Académique Documents

Professionnel Documents

Culture Documents

KRBL Factsheet March 2012 PDF

Transféré par

hamsTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

KRBL Factsheet March 2012 PDF

Transféré par

hamsDroits d'auteur :

Formats disponibles

KRBL Limited

Factsheet Share Price: Rs. 18.10

20th March 2012

Business Overview: Market Data

KRBL is the world’s largest rice millers and Basmati

Sector Food Products

rice exporters. The Company is a branded Basmati

rice company, with manufacturing capacities of 195 Market Cap (mn) $88/Rs.4,400

MT/per hour. The Company has also set up a seed Enterprise Val (mn) $276/Rs.13,840

farm and a 4 MT per hour seed grading plant for its

O/S Shares (mn) 243

R&D activities and new products testing. It holds a

~25% market share in the branded Basmati exports Free Float (%) 35%

from India and a ~30% share in the branded Basmati Dividend Yield 1.1%

sale in the domestic market. The Company’s domestic

52 Week H/L (Rs.) 34.45 / 12.75

and international brand portfolio includes India Gate,

Indian Farm, Doon, Unity, Nur Jahan, Bemisal, 12m ADT (‘000) $601

Aarati. KRBL’s branded Basmati rice has strong BSE Ticker 530813

demand in countries like Saudi Arabia, Kuwait, USA

NSE Ticker KRBL

and the Middle East. It holds a leading position in the

Middle East, the world’s largest Basmati market. Share Price Performance

25 4

Q3 FY2012 vs Q3 FY2011 Highlights:

• Sales increased by 20.8%

Rebased to KRBL's Price

22

3

• Export sales increased by 73.1% 19

Million

• EBITDA increased by 28.9% 2

• Net Profit increased by 41.7% (after adjusting

16

foreign exchange losses) 13

1

Senior Management: 10 0

Dec-11 Jan-12 Feb-12 Mar-12

Name Position Vol KRBL 34.1% BSE Midcap 23.2%

Anil Kumar Mittal Chairman & Managing Research Coverage

Director No. of Analysts 2

Arun Kumar Gupta Joint Managing Director Buy / Hold / Sell 50% / 0% / 50%

Anoop Kumar Gupta Joint Managing Director Avg. Target Rs. 25

Rakesh Mehrotra Chief Financial Officer

Shareholding Pattern

Valuation Metrics:

35% 37% 37% 39%

FYE Mar 31 FY11 FY12E 1% 1% 1% 1%

5%

EV/Revenue 0.9x 0.8x 6% 5% 3%

EV/EBITDA 5.7x 5.6x 57% 57% 57% 57%

P/E 3.7x 3.9x

Net Debt/EBITDA 3.9x 3.8x

P/BV 0.7x Mar-11 Jun-11 Sep-11 Dec-11

Promoters FII DII Others

KRBL Limited

Factsheet

20th March 2012

Summary Financials:

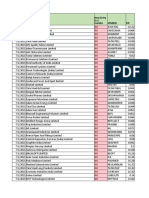

FYE Mar 31 2008 2009 2010 2011 2012E FY2011 Revenue Breakup

Net Revenue ($ mn) 198 260 313 308 324

Growth (%) 9.1% 31.6% 20.4% (1.8)% 5.2%

EBITDA ($ mn) 31 41 44 48 49 By Products

Growth (%) 27.0% 32.7% 7.3% 10.2% 2.6%

Margin (%) 15.4% 15.6% 13.9% 15.6% 15.2%

Net Income ($ mn) 11 13 25 24 22

Growth (%) 11.2% 19.0% 90.4% (3.4)% (5.9)%

Margin (%) 5.5% 5.0% 7.9% 7.8% 6.9%

EPS ($) 0.04 0.05 0.10 0.10 0.09

Growth (%) 11.1% 19.0% 90.3% (3.3)% (5.1)%

Dividend (Rs.) 0.20 0.20 0.30 0.30 -

Yield (%) 1.6% 2.1% 1.3% 1.1% -

Strategy and Operations:

KRBL is the India’s largest selling branded Basmati

rice company

KRBL’s share in India’s Basmati production is By Region

expected to increase to ~25% and shall be processing

900,000 MT of Basmati rice by FY2016

Operates in two business segments:

Agri Business: which includes sale of Basmati

and non-Basmati rice, along with by-products -

rice bran oil, de-oiled cake and furfural oil

Energy Business: which generates power from

wind turbine and husk based power plant. The

Company’s wind power generation capacity is

39.8 MW and its bio mass power generation

capacity is 15.8 MW

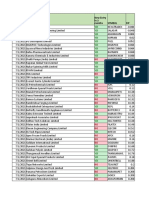

Production Capacity

Dhuri Plant in Punjab is the largest, fully integrated

rice milling plant in the world Grading &

Plant Capacity Packing

Function

Capacity utilization at Dhuri plant is expected Location (MT/hr) Capacity

(MT/Hour)

to increase to 50% by FY14

Ghaziabad Rice

The Company has rice warehousing capacity of (U.P.) Processing

45 30

50,000 tonnes and paddy warehousing capacity of 1

Dhuri Rice

million tonnes (Punjab) Processing

150 50

Collaboration with Buhler, world’s leading rice Delhi Grading 30

milling machine manufacturer, for process /

machine improvement

Important Notice

Information Sources: Share price information and estimates are sourced from FactSet. Company description and financials are sourced from annual

reports and presentations. Financials converted from INR to US$ at spot rate of 50.395. Free float: Shareholdings of investors that would not, in the

normal course, come into the open market for trading are treated as 'Controlling/ Strategic Holdings' and hence not included in free-float.

Churchgate Partners is an independent, privately-owned financial services firm that provides

investor relations and advisory services to corporates, institutional investors and family offices, with

a focus on the Indian subcontinent

Churchgate (Marathi: ) is an area in downtown South Mumbai (formerly Bombay). The station

gets its name from Church Gate street (now Veer Nariman Road) which lies on the immediate south

of the station. During the eighteenth and up to the mid 19th century, Bombay was a walled city. The

city walls had three gates, and Church Gate, named after St. Thomas Cathedral, Mumbai was one of

the gates

This presentation has been prepared by Churchgate Partners LLP and Churchgate Advisory Pvt. Ltd. (together “Churchgate Partners”) for the exclusive

use of the party to whom Churchgate Partners delivers this presentation (together with its subsidiaries and affiliates, the “Client”) using information

provided by the Client and other publicly available information. Churchgate Partners has not Independently verified the information contained herein, nor

does Churchgate Partners make any representation or warranty, either express or implied, as to the accuracy, completeness or reliability of the information

contained in this presentation. Any estimates or projections as to events that may occur in the future (including projections of revenue, expense, net income

and stock performance) are based upon the best judgment of Churchgate Partners from the information provided by the Client and other publicly available

information as of the date of this presentation. There is no guarantee that any of these estimates or projections will be achieved. Actual results will vary

from the projections and such variations may be material. Nothing contained herein is, or shall be relied upon as, a promise or representation as to the past

or future. Churchgate Partners expressly disclaims any and all liability relating or resulting from the use of this presentation.

This presentation has been prepared solely for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any securities or

related financial instruments. The Client should not construe the contents of this presentation as legal, tax, accounting or investment advice or a

recommendation. The Client should consult its own counsel, tax and financial advisors as to legal and related matters concerning any transaction described

herein. This presentation does not purport to be all-inclusive or to contain all of the information that the Client may require. No investment, divestment or

other financial decisions or actions should be based solely on the information in this presentation.

This presentation has been prepared on a confidential basis solely for the use and benefit of the Client; provided that the Client and any of its employees,

representatives, or other agents may disclose to any and all persons, without limitation of any kind, the tax treatment and tax structure of the transaction

and all materials of any kind (including opinions or other tax analyses) that are provided to the Client relating to such tax treatment and tax structure.

Distribution of this presentation to any person other than the Client and those persons retained to advise the Client, who agree to maintain the

confidentiality of this material and be bound by the limitations outlined herein, is unauthorized. This material must not be copied, reproduced, distributed

or passed to others at any time without the prior written consent of Churchgate Partners.

For some of the companies discussed in this presentation, Churchgate Partners may have corporate advisory relationships or investments

through the Churchgate India Fund. Churchgate Partners’ analysis and reports have been prepared solely for informational purposes and are

not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Any analysis performed by

Churchgate Partners should only be a single factor in making any investment decision.

Churchgate Partners Regional Contacts

Sumir Bhardwaj John Nelson Saket Somani

London, UK New York, US Hyderabad, India

sumir@churchgatepartners.com john@churchgatepartners.com saket@churchgatepartnersindia.com

UK Mobile: +44 77 68 69 67 60 USA Mobile: +1 212 464 8771 India Mobile: + 91 998 502 0109

India Mobile: + 91 965 410 5019 Direct Line: + 91 22 3953 7444

Direct Line: + 44 207 389 7914

7th Floor, Block III, White House

100 Pall Mall (4th Flr) 347 5th Ave, #1402 Kundan Bagh, Begumpet

London SW1Y 5NQ New York, NY 10016 Hyderabad 500 016

Deepak Balwani Anand Agrawal Bijay Sharma

New Delhi, India Bengaluru, India Mumbai, India

deepak@churchgatepartnersindia.com anand@churchgatepartnersindia.com bijay@churchgatepartnersindia.com

India Mobile: +91 989 150 3939 India Mobile: +91 970 320 0458 India Mobile: +91 814 222 2139

Direct Line: + 91 22 3953 7444 Direct Line: + 91 22 3953 7444 Direct Line: + 91 22 3953 7444

WINGS First Floor, 16th Floor, Tower II

L 41 Connaught Circus 16/1, Cambridge Road, Indiabulls Finance Centre S B Marg,

New Delhi 110 001 Ulsoor, Bengaluru 560 008 Elphinstone (W), Mumbai 400 013

Churchgate Partners LLP is authorized and regulated by the Financial Services Authority

Follow us on:

Website: www.churchgatepartners.com

3

Vous aimerez peut-être aussi

- PB Fintech Icici SecuritiesDocument33 pagesPB Fintech Icici SecuritieshamsPas encore d'évaluation

- TRADEJINI MCX Margin File For 17/06/2022: Underlying Group Symbol Expiry Total Long Margin Total Short MarginDocument3 pagesTRADEJINI MCX Margin File For 17/06/2022: Underlying Group Symbol Expiry Total Long Margin Total Short MarginhamsPas encore d'évaluation

- HDFC Securities Institutional Equities Aditya Birla Sunlife AMC Initiating CoverageDocument13 pagesHDFC Securities Institutional Equities Aditya Birla Sunlife AMC Initiating CoveragehamsPas encore d'évaluation

- IndicecDocument2 pagesIndicechamsPas encore d'évaluation

- Chartlink Watch ListDocument14 pagesChartlink Watch ListhamsPas encore d'évaluation

- Investment Banking: Kotak Mahindra Capital Company LimitedDocument3 pagesInvestment Banking: Kotak Mahindra Capital Company LimitedhamsPas encore d'évaluation

- Anticipation Bo, Technical Analysis ScannerDocument6 pagesAnticipation Bo, Technical Analysis ScannerhamsPas encore d'évaluation

- Som Distilleries & Breweries LimitedDocument7 pagesSom Distilleries & Breweries LimitedhamsPas encore d'évaluation

- Sumitomo Chemicals offers strong visibility in CRAMS segmentDocument7 pagesSumitomo Chemicals offers strong visibility in CRAMS segmenthamsPas encore d'évaluation

- Why Inflation Matters ?: Rohit ChauhanDocument9 pagesWhy Inflation Matters ?: Rohit ChauhanhamsPas encore d'évaluation

- Dly 02 May-2022Document7 pagesDly 02 May-2022hamsPas encore d'évaluation

- WB Issues 04MAY22Document8 pagesWB Issues 04MAY22hamsPas encore d'évaluation

- AIR INDIA - Concessionary FareDocument2 pagesAIR INDIA - Concessionary FarehamsPas encore d'évaluation

- MH-daily - 5x VOLUME SHOCKERS, Technical Analysis ScannerDocument2 pagesMH-daily - 5x VOLUME SHOCKERS, Technical Analysis ScannerhamsPas encore d'évaluation

- Anticipation Bo, Technical Analysis ScannerDocument6 pagesAnticipation Bo, Technical Analysis ScannerhamsPas encore d'évaluation

- ET NewsDocument1 pageET NewshamsPas encore d'évaluation

- Startegy Varaible TreeDocument1 pageStartegy Varaible TreehamsPas encore d'évaluation

- Nishtha Hamne - English Literature - Wolves of Cenogratz (Character Traits)Document2 pagesNishtha Hamne - English Literature - Wolves of Cenogratz (Character Traits)hamsPas encore d'évaluation

- Adobe Scan Mar 27, 2021 21Document1 pageAdobe Scan Mar 27, 2021 21hamsPas encore d'évaluation

- Pandemic Dairies: by Nishtha HamneDocument7 pagesPandemic Dairies: by Nishtha HamnehamsPas encore d'évaluation

- Index 12jul2021Document76 pagesIndex 12jul2021hamsPas encore d'évaluation

- 1.why COVID-19 Silent Hypoxemia Is Baffling To Physicians PDFDocument5 pages1.why COVID-19 Silent Hypoxemia Is Baffling To Physicians PDFMuhammad Arif HasanPas encore d'évaluation

- Date Mcap Rank Quality Momentu M RankDocument23 pagesDate Mcap Rank Quality Momentu M RankhamsPas encore d'évaluation

- Index 12jul2021Document76 pagesIndex 12jul2021hamsPas encore d'évaluation

- LPHS 2021-22 Academic Calendar Now OnlineDocument1 pageLPHS 2021-22 Academic Calendar Now OnlinehamsPas encore d'évaluation

- Yes Yes Yes Yes Yes Yes YesDocument5 pagesYes Yes Yes Yes Yes Yes YeshamsPas encore d'évaluation

- Date New Entry In3 Months: YES YES YES YES YES YES YES YES YESDocument6 pagesDate New Entry In3 Months: YES YES YES YES YES YES YES YES YEShamsPas encore d'évaluation

- RS RankingsDocument3 pagesRS RankingshamsPas encore d'évaluation

- Top50-Quality-Jul21 - 601 - 1100Document12 pagesTop50-Quality-Jul21 - 601 - 1100hamsPas encore d'évaluation

- Stock FIP and Quality Momentum DataDocument12 pagesStock FIP and Quality Momentum DatahamsPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5783)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Indian RailwaysDocument17 pagesIndian RailwaysArchana PatilPas encore d'évaluation

- City Travel Briefing MumbaiDocument29 pagesCity Travel Briefing Mumbaipiyush saxenaPas encore d'évaluation

- Upper Thane BrochureDocument28 pagesUpper Thane BrochureVignesh RajaPas encore d'évaluation

- Channel Partner Short DataDocument38 pagesChannel Partner Short Datamanisha100% (1)

- Contacts list of manufacturing professionalsDocument21 pagesContacts list of manufacturing professionalsCE CERTIFICATEPas encore d'évaluation

- TMC DMPDocument124 pagesTMC DMPbombonde_797469Pas encore d'évaluation

- Case Study: Monopoly - Mumbai TaxiDocument2 pagesCase Study: Monopoly - Mumbai Taxibunta00767% (3)

- Is 2551 1982 PDFDocument15 pagesIs 2551 1982 PDFjitesh26Pas encore d'évaluation

- Company List - HVACDocument30 pagesCompany List - HVACmrsuhel100% (1)

- EqfqeDocument7 pagesEqfqeSiddharth RamkumarPas encore d'évaluation

- Mumbai CollegesDocument180 pagesMumbai Collegesऋषिकेश कोल्हे पाटिलPas encore d'évaluation

- Runwal Group's Luxury Residential Project in KanjurmargDocument63 pagesRunwal Group's Luxury Residential Project in KanjurmargshantghoshPas encore d'évaluation

- Bombay Rayon Fashions Lt1Document73 pagesBombay Rayon Fashions Lt1Kshatriy'as Thigala100% (2)

- Ida PR 2010 Mar 2011Document3 228 pagesIda PR 2010 Mar 2011Choudhary SourabhPas encore d'évaluation

- Apsicon 20131st Announcement BrochureDocument2 pagesApsicon 20131st Announcement Brochureakashgupta3801Pas encore d'évaluation

- Company SecDocument30 pagesCompany SecVirender RawatPas encore d'évaluation

- List of Placement Consultants / Agencies: SL# Name of Company Contact Person Address Phone Fax EmailDocument52 pagesList of Placement Consultants / Agencies: SL# Name of Company Contact Person Address Phone Fax Emailvishal kumar sinhaPas encore d'évaluation

- Nursing Home Machineries and Equipment Supplier ListDocument20 pagesNursing Home Machineries and Equipment Supplier ListSanjay SinghPas encore d'évaluation

- 21st Century Contemporary ArchitectureDocument30 pages21st Century Contemporary ArchitectureShahab SaquibPas encore d'évaluation

- Important LeadsDocument20 pagesImportant LeadsDhir100% (1)

- Ranking CET Colleges MAH MMS MBA CET For CAP RoundsDocument32 pagesRanking CET Colleges MAH MMS MBA CET For CAP RoundsSahayog MorePas encore d'évaluation

- Pharmaceutical CompanyDocument52 pagesPharmaceutical Companyપ્રીતિ દવે વૈદ્ય100% (2)

- Sample CVDocument4 pagesSample CVanilPas encore d'évaluation

- Bank Ifsc Code Micr Codebranch Name AddressDocument30 pagesBank Ifsc Code Micr Codebranch Name Addressanoopkumar.mPas encore d'évaluation

- Baiganwadi OriginalDocument20 pagesBaiganwadi OriginalAshish Gokawar100% (2)

- SR - No Title Name Designation: Hidemasa OdaDocument15 pagesSR - No Title Name Designation: Hidemasa OdaManan TyagiPas encore d'évaluation

- IGM ItemNhavaShevaDocument307 pagesIGM ItemNhavaShevaShainaazKhanPas encore d'évaluation

- Sbi Corporate CentreDocument36 pagesSbi Corporate Centreamitsh20072458Pas encore d'évaluation

- Towards A Proposal For - Kho Ta Chi Wa Di - An Invitation For Public Engagement Towards A Proposal For KhotachiwadiDocument33 pagesTowards A Proposal For - Kho Ta Chi Wa Di - An Invitation For Public Engagement Towards A Proposal For Khotachiwadishrey100% (1)

- INDORE INSTITUTE OF LAW ADMINISTERS JUSTICE IN EARLY BOMBAYDocument23 pagesINDORE INSTITUTE OF LAW ADMINISTERS JUSTICE IN EARLY BOMBAYSARIKA100% (1)