Académique Documents

Professionnel Documents

Culture Documents

India Sudar Tax Filed Statement FY 2017-18

Transféré par

India Sudar Educational and Charitable Trust0 évaluation0% ont trouvé ce document utile (0 vote)

26 vues8 pagesIndia Sudar Tax Filed Statement FY 2017-18

Copyright

© © All Rights Reserved

Formats disponibles

PDF ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentIndia Sudar Tax Filed Statement FY 2017-18

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

26 vues8 pagesIndia Sudar Tax Filed Statement FY 2017-18

Transféré par

India Sudar Educational and Charitable TrustIndia Sudar Tax Filed Statement FY 2017-18

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 8

CA. P.V.HLS. Kishore Babu, 8.com., F.c.A.

Chartered Accountant

Cell : 98401 43777

AUDIT REPORT

| have examined the accounts of INDIA SUDAR EDUCATIONAL AND

CHRITABLE TRUST, Flat No. D, Lakshmi Sree Apartments, New No.2,

Old No. 43, Vedha Nagar, Chinmaya Nagar, Stage Il Extenstion, Chennai -

800092. Registration No.454/2004- Tamilnadu for the financial year ended on

31% March 2018 and the attached Balance Sheet as at 31° March 2018 and the

income and expenditure account for the period ended on 31% March 2018 that

are annexed there to and report that:

In my opinion and to best of my information and according to the explanations

given to us the said accounts give the true and fair view,

i) In case of Balance Sheet as at 31" March 2018 and

il) In case of Income and expenditure account the excess of expenditure

over income for the period ended 31° March 2018.

| have obtained all information and explanations, which to the best of my

Knowledge and belief were necessary for the purpose of Audit. In my opinion

Proper books of accounts are maintained .The Balance sheet and income and

Expenditure account referred to in this report are in agreement with the books of

accounts.

Place : Chennai - 17

Date : 24-09-2018

PN\H.S, KISHORE BABU, 8,com.FCA,

= MEMBERSHIP No,26488

#26, CHARI STREET, T.NAGAR,

CHENNAI-600017.

Flat # 4, # 26, Chari Street, T. Nagar, Chennai - 600 017. Tel : 044 - 2814 4188

E-mail : saikishorep@kcms.co.in

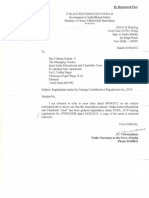

INDIAN INCOME TAX RETURN VERIFICATION FORM

Where the data of dhe Return of Income in Form ITR-1 (SAHAM), 1TR-2,1TR-3,

TTR-4(SUGAM), ITR-5,ITR-7 transmitted electronically without digital signature] «

(Pease see Rule 12 ofthe Income tox Rules, 1962)

‘Assessment Year

2018-19

‘Name PAN

ND CHARITABLE TRUST

g__| INDIA SUDAR EDUCATIONAL AND CHARTTARLETRU noo

z

2g | MatooriBtock No Name Of Premises Building’ Vilage Sob aaain

2. ee; ——l Ing m7

298 | NEWNozoLDNOw DLAKSHMI SREE APTS: roid

EEG Frans

$25 | ResdSiraPon Ota ArealLocatity

a5! VEDHA NAGAR CHINMAVA NAGAR STAGE WENT Seams AOPBOI

32 | Tomiciiane [State in/ZipCode| Andhaar Number) Enrollment 1D

2° | caennar

2 TAMILNADU 600092,

© | Designation of AO (Ward Cree) | [Oricinat or Revised oRraINAL

fling Acknowledgement Number [349866180271018 J[oawoo-meevyyy)|_27-102018

1 Gross Total eome 1 °

2 Deduetions unser Chapter-VEA 2 °

3 | Total come 3 o

g ‘a [Current Year Toss, Tan 3a 0

8 < [Wp NatarPayaiie a 0

23 | amerestand Fee Payae 5 ©

SE | 6 rota Tas, tnterest and Fee Payable 6 7

8% |Z) mueraa

ce [Advance Tax Ta 3

£2 | [otis a o

g = [res Te °

a | Se Assessment Tax 7a a

[Tota Taxes Paid ae PT Te

| Tex Payable 70) ®

9 Retina (e-) 9 °

10] Exempt tncome “Azreultuee "J “2

y Others 10 fA

‘VERIFICATION

|, BALAMANIKANDAN K. son/daughter of K. KRISHNAN.

solemnly declare tothe best of my Knowledge and belie, the iformiation gah We was

electronically by me vide acknowledgement number mentioned

shown therein are ely stat and are in accordance with the provisions othe Incame:tay At, 196)

1s agra Year relevant to te aesessment year 2018-19. [further declare that Lam making i

MANAGING TRUSTEE, and Ta also

ppetent to make this return ad verify i

Sign here wl a Date 27-10-2018 Place CHENNAI

Ar the return has been prepared by a Tax Return Preparer (TRP) give further details av below:

[Mentification No. of TRP

Name of TRE Counter Signature of TRP

For Office Use Only

eee) ESSIREET

Seal and signature of Ax Mab8CC7 09016027 118FCAOKETICSFBRSESDSE2KROCOISEDOEASSARE

receiving official

"8 Centre, Income Tax Department, Bengalurw S60S00°, by ORDINARY

eiting th data tonal Fo ITV sal tbe recived any ber

ie ofthe Icom Deparent rin any mane. Te conan oe of th Fy

Pees ‘nm ITR-V at TTD-CPC wil be sett. the email

NAME

ADDRESS

PAN

DATE OF FORMATION

INCOME TAX 12AA Regn No.

80G Regn No,

PREVIOUS YEAR

ASSESSMENT YEAR

INDIA SUDAR EDUCATIONAL AND.

CHARITABLE TRUST

D, Lakshmi Sree Apartments

New No.2 Old No 43, Vedha Nagar,

Chinmaya Nagar Stage Il Extn

Chennai- 600 092

AAATI42886

24-03-2004

2(88)04-05 Dated 29-09-2004

2(58)04-05 Dated 22/08/2008

01-04-2017 - 31-03-2018

2018-2019

COMPUTATION OF SOURCES AND APPLICATIONS

SOURCES

Income as per Income and Expenditure account

APPLICATIONS

___1380776.00

Expenditure as per income and Expenditure account

1380116.00

Before Depreciation

85% of Income

Less: Actual Applied

Excess Spent

1358259,00

1358259.00

1173098.60

—__1358259.00,

-185160.40

‘L40008-IVNNSHO

“MYOYN'L LBBULS ISVHO 92 #

29r9Z ON dIHSUENIN

“you woe ‘Ng¥d SHOHSI ‘SHA

=<

‘tu arojeq paonpoud sp1ooax pue syoog od sy

8107-60-42

LI > Feauoy,

SSLST Ssest__

ooo0r arqeang sooq upny

Ssust 668ZT.ON 9/V TPE IDIOT

ssis ssle SUMOOUT JOA0 ainypuadxs] Jo ssaox_q :ppy

URE BE z019I- pun sndiop,

qunoury spssy qunowy SonTTge!

S1OZ-E-1¢ 18 Se 1oays oowDyEg

260 009 -eUUEY

WX [] og SEN eke

JUBUN BYPAAS Cb “ON PIO ‘Z “ON ‘SIdy sag Huysse] Sq |

ISOUL FTA. LVS NV TVWNOLLVONGA A¥aNS VIGNI |

INDIA SUDAR EDUCATIONAL AND CHARITABLE TRUST

D, Lakshmi Sree Apts, New No. 2, Old No. 43, Vedha Nagar

‘Chinmaya Nagar Stage II Extn.

Chennai- 600 092

Income and Expenditure account for the year ended 31-3-2018

Expenditure Total Income Total

Amouat(1NR) Amount INR)

Deploying Teachers Project 1024900 Donation Received 1377963

Distribution of Education Stationeries 58321 Interest Received 2153

Awareness and Training Programm 60130

Education Aid for Individual 85954

India Sudar Computer Tra

Centre Expenses 62300

India Sudar Library Expenses 37467

Infrastructure for Schools 19186

Audit Fees 10000

Bank Charges l

Excess of Income

Over Expenditure 21857

1380116 1380116

Chennai - 17

24-09-2018

‘As per Books and records produced before me

Ve

PVH. KISHORE BABU, a.com.e0A

ERSHIP No.26a0a

I STREET, T.NAGAR,

CHENNAl-600017,

INDIA SUDAR EDUCATIONAL AND CHARITABLE TRUST

D, Lakshmi Sree Apts, New No.2 Old No. 43, Vedha Nagar

Chinmaya Nagar Stage Il Extn,

Chennai- 600 092

s and Payments account for the year ended 31-3-2018

Receipts Total Payments Total

Amount INR) Amount(INR)

Opening Balance Deploying Teachers Project 1024900

Cash in hand : Distribution of Education Stationeries 58321

Cash at Bank Awareness and Training Programm 60130

ICICI Bank Ae No.12899 11397 Education Aid for Individual 85954

ICICI Bank Ale No, 23735 1 India Sudar Computer Training

Centre Expenses 62300

Donation Received 1377963 India Sudar Library Expenses 37467

Interest Received 2153 Infrastructure for Schools 19186

Audit Fees 27500

Bank Charges 1

Closing Balance

Cash in Hand -

Cash at Bank

ICICI Bank Ave No.12899 15755

1391514 1391514

Chennai - 17

24-09-2018

‘As per Books and records produced before me

PVH.S, KISHORE BABU, Bcom.FCA,

MEMBERSHIP No.26488

#28, CHARI STREET, T.NAGAR,

‘CHENNAI-600017.

FORM NO. 108

[See rule 178]

[Audit report under section 12A(b) of the Inconte-tax Act, 1961, In the case of charitable or religious trust or institutions

have examined the balance sheet of INDIA SUDAR EDUCATIONAL AND CHARITABLE-TRUST , AAATI42886 [name

and PAN ofthe trust or institation] as a S1ML¥2048 and the Profit and loss account for the year ended on that date which are in

agrecment with the books of account maintained by th said trust or institution

Ihave obtained al the information and explanations which othe bes of my knowledge and helief were necessary forthe purposes

‘ofthe audit. In my opinion, proper books of account have been kept by the head office and the branches ofthe abovenamed trust

visited by me so fa as appears from my examination ofthe books, and proper Retums adequate forthe purposes of audit have

been received from branches not visited by me, subject to the comments given below:

NIL.

In my opinion and tothe best of my information, and according to information given to me , te sald accouns give a rue and

ftir view-

iin the case ofthe balance sheet, of the tae of affairs ofthe above named trust as at 31/03/2018 and

i) n the case ofthe profit and loss account, of the profit or las of its accounting year ending on 30872018

‘The preseibed particulars are annoxed hereto,

Place (CHENNAL

Date 241092018

Name

‘Membership Number e268

FRN (Firm Registration Number)

Address ‘No.2, CHARISTREET TNA

GAR CHENNAL-I7

ANNEXURE

Statement of partieulars

1. APPLICATION OF INCOME FOR CHARITABLE OR RELIGIOUS PURPOSES

1: Amount of income of the previous year applied to TD

charitable or religious purposes in India during that. year (

Llo

‘Whether the trast has exercised the option underclause 1] Not

(2) ofthe Explanation w Section 11(1P2IF so, the details

‘ofthe amount of income deem jo have been applied to

charitable or religious purposes i India during the previous

year(®)

‘| Amount of income aeeumalated OF el apart for application! Yes

to charitable or religious purposes, tothe extent does not rc

exceed 5 percent a the incamiederived from property

held under trust wholly for such purposes! (t)

“| Amount of income eligible for exemption under section | Na

LGXe) Give details)

‘5 | Amount of income, in addition to the amount Tend To

initem 3 above, accumulated or set apt for specified

purposes under section 11(2)(&)

{6 | Wheiber the amount of income mentioned a tems S above | No

has been invested or deposited in the manner lad down in|

section 11(2X0) ?1°S0, the details thereof.

7,| Whether any part ofthe incom in respect of which an No.

‘option was exercised under clause (2) ofthe Explanation to

| section 11(1) im any eatir year is deemed to be income of,

the previous year under section 11(1B) ? Ifo, the details

| ereor

‘| Whether, during the previous year, any part oF income sccumuTated oF Se apart Tor Specified purposes under secon

11G) in any earlier year

[ay] las been applied for purposes other than charitable or] No

religious purposes ot has ceased to be accumulated oF

set apart for application thereto, oF

Jt) has ceased to remain invested in any security rerred | No

ton section 11(2)(0)) or deposited in any account

referred to in section 112XbMi) oF seetion 11(2)b)

id, oF

[co] Bas not been wilised Tor purposes for Which War

accumulated o set apart during the period for which

‘twas tobe accumulated or set apart or inthe year

immediacy following the expiry thereof? Iso the

details thereof

1

‘No 4

ee

1 APPHICATION OR USE OF INCOME OR PROPERTY FOR THE BENT OF FERSONS REFERRED TOIN SECTION 13(3)

[1] Waetie any rao he income or ropeny fe tat oe Ee OF PERSONS REF he beliaty] Nowe sea ay

the amount, rate of neest charged

2 Securit an

rah ote income or propery fe ial was malls GF CGRISISTO BSNS

dry ltl fo the wt of my sac person during the review yeah

Vous aimerez peut-être aussi

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Career Guidance Awareness Poster - India Sudar - Part ADocument22 pagesCareer Guidance Awareness Poster - India Sudar - Part AIndia Sudar Educational and Charitable Trust100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- 03 Defense Poster IndiasdarDocument4 pages03 Defense Poster IndiasdarIndia Sudar Educational and Charitable TrustPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Civil Service Poster IndiasudarDocument1 pageCivil Service Poster IndiasudarIndia Sudar Educational and Charitable Trust100% (1)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- 11 Paramedical Poster IndiasudarDocument3 pages11 Paramedical Poster IndiasudarIndia Sudar Educational and Charitable TrustPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- 07 Agri Poster IndiasudarDocument2 pages07 Agri Poster IndiasudarIndia Sudar Educational and Charitable TrustPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- India Sudar Tax Filed Statement FY 2019-20Document8 pagesIndia Sudar Tax Filed Statement FY 2019-20India Sudar Educational and Charitable TrustPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- India Sudar - Rainwater Harvesting MethodDocument16 pagesIndia Sudar - Rainwater Harvesting MethodIndia Sudar Educational and Charitable TrustPas encore d'évaluation

- 02 CA CMA CS Poster India SudarDocument2 pages02 CA CMA CS Poster India SudarIndia Sudar Educational and Charitable TrustPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- India Sudar CSR1 Registration Number Approval LetterDocument1 pageIndia Sudar CSR1 Registration Number Approval LetterIndia Sudar Educational and Charitable TrustPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- India Sudar - Science Experimental Based Learning and Awareness - Ebook - OCPL - Ver 2.0Document110 pagesIndia Sudar - Science Experimental Based Learning and Awareness - Ebook - OCPL - Ver 2.0India Sudar Educational and Charitable Trust100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- India Sudar - Science Experimental Based Learning and Awareness - Ebook - OCPL - Ver 2.0Document110 pagesIndia Sudar - Science Experimental Based Learning and Awareness - Ebook - OCPL - Ver 2.0India Sudar Educational and Charitable Trust100% (1)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- India Sudar Educational and Charitable TrustDocument2 pagesIndia Sudar Educational and Charitable TrustIndia Sudar Educational and Charitable TrustPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- India Sudar Income Tax Return and FCRA FC4 - 2014-15 PDFDocument11 pagesIndia Sudar Income Tax Return and FCRA FC4 - 2014-15 PDFIndia Sudar Educational and Charitable TrustPas encore d'évaluation

- India Sudar FCRA CertificateDocument3 pagesIndia Sudar FCRA CertificateIndia Sudar Educational and Charitable TrustPas encore d'évaluation

- India Sudar Scholarship FormDocument4 pagesIndia Sudar Scholarship FormIndia Sudar Educational and Charitable TrustPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)