Académique Documents

Professionnel Documents

Culture Documents

Music Mart Solution

Transféré par

Stranger SinhaDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Music Mart Solution

Transféré par

Stranger SinhaDroits d'auteur :

Formats disponibles

Music Mart, Inc.

On Jan.1 John Smith starts an incorporated CD and tape store called Music Mart, Inc. He does this by

depositing $25,000 of his own funds in a bank account that he has opened in the name of the business

entity and taking $25,000 of stock certificates in return. He is the sole owner of the corporation. The

balance sheet of Music Mart, Inc., will then be as follows:

MUSIC MART

Balance Sheet

As of January 1

Assets Liabilities and Owner’s Equity

Cash $25,000 Paid-in capital $25,000

On Jan.2 Music Mart borrows $12,500 from a bank; the loan is evidenced by a legal document called a

note. This transaction increases the asset, cash, and the business incurs a liability to the bank called notes

payable. The balance sheet after this transaction will appear thus:

MUSIC MART

Balance Sheet

As of January 2

Assets Liabilities and Owner’s Equity

Cash $37,500 Notes payable $12,500

Paid-in capital 25,000

Total $37,500 Total $37,500

On Jan.3, The business buys (merchandise it intends to sell) in the amount of $5,000, paying cash. This

transaction decreases cash and increases another asset, inventory. The balance sheet will now be as

follows:

MUSIC MART

Balance Sheet

As of January 3

Assets Liabilities and Owner’s Equity

Cash $32,500 Notes payable $12,500

Inventory 5,000 Paid-in capital 25,000

Total $37,500 Total $37,500

On Jan.4, for $750 cash, the store sells merchandise that costs $500. The effect of this transaction is to

decrease inventory by $500, increase cash by $750, and increase owner’s equity by the difference, or

$250. The $250 is the profit on this sale. To distinguish it from the paid-up capital portion of owner’s

equity, it is recorded as retained earnings. The balance sheet will then look like this:

MUSIC MART

Balance Sheet

As of January 4

Assets Liabilities and Owner’s Equity

Cash $33,250 Notes payable $12,500

Inventory 4,500 Paid-in capital 25,000

Retained earnings 250

Total $37,750 Total $37,750

On a sheet of paper, set up in pencil the balance sheet of Music Mart, Inc., as it appears after the last

sheet of Music Mart, Inc., as it appears after the last transaction described in the text (January 4), leaving

considerable space between each item. Record the effect, if any, of the following events on the balance

sheet, either by revising existing figures (cross out, rather than erase) or by adding new items as necessary.

At least one of these events does not affect the balance sheet. The basic equation, Assets = Liabilities +

Owners’ equity, must be preserved at all times. Errors will be minimized if you make a separate list of the

balance sheet items affected by each transaction and the (+ or - ) by which each is to be changed.

After you have recorded these events, prepare a balance sheet in proper form. Assume that all these

transactions occurred in January and that there were no other transactions in January.

1. The store purchased and received merchandise for inventory for $5,000, agreeing to pay within

30 days.

Assets Liabilities and Owner’s Equity

Cash $33,250 Notes payable $12,500

Inventory 9,500 Paid-in capital 25,000

Retained earnings 250

Trade Creditor 5000

Total $42,750 Total $42,750

2. Merchandise costing $1,500 was sold for $2,300, which was received in cash.

Assets Liabilities and Owner’s Equity

Cash $35,550 Notes payable $12,500

Inventory 8000 Paid-in capital 25,000

Retained earnings 1050

Trade Creditor 5000

Total $43,550 Total $43,550

3. Merchandise costing $1,700 was sold for $2,620, the customers agreeing to pay $2,620 within 30

days.

Assets Liabilities and Owner’s Equity

Cash $35,550 Notes payable $12,500

Inventory 6300 Paid-in capital 25,000

Receivable 2620 Retained earnings 1970

Trade Creditor 5000

Total $44470 Total $44470

4.

5. The store purchased a three-year fire insurance policy for $1,224, paying cash.

Assets Liabilities and Owner’s Equity

Cash $34326 Notes payable $12,500

Inventory 6300 Paid-in capital 25,000

Receivable 2620 Retained earnings 1970

Pre-Paid Insurance $1224 Trade Creditor 5000

Total $44470 Total $44470

6. The store purchased two lots of land of equal size for a total of $24,000. It paid $6,000 in cash and

gave a 10-year mortgage for $18,000.

Assets Liabilities and Owner’s Equity

Cash $28326 Notes payable $12,500

Land $24000 Mortgage loan $18000

Inventory 6300 Paid-in capital 25,000

Receivable 2620 Retained earnings 1970

Pre-Paid Insurance $1224 Trade Creditor 5000

Total $62470 Total $62470

7. The store sold one of the two lots of land for $12,000. It received $3,000 cash, and in addition,

the buyer assumed $9,000 of the mortgage; that is, Music Mart, Inc., became no longer

responsible for this half.

Assets Liabilities and Owner’s Equity

Cash $31326 Notes payable $12,500

Land $12000 Mortgage loan $9000

Inventory 6300 Paid-in capital 25,000

Receivable 2620 Retained earnings 1970

Pre-Paid Insurance $1224 Trade Creditor 5000

Total $53470 Total $53470

8. Smith received a bonafide offer of $33,000 for the business; although his equity was then only

$26,970, he rejected the offer. It was evident that the store had already acquired goodwill of

$6,030.

Assets Liabilities and Owner’s Equity

Cash $31326 Notes payable $12,500

Land $12000 Mortgage loan $9000

Inventory 6300 Paid-in capital 25,000

Receivable 2620 Retained earnings 1970

Pre-Paid Insurance $1224 Trade Creditor 5000

Total $53470 Total $53470

9. Smith withdrew $1,000 cash from the store’s bank account for his personal use.

Assets Liabilities and Owner’s Equity

Cash $30326 Notes payable $12,500

Land $12000 Mortgage loan $9000

Inventory 6300 Paid-in capital 24,000

Receivable 2620 Retained earnings 1970

Pre-Paid Insurance $1224 Trade Creditor 5000

Total $52470 Total $52470

10. Smith took merchandise costing $750 from the store’s inventory for his personal use.

Assets Liabilities and Owner’s Equity

Cash $30326 Notes payable $12,500

Land $12000 Mortgage loan $9000

Inventory 5550 Paid-in capital 23250

Receivable 2620 Retained earnings 1970

Pre-Paid Insurance $1224 Trade Creditor 5000

Total $51720 Total $51720

11. Smith learned that the individual who purchased the land (No.6 above) subsequently sold it for

$14,000. The lot still owned by Music Mart, Inc., was identical in value with this other plot.

Assets Liabilities and Owner’s Equity

Cash $30326 Notes payable $12,500

Land $12000 Mortgage loan $9000

Inventory 5550 Paid-in capital 23250

Receivable 2620 Retained earnings 1970

Pre-Paid Insurance $1224 Trade Creditor 5000

Total $51720 Total $51720

12. The store paid off $6,000 of its note payable (disregard interest).

Assets Liabilities and Owner’s Equity

Cash $24326 Notes payable $6,500

Land $12000 Mortgage loan $9000

Inventory 5550 Paid-in capital 23250

Receivable 2620 Retained earnings 1970

Pre-Paid Insurance $1224 Trade Creditor 5000

Total $45720 Total $45720

13. Smith sold one-third of the stock he owned in Music Mart, Inc., for $11,000 cash.

Assets Liabilities and Owner’s Equity

Cash $24326 Notes payable $6,500

Land $12000 Mortgage loan $9000

Inventory 5550 Paid-in capital 23250

Receivable 2620 Retained earnings 1970

Pre-Paid Insurance $1224 Trade Creditor 5000

Total $45720 Total $45720

14. Merchandise costing $850 was sold for $1,310, which was received in cash.

Assets Liabilities and Owner’s Equity

Cash $25636 Notes payable $6,500

Land $12000 Mortgage loan $9000

Inventory 4700 Paid-in capital 23250

Receivable 2620 Retained earnings 2430

Pre-Paid Insurance $1224 Trade Creditor 5000

Total $46180 Total $46180

Vous aimerez peut-être aussi

- Case Music MartDocument23 pagesCase Music MartDarwin Dionisio Clemente75% (4)

- Problem 2-2: J.L. Gregory CompanyDocument5 pagesProblem 2-2: J.L. Gregory CompanyKAPIL MBA 2021-23 (Delhi)Pas encore d'évaluation

- Balance Sheet and Transactions Analysis for Charles CompanyDocument14 pagesBalance Sheet and Transactions Analysis for Charles CompanyArunesh SN100% (1)

- Case Study15Document6 pagesCase Study15Arpita SahuPas encore d'évaluation

- Case 2-2 Music Mart Balance Sheet 1 OctDocument5 pagesCase 2-2 Music Mart Balance Sheet 1 OctAnubhav Jha100% (3)

- Ribbons an’ Bows case analysisDocument4 pagesRibbons an’ Bows case analysisShivam Kanojia100% (2)

- Q3 Navin PackagingDocument3 pagesQ3 Navin PackagingRishabh ChawlaPas encore d'évaluation

- Dispensers of CaliforniaDocument4 pagesDispensers of CaliforniaShweta GautamPas encore d'évaluation

- Maynard Company Balance Sheets"TITLE "TITLE Maynard Company June Income StatementDocument2 pagesMaynard Company Balance Sheets"TITLE "TITLE Maynard Company June Income Statementriya lakhotiaPas encore d'évaluation

- Maynard CompanyDocument5 pagesMaynard CompanyNikitha Andrea SaldanhaPas encore d'évaluation

- Assumptions - : Cash Flow From Operations $ 0Document4 pagesAssumptions - : Cash Flow From Operations $ 0Krish HegdePas encore d'évaluation

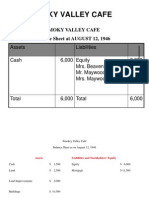

- Smokey Valley Cafe Balance Sheets 1946Document3 pagesSmokey Valley Cafe Balance Sheets 1946mohit_namanPas encore d'évaluation

- Ram Traders - NidhiDocument5 pagesRam Traders - NidhinidhidPas encore d'évaluation

- Problems On Profitable Product MixDocument9 pagesProblems On Profitable Product MixUdita DasPas encore d'évaluation

- WCM QuestionsDocument5 pagesWCM QuestionsBhavin BaxiPas encore d'évaluation

- AHM13e - Chapter - 06 Solution To Problems and Key To CasesDocument26 pagesAHM13e - Chapter - 06 Solution To Problems and Key To CasesGaurav ManiyarPas encore d'évaluation

- Chapter 6 Cost of Sales and Inventories GuideDocument62 pagesChapter 6 Cost of Sales and Inventories GuideRosedel Rosas100% (2)

- Maynard Company (A & B)Document9 pagesMaynard Company (A & B)akashnathgarg0% (1)

- Chapter 7Document19 pagesChapter 7Arun Kumar SatapathyPas encore d'évaluation

- Lone Pine Cafe Balance Sheets Case StudyDocument13 pagesLone Pine Cafe Balance Sheets Case StudyCynthia Anggi Maulina100% (1)

- Mansa Building Case Study AnalysisDocument14 pagesMansa Building Case Study AnalysisRikki DasPas encore d'évaluation

- Modern Pharma SolnDocument3 pagesModern Pharma SolnSakshiPas encore d'évaluation

- Campus PizzeriaDocument12 pagesCampus PizzeriaSHIVAM SRIVASTAVAPas encore d'évaluation

- Stock Valuation Problems SolvedDocument6 pagesStock Valuation Problems SolvedShubham Aggarwal100% (1)

- Industrial Relations at Asian Paints - ePGPX03 - Group - 9Document13 pagesIndustrial Relations at Asian Paints - ePGPX03 - Group - 9manik singh0% (2)

- Spencer Tire PurchaseDocument28 pagesSpencer Tire PurchaseJitendra Choudhary0% (2)

- Case Analysis American University of Beirut Medical Centre (AUBMC) PACADI FrameworkDocument7 pagesCase Analysis American University of Beirut Medical Centre (AUBMC) PACADI FrameworkAdarsh Nayan100% (1)

- Thumbs-Up Inc.Document4 pagesThumbs-Up Inc.Rakshit Chandra Shekhar JoshiPas encore d'évaluation

- Boardroom GameDocument12 pagesBoardroom GameShivam SomaniPas encore d'évaluation

- Question: Erika and Kitty, Who Are Twins, Just Received $30,000 Each For Their 25th Birthday. They Both Hav..Document4 pagesQuestion: Erika and Kitty, Who Are Twins, Just Received $30,000 Each For Their 25th Birthday. They Both Hav..Malik AsadPas encore d'évaluation

- Problems & Solutions - RNSDocument28 pagesProblems & Solutions - RNSAyushi0% (1)

- Ikea-Case-Analysis 2Document10 pagesIkea-Case-Analysis 2Nicole ClianoPas encore d'évaluation

- Sharma Industries structural dilemma case studyDocument7 pagesSharma Industries structural dilemma case studyRohanPas encore d'évaluation

- Managers We Are Katti With You - PPL - Group-4Document11 pagesManagers We Are Katti With You - PPL - Group-4kjhathiPas encore d'évaluation

- Problem 3-1Document2 pagesProblem 3-1Omar CirunayPas encore d'évaluation

- Hamilton - Case BDocument8 pagesHamilton - Case BJayash KaushalPas encore d'évaluation

- Chemalite Inc Cash Flow AnalysisDocument2 pagesChemalite Inc Cash Flow AnalysisAnuragPas encore d'évaluation

- Lori Crump Accounting Case StudyDocument1 pageLori Crump Accounting Case StudyHarsh Anchalia100% (1)

- Lone Pine Cafe-CaseDocument28 pagesLone Pine Cafe-CaseNadya Rizkita100% (2)

- HDFC Bank SWOT Analysis and Management InsightDocument9 pagesHDFC Bank SWOT Analysis and Management InsightDumb LittyPas encore d'évaluation

- EZ Trailers Production OptimizationDocument3 pagesEZ Trailers Production OptimizationSomething ChicPas encore d'évaluation

- Somany Ceramics Recruitment Case StudyDocument5 pagesSomany Ceramics Recruitment Case StudyTUSAR singhPas encore d'évaluation

- Statement of Profit and Loss, Balance Sheet and Cash Flow Analysis for 1999Document4 pagesStatement of Profit and Loss, Balance Sheet and Cash Flow Analysis for 1999Jayash KaushalPas encore d'évaluation

- Income Statements 2010Document10 pagesIncome Statements 2010Shivam GoelPas encore d'évaluation

- Making A Tough Personnel Decision at Nova Waterfront HotelDocument11 pagesMaking A Tough Personnel Decision at Nova Waterfront HotelSiddharthPas encore d'évaluation

- Manager We Are Katti With YouDocument6 pagesManager We Are Katti With Youmanik singhPas encore d'évaluation

- Clinical Cost Classification and Break-Even AnalysisDocument9 pagesClinical Cost Classification and Break-Even AnalysisKristal Fialho Costa JolyPas encore d'évaluation

- Case Analysis - Nitish@Solutions Unlimited 1Document5 pagesCase Analysis - Nitish@Solutions Unlimited 1Piyush SahaPas encore d'évaluation

- Northboro Machine Tools CorporationDocument9 pagesNorthboro Machine Tools Corporationsheersha kkPas encore d'évaluation

- Case Report - Grenell FarmDocument5 pagesCase Report - Grenell Farmajsibal100% (1)

- Assignment 3 Mismanagement of Fiscal Policy Greece's Achilles' HeelDocument6 pagesAssignment 3 Mismanagement of Fiscal Policy Greece's Achilles' HeelYash Aggarwal100% (1)

- Lewis Corporation case study: Analysis of inventory valuation methodsDocument7 pagesLewis Corporation case study: Analysis of inventory valuation methodsSudeep ShahPas encore d'évaluation

- Forest City Tennis Club General Ledger and Financial StatementsDocument9 pagesForest City Tennis Club General Ledger and Financial StatementsAhmedNiaz100% (1)

- ICICI Bank's Strategy to Capture Untapped Retail MarketDocument13 pagesICICI Bank's Strategy to Capture Untapped Retail MarketSonaldeep100% (1)

- Fra Mid-Term Pgp13Document3 pagesFra Mid-Term Pgp13Gauri AgarwalPas encore d'évaluation

- 704Document3 pages704Bhoomi GhariwalaPas encore d'évaluation

- 704Document5 pages704Bhoomi GhariwalaPas encore d'évaluation

- Accounting Exams - 1Document2 pagesAccounting Exams - 1MachelMDotAlexanderPas encore d'évaluation

- Instructions: 2-36 CHAPTERDocument4 pagesInstructions: 2-36 CHAPTERahmad Fauzani MuslimPas encore d'évaluation

- Group assignment: Financial accountingDocument4 pagesGroup assignment: Financial accountingNguyen HuongPas encore d'évaluation

- 560289Document20 pages560289Stranger SinhaPas encore d'évaluation

- Actuarial Society of India: ExaminationsDocument5 pagesActuarial Society of India: ExaminationsStranger SinhaPas encore d'évaluation

- Case Method of LearningDocument8 pagesCase Method of LearningStranger SinhaPas encore d'évaluation

- Maynard A SolutionDocument3 pagesMaynard A SolutionStranger SinhaPas encore d'évaluation

- Institute of Actuaries of India: ExaminationsDocument7 pagesInstitute of Actuaries of India: ExaminationsStranger SinhaPas encore d'évaluation

- Current Assets: Asofjunei As of June 30Document3 pagesCurrent Assets: Asofjunei As of June 30Stranger SinhaPas encore d'évaluation

- JPMorgan Chase Organisational Behaviour StrategiesDocument3 pagesJPMorgan Chase Organisational Behaviour StrategiesStranger SinhaPas encore d'évaluation

- Analyzing Business Markets Chapter 7 OutlineDocument21 pagesAnalyzing Business Markets Chapter 7 OutlineStranger SinhaPas encore d'évaluation

- Usin Activity-Based Costing (ABC) To Measure Profitability On A Commercial Loan Portfolio - Mehmet C. KocakulahDocument19 pagesUsin Activity-Based Costing (ABC) To Measure Profitability On A Commercial Loan Portfolio - Mehmet C. KocakulahUmar Farooq Attari100% (2)

- The Investment Function in Banking and Financial-Services ManagementDocument18 pagesThe Investment Function in Banking and Financial-Services ManagementHaris FadžanPas encore d'évaluation

- Product MarketingDocument2 pagesProduct MarketingAmirul AzwanPas encore d'évaluation

- Presentation On Attrition Rate of DeloitteDocument13 pagesPresentation On Attrition Rate of DeloitteRohit GuptaPas encore d'évaluation

- Engagements To Review Financial Statements PSRE 2400Document13 pagesEngagements To Review Financial Statements PSRE 2400ChristineThereseBrazulaPas encore d'évaluation

- Quality Improvement With Statistical Process Control in The Automotive IndustryDocument8 pagesQuality Improvement With Statistical Process Control in The Automotive Industryonii96Pas encore d'évaluation

- Supply Chain-Case Study of DellDocument3 pagesSupply Chain-Case Study of DellSafijo Alphons100% (1)

- Hygienic Chappathi Business Loan ReportDocument13 pagesHygienic Chappathi Business Loan ReportJose PiusPas encore d'évaluation

- Water and Diamond ParadoxDocument19 pagesWater and Diamond ParadoxDevraj100% (1)

- Lecture7 - Equipment and Material HandlingDocument52 pagesLecture7 - Equipment and Material HandlingAkimBiPas encore d'évaluation

- The Cost of Capital, Corporate Finance and The Theory of Investment-Modigliani MillerDocument38 pagesThe Cost of Capital, Corporate Finance and The Theory of Investment-Modigliani MillerArdi GunardiPas encore d'évaluation

- LC Financial Report & Google Drive Link: Aiesec Delhi IitDocument6 pagesLC Financial Report & Google Drive Link: Aiesec Delhi IitCIM_DelhiIITPas encore d'évaluation

- Business PlanDocument31 pagesBusiness PlanBabasab Patil (Karrisatte)100% (1)

- Annual Training Calendar 2011-2012Document10 pagesAnnual Training Calendar 2011-2012krovvidiprasadaraoPas encore d'évaluation

- SAP Project Systems OverviewDocument6 pagesSAP Project Systems OverviewkhanmdPas encore d'évaluation

- E-Challan CCMT ChallanDocument2 pagesE-Challan CCMT ChallanSingh KDPas encore d'évaluation

- Advanced Accounting Part 2 Dayag 2015 Chapter 12Document17 pagesAdvanced Accounting Part 2 Dayag 2015 Chapter 12crispyy turon100% (1)

- Ch. 13 Leverage and Capital Structure AnswersDocument23 pagesCh. 13 Leverage and Capital Structure Answersbetl89% (27)

- E-Business Tax Application SetupDocument25 pagesE-Business Tax Application Setuprasemahe4100% (1)

- Cash Inflow and OutflowDocument6 pagesCash Inflow and OutflowMubeenPas encore d'évaluation

- c19b - Cash Flow To Equity - ModelDocument6 pagesc19b - Cash Flow To Equity - ModelaluiscgPas encore d'évaluation

- AU Small Finance Bank LTD.: General OverviewDocument3 pagesAU Small Finance Bank LTD.: General Overviewdarshan jainPas encore d'évaluation

- Main Theories of FDIDocument22 pagesMain Theories of FDIThu TrangPas encore d'évaluation

- Afghan Rose Project - Some More DetailsDocument4 pagesAfghan Rose Project - Some More DetailsShrinkhala JainPas encore d'évaluation

- Hygeia International: I. Title of The CaseDocument7 pagesHygeia International: I. Title of The CaseDan GabonPas encore d'évaluation

- Term Paper-IMCDocument9 pagesTerm Paper-IMCMazharul Islam AnikPas encore d'évaluation

- BDW94CDocument7 pagesBDW94CWalter FabianPas encore d'évaluation

- Finals Quiz #2 Soce, Soci, Ahfs and Do Multiple Choice: Account Title AmountDocument3 pagesFinals Quiz #2 Soce, Soci, Ahfs and Do Multiple Choice: Account Title AmountNew TonPas encore d'évaluation

- Ravikumar S: Specialties: Pre-Opening, Procurement, Implementing Best Practices, Budgets, CostDocument2 pagesRavikumar S: Specialties: Pre-Opening, Procurement, Implementing Best Practices, Budgets, CostMurthy BanagarPas encore d'évaluation

- Idea Bridge - 100 Success Plan For Crisis Recovery & New CeoDocument6 pagesIdea Bridge - 100 Success Plan For Crisis Recovery & New CeoJairo H Pinzón CastroPas encore d'évaluation