Académique Documents

Professionnel Documents

Culture Documents

Preference Shares - July 16 2019

Transféré par

Tiso Blackstar Group0 évaluation0% ont trouvé ce document utile (0 vote)

13 vues1 pagePreference Shares - July 16 2019

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentPreference Shares - July 16 2019

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

13 vues1 pagePreference Shares - July 16 2019

Transféré par

Tiso Blackstar GroupPreference Shares - July 16 2019

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

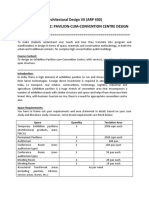

Markets and Commodity figures

16 July 2019

Company Close (cents)

Day move (cents)

Day move (%)

High Low Volume trade

12m

(000)

% move12m high 12m low Market cap Yield

(R'm) P/E ratio

KRUGER RANDS 0 0 0 0 0 0 0 0 0 0 0 0 0

KR 2080000 0 0 0 0 0 23.1 2100000 1600000 0 0 0 0

KRHALF 800000 0 0 0 0 0 -3 850000 800000 0 0 0 0

KRQRTR 400000 0 0 0 0 0 -0.6 415000 400000 0 0 0 0

KRTENTH 160000 0 0 0 0 0 6.7 160000 160000 0 0 0 0

EXCHANGE TRADED PRODUCTS

0 0 0 0 0 0 0 0 0 0 0 0 0

2YRDOLLARCST 138910 50 0 139020 138730 21 6.3 152670 129515 22.2 0 0 0.9

AFRICAGOLD 19299 35 0.2 19344 19233 1 19.1 20470 15805 134.8 0 0 0

AFRICAPALLAD 21017 -254 -1.2 21298 20996 2 74.9 22900 6668 2773.7 0 0 0

AFRICAPLATIN 11623 103 0.9 11623 11434 13 8.3 16000 10111 1837.4 0 0 0

AFRICARHODIU 48000 -250 -0.5 48500 47500 0 64.4 51245 22222 275.3 0 0 0

AGLSBR 16 -1 -5.9 16 16 0 -42.9 31 13 17 0 0 0

AMIBIG50EX-S 1287 -28 -2.1 1350 1287 15 -0.6 5644 1195 21.4 0 0 0

AMIRLSTTEX-S 3808 0 0 3824 3791 0 -18.1 6900 1998 1 0 0 0

AMSSBP 12 0 0 12 12 0 -60 30 4 12 0 0 0

AMSSBQ 10 -1 -9.1 10 10 0 -65.5 34 9 11 0 0 0

ANGSBU 6 0 0 6 6 0 -79.3 29 3 6 0 0 0

ANGSBV 5 0 0 5 5 0 -80 25 5 5 0 0 0

ANGSBW 26 0 0 26 26 0 0 29 25 26 0 0 0

ASHBURTONGBL 4500 -22 -0.5 4527 4470 5 7.1 4987 3754 535.8 0 0 1.5

ASHBURTONINF 2057 1 0 2066 2046 67 1.6 2143 1918 329.7 0 0 2.5

ASHBURTONMID 717 8 1.1 720 713 42 3.2 764 651 361.6 0 0 2.4

ASHBURTONTOP 5237 55 1.1 5237 5125 17 5.1 5576 4367 1621.4 0 0 1.5

ASHBURTONWOR 698 2 0.3 700 696 17 5.9 780 603 112.3 0 0 0.5

BHPSBP 12 0 0 12 12 0 -61.3 31 11 12 0 0 0

CORE DIVTRAX 2604 38 1.5 2613 2572 26 -4.9 3009 2485 294 0 0 1.2

CORE GLPROP 3798 -22 -0.6 3810 3775 12 12.4 4075 3330 475.3 0 0 2.7

CORE PREF 940 6 0.6 945 928 57 15.8 965 797 339.4 0 0 6.5

CORE S&P500 4197 -17 -0.4 4224 4183 17 12.4 4579 3500 816.4 0 0 1.3

CORE SAPY 5050 24 0.5 5075 5015 11 -5.7 5530 4824 157.2 0 0 8.2

CORE TOP50 2334 26 1.1 2344 2308 23 3.5 2464 2041 1321 0 0 2

CORESHARESGL 1220 0 0 1233 1211 70 12.2 1310 1065 410.5 0 0 1.4

CORESHARESPR 1578 3 0.2 1595 1559 35 -5.7 1732 1500 263.7 0 0 8.9

CORESHARESSC 4542 35 0.8 4565 4496 1 -0.6 4970 4230 121.9 0 0 1.8

DOLLARCSTDL 137865 -210 -0.2 138070 137650 21 11.8 148350 121525 117.4 0 0 1.4

EXXSBT 9 0 0 9 9 0 -71 32 9 9 0 0 0

FSRSBV 14 -2 -12.5 14 14 0 -53.3 38 12 16 0 0 0

FSRSBW 25 -1 -3.8 25 25 0 -19.4 31 20 26 0 0 0

GFISBR 31 -1 -3.1 31 31 0 -3.1 34 27 32 0 0 0

GFISBU 4 0 0 4 4 0 -87.9 33 2 4 0 0 0

HARSBT 4 0 0 4 4 0 -87.1 31 3 4 0 0 0

HARSBU 8 0 0 8 8 0 -72.4 29 8 8 0 0 0

IMPSBS 9 0 0 9 9 0 -71.9 32 9 9 0 0 0

KIOSBV 6 1 20 6 6 0 -80.6 32 5 5 0 0 0

KIOSBW 22 2 10 22 19 80 -31.3 44 16 20 0 0 0

KRCSTDLCRTFC 2028350 3950 0.2 2030800 2028350 0 17.6 2123200 1676500 673.4 0 0 0

MTNSBQ 22 -2 -8.3 22 22 0 -31.3 34 22 24 0 0 0

NEWFUNDSEQUI 3540 18 0.5 3543 3519 43 29.2 3632 2500 186.3 0 0 2.9

NEWFUNDSGOVI 6664 -42 -0.6 6697 6623 37 11 6999 5790 876.8 0 0 8.3

NEWFUNDSILBI 6887 1 0 6923 6887 0 4.3 6988 6555 62 0 0 2.6

NEWFUNDSMAPP 2212 16 0.7 2213 2202 0 3.8 2300 1610 39.7 0 0 2.5

NEWFUNDSNEWS 4993 55 1.1 4993 4978 0 0 5356 4258 38.2 0 0 1.1

NEWFUNDSS&P 3291 28 0.9 3303 3287 0 -9.6 3774 3157 43.1 0 0 4.3

NEWFUNDSSHAR 329 3 0.9 329 328 0 5.8 350 227 50.8 0 0 2.4

NEWFUNDSSWIX 1764 19 1.1 1764 1751 0 2.6 1952 1517 17.5 0 0 0.5

NEWFUNDSTRAC 2553 5 0.2 2555 2545 3 7.4 2555 2370 211.9 0 0 4.7

NEWGOLD 11515 81 0.7 11539 11368 18 7.9 12648 10474 12531.7 0 0 0

NEWGOLDISSUE 18505 32 0.2 18536 18472 16 19.2 19398 15111 10691.8 0 0 0

NEWGOLDPLLDM 21071 -237 -1.1 21146 21009 12 75.3 22838 11564 976.9 0 0 0

NFEQUITYVALU 959 7 0.7 960 959 0 -1.5 1038 882 114.4 0 0 2.6

NFLOWVLTLTY 1035 5 0.5 1041 1035 0 3.5 1062 907 120 0 0 2.3

NFVMDFNSV 978 6 0.6 980 978 0 0 997 951 50.4 0 0 0.5

NFVMHIGH 1001 7 0.7 1001 1001 1 5.4 1025 917 53.4 0 0 0.1

NFVMMDRT 944 8 0.9 946 944 1 0 968 879 52.1 0 0 0.4

NPNSBX 12 -1 -7.7 12 12 0 -65.7 37 12 13 0 0 0

NPNSBY 24 0 0 24 24 0 -25 44 24 24 0 0 0

SATRIX40PRTF 5242 57 1.1 5245 5170 142 5.8 5425 4400 8808.9 0 0 0.9

SATRIXDIVIPL 258 4 1.6 260 254 1531 10.3 267 226 1707.9 0 0 1.1

SATRIXFINI 1717 27 1.6 1723 1692 81 7.4 1811 1502 779.7 0 0 1.4

SATRIXILBI 589 0 0 592 586 141 5.2 601 552 94.3 0 0 1.5

SATRIXINDI 7128 73 1 7150 7027 31 -1.3 7900 6090 1960.5 0 0 1

SATRIXMMNTM 1065 11 1 1070 1055 4 12.1 1095 906 19.1 0 0 0.1

SATRIXMSCI 4097 -1 0 4109 4085 43 11.2 4395 3350 1777.3 0 0 0

SATRIXMSCIEM 3963 14 0.4 3974 3939 15 6.5 4248 3557 532 0 0 0

SATRIXNASDAQ 6200 16 0.3 6224 6200 2 14.2 6639 4896 403.3 0 0 0

SATRIXPRTFL 1591 5 0.3 1598 1581 52 -11.6 1900 1490 245.4 0 0 4.9

SATRIXQLTY 868 7 0.8 872 860 194 5.1 963 780 147.5 0 0 1.5

SATRIXRAFI40 1499 19 1.3 1506 1480 12 7.7 1554 1261 1034.2 0 0 1.7

SATRIXRESI 4699 38 0.8 4719 4644 6 16.6 5002 3709 386.3 0 0 0.7

SATRIXS&P500 4138 1 0 4149 4114 11 15.2 4401 3406 615.3 0 0 0

SATRIXSWIXTO 1111 10 0.9 1111 1104 11 0.8 1252 954 386.7 0 0 0.8

SBKSBP 6 2 50 6 6 0 -76 25 4 4 0 0 0

SBKSBQ 17 -2 -10.5 17 17 0 -52.8 37 14 19 0 0 0

SGLSBQ 17 -1 -5.6 17 17 0 -63 63 17 18 0 0 0

SGLSBR 10 0 0 10 10 0 -58.3 24 10 10 0 0 0

SGLSBS 23 0 0 23 23 0 -14.8 29 23 23 0 0 0

SHPSBR 29 -2 -6.5 29 29 0 -9.4 47 22 31 0 0 0

SOLSBR 48 -9 -15.8 48 48 0 41.2 58 9 57 0 0 0

SOLSBS 34 -5 -12.8 34 34 0 21.4 40 24 39 0 0 0

STANLIB 4905 25 0.5 4937 4867 5 -6 6485 4675 99.1 0 0 8.7

STANLIBBOND 7147 14 0.2 7161 7147 0 3.5 7161 6887 7.1 0 0 0

STANLIBG7GOV 7671 -20 -0.3 7720 7621 0 8.8 8377 6929 7.1 0 0 1.8

STANLIBGLOBA 1937 20 1 1956 1937 1 13.1 2100 1658 20.8 0 0 4.2

STANLIBMSCI 4090 3 0.1 4110 4090 0 11.1 4545 3473 63 0 0 0

STANLIBS&P50 20736 10 0 20823 20619 0 15.4 23098 15318 17.6 0 0 0

STANLIBSWIX4 1101 17 1.6 1101 1101 2 0.1 1193 905 1911.8 0 0 1.4

STANLIBTOP40 5191 61 1.2 5193 5137 1 4.8 5415 4305 710.6 0 0 2

SYGNIAITRIX 2533 5 0.2 2537 2521 354 10.5 2997 1985 617.7 0 0 0

SYGNIAITRIXG 3914 -15 -0.4 3930 3914 58 13.4 4201 3400 288.9 0 0 0.7

SYGNIAITRIXS 4231 7 0.2 4238 4208 165 13.7 4612 3505 960.6 0 0 0.8

SYGNIAITRIXT 5275 56 1.1 5275 5242 1 6.4 5420 4218 219.2 0 0 1.4

TOPSBS 4 -1 -20 4 4 0 -88.9 40 4 5 0 0 0

TOPSBT 18 -2 -10 18 18 2000 -21.7 46 15 20 0 0 0

TOPSBU 11 -2 -15.4 11 11 0 -54.2 24 10 13 0 0 0

TOPSBV 21 -2 -8.7 21 21 0 -4.5 25 21 23 0 0 0

TOPSKR 634 -96 -13.2 685 634 4 1.1 802 627 730 0 0 0

TOPSKS 798 -99 -11 798 798 0 -1.5 970 798 897 0 0 0

TOPSKX 17 0 0 0 0 0 0 1666 17 17 0 0 0

TOPSKZ 516 -105 -16.9 573 508 167 0 1170 32 621 0 0 0

WHLSBP 5 -2 -28.6 5 5 0 -82.8 53 5 7 0 0 0

DEBT 0 0 0 0 0 0 0 0 0 0 0 0 0

AECI5,5% 1310 -45 -3.3 1310 1310 2 -3 1400 1300 40.7 0 0 7.8

AFRICANOVER 1000 0 0 0 0 0 -4.9 1000 1000 2.8 0 0 1.2

BARWORLD6%PR 123 0 0 0 0 0 1.7 123 123 0.5 0 0 9.8

CAPITEC-P 10190 -10 -0.1 10190 9812 0 26.5 10990 8055 92.2 0 0 8.2

CAXTON-P 19000 0 0 0 0 0 0 19000 16000 9.5 0 0 2.6

DISC-B-P 9550 48 0.5 9550 9500 17 14 10000 8090 760.2 0 0 10.6

FIRSTRANDB-P 8713 23 0.3 8749 8665 59 9.6 9100 7500 3910.5 0 0 8.7

FOSCHINI 126 0 0 0 0 0 1.6 126 124 0.3 0 0 10.3

GRINDRODPREF 8000 -100 -1.2 8000 8000 0 11.9 9000 6960 599.4 0 0 11.1

IBRDMBLPRF1 101673 16 0 101723 101673 1 -0.1 101748 100279 347.4 0 0 5.5

INVESTEC 8650 40 0.5 8650 8615 5 18.5 9500 7151 1330 0 0 9.7

INVESTECPREF 8850 0 0 0 0 0 -3.8 11100 8850 243.8 0 0 3.5

INVICTA-P 8800 150 1.7 8800 8700 1 12.1 9450 7475 648.8 0 0 12.4

LIBERTY11C 108 0 0 0 0 0 0 145 98 16.2 0 0 10.2

NAMPAK6%PREF 126 0 0 0 0 0 0.8 126 120 0.5 0 0 9.5

NAMPAK6,5%PR 131 0 0 0 0 0 18 131 121 0.1 0 0 9.9

NEDBANKPREF 965 0 0 980 960 544 7.2 990 840 3457.4 0 0 8.7

NETCAREPREF 8110 10 0.1 8110 8110 0 17.9 8350 6840 526.5 0 0 10.3

PSGSERV 8350 0 0 8440 8349 11 16.8 8800 6900 1454.2 0 0 10.1

RECMANDCLBR 1720 0 0 0 0 0 -13.4 2000 1584 815.3 0 0 0

REXTRFRM 130 0 0 0 0 0 -35 130 121 0.2 0 0 9.2

SASFIN-P 7800 0 0 7800 7800 8 15.6 8000 6660 140.2 0 0 10.7

INVLTD 1124755 -4183 -0.4 1124755 1124755 0 9.1 1137098 1031139 12.4 0 0 0

UBSNPNEX 76774 -701 -0.9 76774 76774 0 0 109497 42954 774.8 0 0 0

INVLTD 1119377 8757 0.8 1119377 1119377 0 7.8 1137098 1031139 12.2 0 0 0

ASSET BACKED SECURITIES

0 0 0 0 0 0 0 0 0 0 0 0 0

DBRMII 1695 7 0.4 1695 1690 0 0 1695 1602 337.6 0 0 0

DBSTBXX6 5996 215 3.7 5996 5996 0 0 6956 2915 289.1 0 0 27.6

ASSET BACKED SECURITIES

0 0 0 0 0 0 0 0 0 0 0 0 0

UBSNPNEX 90594 -2951 -3.2 91493 90594 14 0 94794 42954 935.5 0 0 0

ASSET BACKED SECURITIES

0 0 0 0 0 0 0 0 0 0 0 0 0

DBMSCIAFETN 11325 75 0.7 11325 11325 0 3.4 12250 10745 2250 0 0 0

DBMSCICHETN 7623 88 1.2 7623 7450 1 16 41275 6022 1507 0 0 0

DBMSCIEMETN 6347 22 0.3 6347 6250 0 7 47325 5700 1265 0 0 0

FRKBONDGOLD 1720600 -22900 -1.3 1720600 1720600 0 1.3 1942200 1612300 2434.3 0 0 0

FRSFRPT9JUN1 115500 500 0.4 115500 115500 0 -6.3 138800 110700 846 0 0 0

GOLDCMMDTY-L 17986 -194 -1.1 18079 17939 0 -0.6 20534 16911 181.8 0 0 0

IBLUSDZAROCT 134740 -1916 -1.4 134740 134740 0 3.3 145570 116000 478.3 0 0 0.9

IBSWX40TR2ET 18655 281 1.5 18655 18655 0 -0.8 20256 1 918.7 0 0 0

IBTOP40CLIQU 123962 -74 -0.1 123962 123962 0 4.1 130581 119103 1.2 0 0 0

IBTOP40TR2ET 7360 112 1.5 7360 7360 0 0.1 7819 1 924.1 0 0 0

IBVR1ETN 127893 22 0 127893 127893 10 6.8 127893 119796 2129.1 0 0 0

NEWWAVEETN 11088 66 0.6 11088 11088 0 -6.4 13515 10267 23 0 0 0

NEWWAVEEUROE 1560 -22 -1.4 1565 1554 0 3.2 1706 1422 51.5 0 0 0

NEWWAVEGBPET 1752 -21 -1.2 1752 1752 0 3.6 1911 1615 128.7 0 0 0.1

ZA084 77700 0 0 0 0 0 0 0 0 108.8 0 0 0

ASSET BACKED SECURITIES

0 0 0 0 0 0 0 0 0 0 0 0 0

ADBEE(RF) 4815 -80 -1.6 4895 4815 2 45.8 5200 3100 1265 0 0 0

DBGLOBE 19739 0 0 0 0 0 0 0 0 2 0 0 0

DBHAVEN 31452 0 0 0 0 0 0 0 0 3.1 0 0 0

DBMSCIAFETN 11274 6 0.1 11274 11274 0 2.9 55585 8018 2253.6 0 0 0

DBMSCICHETN 6894 47 0.7 6894 6880 0 26.8 7497 5038 1369.4 0 0 0

DBMSCIEMETN 6027 5 0.1 6027 6005 0 16.3 6300 4237 1204.4 0 0 0

FRKBONDGOLD 1774000 -13800 -0.8 1774000 1774000 0 -5.4 1988900 1611900 2496.1 0 0 0

FRSFRPT9JUN1 132050 -400 -0.3 132050 132050 0 -12.1 155600 65901 974.4 0 0 0

GOLDCMMDTY-L 18889 -134 -0.7 18946 18889 0 13 21485 16711 190.2 0 0 0

IBETNT1CT46 1389135 0 0 0 0 0 0.1 1403037 1385563 48.6 0 0 0

IBGOLDENETN 12654 -25 -0.2 12654 12654 0 -18.6 17000 1 352.2 0 0 0

IBLUSDZAROCT 132475 -725 -0.5 132475 132475 0 -1.2 144142 125059 466.2 0 0 0

IBSWX40TRI 17697 32 0.2 17697 17697 0 5.7 17941 12618 883.3 0 0 0

SILVERCOMMOD 14894 -77 -0.5 14894 14894 0 -26.2 22935 13989 74.9 0 0 0

SBCOPPERETN 1329 -4 -0.3 1329 1329 0 8 1439 911 133.3 0 0 0

SBCORNETN 820 -46 -5.3 820 820 0 -16.2 979 765 43.3 0 0 0

SBWHEATETN 764 -41 -5.1 764 764 0 -10.7 856 618 40.3 0 0 0

SBWTIOIL 830 -1 -0.1 830 830 0 -20 1124 750 290.9 0 0 0

These figures are supplied by parties external to Business Day. Business Day will not warrant the accuracy of the figures.

Vous aimerez peut-être aussi

- Anti Corruption Working GuideDocument44 pagesAnti Corruption Working GuideTiso Blackstar GroupPas encore d'évaluation

- Harmonic Pattern by Jay PurohitDocument35 pagesHarmonic Pattern by Jay PurohitNickKr100% (5)

- CH.5 Strategic Analysis of Ben and JerryDocument9 pagesCH.5 Strategic Analysis of Ben and JerryJackie100% (1)

- Competition Law LLMDocument17 pagesCompetition Law LLMritu kumarPas encore d'évaluation

- OTHM - PGD A & F - Assignment Brief - Investment AnalysisDocument3 pagesOTHM - PGD A & F - Assignment Brief - Investment AnalysisIsurika PereraPas encore d'évaluation

- Free Masons Forerunners of DajjalDocument19 pagesFree Masons Forerunners of Dajjalapi-3709309100% (4)

- Open Letter To President Ramaphosa - FinalDocument3 pagesOpen Letter To President Ramaphosa - FinalTiso Blackstar GroupPas encore d'évaluation

- Peer Graded Assignments 1-3 Full VersionDocument7 pagesPeer Graded Assignments 1-3 Full VersionMihail100% (1)

- Critical Skills List - Government GazetteDocument24 pagesCritical Skills List - Government GazetteTiso Blackstar GroupPas encore d'évaluation

- Database Management Systems: Understanding and Applying Database TechnologyD'EverandDatabase Management Systems: Understanding and Applying Database TechnologyÉvaluation : 4 sur 5 étoiles4/5 (8)

- The Sales ProcessDocument23 pagesThe Sales ProcessArun Mishra100% (1)

- Preference Shares - July 7 2019Document1 pagePreference Shares - July 7 2019Anonymous io6Sv9mF9yPas encore d'évaluation

- Preference Shares - July 18 2019Document1 pagePreference Shares - July 18 2019Lisle Daverin BlythPas encore d'évaluation

- Preference Shares - July 15 2019Document1 pagePreference Shares - July 15 2019Tiso Blackstar GroupPas encore d'évaluation

- Preference Shares - March 24 2019Document1 pagePreference Shares - March 24 2019Anonymous 7A1d7fjj3Pas encore d'évaluation

- Preference Shares - July 14 2019Document1 pagePreference Shares - July 14 2019Anonymous C13oy8Pas encore d'évaluation

- Preference Shares - September 2 2019Document1 pagePreference Shares - September 2 2019Tiso Blackstar GroupPas encore d'évaluation

- Preference Shares - September 15 2019Document1 pagePreference Shares - September 15 2019Anonymous yid6usiNPas encore d'évaluation

- Preference Shares - July 29 2019Document1 pagePreference Shares - July 29 2019Lisle Daverin BlythPas encore d'évaluation

- Preference Shares - July 4 2019Document1 pagePreference Shares - July 4 2019Tiso Blackstar GroupPas encore d'évaluation

- Preference Shares - April 9 2019Document1 pagePreference Shares - April 9 2019Tiso Blackstar GroupPas encore d'évaluation

- Preference Shares - May 26 2019Document1 pagePreference Shares - May 26 2019Lisle Daverin BlythPas encore d'évaluation

- Preference Shares - September 18 2019Document1 pagePreference Shares - September 18 2019Anonymous MPsxhBPas encore d'évaluation

- Preference Shares - April 11 2019Document1 pagePreference Shares - April 11 2019Tiso Blackstar GroupPas encore d'évaluation

- Preference Shares - October 3 2019Document1 pagePreference Shares - October 3 2019Tiso Blackstar GroupPas encore d'évaluation

- Preference Shares - September 9 2019Document1 pagePreference Shares - September 9 2019Lisle Daverin BlythPas encore d'évaluation

- Preference Shares - June 6 2019Document1 pagePreference Shares - June 6 2019Tiso Blackstar GroupPas encore d'évaluation

- Preference Shares - July 23 2019Document1 pagePreference Shares - July 23 2019Tiso Blackstar GroupPas encore d'évaluation

- Preference Shares - July 22 2019Document1 pagePreference Shares - July 22 2019Tiso Blackstar GroupPas encore d'évaluation

- Preference Shares - March 19 2019Document1 pagePreference Shares - March 19 2019Tiso Blackstar GroupPas encore d'évaluation

- Preference Shares - March 11 2019Document1 pagePreference Shares - March 11 2019Tiso Blackstar GroupPas encore d'évaluation

- Preference Shares - April 10 2019Document1 pagePreference Shares - April 10 2019Tiso Blackstar GroupPas encore d'évaluation

- Preference Shares - July 31 2019Document1 pagePreference Shares - July 31 2019Tiso Blackstar GroupPas encore d'évaluation

- Preference Shares - March 26 2019Document1 pagePreference Shares - March 26 2019Tiso Blackstar GroupPas encore d'évaluation

- Preference Shares - July 17 2019Document1 pagePreference Shares - July 17 2019Lisle Daverin BlythPas encore d'évaluation

- Preference Shares - March 17 2019Document1 pagePreference Shares - March 17 2019Tiso Blackstar GroupPas encore d'évaluation

- Preference Shares - August 19 2019Document1 pagePreference Shares - August 19 2019Lisle Daverin BlythPas encore d'évaluation

- Preference Shares - March 25 2019Document1 pagePreference Shares - March 25 2019Lisle Daverin BlythPas encore d'évaluation

- Preference Shares - June 2 2019Document1 pagePreference Shares - June 2 2019Lisle Daverin BlythPas encore d'évaluation

- Preference Shares - March 27 2019Document1 pagePreference Shares - March 27 2019Tiso Blackstar GroupPas encore d'évaluation

- Metals - March 31 2019Document1 pageMetals - March 31 2019Anonymous 7A1d7fjj3Pas encore d'évaluation

- Preference Shares - April 14 2019Document1 pagePreference Shares - April 14 2019Lisle Daverin BlythPas encore d'évaluation

- Preference Shares - September 16 2019Document1 pagePreference Shares - September 16 2019Lisle Daverin BlythPas encore d'évaluation

- Preference Shares - April 15 2019Document1 pagePreference Shares - April 15 2019Lisle Daverin BlythPas encore d'évaluation

- PreferenceShares - February 19 2018Document1 pagePreferenceShares - February 19 2018Tiso Blackstar GroupPas encore d'évaluation

- Preference Shares - July 27 2018Document1 pagePreference Shares - July 27 2018Tiso Blackstar GroupPas encore d'évaluation

- Preference Shares - July 24 2019Document1 pagePreference Shares - July 24 2019Lisle Daverin BlythPas encore d'évaluation

- Preference Shares - July 31 2018Document1 pagePreference Shares - July 31 2018Tiso Blackstar GroupPas encore d'évaluation

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupPas encore d'évaluation

- Preference Shares - June 3 2019Document1 pagePreference Shares - June 3 2019Lisle Daverin BlythPas encore d'évaluation

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupPas encore d'évaluation

- Preference Shares - March 18 2019Document1 pagePreference Shares - March 18 2019Tiso Blackstar GroupPas encore d'évaluation

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupPas encore d'évaluation

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupPas encore d'évaluation

- Preference Shares - May 28 2019Document1 pagePreference Shares - May 28 2019Tiso Blackstar GroupPas encore d'évaluation

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupPas encore d'évaluation

- Preference Shares - September 11 2019Document1 pagePreference Shares - September 11 2019Tiso Blackstar GroupPas encore d'évaluation

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupPas encore d'évaluation

- Preference Shares - March 28 2019Document1 pagePreference Shares - March 28 2019Tiso Blackstar GroupPas encore d'évaluation

- Preference Shares - July 30 2019Document1 pagePreference Shares - July 30 2019Lisle Daverin BlythPas encore d'évaluation

- Preference Shares - August 28 2019Document1 pagePreference Shares - August 28 2019Lisle Daverin BlythPas encore d'évaluation

- Preference Shares - August 12 2019Document1 pagePreference Shares - August 12 2019Tiso Blackstar GroupPas encore d'évaluation

- Preference Shares - October 23 2018Document1 pagePreference Shares - October 23 2018Tiso Blackstar GroupPas encore d'évaluation

- Preference Shares - September 1 2019Document1 pagePreference Shares - September 1 2019Anonymous 6g229lSxPas encore d'évaluation

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupPas encore d'évaluation

- Preference Shares - April 4 2019Document1 pagePreference Shares - April 4 2019Tiso Blackstar GroupPas encore d'évaluation

- Preference Shares - June 30 2019Document1 pagePreference Shares - June 30 2019Anonymous gJMNpPtRmXPas encore d'évaluation

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupPas encore d'évaluation

- Preference Shares - July 8 2019Document1 pagePreference Shares - July 8 2019Lisle Daverin BlythPas encore d'évaluation

- PreferenceShares - June 26 2017Document1 pagePreferenceShares - June 26 2017Tiso Blackstar GroupPas encore d'évaluation

- Ramaphosa's Letter To MkhwebaneDocument1 pageRamaphosa's Letter To MkhwebaneTiso Blackstar GroupPas encore d'évaluation

- Collective InsightDocument10 pagesCollective InsightTiso Blackstar GroupPas encore d'évaluation

- Shoprite Food Index 2023Document19 pagesShoprite Food Index 2023Tiso Blackstar GroupPas encore d'évaluation

- Arena Holdings Pty LTD - BBBEE Certificate - 2023Document2 pagesArena Holdings Pty LTD - BBBEE Certificate - 2023Tiso Blackstar GroupPas encore d'évaluation

- Ramaphosa's Letter To MkhwebaneDocument1 pageRamaphosa's Letter To MkhwebaneTiso Blackstar GroupPas encore d'évaluation

- Ramaphosa's Letter To MkhwebaneDocument1 pageRamaphosa's Letter To MkhwebaneTiso Blackstar GroupPas encore d'évaluation

- Letter From Reuel Khoza Chairman of The Eskom Board 1999Document2 pagesLetter From Reuel Khoza Chairman of The Eskom Board 1999Tiso Blackstar GroupPas encore d'évaluation

- Letter From Reuel Khoza Chairman of The Eskom Board 1999Document2 pagesLetter From Reuel Khoza Chairman of The Eskom Board 1999Tiso Blackstar GroupPas encore d'évaluation

- JudgmentDocument30 pagesJudgmentTiso Blackstar GroupPas encore d'évaluation

- BondsDocument3 pagesBondsTiso Blackstar GroupPas encore d'évaluation

- JP Verster's Letter To African PhoenixDocument2 pagesJP Verster's Letter To African PhoenixTiso Blackstar GroupPas encore d'évaluation

- Tobacco Bill - Cabinet Approved VersionDocument41 pagesTobacco Bill - Cabinet Approved VersionTiso Blackstar GroupPas encore d'évaluation

- Collective Insight September 2022Document14 pagesCollective Insight September 2022Tiso Blackstar GroupPas encore d'évaluation

- Statement From The SA Tourism BoardDocument1 pageStatement From The SA Tourism BoardTiso Blackstar GroupPas encore d'évaluation

- BondsDocument3 pagesBondsTiso Blackstar GroupPas encore d'évaluation

- FairbairnDocument2 pagesFairbairnTiso Blackstar GroupPas encore d'évaluation

- LibertyDocument1 pageLibertyTiso Blackstar GroupPas encore d'évaluation

- Sanlam Stratus Funds - June 1 2021Document2 pagesSanlam Stratus Funds - June 1 2021Lisle Daverin BlythPas encore d'évaluation

- The ANC's New InfluencersDocument1 pageThe ANC's New InfluencersTiso Blackstar GroupPas encore d'évaluation

- Fuel Prices - June 30 2022Document1 pageFuel Prices - June 30 2022Tiso Blackstar GroupPas encore d'évaluation

- Forward Rates - June 30 2022Document2 pagesForward Rates - June 30 2022Tiso Blackstar GroupPas encore d'évaluation

- Forward Rates - June 29 2022Document2 pagesForward Rates - June 29 2022Tiso Blackstar GroupPas encore d'évaluation

- Fuel Prices - June 28 2022Document1 pageFuel Prices - June 28 2022Tiso Blackstar GroupPas encore d'évaluation

- Forward Rates - June 28 2022Document2 pagesForward Rates - June 28 2022Tiso Blackstar GroupPas encore d'évaluation

- 12 Business Studies Sp04Document13 pages12 Business Studies Sp04MANTAVYA VYASPas encore d'évaluation

- Fox Rothschild LLP Yann Geron Kathleen Aiello 100 Park Avenue, 15 Floor New York, New York 10017 (212) 878-7900Document27 pagesFox Rothschild LLP Yann Geron Kathleen Aiello 100 Park Avenue, 15 Floor New York, New York 10017 (212) 878-7900Chapter 11 DocketsPas encore d'évaluation

- The Ethical and Social Responsibilities of The Entrepreneur: Reported By: Berceles, Manuel, Toledo, VillanuevaDocument3 pagesThe Ethical and Social Responsibilities of The Entrepreneur: Reported By: Berceles, Manuel, Toledo, VillanuevaJojenPas encore d'évaluation

- Robert Half Salary Guide 2012Document9 pagesRobert Half Salary Guide 2012cesarthemillennialPas encore d'évaluation

- Calculation of Depreciation As Per Income Tax ActDocument12 pagesCalculation of Depreciation As Per Income Tax Act24.7upskill Lakshmi V100% (1)

- Retail Foods - The Hague - Netherlands - 06-30-2020Document10 pagesRetail Foods - The Hague - Netherlands - 06-30-2020sb AgrocropsPas encore d'évaluation

- Internship Report On Customer Satisfaction of Dutch-Bangla Bank LimitedDocument59 pagesInternship Report On Customer Satisfaction of Dutch-Bangla Bank LimitedIbrahim Khailil 1915216660Pas encore d'évaluation

- (2009) MURRAY - Towards A Common Understanding of The Differences Between Purchasing, Procurement and Commissioning in The UK Public SectorDocument5 pages(2009) MURRAY - Towards A Common Understanding of The Differences Between Purchasing, Procurement and Commissioning in The UK Public SectorfranksmPas encore d'évaluation

- Pavilion-cum-Convention Centre DesignDocument5 pagesPavilion-cum-Convention Centre DesignHarman VirdiPas encore d'évaluation

- IFI Banking TranscriptDocument21 pagesIFI Banking TranscriptAnonymous NeRBrZyAUbPas encore d'évaluation

- Bank Exam Question Papers - Bank of IndiaDocument34 pagesBank Exam Question Papers - Bank of IndiaGomathi NayagamPas encore d'évaluation

- Mba-1 SemDocument14 pagesMba-1 SemAnantha BhatPas encore d'évaluation

- Business Cycles (BBA BI)Document19 pagesBusiness Cycles (BBA BI)Yograj PandeyaPas encore d'évaluation

- Activity Based CostingDocument8 pagesActivity Based CostingAli AhmiiPas encore d'évaluation

- EduHubSpot ITTOs CheatSheetDocument29 pagesEduHubSpot ITTOs CheatSheetVamshisirPas encore d'évaluation

- Chap 13Document18 pagesChap 13N.S.RavikumarPas encore d'évaluation

- PR 5 Akuntansi ManajemenDocument2 pagesPR 5 Akuntansi ManajemenAhmad Sulthon Alauddin0% (1)

- An Introduction To The Supply Chain Council's SCOR MethodologyDocument17 pagesAn Introduction To The Supply Chain Council's SCOR MethodologyLuis Andres Clavel Diaz100% (1)

- Marketing SlidesDocument256 pagesMarketing SlidesDavid Adeabah OsafoPas encore d'évaluation

- Higher Pension As Per SC Decision With Calculation - Synopsis1Document13 pagesHigher Pension As Per SC Decision With Calculation - Synopsis1hariveerPas encore d'évaluation

- Primus Industries - TOC Case StudyDocument2 pagesPrimus Industries - TOC Case StudySUJIT SONAWANEPas encore d'évaluation

- ACT450 - Fa20 - Project Deliverable PDFDocument10 pagesACT450 - Fa20 - Project Deliverable PDFHassan SheikhPas encore d'évaluation

- Ao239 1 PDFDocument5 pagesAo239 1 PDFAnonymous wqT95XZ5Pas encore d'évaluation