Académique Documents

Professionnel Documents

Culture Documents

The Galaxy Dividend Income Growth Fund

Transféré par

Ashlesh MangrulkarCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

The Galaxy Dividend Income Growth Fund

Transféré par

Ashlesh MangrulkarDroits d'auteur :

Formats disponibles

The Galaxy Dividend Income Growth Fund’s Option

Investment Strategies

FM1 Assignment

Ashlesh Mangrulkar

B18014 (Section A)

08-OCTOBER-2018

Name : Ashlesh Mangrulkar SID: B18014 Section A

Introduction

The Galaxy Dividend Income Growth Fund is a closed end mutual fund (funds

listed on the stock exchange and traded throughout the day) offering

investment opportunities to different institutions in the US.

The fund has traditionally generated income through 2 primary routes :

a.) Investing at least 75% of its total assets in the equities of firms that paid

dividends to its existing shareholders, planned to increase the dividend payout

and had the capability to undergo capital appreciation.

b.) Invest in equities that at present were not paying dividends to their

shareholders, but near term growth potential was bright and would eventually

pay out dividends in the long run.

The Fund has paid dividends of $0.40 annually per share even when returns

have been negative. To meet this, it has even recommended cash distributions

that exceeded income generated through some return of capital.

The management has proposed that the Fund can engage in options trading.

The directors have requested for a pilot study of potential profit and losses

from selective options trading. Two stocks in the fund’s portfolio : JPMorgan

Chase & Co. and Facebook, Inc. have been selected for the study.

Name : Ashlesh Mangrulkar SID: B18014 Section A

Financial Problems

1. Low Yield financial environment since the 2008 financial crisis has

affected the traditional investment returns for the Fund.

The Fund has found it increasing difficult to meet its level cash dividend

policy of $0.40 per share annually. It has even recommended payouts that

have exceeded its net investment income resulting in return of capital. The

Fund has to decide on an options strategy to boost its incomes by buying

options or by earning premiums by selling or writing options. The Fund is

already being traded at a discount of 12% from its NAV. It has $1.25 billion

in assets and 117 million shares, resulting in NAV of $10.68.

2. Analyzing volatility of underlying asset and rigid dividend policy

The Fund has a policy of giving out dividend of $0.40 annually since its

inception. Despite factoring market volatilities and fluctuations it hasn’t

historically deviated from its performance. This creates a stress on asset

value and fund managers are pressurized to generate high returns which

can be difficult in bearish market. The Fund had to resort to using its capital

to sustain the policy. An alternative to exploring new investment channels

can be to make dividends a function of market movement. Through

derivatives trading, the Fund is increasing its exposure to the volatility of

the stock prices. In volatile markets, writing an option becomes more

attractive than buying options.

3. Calculating risk/reward payoff which is dependent on risk appetite.

Each options strategy has an associated payoff. Conservative investors, for

example, do not invest in naked calls ( writing call options without owning

the underlying security) and invest in covered calls. Depending on the stock

biases we might go bullish, bearish or neutral. The Fund traditionally has

shown a preference in companies that pay dividends to shareholders. In the

case, we have 2 companies, JPMorgan Chase & Co. that has historically paid

dividends and Facebook, Inc. that has a higher P/E ratio.

Name : Ashlesh Mangrulkar SID: B18014 Section A

4. Deciding on an options strategy for the Fund for generating higher risk

adjusted returns through returns and premiums.

There are 2 key aspects when trading options on stocks : strike price and

maturity time period. To be able to calculate future payoffs the Fund

should be able to predict with reasonable accuracy the share price on

maturity of JPMorgan Chase & Co. and Facebook, Inc. The options

premium will be decided by the maturity period. There is also an

opportunity to generate returns through any arbitrage opportunity due

to a mismatch in put-call parity that may exist in the market. The Fund

can also earn income through premiums by writing call options that are

worthless at time of maturity. Options are useful to hedge risk if the

Fund should want to protect its investment, for example by investing in

call options to hedge risk against bearish market trends.

5. Information on market ‘Events’ that can affect the short term and long

term outlook

An event can significantly affect the volatility of stock price and its value.

Market events such as regulations announced by the Govt. or change in

treasury rates ( esp. in case of banks) or company events such as new

product launches, annual/quarterly earnings report or sector -specific

regulation need to be studied. Past financial performance might be soft

indicator of future performance but any analysis on predicted maturity

price should take events into account. For example, higher dividend in

one quarter might affect the stock price bullishly but also result in

increased volatility of asset value. Events can be categorized as market-

wide or stock-price events.

Name : Ashlesh Mangrulkar SID: B18014 Section A

Analysis and Interpretations

1. Analysis of JPMorgan Chase & Co. and Facebook Inc.

a) JPMorgan Chase & Co.

Since 2009, JP has shown stable operating and net incomes. It has paid

regular dividends to its shareholders. In 2014, it is projected to pay an

annual dividend of $1.52 per share, in line with existing trends. The stock

price hasn’t shown significant variability and returns per day is between

-$0.04 to $0.04. The Price to Earnings ratio had shown a decrease in 2012

but has bounced back since then. The financial firm has strong

fundamentals and is not highly volatile. The stock has performed well in

2013 ( lowest stock price ~ highest stock price in 2012) and investors will

prefer to go bullish on this stock.

b) Facebook, Inc

Facebook went public with its IPO in 2012. It hasn’t paid any dividends to its

shareholders and is not projected to pay any in the foreseeable future. The

stock is subject to high volatility, by analyzing the daily stock price returns.

One particular instance had a return of 29.61% return. The business model

of Facebook is fairly robust and is globally poised to be the next big thing,

but since it’s a fairly new company its stock price is subject to

misinformation and conjecture. Its P/E ratio should stabilize in a few years,

as should its net income and revenue, because it leads to significant

unpredictability for investors. Most investors would prefer to hold

Facebook’s stock and go long, with a call option to hedge their investment.

Options Strategy

The Fund has conventionally favored higher investment in dividend paying

firms. The same will be followed here. The aim is to increase risk adjusted

performance of the fund, and increase income through call writing to

support its cash dividend payout policy.

Name : Ashlesh Mangrulkar SID: B18014 Section A

Facebook, Inc.

Covered Call : A covered call strategy is useful to generate steady income

from a stock that is already owned, while safeguarding the investment. It

also limits the amount of gains that can be made. Through covered calls we

sell a call option at a strike price above the current stock price. The

following situations may occur hence :

a) The stock price increases above the strike price : In that case the buyer

of the call will exercise his right to the option and purchase the stocks

from us. At maturity, our income will be limited by

Profit = Amount made by writing call + (Strike price of Call - purchase

price of stock)*no. of shares

b) The stock price remains neutral or falls below the current

traded price: The buyer of the call will not exercise his right to buy shares

and it will become worthless. Our income will be restricted to the

premium earned from selling the call. However, the capital has

depreciated in this case on our investment in the stock.

Profit = Premium made by writing call

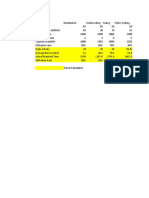

Profit/Loss

Stock Price

Strike Price

Profit/Loss

Bull Buy Write

Spread Strike 1 Strike 2

Stock Price 60 65

50 -0.15

55 -0.15

57.74 -0.15

60 -0.15

62.5 2.35

65 4.85

68 4.85

Name : Ashlesh Mangrulkar SID: B18014 Section A

JPMorgan Chase & Co.

Bull Call Spread

In case of this stock, we expect a moderate increase in the price of the stock,

hence we will purchase a call option at a strike price and write the same

number of calls at a higher strike price. The following cases may occur:

a) The price of the stock falls below the 1st strike price : The maximum loss

is made and is equal to the price of premium paid for the 2 calls.

b) The price of stock is between the 2 strike prices : The total payoff is

equal to difference of the 2 calls and the profit made from selling the

stock at a higher value

c) The price of stock exceeds the 2nd strike price : The total payoff is

maximized at the 2nd strike price. Any movement above the 2nd strike

price is forfeited.

Strike Price 2

Profit/Loss

Strike Price 1 Stock Price

The profit/loss for this analysis is given below

Profit/Loss

Bull Buy Write

Spread Strike 1 Strike 2

Stock Price 60 65

50 -0.15

55 -0.15

57.74 -0.15

60 -0.15

62.5 2.35

65 4.85

68 4.85

Name : Ashlesh Mangrulkar SID: B18014 Section A

Recommendations

The Fund is operating on some rigid criteria which have been set by its board of

directors. It seeks to supplement its income by trading in options.

The recommendations are :

1. The Fund doesn’t have significant expertise when it comes to options

trading, and hence for different stocks under its portfolio it will have to

devise a separate strategy for each stock based on its business

fundamentals. It will have to invest in developing the intellectual capital

to develop some level of expertise in this regard. In case of Facebook,

Inc. it is a volatile stock compared to JPMorgan Chase & Co. which was

offering dividends regularly to its shareholders.

2. To prevent return of capital, the Fund can effectively change its dividend

payout criteria, w.r.t market performance. Rather than forcible sticking

to a fixed payout plan, it can tie it with market performance, thus

rewarding shareholders when markets perform above expectations.

3. Since the stock price is trading below NAV, the Fund is inclined to take

bold steps to improve its performance, but such a knee-jerk reaction is

undesirable. It could try to improve its performance by changing its

investment model of 75%-25%. In case of IPOs though no dividend is

paid, the Fund can take advantage of the market movements in its favor.

4. The Fund can benchmark its performance with other closed end Mutual

Funds that are operating in the same market and compare the returns it

offers w.r.t to them. It can adopt their best practices.

Name : Ashlesh Mangrulkar SID: B18014 Section A

Vous aimerez peut-être aussi

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)D'EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)Pas encore d'évaluation

- CFA Career Guide India 2023Document80 pagesCFA Career Guide India 2023Anmol Arjun100% (1)

- Blades Hedge Thai Baht, British PoundDocument7 pagesBlades Hedge Thai Baht, British PoundAl-Imran Bin KhodadadPas encore d'évaluation

- 14 - Dividend Policy SumsDocument17 pages14 - Dividend Policy SumsRISHA SHETTYPas encore d'évaluation

- Dividend Policy Gorden, Walter & MM Model Practice QuestionsDocument1 pageDividend Policy Gorden, Walter & MM Model Practice QuestionsAmjad AliPas encore d'évaluation

- Single PopulationDocument25 pagesSingle PopulationJai GuptaPas encore d'évaluation

- International Fisher EffectDocument9 pagesInternational Fisher EffectAllwynThomasPas encore d'évaluation

- Currency Exchange RatesDocument37 pagesCurrency Exchange RatesPrachi Gupta100% (1)

- Module 21 PDFDocument10 pagesModule 21 PDFAnonymous unF72wA2JPas encore d'évaluation

- Module 2: Measuring Security Returns and RisksDocument20 pagesModule 2: Measuring Security Returns and Risksjhumli100% (1)

- DRM Chapter 10Document47 pagesDRM Chapter 10bhaduariyaPas encore d'évaluation

- 522 114 Solutions-4Document5 pages522 114 Solutions-4Mruga Pandya100% (3)

- Leverage: Leverage Is That Portion of The Fixed Costs Which Represents A Risk To The Firm. TypesDocument17 pagesLeverage: Leverage Is That Portion of The Fixed Costs Which Represents A Risk To The Firm. Typessameer0725Pas encore d'évaluation

- Risk and ReturnDocument15 pagesRisk and ReturnShimanta EasinPas encore d'évaluation

- iNVESTMENT ANALYSIS & PORTFOLIO MANAGEMENT - PRASSANADocument136 pagesiNVESTMENT ANALYSIS & PORTFOLIO MANAGEMENT - PRASSANAdalaljinal100% (1)

- Financial Derivatives and Risk Management ExplainedDocument1 pageFinancial Derivatives and Risk Management Explainedmm1979Pas encore d'évaluation

- Topic: Markowitz Theory (With Assumptions) IntroductionDocument3 pagesTopic: Markowitz Theory (With Assumptions) Introductiondeepti sharmaPas encore d'évaluation

- Industry and Life Cycle AnalysisDocument31 pagesIndustry and Life Cycle AnalysisASK ME ANYTHING SMARTPHONEPas encore d'évaluation

- Likert Scale: Itemized Rating Scale - in The Itemized Rating Scale, The Respondents Are Provided WithDocument1 pageLikert Scale: Itemized Rating Scale - in The Itemized Rating Scale, The Respondents Are Provided WithDisha groverPas encore d'évaluation

- Present Value of AnnuitiesDocument2 pagesPresent Value of AnnuitiesJai Prakash100% (1)

- Sip Report NJ GroupDocument32 pagesSip Report NJ Groupsarika sharmaPas encore d'évaluation

- Financial Analysis: Alka Assistant Director Power System Training Institute BangaloreDocument40 pagesFinancial Analysis: Alka Assistant Director Power System Training Institute Bangaloregaurang1111Pas encore d'évaluation

- Oaf 624 Course OutlineDocument8 pagesOaf 624 Course OutlinecmgimwaPas encore d'évaluation

- Bank Discount CalculationDocument3 pagesBank Discount CalculationPrakash ViswaPas encore d'évaluation

- A Comprehensive Study On Financial Planning and ForecastingDocument66 pagesA Comprehensive Study On Financial Planning and ForecastingInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- SYBBIDocument13 pagesSYBBIshekhar landagePas encore d'évaluation

- Bond Valuation TheoremsDocument13 pagesBond Valuation Theoremsshivbahadur71% (7)

- Leverage AnalysisDocument29 pagesLeverage AnalysisFALAK OBERAIPas encore d'évaluation

- Capital Structure: Overview of The Financing DecisionDocument68 pagesCapital Structure: Overview of The Financing DecisionHay JirenyaaPas encore d'évaluation

- Chapter 11 - Cost of Capital - Text and End of Chapter Questions PDFDocument63 pagesChapter 11 - Cost of Capital - Text and End of Chapter Questions PDFNbua AhmadPas encore d'évaluation

- Stock ValuvationDocument30 pagesStock ValuvationmsumanraoPas encore d'évaluation

- Project Analysis: Principles of Corporate FinanceDocument16 pagesProject Analysis: Principles of Corporate FinancechooisinPas encore d'évaluation

- Portfolio Construction Models Risk ReturnDocument40 pagesPortfolio Construction Models Risk ReturnjitendraPas encore d'évaluation

- Construction of The Optimal PortfolioDocument4 pagesConstruction of The Optimal PortfolioRavi KhatriPas encore d'évaluation

- Fundamental Analysis GuideDocument12 pagesFundamental Analysis GuidezaryPas encore d'évaluation

- HDFC Balanced Advantage Fund OverviewDocument11 pagesHDFC Balanced Advantage Fund OverviewManasi AjithkumarPas encore d'évaluation

- Forward Auction CreationDocument46 pagesForward Auction CreationAnkushPas encore d'évaluation

- Kota Tutoring: Financing The ExpansionDocument7 pagesKota Tutoring: Financing The ExpansionAmanPas encore d'évaluation

- Chapter 11: The Black-Scholes Analysis: DS SDT SDZDocument6 pagesChapter 11: The Black-Scholes Analysis: DS SDT SDZAmar RaoPas encore d'évaluation

- Binomial Tree Option Pricing ModelDocument22 pagesBinomial Tree Option Pricing ModelXavier Francis S. LutaloPas encore d'évaluation

- Fixed Income Instruments in IndiaDocument90 pagesFixed Income Instruments in Indiaapi-19459467100% (11)

- IFM Question Bank SolvedDocument11 pagesIFM Question Bank SolvedRavindra Babu100% (1)

- Internship Report On Financial Performance Analysis of Jamuna Bank LimitedDocument51 pagesInternship Report On Financial Performance Analysis of Jamuna Bank Limitedsumaiya suma0% (1)

- Topic 55 Binomial Trees - Answers PDFDocument12 pagesTopic 55 Binomial Trees - Answers PDFSoumava PalPas encore d'évaluation

- Ifm-Chapter 9-Forecasting Financial Statement (Slide)Document36 pagesIfm-Chapter 9-Forecasting Financial Statement (Slide)minhhien222Pas encore d'évaluation

- 7 - The Stock MarketDocument20 pages7 - The Stock MarketcihtanbioPas encore d'évaluation

- M09 Gitman50803X 14 MF C09Document56 pagesM09 Gitman50803X 14 MF C09dhfbbbbbbbbbbbbbbbbbhPas encore d'évaluation

- Valuation of Forward ContractDocument13 pagesValuation of Forward ContractVaidyanathan RavichandranPas encore d'évaluation

- Chapter 6 Discounted Cash Flow ValuationDocument27 pagesChapter 6 Discounted Cash Flow ValuationAhmed Fathelbab100% (1)

- Chapter 04 Working Capital 1ce Lecture 050930Document71 pagesChapter 04 Working Capital 1ce Lecture 050930rthillai72Pas encore d'évaluation

- IFM Notes Full Rudramurthy SirDocument96 pagesIFM Notes Full Rudramurthy Sirsagar_us100% (1)

- Module 9 - Discussion For CH 10Document3 pagesModule 9 - Discussion For CH 10mayank.dce123Pas encore d'évaluation

- Revenue (Sales) XXX (-) Variable Costs XXXDocument10 pagesRevenue (Sales) XXX (-) Variable Costs XXXNageshwar SinghPas encore d'évaluation

- Risk and Return FundamentalsDocument3 pagesRisk and Return FundamentalsJustz LimPas encore d'évaluation

- Dynamic Forward HedgingDocument37 pagesDynamic Forward HedgingCDPas encore d'évaluation

- Sapm Work NotesDocument138 pagesSapm Work NotesShaliniPas encore d'évaluation

- P7 ShareDocument16 pagesP7 Sharerafialazmi2004Pas encore d'évaluation

- The Galaxy Dividend Income Growth FundDocument9 pagesThe Galaxy Dividend Income Growth FundKaustav Dey100% (1)

- Chapter 16: Distributions To Shareholders Dividends and Share RepurchasesDocument22 pagesChapter 16: Distributions To Shareholders Dividends and Share RepurchasesAnita EstreraPas encore d'évaluation

- Strategic Financial Management - V - STDocument9 pagesStrategic Financial Management - V - STWorlex zakiPas encore d'évaluation

- Sevilla ChristinaDocument34 pagesSevilla ChristinaAshlesh MangrulkarPas encore d'évaluation

- Annual Report - Students' ParliamentDocument50 pagesAnnual Report - Students' ParliamentAshlesh MangrulkarPas encore d'évaluation

- Lex CaseDocument8 pagesLex CaseAshlesh MangrulkarPas encore d'évaluation

- TeamAchieve XLRI EXL Acumen 2018 Case DataDocument327 pagesTeamAchieve XLRI EXL Acumen 2018 Case DataAshlesh MangrulkarPas encore d'évaluation

- BSC Basics & Strategy MapDocument15 pagesBSC Basics & Strategy MapAshlesh MangrulkarPas encore d'évaluation

- References-Ashlesh Mangrulkar Aditya Anand XLRIDocument1 pageReferences-Ashlesh Mangrulkar Aditya Anand XLRIAshlesh MangrulkarPas encore d'évaluation

- Objective: Consumer Behaviour Towards Food Delivery ServicesDocument2 pagesObjective: Consumer Behaviour Towards Food Delivery ServicesAshlesh MangrulkarPas encore d'évaluation

- BSC - BM & HRM 2018-20 - Introduction (S 1&2)Document33 pagesBSC - BM & HRM 2018-20 - Introduction (S 1&2)Ashlesh MangrulkarPas encore d'évaluation

- Ethics of Business Turnaround Mangement: Global Trade War (Us - China)Document12 pagesEthics of Business Turnaround Mangement: Global Trade War (Us - China)Ashlesh MangrulkarPas encore d'évaluation

- Invict AsDocument2 pagesInvict AsAshlesh MangrulkarPas encore d'évaluation

- ContentsDocument1 pageContentsAshlesh MangrulkarPas encore d'évaluation

- MM2 Course Focuses Marketing ActivitiesDocument6 pagesMM2 Course Focuses Marketing ActivitiesAshlesh MangrulkarPas encore d'évaluation

- Smu Lkygbpc IntroDocument25 pagesSmu Lkygbpc IntroAshlesh MangrulkarPas encore d'évaluation

- 68 Product Life Cycle PowerpointDocument2 pages68 Product Life Cycle PowerpointAshlesh MangrulkarPas encore d'évaluation

- ContentsDocument1 pageContentsAshlesh MangrulkarPas encore d'évaluation

- MM2 Course Focuses Marketing ActivitiesDocument6 pagesMM2 Course Focuses Marketing ActivitiesAshlesh MangrulkarPas encore d'évaluation

- Why visit a museum? Benefits of the experienceDocument1 pageWhy visit a museum? Benefits of the experienceAshlesh MangrulkarPas encore d'évaluation

- New Doc 2019-01-19 22.38.43 PDFDocument2 pagesNew Doc 2019-01-19 22.38.43 PDFAshlesh MangrulkarPas encore d'évaluation

- Sales Forecast TruEarthDocument7 pagesSales Forecast TruEarthAshlesh MangrulkarPas encore d'évaluation

- The Business Model CanvasDocument4 pagesThe Business Model CanvasAshlesh MangrulkarPas encore d'évaluation

- Metaheuristics For Combinatorial Optimization: Ajith Kumar JDocument15 pagesMetaheuristics For Combinatorial Optimization: Ajith Kumar JAshlesh MangrulkarPas encore d'évaluation

- The Business Model Canvas: A Visual Template for Strategic Business PlanningDocument4 pagesThe Business Model Canvas: A Visual Template for Strategic Business PlanningAshlesh MangrulkarPas encore d'évaluation

- SAP Setup GuideDocument46 pagesSAP Setup GuideAbdoulaye AwPas encore d'évaluation

- Socrates - Quarter 2 ReportDocument11 pagesSocrates - Quarter 2 ReportAshlesh MangrulkarPas encore d'évaluation

- Installation SAPGUI 720 730 740 For MacOSXDocument10 pagesInstallation SAPGUI 720 730 740 For MacOSXAshlesh MangrulkarPas encore d'évaluation

- Hamluther2014 PfmhousingDocument11 pagesHamluther2014 PfmhousingAshlesh MangrulkarPas encore d'évaluation

- ManzanaDocument1 pageManzanaAshlesh MangrulkarPas encore d'évaluation

- Ev Iitbhu QuizDocument1 pageEv Iitbhu QuizAshlesh MangrulkarPas encore d'évaluation

- MIS Raj EditDocument9 pagesMIS Raj EditAshlesh MangrulkarPas encore d'évaluation

- Naisoso ANZ FinanceDocument2 pagesNaisoso ANZ FinanceRupam KumarPas encore d'évaluation

- Point and Figure Charts PDFDocument5 pagesPoint and Figure Charts PDFCarlos Daniel Rodrigo CPas encore d'évaluation

- INDONESIAN FINANCIAL MARKET DEVELOPMENTDocument10 pagesINDONESIAN FINANCIAL MARKET DEVELOPMENT005Silviana MSBisdigAPas encore d'évaluation

- Factors Affecting The Net Interest Margin of Commercial Bank of EthiopiaDocument12 pagesFactors Affecting The Net Interest Margin of Commercial Bank of EthiopiaJASH MATHEWPas encore d'évaluation

- RP @sebi GuidelinesDocument8 pagesRP @sebi GuidelinesGouri ShankarPas encore d'évaluation

- Hullofod 9 Emultiplechoicequestionsandanswersch 01 DocDocument7 pagesHullofod 9 Emultiplechoicequestionsandanswersch 01 DocfawefwaePas encore d'évaluation

- Byron Wien and Joe Zidle Announce Ten Surprises For 2020Document1 pageByron Wien and Joe Zidle Announce Ten Surprises For 2020pan0Pas encore d'évaluation

- Capital Market LineDocument2 pagesCapital Market Linegauravjindal1Pas encore d'évaluation

- EFB201 Fixed Income and Equity Markets Part B TutDocument4 pagesEFB201 Fixed Income and Equity Markets Part B Tuthowunfung0705Pas encore d'évaluation

- Chapter 8 Summary Book Financial Markets and Institutions PDFDocument9 pagesChapter 8 Summary Book Financial Markets and Institutions PDFAnonymous sR5QAqGhPas encore d'évaluation

- Personal Loan For Bad Credit Score - Loans For You in Difficult OccasionsDocument3 pagesPersonal Loan For Bad Credit Score - Loans For You in Difficult OccasionsNguyen21HassanPas encore d'évaluation

- Financial System and Financial MarketDocument10 pagesFinancial System and Financial MarketPulkit PareekPas encore d'évaluation

- Handout For Women Who Blockchain Breakout SessionDocument4 pagesHandout For Women Who Blockchain Breakout SessionRene LubovPas encore d'évaluation

- Bombay Stock Exchange - WikipediaDocument8 pagesBombay Stock Exchange - Wikipediaramthecharm_46098467Pas encore d'évaluation

- TOBIN'S Q THEORYDocument38 pagesTOBIN'S Q THEORYas111320034667Pas encore d'évaluation

- Chapter 018Document55 pagesChapter 018Siti Nor Azliza AliPas encore d'évaluation

- December 2013Document4 pagesDecember 2013Heather PagePas encore d'évaluation

- Ethics in Business DisciplinesDocument16 pagesEthics in Business DisciplinesSonal TiwariPas encore d'évaluation

- Candlestick Patterns Cheat SheetDocument1 pageCandlestick Patterns Cheat SheetSoleh Muhammad100% (1)

- First Purchase Agreement GRAMDocument40 pagesFirst Purchase Agreement GRAMFrank TopbottomPas encore d'évaluation

- Lazy River Scalping StrategyDocument10 pagesLazy River Scalping StrategyPanayiotis Peppas0% (1)

- Winter09 3P96 Midterm1 SolutionDocument5 pagesWinter09 3P96 Midterm1 SolutionAdnan Hassan100% (2)

- Designing A Hybrid AI System As A Forex Trading Decision Support ToolDocument5 pagesDesigning A Hybrid AI System As A Forex Trading Decision Support Toolhamed mokhtariPas encore d'évaluation

- MAVI Investor Presentation - DecemberDocument34 pagesMAVI Investor Presentation - DecemberSarah Princess RahmanPas encore d'évaluation

- Stock and Commodity MarketsDocument63 pagesStock and Commodity MarketsAryan SinghPas encore d'évaluation

- IFRS 5 Non-Current Assets Held For Sale and Discontinued OperationsDocument12 pagesIFRS 5 Non-Current Assets Held For Sale and Discontinued Operationsanon_419651076Pas encore d'évaluation

- What Is Financial Mathematics?Document52 pagesWhat Is Financial Mathematics?BoladePas encore d'évaluation

- Study of Perception of Retail Investors in India Over Bank NiftyDocument15 pagesStudy of Perception of Retail Investors in India Over Bank Niftygaurav sharmaPas encore d'évaluation

- Kholipah & Suryandari (2019)Document14 pagesKholipah & Suryandari (2019)Riyandi JoshuaPas encore d'évaluation

- Bre-X FullcaseDocument18 pagesBre-X FullcaseDeepti Suresh MhaskePas encore d'évaluation