimamPas encore d'évaluation

- July Month Salary SlipDocument1 pageJuly Month Salary SlipThakur Paras ChauhanPas encore d'évaluation

- Salary Reciept - SeptDocument1 pageSalary Reciept - SeptdivanshuPas encore d'évaluation

- Pushparaj R PayslipDocument3 pagesPushparaj R PayslipHenry suryaPas encore d'évaluation

- Payslip Jul 2023Document1 pagePayslip Jul 2023Kartika RaguvanshiPas encore d'évaluation

- Chotte Lal 2023 24Document1 pageChotte Lal 2023 24ajay singhPas encore d'évaluation

- Ixfaekuh1tnhpn552c1oyh454637235978572027924091013 PDFDocument1 pageIxfaekuh1tnhpn552c1oyh454637235978572027924091013 PDFAnonymous zmxmihtJPas encore d'évaluation

- Chandan Salary SlipDocument5 pagesChandan Salary SlipSumit BhardwajPas encore d'évaluation

- ATPL10060 - Kolli Sravani - JUNE - 2018 PDFDocument1 pageATPL10060 - Kolli Sravani - JUNE - 2018 PDFsravani kolliPas encore d'évaluation

- Payslip Lyka Labs-Ramjeet PalDocument1 pagePayslip Lyka Labs-Ramjeet PalPankaj PandeyPas encore d'évaluation

- Payslip 90002364 10 2020Document1 pagePayslip 90002364 10 2020souvik deyPas encore d'évaluation

- Sandy Jan PayslipDocument1 pageSandy Jan PayslipJoginderPas encore d'évaluation

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document3 pagesItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Mohammad AliPas encore d'évaluation

- A2508-Salary Slip-AprDocument1 pageA2508-Salary Slip-AprCAT ClusterPas encore d'évaluation

- 1600 SalarySlip December 2020Document1 page1600 SalarySlip December 2020Mickey CreationPas encore d'évaluation

- PaySlip1 OctDocument1 pagePaySlip1 Octjesten jadePas encore d'évaluation

- Oct2022Document2 pagesOct2022Rishi KumarPas encore d'évaluation

- Fidelis Corporate Solutions Private Limited: Payslip For The Month of May 2022Document2 pagesFidelis Corporate Solutions Private Limited: Payslip For The Month of May 2022Dominic angelesPas encore d'évaluation

- Priya It and HR Solutions: Total Earnings Total DeductionsDocument1 pagePriya It and HR Solutions: Total Earnings Total DeductionsSachin AutiPas encore d'évaluation

- Payslip MayDocument1 pagePayslip Mayhdfccreditcard328Pas encore d'évaluation

- Senthil Vel - June 2023 - Salary SlipDocument1 pageSenthil Vel - June 2023 - Salary SlipJenish Christin rajPas encore d'évaluation

- Earnings Deductions Reimbursements: Nexteer Automotive India PVT LTD Payslip For The Month of April 2021Document1 pageEarnings Deductions Reimbursements: Nexteer Automotive India PVT LTD Payslip For The Month of April 2021Nanha-Munna swaggerPas encore d'évaluation

- 11 2020 WSS-0078Document1 page11 2020 WSS-0078shivam singhPas encore d'évaluation

- SalarySlipwithTaxDetails JulyDocument2 pagesSalarySlipwithTaxDetails JulyParveen SainiPas encore d'évaluation

- GSS Salary Slip - LR Yemineni 30.03.2013Document1 pageGSS Salary Slip - LR Yemineni 30.03.2013Mytreyi AtluriPas encore d'évaluation

- Payslip Jun PDFDocument1 pagePayslip Jun PDFtrack ViewPas encore d'évaluation

- Sep2022 STFC PayslipDocument1 pageSep2022 STFC PayslipAjith NandhaPas encore d'évaluation

- March 2022Document1 pageMarch 2022Urmila UjgarePas encore d'évaluation

- Pay Slip - 604316 - May-22Document1 pagePay Slip - 604316 - May-22ArchanaPas encore d'évaluation

- Awais Ahmed (UTL0477)Document1 pageAwais Ahmed (UTL0477)Awais AhmedPas encore d'évaluation

- Vistaar Financial Services Private Limited: Payslip For The Month of February 2018Document1 pageVistaar Financial Services Private Limited: Payslip For The Month of February 2018AlleoungddghPas encore d'évaluation

- Wipro FebruaryDocument1 pageWipro FebruaryDeum degOnPas encore d'évaluation

- OE0036Document1 pageOE0036kumud kalaPas encore d'évaluation

- Description Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationDocument2 pagesDescription Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationRakesh6nairPas encore d'évaluation

- State Bank of India: METRO BRANCH (13398)Document1 pageState Bank of India: METRO BRANCH (13398)VISHESH JAISWAL0% (1)

- Project Completion CertificateDocument2 pagesProject Completion CertificateSadha SivamPas encore d'évaluation

- MECHANICAL ENGINEERING Paper-II PDFDocument46 pagesMECHANICAL ENGINEERING Paper-II PDFVISHESH JAISWALPas encore d'évaluation

- MECHANICAL ENGINEERING Paper-II PDFDocument46 pagesMECHANICAL ENGINEERING Paper-II PDFVISHESH JAISWALPas encore d'évaluation

- Optics PDFDocument23 pagesOptics PDFabhishekPas encore d'évaluation

- Receipt Voucher: Tvs Electronics LimitedDocument1 pageReceipt Voucher: Tvs Electronics LimitedKrishna SrivathsaPas encore d'évaluation

- VAT Act 1997Document105 pagesVAT Act 1997JesseNderingoPas encore d'évaluation

- LilliputDocument17 pagesLilliputSharn GillPas encore d'évaluation

- National Budget Slides SummaryDocument248 pagesNational Budget Slides SummaryoladolapoPas encore d'évaluation

- Case Study NZ Fire ServiceDocument3 pagesCase Study NZ Fire ServiceMohd Zaidin MohamadPas encore d'évaluation

- BLT Business TaxesDocument10 pagesBLT Business TaxesjennyMBPas encore d'évaluation

- Module 3 BailmentDocument18 pagesModule 3 BailmentVaibhav GadhveerPas encore d'évaluation

- Essentials of Corporate Finance 8th Edition Ross Solutions ManualDocument7 pagesEssentials of Corporate Finance 8th Edition Ross Solutions ManualBryanHarriswtmi100% (57)

- OrderInvoice - 53821082004769033Document1 pageOrderInvoice - 53821082004769033Yoyo ToyoPas encore d'évaluation

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsRITIKAPas encore d'évaluation

- Times Leader 08-25-2011Document48 pagesTimes Leader 08-25-2011The Times LeaderPas encore d'évaluation

- 12 Accountancy Revision Notes Part B CH 1 PDFDocument20 pages12 Accountancy Revision Notes Part B CH 1 PDFniks525Pas encore d'évaluation

- RR 10-98Document2 pagesRR 10-98matinikkiPas encore d'évaluation

- Setting Up Document Approvals Oracle Fusion ProcurementDocument89 pagesSetting Up Document Approvals Oracle Fusion Procurementdreamsky70224360% (5)

- (As Per The Deed of The Employees Provident Fund Trust & Form 40A in Income Tax Rules) Form of Nomination NSEIL Employees Provident Fund TrustDocument2 pages(As Per The Deed of The Employees Provident Fund Trust & Form 40A in Income Tax Rules) Form of Nomination NSEIL Employees Provident Fund TrustDivya GangwaniPas encore d'évaluation

- Barque Hotels Private Limited-2927Document1 pageBarque Hotels Private Limited-2927Shimoyal RehmanPas encore d'évaluation

- Release Notes Insurance 471 (FS-CM, FS-CD) EDocument133 pagesRelease Notes Insurance 471 (FS-CM, FS-CD) EViviana GuimarãesPas encore d'évaluation

- InvoiceDocument1 pageInvoiceAjit SharmaPas encore d'évaluation

- Tenant Clearance Form For SD-NATHANIELS DORMDocument5 pagesTenant Clearance Form For SD-NATHANIELS DORMALPHA ROSEPas encore d'évaluation

- Unit #3 Consumer-ArithmeticDocument4 pagesUnit #3 Consumer-ArithmeticChet AckPas encore d'évaluation

- Solution Manual For South Western Federal Taxation 2020 Individual Income Taxes 43rd Edition James C YoungDocument24 pagesSolution Manual For South Western Federal Taxation 2020 Individual Income Taxes 43rd Edition James C YoungJohnValenciaajgq100% (35)

- GR 168557Document1 pageGR 168557Crestu JinPas encore d'évaluation

- Detroit Contract With ShotSpotter Inc.Document307 pagesDetroit Contract With ShotSpotter Inc.Malachi BarrettPas encore d'évaluation

- 2281 w05 QP 1Document12 pages2281 w05 QP 1mstudy123456Pas encore d'évaluation

- TX - Mock Test - Đáp ÁnDocument12 pagesTX - Mock Test - Đáp ÁnPhán Tiêu Tiền100% (1)

- Logitech M-171 Wireless Optical Mouse: Grand Total 625.00Document1 pageLogitech M-171 Wireless Optical Mouse: Grand Total 625.00rupeshghadiPas encore d'évaluation

- Tally Accounting Book by Ca MD ImranDocument6 pagesTally Accounting Book by Ca MD ImranMd ImranPas encore d'évaluation

- 2008 BIR - Ruling - DA 128 08 - 20180320 1159 1heemgd PDFDocument2 pages2008 BIR - Ruling - DA 128 08 - 20180320 1159 1heemgd PDFAleezah Gertrude RaymundoPas encore d'évaluation

- Composite Casing-Tubing JIP Attachments To Project Agreement Rev. 0Document13 pagesComposite Casing-Tubing JIP Attachments To Project Agreement Rev. 0Osama AshourPas encore d'évaluation

- 4358945Document5 pages4358945mohitgaba19Pas encore d'évaluation