Académique Documents

Professionnel Documents

Culture Documents

Types of Losses

Transféré par

Cindy-chan DelfinTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Types of Losses

Transféré par

Cindy-chan DelfinDroits d'auteur :

Formats disponibles

LOSSES

Delfin, Cindy

Garcia, Rosie

Gerano, Paul

Nava, Patrice Marie

Patricio, Justine

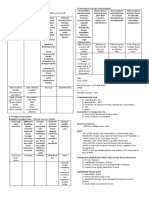

What are the types of losses in Marine Insurance?

1. Partial Loss

2. Constructive Total Loss

3. Actual Total Loss

What is a partial loss?

"Every loss which is not total is partial." (Section 130, Insurance Code of the Philippines)

What is an actual loss?

An actual total loss is caused by:

1. A total destruction of the thing insured;

2. The irretrievable loss of the thing by sinking, or by being broken up;

3. Any damage to the thing which renders it valueless to the owner for the purpose for which he held it;

or

4. Any other event which effectively deprives the owner of the possession, at the port of destination, of

the thing insured. (Section 132, Insurance Code of the Philippines)

What is a constructive total loss?

It is sometimes referred to as a technical total loss. As a consequence, it gives the insured a right to

abandon. Abandonment is necessary in order to recover for a total loss.

A person insured by a contract of marine insurance may abandon the thing insured, or any particular

portion thereof separately valued by the policy, or otherwise separately insured, and recover for a total loss

thereof, when the cause of the loss is a peril insured against:

1. If more than three-fourths (¾) thereof in value is actually lost, or would have to be expended to

recover it from the peril;

2. If it is injured to such an extent as to reduce its value more than three-fourths (¾);

3. If the thing insured is a ship, and the contemplated voyage cannot be lawfully performed without

incurring either an expense to the insured of more than three-fourths (¾) the value of the thing

abandoned or a risk which a prudent man would not take under the circumstances; or

4. If the thing insured, being cargo or freightage, and the voyage cannot be performed, nor another ship

procured by the master, within a reasonable time and with reasonable diligence, to forward the

cargo, without incurring the like expense or risk mentioned in the preceding subparagraph. But

freightage cannot in any case be abandoned unless the ship is also abandoned. (Section 141,

Insurance Code of the Philippines)

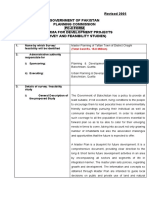

What is abandonment?

Abandonment is the act of the insured by which, after a constructive total loss, he declares the

relinquishment to the insurer of his interest in the thing insured. It must satisfy the following:

5. An abandonment must be made within a reasonable time after receipt of reliable information of the loss,

but where the information is of a doubtful character, the insured is entitled to a reasonable time to make

inquiry.

6. An abandonment must be neither partial nor conditional.

7. Abandonment is made by giving notice thereof to the insurer, which may be done orally, or in writing:

Provided, That if the notice be done orally, a written notice of such abandonment shall be submitted

within seven (7) days from such oral notice.

8. A notice of abandonment must be explicit, and must specify the particular cause of the abandonment, but

need state only enough to show that there is probable cause therefor, and need not be accompanied with

proof of interest or of loss. (Sections 142-146, Insurance Code of the Philippines)

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Caterpillar Cat 330L EXCAVATOR (Prefix 8FK) Service Repair Manual (8FK00001 and Up)Document27 pagesCaterpillar Cat 330L EXCAVATOR (Prefix 8FK) Service Repair Manual (8FK00001 and Up)kfm8seuuduPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Jurists Suggested Tax Law AnswersDocument10 pagesJurists Suggested Tax Law AnswersCindy-chan DelfinPas encore d'évaluation

- Tax Reviewer Bar2021Document102 pagesTax Reviewer Bar2021Cindy-chan DelfinPas encore d'évaluation

- Conflict of Laws Notes - Agpalo Book PDFDocument40 pagesConflict of Laws Notes - Agpalo Book PDFblueberry712100% (19)

- Notes On SuccessionDocument239 pagesNotes On SuccessionCindy-chan Delfin0% (1)

- The 21 Irrefutable Laws of Leadership by John MaxwellDocument10 pagesThe 21 Irrefutable Laws of Leadership by John MaxwellRemus Romano ReyesPas encore d'évaluation

- Tool Catalog Ei18e-11020Document370 pagesTool Catalog Ei18e-11020Marcelo Diesel85% (13)

- Paper 19 Revised PDFDocument520 pagesPaper 19 Revised PDFAmey Mehta100% (1)

- Code of Professional ResponsibilityDocument9 pagesCode of Professional ResponsibilitybbyshePas encore d'évaluation

- RA 8042 and RA 10022 ComparedDocument37 pagesRA 8042 and RA 10022 ComparedCj GarciaPas encore d'évaluation

- Employee Training and DevelopmentDocument33 pagesEmployee Training and DevelopmentMoogii50% (2)

- Overview of The Ip SystemDocument54 pagesOverview of The Ip SystemCindy-chan DelfinPas encore d'évaluation

- Vs. Honorable Court of Appeals, RepublicDocument58 pagesVs. Honorable Court of Appeals, RepublicCindy-chan DelfinPas encore d'évaluation

- R.A. - 7832 (Anti Pilferage Act of 1994)Document5 pagesR.A. - 7832 (Anti Pilferage Act of 1994)Vert WheelerPas encore d'évaluation

- Identification 2Document72 pagesIdentification 2Cindy-chan DelfinPas encore d'évaluation

- IPC Patents Presentation 2016Document99 pagesIPC Patents Presentation 2016Cindy-chan DelfinPas encore d'évaluation

- Dr. Gregorio Y. Zara: Inventor of The Two-Way Television Telephone or VideophoneDocument6 pagesDr. Gregorio Y. Zara: Inventor of The Two-Way Television Telephone or VideophoneCindy-chan DelfinPas encore d'évaluation

- Death by Ekkxplosion and Thermal InjhjkhkhjuriesDocument50 pagesDeath by Ekkxplosion and Thermal InjhjkhkhjuriesBarry BrananaPas encore d'évaluation

- Corporate TaxDocument5 pagesCorporate TaxCindy-chan DelfinPas encore d'évaluation

- Alfredo M. Anos Sr. and The 3-In-1 Ambulance: Precious Hope H. Morante ReporterDocument8 pagesAlfredo M. Anos Sr. and The 3-In-1 Ambulance: Precious Hope H. Morante ReporterCindy-chan DelfinPas encore d'évaluation

- Answers To Questions On Patents: "Foundation Course On IP"Document31 pagesAnswers To Questions On Patents: "Foundation Course On IP"Cindy-chan DelfinPas encore d'évaluation

- Family Alcohol DrugsDocument37 pagesFamily Alcohol DrugsCindy-chan DelfinPas encore d'évaluation

- Intro, CSIDocument37 pagesIntro, CSIianmaranon2Pas encore d'évaluation

- INSURANCE LOSS NOTICEDocument5 pagesINSURANCE LOSS NOTICECindy-chan DelfinPas encore d'évaluation

- Death by Asphyxia: Dr. G. Villaret-Matejka College of Law University of San AgustinDocument54 pagesDeath by Asphyxia: Dr. G. Villaret-Matejka College of Law University of San AgustinCindy-chan DelfinPas encore d'évaluation

- Philippines Taxation GuideDocument8 pagesPhilippines Taxation GuideCindy-chan DelfinPas encore d'évaluation

- Aspect of DeathDocument64 pagesAspect of DeathCindy-chan DelfinPas encore d'évaluation

- Significant Rulings in Civil Law 2Document41 pagesSignificant Rulings in Civil Law 2BadronDimangadapPas encore d'évaluation

- Ballistics Classification and EffectsDocument85 pagesBallistics Classification and EffectsCindy-chan DelfinPas encore d'évaluation

- The Law Pertaining To The State and Its Relationship With Its CitizensDocument110 pagesThe Law Pertaining To The State and Its Relationship With Its CitizensCindy-chan DelfinPas encore d'évaluation

- Law on Sales Contract DeliveryDocument53 pagesLaw on Sales Contract DeliveryCindy-chan DelfinPas encore d'évaluation

- Civil Law Exam NotesDocument11 pagesCivil Law Exam NotesCindy-chan DelfinPas encore d'évaluation

- Special ContractsDocument517 pagesSpecial ContractsCindy-chan DelfinPas encore d'évaluation

- Co-Ownership, Partition, Possession: Property Lecture 4 - 2019Document18 pagesCo-Ownership, Partition, Possession: Property Lecture 4 - 2019Cindy-chan DelfinPas encore d'évaluation

- Matrix of Selected Crimes - Scanned SearchableDocument31 pagesMatrix of Selected Crimes - Scanned SearchableCindy-chan DelfinPas encore d'évaluation

- Jurists Human Relations NotesDocument2 pagesJurists Human Relations NotesCindy-chan DelfinPas encore d'évaluation

- TT1 2lecture SpinningDocument29 pagesTT1 2lecture SpinninghaiPas encore d'évaluation

- Chapter-5-Entrepreneurial-Marketing Inoceno de Ocampo EvangelistaDocument63 pagesChapter-5-Entrepreneurial-Marketing Inoceno de Ocampo EvangelistaMelgrey InocenoPas encore d'évaluation

- Refractomax 521 Refractive Index Detector: FeaturesDocument2 pagesRefractomax 521 Refractive Index Detector: FeaturestamiaPas encore d'évaluation

- Dhilshahilan Rajaratnam: Work ExperienceDocument5 pagesDhilshahilan Rajaratnam: Work ExperienceShazard ShortyPas encore d'évaluation

- OspndDocument97 pagesOspndhoangdo11122002Pas encore d'évaluation

- Kitchen in The Food Service IndustryDocument37 pagesKitchen in The Food Service IndustryTresha Mae Dimdam ValenzuelaPas encore d'évaluation

- JESTEC TemplateDocument11 pagesJESTEC TemplateMuhammad FakhruddinPas encore d'évaluation

- In Gov cbse-SSCER-191298202020 PDFDocument1 pageIn Gov cbse-SSCER-191298202020 PDFrishichauhan25Pas encore d'évaluation

- PC-II Taftan Master PlanDocument15 pagesPC-II Taftan Master PlanMunir HussainPas encore d'évaluation

- Rural Perception of SUV CarsDocument29 pagesRural Perception of SUV CarsritusinPas encore d'évaluation

- Notes and Questions On-Op AmpDocument11 pagesNotes and Questions On-Op AmpjitenPas encore d'évaluation

- Mphasis Placement PaperDocument3 pagesMphasis Placement PapernagasaikiranPas encore d'évaluation

- CO2 System OperationDocument19 pagesCO2 System OperationJoni NezPas encore d'évaluation

- Stock Futures Are Flat in Overnight Trading After A Losing WeekDocument2 pagesStock Futures Are Flat in Overnight Trading After A Losing WeekVina Rahma AuliyaPas encore d'évaluation

- Patient Safety IngDocument6 pagesPatient Safety IngUlfani DewiPas encore d'évaluation

- Priceliost Ecatalog 2021 Div. DiagnosticDocument2 pagesPriceliost Ecatalog 2021 Div. Diagnosticwawan1010Pas encore d'évaluation

- ADVOCACY AND LOBBYING NDocument7 pagesADVOCACY AND LOBBYING NMwanza MaliiPas encore d'évaluation

- Catalog CONSUDocument19 pagesCatalog CONSUVăn Nam PhạmPas encore d'évaluation

- Motorola l6Document54 pagesMotorola l6Marcelo AriasPas encore d'évaluation

- z2OrgMgmt FinalSummativeTest LearnersDocument3 pagesz2OrgMgmt FinalSummativeTest LearnersJade ivan parrochaPas encore d'évaluation

- Air Purification Solution - TiPE Nano Photocatalyst PDFDocument2 pagesAir Purification Solution - TiPE Nano Photocatalyst PDFPedro Ortega GómezPas encore d'évaluation

- Cough: by Dr. Meghana Patil (Intern Batch 2016)Document24 pagesCough: by Dr. Meghana Patil (Intern Batch 2016)Meghana PatilPas encore d'évaluation

- 1st WeekDocument89 pages1st Weekbicky dasPas encore d'évaluation

- SOLUTIONS : Midterm Exam For Simulation (CAP 4800)Document14 pagesSOLUTIONS : Midterm Exam For Simulation (CAP 4800)Amit DostPas encore d'évaluation