Académique Documents

Professionnel Documents

Culture Documents

Cost Definitions

Transféré par

Monina CabalagDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Cost Definitions

Transféré par

Monina CabalagDroits d'auteur :

Formats disponibles

Cost Definitions

Absorption Costs: Direct labor plus direct materials Expense: A cost that has been matched with revenue and

plus factory overhead. has therefore been recognized on the income statement.

Avoidable Cost: A cost that can be eliminated by Factory Burden: Synonym for overhead.

choosing one alternative over another.

Factory Overhead Applied: The amount of overhead

Committed Fixed Costs: Organizational investments that has been assigned to work-in-process through the

with a multiyear planning horizon that cannot be use of a predetermined overhead rate in a normal costing

significantly reduced even for short periods of time system.

without making fundamental changes. Compare with

Discretionary Fixed Costs. Factory Overhead Costs: Synonym with Overhead.

Common Cost: A cost that is incurred to support a Finished Goods: Work-in-process that has been

number of cost objects but cannot be traced to them completed and is ready for sale.

individually. A common cost is a type of indirect cost.

Fixed Cost: A cost that remains constant in total

Conversion Costs: Direct labor plus factory overhead. regardless of the level of activity.

The cost of converting direct materials into a finished Full Cost: Synonym for absorption cost.

product.

Incremental Cost: An increase in cost from one

Cost: An amount paid or required in payment for a alternative to another or the cost to produce the next

purchase; a price, or the expenditure of something, such product unit.

as time or labor, necessary for the attainment of a goal:

Indirect Costs: Costs that cannot easily be identified

Cost of Goods Manufactured: The production cost with a final cost object.

(direct labor plus direct materials plus overhead) of

work-in-process finished this period and transferred Indirect Labor: Labor costs (within the factory) that

from the factory to the finished goods storeroom. cannot easily be identified with a final cost object,

Cost of Goods Sold: The production cost (direct labor Indirect Materials: Material cost (within the factory)

plus direct materials plus overhead) of goods sold this that cannot easily be identified with a final cost object.

period.

Inventoriable Costs: Direct labor, direct materials and

Differential Costs: The difference in costs between two overhead.

alternatives.

Joint Costs: Cost incurred by a joint process prior to the

Direct Cost: A cost that can be easily traced to a specific time products are separately identifiable.

cost object.

Manufacturing Costs: Synonym for product costs.

Direct Labor: Labor that can easily be identified with a

specific cost object. Manufacturing Costs Added: The sum of direct labor,

direct materials and overhead incurred during the

Direct Materials: Materials that can easily be identified accounting period.

with a specific cost object.

Manufacturing Overhead Costs: Synonym for

Discretionary Fixed Costs: Costs that arise from annual overhead.

decisions of management to spend on certain fixed costs

items. Compare with Committed Fixed Costs. Marginal Cost: Synonym for incremental cost.

Compiled by Richard E. McDermott, January 3, 2012. Page 1

Cost Definitions

Mixed Cost: Costs that have both a fixed and variable Work-in-Process: Units of product that are only

element. partially complete and will require further work before

they are ready for sale to the customer.

Nonmanufacturing Costs: Administrative and

marketing costs.

Opportunity Cost: The potential benefit given up when

one alternative is selected over another.

Out of Pocket Costs: Actual cash outlay costs.

Overhead Costs: Indirect costs (within the factory)..

Period Costs: The sum of administrative and marketing

costs. Costs that appear on the income statement in the

period in which they are incurred.

Prime Costs: Direct labor plus direct materials.

Product Costs: The sum of direct labor, direct materials

and overhead. Synonymous with inventoriable costs,

manufacturing costs and production costs.

Production Costs: Synonymous with inventoriable

costs, manufacturing costs and product costs.

Raw Materials: Materials in the raw materials

storeroom which have not been put into production or

applied to an overhead account.

Relevant Costs: Costs that differ between alternatives.

Selling and Administrative Costs: Synonymous with

period costs.

Semi-variable Costs: Costs that vary non-proportionally

with activity or volume.

Standard Cost: In a standard costing system, what a

cost “should be.”

Sunk Costs: A cost that has been incurred and cannot be

changed by any decision now or in the future.

Variable Costs: A cost that varies proportionally with

the level of activity.

Compiled by Richard E. McDermott, January 3, 2012. Page 2

Vous aimerez peut-être aussi

- Managerial Accounting and Cost Concepts Cap. 1.: (Introducción y Tipos de Costos)Document15 pagesManagerial Accounting and Cost Concepts Cap. 1.: (Introducción y Tipos de Costos)Eugenio CamposPas encore d'évaluation

- Basic Cost Management ConceptsDocument7 pagesBasic Cost Management ConceptsImadPas encore d'évaluation

- Cost Accounting and ControlDocument14 pagesCost Accounting and Controlkaye SagabaenPas encore d'évaluation

- Lesson 10 - Manufacturing BusinessDocument4 pagesLesson 10 - Manufacturing BusinessVISITACION JAIRUS GWENPas encore d'évaluation

- Part III-Managerial AccountingDocument91 pagesPart III-Managerial AccountingGebrePas encore d'évaluation

- Cost Defined: Introduction To Cost Accounting, Cost Concepts, Cost Behavior Analysis and Cost Accounting CycleDocument4 pagesCost Defined: Introduction To Cost Accounting, Cost Concepts, Cost Behavior Analysis and Cost Accounting Cyclecriselyn agtingPas encore d'évaluation

- Basic Cost Management ConceptsDocument4 pagesBasic Cost Management ConceptsElvie Abulencia-BagsicPas encore d'évaluation

- Chapter 2Document20 pagesChapter 2Sarah Jane Dice DegonesPas encore d'évaluation

- Classification of CostsDocument2 pagesClassification of CostsBeatrize ValerioPas encore d'évaluation

- Lecture 2 Cost Terms, Concepts and ClassificationDocument34 pagesLecture 2 Cost Terms, Concepts and ClassificationTgrh TgrhPas encore d'évaluation

- Sesi 2 Akuntansi Manajemen - Rev1Document32 pagesSesi 2 Akuntansi Manajemen - Rev1Dian Permata SariPas encore d'évaluation

- ModuleNo1 BasicConceptsDocument4 pagesModuleNo1 BasicConceptsLyerey Jed MartinPas encore d'évaluation

- Chapter 2 Cost Terms Concepts and ClassificationsDocument51 pagesChapter 2 Cost Terms Concepts and ClassificationsMulugeta Girma100% (1)

- Sesi 2 Akuntansi ManajemenDocument33 pagesSesi 2 Akuntansi ManajemenDian Permata SariPas encore d'évaluation

- The COST Concept in Managerial Accounting: For Planning, Budgeting, Cost Control, Decision-MakingDocument8 pagesThe COST Concept in Managerial Accounting: For Planning, Budgeting, Cost Control, Decision-MakingRobin LlagunoPas encore d'évaluation

- Chapter 02Document57 pagesChapter 02Adam AbdullahiPas encore d'évaluation

- Chapter 2Document5 pagesChapter 2Hania M. CalandadaPas encore d'évaluation

- Product Costing: Job and Process Operations: 1. Inventory Costs in Various OrganizationsDocument30 pagesProduct Costing: Job and Process Operations: 1. Inventory Costs in Various OrganizationsAnne Thea AtienzaPas encore d'évaluation

- Cost HandoutDocument31 pagesCost HandoutTilahun GirmaPas encore d'évaluation

- Term Associated With CostDocument6 pagesTerm Associated With Costaashir chPas encore d'évaluation

- CH 02Document40 pagesCH 02hoangmyduyennguyen2004Pas encore d'évaluation

- Acc 201Document3 pagesAcc 201Remmington Kalanii PennPas encore d'évaluation

- Managerial Accounting SeminarDocument2 pagesManagerial Accounting SeminarIbrahimm Denis FofanahPas encore d'évaluation

- Managerial AccountingDocument16 pagesManagerial AccountingLinh ChiPas encore d'évaluation

- Module 2 Basic Cost Management ConceptDocument12 pagesModule 2 Basic Cost Management ConceptWendryPas encore d'évaluation

- Cost ClassificationDocument6 pagesCost ClassificationAnonymous yy8In96j0r100% (1)

- Cost ClassificationDocument19 pagesCost ClassificationAli AshhabPas encore d'évaluation

- Chap 2 The-Manager-and-Management-AccountingDocument11 pagesChap 2 The-Manager-and-Management-Accountingqgminh7114Pas encore d'évaluation

- Chapter 2Document10 pagesChapter 2Aklil TeganewPas encore d'évaluation

- Cost Classification or Cost Flow in An OrgaizationDocument8 pagesCost Classification or Cost Flow in An OrgaizationvaloruroPas encore d'évaluation

- Classification of Costs - TutorialDocument1 pageClassification of Costs - TutorialAnimesh MayankPas encore d'évaluation

- 25885110Document21 pages25885110Llyana paula SuyuPas encore d'évaluation

- STCM 03AbsorptionandVariableCostingDocument5 pagesSTCM 03AbsorptionandVariableCostingdin matanguihanPas encore d'évaluation

- Checkpoint Activity 1:: Term/ConceptDocument2 pagesCheckpoint Activity 1:: Term/ConceptlalalalaPas encore d'évaluation

- 2MATypes of CostDocument44 pages2MATypes of CostAARUSHI NARANG-DMPas encore d'évaluation

- CA Notes4Document21 pagesCA Notes4jeyoon13Pas encore d'évaluation

- Cost: As A Resource Sacrificed or Forgone To Achieve A Specific Objective. It Is Usually MeasuredDocument19 pagesCost: As A Resource Sacrificed or Forgone To Achieve A Specific Objective. It Is Usually MeasuredTilahun GirmaPas encore d'évaluation

- ACCT102 II Cheat SheetDocument3 pagesACCT102 II Cheat SheetJanice OwusuPas encore d'évaluation

- Elements of Cost and Cost Sheet - FYBBA-IBDocument25 pagesElements of Cost and Cost Sheet - FYBBA-IBSakuraPas encore d'évaluation

- Module 1 and Module 2Document32 pagesModule 1 and Module 2tygurPas encore d'évaluation

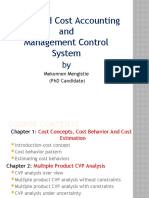

- Advanced Cost Accounting and Management Control System: Mekonnen Mengistie (PHD Candidate)Document62 pagesAdvanced Cost Accounting and Management Control System: Mekonnen Mengistie (PHD Candidate)Kalkidan ZerihunPas encore d'évaluation

- CH 02Document40 pagesCH 02lyonanh289Pas encore d'évaluation

- Chapter 2Document18 pagesChapter 2Hk100% (1)

- Cost Accounting Concepts: Prof. Dr. Farid MoharamDocument90 pagesCost Accounting Concepts: Prof. Dr. Farid Moharammohamed el kadyPas encore d'évaluation

- Chapter 2Document17 pagesChapter 2Ngọc Minh Đỗ ChâuPas encore d'évaluation

- Module 1-3 ACCTG 201Document32 pagesModule 1-3 ACCTG 201Sky SoronoiPas encore d'évaluation

- Cost Terms, Concepts, and ClassificationDocument27 pagesCost Terms, Concepts, and ClassificationParadise VillagePas encore d'évaluation

- MA NotesDocument47 pagesMA NotesPeiyi TayPas encore d'évaluation

- PDFenDocument68 pagesPDFenby ScribdPas encore d'évaluation

- LP3-Product Costing MethodsDocument12 pagesLP3-Product Costing MethodsCarla GarciaPas encore d'évaluation

- MaxwelDocument4 pagesMaxwelJayesh ChopadePas encore d'évaluation

- Cost Terminologies and ClassficationsDocument51 pagesCost Terminologies and ClassficationsLim Jie XiPas encore d'évaluation

- Cost TerminologyDocument2 pagesCost TerminologyChristine TutorPas encore d'évaluation

- Chapter 3 - Virtual - Classroom-M.Document61 pagesChapter 3 - Virtual - Classroom-M.rebeccahf7Pas encore d'évaluation

- MDTERM EXAMINATION REVIEWER ACC211bDocument6 pagesMDTERM EXAMINATION REVIEWER ACC211bSITTIE SAILAH PATAKPas encore d'évaluation

- Group 8 - Chap 2 An Introduction To Cost Terms and PurposeseDocument39 pagesGroup 8 - Chap 2 An Introduction To Cost Terms and Purposeseqgminh7114Pas encore d'évaluation

- Chapter 2 Hilton 10th Instructor NotesDocument10 pagesChapter 2 Hilton 10th Instructor NotesKD MV100% (1)

- 1b - Cost Concepts and Terminology - 14sept06Document31 pages1b - Cost Concepts and Terminology - 14sept06Zaid AnsariPas encore d'évaluation

- Discussion 2 Cost Concepts Terminologies and Behaviors 1Document7 pagesDiscussion 2 Cost Concepts Terminologies and Behaviors 1RHEGIE WAYNE PITOGOPas encore d'évaluation

- ApDocument8 pagesApMonina Cabalag100% (1)

- Cash and Cash EquivDocument8 pagesCash and Cash EquivMonina Cabalag0% (1)

- Cash and Cash EquivDocument8 pagesCash and Cash EquivMonina Cabalag0% (1)

- Donor's Tax Quizzer-2Document5 pagesDonor's Tax Quizzer-2Monina Cabalag0% (1)

- Contracts ReviewerDocument7 pagesContracts ReviewerMonina CabalagPas encore d'évaluation

- Cash and Cash EquivDocument8 pagesCash and Cash EquivMonina Cabalag0% (1)

- Cost Management Accounting, Overhead by CIMADocument12 pagesCost Management Accounting, Overhead by CIMAWasif MohammadPas encore d'évaluation

- Bca PDFDocument84 pagesBca PDFHarder4 FunPas encore d'évaluation

- QuizDocument9 pagesQuizCertified Public AccountantPas encore d'évaluation

- Management Accounting CLCDocument165 pagesManagement Accounting CLCGiang MaPas encore d'évaluation

- Minimum Wage Order No. IV-A - 14 - Region IV-A PDFDocument36 pagesMinimum Wage Order No. IV-A - 14 - Region IV-A PDFIan FranklinPas encore d'évaluation

- Accounting ReviewerDocument7 pagesAccounting ReviewerJaphet RiveraPas encore d'évaluation

- Blank Project Proforma For The WBBCCSDocument4 pagesBlank Project Proforma For The WBBCCSRajib StudioPas encore d'évaluation

- Relevant Decision FactorPart3Document3 pagesRelevant Decision FactorPart3naddiePas encore d'évaluation

- 2.advanced Cost Accounting Test One 2017Document4 pages2.advanced Cost Accounting Test One 2017smlingwaPas encore d'évaluation

- Bernie SteerDocument3 pagesBernie SteerMigs CruzPas encore d'évaluation

- 505C Cost AccountingDocument38 pages505C Cost AccountingUjjal ShiwakotiPas encore d'évaluation

- Principles of Cost Accounting Vanderbeck 15th Edition Solutions ManualDocument44 pagesPrinciples of Cost Accounting Vanderbeck 15th Edition Solutions ManualBrittanyMorrismxgo100% (40)

- Feasibility Study of Best Coffee Roasting, Grinding and PackingDocument19 pagesFeasibility Study of Best Coffee Roasting, Grinding and PackingFekaduPas encore d'évaluation

- Acct Chapter 15BDocument20 pagesAcct Chapter 15BEibra Allicra100% (1)

- Cost AccountingDocument64 pagesCost AccountingKrestyl Ann GabaldaPas encore d'évaluation

- Final Report (ACN-202)Document9 pagesFinal Report (ACN-202)Srijon GgPas encore d'évaluation

- Audit ProceduresDocument36 pagesAudit ProceduresRoshaan AhmadPas encore d'évaluation

- Chapter 05Document24 pagesChapter 05adarshPas encore d'évaluation

- CH 4 Profit PlanningDocument16 pagesCH 4 Profit PlanningMona ElzaherPas encore d'évaluation

- Spoilage, Rework, and ScrapDocument35 pagesSpoilage, Rework, and ScrapMohammed S. ZughoulPas encore d'évaluation

- Job Order Costing HMDocument11 pagesJob Order Costing HMYamato De Jesus NakazawaPas encore d'évaluation

- Week1 Exercises KarinaPadillaDocument7 pagesWeek1 Exercises KarinaPadillakarina padillaPas encore d'évaluation

- Decision Making QuestionsDocument3 pagesDecision Making QuestionsOsama RiazPas encore d'évaluation

- Incremental AnalysisDocument82 pagesIncremental AnalysisMicha Silvestre100% (1)

- RECP 674 Advanced Management Accounting (CTA LEVEL)Document219 pagesRECP 674 Advanced Management Accounting (CTA LEVEL)Lawrence Maretlwa100% (1)

- Pricing Decision: Basic ConceptsDocument47 pagesPricing Decision: Basic ConceptssulukaPas encore d'évaluation

- Chapter 1 - Inventory Valuation: Caf-08 Cma Complete TheoryDocument8 pagesChapter 1 - Inventory Valuation: Caf-08 Cma Complete TheoryShehrozSTPas encore d'évaluation

- Standard Costing and Variance Analysis !!!Document82 pagesStandard Costing and Variance Analysis !!!Kaya Duman100% (1)

- CH 14Document4 pagesCH 14sweetescape1100% (3)