Académique Documents

Professionnel Documents

Culture Documents

FAR Reviewer

Transféré par

Mich Clemente0 évaluation0% ont trouvé ce document utile (0 vote)

99 vues3 pagesThe document provides a review of easy, average, and difficult questions that may be asked on a financial accounting review. Easy questions cover topics like interim financial statements, uncertainties in financial reporting, changes in business models, and events after the reporting period. Average questions involve calculations like amortization, discounting, and inventory. Difficult questions address lease accounting, fair value options, computation of net income, and retirement benefits.

Description originale:

Financial Accounting and Reporting reviewer

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentThe document provides a review of easy, average, and difficult questions that may be asked on a financial accounting review. Easy questions cover topics like interim financial statements, uncertainties in financial reporting, changes in business models, and events after the reporting period. Average questions involve calculations like amortization, discounting, and inventory. Difficult questions address lease accounting, fair value options, computation of net income, and retirement benefits.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

99 vues3 pagesFAR Reviewer

Transféré par

Mich ClementeThe document provides a review of easy, average, and difficult questions that may be asked on a financial accounting review. Easy questions cover topics like interim financial statements, uncertainties in financial reporting, changes in business models, and events after the reporting period. Average questions involve calculations like amortization, discounting, and inventory. Difficult questions address lease accounting, fair value options, computation of net income, and retirement benefits.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 3

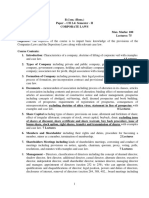

FAR Reviewer

EASY QUESTIONS

1. Under the new Conceptual Framework for Financial Reporting (2018),

a. INTERIM FINANCIAL STATEMENTS are not a common type of financial statement

prepared by a reporting entity. Combined, consolidated and unconsolidated financial

statements were mentioned in the conceptual framework. Interim financial statements

are covered by IAS 34.

b. UNCERTAINTIES:

i. Outcome uncertainty – uncertainty about the amount or timing of any inflow or

outflow of economic benefits that will result from an asset or liability

ii. Existence uncertainty – uncertainty about whether an asset or liability exists

iii. Measurement uncertainty – uncertainty that arises when monetary amounts in

financial reports cannot be observed directly and must be estimated.

2. Change in business model will occur only when an entity either begins or ceases to perform an

activity that is significant to its operations. These include:

a. Acquisition of a business line

i. Entity acquires a company that manages commercial loans and has a business

model that holds the loans in order to collect contractual cash flows. The

portfolio is no longer held for sale

b. Disposal of a business line

c. Termination of a business line

i. A financial services firm decides to shut down its retail mortgage business. That

business no longer accepts new business and the financial services firm is

actively marketing its mortgage loan portfolio for sale.

3. NOT a change in business model:

a. Change in intention related to particular financial assets

b. The temporary disappearance of a particular market for financial assets

c. Transfer of financial assets between parts of the entity with different business models.

4. Dividends received and interest received can either be classified as operating or investing

activities in the statement of cash flows.

5. BOTH fair value model and revaluation model use the fair value of the asset on the date of

subsequent measurement.

6. RECOGNITION OF ELEMENTS OF THE FINANCIAL STATEMENTS

a. Not all items that meet the definition of an asset, liability, equity, income, or expense

are recognized. An asset or liability, income or expense is recognized only if its

recognition provides users of financial statements with useful information that is (1)

relevant and (2) faithful.

7. RETROSPECTIVE APPLICATIONS OF CHANGES (IAS 8):

a. Change in reporting entity

b. Change in accounting policy

c. Change in measurement basis

8. PROSPECTIVE APPLICATION OF CHANGES (IAS 8):

a. Changes in accounting estimates

9. IFRS FOR SMEs: ORIGINAL ISSUE OF SHARES OR OTHER EQUITY INSTRUMENTS

a. If issued prior to receipt of cash, the entity shall present the amount receivable as an

offset to equity in its SFP, not as an asset (CONTRA-EQUITY ACCOUNT)

b. If payment received prior to issuance, the entity cannot be required to repay the cash or

other resources received. The entity shall recognize the corresponding increase in

equity to the extent of consideration received

c. To the extent that the instrument has been subscribed for but not issued, AND the

entity has not yet received payment, the entity shall not recognize an increase in equity.

10. Events After Reporting Period (EARP)

a. Adjusting Events

i. Settlement after the reporting period of a court case that confirms that the

entity had a present obligation at the end of the reporting period.

b. Non-adjusting events (may require disclosure)

i. BusCom

ii. Plan to discontinue an operation

iii. Major purchases of assets, Classifying NCAHFSDO, Disposals, Expropriation

iv. Destruction of major production plant by a fire

v. Announcing, commencing a major restructuring

vi. Major ordinary share transactions and potential ordinary share transactions

after reporting period

vii. Abnormally large changes after the reporting period in asset prices or foreign

exchange rates

viii. Changes in tax rates or tax laws enacted or announced after the reporting

period

ix. Entering into significant commitments or contingent liabilities

x. Commencing major litigation arising solely out of events that occurred after the

reporting period

11. REVENUE RECOGNITION

a. SMEs

i. When the outcome of a transaction involving the rendering of services can be

estimated reliably (recognized using stage of completion or percentage of

completion method. Conditions: (1) amount, stage of completion, costs incurred

can be measured reliably, and (2) probable economic benefits will flow to the

entity.

b. IFRS 15

i. When the entity satisfies a performance obligation. Transfer of “control.”

12. IAS 8 Accounting Policies, Changes in Estimates and Errors

a. Disclosure regarding the accounting policy change if it may have an effect on

subsequent reporting periods.

13. Difference between ‘in the money’ and ‘out of the money’

14. Underlying assumption of Conceptual Framework: Going Concern

AVERAGE QUESTIONS (Questions are very straightforward; you just have to be able think fast)

1. Bonus computations (FIN3)

2. Amortization of Bond premium (or in general, really)

3. Refinancing (ACFINA1)

4. Gain or Loss on Extinguishment of Liability

5. Deferred Rental Income (Operating Leases include Security Deposit, Last month’s rent and

leasehold improvements after depreciation)

6. Interim reporting: The effect of a disposal of a segment of business are reported separately in

the interim periods in which they occur. The property taxes, if clearly benefits the entire year,

then the property taxes are allocated over the interim periods reported.

7. Computation of Beg. RE from End. RE

8. Discounting own note, customer’s note, factoring

9. Beginning inventory computations squeeze

10. SMEs may replace these two financial statements: SCI and SCE

DIFFICULT QUESTIONS

1. Initial Measurement of ROUA

2. Election of Fair Value option for financial liability

3. LEASE LIABILITY

a. Fixed payments

b. Variable lease payments

c. Guaranteed residual value

d. Bargain Purchase Option (CERTAIN0

e. Termination Fees

4. ANNUAL DEPRECIATION (Leases for SMEs)

a. ASSET RECOGNITION: lower of PV of lease payments and fair value. Any initial direct

costs of the lessee are added to the amount recognized as an asset.

b. If there is no certainty that the lessee will obtain ownership by the end of the lease

term, the asset shall be fully depreciated over the shorter of the lease term and its

useful life.

c. A lessee shall also assess at each reporting date whether an asset leased under a finance

lease in impaired.

5. Computation of Net Income

a. RE, End. + Dividends declared (Cash and Stock) – RE, Beg. = Net Income

6. Computation of Current Assets

7. Computation of Liabilities

8. Computation of Taxable Income

9. Retirement Benefits

10. Book Value per Ordinary Share with cumulative preference shares and liquidation value

Vous aimerez peut-être aussi

- A Summary of Accounting PoliciesDocument4 pagesA Summary of Accounting PoliciesCharles GalidoPas encore d'évaluation

- 2 Statement of Financial PositionDocument7 pages2 Statement of Financial Positionreagan blairePas encore d'évaluation

- Summary of PAS 8 (Accounting Policies, Changes in Accounting Estimates and Errors)Document3 pagesSummary of PAS 8 (Accounting Policies, Changes in Accounting Estimates and Errors)Mary Jullianne Caile SalcedoPas encore d'évaluation

- The Philippine Public Sector Accounting StandardsDocument8 pagesThe Philippine Public Sector Accounting StandardsRichel ArmayanPas encore d'évaluation

- Act-6j03 Comp1 1stsem05-06Document14 pagesAct-6j03 Comp1 1stsem05-06RegenLudevesePas encore d'évaluation

- 6959 - PAS 1 - Presentation of Financial StatementsDocument7 pages6959 - PAS 1 - Presentation of Financial Statementsjohn paulPas encore d'évaluation

- Select The Best Answer From The Choices Given.: TheoryDocument14 pagesSelect The Best Answer From The Choices Given.: TheoryROMAR A. PIGAPas encore d'évaluation

- Events After The Reporting PeriodDocument4 pagesEvents After The Reporting PeriodGlen JavellanaPas encore d'évaluation

- Cape Accounting Unit 1 NotesDocument27 pagesCape Accounting Unit 1 NotesDajuePas encore d'évaluation

- Midterm (Red Palacio)Document6 pagesMidterm (Red Palacio)Red Cloudy PalacioPas encore d'évaluation

- 40 - Financial Statements - TheoryDocument9 pages40 - Financial Statements - TheoryROMAR A. PIGAPas encore d'évaluation

- CAPE Accounting Unit 1 NotesDocument27 pagesCAPE Accounting Unit 1 Notessashawoody16779% (14)

- IMChap005Document34 pagesIMChap005cynthia dewiPas encore d'évaluation

- International Financial Reporting Standards:: Chapter OutlineDocument35 pagesInternational Financial Reporting Standards:: Chapter OutlineFarhan Osman ahmedPas encore d'évaluation

- Quick Notes - MFRS108, MFRS110, MFRS137Document4 pagesQuick Notes - MFRS108, MFRS110, MFRS137Ayda S.Pas encore d'évaluation

- National Mock Board Examination 2017 Financial Accounting and ReportingDocument9 pagesNational Mock Board Examination 2017 Financial Accounting and ReportingSam0% (1)

- Nfjpia Nmbe Far 2017 Ans-1Document10 pagesNfjpia Nmbe Far 2017 Ans-1Stephen ChuaPas encore d'évaluation

- Lesson 2Document9 pagesLesson 2Jamaica bunielPas encore d'évaluation

- FAR MockBoard (NFJPIA) - 2017Document9 pagesFAR MockBoard (NFJPIA) - 2017ken100% (1)

- Financial Accountinng 3Document10 pagesFinancial Accountinng 3Nami2mititPas encore d'évaluation

- 40 - Financial Statements - TheoryDocument9 pages40 - Financial Statements - TheoryクロードPas encore d'évaluation

- The Financial Statements PreparationDocument11 pagesThe Financial Statements PreparationanacldnPas encore d'évaluation

- CFAS Quiz 1 Final ADocument5 pagesCFAS Quiz 1 Final ADesiree Angelique RebonquinPas encore d'évaluation

- Intermediate Accounting 3 Prelim Examination - Set BDocument18 pagesIntermediate Accounting 3 Prelim Examination - Set BnovyPas encore d'évaluation

- QuestionsDocument7 pagesQuestionsPangitkaPas encore d'évaluation

- FAR Review Course Pre-Board - Answer KeyDocument17 pagesFAR Review Course Pre-Board - Answer KeyROMAR A. PIGAPas encore d'évaluation

- Final Theories ReviewerDocument16 pagesFinal Theories Reviewermary jane facerondaPas encore d'évaluation

- Events After The Reporting Period (MFRS)Document14 pagesEvents After The Reporting Period (MFRS)ShasabellaPas encore d'évaluation

- Cfas Quizzes 1 3Document10 pagesCfas Quizzes 1 3mikamiiPas encore d'évaluation

- DocumentDocument7 pagesDocumentMae Ann AvenidoPas encore d'évaluation

- Lesson 3Document11 pagesLesson 3shadowlord468Pas encore d'évaluation

- What It Does:: With PfrssDocument7 pagesWhat It Does:: With PfrssOlive Jean TiuPas encore d'évaluation

- Chapter 13Document2 pagesChapter 13Vince PeredaPas encore d'évaluation

- Nfjpia Nmbe Far 2017 AnsDocument9 pagesNfjpia Nmbe Far 2017 AnsSamieePas encore d'évaluation

- Daily Grind No. 1Document2 pagesDaily Grind No. 1Ronel CaagbayPas encore d'évaluation

- Toa Drill 2 (She, SFP, Sme, Lease, Govt GrantsDocument15 pagesToa Drill 2 (She, SFP, Sme, Lease, Govt GrantsROMAR A. PIGAPas encore d'évaluation

- 40 Financial Statements TheoryDocument9 pages40 Financial Statements TheoryPrincesPas encore d'évaluation

- 1 - Quiz 6 PAS 8 PAS 10 PAS 24 PAS 12 PAS 34 PFRS 1Document4 pages1 - Quiz 6 PAS 8 PAS 10 PAS 24 PAS 12 PAS 34 PFRS 1quintanamarfrancisPas encore d'évaluation

- Pas 1: Presentation of Financial StatementsDocument9 pagesPas 1: Presentation of Financial StatementsJung Jeon0% (1)

- NAS For MEs ChecklistDocument4 pagesNAS For MEs Checklistsumankandel015Pas encore d'évaluation

- KẾ TOÁN QUỐC TẾ NÂNG CAO - ÔNDocument7 pagesKẾ TOÁN QUỐC TẾ NÂNG CAO - ÔNcamnhu622003Pas encore d'évaluation

- Review 105 - Day 3 Theory of AccountsDocument13 pagesReview 105 - Day 3 Theory of AccountsKathleen PardoPas encore d'évaluation

- Mock Examination QuestionnaireDocument9 pagesMock Examination QuestionnaireRenabelle CagaPas encore d'évaluation

- D3Document13 pagesD3neo14Pas encore d'évaluation

- EXERCISES - Chapters 2 and 3: Part I True or FalseDocument4 pagesEXERCISES - Chapters 2 and 3: Part I True or FalseCaroline BagsikPas encore d'évaluation

- Chapter 12 Events After The Reporting Period PAS10Document3 pagesChapter 12 Events After The Reporting Period PAS10MicsjadeCastilloPas encore d'évaluation

- Fabm1 Lesson 2Document21 pagesFabm1 Lesson 2JoshuaPas encore d'évaluation

- Aaa Standards by BeingaccaDocument9 pagesAaa Standards by Beingaccakshama3102100% (1)

- (Acctg 112) Pas 8, 10, 12Document8 pages(Acctg 112) Pas 8, 10, 12Mae PandoraPas encore d'évaluation

- Ias 10 Events After The Reporting Period SummaryDocument2 pagesIas 10 Events After The Reporting Period Summaryanon_806011137Pas encore d'évaluation

- Chap 1Document3 pagesChap 1Chaeyoung SonPas encore d'évaluation

- General Features of Financial Statements-2Document17 pagesGeneral Features of Financial Statements-2Elisabeth HenangerPas encore d'évaluation

- Quizzer - Revised Conceptual FrameworkDocument6 pagesQuizzer - Revised Conceptual FrameworkJohn Reiven Adaya Mendoza100% (1)

- Chapter 14 Financial StatementsDocument82 pagesChapter 14 Financial StatementsKate CuencaPas encore d'évaluation

- FAR Review Course Pre-Board - FinalDocument17 pagesFAR Review Course Pre-Board - FinalROMAR A. PIGA100% (1)

- Valix MCQ Chapt 9 10 11 14 PDFDocument26 pagesValix MCQ Chapt 9 10 11 14 PDFRengeline LucasPas encore d'évaluation

- D4Document13 pagesD4neo14Pas encore d'évaluation

- Chapter 15Document88 pagesChapter 15YukiPas encore d'évaluation

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeD'Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeÉvaluation : 1 sur 5 étoiles1/5 (1)

- She P1&2 - Lecture Notes & ExercisesDocument8 pagesShe P1&2 - Lecture Notes & ExercisesMich ClementePas encore d'évaluation

- Ppe - Intpraa - 03182020 - Part 2Document6 pagesPpe - Intpraa - 03182020 - Part 2Mich ClementePas encore d'évaluation

- April 13 Topics - Links - Supplementary VideosDocument1 pageApril 13 Topics - Links - Supplementary VideosMich ClementePas encore d'évaluation

- Intpraa Roadmap Final 04112020Document1 pageIntpraa Roadmap Final 04112020Mich ClementePas encore d'évaluation

- Discontinued Operations: Property, Plant and Equipment 2020-SPN PART 1Document13 pagesDiscontinued Operations: Property, Plant and Equipment 2020-SPN PART 1Mich ClementePas encore d'évaluation

- The Impact of Video Games in Philippine Cultural History: by Lorenzo Miguel "Migo" Alcasabas Speecom A51Document20 pagesThe Impact of Video Games in Philippine Cultural History: by Lorenzo Miguel "Migo" Alcasabas Speecom A51Mich ClementePas encore d'évaluation

- Intangible Assets - Impairment of Assets PDFDocument9 pagesIntangible Assets - Impairment of Assets PDFMich ClementePas encore d'évaluation

- NCR Cup 1 Final RoundDocument6 pagesNCR Cup 1 Final RoundMich ClementePas encore d'évaluation

- MODFIN2 Calendar PDFDocument1 pageMODFIN2 Calendar PDFMich ClementePas encore d'évaluation

- CE On Petty Cash PDFDocument2 pagesCE On Petty Cash PDFMich ClementePas encore d'évaluation

- HW On Cash PDFDocument6 pagesHW On Cash PDFMich ClementePas encore d'évaluation

- Intangible Assets - Impairment of Assets PDFDocument9 pagesIntangible Assets - Impairment of Assets PDFMich ClementePas encore d'évaluation

- NCR CUP 1 ELIMINATION ROUND and CLINCHERDocument9 pagesNCR CUP 1 ELIMINATION ROUND and CLINCHERMich ClementePas encore d'évaluation

- NCR Cup 2 Judges' Copy - Elimination RoundDocument17 pagesNCR Cup 2 Judges' Copy - Elimination RoundMich ClementePas encore d'évaluation

- Work 2 Joshi ClassDocument6 pagesWork 2 Joshi ClassSatyajeet RananavarePas encore d'évaluation

- Apollo Planning Audit Mini CaseDocument24 pagesApollo Planning Audit Mini Casepthav0% (5)

- Aviva 2012 Annual ReportDocument280 pagesAviva 2012 Annual ReportAviva GroupPas encore d'évaluation

- Stern MBA Valuation Final ProjectDocument31 pagesStern MBA Valuation Final Projectjimingli100% (1)

- WEEK 6 Seminar Q&AsDocument26 pagesWEEK 6 Seminar Q&AsMeenakshi SinhaPas encore d'évaluation

- Apple 20 FDocument1 pageApple 20 FAndres_francisco316Pas encore d'évaluation

- Declaration of Trust and Deed of Assignment SampleDocument3 pagesDeclaration of Trust and Deed of Assignment SampleIpe Closa96% (24)

- Introduction To Managerial Accounting and Job Order Cost SystemsDocument57 pagesIntroduction To Managerial Accounting and Job Order Cost SystemsRajanPas encore d'évaluation

- GoodwillDocument16 pagesGoodwillapoorva100% (1)

- 1.5.1 ActivityDocument3 pages1.5.1 ActivityGWYNETTE CAMIDCHOLPas encore d'évaluation

- Capital Market - Study NotesDocument25 pagesCapital Market - Study Notessivaji naikPas encore d'évaluation

- Top 5 Index Funds To Invest in 2020Document5 pagesTop 5 Index Funds To Invest in 2020ramkrishna mahatoPas encore d'évaluation

- Company Study - Ayala Land CorporationDocument7 pagesCompany Study - Ayala Land CorporationRalph Adrian MielPas encore d'évaluation

- Corporate Law Practice ExamDocument20 pagesCorporate Law Practice ExamnmiragliaPas encore d'évaluation

- Accounting Chapter 3Document14 pagesAccounting Chapter 3Huy Nguyễn NgọcPas encore d'évaluation

- Fabm1 Grade-11 Qtr4 Module2 Week-2Document6 pagesFabm1 Grade-11 Qtr4 Module2 Week-2Crestina Chu BagsitPas encore d'évaluation

- 2Chap2Plant Asset and Intangible Asset (2) - Copy-2Document18 pages2Chap2Plant Asset and Intangible Asset (2) - Copy-2seneshaw tibebuPas encore d'évaluation

- Mid-Term Examination Financial Accounting II Duration:90mnDocument3 pagesMid-Term Examination Financial Accounting II Duration:90mnDavin HornPas encore d'évaluation

- Global Securities OperationsDocument264 pagesGlobal Securities Operationsnishant hawelia100% (1)

- Principles of Accounting Needles 12th Edition Solutions ManualDocument49 pagesPrinciples of Accounting Needles 12th Edition Solutions ManualJosephWoodsdbjt100% (41)

- Knowledge, Innovation, & Entrepreneurship: From Perpective of Strategic ManagementDocument32 pagesKnowledge, Innovation, & Entrepreneurship: From Perpective of Strategic ManagementArinartPas encore d'évaluation

- Activity 06 - Financial Statement PreparationDocument4 pagesActivity 06 - Financial Statement PreparationMariz TiuPas encore d'évaluation

- Tax ReconDocument12 pagesTax ReconArah Monica Dela TorrePas encore d'évaluation

- Problem.1. "If We Can Get That New Robot To Combine With Our Other Automated Equipment, We Wil Have Manager For Diller ProductsDocument6 pagesProblem.1. "If We Can Get That New Robot To Combine With Our Other Automated Equipment, We Wil Have Manager For Diller ProductsMd. Shahriar Kabir RishatPas encore d'évaluation

- Estimated Balance Sheet 2020 PDFDocument2 pagesEstimated Balance Sheet 2020 PDFsantosh ghotekarPas encore d'évaluation

- Cash Cheque Deposit Slip V1Document1 pageCash Cheque Deposit Slip V1THUNDER GAMINGPas encore d'évaluation

- Notes - MARKETING - OF - FINANCIAL SERVICES - 2020Document69 pagesNotes - MARKETING - OF - FINANCIAL SERVICES - 2020Rozy SinghPas encore d'évaluation

- Study Notes in MAS Capital Budgeting Part 1 PDFDocument2 pagesStudy Notes in MAS Capital Budgeting Part 1 PDFHerald JoshuaPas encore d'évaluation

- Corporate LawsDocument4 pagesCorporate LawsAnjaliPas encore d'évaluation

- Chapter 2 - Asset-Liability ManagementDocument4 pagesChapter 2 - Asset-Liability ManagementDewan AlamPas encore d'évaluation