Académique Documents

Professionnel Documents

Culture Documents

Republic of The Philippines Social Security System

Transféré par

Leomark RespondeTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Republic of The Philippines Social Security System

Transféré par

Leomark RespondeDroits d'auteur :

Formats disponibles

sss.gov.ph My.

SSS Corporate Profile Membership Benefits Loans Publications Other Services Saturday, July 14, 2018

10 KB

For optimal viewing and functionality,

the SSS Website requires Internet Explorer (IE) version 11.

DOWNLOAD IE v.11 HERE

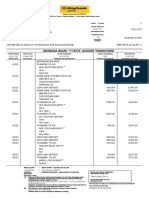

Rate of Contributions to SSS

The monthly contributions are based on the compensation of members ( Please see table on the last page). The current SSS contribution rate is 11% of the monthly salary

credit not exceeding P16,000 and this is being shared by the employer (7.37%) and the employee (3.63%).

Self-employed and voluntary members pay the 11% of the monthly salary credit (MSC) based on the monthly earnings declared at the time of registration.

For OFWs, the minimum monthly salary credit is pegged at P5,000.

For the non-working spouse, the contribution will be based on 50% of the working spouse's last posted monthly salary credit but in no case shall it be lower than P1,000.

Due Dates of Contributions

For Employed members

It is important that you are aware of the payment deadlines for contributions and member loans in order to avoid incurring penalties. If you are an employee-member, your

employer must pay your contributions and member loans monthly in accordance with the prescribed schedule of payment which is according tothe 10th digit of the

Employer's ID Number. Late payments will result to penalties and delays in the processing of your benefits and loans.

The frequency of payment is on a monthly basis for business and household employers.

For Self-employed and Voluntary members

If you are a self-employed or a voluntary member, the prescribed schedule of payment is also being followed, (depending on the 10th (last digit) of the SE/VM SS number).

However, the frequency of contribution payments for self-employed or a voluntary member can be on a monthly or quarterly basis. A quarter covers three (3) consecutive

calendar months ending on the last day of March, June, September and December. Any payment for one, two or all months for a calendar quarter may be made.

For OFWs

Payment of contributions for the months of January to December of a given year may be paid within the same year; contributions for the months of October to December

of a given year may also be paid on or before the 31st of January of the succeeding year.

Due Dates of Loan Payments

For member loans, payment should be made monthly in accordance with the prescribed schedule of payment which is according to the 10th digit of the SS ID/Number.

SSS Homepage Copyright © 1997 Terms of Service

SSS Building East Avenue, Diliman Quezon City, Philippines

For comments, concerns and inquiries contact: International Toll-Free Nos.:

SSS Trunkline No. (632) 920-6401 Asia Middle East Europe

SSS Call Center: 920-6446 to 55 Hongkong: 001-800-0225-5777 Qatar: 00800-100-260 Italy: 00-800-0225-5777

IVRS: 917-7777 Singapore: 001-800-0225-5777 UAE: 800-0630-0038 UK: 00-800-0225-5777

Toll-Free No.: 1-800-10-2255777 Malaysia: 00-800-0225-5777 Saudi Arabia: 800-863-0022

SSS Email: member_relations@sss.gov.ph Taiwan: 00-800-0225-5777 Bahrain: 8000-6094

SSS Facebook: https://www.facebook.com/SSSPh Brunei: 801-4275

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- 2023 DPWH Standard List of Pay Items Volume II DO 6 s2023Document103 pages2023 DPWH Standard List of Pay Items Volume II DO 6 s2023Alaiza Mae Gumba100% (1)

- Hometrek InsideDocument1 pageHometrek InsideLeomark RespondePas encore d'évaluation

- Business Economics - Question BankDocument4 pagesBusiness Economics - Question BankKinnari SinghPas encore d'évaluation

- Pedestal and Base Plate Design - Steel Design: Significant DataDocument1 pagePedestal and Base Plate Design - Steel Design: Significant DataLeomark RespondePas encore d'évaluation

- Weight/m (KG/M) Total Weight (KG)Document2 pagesWeight/m (KG/M) Total Weight (KG)Leomark RespondePas encore d'évaluation

- I Beam CalculationDocument2 pagesI Beam CalculationLeomark RespondePas encore d'évaluation

- Properties of Wide Flange Sections Columns (W Shapes)Document1 pageProperties of Wide Flange Sections Columns (W Shapes)Leomark RespondePas encore d'évaluation

- Taking Over Checklist (Contractor) Rev 12.18Document1 pageTaking Over Checklist (Contractor) Rev 12.18Leomark RespondePas encore d'évaluation

- C Joist DimensionalDocument1 pageC Joist DimensionalLeomark RespondePas encore d'évaluation

- Okada Manila: Electrical Panel BoardDocument1 pageOkada Manila: Electrical Panel BoardLeomark RespondePas encore d'évaluation

- BenchmarkDocument1 pageBenchmarkLeomark RespondePas encore d'évaluation

- IdakDocument39 pagesIdakLeomark RespondePas encore d'évaluation

- Strip Method Best WordDocument28 pagesStrip Method Best WordLeomark RespondePas encore d'évaluation

- Price List For Reinforcing Steel Bars: Search..Document2 pagesPrice List For Reinforcing Steel Bars: Search..Leomark RespondePas encore d'évaluation

- Program of Work: Department of Public Works and HighwaysDocument3 pagesProgram of Work: Department of Public Works and HighwaysLeomark RespondePas encore d'évaluation

- Reinforcing Steel Bars Price List: Structural (Astm Grade 33)Document1 pageReinforcing Steel Bars Price List: Structural (Astm Grade 33)Leomark RespondePas encore d'évaluation

- Aopen Dex5350 PDFDocument2 pagesAopen Dex5350 PDFLeomark RespondePas encore d'évaluation

- KOR CFW BrochureDocument2 pagesKOR CFW BrochureLeomark Responde50% (2)

- Split Type Wall Mounted Inverter - KoppelDocument2 pagesSplit Type Wall Mounted Inverter - KoppelLeomark RespondePas encore d'évaluation

- Split Type Wall Mounted ERA Series - KoppelDocument2 pagesSplit Type Wall Mounted ERA Series - KoppelLeomark RespondePas encore d'évaluation

- Koppel Ceiling SuspendedDocument2 pagesKoppel Ceiling SuspendedLeomark RespondePas encore d'évaluation

- KoppelDocument2 pagesKoppelLeomark RespondePas encore d'évaluation

- 9D., O.or.: Plexiglas SatiniceoDocument4 pages9D., O.or.: Plexiglas SatiniceoLeomark RespondePas encore d'évaluation

- Situatie Avize ATRDocument291 pagesSituatie Avize ATRIoan-Alexandru CiolanPas encore d'évaluation

- Project On SurveyorsDocument40 pagesProject On SurveyorsamitPas encore d'évaluation

- GEARS September 2013Document128 pagesGEARS September 2013Rodger Bland100% (3)

- Independent Power Producer (IPP) Debacle in Indonesia and The PhilippinesDocument19 pagesIndependent Power Producer (IPP) Debacle in Indonesia and The Philippinesmidon64Pas encore d'évaluation

- HPAS Prelims 2019 Test Series Free Mock Test PDFDocument39 pagesHPAS Prelims 2019 Test Series Free Mock Test PDFAditya ThakurPas encore d'évaluation

- Regional Policy in EU - 2007Document65 pagesRegional Policy in EU - 2007sebascianPas encore d'évaluation

- Smart Home Lista de ProduseDocument292 pagesSmart Home Lista de ProduseNicolae Chiriac0% (1)

- International Financial Management 8th Edition Eun Test BankDocument38 pagesInternational Financial Management 8th Edition Eun Test BankPatrickLawsontwygq100% (15)

- Jay Chou Medley (周杰伦小提琴串烧) Arranged by XJ ViolinDocument2 pagesJay Chou Medley (周杰伦小提琴串烧) Arranged by XJ ViolinAsh Zaiver OdavarPas encore d'évaluation

- (Paper) Intellectual Capital Performance in The Case of Romanian Public CompaniesDocument20 pages(Paper) Intellectual Capital Performance in The Case of Romanian Public CompaniesishelPas encore d'évaluation

- Buku Petunjuk Tata Cara Berlalu Lintas Highwaycode Di IndonesiaDocument17 pagesBuku Petunjuk Tata Cara Berlalu Lintas Highwaycode Di IndonesiadianPas encore d'évaluation

- Technical Question Overview (Tuesday May 29, 7pm)Document2 pagesTechnical Question Overview (Tuesday May 29, 7pm)Anna AkopianPas encore d'évaluation

- Community Development Fund in ThailandDocument41 pagesCommunity Development Fund in ThailandUnited Nations Human Settlements Programme (UN-HABITAT)100% (1)

- Business Plan SampleDocument14 pagesBusiness Plan SampleGwyneth MuegaPas encore d'évaluation

- Democratic Developmental StateDocument4 pagesDemocratic Developmental StateAndres OlayaPas encore d'évaluation

- 4 P'sDocument49 pages4 P'sankitpnani50% (2)

- MBBcurrent 564548147990 2022-12-31 PDFDocument10 pagesMBBcurrent 564548147990 2022-12-31 PDFAdeela fazlinPas encore d'évaluation

- Forex Fluctuations On Imports and ExportsDocument33 pagesForex Fluctuations On Imports and Exportskushaal subramonyPas encore d'évaluation

- Lecture 6Document19 pagesLecture 6salmanshahidkhan100% (2)

- Request BADACODocument1 pageRequest BADACOJoseph HernandezPas encore d'évaluation

- Intellectual Property RightsDocument2 pagesIntellectual Property RightsPuralika MohantyPas encore d'évaluation

- Dog and Cat Food Packaging in ColombiaDocument4 pagesDog and Cat Food Packaging in ColombiaCamilo CahuanaPas encore d'évaluation

- Posting Journal - 1-5 - 1-5Document5 pagesPosting Journal - 1-5 - 1-5Shagi FastPas encore d'évaluation

- BS Irronmongry 2Document32 pagesBS Irronmongry 2Peter MohabPas encore d'évaluation

- Manual Goldfinger EA MT4Document6 pagesManual Goldfinger EA MT4Mr. ZaiPas encore d'évaluation

- Percentage and Its ApplicationsDocument6 pagesPercentage and Its ApplicationsSahil KalaPas encore d'évaluation

- Design Analysis of The Lotus Seven S4 (Type 60) PDFDocument18 pagesDesign Analysis of The Lotus Seven S4 (Type 60) PDFChristian Villa100% (4)

- Scheme For CBCS Curriculum For B. A Pass CourseDocument18 pagesScheme For CBCS Curriculum For B. A Pass CourseSumanPas encore d'évaluation