Académique Documents

Professionnel Documents

Culture Documents

Form No. 16: (See Rule 31 (1) (A) )

Transféré par

amit kr AdhikaryDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Form No. 16: (See Rule 31 (1) (A) )

Transféré par

amit kr AdhikaryDroits d'auteur :

Formats disponibles

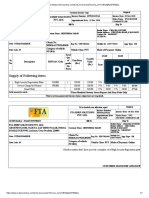

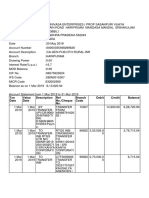

FORM NO.

16

[see rule 31 (1) (a) ]

Certificate under section 203 of the income tax Act, 1961 fot tax deducted at source from income chargeable

under the head “ salaries”

Name and address of the Employer Name and designation of the Employee

BURDWAN DENTAL COLLEGE & HOSPITAL. Ranajit Mitra

Burdwan. (Power House Para) 713101 L.D.C

PAN NO. of the Deductor TAN No. of the Deductor PAN NO. of the Employee

CALB12599G BFOPM4870E

Acknowledgement Nos. Of all quarterly statements TDS under From To Assessment Year

sub-section (3) of section 200 as provided by TIN Facilitation 01-04-2013 31-03-2014 2014-2015

center of NSDL web site

Quarter Acknowledgement No Date (DD/MM/YYYY)

Q1 050520200195673 07/10/2013

Q2 050520200198764 29/10/2013

Q3 050529600005032 30/01/2014

Q4 05052 /2014

DETAILS OF SALARY PAID AND ANY OTHER INCOME AND TAX DEDUCTED

SL. NO. Particulars Amount ( Rs.) Amount ( Rs.) Amount ( Rs.)

1 Gross salary

(a) Salary as Per Provision contained in Section 17 (1) Rs. 193216

(b) Value of perquisites under section 17(2) nil

( as per Form No 12B A, wherever applicable)

(c) Profit in lieu of salary under section 17(3) nil

( as per Form No 12B A, wherever applicable)

(d) TOTAL nil Rs. 193216

2 Less: Allowance to the extent exempt under section

10(14)

3 Balance (1-2) Rs. 193216

4 Deduction

(a) Entertainment allowance

(b) Tax on Employment Rs. 1560

5 Aggregate of 4 (a) and (b) Rs. 1560

6 Income Chargeable under the head “Salaries” (3-5) Rs. 191656

7 Add

Any other income reported by the employee

(a) Income from house property

(b) Interest from NSC and others

(c) Any other income (Bank interest) Rs. Nil

8 Aggregate of 7(a), (b) and (c)

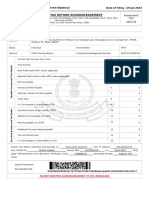

9 Less

Borrowed interest on capital for house property U/S Rs. Nil

23(2)(a)/24 (b)

10 Gross total income (6+8) Rs. 191656

11 Deduction under Chapter VI- Rs. 191656

(A) Section 80C, 80CC, and 80CCD Gross Amount Qualifying Amount Deducible Amount

(a) Section 80C

(i) G.P.F. Rs. 18000 Rs. 18000

(ii) Insurance Premium

(iii) N.S.C.

(iv) Accrued Interest on NSC

(v) Repayment of House Building Loan Rs. Rs.

(vi) GISS Rs. 240 Rs. 240

(vii) Tuition fees.

(viii) Others (PPF) Rs. Rs.

(b) Section 80CC

(c) Section 80CCD Rs. Rs.

(B) Other Section (e.g. 80E, 80G etc.)

(a) 80D--Medical Insurance Premium Rs. Rs.

(b) 80DD-- Medical Treatment of handicapped Dependant

(c) 80DDB--Deduction for Medical Treatment

(d) 80E --Repayment of loan for higher education Rs. Rs.

(e) 80G- -Donation to Charitable institution

(f) 80GG--Deduction for rent paid

(g) 80GGA-- Donation for Scientific research

(h) 80U--person with Disability

12 Aggregate of deducible amount under Chapter VI-A Rs. 18240

13 Total Income Rs . 173416

14 Tax on total income Rs. nil

15 Surcharge

16 Education Cess @ 3% Rs .

17 Tax Payable (13+14+15) Rs.

18 Relief under section 89 9attach details)

19 Tax Payable(16-17) Rs.

20 Less:- (a) Tax deducted at source u/s 192 (1) Rs.

(b) Tax paid by the employer on behalf of the employee u/s 192 (1A) on perquisites u/s 17(2)

21 Tax Payable/Refundable NIL

DETAILS OF TAX DEDUCTED AND DEPOSITED INTO CENTRAL GOVERNMENTACCOUNT

(The Employer is to provide transaction –wise details of tax deducted and deposited

Month TDS Surcharge Edu.-Cess Total Tax Vouvc- BSR Code of Bank Deposit Voucher/Chal

No. Date No.

March/13 Rs. Bdn-Treasur-2

April/13 Rs. Bdn-Treasur-2

May/13 Rs. Bdn-Treasur-2

June/13 Rs. Bdn-Treasur-2

July/13 Rs. Bdn-Treasur-2

Aug. /13 Rs. Bdn-Treasur-2

Sept./13 Rs. Bdn-Treasur-2

Oct./13 Rs. Bdn-Treasur-2

Nov./13 Rs. Bdn-Treasur-2

Dec./13 Rs. Bdn-Treasur-2

Jan./14 Rs. Bdn-Treasur-2

Feb./14 Rs. Bdn-Treasur-2

TOTAL Rs.nil

I certify that a sum of Rs.Nil (Nil) has been deducted at source and paid to the credit of the Central Government. I

further certify that information given above is true and correct based on the books of account, documents and other

available records.

Place: Burdwan Signature of the person responsible for deduction of tax

Date: Full Name: Dr. Tamal Kanti Patra

Designation: Principal cum Superintendent

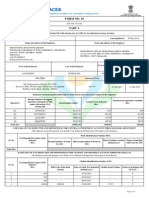

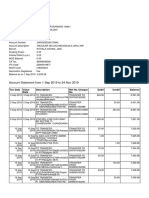

FORM NO. 16

[see rule 31 (1) (a) ]

Certificate under section 203 of the income tax Act, 1961 fot tax deducted at source from income chargeable

under the head “ salaries”

Name and address of the Employer Name and designation of the Employee

BURDWAN DENTAL COLLEGE & HOSPITAL. Ranajit Mitra

Burdwan. (Power House Para) 713101 L.D.C

PAN NO. of the Deductor TAN No. of the Deductor PAN NO. of the Employee

CALB12599G BFOPM4870E

Acknowledgement Nos. Of all quarterly statements TDS under From To Assessment Year

sub-section (3) of section 200 as provided by TIN Facilitation 01-04-2014 31-03-2015 2015-2016

center of NSDL web site

Quarter Acknowledgement No Date (DD/MM/YYYY)

Q1 092059600012122 07/07/2014

Q2 050529600024315 14/10/2014

Q3 050529600027771 13/01/2015

Q4 050529600038993 14/05/2015

DETAILS OF SALARY PAID AND ANY OTHER INCOME AND TAX DEDUCTED

SL. NO. Particulars Amount ( Rs.) Amount ( Rs.) Amount ( Rs.)

1 Gross salary

(a) Salary as Per Provision contained in Section 17 (1) Rs. 206372

(b) Value of perquisites under section 17(2) nil

( as per Form No 12B A, wherever applicable)

(c) Profit in lieu of salary under section 17(3) nil

( as per Form No 12B A, wherever applicable)

(d) TOTAL nil Rs. 206372

2 Less: Allowance to the extent exempt under section

10(14)

3 Balance (1-2) Rs. 206372

4 Deduction

(a) Entertainment allowance

(b) Tax on Employment Rs. 1560

5 Aggregate of 4 (a) and (b) Rs. 1560

6 Income Chargeable under the head “Salaries” (3-5) Rs. 204812

7 Add

Any other income reported by the employee

(a) Income from house property

(b) Interest from NSC and others

(c) Any other income (Bank interest) Rs. Nil

8 Aggregate of 7(a), (b) and (c)

9 Less

Borrowed interest on capital for house property U/S Rs. Nil

23(2)(a)/24 (b)

10 Gross total income (6+8) Rs.204812

11 Deduction under Chapter VI- Rs. 204812

(A) Section 80C, 80CC, and 80CCD Gross Amount Qualifying Amount Deducible Amount

(a) Section 80C

(i) G.P.F. Rs. 18000 Rs. 18000

(ii) Insurance Premium

(iii) N.S.C.

(iv) Accrued Interest on NSC

(v) Repayment of House Building Loan Rs. Rs.

(vi) GISS Rs. 240 Rs. 240

(vii) Tuition fees.

(viii) Others (PPF) Rs. Rs.

(b) Section 80CC

(c) Section 80CCD Rs. Rs.

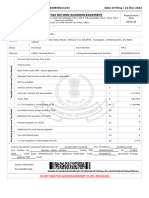

(B) Other Section (e.g. 80E, 80G etc.)

(a) 80D--Medical Insurance Premium Rs. Rs.

(b) 80DD-- Medical Treatment of handicapped Dependant

(c) 80DDB--Deduction for Medical Treatment

(d) 80E --Repayment of loan for higher education Rs. Rs.

(e) 80G- -Donation to Charitable institution

(f) 80GG--Deduction for rent paid

(g) 80GGA-- Donation for Scientific research

(h) 80U--person with Disability

12 Aggregate of deducible amount under Chapter VI-A Rs. 18240

13 Total Income Rs . 186572

14 Tax on total income Rs. nil

15 Surcharge

16 Education Cess @ 3% Rs .

17 Tax Payable (13+14+15) Rs.

18 Relief under section 89 9attach details)

19 Tax Payable(16-17) Rs.

20 Less:- (a) Tax deducted at source u/s 192 (1) Rs.

(b) Tax paid by the employer on behalf of the employee u/s 192 (1A) on perquisites u/s 17(2)

21 Tax Payable/Refundable NIL

DETAILS OF TAX DEDUCTED AND DEPOSITED INTO CENTRAL GOVERNMENTACCOUNT

(The Employer is to provide transaction –wise details of tax deducted and deposited

Month TDS Surcharge Edu.-Cess Total Tax Vouvc- BSR Code of Bank Deposit Voucher/Chal

No. Date No.

Mar/14 Rs. Bdn-Treasur-2

Apr/14 Rs. Bdn-Treasur-2

May/14 Rs. Bdn-Treasur-2

June/14 Rs. Bdn-Treasur-2

Jul/14 Rs. Bdn-Treasur-2

Aug /14 Rs. Bdn-Treasur-2

Sept/14 Rs. Bdn-Treasur-2

Oct./14 Rs. Bdn-Treasur-2

Nov./14 Rs. Bdn-Treasur-2

Dec./14 Rs. Bdn-Treasur-2

Jan./15 Rs. Bdn-Treasur-2

Feb./15 Rs. Bdn-Treasur-2

TOTAL Rs.nil

I certify that a sum of Rs.Nil (Nil) has been deducted at source and paid to the credit of the Central Government. I

further certify that information given above is true and correct based on the books of account, documents and other

available records.

Place: Burdwan Signature of the person responsible for deduction of tax

Date: Full Name: Dr. Tamal Kanti Patra

Designation: Principal cum Superintendent

Vous aimerez peut-être aussi

- 2020 07 21 14 18 51 966 - 1595321331966 - XXXPA5493X - Acknowledgement PDFDocument1 page2020 07 21 14 18 51 966 - 1595321331966 - XXXPA5493X - Acknowledgement PDFVasanth Kumar AllaPas encore d'évaluation

- Lucky ScootyDocument1 pageLucky ScootyPramodKumarPas encore d'évaluation

- Statement 603062178 20190626 162447 2Document1 pageStatement 603062178 20190626 162447 2Emmanuel melvinPas encore d'évaluation

- GST Chart Book by CA Pranav ChandakDocument54 pagesGST Chart Book by CA Pranav ChandakAman AhujaPas encore d'évaluation

- Form No. 16: Part ADocument2 pagesForm No. 16: Part AasifPas encore d'évaluation

- UnknownDocument1 pageUnknownBSNL BBOVERWIFIPas encore d'évaluation

- Solution Manual For Principles of Taxation For Business and Investment Planning 16th Edition by JonesDocument5 pagesSolution Manual For Principles of Taxation For Business and Investment Planning 16th Edition by JonesThanhTrúcc100% (1)

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearAmiya Ranjan PaniPas encore d'évaluation

- Form16 (2021-2022)Document2 pagesForm16 (2021-2022)Anushka PoddarPas encore d'évaluation

- FS51853 KPMG PDFDocument9 pagesFS51853 KPMG PDFAman AgrawalPas encore d'évaluation

- Form 16Document2 pagesForm 16robin0903Pas encore d'évaluation

- Salary Jan 2001Document2 pagesSalary Jan 2001Kharde HrishikeshPas encore d'évaluation

- Itr 23-24Document1 pageItr 23-24addy01.0001Pas encore d'évaluation

- Biapg2824f - Partb - 2019-20 Sameer PDFDocument3 pagesBiapg2824f - Partb - 2019-20 Sameer PDFGanesh LohakarePas encore d'évaluation

- Ashok ITR 2022-23Document1 pageAshok ITR 2022-23SHIFAZ SULAIMANPas encore d'évaluation

- Itr21 22Document1 pageItr21 22RahulMahajanPas encore d'évaluation

- Vipin Form 16Document5 pagesVipin Form 16Jagdish Sharma CAPas encore d'évaluation

- PDF 816776770290723Document1 pagePDF 816776770290723Sunita SinghPas encore d'évaluation

- Form 16 651746Document4 pagesForm 16 651746Arslan1112Pas encore d'évaluation

- Quater 1Document3 pagesQuater 1सर्व ब्राह्मण समाज संगठनPas encore d'évaluation

- Namdev ITR ACK 2022-23Document1 pageNamdev ITR ACK 2022-23cagopalofficebackupPas encore d'évaluation

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengalurupaappaapPas encore d'évaluation

- Ack 657377180240723Document1 pageAck 657377180240723SRIYA GADAGOJUPas encore d'évaluation

- BLSPM3354H Partb 2021-22Document3 pagesBLSPM3354H Partb 2021-22kumar reddyPas encore d'évaluation

- 910010041067322 (1)Document2 pages910010041067322 (1)MiteshSuneriyaPas encore d'évaluation

- Form 16 Part B 2016-17Document4 pagesForm 16 Part B 2016-17atulsharmaPas encore d'évaluation

- 1577696289179nnEgWiK0UqmaDjqK PDFDocument4 pages1577696289179nnEgWiK0UqmaDjqK PDFConcepts Classes IndorePas encore d'évaluation

- Form16 2021Document8 pagesForm16 2021Mahammad HachanPas encore d'évaluation

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment Yearvikas guptaPas encore d'évaluation

- OTUqn 3 Lhohr QQ8 P EDocument3 pagesOTUqn 3 Lhohr QQ8 P Ebipin_santoshiPas encore d'évaluation

- Application No: Regular: M.G.Road, Fort, Mumbai-400032, Maharashtra (India) Academic Year: 2020-2021Document2 pagesApplication No: Regular: M.G.Road, Fort, Mumbai-400032, Maharashtra (India) Academic Year: 2020-2021chinmay ajgaonkarPas encore d'évaluation

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearAditya Adi SinghPas encore d'évaluation

- Form 16 - TCSDocument3 pagesForm 16 - TCSBALAPas encore d'évaluation

- BFJPJ5437H 2019-20 SignedDocument5 pagesBFJPJ5437H 2019-20 SignedUjjwal JoshiPas encore d'évaluation

- Bijay Kumar Nayak Audit Report Ay 23-24Document19 pagesBijay Kumar Nayak Audit Report Ay 23-24tapireg689Pas encore d'évaluation

- Clhps7458a 2019-20Document2 pagesClhps7458a 2019-20Gurudeep singhPas encore d'évaluation

- Bhitar Gaon PDFDocument1 pageBhitar Gaon PDFNeha SinghPas encore d'évaluation

- 17 Digital Telecom V BatangasDocument2 pages17 Digital Telecom V BatangasJesse Nicole SantosPas encore d'évaluation

- GGGDocument13 pagesGGGDikesh JaiswalPas encore d'évaluation

- Telangana State Board of Intermediate Education: Hyderabad: Online Memorandum of MarksDocument1 pageTelangana State Board of Intermediate Education: Hyderabad: Online Memorandum of MarksSaikishore Naidu100% (1)

- Account StatementDocument5 pagesAccount StatementBhagyavanti BPas encore d'évaluation

- Sbi March PDFDocument7 pagesSbi March PDFkalyanPas encore d'évaluation

- ITR Form AY 21-22Document96 pagesITR Form AY 21-22Anurag Kumar ReloadedPas encore d'évaluation

- AccountDocument10 pagesAccountDeepak GautamPas encore d'évaluation

- Itr 2018-19 PDFDocument1 pageItr 2018-19 PDFMalik MuzafferPas encore d'évaluation

- Property Tax Payment ReceiptDocument1 pageProperty Tax Payment ReceiptC.A. Ankit JainPas encore d'évaluation

- Itr 22-23Document1 pageItr 22-23MoghAKaranPas encore d'évaluation

- 26 Li Yao vs. CIRDocument2 pages26 Li Yao vs. CIRMichelle Montenegro - AraujoPas encore d'évaluation

- IBC v. Amarilla GR 162775 October 27, 2006Document2 pagesIBC v. Amarilla GR 162775 October 27, 2006Vel JunePas encore d'évaluation

- (CERDENA) Fisher vs. Trinidad, 43 Phil. 973 (1922)Document1 page(CERDENA) Fisher vs. Trinidad, 43 Phil. 973 (1922)Chaze CerdenaPas encore d'évaluation

- Impact On GST in Retail Sector.Document47 pagesImpact On GST in Retail Sector.Priyanka Satam100% (6)

- Form16 (2020-2021)Document2 pagesForm16 (2020-2021)Saras ShendePas encore d'évaluation

- 2014-15 Form 16Document4 pages2014-15 Form 16om shanker soniPas encore d'évaluation

- High School 10th Marksheet - Rohit SagarDocument1 pageHigh School 10th Marksheet - Rohit SagarRohit SagarPas encore d'évaluation

- Government of Telangana: PAYSLIP:-DEC-2020Document2 pagesGovernment of Telangana: PAYSLIP:-DEC-2020Raghavendra BiduruPas encore d'évaluation

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument2 pagesIncome From Salaries: Rs. Rs. Rs. SCH - Nosrinivas maguluriPas encore d'évaluation

- Bill Oct 16Document1 pageBill Oct 16deePas encore d'évaluation

- Registration CertificateDocument1 pageRegistration CertificateLuckyGuptaPas encore d'évaluation

- LIC Premium 2016 PDFDocument1 pageLIC Premium 2016 PDFRakesh KumarPas encore d'évaluation

- Final Itr PDFDocument8 pagesFinal Itr PDFharish1000Pas encore d'évaluation

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillagesamaadhuPas encore d'évaluation

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment Yearshyam krishnaPas encore d'évaluation

- Zerodha Broking Limited: Transaction With Holding StatementDocument1 pageZerodha Broking Limited: Transaction With Holding StatementChandradeep Reddy TeegalaPas encore d'évaluation

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearRavi KumarPas encore d'évaluation

- Itr - Return Sub2019-20 PDFDocument6 pagesItr - Return Sub2019-20 PDFBIDHANPas encore d'évaluation

- Form 16 Excel FormatDocument12 pagesForm 16 Excel Formatankeet3Pas encore d'évaluation

- Form No.16 Aa-1Document2 pagesForm No.16 Aa-1Vishnu Vardhan APas encore d'évaluation

- Job Order Costing - Del Rosario, Jameine SDocument42 pagesJob Order Costing - Del Rosario, Jameine SPatrick LancePas encore d'évaluation

- Đề Số 16 - 121Document8 pagesĐề Số 16 - 121PD HoàngPas encore d'évaluation

- InvoiceDocument1 pageInvoiceFaith Fellowship Church100% (1)

- Taxation Handbook 4th Edition 2022 - 10.02.2022Document170 pagesTaxation Handbook 4th Edition 2022 - 10.02.2022Mercy Akello100% (1)

- Payroll SystemDocument5 pagesPayroll SystemJohn Daryll GabutinPas encore d'évaluation

- Segment Results PDFDocument1 pageSegment Results PDFhkm_gmat4849Pas encore d'évaluation

- Gpi Projects Pvt. LTD.: November 2018 204 Pay Slip For The Month ofDocument1 pageGpi Projects Pvt. LTD.: November 2018 204 Pay Slip For The Month offGPas encore d'évaluation

- Vanishing Deductions X Estate Tax ComputationDocument2 pagesVanishing Deductions X Estate Tax ComputationShiela Mae OblanPas encore d'évaluation

- Test PDFDocument1 pageTest PDFAnuj MittalPas encore d'évaluation

- Actividad 1Document2 pagesActividad 1Diana Marcela MONCADA SUAREZPas encore d'évaluation

- Federal Taxation 2013 7th Edition Pratt Test BankDocument31 pagesFederal Taxation 2013 7th Edition Pratt Test Bankaletheasophroniahae100% (28)

- FTX (Uk) JDocument4 pagesFTX (Uk) JpavishnePas encore d'évaluation

- Comparision Between Pre GST and Post Gst....Document26 pagesComparision Between Pre GST and Post Gst....Yash MalhotraPas encore d'évaluation

- Direct Tax CodeDocument12 pagesDirect Tax CodeSaravanan VaithiPas encore d'évaluation

- Bruhat Bengaluru Mahanagara Palike - Revenue Department: Xjdœ LXD - /HZ Eud/ Eĺ Lbx¡E (6 E LDocument1 pageBruhat Bengaluru Mahanagara Palike - Revenue Department: Xjdœ LXD - /HZ Eud/ Eĺ Lbx¡E (6 E LManjunathPas encore d'évaluation

- Tax3701 TL 102Document80 pagesTax3701 TL 102Jerome ChettyPas encore d'évaluation

- GEPCO ONLINE BILL MarchDocument1 pageGEPCO ONLINE BILL Marchali razaPas encore d'évaluation

- Lecture 1 - Introduction To Statutory ValuationDocument11 pagesLecture 1 - Introduction To Statutory ValuationQayyumPas encore d'évaluation

- Percentage & Ratio and Proportion Past Paper QuestionsDocument39 pagesPercentage & Ratio and Proportion Past Paper QuestionsinternationalmakkhayarPas encore d'évaluation

- Boat Bassheads 242 Wired Headset: Grand Total 449.00Document1 pageBoat Bassheads 242 Wired Headset: Grand Total 449.00acaPas encore d'évaluation

- Tax Assignment Final PDFDocument20 pagesTax Assignment Final PDFABPas encore d'évaluation

- Topic: Registration of Assesee Under GSTDocument11 pagesTopic: Registration of Assesee Under GSTSukruth SPas encore d'évaluation

- Tax Rate Notification For ContractorsDocument3 pagesTax Rate Notification For ContractorsCaleb JPas encore d'évaluation