Académique Documents

Professionnel Documents

Culture Documents

NPS Transaction Statement For Tier I Account

Transféré par

Akash RahangdaleTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

NPS Transaction Statement For Tier I Account

Transféré par

Akash RahangdaleDroits d'auteur :

Formats disponibles

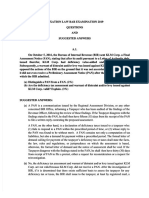

NPS Transaction Statement for Tier I Account

Statement Period: From April 01, 2019 to June 30, 2019 Statement Generation Date : July 03, 2019

PRAN 110036847316 Registration Date 17-Dec-15

Subscriber Name SHRI AKASH CHHABILAL RAHANGDALE Tier I Status Active

BANK OF INDIA Tier II Status Not Activated

NEAR TAHASIL OFFICE Scheme Choice CORPORATE STANDARD

KORCHI CBO Registration No 6500266

Address CBO Name BANK OF INDIA

KORCHI DIST GADCHIROLI

C/5, G-BLOCK, STAR HOUSE

MAHARASHTRA - 441209 CBO Address BANDRA KURLA COMPLEX, BANDRA EAST

MUMBAI, 400051

INDIA

CHO Registration No 5500261

Mobile Number +919405782120 CHO Name BANK OF INDIA

Email ID AKASHRAHA17@GMAIL.COM C/5, G-BLOCK, STAR HOUSE

CHO Address BANDRA KURLA COMPLEX, BANDRA EAST

IRA Status IRA compliant MUMBAI, 400051

Tier I Nominee Name/s Percentage

NIRMALA CHHABILAL RAHANGDALE 100%

Summary

The total contribution to your pension account till June 30, 2019 was Rs. 258514.48.

The total value of your contributions as on June 30, 2019 was Rs. 315201.48.

Your contributions have earned a return of Rs.56687.00 till June 30, 2019.

Current Scheme Preference

Investment Option Scheme Details Percentage

Scheme 1 SBI PENSION FUNDS PVT. LTD. SCHEME - CORPORATE-CG 100.00%

Investment Details Summary

Withdrawal/

Total Contribution Notional Gain / deduction in units

No of Contribution Total Withdrawal Current Valuation Loss Return of towards

(Rs) (Rs) (Rs) (Rs) Invesment(XIRR) intermediary

charges (Rs.)

258514.48 44 0.0000 315201.48 56687.00 9.67% 45.72

Investment Details - Scheme Wise Summary

Total Net Latest NAV Value at NAV Unrealized Gain /

PFM/Scheme Contribution Total Units Loss

(Rs) Date (Rs) (Rs)

SBI PENSION FUNDS PVT. LTD. SCHEME - 18.8571

257873.75 16715.2684 315201.48 57327.73

CORPORATE-CG 28-Jun-2019

Total 257873.75 315201.48 57327.73

Changes made during the selected period

No change affected in this period

Contribution/ Redemption Details

Contribution

Date Particulars Uploaded By Employee Employer's Total

Contribution Contribution (Rs)

(Rs) (Rs)

01-Apr-2019 Opening balance 2,47,717.10

02-May- For April, 2019 Bank of India (5000424), 2737.90 2737.90 5475.80

2019

03-Jun- For May, 2019 Bank of India (5000424), 2660.79 2660.79 5321.58

2019

30-Jun-2019 Closing Balance at NSDL CRA 2,58,514.48

Transaction Details

SBI PENSION FUNDS PVT. LTD. SCHEME -

Withdrawal/ deduction in CORPORATE-CG

Date Particulars units towards

intermediary charges Amount (Rs)

(Rs.) Units

NAV (Rs)

01-Apr-2019 Opening Balance 16130.7240

(45.72)

06-Apr-2019 Billing for Q4, 2018-2019 (45.72) (2.5272)

18.0910

5475.80

02-May-2019 By Contribution for April,2019 302.4434

18.1052

5321.58

03-Jun-2019 By Contribution for May,2019 284.6282

18.6966

30-Jun-2019 Closing Balance at NSDL CRA 257873.75 16715.2684

Notes

1. The 'Investment Details' section gives an overall status of the total contribution processed under the account and the returns accrued

2. 'Notional Gain / Loss' indicates the overall gain or loss after factoring for the withdrawals processed in the account.

3. 'Total Net Contributions' indicates the cost of units currently held in the PRAN account

4. 'Unrealized Gain / Loss' indicates the gain / loss in the account for the current units balance in the account.

Returns based on Inflows' gives the annualized effective compounded return rate in PRAN account and is calculated using the formula of XIRR. The

5. calculation is done considering all the contribution / redemptions processed in PRAN account since inception and the latest valuation of the

investments. The transactions are sorted based on the NAV date.

6.

'Changes made during the selected period' indicates all the change requests processed in PRAN account during the period for which the

statement is generated

The section 'Contribution / Redemption Details' gives the details of the contributions and redemption processed in subscribers' account during the

7. period for which the statement is generated. While contribution amount indicates the amount invested in subscribers account, the redemption

amount indicates the cost of units redeemed from the account. The cost of units is calculated on a First-In-First-Out (FIFO) basis. The details are

sorted based on date when the transaction is posted in PRAN account, which may / may not be the date for allotment of the NAV.

'Transaction Details' gives the units allotted under different schemes / asset classes for each of the contributions processed in subscribers'

8. account during the period for which the statement is generated. It also contains units debited from the account for redemption and rectification. The

details are sorted based on date when the transaction is posted in PRAN account, which may / may not be the date for allotment of the NAV.

The Amount in the Closing Balance under the section 'Transaction Details' refers to the Units Balance in the books of NSDL CRA and it gives the

9. cost of investment of the balance units and not a sum total of all contributions and withdrawals. The cost of units is calculated on a First-In-First-Out

(FIFO) basis.

For transactions with the remarks "To Unit Redemption", the cost of units redeemed are adjusted against the total contribution in the Investment

10. Details section. Further, the cost of units is calculated on a First-In-First-Out (FIFO) basis. For calculating the 'Returns based on Inflows', the actual

redemption value corresponding to the units redeemed has been considered.

11. The Transaction statement is dynamic. The value and other computations in the Transaction statement depend upon the generation date.

12. The above returns are calculated based on scheme NAVs and the securities held under the scheme portfolio are valued on mark to market basis

and are subject to change on NAV fluctuations.

If you are an employee or if you are self-employed , you will be able to avail of deduction on contribution made from your taxable income to the extent

of (u/s 80 CCD (1) of income Tax Act, 1961)

- 10% of salary (Basic + DA ) - if you are salaried employee

- 10% of your gross income - if you are self-employed

However, please note that the maximum deduction from your taxable income is limited to RS.1.50 lac, as permitted under Sec 80 CCE of the

13.

Income Tax Act.

Further, an additional deduction from your taxable income to the extent of Rs. 50,000/- is available only for contribution in NPS u/s Sec. 80 CCD (1B).

To give an example, your salary is Rs.15 lac per annum. On contribution of Rs. 2 lac, you can avail:

Deduction under Sec. 80 CCD (1) - Rs. 1.50 lac

Deduction under Sec. 80 CCD (1B) - Rs. 0.50 lac

Total deduction - Rs. 2.00 lac

Also note that your employer's contribution upto 10% of your salary is fully deductible from your taxable income.

14. Best viewed in Internet Explorer 9.0 & above or Mozilla Firefox Ver 3 & above with a resolution of 1024 X 768.

Retired life ka sahara, NPS hamara

Home | Contact Us | System Configuration / Best Viewed | Entrust Secured | Privacy Policy | Grievance Redressal Policy

Vous aimerez peut-être aussi

- National Pension Scheme (NPS) ReceiptDocument1 pageNational Pension Scheme (NPS) ReceiptHarish Ghorpade59% (17)

- No VBVDocument2 pagesNo VBVJuan C Garzn89% (9)

- Payment ReceiptDocument1 pagePayment ReceiptAnjan Debnath75% (4)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAmit Gupta50% (2)

- Home Loan Provisional Certificate ICICI 2019-20Document1 pageHome Loan Provisional Certificate ICICI 2019-20nikhil80% (5)

- PDFDocument1 pagePDFVENKAT RAO0% (1)

- Jul 2021 Payment - ReceiptDocument1 pageJul 2021 Payment - ReceiptSandeepNayak0% (2)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRaj Bharath33% (3)

- Medical PolicyDocument1 pageMedical PolicyAshok Dangwal100% (5)

- PDFDocument5 pagesPDFSandip SelokarPas encore d'évaluation

- NPS Contribution 2019 20 PDFDocument1 pageNPS Contribution 2019 20 PDFbindhu lingalaPas encore d'évaluation

- Nps 2021Document3 pagesNps 2021Joyanto Saha100% (2)

- National Pension SchemeDocument1 pageNational Pension SchemeHarish Ghorpade67% (6)

- Interest CertificateDocument1 pageInterest CertificateSanjay kumarPas encore d'évaluation

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRajakumar Reddy25% (4)

- Payment ReceiptDocument1 pagePayment ReceiptPranay Kumar0% (1)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRahul PanwarPas encore d'évaluation

- Interest CertificateDocument1 pageInterest Certificateadi0077Pas encore d'évaluation

- PremiumDocument2 pagesPremiumapsec0% (2)

- Max Life InsuranceDocument1 pageMax Life InsuranceLohith Labhala100% (1)

- PPF e Receipt PDFDocument1 pagePPF e Receipt PDFManoj KumarPas encore d'évaluation

- Loan Certificate From HDFCDocument1 pageLoan Certificate From HDFCAyaan AhmedPas encore d'évaluation

- HDFC Ergo Policy Renewal 2023 SelfDocument5 pagesHDFC Ergo Policy Renewal 2023 SelfGopivishnu KanchiPas encore d'évaluation

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferencePullakiranreddy ReddyPas encore d'évaluation

- HDFC ERGO General Insurance Company LimitedDocument5 pagesHDFC ERGO General Insurance Company LimitedChiranjib PatraPas encore d'évaluation

- Icici Premium Paid Certificate SampleDocument1 pageIcici Premium Paid Certificate SampleRahul Kandiyal100% (1)

- Health Insurance Premium Receipt-RaviDocument2 pagesHealth Insurance Premium Receipt-RaviSanjay Balamurthy100% (1)

- Birla Sun Life PremiumDocument1 pageBirla Sun Life PremiumBALAJI NAIK MudavatuPas encore d'évaluation

- 80D CertificateDocument1 page80D CertificateD Kesava Rao0% (1)

- Premium Paid Certificate Sandip PatilDocument2 pagesPremium Paid Certificate Sandip Patilbebo03450% (2)

- NPS Transaction Statement For Tier I AccountDocument2 pagesNPS Transaction Statement For Tier I AccountthilaksafaryPas encore d'évaluation

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceGaurav SrivastavPas encore d'évaluation

- Housing Loan (244675100001380) Final CertificateDocument1 pageHousing Loan (244675100001380) Final CertificateGautamChakrabortyPas encore d'évaluation

- NPS Transaction Statement For Tier II Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier II Account: Current Scheme PreferenceVikash ChetiwalPas encore d'évaluation

- NPS Transaction Statement For Tier II Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier II Account: Current Scheme PreferencePradeep KumarPas encore d'évaluation

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme Preferencekids funPas encore d'évaluation

- PPFDocument1 pagePPFArnab RoyPas encore d'évaluation

- Repay CertificateDocument1 pageRepay Certificateacrajesh50% (2)

- Repay Certificate - LIC HFL - Customer PortalDocument1 pageRepay Certificate - LIC HFL - Customer Portaltechgovind33% (3)

- Enrollment Agreement FormDocument2 pagesEnrollment Agreement FormRicky SabinoPas encore d'évaluation

- Electricity Bill ReceiptDocument1 pageElectricity Bill ReceiptANKESH SHRIVASTAVA100% (2)

- Telephone Bill AugDocument3 pagesTelephone Bill AugmayureshjanorkarPas encore d'évaluation

- 2019 Bar Questions and Suggested Answers PDFDocument28 pages2019 Bar Questions and Suggested Answers PDFKarl Shariff Ajihil100% (5)

- Centralrecordkeepingagency: National Pension System Transaction Statement - Tier IDocument2 pagesCentralrecordkeepingagency: National Pension System Transaction Statement - Tier Izuheb0% (1)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme Preferencevikas_2Pas encore d'évaluation

- NPS Transaction Statement For Tier I AccountDocument4 pagesNPS Transaction Statement For Tier I AccountabhishekPas encore d'évaluation

- NPS Transaction Statement For Tier I AccountDocument4 pagesNPS Transaction Statement For Tier I AccountabhishekPas encore d'évaluation

- PDFDocument3 pagesPDFKritarth KapoorPas encore d'évaluation

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceLaya DonthulaPas encore d'évaluation

- NPS Transaction Statement For Tier I AccountDocument3 pagesNPS Transaction Statement For Tier I Accountvikas0207ikash0% (1)

- Premium CertificateDocument2 pagesPremium CertificateSowmalya Mandal100% (4)

- Payment ReceiptDocument1 pagePayment Receiptnizamsagar tsgenco75% (4)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceNIkhil GuptaPas encore d'évaluation

- PPF E-Receipt: Reference Number Name of Account Holder PPF Account Number Transaction Date RemarksDocument1 pagePPF E-Receipt: Reference Number Name of Account Holder PPF Account Number Transaction Date Remarksanurag srivastavaPas encore d'évaluation

- Housing Loan (0363675100002233) Final Certificate - 2016-17 PDFDocument1 pageHousing Loan (0363675100002233) Final Certificate - 2016-17 PDFsikha singh50% (2)

- Naresh Kumar: Customer Care CenterDocument2 pagesNaresh Kumar: Customer Care Centernaresh2912275% (4)

- PPFCertificateSikha PDFDocument1 pagePPFCertificateSikha PDFsikha singhPas encore d'évaluation

- Mediclaim Premium Receipt 2018Document1 pageMediclaim Premium Receipt 2018faizahamed111100% (1)

- Premium Paid Certificate: Date: 14-SEP-20 16Document1 pagePremium Paid Certificate: Date: 14-SEP-20 16Koushik DuttaPas encore d'évaluation

- Interest CertificateDocument1 pageInterest Certificatevipin mishraPas encore d'évaluation

- NPS Transaction Statement For Tier I AccountDocument2 pagesNPS Transaction Statement For Tier I AccountABhishekPas encore d'évaluation

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAbburi Kumar AshokPas encore d'évaluation

- 1516352333813Document3 pages1516352333813gullipalli srinivasa raoPas encore d'évaluation

- Nps 123Document3 pagesNps 123Md Sharma SharmaPas encore d'évaluation

- NPS Transaction Statement For Tier I AccountDocument3 pagesNPS Transaction Statement For Tier I AccountY. T. RPas encore d'évaluation

- Notes Sources of Government RevenueDocument2 pagesNotes Sources of Government RevenueBhavina Joshi IPSAPas encore d'évaluation

- Income From Business and ProfessionDocument24 pagesIncome From Business and ProfessionTaher JamilPas encore d'évaluation

- IMPS FAQsBankers PDFDocument5 pagesIMPS FAQsBankers PDFAccounting & TaxationPas encore d'évaluation

- Debit Mandate Form NACH / ECS / DIRECT DEBIT: Mthly Qtly H-Yrly Yrly As & When PresentedDocument1 pageDebit Mandate Form NACH / ECS / DIRECT DEBIT: Mthly Qtly H-Yrly Yrly As & When PresentedPerumal sPas encore d'évaluation

- Pajak InternasionalDocument60 pagesPajak InternasionalTutunKasepPas encore d'évaluation

- Responsibilities of TaxpayersDocument10 pagesResponsibilities of Taxpayers'Aisyah Roselan0% (1)

- Call in AdvanceDocument2 pagesCall in AdvanceOberoi MalhOtra MeenakshiPas encore d'évaluation

- Taco 0067596020700018Document1 pageTaco 0067596020700018Meera CompanyPas encore d'évaluation

- CIR vs. Procter & Gamble, G.R. No. L-66838, April 15, 1988Document5 pagesCIR vs. Procter & Gamble, G.R. No. L-66838, April 15, 1988Lou Ann AncaoPas encore d'évaluation

- Sticker Retour 2104694237 0Document2 pagesSticker Retour 2104694237 0Stefan OglinzanuPas encore d'évaluation

- Sadaki Perth Class Registration 1Document2 pagesSadaki Perth Class Registration 1Anonymous O3igFXhPas encore d'évaluation

- State Bank of India - Personal BankingDocument2 pagesState Bank of India - Personal BankingeSupport GlobalIT Business Solutions LimitedPas encore d'évaluation

- Data DictionaryDocument2 pagesData DictionarysailushaPas encore d'évaluation

- Rutendo KamukonoDocument3 pagesRutendo KamukonoHazel ChatsPas encore d'évaluation

- Account Number: 06290010022785770016 Account Title: IRUM ZULNOORAIN Currency: PKR Opening Balance: 1,235,418.27 Closing Balance: 454.87Document7 pagesAccount Number: 06290010022785770016 Account Title: IRUM ZULNOORAIN Currency: PKR Opening Balance: 1,235,418.27 Closing Balance: 454.87MentoriansPas encore d'évaluation

- Power of Commissioner Penalties PDFDocument14 pagesPower of Commissioner Penalties PDFKomal JaiswalPas encore d'évaluation

- Oluwale AdebayoDocument1 pageOluwale Adebayowhitneydemetria007Pas encore d'évaluation

- Tender Review and Documents ChecklistDocument2 pagesTender Review and Documents ChecklistsugamsehgalPas encore d'évaluation

- SampleDocument13 pagesSampleDodger AmarinePas encore d'évaluation

- Taxation Law Exam MCQDocument10 pagesTaxation Law Exam MCQSong Ong0% (1)

- OpTransactionHistoryUX330 10 2022Document8 pagesOpTransactionHistoryUX330 10 2022Pudhu BazzarPas encore d'évaluation

- PR 7 Diagnostic ExamDocument8 pagesPR 7 Diagnostic ExamMendoza Ron NixonPas encore d'évaluation

- Statement - XXXX XXXX 4751 - 22mar2024 - 14 - 39Document5 pagesStatement - XXXX XXXX 4751 - 22mar2024 - 14 - 39Aditya BehalPas encore d'évaluation

- Wire Transfer Form 05Document2 pagesWire Transfer Form 05eghideafesumePas encore d'évaluation

- Well KidDocument1 pageWell Kidtahirliayla0Pas encore d'évaluation