Académique Documents

Professionnel Documents

Culture Documents

Financial Accounting and Reporting 1

Transféré par

Anj Hwan0 évaluation0% ont trouvé ce document utile (0 vote)

13 vues2 pagesFinancial accounting and reporting 1

Titre original

Coverage

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentFinancial accounting and reporting 1

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

13 vues2 pagesFinancial Accounting and Reporting 1

Transféré par

Anj HwanFinancial accounting and reporting 1

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

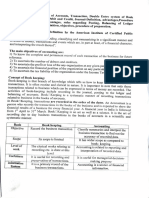

FINANCIAL ACCOUNTING AND REPORTING 1

Topics Subtopics

Introduction to Accounting Definition of Accounting

The Generally Accounting Accepted Principles

Elements of Financial Statement

Users of Accounting Information

Analyzing Business Transactions Manual and Computerized System

Definition of Business Transactions

Effects of Business Transactions on Accounts

Accounting Process - Service Journalizing Business Transactions

Posting to Ledger

Preparing Trial Balance

Journalizing Adjusting Entries

- Cash Basis vs. Accrual Basis

- Types of Adjusting Entries

- Effects of Failure to Record

Preparing Worksheet and Financial Statements

Journalizing and Posting Closing Entries

Post- Closing Trial Balances

Accounting Process – Income Statement of Merchandising Business

Merchandising Inventory System

Sales and Related Accounts

Purchase and Related Accounts

Special Journals Types of Special Journals

- Sales Journal

- Purchase Journal

- Cash Receipts Journal

- Cash Disbursement Journal

Subsidiary Ledgers

Schedule of Accounts Receivable

Schedule of Accounts Payable

INTERMEDIATE ACCOUNTING 1

Topics Subtopics

Cash and Cash Equivalents Nature of Financial Assets

Cash as Financial Assets

Nature and Composition of Cash Equivalents

Presentation and Measurement of Cash in the

Statement of Financial Position

Petty Cash Fund

Cash Short and Over

Bank Reconciliation

Proof of Cash

Receivables Nature of Receivables

Accounting for Account Receivable and Related

Revenues

Initial Recognition

Measuring Impairment Loss

Impairment of Accounts Receivable

Accounting for Notes Receivable

Pledging

Discounting of Notes Receivable

Factoring

Disclosure Requirements

Vous aimerez peut-être aussi

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionD'EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionÉvaluation : 5 sur 5 étoiles5/5 (1)

- Orca Share Media1547030319812Document523 pagesOrca Share Media1547030319812Maureen Joy Andrada80% (10)

- Certified Accounting Technician: An E-Learning ApproachDocument73 pagesCertified Accounting Technician: An E-Learning ApproachArra StypayhorliksonPas encore d'évaluation

- Problems On Noninterest Bearing NotesDocument3 pagesProblems On Noninterest Bearing NotesAnj HwanPas encore d'évaluation

- Bank of Punjab A/C: 6580048830600077 Bank of Punjab A/C: 6580048830600077 Bank of Punjab A/C: 6580048830600077Document1 pageBank of Punjab A/C: 6580048830600077 Bank of Punjab A/C: 6580048830600077 Bank of Punjab A/C: 6580048830600077muneeba qureshiPas encore d'évaluation

- Accounting Process1Document2 pagesAccounting Process1The NPas encore d'évaluation

- Chapter 1: Basic Concepts of Accounting and Recording ProcessDocument15 pagesChapter 1: Basic Concepts of Accounting and Recording Processckyn greenleaf100% (2)

- Introduction To Financial AccountingDocument64 pagesIntroduction To Financial AccountingAnonymous HumanPas encore d'évaluation

- One BookDocument29 pagesOne BookOnebookPas encore d'évaluation

- Accounting For Managers: Dr.R.Vasanthagopal University of KeralaDocument22 pagesAccounting For Managers: Dr.R.Vasanthagopal University of KeralaSmitha K BPas encore d'évaluation

- 11CBSE Chapter 1 Meaning and Objective of AccountingDocument8 pages11CBSE Chapter 1 Meaning and Objective of AccountingSanyam YadavPas encore d'évaluation

- Fund W1-3Document55 pagesFund W1-3Edren LoyloyPas encore d'évaluation

- No. Nama Pengajar Alamat E-Mail: Introduction To AccountingDocument5 pagesNo. Nama Pengajar Alamat E-Mail: Introduction To AccountingNuky Presiari DjajalaksanaPas encore d'évaluation

- Introductuion To AccountsDocument4 pagesIntroductuion To AccountsJoanne CrysantherPas encore d'évaluation

- Cima p4Document3 pagesCima p4fawad aslamPas encore d'évaluation

- Accounting For Managers: Dr.R.Vasanthagopal University of KeralaDocument22 pagesAccounting For Managers: Dr.R.Vasanthagopal University of KeralaYameen KhanPas encore d'évaluation

- Module 001: Review of The Basic Accounting Concepts and PrinciplesDocument18 pagesModule 001: Review of The Basic Accounting Concepts and PrinciplesHo Ming LamPas encore d'évaluation

- Lecture Note F3 - Part 1Document45 pagesLecture Note F3 - Part 1mai linhPas encore d'évaluation

- TO Accounting: Dr. Ritika BhatiaDocument35 pagesTO Accounting: Dr. Ritika BhatiaRahul Rajendra Kumar BanyalPas encore d'évaluation

- Accounting Cycle For A Merchandising Business The Basic Accounting CycleDocument4 pagesAccounting Cycle For A Merchandising Business The Basic Accounting CycleEloizaMariePas encore d'évaluation

- Accountacy Trial BalanceDocument5 pagesAccountacy Trial BalanceNihar patraPas encore d'évaluation

- Chapter 4Document6 pagesChapter 4meahangela.labadan.23Pas encore d'évaluation

- ACC 106 SAS 2 NOTES - Review of The Accounting ProcessDocument5 pagesACC 106 SAS 2 NOTES - Review of The Accounting ProcessbakdbdkPas encore d'évaluation

- Unit 1 - Basics of AccountancyDocument16 pagesUnit 1 - Basics of AccountancyBhavya DingrejaPas encore d'évaluation

- Key Financial Management ControlsDocument1 pageKey Financial Management ControlsjanePas encore d'évaluation

- Learner's Guide Senior Secondary Course-AccountancyDocument3 pagesLearner's Guide Senior Secondary Course-AccountancyAkshay KumarPas encore d'évaluation

- On CFS FFSDocument31 pagesOn CFS FFSShirsendu MondolPas encore d'évaluation

- Basic Accounting Table of ContentsDocument2 pagesBasic Accounting Table of ContentsrynnaPas encore d'évaluation

- Basics of Accounting: Group 1 Garima Reethika Rohit Sonali SwatiDocument21 pagesBasics of Accounting: Group 1 Garima Reethika Rohit Sonali Swatiloyu59Pas encore d'évaluation

- AccountingDocument2 pagesAccountingazazelrallosPas encore d'évaluation

- Satuan Acara Pengajaran: ACCT11101 - Pengantar Akuntansi 1 PengajarDocument5 pagesSatuan Acara Pengajaran: ACCT11101 - Pengantar Akuntansi 1 PengajarZaharuddin G. DjallePas encore d'évaluation

- Accounting - Chapter 3 Accrual Accounting ConceptsDocument27 pagesAccounting - Chapter 3 Accrual Accounting ConceptsheinlinnPas encore d'évaluation

- The Accounting CycleDocument15 pagesThe Accounting CycleShiela LanadoPas encore d'évaluation

- Living in The Information AgeDocument45 pagesLiving in The Information AgeMahesh SindhaPas encore d'évaluation

- Control, LaaDocument147 pagesControl, LaadomithuoPas encore d'évaluation

- FAR1 - Lecture 03 Accounting Cycle - Steps 1-4Document4 pagesFAR1 - Lecture 03 Accounting Cycle - Steps 1-4Patricia Camille AustriaPas encore d'évaluation

- Kimberly Nicole B. Ledona Bsa 2B: GUIDE QUESTIONS: Report On Revenue CycleDocument3 pagesKimberly Nicole B. Ledona Bsa 2B: GUIDE QUESTIONS: Report On Revenue CycleKimberly NicolePas encore d'évaluation

- Summary ReviewerDocument3 pagesSummary ReviewerJohn Aries MiranoPas encore d'évaluation

- Chapter 1 - Introduction 1-1Document7 pagesChapter 1 - Introduction 1-1Animaw YayehPas encore d'évaluation

- Topic 1 - Accounting EnvironmentDocument33 pagesTopic 1 - Accounting EnvironmentdenixngPas encore d'évaluation

- Bba 2020 2024Document85 pagesBba 2020 2024umairtufail786Pas encore d'évaluation

- Explain What Accounting IsDocument4 pagesExplain What Accounting IsWawex DavisPas encore d'évaluation

- BoA CPA Board Syllabus MappingDocument27 pagesBoA CPA Board Syllabus MappingTrisha Monique VillaPas encore d'évaluation

- TOS 1S2324 1st Yr StudentDocument6 pagesTOS 1S2324 1st Yr StudentErica UbaldePas encore d'évaluation

- CBSE Class 11 Accountancy Syllabus Updated For 20Document1 pageCBSE Class 11 Accountancy Syllabus Updated For 20AarushPas encore d'évaluation

- Marks Weightage of CBSE Class 11 Accountancy Syllabus Term 1Document1 pageMarks Weightage of CBSE Class 11 Accountancy Syllabus Term 1AarushPas encore d'évaluation

- Marks Weightage of CBSE Class 11 Accountancy Syllabus Term 1Document1 pageMarks Weightage of CBSE Class 11 Accountancy Syllabus Term 1AarushPas encore d'évaluation

- SAP FI OverviewDocument16 pagesSAP FI OverviewManoj Kumar100% (1)

- Lecture 5 - Books of Accounts and Double Entry SystemDocument7 pagesLecture 5 - Books of Accounts and Double Entry SystemmallarilecarPas encore d'évaluation

- Accounting FOR ManagementDocument63 pagesAccounting FOR ManagementAnonymous 1ClGHbiT0JPas encore d'évaluation

- Foundation FA S1Document18 pagesFoundation FA S1narmadaPas encore d'évaluation

- View SyllabusDocument9 pagesView SyllabusMadhu kumarPas encore d'évaluation

- Foundation FA S1 - LecturerDocument24 pagesFoundation FA S1 - LecturernarmadaPas encore d'évaluation

- Financial AccountingDocument53 pagesFinancial Accountingnikhil100% (1)

- Chương 2 - KTUC - SVDocument7 pagesChương 2 - KTUC - SVnhuhuyen.01112003Pas encore d'évaluation

- Unit 1Document40 pagesUnit 1v9510491Pas encore d'évaluation

- Nadiatul - Summary Week 5Document4 pagesNadiatul - Summary Week 5nadxco 1711Pas encore d'évaluation

- Week 1 - Control Accounts (In Sessional)Document4 pagesWeek 1 - Control Accounts (In Sessional)Teresa ManPas encore d'évaluation

- 1.01 - Content NotesDocument8 pages1.01 - Content Notesapi-262218593Pas encore d'évaluation

- 004 - Red Flags-Bank AudtsDocument41 pages004 - Red Flags-Bank Audtschandra sekharPas encore d'évaluation

- Chapter 01 - Accounting in ActionDocument69 pagesChapter 01 - Accounting in ActionFatman RulesPas encore d'évaluation

- AcounBM2 - 2016.PPT - Unit 3.special Journals PDFDocument4 pagesAcounBM2 - 2016.PPT - Unit 3.special Journals PDFLimuel MacasaetPas encore d'évaluation

- Notes in ReceivablesDocument9 pagesNotes in ReceivablesAnj HwanPas encore d'évaluation

- Notes in Property, Plant and EquipmentDocument3 pagesNotes in Property, Plant and EquipmentAnj HwanPas encore d'évaluation

- The Accounting EquationDocument1 pageThe Accounting EquationAnj HwanPas encore d'évaluation

- BIOLOGICAL ASSETS (5 Cows X P20,000 Fair Value) CashDocument2 pagesBIOLOGICAL ASSETS (5 Cows X P20,000 Fair Value) CashAnj HwanPas encore d'évaluation

- Introduction To Adjusting EntriesDocument1 pageIntroduction To Adjusting EntriesAnj HwanPas encore d'évaluation

- Intermediate Accounting 2Document2 pagesIntermediate Accounting 2Anj HwanPas encore d'évaluation

- Basic Accounting - Prepaid ExpensesDocument1 pageBasic Accounting - Prepaid ExpensesAnj HwanPas encore d'évaluation

- Interesting Philippines FactsDocument2 pagesInteresting Philippines FactsAnj HwanPas encore d'évaluation

- Interesting Philippines FactsDocument1 pageInteresting Philippines FactsAnj HwanPas encore d'évaluation

- 41 Interesting Facts About CatsDocument2 pages41 Interesting Facts About CatsAnj HwanPas encore d'évaluation

- Mixed Cost High-Low Method ProblemDocument1 pageMixed Cost High-Low Method ProblemAnj HwanPas encore d'évaluation

- The Modern World System by WallersteinDocument10 pagesThe Modern World System by WallersteinAnj HwanPas encore d'évaluation

- Essay About Internet AddictionDocument2 pagesEssay About Internet AddictionAnj HwanPas encore d'évaluation

- Patterns in Nature - Symmetry, Fractals, Tessellations and More Geometry!Document2 pagesPatterns in Nature - Symmetry, Fractals, Tessellations and More Geometry!Anj HwanPas encore d'évaluation

- Mathematical Methods Involved in Numerical Weather Prediction by Dr. Neena Joseph ManiDocument1 pageMathematical Methods Involved in Numerical Weather Prediction by Dr. Neena Joseph ManiAnj HwanPas encore d'évaluation

- Juan - Angela Marie - BSMA1-3 PDFDocument8 pagesJuan - Angela Marie - BSMA1-3 PDFAnj HwanPas encore d'évaluation

- Art Appreciation WorksheetDocument3 pagesArt Appreciation WorksheetAnj HwanPas encore d'évaluation

- Assignment #2Document2 pagesAssignment #2Anj HwanPas encore d'évaluation

- European Union Transgovernmental Networks: The Emergence of A New Political Space Beyond The Nation-State?Document27 pagesEuropean Union Transgovernmental Networks: The Emergence of A New Political Space Beyond The Nation-State?Anj HwanPas encore d'évaluation

- SAO Report2010-02 MaguindanaoProvDocument164 pagesSAO Report2010-02 MaguindanaoProvAnj HwanPas encore d'évaluation

- RPP EspDocument11 pagesRPP EspKrissiana PermataPas encore d'évaluation

- Opening Balance - 4204276.88Document40 pagesOpening Balance - 4204276.88DIVYANSHU CHATURVEDIPas encore d'évaluation

- RTC Bus Complex Visakhapatnam Architectural InterventionDocument14 pagesRTC Bus Complex Visakhapatnam Architectural Interventionvenkat bathinaPas encore d'évaluation

- 1600-VT MaterialsDocument2 pages1600-VT MaterialsgennadacawePas encore d'évaluation

- 23 (1) (1) .10.2011 As Per Merchant Payment ReportDocument108 pages23 (1) (1) .10.2011 As Per Merchant Payment Reportrupeshrudra003Pas encore d'évaluation

- Bir Form No. 2551Q - Quarterly Percentage Tax Return Guidelines and Instructions Who Shall File Basis of TaxDocument2 pagesBir Form No. 2551Q - Quarterly Percentage Tax Return Guidelines and Instructions Who Shall File Basis of TaxkehlaniPas encore d'évaluation

- Cir v. Phoenix DigestDocument3 pagesCir v. Phoenix DigestkathrynmaydevezaPas encore d'évaluation

- Tax ProbDocument3 pagesTax ProbJohn Paul Acebedo14% (7)

- 2020 Kempal Bir Loa DocsDocument5 pages2020 Kempal Bir Loa DocsPajarillo Kathy AnnPas encore d'évaluation

- Sepco Online BilllDocument1 pageSepco Online Billlshaikh_piscesPas encore d'évaluation

- Rs. 0.56 Rs. 16,377.00 Rs. 13,880.15: 20 Feb 2023 To 19 Mar 2023Document11 pagesRs. 0.56 Rs. 16,377.00 Rs. 13,880.15: 20 Feb 2023 To 19 Mar 2023himanshu ranjanPas encore d'évaluation

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Rohit JainPas encore d'évaluation

- Kenny Delight Inv 375 30 KGS PistaDocument2 pagesKenny Delight Inv 375 30 KGS Pistavinay sainiPas encore d'évaluation

- General Principles of VatDocument2 pagesGeneral Principles of VatCali Shandy H.Pas encore d'évaluation

- Kolkata Bokaro 2018-12-30: From TO Date of JourneyDocument3 pagesKolkata Bokaro 2018-12-30: From TO Date of JourneyDigvijay SingjPas encore d'évaluation

- Deliveroo Order Receipt 2031511209Document2 pagesDeliveroo Order Receipt 2031511209jak.g.lewisPas encore d'évaluation

- Brain DumpDocument1 pageBrain DumpChantie BorlonganPas encore d'évaluation

- AMEXDocument2 pagesAMEXamma green technology demolishing the plasticPas encore d'évaluation

- BOLADocument1 pageBOLARichelle Calandria VedadPas encore d'évaluation

- MmsDocument18 pagesMmsvinay dhingraPas encore d'évaluation

- TranportDocument1 pageTranportapi-13460137Pas encore d'évaluation

- Assignment 1Document12 pagesAssignment 1anniekohliPas encore d'évaluation

- General Banking System of IFIC Bank LTDDocument68 pagesGeneral Banking System of IFIC Bank LTDMd. Monirul IslamPas encore d'évaluation

- Motorcycle Insurance ReceiptDocument1 pageMotorcycle Insurance ReceiptWan RidhwanPas encore d'évaluation

- Finacle - CommandDocument5 pagesFinacle - CommandvpsrnthPas encore d'évaluation

- Disbursement Voucher: Teravera CorporationDocument1 pageDisbursement Voucher: Teravera CorporationKesMercadoPas encore d'évaluation

- Employee Tax Withholding GuideDocument355 pagesEmployee Tax Withholding GuideCassie JaysonPas encore d'évaluation

- Challan Morab PDFDocument2 pagesChallan Morab PDFEgov DharwadPas encore d'évaluation

- Cheminformatic Institute of Science Studies Lucknow: Tele:-0522 - 430 64 64 Mob: 09554064000, 09559196700Document1 pageCheminformatic Institute of Science Studies Lucknow: Tele:-0522 - 430 64 64 Mob: 09554064000, 09559196700dmannewarPas encore d'évaluation