Académique Documents

Professionnel Documents

Culture Documents

Financial and Managerial Accounting PDF

Transféré par

cons theDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Financial and Managerial Accounting PDF

Transféré par

cons theDroits d'auteur :

Formats disponibles

Chapter 1 Introduction to Accounting and Business

43

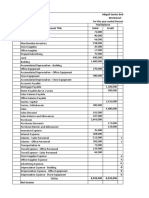

PR 1-2B Financial statements OBJ. 5

1. Net income: The amounts of the assets and liabilities of Wilderness Travel Service at April 30, 2014,

$200,000 the end of the current year, and its revenue and expenses for the year are listed below.

The retained earnings was $145,000 at May 1, 2013, the beginning of the current year,

and dividends of $40,000 were paid during the current year.

Accounts payable $ 25,000 Rent expense $ 75,000

Accounts receivable 210,000 Supplies 9,000

Capital stock 35,000 Supplies expense 12,000

Cash 146,000 Taxes expense 10,000

Fees earned 875,000 Utilities expense 38,000

Miscellaneous expense 15,000 Wages expense 525,000

Instructions

1. Prepare an income statement for the current year ended April 30, 2014.

2. Prepare a retained earnings statement for the current year ended April 30, 2014.

3. Prepare a balance sheet as of April 30, 2014.

4. What item appears on both the income statement and retained earnings statement?

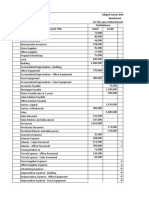

1. Net income: PR 1-3B Financial statements OBJ. 5

$10,900 Jose Loder established Bronco Consulting on August 1, 2014. The effect of each transac-

tion and the balances after each transaction for August are shown below.

Assets 5 Liabilities 1 Stockholders’ Equity

Accounts Accounts Capital Fees Salaries Rent Auto Supplies Misc.

Cash + Receivable + Supplies = Payable + Stock − Dividends + Earned − Expense − Expense − Expense − Expense − Expense

a. +75,000 +75,000

b. +9,000 +9,000

Bal. 75,000 9,000 9,000 75,000

c. +92,000 +92,000

Bal. 167,000 9,000 9,000 75,000 92,000

d. –27,000 –27,000

Bal. 140,000 9,000 9,000 75,000 92,000 –27,000

e. –6,000 –6,000

Bal. 134,000 9,000 3,000 75,000 92,000 –27,000

f. +33,000 +33,000

Bal. 134,000 33,000 9,000 3,000 75,000 125,000 –27,000

g. –23,000 –15,500 –7,500

Bal. 111,000 33,000 9,000 3,000 75,000 125,000 –27,000 –15,500 –7,500

h. –58,000 –58,000

Bal. 53,000 33,000 9,000 3,000 75,000 125,000 –58,000 –27,000 –15,500 –7,500

i. –6,100 –6,100

Bal. 53,000 33,000 2,900 3,000 75,000 125,000 –58,000 –27,000 –15,500 –6,100 –7,500

j. –5,000 –5,000

Bal. 48,000 33,000 2,900 3,000 75,000 –5,000 125,000 –58,000 –27,000 –15,500 –6,100 –7,500

Instructions

1. Prepare an income statement for the month ended August 31, 2014.

2. Prepare a retained earnings statement for the month ended August 31, 2014.

3. Prepare a balance sheet as of August 31, 2014.

4. (Optional). Prepare a statement of cash flows for the month ending August 31, 2014.

PR 1-4B Transactions; financial statements OBJ. 4, 5

2. Net income: On April 1, 2014, Maria Adams established Custom Realty. Maria completed the following

$10,850 transactions during the month of April:

Vous aimerez peut-être aussi

- AHM13e Chapter - 02 - Solution To Problems and Key To CasesDocument23 pagesAHM13e Chapter - 02 - Solution To Problems and Key To CasesGaurav ManiyarPas encore d'évaluation

- Uy Law Office Balance SheetDocument2 pagesUy Law Office Balance SheetA c100% (1)

- This Study Resource WasDocument5 pagesThis Study Resource WasDevia SuswodijoyoPas encore d'évaluation

- MBF Question Paper in Two SetsDocument6 pagesMBF Question Paper in Two Setsracingvicky05100% (2)

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons thePas encore d'évaluation

- Exercise of Chapter 1 - Introduction To Accounting and Businesses - Page 45Document1 pageExercise of Chapter 1 - Introduction To Accounting and Businesses - Page 45Yến HuỳnhPas encore d'évaluation

- Fabm 1 ExamDocument2 pagesFabm 1 ExamJasfer Niño100% (1)

- Book 1Document6 pagesBook 1xbautista124Pas encore d'évaluation

- Abm Task3 BacuetesDocument2 pagesAbm Task3 BacuetesbacuetesjustinPas encore d'évaluation

- FADocument3 pagesFAYukta GoelPas encore d'évaluation

- Abigail Santos Boutique, Worksheet and Financial Statement For MerchandisingDocument9 pagesAbigail Santos Boutique, Worksheet and Financial Statement For MerchandisingFeiya LiuPas encore d'évaluation

- Problem 3 Chapter1 (Accounting in Action)Document4 pagesProblem 3 Chapter1 (Accounting in Action)Amelia LarasatiPas encore d'évaluation

- Account Titles Trial Balance Adjustment Dr. Cr. Dr. CRDocument4 pagesAccount Titles Trial Balance Adjustment Dr. Cr. Dr. CRplaylist erikyoongPas encore d'évaluation

- Toko Kenanga Neraca Percobaan / Work Sheet Per 31 Desember 2016 No Keterangan Neraca Saldo Penyesuaian Debet Kredit Debet KreditDocument4 pagesToko Kenanga Neraca Percobaan / Work Sheet Per 31 Desember 2016 No Keterangan Neraca Saldo Penyesuaian Debet Kredit Debet KreditWasiah R MaharyPas encore d'évaluation

- Travel Agency RubisomethingDocument12 pagesTravel Agency RubisomethingItsRenz YTPas encore d'évaluation

- Act 110 Bonus Activity (Dimalawang)Document10 pagesAct 110 Bonus Activity (Dimalawang)Kilwa DyPas encore d'évaluation

- Assignment1 POADocument13 pagesAssignment1 POABqnezaPas encore d'évaluation

- UntitledDocument5 pagesUntitledm habiburrahman55Pas encore d'évaluation

- Bab 1-Bab 5Document67 pagesBab 1-Bab 5Wawan DarmawanPas encore d'évaluation

- Abigail Santos Boutique, Financial Statement For MerchandisingDocument9 pagesAbigail Santos Boutique, Financial Statement For MerchandisingFeiya Liu100% (1)

- Untitled DocumentDocument2 pagesUntitled DocumentRochelle ObadoPas encore d'évaluation

- H.W ch4q7 Acc418Document4 pagesH.W ch4q7 Acc418SARA ALKHODAIRPas encore d'évaluation

- HO1 Problems and ExercisesDocument2 pagesHO1 Problems and ExercisesGuiana WacasPas encore d'évaluation

- Financial Transaction (Evelyn Tria)Document2 pagesFinancial Transaction (Evelyn Tria)Mika CunananPas encore d'évaluation

- NERACA LAJUR MILKITA COOKIES 4 (AutoRecovered)Document7 pagesNERACA LAJUR MILKITA COOKIES 4 (AutoRecovered)ekaPas encore d'évaluation

- The Unadjusted Trial Balance of Farish Investment Advisers at December 31, 2018, FollowsDocument3 pagesThe Unadjusted Trial Balance of Farish Investment Advisers at December 31, 2018, Followsb1112014041Pas encore d'évaluation

- Jawaban Lab Pengantar AkuntansiDocument71 pagesJawaban Lab Pengantar AkuntansiWida Nurul AeniPas encore d'évaluation

- Problem 11Document2 pagesProblem 11Nepal Bishal ShresthaPas encore d'évaluation

- Clenneth CompanyDocument21 pagesClenneth CompanyRich ann belle AuditorPas encore d'évaluation

- Af Cash FlowDocument1 pageAf Cash FlowHarvey Oli100% (1)

- Dzaky Farhansyah - V1620034 - E5-19 - P5-8A - P5-7ADocument15 pagesDzaky Farhansyah - V1620034 - E5-19 - P5-8A - P5-7ADzaky FarhansyahPas encore d'évaluation

- Example of WorksheetDocument5 pagesExample of WorksheetAizen IchigoPas encore d'évaluation

- Revision Questions - 2 Statement of Cash Flows - SolutionDocument7 pagesRevision Questions - 2 Statement of Cash Flows - SolutionNadjah JPas encore d'évaluation

- AnswersDocument24 pagesAnswersDeul ErPas encore d'évaluation

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons thePas encore d'évaluation

- Jawaban P2-27 - 2-28BDocument2 pagesJawaban P2-27 - 2-28BFarrell P. NakegaPas encore d'évaluation

- Quiz FS MerchandisingDocument3 pagesQuiz FS Merchandisingchey dabestPas encore d'évaluation

- Chapter 3 Exercises and Problems AnswersDocument6 pagesChapter 3 Exercises and Problems AnswersIskaPas encore d'évaluation

- Yeahna Auditing-WPS OfficeDocument4 pagesYeahna Auditing-WPS OfficeDante PagariganPas encore d'évaluation

- CHAPTER 3 (Accounting Equation)Document5 pagesCHAPTER 3 (Accounting Equation)lcPas encore d'évaluation

- Fay Deliveries BalancingDocument7 pagesFay Deliveries BalancingJessa Mae GardocePas encore d'évaluation

- Project OverviewDocument6 pagesProject OverviewWakin PoloPas encore d'évaluation

- Professor Office's Beach Cabana Balance Sheets As of December 31, 2014 and 2013Document3 pagesProfessor Office's Beach Cabana Balance Sheets As of December 31, 2014 and 2013Precious Uminga100% (1)

- Accbp100 3rd Exam AnswersDocument8 pagesAccbp100 3rd Exam AnswersAlthea Marie OrtizPas encore d'évaluation

- Soal Quiz Cashflow KS-47Document6 pagesSoal Quiz Cashflow KS-47Sri Winarsih RamadanaPas encore d'évaluation

- ACC10007-timed WorksheetDocument7 pagesACC10007-timed WorksheetsummerPas encore d'évaluation

- Review Exercises FabmDocument4 pagesReview Exercises Fabmgerardcatalla02Pas encore d'évaluation

- MODULE 8 Learning ActivitiesDocument5 pagesMODULE 8 Learning ActivitiesChristian Cyrous AcostaPas encore d'évaluation

- The Accounting Cycle PHASE 1 - RECORDING AND CLASSIFYING PROCESS (During The Accounting Period)Document19 pagesThe Accounting Cycle PHASE 1 - RECORDING AND CLASSIFYING PROCESS (During The Accounting Period)Allondra DapengPas encore d'évaluation

- Submitted BY: Submitted TO:: Syeda Mehar Un Nisa Sir Zeeshan AkramDocument3 pagesSubmitted BY: Submitted TO:: Syeda Mehar Un Nisa Sir Zeeshan AkramSyeda MeharPas encore d'évaluation

- Marc Gian Talisic-Activity-2-JournalizingDocument8 pagesMarc Gian Talisic-Activity-2-JournalizingArien Evangelista TalisicPas encore d'évaluation

- PT Mekar Jaya Work Sheet Per 31 Dec 2017Document14 pagesPT Mekar Jaya Work Sheet Per 31 Dec 2017Putudevi FebriadnyaniPas encore d'évaluation

- Independent Activity 12Document3 pagesIndependent Activity 12Marls PantinPas encore d'évaluation

- P3-28, 20, 21, 22Document8 pagesP3-28, 20, 21, 22jyraEB9390Pas encore d'évaluation

- Soal AKM 2015Document24 pagesSoal AKM 2015Siti Armayani RayPas encore d'évaluation

- Exercise 8-7 Page 319Document3 pagesExercise 8-7 Page 319Dianne Jane LirayPas encore d'évaluation

- Accounting Equation - Philips Truck RentalDocument2 pagesAccounting Equation - Philips Truck RentalIshanPas encore d'évaluation

- RM Music Worksheet For The Ended Period July, 31 2016Document25 pagesRM Music Worksheet For The Ended Period July, 31 2016AmandaPas encore d'évaluation

- Seatwork 5Document2 pagesSeatwork 5Jasmine ManingoPas encore d'évaluation

- CHAPTER 4 (Accounts)Document14 pagesCHAPTER 4 (Accounts)lcPas encore d'évaluation

- Income & Expense SummaryDocument18 pagesIncome & Expense SummaryCrestina100% (3)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsD'EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsPas encore d'évaluation

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons thePas encore d'évaluation

- Exhibit 1: Chapter 2 Analyzing TransactionsDocument1 pageExhibit 1: Chapter 2 Analyzing Transactionscons thePas encore d'évaluation

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons thePas encore d'évaluation

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons the100% (1)

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons thePas encore d'évaluation

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons thePas encore d'évaluation

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons thePas encore d'évaluation

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons thePas encore d'évaluation

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons thePas encore d'évaluation

- Problems Series B: InstructionsDocument1 pageProblems Series B: Instructionscons thePas encore d'évaluation

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons thePas encore d'évaluation

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons thePas encore d'évaluation

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons thePas encore d'évaluation

- Financial and Managerial Accounting PDFDocument1 pageFinancial and Managerial Accounting PDFcons thePas encore d'évaluation

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons thePas encore d'évaluation

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons thePas encore d'évaluation

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons thePas encore d'évaluation

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons thePas encore d'évaluation

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons thePas encore d'évaluation

- Financial and Managerial Accounting PDFDocument1 pageFinancial and Managerial Accounting PDFcons thePas encore d'évaluation

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons thePas encore d'évaluation

- Financial and Managerial Accounting PDFDocument1 pageFinancial and Managerial Accounting PDFcons thePas encore d'évaluation

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons thePas encore d'évaluation

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons thePas encore d'évaluation

- Financial and Managerial Accounting PDFDocument1 pageFinancial and Managerial Accounting PDFcons thePas encore d'évaluation

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons thePas encore d'évaluation

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons thePas encore d'évaluation

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons thePas encore d'évaluation

- 8508 QuestionsDocument3 pages8508 QuestionsHassan MalikPas encore d'évaluation

- Active Value Investing in Range Bound /sideways/ Markets: Vitaliy N. Katsenelson, CFA yDocument32 pagesActive Value Investing in Range Bound /sideways/ Markets: Vitaliy N. Katsenelson, CFA ythjamesPas encore d'évaluation

- Mishkin 6ce TB Ch13Document32 pagesMishkin 6ce TB Ch13JaeDukAndrewSeo50% (2)

- Present A Current Critical Strategic Analysis of One Business Unit Within General ElectricDocument12 pagesPresent A Current Critical Strategic Analysis of One Business Unit Within General Electricokey obiPas encore d'évaluation

- Whaley+Wilmott TheBestHedgingStrategyDocument5 pagesWhaley+Wilmott TheBestHedgingStrategydlr1949Pas encore d'évaluation

- Evolution of AccountingDocument4 pagesEvolution of AccountingRukshan WidanagamagePas encore d'évaluation

- WACCDocument7 pagesWACCAndre IndoPas encore d'évaluation

- Chaloping-March - The Mining Policy of The Philippines and Resource Nationalism Towards Nation-BuildingDocument15 pagesChaloping-March - The Mining Policy of The Philippines and Resource Nationalism Towards Nation-BuildingA. GatmaytanPas encore d'évaluation

- Elements of Business PlanDocument10 pagesElements of Business PlanMahbubur RahmanPas encore d'évaluation

- Term Paper of EntrepreneurshipDocument11 pagesTerm Paper of Entrepreneurshipreaderboy2Pas encore d'évaluation

- Social Entre - ResearchDocument191 pagesSocial Entre - ResearchHarendra KumarPas encore d'évaluation

- Audit of Shareholders' Equity: Auditing ProblemsDocument4 pagesAudit of Shareholders' Equity: Auditing ProblemsKenneth Adrian AlabadoPas encore d'évaluation

- Fin315 - Business Finance Chapter 10 and 11 NAME (PLEASE PRINT)Document8 pagesFin315 - Business Finance Chapter 10 and 11 NAME (PLEASE PRINT)Ryan Xuan0% (1)

- Open Bionics LTD Ob Valuation Exit Opportunities 2022Document4 pagesOpen Bionics LTD Ob Valuation Exit Opportunities 2022Dragan SaldzievPas encore d'évaluation

- Himalayan Bank LTD Nepal Introduction (Essay)Document2 pagesHimalayan Bank LTD Nepal Introduction (Essay)Chiran KandelPas encore d'évaluation

- Overconfidence and Investment Decisions in Nepalese Stock MarketDocument10 pagesOverconfidence and Investment Decisions in Nepalese Stock MarketMgc RyustailbPas encore d'évaluation

- Impact of Foreign Direct Investment On Indian EconomyDocument8 pagesImpact of Foreign Direct Investment On Indian Economysatyendra raiPas encore d'évaluation

- Depreciation Accounting Part 2 PDFDocument37 pagesDepreciation Accounting Part 2 PDFShihab MonPas encore d'évaluation

- RTIDocument10 pagesRTIPriya AgarwalPas encore d'évaluation

- SyllabusDocument11 pagesSyllabusMuhammad Qaisar LatifPas encore d'évaluation

- Assignment Financial Market Regulations: Mdu-CpasDocument10 pagesAssignment Financial Market Regulations: Mdu-CpasTanuPas encore d'évaluation

- Reliance Money LTD: Presentation of Industrial Internship Project On Derivatives & Portfolio Management ServicesDocument40 pagesReliance Money LTD: Presentation of Industrial Internship Project On Derivatives & Portfolio Management ServicesdashrathkabraPas encore d'évaluation

- CCVF BrochureDocument35 pagesCCVF BrochurekamalchakilamPas encore d'évaluation

- Test Bank 3Document1 pageTest Bank 3GabyVionidyaPas encore d'évaluation

- Banking Laws Non Performing Assets A Study of Legal RegulationsDocument26 pagesBanking Laws Non Performing Assets A Study of Legal Regulationssandhya raniPas encore d'évaluation

- Assignment On WB, IMF & WTODocument18 pagesAssignment On WB, IMF & WTOdead_fahad100% (1)

- Owl Creek Q2 2010 LetterDocument9 pagesOwl Creek Q2 2010 Letterjackefeller100% (1)