Académique Documents

Professionnel Documents

Culture Documents

12 Accountancy Ch01 Test Paper 01 Profit and Loss Appropriation

Transféré par

Hari SharmaCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

12 Accountancy Ch01 Test Paper 01 Profit and Loss Appropriation

Transféré par

Hari SharmaDroits d'auteur :

Formats disponibles

Test Papers Designed By : Dr. Vinod Kumar (e-mail : authorcbse@gmail.

com)

Dr. Vinod Kumar is a great name in the field of Accountancy.

He is author of very popular book “Ultimate Book of Accountancy” class 12th and 11th.

Contact Detail : Vishvas Publications 09216629576 and 09256657505

Website : http://bestaccountancybook.in/ and http://vishvasbooks.com/

CBSE TEST PAPER-01

Class - XII Accountancy (Basics of Partnership)

Topic : Profit & Loss Appropriation A/c

1. Where would you record “Rent paid to Partner” while preparing P/L Appropriation [1]

A/c

2. Why don’t we show Manager’s Commission and Interest on Partner’s Loan in P/L [1]

Appropriation Account?

3. What should we do when appropriations are more than the profits? [1]

4. What do understand by the following: [1]

(a) When ‘Interest on capital is Treated as an appropriation’

(b) When “Interest on capital is Treated as a charge”

5. David and John were partners in a firm sharing profits in the ratio of 4 : 1. Their [4]

capitals on 1.4.2006 were : David Rs.2,50,000 and John Rs.50,000. The partnership

deed provided that David will get a commission of 10% on the net profit after

allowing a salary of Rs.2,500 per month to John. The profit of the firm for the year

ended 31.3.2007 was Rs.1,40,000.

Prepare Profit and Loss Appropriation Account for the year ended 31.3.2007.

6. A, B and C were partners in a firm having capitals of Rs.60,000, Rs.60,000 and [6]

Rs.80,000 respectively. Their current account balances were : A Rs.10,000; B Rs.5,000

and C Rs.2,000 (Dr.). According to the partnership deed the partners were entitled to

interest on capital @5% p.a. C being the working partner was also entitled to a salary

of Rs.6,000 p.a. The profits were to be divided as follows:

(a)The first Rs.20,000 in proportion to their capitals

(b) Next Rs.30,000 in the ratio of 5 : 3 : 2

(c) Remaining profits to be shared equally

The firm made a profit of Rs.1,56,000 before charging any of the above items.

Prepare the profit and loss appropriation account and pass the necessary Journal

entry for the appropriation of profits.

7. X and Y were partners in a firm sharing profits and losses in the ratio of their capitals [3]

which were Rs.5,00,000 and Rs.4,00,000 respectively. The partnership agreement

Material downloaded from http://myCBSEguide.com and http://onlineteachers.co.in

Portal for CBSE Notes, Test Papers, Sample Papers, Tips and Tricks

provided a salary of Rs.20,000 p.a. to Y and 10% p.a. interest on partners capital. The

profit of the firm for the year ended 31st March, 2008 was Rs.1,46,000. Prepare P/L

Appropriation Account of X and Y for the year ended 31st March 2008.

8. Angad, Fateh and Kothari were partners in a firm sharing profits in the ratio of 3 : 4 : [4]

5. The fixed capitals were Angad Rs.2,00,000, Fateh Rs.2,50,000 and Kothari

Rs.3,00,000 respectively. The partnership deed provided for the following :

(13) Interest on capital @6% p.a.

(ii) Salary of Rs.15,000 p.a. to Kothari.

(iii) Interest on partner’s drawings will be charged @12% p.a.

During the year ended 31.3.2009 the firm earned a profit of Rs.1,35,000. Angad

withdrew Rs.5,000 on 1.4.2008, Fateh withdrew Rs.6,000 on 30.9.2008 and Kothari

withdrew Rs.7,500 on 31.12.2008.

Prepare Profit and Loss Appropriation Account for the year ended 31.3.2009

9. DK, EK and FK were partners in a firm sharing profits in the ratio of 7:4:9. Their fixed [4]

capitals were ; DK Rs.2,00,000; EK Rs.75,000 and FK Rs.3,50,000. Their Partnership

deed provided for the following:

(13) Interest on capital @ 9% per annum and Interest on drawings @ 6%

per annum.

(ii) Salary of Rs.6,000 per month to EK.

DK Withdrew Rs.25,000 ; EK withdrew Rs.15,000 during the year and interest on

FK’s

Drawings was Rs.1,250 on average basis.

During the year ended 31st December, 2013, the firm earned a profit of Rs.1,70,000.

Prepare P/L Appropriation Account.

10. Singh and King entered into partnership on 1st April 2013 without any partnership [4]

deed. They introduced capitals of Rs.5,00,000 and Rs.3,00,000 respectively. On 31st

October 2013, Singh advanced Rs.2,00,000 by way of loan to the firm without any

agreement as to interest.

The profit and loss account for the year ended 31.3.2014 showed a profit of

Rs.4,30,000 but the Partners could not agree upon the amount of interest on loan to

be charged and the basis of division of profits.

Pass a journal entry for the distribution of the profit between the partners and

prepare the capital accounts of both the partners and Loan account of Singh.

11. Ashok and Rohit were partners in a firm sharing profits in the ratio of 5 : 3. Their [4]

fixed capitals on 1-4-2010 were : Ashok Rs.60,000 and Rohit Rs.80,000. They

agreed to allow interest on capital @12% p.a. and to charge interest on drawings

@15% irrespective of time period. The profit of the firm for the year ended 31-3-

2011 before all adjustments were Rs.12,600 during the year. The drawing made by

Ashok and Rohit were Rs.2,000 and Rs.4,000 during the year. Prepare profit and loss

appropriation account. The interest on capital will be allowed even if the firm incurs

Material downloaded from http://myCBSEguide.com and http://onlineteachers.co.in

Portal for CBSE Notes, Test Papers, Sample Papers, Tips and Tricks

loss.

12. Singh and Gupta decided to start a partnership firm to manufacture low cost jute bags [6]

as plastic bags were creating many environmental problems. They contributed

capitals of Rs. 1,00,000 and Rs. 50,000 on 1st April, 2012 for this. Singh expressed his

willingness to admit Shakti as a partner without capital, who is specially abled but a

very creative and intelligent friend of his. Gupta agreed to this. The terms of

partnership were as follows :

(i) Singh, Gupta and Shakti will share profits in the ratio of 2 : 2 : 1.

(ii) Interest on capital will be provided @ 6% p.a.

Due to shortage of capital, Singh contributed Rs. 25,000 on 30th September, 2012 and

Gupta contributed Rs. 10,000 on 1st January, 2013 as additional capital. The profit of

the firm for the year ended 31st March, 2013 was Rs. 1,68,900.

(a) Identify any two values which the firm wants to communicate to the society.

(b) Prepare Profit and Loss Appropriation Account for the year ending 31st March,

2013.

13. Vinod and Kumar are partners in a firm sharing profits in the ratio of 3:2. The [4]

partnership deed provided that Vinod was to be paid salary of Rs.5,000 per month

and Kumar was to get a commission of Rs.20,000 per year. Interest on capital was to

be allowed @5% p.a. and interest on drawings was to be charged @6% p.a. interest

on Vinod’s drawings was Rs.2,500 and on Kumar’s drawings Rs.850. Capital of the

partners were Rs.4,00,000 and Rs.3,00,000 respectively and were fixed. The firm

earned a profit of Rs.1,81,150 for the year ended 31st March, 2014. Prepare Profit and

Loss Appropriation Account of the firm

Accountancy Challenge

Challenge : 1

Vinod and Kumar are partners sharing profits and losses in the ratio of 3:2. Capital of Vinod is

5,00,000 and Kumar Rs. 3,00,000. As per partnership deed partners are entitled for 12% interest on

capital. The profit for the year was 60,000. Show the distribution of profit.

Challenge : 2

Vinod and Kumar were partners in a firm sharing profits in the ratio of 3:2. Their fixed capitals on 1-4-

2010 were Vinod Rs.2,00,000 and Kumar Rs.4,00,000. They agreed to allow interest on capital @12%

p.a. and charge on drawings @ 15% p.a. The firm earned a profit, before all above adjustments, of

Rs.60,000 for the year ended 31-3-2011. The drawings of Vinod and Kumar during the year were

Rs.6,000 and Rs.10,000 respectively.

Showing your calculation clearly prepare, profit and loss appropriation account of Vinod and Kumar.

The interest on capital will be allowed even if the firm incurs loss.

Material downloaded from http://myCBSEguide.com and http://onlineteachers.co.in

Portal for CBSE Notes, Test Papers, Sample Papers, Tips and Tricks

Vous aimerez peut-être aussi

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawD'EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawÉvaluation : 3.5 sur 5 étoiles3.5/5 (4)

- AHLCON PUBLIC SCHOOL Accountancy Class XII AssignmentDocument59 pagesAHLCON PUBLIC SCHOOL Accountancy Class XII Assignmentrajat0% (1)

- Delhi Public School: ACCOUNTANCY - (Subject Code: 055)Document4 pagesDelhi Public School: ACCOUNTANCY - (Subject Code: 055)AbhishekPas encore d'évaluation

- Indus Universal School Accountancy worksheet on partnershipDocument7 pagesIndus Universal School Accountancy worksheet on partnershipLexPas encore d'évaluation

- Partnership Fundamentals - WorksheetDocument7 pagesPartnership Fundamentals - WorksheetMihika GunturPas encore d'évaluation

- 7 Wi 8 Es AVatv NFK 0 LF QHaDocument9 pages7 Wi 8 Es AVatv NFK 0 LF QHaPranshu SethiPas encore d'évaluation

- Dr. Vinod Kumar: Contact DetailDocument2 pagesDr. Vinod Kumar: Contact Detailyokesh ashokPas encore d'évaluation

- 12 Accountancy ch01 Test Paper 04 Past Adjestments PDFDocument3 pages12 Accountancy ch01 Test Paper 04 Past Adjestments PDFRicha SharmaPas encore d'évaluation

- Accounting For Partnership FirmDocument11 pagesAccounting For Partnership FirmNeha AhilaniPas encore d'évaluation

- Fundamental of Partnership - Test-17-11-2023Document2 pagesFundamental of Partnership - Test-17-11-2023umangchh2306Pas encore d'évaluation

- Long Answer Type QuestionDocument75 pagesLong Answer Type Questionincome taxPas encore d'évaluation

- Basic Concept (Test)Document4 pagesBasic Concept (Test)Midhun PerozhiPas encore d'évaluation

- Partnership AccountingDocument21 pagesPartnership AccountingTharun P.Mu.Pas encore d'évaluation

- Dr. Vinod Kumar: Contact DetailDocument2 pagesDr. Vinod Kumar: Contact Detailyokesh ashokPas encore d'évaluation

- Basics of Partnership Unit 1Document1 pageBasics of Partnership Unit 1Kalpesh ShahPas encore d'évaluation

- Xii Comm Holiday Homework 2020 23Document44 pagesXii Comm Holiday Homework 2020 23Mohit SuryavanshiPas encore d'évaluation

- Holidays Home Work Xii 2023-24Document5 pagesHolidays Home Work Xii 2023-24Akshat TiwariPas encore d'évaluation

- Practical (TSG 2020-21)Document24 pagesPractical (TSG 2020-21)Gaming With AkshatPas encore d'évaluation

- Answers NCERT Solutions For Class 12 Accountancy Freehomedelivery NetDocument149 pagesAnswers NCERT Solutions For Class 12 Accountancy Freehomedelivery NetAnkur MishraPas encore d'évaluation

- GKJ Accounts Xii - Rs 68.00Document67 pagesGKJ Accounts Xii - Rs 68.00sintisharma67Pas encore d'évaluation

- WS 2 FUNDAMENTALS OF PARTNERSHIP - DocxDocument5 pagesWS 2 FUNDAMENTALS OF PARTNERSHIP - DocxGeorge Chalissery RajuPas encore d'évaluation

- Class XII Assignment - 2 Accounting For Partnership Firms-Fundamentals 1Document3 pagesClass XII Assignment - 2 Accounting For Partnership Firms-Fundamentals 1Lester Williams100% (1)

- Partnership Fundamental 12 (2023)Document3 pagesPartnership Fundamental 12 (2023)Hansika SahuPas encore d'évaluation

- ACC Assignment Questions Extra PractiseDocument20 pagesACC Assignment Questions Extra Practisesikeee.exePas encore d'évaluation

- Ch1 AssignmentDocument3 pagesCh1 AssignmentRachit JainPas encore d'évaluation

- Fundamentals of Partnership: Dhiman ClaimsDocument7 pagesFundamentals of Partnership: Dhiman ClaimsAyareena GiriPas encore d'évaluation

- RKG Imp Q (CH 1 & 2) DoneDocument3 pagesRKG Imp Q (CH 1 & 2) Donepriyanshi.bansal25Pas encore d'évaluation

- Sample Paper 4Document6 pagesSample Paper 4Ashish BatraPas encore d'évaluation

- REVISION 2022 Part A - CH. 2Document5 pagesREVISION 2022 Part A - CH. 2ADAM ABDUL RAZACKPas encore d'évaluation

- Fundamentals of Accounting ProblemsDocument1 pageFundamentals of Accounting ProblemsAditya ThakurPas encore d'évaluation

- 28 07 2023 - 344571Document4 pages28 07 2023 - 344571Boda TanviPas encore d'évaluation

- Worksheet 1-Fundamentals of PartnershipDocument6 pagesWorksheet 1-Fundamentals of Partnershipshakir surtiPas encore d'évaluation

- Without AnswerDocument4 pagesWithout AnswerRakesh AryaPas encore d'évaluation

- Accountancy Practice Sheet on Partnership FundamentalsDocument10 pagesAccountancy Practice Sheet on Partnership FundamentalsMarivisiasPas encore d'évaluation

- Fundamentals One Shot Sunil PandaDocument27 pagesFundamentals One Shot Sunil PandaTûshar ThakúrPas encore d'évaluation

- Partnership Fundamentals Assignment SolutionsDocument8 pagesPartnership Fundamentals Assignment Solutionssainimanish170gmailc100% (1)

- 12 Accountancy Ch01 Test Paper 04 Past AdjustmentsDocument2 pages12 Accountancy Ch01 Test Paper 04 Past AdjustmentsSACHIN YADAV100% (1)

- Class XII ACCOUNTANCY ASSIGNMENTDocument3 pagesClass XII ACCOUNTANCY ASSIGNMENTTvisha DhingraPas encore d'évaluation

- Partnership FundamentalsDocument3 pagesPartnership FundamentalsDeepanshu kaushikPas encore d'évaluation

- APS Class 12th Accountancy ExamDocument5 pagesAPS Class 12th Accountancy Exammmt05Pas encore d'évaluation

- 12 Cbse Accountancy Set 1 QPDocument12 pages12 Cbse Accountancy Set 1 QPAymenPas encore d'évaluation

- Wa0011.Document6 pagesWa0011.Pieck AckermannPas encore d'évaluation

- CH 1 PaperDocument2 pagesCH 1 PaperMaulik ThakkarPas encore d'évaluation

- Accontancy 1st Unit Test 2020-21Document2 pagesAccontancy 1st Unit Test 2020-21Kul DeepPas encore d'évaluation

- 12th Partnership Fundamentals GS Test 18.04.2021Document2 pages12th Partnership Fundamentals GS Test 18.04.2021Shreekumar MaheshwariPas encore d'évaluation

- Accounts and Business Studies Question BankDocument5 pagesAccounts and Business Studies Question BankAkshat TiwariPas encore d'évaluation

- Accounting For Partnership Firms - Fundamentals (Revision)Document4 pagesAccounting For Partnership Firms - Fundamentals (Revision)pratham bhagatPas encore d'évaluation

- Class 12 Accounts CA Parag GuptaDocument368 pagesClass 12 Accounts CA Parag GuptaJoel Varghese0% (1)

- Accounts Test XiiDocument1 pageAccounts Test XiiPoonam SinghPas encore d'évaluation

- Accountancy For Class XII Full Question PaperDocument35 pagesAccountancy For Class XII Full Question PaperSubhasis Kumar DasPas encore d'évaluation

- Class Test Fundamentals and Goodwill Set A 01.05.2023 1Document2 pagesClass Test Fundamentals and Goodwill Set A 01.05.2023 1ANTECPas encore d'évaluation

- 12 Account SP 01 PDFDocument24 pages12 Account SP 01 PDFJanvi KushwahaPas encore d'évaluation

- 1 TEST, 2020-21 Class: Xii AccountancyDocument1 page1 TEST, 2020-21 Class: Xii AccountancyKul DeepPas encore d'évaluation

- +2 Accounts RTP 2023-24 Partnership Fundamental & Goodwill - 29089845Document9 pages+2 Accounts RTP 2023-24 Partnership Fundamental & Goodwill - 29089845vanshkapoorr3Pas encore d'évaluation

- Partnership Accounts Problems and SolutionsDocument4 pagesPartnership Accounts Problems and SolutionsSmita AdhikaryPas encore d'évaluation

- Partnership Fundamnetal - 1Document2 pagesPartnership Fundamnetal - 1Harsh ShahPas encore d'évaluation

- Paper For Term-1 2020-21 For Accountancy Xii PDFDocument11 pagesPaper For Term-1 2020-21 For Accountancy Xii PDFPrashil AgrawalPas encore d'évaluation

- Accounting For PartnershipDocument7 pagesAccounting For PartnershipShajila AnvarPas encore d'évaluation

- FUNDAMENTAL OF PARTNERSHIP Class 12Document1 pageFUNDAMENTAL OF PARTNERSHIP Class 12Varun HurriaPas encore d'évaluation

- 12a PP-01 (1N2) AfpDocument6 pages12a PP-01 (1N2) AfpA.c. GuptaPas encore d'évaluation

- Eportfolio AssignmentDocument12 pagesEportfolio Assignmentapi-300872702Pas encore d'évaluation

- Strategic Management - Chapter (1) - Modified Maps - Coloured - March 2021Document4 pagesStrategic Management - Chapter (1) - Modified Maps - Coloured - March 2021ahmedgelixPas encore d'évaluation

- Bizhub 40P: Designed For ProductivityDocument4 pagesBizhub 40P: Designed For ProductivityionutkokPas encore d'évaluation

- Inventory Management in Pharmacy Practice: A Review of LiteratureDocument6 pagesInventory Management in Pharmacy Practice: A Review of LiteratureMohammed Omer QurashiPas encore d'évaluation

- 42k S4hana2021 Set-Up en XXDocument166 pages42k S4hana2021 Set-Up en XXarunkumar dharmarajanPas encore d'évaluation

- Math 10-3 Unit 1.4 Worksheet - Sales 2018-19 W - KEYDocument8 pagesMath 10-3 Unit 1.4 Worksheet - Sales 2018-19 W - KEYBob SmynamePas encore d'évaluation

- EDHEC 10-2021 - Strategy (1108) - Answers To Real Options PartDocument7 pagesEDHEC 10-2021 - Strategy (1108) - Answers To Real Options PartSASPas encore d'évaluation

- Tax 1 (Reviewer)Document15 pagesTax 1 (Reviewer)Lemuel Angelo M. Eleccion100% (1)

- Michigan State FRSDocument88 pagesMichigan State FRSMatt BrownPas encore d'évaluation

- Case Study On Failure of Kellogg's in IndiaDocument10 pagesCase Study On Failure of Kellogg's in IndiaPUSPENDRA RANAPas encore d'évaluation

- Lamoreaux, Problem of Bigness (2019)Document24 pagesLamoreaux, Problem of Bigness (2019)mayatakiya108Pas encore d'évaluation

- Employee Satisfaction Result Period 2023Document15 pagesEmployee Satisfaction Result Period 2023Doppy LianoPas encore d'évaluation

- Simplify The Above ParagraphDocument56 pagesSimplify The Above ParagraphAmjad NiaziPas encore d'évaluation

- International Journal of Hospitality Management: Waseem Ul Hameed, Qasim Ali Nisar, Hung-Che WuDocument15 pagesInternational Journal of Hospitality Management: Waseem Ul Hameed, Qasim Ali Nisar, Hung-Che WuShoaib ImtiazPas encore d'évaluation

- Zerrudo ENTREP ANSWER SHEETSDocument8 pagesZerrudo ENTREP ANSWER SHEETSGlen DalePas encore d'évaluation

- SBLC Monetizing MOUDocument9 pagesSBLC Monetizing MOUDinni Resa75% (4)

- Internship Report On Organizational Study At: Peddinti Sushma Sheela Reg - No.PG2012Document36 pagesInternship Report On Organizational Study At: Peddinti Sushma Sheela Reg - No.PG2012gangadhar adapaPas encore d'évaluation

- Cost Accounting Traditions and Innovations: Standard CostingDocument45 pagesCost Accounting Traditions and Innovations: Standard CostingMaricon BerjaPas encore d'évaluation

- Week 6 Parts of A Business LetterDocument22 pagesWeek 6 Parts of A Business LetterMc HernanPas encore d'évaluation

- Articles of Incorporation Publishing CompanyDocument3 pagesArticles of Incorporation Publishing CompanySheryl VelascoPas encore d'évaluation

- Quality of Life in Europe 2009Document60 pagesQuality of Life in Europe 2009IulianStoianPas encore d'évaluation

- RFP for AIIMS Guwahati Executing AgencyDocument32 pagesRFP for AIIMS Guwahati Executing AgencyAmlan BiswalPas encore d'évaluation

- Management ScienceDocument3 pagesManagement ScienceMario HernándezPas encore d'évaluation

- (4 Marks) : Page 1 of 2Document2 pages(4 Marks) : Page 1 of 2Saiful IslamPas encore d'évaluation

- Block-2 - MS 55 - IGNOUDocument66 pagesBlock-2 - MS 55 - IGNOUNirupama SahooPas encore d'évaluation

- Accounting Disclosure RulesDocument27 pagesAccounting Disclosure RulesDanica DanaePas encore d'évaluation

- SE Chapter-1 semVIDocument12 pagesSE Chapter-1 semVIAmrutraj KumbharPas encore d'évaluation

- Supply Chain Management and LogisticsDocument14 pagesSupply Chain Management and LogisticsEmaPas encore d'évaluation

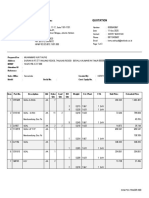

- PT Trakindo Utama: QuotationDocument3 pagesPT Trakindo Utama: QuotationANISPas encore d'évaluation

- Ratika CVDocument2 pagesRatika CVKushal BhatiaPas encore d'évaluation