Académique Documents

Professionnel Documents

Culture Documents

Bureau of Internal Revenue What Are The Powers and Duties of The BIR?

Transféré par

B-an JavelosaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Bureau of Internal Revenue What Are The Powers and Duties of The BIR?

Transféré par

B-an JavelosaDroits d'auteur :

Formats disponibles

BUREAU OF INTERNAL REVENUE

What are the powers and duties of the BIR?

1. Assessment and collection of all national revenue taxes, fese and charges;

2. Enforcement of all forfeitures, penalties, and fines on internal revenue taxes, fees

and charges;

3. Execution of judgments in all cases decided in its favor by the Court of Tax Appeals

and the ordinary courts; and

4. Give effect and administer the supervisory and police powers conferred to it by the

Tax Code and other laws. (Sec. 2, NIRC)

5. Recommend to the Secretary of Finance all needful rules and regulations for the

effective enforcement of the provision of the NIRC.

Bureau of Customs

What are the functions of the Bureau of Customs?

1. The assessment and collection of the lawful revenues from imported articles and all

other dues, fees, charges, fines and penalties accruing under the tariff and customs

laws;

2. The prevention and suppression of smuggling and other frauds upon the customs;

3. The enforcement of the tariff and custom laws and all other laws, rules and regulations

relating to the tariff and customs administration ;

4. The supervision and control over the entrance and clearance of vessels and aircraft

engaged in foreign commerce;

5. The supervision and control over the handling of foreign mails arriving in the Philippines,

for the purpose of the collection of the lawful duty on the dutiable articles thus

imported and the prevention of smuggling through the medium of such mails;

6. Supervise and control all import and export cargoes, landed or stored in piers, airports,

terminal facilities, including container yards and freight stations, for the protection of

government revenue;

7. Exercise exclusive original jurisdiction over seizure and forfeiture cases under the tariff

and customs laws;

Vous aimerez peut-être aussi

- Tariff and Customs LawDocument15 pagesTariff and Customs LawJel LyPas encore d'évaluation

- TCCP Vol. IiDocument3 pagesTCCP Vol. Iiladyfat100% (1)

- The Tax CollectorsDocument4 pagesThe Tax CollectorsCelwen Damas AmadPas encore d'évaluation

- Tariff and Customs LawDocument16 pagesTariff and Customs LawAlice Marie AlburoPas encore d'évaluation

- Chapter 12: Tariff and Customs Code: Tax Reviewer: Law of Basic Taxation in The PhilippinesDocument18 pagesChapter 12: Tariff and Customs Code: Tax Reviewer: Law of Basic Taxation in The PhilippinesTeps RaccaPas encore d'évaluation

- Finals Reviewer - Cm2Document7 pagesFinals Reviewer - Cm2mandocdocmica55Pas encore d'évaluation

- Tariff and Customs CodeDocument16 pagesTariff and Customs CodeAlex OngPas encore d'évaluation

- Bureau of CustomsDocument5 pagesBureau of CustomsPINEDA, REINA ALLYZA P.Pas encore d'évaluation

- TARIFF AND CUSTOMS LAWS EXPLAINED3.Enforcement of Tariff and Customs Laws.4.Regulation of importation and exportation of goodsDocument6 pagesTARIFF AND CUSTOMS LAWS EXPLAINED3.Enforcement of Tariff and Customs Laws.4.Regulation of importation and exportation of goodsEarleen Del RosarioPas encore d'évaluation

- 09 Tariff and Customs Edited Joni May 27 FINALDocument34 pages09 Tariff and Customs Edited Joni May 27 FINALArgel CosmePas encore d'évaluation

- Customs Jurisdiction and Importation RulesDocument11 pagesCustoms Jurisdiction and Importation RulesCyril JeannePas encore d'évaluation

- (S) Cmta pt2Document5 pages(S) Cmta pt2ALVIN RYAN SALI. KIPLIPas encore d'évaluation

- Tariff and Customs LawsDocument31 pagesTariff and Customs LawsIrene QuimsonPas encore d'évaluation

- TCCP Vol. IiDocument89 pagesTCCP Vol. Iiladyfat100% (5)

- CUSTOMS LAW OF CHINADocument13 pagesCUSTOMS LAW OF CHINAistvan arsennioPas encore d'évaluation

- CMTA SummaryDocument36 pagesCMTA SummaryAngie Douglas100% (2)

- Memory AidDocument13 pagesMemory AidLuis GuerreroPas encore d'évaluation

- Q and A in Tariff and Customs Law (Final 7.11.14)Document44 pagesQ and A in Tariff and Customs Law (Final 7.11.14)Castelo Banlaygas100% (2)

- Vn081en 2Document53 pagesVn081en 2Mai AnhPas encore d'évaluation

- Temporary Entry and Prohibited and Restricted ImportsDocument23 pagesTemporary Entry and Prohibited and Restricted ImportsAndrey MontecilloPas encore d'évaluation

- Final Glossary CmtaDocument8 pagesFinal Glossary CmtaTyronePas encore d'évaluation

- Reviewer On Tariff and Customs DutiesDocument48 pagesReviewer On Tariff and Customs DutiesMiguel Anas Jr.100% (5)

- CMTA RA 10863 - An Act Modernizing The Customs and Tariff AdministrationDocument63 pagesCMTA RA 10863 - An Act Modernizing The Customs and Tariff AdministrationJustin Zuniga0% (1)

- Tariff and Customs LawsDocument46 pagesTariff and Customs LawsMaria Josephine Olfato Pancho100% (1)

- Memo Aid 001Document9 pagesMemo Aid 001Luis GuerreroPas encore d'évaluation

- Ra 10863 - CmtaDocument134 pagesRa 10863 - CmtaRobert MaestrePas encore d'évaluation

- Contacts in ObliconDocument22 pagesContacts in ObliconfantasighPas encore d'évaluation

- R.A. 10863 Title 2. Bureau of Customs PresentationDocument22 pagesR.A. 10863 Title 2. Bureau of Customs PresentationResti JovenPas encore d'évaluation

- Bureau of Customs - Power PointDocument33 pagesBureau of Customs - Power Pointhellofrom theothersidePas encore d'évaluation

- CmtaDocument100 pagesCmtaChell MinsPas encore d'évaluation

- Organization and Function of Tax Related Government AgenciesDocument16 pagesOrganization and Function of Tax Related Government AgenciesWally AranasPas encore d'évaluation

- Royal Malaysian Customs ProceduresDocument12 pagesRoyal Malaysian Customs ProceduresSafwan Hadi100% (1)

- Republic Act No. 10863Document109 pagesRepublic Act No. 10863Hib Atty TalaPas encore d'évaluation

- TM1 ReviewerDocument112 pagesTM1 ReviewerDonnabel FontePas encore d'évaluation

- Customs Regulations Export Import Procedures SEZ FTP 2014Document287 pagesCustoms Regulations Export Import Procedures SEZ FTP 2014chetanpatelhPas encore d'évaluation

- REVIEWER - Organization and Function of The BOC - MacadangdangMaViancaJoyR PDFDocument4 pagesREVIEWER - Organization and Function of The BOC - MacadangdangMaViancaJoyR PDFHera AsuncionPas encore d'évaluation

- Tariff and Customs Code FunctionsDocument7 pagesTariff and Customs Code FunctionsJessie Mae CamillePas encore d'évaluation

- Decree 167.2016.ND - CPDocument25 pagesDecree 167.2016.ND - CPMinh LinhTinhPas encore d'évaluation

- Customs, Excise and GST Full MaterialDocument55 pagesCustoms, Excise and GST Full MaterialramPas encore d'évaluation

- RA Republic Act No. 10863 PDFDocument165 pagesRA Republic Act No. 10863 PDFLex Tamen CoercitorPas encore d'évaluation

- RA - Republic Act No. 10863 PDFDocument130 pagesRA - Republic Act No. 10863 PDFFrancis Punx100% (1)

- Republic Act No 10863 Tariff CustomsDocument89 pagesRepublic Act No 10863 Tariff CustomsIdej CruzPas encore d'évaluation

- Tariffs and Customs LawDocument19 pagesTariffs and Customs LawAzrael CassielPas encore d'évaluation

- Cmta (Sec100 121)Document12 pagesCmta (Sec100 121)Valerie VelgadoPas encore d'évaluation

- ph04 PDFDocument38 pagesph04 PDFJojo Aboyme CorcillesPas encore d'évaluation

- Kingdom of Cambodia Ation Religion King: ND THDocument36 pagesKingdom of Cambodia Ation Religion King: ND THPhalla KuchPas encore d'évaluation

- Allowing Foreign Vessels to Transport Domestic CargoesDocument6 pagesAllowing Foreign Vessels to Transport Domestic CargoesSa KiPas encore d'évaluation

- Accountancy Philippines - Tariff and Customs Code Reviewer - CPALE Tax - Part 1Document9 pagesAccountancy Philippines - Tariff and Customs Code Reviewer - CPALE Tax - Part 1Alec ReyesPas encore d'évaluation

- Modernizing Customs and Tariff AdministrationDocument47 pagesModernizing Customs and Tariff AdministrationSanchez RomanPas encore d'évaluation

- Indian Customs Procedures and RegulationsDocument110 pagesIndian Customs Procedures and RegulationsShubham ShuklaPas encore d'évaluation

- Notes On Tariff - OdtDocument36 pagesNotes On Tariff - OdtkeziahcorporalPas encore d'évaluation

- DAY 01 CL - 1 - Principles of Customs LawsDocument59 pagesDAY 01 CL - 1 - Principles of Customs LawsClinton SamsonPas encore d'évaluation

- Customs Law of People's Republic of China: Chapter I General ProvisionsDocument12 pagesCustoms Law of People's Republic of China: Chapter I General Provisionsistvan arsennioPas encore d'évaluation

- Procedure For Clearance of Imported and Export GoodsDocument74 pagesProcedure For Clearance of Imported and Export GoodsA. Gaffar ShaikPas encore d'évaluation

- R.A. 10863 Cmta PDFDocument105 pagesR.A. 10863 Cmta PDFRonah CabalozaPas encore d'évaluation

- Cmta Ra 10863Document168 pagesCmta Ra 10863Twish BarriosPas encore d'évaluation

- (S) Cmta PT 1Document10 pages(S) Cmta PT 1ALVIN RYAN SALI. KIPLIPas encore d'évaluation

- Foreign Exchange Transactions ActD'EverandForeign Exchange Transactions ActPas encore d'évaluation

- People Vs Lopez - Sec 15Document19 pagesPeople Vs Lopez - Sec 15B-an JavelosaPas encore d'évaluation

- Percentage Tax Excise Tax Documentary Stamp: Taxation LawDocument23 pagesPercentage Tax Excise Tax Documentary Stamp: Taxation LawB-an JavelosaPas encore d'évaluation

- Withholding Tax: Taxation LawDocument21 pagesWithholding Tax: Taxation LawB-an JavelosaPas encore d'évaluation

- Plaintiff,: CRIM. CASE N0.xxx For: Viol - of Sec.11, Art - II, R.A. 9165Document2 pagesPlaintiff,: CRIM. CASE N0.xxx For: Viol - of Sec.11, Art - II, R.A. 9165B-an JavelosaPas encore d'évaluation

- General Principles: Taxation LawDocument17 pagesGeneral Principles: Taxation LawB-an Javelosa100% (1)

- Taxation VATDocument22 pagesTaxation VATB-an JavelosaPas encore d'évaluation

- Taxation Income TaxationDocument73 pagesTaxation Income TaxationB-an Javelosa0% (1)

- Juris Section 5 (Transportation)Document45 pagesJuris Section 5 (Transportation)B-an JavelosaPas encore d'évaluation

- SalesDocument8 pagesSalesB-an JavelosaPas encore d'évaluation

- NOLI and FILIDocument9 pagesNOLI and FILIB-an Javelosa0% (1)

- Crim - Case N0. XX For: Viol - of Sec.5, Art - II, R.A. 9165 Crim - Case N0. XX For: Viol - of Sec.11, Art - II, R.A. 9165Document3 pagesCrim - Case N0. XX For: Viol - of Sec.5, Art - II, R.A. 9165 Crim - Case N0. XX For: Viol - of Sec.11, Art - II, R.A. 9165B-an JavelosaPas encore d'évaluation

- Ra 10640Document3 pagesRa 10640B-an JavelosaPas encore d'évaluation

- DELA CRUZ Vs PEOPLEDocument39 pagesDELA CRUZ Vs PEOPLEB-an JavelosaPas encore d'évaluation

- 2021 CAMPANILLA Pre-Week MaterialsDocument115 pages2021 CAMPANILLA Pre-Week MaterialsJay Telan100% (5)

- Certification DocsDocument1 pageCertification DocsB-an JavelosaPas encore d'évaluation

- Certification DocsDocument1 pageCertification DocsB-an JavelosaPas encore d'évaluation

- ADDRESSDocument2 pagesADDRESSB-an Javelosa100% (1)

- Taxation Report - Percentage TaxDocument3 pagesTaxation Report - Percentage TaxB-an JavelosaPas encore d'évaluation

- PP Vs AMERIL GR 222192 PDFDocument15 pagesPP Vs AMERIL GR 222192 PDFB-an JavelosaPas encore d'évaluation

- Using Uniform Legal Citation 2018Document4 pagesUsing Uniform Legal Citation 2018B-an JavelosaPas encore d'évaluation

- Juris ConvictionDocument23 pagesJuris ConvictionB-an JavelosaPas encore d'évaluation

- Police Ranks and Civilian EquivalentsDocument1 pagePolice Ranks and Civilian EquivalentsB-an JavelosaPas encore d'évaluation

- 6 CDO Activity Log 6.2019Document1 page6 CDO Activity Log 6.2019B-an JavelosaPas encore d'évaluation

- Warrantless search of passenger at airport upheldDocument49 pagesWarrantless search of passenger at airport upheldB-an JavelosaPas encore d'évaluation

- PNP Rank PDFDocument1 pagePNP Rank PDFB-an JavelosaPas encore d'évaluation

- ProbateDocument16 pagesProbateB-an JavelosaPas encore d'évaluation

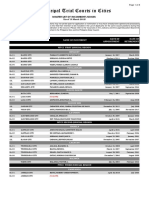

- Municipal Trial Courts in Cities: Master List of Incumbent JudgesDocument8 pagesMunicipal Trial Courts in Cities: Master List of Incumbent JudgesB-an JavelosaPas encore d'évaluation

- Mandatory PolicyDocument2 pagesMandatory PolicyB-an JavelosaPas encore d'évaluation

- Municipal Trial Courts in Cities: Master List of Incumbent JudgesDocument8 pagesMunicipal Trial Courts in Cities: Master List of Incumbent JudgesB-an JavelosaPas encore d'évaluation