Académique Documents

Professionnel Documents

Culture Documents

Apple: December 11-12-2016:itpm Senior Trading Mentor Raj Malhotra Interview On Why Traders Fail

Transféré par

denisTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Apple: December 11-12-2016:itpm Senior Trading Mentor Raj Malhotra Interview On Why Traders Fail

Transféré par

denisDroits d'auteur :

Formats disponibles

December 11-12-2016:ITPM SENIOR TRADING MENTOR RAJ MALHOTRA INTERVIEW ON WHY

TRADERS FAIL.

1. Cutting winners too soon

This is a very classic mistake. Young traders are too quick to take a small profit when

a position starts to go their way and miss the really big move. Be patient with winning

trades.

Apple is a great example. If you had made a $10,000 investment in Apple in July

2002, nine months after the release of the first iPod, you would be a millionaire today.

However, how many people do you know who became millionaires trading Apple?

Apple is an example of a company that everyone knows about; its explosion was in

front of everyone's eyes; but it remained under owned by the public.

You may have heard ridiculous phrases like, "It's had such a big move, it can't go up

anymore." In fact, when the stock was trading around $700 (before splitting 10 for 1),

I heard more Apple bears than bulls.

Perhaps, it's human nature to take small gains. However, to really make a lot of

money trading, you should try to be very profitable on a few trades, as opposed to

trying to be slightly profitable on every call. After all, at the end of the day, there is

only one way to keep score.

2. Letting losers run

This is the second classic mistake. Young traders fall in love with losers and never get

out. Be impatient with losing trades! The key on losing trades is to set hard stop losses

and move on.

Novice traders look for excuses on why the market is wrong and hold onto these

fleabags. Remember the market is always right! You will hear excuses like "The stock

is down so much, it can't go lower." Well it can go lower! Look at classic examples

like Blockbuster, Polaroid or Donald Trump's popularity among Mexican-Americans.

Perhaps, inexperienced traders hesitation to cut losers stems from the fact that it is

admitting defeat. Get over it! Sometimes the best trade is to get out early to only lose

5 percent, when holding too long costs you 50 percent.

3. Doing the consensus trades

One mistake young traders make is falling in love with consensus trades. If everybody

loves the trade, it must be good right?

Getting into consensus trades is like playing a game of three-card monte. It looks so

easy, you make a few bucks and then all of a sudden, you lose all your money and

can't figure out what happened.

Consensus trades usually mean that all the news is priced in. Then, what happens is

that sentiment reverses and inexperienced traders never react quickly enough. They

tend to get stopped out at the worst possible time, lose all the money they made, and

claim the game is rigged (just like three-card monte).

4. Listening to Wall Street geniuses

Warren Buffett famously said, "Derivatives are financial weapons of mass

destruction" in Berkshire Hathaway's 2002 annual report. Last month he stated, "In

my view, derivatives are financial weapons of mass destruction that … are potentially

lethal."

I traded long-term S&P 500 options for Bank of America from 2002-2009, and the

biggest seller of long dated S&P 500 puts was ... Berkshire Hathaway!! The man

warning us about the nuclear threat of derivatives was enabling the massive

destruction of the global markets.

That's like President Obama warning about the threat of a nuclear Iran, then enabling

them to build a bomb that could cause massive destruction. (Oh wait,

that is happening.)

So why, on one hand, is Warren Buffett warning about the dangers of derivatives and

then selling naked puts? Possibly to deceive sell-side traders into thinking they know

his direction, when he is actually doing the opposite.

The point is that, when listening to these Wall Street icons, they are saying things

publicly for a reason and it's not to your benefit. So, next time you hear Carl

Icahn or Bill Ackman publicly talking about their market views, be careful!

5. Bad time-management habits

There are tens of thousands of stocks in the U.S. alone. There are stock markets in

every major country, Along with bond markets, currencies, commodities, etc. With so

much information, every good trader works hard but they have to work smart.

For example, if a company looks attractive, figure out what it does! The best place to

figure that out is its website. Working smart means keeping it simple. Get the

important information as quickly as possible and forget the noise.

Time management also means forget about past trades. The future is in front of you.

Worrying about what you coulda, shoulda done, is time wasted. And time means

money.

6. Not focusing on your strengths

A common mistake most inexperience traders make is trading outside their comfort

zone. I often see young traders have a little success trading U.S. stocks, then decide

they can also trade brent crude futures.

Stick to what works. Work really hard at what you are good at. That's how you

become great at something. You would never see a great stock investor like Peter

Lynch stop mid-career to go trade short- term Greek debt. Just like you wouldn't see

Michael Jordan quit basketball mid-career to go play baseball. (OOPS!!)

The point is, when you get good at a particular style of trading, get great at it! You

can't be great until you are good. That's how you build a long-term career at this.

Focus on your strengths.

Vous aimerez peut-être aussi

- How to Turn $ 5,000 into a MillionD'EverandHow to Turn $ 5,000 into a MillionÉvaluation : 4.5 sur 5 étoiles4.5/5 (26)

- The 5 Mistakes Every Investor Makes and How to Avoid Them (Review and Analysis of Mallouk's Book)D'EverandThe 5 Mistakes Every Investor Makes and How to Avoid Them (Review and Analysis of Mallouk's Book)Pas encore d'évaluation

- Bill LipschutzDocument4 pagesBill Lipschutzartus14Pas encore d'évaluation

- The Wit and Wid Som of Peter LynchDocument4 pagesThe Wit and Wid Som of Peter LynchTami ColePas encore d'évaluation

- Understand Trading in 2 Hours SteveRyanDocument63 pagesUnderstand Trading in 2 Hours SteveRyanAkash Biswal100% (2)

- What I Learned Losing A Million DollarsDocument12 pagesWhat I Learned Losing A Million DollarsColumbia University Press45% (20)

- Golden Penny StocksDocument41 pagesGolden Penny Stocksjames100% (2)

- BMA Premium Hedge Fund Secrets RevealedDocument16 pagesBMA Premium Hedge Fund Secrets RevealedZack LewisPas encore d'évaluation

- Knowledge Is Power, So Be As Powerful As You Can!Document27 pagesKnowledge Is Power, So Be As Powerful As You Can!Ahemad ShamimPas encore d'évaluation

- Free Bonus Book For A Beginners Guide To The StockmarketDocument22 pagesFree Bonus Book For A Beginners Guide To The StockmarketDraganPas encore d'évaluation

- Barbara Rockefeller - The Global TraderDocument19 pagesBarbara Rockefeller - The Global TraderDanFXMPas encore d'évaluation

- Don Fishback Ofb - 80 PDFDocument90 pagesDon Fishback Ofb - 80 PDFCristina0% (1)

- How to Make More Money By Sitting on Your Butt: and Other Contrarian Conclusions From a Lifetime in the MarketsD'EverandHow to Make More Money By Sitting on Your Butt: and Other Contrarian Conclusions From a Lifetime in the MarketsÉvaluation : 4.5 sur 5 étoiles4.5/5 (2)

- The Power of Pareto's Law - How To Win The Stock Market and Maximize Wealth Creation!Document24 pagesThe Power of Pareto's Law - How To Win The Stock Market and Maximize Wealth Creation!valleaxelssonPas encore d'évaluation

- WinningDocument5 pagesWinningbozzaitabob4493Pas encore d'évaluation

- What I Learned Losing A Million Dollars PDFDocument12 pagesWhat I Learned Losing A Million Dollars PDFDimitrie Chiorean100% (1)

- Substituted 'Whorehouse' With 'Harem' When They Printed The Story - A Sign of The Times.)Document3 pagesSubstituted 'Whorehouse' With 'Harem' When They Printed The Story - A Sign of The Times.)arianashokPas encore d'évaluation

- Know Penny Stock Trading: How to Start Trading Penny Stocks and Make MoneyD'EverandKnow Penny Stock Trading: How to Start Trading Penny Stocks and Make MoneyÉvaluation : 3.5 sur 5 étoiles3.5/5 (3)

- Fundamental AnalysisDocument98 pagesFundamental AnalysisRaj ShahPas encore d'évaluation

- Fundamental Analysis - PpsDocument98 pagesFundamental Analysis - PpsRaj Shah100% (1)

- John F Carter - How I Trade FoDocument259 pagesJohn F Carter - How I Trade FoEma Em87% (15)

- Macroeconomia Latinoamericana 2011Document11 pagesMacroeconomia Latinoamericana 2011JeanPaulEspinoPas encore d'évaluation

- Sangamo Biotechx PDFDocument57 pagesSangamo Biotechx PDFEdgar RPas encore d'évaluation

- The Tao of Trading: How to Build Abundant Wealth in Any Market ConditionD'EverandThe Tao of Trading: How to Build Abundant Wealth in Any Market ConditionÉvaluation : 4.5 sur 5 étoiles4.5/5 (7)

- Warren Buffett - 50% ReturnDocument4 pagesWarren Buffett - 50% ReturnKevin SmithPas encore d'évaluation

- Safe, Debt-Free, and Rich!: High-Return, Low-Risk Investing Strategies to Grow Your WealthD'EverandSafe, Debt-Free, and Rich!: High-Return, Low-Risk Investing Strategies to Grow Your WealthPas encore d'évaluation

- The Death of Capital Gains Investing: And What to Replace It WithD'EverandThe Death of Capital Gains Investing: And What to Replace It WithPas encore d'évaluation

- The Art of Execution: How the world's best investors get it wrong and still make millionsD'EverandThe Art of Execution: How the world's best investors get it wrong and still make millionsÉvaluation : 5 sur 5 étoiles5/5 (21)

- The Power of Options To Slash Your Risk and Make You MoneyDocument50 pagesThe Power of Options To Slash Your Risk and Make You MoneyAhmad Cendana100% (1)

- The Motley Fool Million Dollar Portfolio: How to Build and Grow a Panic-Proof Investment PortfolioD'EverandThe Motley Fool Million Dollar Portfolio: How to Build and Grow a Panic-Proof Investment PortfolioÉvaluation : 5 sur 5 étoiles5/5 (1)

- 10 Golden Rules of Forex TradingDocument29 pages10 Golden Rules of Forex Tradingcsabi30Pas encore d'évaluation

- The Most Common Market Trap and How To Avoid It. - Trading Articles - Trade2WinDocument10 pagesThe Most Common Market Trap and How To Avoid It. - Trading Articles - Trade2Winf carbullidoPas encore d'évaluation

- Michael Price Lecture Notes - 1292015Document4 pagesMichael Price Lecture Notes - 1292015brett_gardner_3Pas encore d'évaluation

- 12 Market Wisdoms From Gerald LoebDocument7 pages12 Market Wisdoms From Gerald LoebJohn MoorePas encore d'évaluation

- OG Market Wizards Compiled by KratosbtcDocument5 pagesOG Market Wizards Compiled by KratosbtcDoğa KandemirPas encore d'évaluation

- Jessie LivermoreDocument5 pagesJessie LivermoreArun Ka100% (1)

- Day Trading QuickStart Guide: The Simplified Beginner's Guide to Winning Trade Plans, Conquering the Markets, and Becoming a Successful Day TraderD'EverandDay Trading QuickStart Guide: The Simplified Beginner's Guide to Winning Trade Plans, Conquering the Markets, and Becoming a Successful Day TraderÉvaluation : 4 sur 5 étoiles4/5 (7)

- How To Trade Forex Like A Wall Street ProDocument16 pagesHow To Trade Forex Like A Wall Street Pro程俊銘Pas encore d'évaluation

- Trade Like A Pirate - 67 Golden - Debra Hague PDFDocument632 pagesTrade Like A Pirate - 67 Golden - Debra Hague PDFniranjannlg100% (1)

- Investing For BeginnersDocument71 pagesInvesting For Beginnersccie100% (8)

- 13 Steps To Investing FoolishlyDocument33 pages13 Steps To Investing FoolishlyadikesaPas encore d'évaluation

- 24 Buffet IdeasDocument4 pages24 Buffet Ideasberto1800Pas encore d'évaluation

- Investment Strategy: Bad Trade?!Document6 pagesInvestment Strategy: Bad Trade?!marketfolly.comPas encore d'évaluation

- BillionaireDocument7 pagesBillionaireanestesista100% (1)

- Interview Trading Psychology Expert Van Tharp PDFDocument9 pagesInterview Trading Psychology Expert Van Tharp PDFcoachbiznesuPas encore d'évaluation

- How To Trade OnlineDocument62 pagesHow To Trade OnlineDerekDrennan100% (1)

- UntitledDocument6 pagesUntitledJoy BuddiesllcPas encore d'évaluation

- PDF 20230116 225248 0000Document39 pagesPDF 20230116 225248 0000sabirniazi5678Pas encore d'évaluation

- Buffett - 50% ReturnsDocument3 pagesBuffett - 50% ReturnsRon BourbondyPas encore d'évaluation

- Who Are You Trading AgainstDocument5 pagesWho Are You Trading AgainstCarlos TresemePas encore d'évaluation

- Warren Buffett Invests Like a Girl: And Why You Should, Too: 8 Essential Principles Every Investor Needs to Create a Profitable PortfolioD'EverandWarren Buffett Invests Like a Girl: And Why You Should, Too: 8 Essential Principles Every Investor Needs to Create a Profitable PortfolioÉvaluation : 3 sur 5 étoiles3/5 (4)

- 10 Forex Sins and Trader TypesDocument6 pages10 Forex Sins and Trader TypesnauliPas encore d'évaluation

- 10 Timeless Rules For InvestorsDocument2 pages10 Timeless Rules For InvestorsnandanbiotechPas encore d'évaluation

- True Money Management: Tim Trush & Julie LavrinDocument12 pagesTrue Money Management: Tim Trush & Julie LavrinSafuan ShukariPas encore d'évaluation

- How to Make Money: When Stock Market Is Low and HighD'EverandHow to Make Money: When Stock Market Is Low and HighPas encore d'évaluation

- 22 Rules of Trading PDFDocument4 pages22 Rules of Trading PDFdebaditya_hit326634100% (1)

- Secrets of The World's Greatest FX Traders2Document11 pagesSecrets of The World's Greatest FX Traders2Wayne Gonsalves100% (2)

- Untitled DocumentDocument2 pagesUntitled DocumentdenisPas encore d'évaluation

- Principles of MARKETING NOTES Student NotesDocument16 pagesPrinciples of MARKETING NOTES Student NotesdenisPas encore d'évaluation

- Order Exposure and Parasitic TradersDocument22 pagesOrder Exposure and Parasitic TradersNo NamePas encore d'évaluation

- Intro To Legal Issues EditedDocument22 pagesIntro To Legal Issues EditeddenisPas encore d'évaluation

- Principles of MarketingDocument2 pagesPrinciples of MarketingdenisPas encore d'évaluation

- PlutarchDocument1 pagePlutarchdenisPas encore d'évaluation

- VB FormsDocument5 pagesVB FormsdenisPas encore d'évaluation

- Tick Size Reduction and Price Clustering in A FX Order Book: Mehdi Lallouache and FR Ed Eric Abergel September 29, 2014Document16 pagesTick Size Reduction and Price Clustering in A FX Order Book: Mehdi Lallouache and FR Ed Eric Abergel September 29, 2014denisPas encore d'évaluation

- Puzzles in The Tokyo Fixing in The Forex Market: Order Imbalances and Bank PricingDocument50 pagesPuzzles in The Tokyo Fixing in The Forex Market: Order Imbalances and Bank PricingdenisPas encore d'évaluation

- All Hustle, No LuckDocument3 pagesAll Hustle, No LuckdenisPas encore d'évaluation

- Create The Following Tables in SQL: Lab Exercise 3Document1 pageCreate The Following Tables in SQL: Lab Exercise 3denisPas encore d'évaluation

- The Balance of PaymentsDocument15 pagesThe Balance of PaymentsdenisPas encore d'évaluation

- SSRN Id229959Document36 pagesSSRN Id229959denisPas encore d'évaluation

- Higher Order Expectations, Illiquidity, and Short-Term TradingDocument69 pagesHigher Order Expectations, Illiquidity, and Short-Term TradingdenisPas encore d'évaluation

- Information Content of The Limit Order BookDocument44 pagesInformation Content of The Limit Order BookdenisPas encore d'évaluation

- The Idea Matrix PDFDocument3 pagesThe Idea Matrix PDFdenisPas encore d'évaluation

- Geometric Binomial Dist PDFDocument8 pagesGeometric Binomial Dist PDFdenisPas encore d'évaluation

- Top Notch 1, 3° Edicion Workbook Answer KeyDocument14 pagesTop Notch 1, 3° Edicion Workbook Answer KeyLuis Lopez90% (61)

- Estrada, Roubenj S. Quiz 1Document13 pagesEstrada, Roubenj S. Quiz 1Roubenj EstradaPas encore d'évaluation

- Quote Generator DocumentDocument47 pagesQuote Generator DocumentPrajwal KumbarPas encore d'évaluation

- India's Information Technology Sector: What Contribution To Broader Economic Development?Document32 pagesIndia's Information Technology Sector: What Contribution To Broader Economic Development?Raj KumarPas encore d'évaluation

- Oxidation Ponds & LagoonsDocument31 pagesOxidation Ponds & LagoonsDevendra Sharma100% (1)

- How To Write The Introduction of An Action Research PaperDocument8 pagesHow To Write The Introduction of An Action Research Papergw1qjewwPas encore d'évaluation

- Incorporation of Industrial Wastes As Raw Materials in Brick's Formulation (Wiemes-Brasil-2016)Document9 pagesIncorporation of Industrial Wastes As Raw Materials in Brick's Formulation (Wiemes-Brasil-2016)juan diazPas encore d'évaluation

- Account Statement 060922 051222Document51 pagesAccount Statement 060922 051222allison squad xXPas encore d'évaluation

- Tutorial MailchimpDocument334 pagesTutorial MailchimpLeandroSabado100% (1)

- Collection of Sum of MoneyDocument4 pagesCollection of Sum of MoneyRaf TanPas encore d'évaluation

- BS en Iso 11114-4-2005 (2007)Document30 pagesBS en Iso 11114-4-2005 (2007)DanielVegaNeira100% (1)

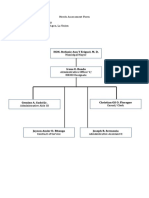

- Needs Assessment Form Company Name: HRMO Address: Sta. Barbara Agoo, La UnionDocument2 pagesNeeds Assessment Form Company Name: HRMO Address: Sta. Barbara Agoo, La UnionAlvin LaroyaPas encore d'évaluation

- History and Development of StatisticsDocument4 pagesHistory and Development of Statisticsjosedenniolim96% (27)

- Latex Hints and TricksDocument24 pagesLatex Hints and TricksbilzinetPas encore d'évaluation

- A Thermoelectric Scanning Facility For The Study of Elemental Thermocouples Robin E Bentley - Meas. Sci. Technol. 11 (2000) 538-546Document10 pagesA Thermoelectric Scanning Facility For The Study of Elemental Thermocouples Robin E Bentley - Meas. Sci. Technol. 11 (2000) 538-546Ver OnischPas encore d'évaluation

- Talent Neuron NewsletterDocument2 pagesTalent Neuron NewsletterTalent NeuronPas encore d'évaluation

- UST G N 2011: Banking Laws # I. The New Central Bank Act (Ra 7653)Document20 pagesUST G N 2011: Banking Laws # I. The New Central Bank Act (Ra 7653)Clauds GadzzPas encore d'évaluation

- XJ600SJ 1997Document65 pagesXJ600SJ 1997astracatPas encore d'évaluation

- Books Confirmation - Sem VII - 2020-2021 PDFDocument17 pagesBooks Confirmation - Sem VII - 2020-2021 PDFRaj Kothari MPas encore d'évaluation

- Global Competitiveness ReportDocument7 pagesGlobal Competitiveness ReportSHOIRYAPas encore d'évaluation

- Manual of Infection Prevention and Control (PDFDrive)Document399 pagesManual of Infection Prevention and Control (PDFDrive)அந்தோணி சாமி100% (1)

- 1LG4253-4AA60 Datasheet enDocument1 page1LG4253-4AA60 Datasheet enanm bPas encore d'évaluation

- Bugreport Fog - in SKQ1.211103.001 2023 04 10 19 23 21 Dumpstate - Log 9097Document32 pagesBugreport Fog - in SKQ1.211103.001 2023 04 10 19 23 21 Dumpstate - Log 9097chandrakanth reddyPas encore d'évaluation

- Gen. Coll.-2014fDocument8 152 pagesGen. Coll.-2014fVeron Golocan Sowagen JovenPas encore d'évaluation

- Solution Manual For A Friendly Introduction To Numerical Analysis Brian BradieDocument14 pagesSolution Manual For A Friendly Introduction To Numerical Analysis Brian BradieAlma Petrillo100% (43)

- Research On Restaurant DesignDocument20 pagesResearch On Restaurant DesignCrizalene Caballero100% (1)

- Offer LetterDocument8 pagesOffer LetterMadhavi Latha100% (3)

- Hach Company v. In-SituDocument8 pagesHach Company v. In-SituPatent LitigationPas encore d'évaluation

- Encryption LessonDocument2 pagesEncryption LessonKelly LougheedPas encore d'évaluation

- Lululemon Sample Case AnalysisDocument49 pagesLululemon Sample Case AnalysisMai Ngoc PhamPas encore d'évaluation