Académique Documents

Professionnel Documents

Culture Documents

Finacc PT 3 Lecture Cash Flows

Transféré par

Camie YoungTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Finacc PT 3 Lecture Cash Flows

Transféré par

Camie YoungDroits d'auteur :

Formats disponibles

ATB (Adjusted Trial Balance) Operating expenses XX 50 000

SCI Accrued expense, beg. XX 20 000

SFP Accrued expense, end (XX) (30 000)

SCE All amounts come from SCI & SFP; existence Prepaid expense, beg. (XX) (50 000)

SCF IAS 7 *separate/special coz challenging Prepaid expense, end XX 30 000

Depreciation (XX) (5 000)

STATEMENT OF CASH FLOWS (IAS 7) Cash payments for OPEX XX 15 000

CASH

1. Cash on hand- coins, bills Given:

2. Cash in bank- savings, checking, current Opex 50 000

3. Operational funds- petty cash fund AE, beg. 20 000 Salaries expense 10 000

4. Checks- if issued/received considered as cash AE, end 30 000 Salaries payable 10 000

CASH EQUIVALENTS Accrued expense √ expense × paid

-short- term highly liquid investments Prepaid expense × expense √ paid

-acquired three months BEFORE maturity

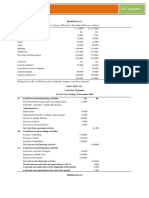

1. Treasury bills ERNST COMPANY

2. Money market Statement of Cash Flows

3. Time deposit For the year ended December 31

4. Certificate of deposit 2017 2016

Assets

CASH FLOW Cash 180 000 150 000

-inflows and outflows of cash and cash equivalents Accounts receivable 230 000 220 000

Inventory 90 000 75 000

NONCASH TRANSACTIONS Prepaid expenses 45 000 60 000

-opposite of cash transactions Total assets ₱ 545 000 ₱ 505 000

Cash may be acquired thru debts; does not define the success of a particular business Liabilities

Accounts payable 130 000 110 000

Cash receipt journal Accrued expenses 20 000 35 000

Cash disbursement journal Total liabilities 150 000 145 000

Sales journal

Purchases journal Equity

Share capital 200 000 200 000

Cash, beg. xx Retained earnings 195 000 160 000

+ receipts xx Total equity 395 000 360 000

- disbursements (xx) Total liabilities and equity ₱ 545 000 ₱ 505 000

Cash, end xx

Sales P 315 000 Purchases* 215 000

SOURCES: A/R, beg. 220 000 AP, beg. 110 000

Operating activities- all cash flows related to main operations A/R, end. (230 000) AP, end (130 000)

Investing activities Cash receipts from Cash payments to

customers

₱ 305 000 suppliers

₱ 195 000

Financing activities

Operating expenses 80 000 Inventory, beg. 75 000

MAIN OPERATIONS:

Accrued expense, beg. 35 000 Purchases (squeeze) 215 000

1. Cash receipts from customers XX 480 000

Accrued expense, end (20 000) Available for sale 290 000

2. Cash payments to suppliers (XX) (180 000)

Prepaid expense, beg. (60 000) Inventory, end (90 000)

3. Cash payments for operating expenses (XX) Prepaid expense, end 45 000 COGS 200 000

4. Cash payments for interest (XX) Cash payments for OPEX ₱ 80 000

5. Cash payments for taxes (XX)

ERNST COMPANY

Statement of Cash Flows

Sales XX P 500 000 P 500 000 For the year ended December 31, 2017

A/R, beg. XX 30 000 50 000 Cash flows from operating activities

A/R, end. (XX) (50 000) (30 000) Cash receipts from customers ₱ 305 000

Cash receipts from customers XX P 480 000 P 520 000 Cash paid to suppliers (195 000)

*walang natanggap pero may sales **may natanggap from sales Cash paid for operating expenses ( 80 000)

Cash xx Cash 500 000 Cash 480 000 Net cash from operating activities ₱ 30 000

Sales xx Sales 500 000 A/R 120 000

A/R xx Cash 20 000 Sales 500 000 Operating activities +50 000

Sales xx A/R 20 000 Investing activities -30 000

Financing activities +10 000

Purchases XX 230 000 Net cash inflow(outflow) 30 000

Add: Cash, beginning 150 000

AP, beg. XX 200 000

=Cash, ending 180 000

AP, end (XX) (250 000)

Cash payments to suppliers XX 180 000

STATEMENT OF CASH FLOWS

1. Operating activities

COGS P 300 000 -direct method and indirect method

Given: Direct method:

Beginning inventory 150 000 Cash collections from customers XX 305 000

Ending inventory 80 000 Cash payments for suppliers (XX) (195 000)

AP, beg. 200 000 Cash payments for operating expenses (XX) (180 000)

AP, end 250 000 Payments for interest (XX) -

Solution: Payments for taxes (XX) -

Inventory, beg. 150 000 Cash inflow (outflow) from operating activities XX ₱ 30 000

Purchases (squeeze) 230 000 2. Investing activities

Available for sale 380 000 3. Financing activities

Inventory, end (80 000) 2017 2016

COGS 300 000 Cash 180 000 150 000 =30k

OPERATING EXPENSES Interest expense 70k Interest expense* XX 100 000 e.g.

Administrative expense Cash 70k

Interest payable, beginning XX -

Distribution/selling expense Interest expense 30k

Interest payable, ending (XX) 30 000

Interest payable 30k

Payments for interest XX ₱ 70 000

ACCRUED EXPENSES (liabilities)

Salaries payable Income tax expense XX

Rent payable Income tax payable, beg. XX

Utilities payable Income tax payable, end. (XX)

Other: all operating expense to be paid but inutang mo Payment for taxes XX

Increase

Indirect method: Interest +O/I 370 000

Profit before tax XX 35 000 -O/F O I F

Adjustments for noncash items: Dividends +O/I 400K

Depreciation XX - -F/O

Impairment loss XX -

Gain on sale (XX) - AlP 280 000

Historical cost 300 000

Loss on sale XX - Cash 70 000

Accumulated depreciation (280 000)

Interest expense XX - Equipment 300 000

Carrying amount 20 000

Decrease (increase) in current assets: Gain on sale-residual 50 000

Accounts receivable XX/(XX) (10 000) Cash 200 000

Inventory XX/(XX) (15 000) Land 500 000 EQUITY METHOD- significant influence >20%

Prepaid expenses XX/(XX) (5 000)

Short- term investments XX/(XX) - Investment in associate 250 000

Investment in associate, beg. 920 000

Increase (decrease) in current liabilities: Investment income 250 000

Share in income(loss) 250 000

Accounts payable XX/(XX) 200 000 Dividends as received (180 000)

Accruals XX/(XX) (15 000) <20% investment (FV method)

Investment in associate, end. ₱ 990 000

Cash payments for interest - - Cash xx

Cash payments for taxes - - Dividend income xx

Cash inflow (outflow) from operating activities ₱ 30 000

Retained earnings, beg. 1 615 000 Overall effect: unhappy

Problem 2. Net income AFTER tax 490 000

because most cash (400k)

Sales P 536 000 Purchases* 434 000 Dividends (387 500)

Retained earnings, end. 1 717 500 came from N/P

A/R, beg. 96 000 AP, beg. 68 000

A/R, end. (138 000) AP, end (90 000)

Cash receipts from Cash payments to Sales P 3 450 000 Purchases* 1 365 000

₱ 494 000 ₱ 412 000

customers suppliers A/R, beg. 1 500 000 AP, beg. 850 000

A/R, end. (1 850 000) AP, end (1 000 000)

Operating expenses 96 000 Cash receipts from Cash payments to

Inventory, beg. 168 000 customers

₱ 3 100 000 suppliers

₱ 1 215 000

Accrued expense, beg. 20 000

Accrued expense, end (16 000) Purchases (squeeze) 434 000

Prepaid expense, beg. - Available for sale 602 000 Operating expenses 1 510 000

Inventory, end (206 000) Inventory, beg. 1 535 000

Prepaid expense, end - Accrued expense, beg. 150 000

COGS 396 000 Purchases (squeeze) 1 365 000

Depreciation (22 000) Accrued expense, end (252 000)

Available for sale 2 900 000

Cash payments for OPEX ₱ 78 000 Prepaid expense, beg. (130 000)

Inventory, end (1 700 000)

Prepaid expense, end 150 000

COGS 1 200 000

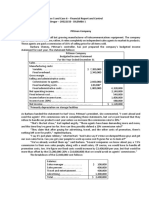

ATKIN CORPORATION Depreciation (400 000)

Statement of Cash Flows Cash payments for OPEX ₱ 1 028 000

For the year ended December 31, 2002

Interest expense 40 000 Income tax expense 210 000

Cash flows from operating activities

Interest payable, beg. 35 000 Income tax payable, beg. 35 000

Cash receipts from customers ₱ 494 000

Interest payable, end (28 000) Income tax payable, end (42 500)

Cash paid to suppliers (412 000)

Payment for interest ₱ 47 000 Payment for taxes ₱ 202 500

Cash paid for operating expenses ( 78 000)

Net cash from operating activities ₱ 4 000

Direct method:

Cash receipts from customers 3 100 000

INDIRECT METHOD:

Cash payments for suppliers (1 215 000)

Profit before tax ₱ 44 000

Cash payments for operating expenses (1 028 000)

Adjustments for noncash items:

Payments for interest (47 000)

Depreciation 22 000

Payments for taxes (202 500)

Decrease (increase) in current assets:

Cash payments for dividends 387 500

Accounts receivable (42 000)

Dividends received 180 000

Inventory (38 000)

Cash inflow (outflow) from operating activities ₱ 400 000

Increase (decrease) in current liabilities:

INDIRECT METHOD:

Accounts payable 22 000

Accruals (4 000)

Cash inflow (outflow) from operating activities Operating activities ₱ 857 000

₱ 4 000

Net income before tax 700 000

Adjustments for noncash items:

Depreciation 400 000

Problem 3. Refer to book

Gain on sale of equipment (50 000)

20x2 20x1

Expropriation loss 200 000

Cash 250 000 220 000

Income from associates (250 000)

30 000

Interest expense 40 000

Decrease (increase) in current assets:

Operating Investing Financing

Accounts receivable (350 000)

-CA; CL -cf involving NCA -cf involving NCL &

Inventories (165 000)

-payment for interest, taxes +300 000 issuance of shares

Prepayments (20 000)

-dividends 410 000 - 260 000

Increase (decrease) in current liabilities:

COVEY CORPORATION Accounts payable 150 000

Statement of Cash Flows Accrued operating expense 102 000

For the year ended December 31, 2002 Cash payments for interest (47 000)

Operating activities Cash payments for taxes (202 500)

Profit before tax ₱ 545 000 Cash payments for dividends (387 500)

Adjustments for noncash items: Dividends received 180 000

Depreciation 140 000 Net cash inflow(outflow)-operating activities 400 000

Gain on sale (100 000)

Decrease (increase) in current assets: Investing activities

Accounts receivable 28 400 Proceeds from sale of equipment 70 000

Inventories (42 000) Acquisition/purchase of equipment (900 000)

Increase (decrease) in current liabilities: Proceeds from expropriation 200 000

Accounts payable 78 000 Net cash inflow(outflow)-investing activities (1 630 000)

Dividends paid (240 000)

Net cash inflow(outflow)-operating activities 410 000 Financing activities

Investing activities Proceeds from issuance of shares 200 000

Proceeds from sale of investment 300 000 Proceeds from borrowing 400 000

Acquisition/purchase of equipment (560 000) Net cash inflow(outflow)-financing activities 600 000

Net cash inflow(outflow)-investing activities (260 000) Net cash inflow(outflow) ₱ 370 000

Financing activities Add: Cash, beg. 400 000

Retirement of bonds (400 000) Cash, end. ₱ 770 000

Proceeds from issuance of shares 280 000

Net cash inflow(outflow)-financing activities (120 000)

Net cash inflow(outflow) ₱ 30 000

Vous aimerez peut-être aussi

- Cash May Be Acquired Thru Debts Does Not Define The Success of A Particular BusinessDocument1 pageCash May Be Acquired Thru Debts Does Not Define The Success of A Particular BusinessCamie YoungPas encore d'évaluation

- Financial Accounting Statements ExplainedDocument2 pagesFinancial Accounting Statements ExplainedPlawan GhimirePas encore d'évaluation

- Assignment in Financial Accounting: Jane B. Evangelista Bsba-2BDocument4 pagesAssignment in Financial Accounting: Jane B. Evangelista Bsba-2BJane Barcelona Evangelista0% (1)

- Revision Accounts 2 XIIDocument3 pagesRevision Accounts 2 XIISahej Kaur AroraPas encore d'évaluation

- Financial StatementsDocument1 pageFinancial StatementsjaphethadadPas encore d'évaluation

- Fa3 PDF LongDocument1 pageFa3 PDF LongAmir LMPas encore d'évaluation

- Illustrative Problem 2.1-2Document3 pagesIllustrative Problem 2.1-2Chincel G. ANIPas encore d'évaluation

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTOPas encore d'évaluation

- Answer To Sample Question 2Document3 pagesAnswer To Sample Question 2Farid AbbasovPas encore d'évaluation

- Prelim Quiz Preparation of Balance Sheet and Income StatementDocument8 pagesPrelim Quiz Preparation of Balance Sheet and Income StatementCHARRYSAH TABAOSARES100% (2)

- 16 UNIT III LiquidationDocument20 pages16 UNIT III LiquidationLeslie Mae Vargas ZafePas encore d'évaluation

- Financial PositionDocument4 pagesFinancial PositionBeth Diaz Laurente100% (2)

- RTP Group-1 For May-2020 (CA Final New Course)Document144 pagesRTP Group-1 For May-2020 (CA Final New Course)Jayendrakumar KatariyaPas encore d'évaluation

- PDF Chapter 2 CompressDocument33 pagesPDF Chapter 2 CompressRonel GaviolaPas encore d'évaluation

- Test Bank 3 - Ia 3Document25 pagesTest Bank 3 - Ia 3jessaPas encore d'évaluation

- FA1 - Group 10 - ch2Document1 pageFA1 - Group 10 - ch2Thu NguyenPas encore d'évaluation

- Cfas 2019 Ch.08 and Ch.09 Long Problems SolutionsDocument15 pagesCfas 2019 Ch.08 and Ch.09 Long Problems SolutionsNathalie GetinoPas encore d'évaluation

- Cash Flow StatementDocument3 pagesCash Flow StatementanupsuchakPas encore d'évaluation

- WS 6 Preparation of SFPDocument5 pagesWS 6 Preparation of SFPEricel MonteverdePas encore d'évaluation

- Cfas Problem 8 1 PDFDocument3 pagesCfas Problem 8 1 PDFAzuh Shi0% (1)

- Quiz 3 Acctg For Business Combination - EntriesDocument6 pagesQuiz 3 Acctg For Business Combination - EntriesNhicoleChoiPas encore d'évaluation

- Cash Flow Statement Problems PDFDocument32 pagesCash Flow Statement Problems PDFnsrivastav179% (29)

- Cash Flow Statement Numericals QDocument3 pagesCash Flow Statement Numericals QDheeraj BholaPas encore d'évaluation

- A. The Following Account Balances Were Presented On December 31, 2017Document3 pagesA. The Following Account Balances Were Presented On December 31, 2017Shiela Mae Pon AnPas encore d'évaluation

- Fabm2 QuizDocument2 pagesFabm2 QuizXin LouPas encore d'évaluation

- Cash Flow (Exercise)Document5 pagesCash Flow (Exercise)abhishekvora7598752100% (1)

- CH 3 In-Class Exercises SOLUTIONS CorrectedDocument2 pagesCH 3 In-Class Exercises SOLUTIONS CorrectedAbdullah alhamaadPas encore d'évaluation

- Lecture No. 2 - Financial Statements & Illustrative ProblemDocument6 pagesLecture No. 2 - Financial Statements & Illustrative ProblemJA LAYUG100% (1)

- Current liabilities of multiple companiesDocument5 pagesCurrent liabilities of multiple companiesPhoebe Dayrit CunananPas encore d'évaluation

- Quiz Inter1 C1Document3 pagesQuiz Inter1 C1Vanessa vnssPas encore d'évaluation

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifPas encore d'évaluation

- Yearly Ledger Changes: AssetsDocument8 pagesYearly Ledger Changes: AssetsMiguel OrjuelaPas encore d'évaluation

- LEC09A - BSA 2201 - 022021-Single Entry Accounting (P)Document2 pagesLEC09A - BSA 2201 - 022021-Single Entry Accounting (P)Kim FloresPas encore d'évaluation

- MA - Vertical Statement Question BankDocument18 pagesMA - Vertical Statement Question Bankmanav.vakhariaPas encore d'évaluation

- INACC Problem 2-3Document3 pagesINACC Problem 2-3Luigi Enderez BalucanPas encore d'évaluation

- LZC Ltd Financial Statement AnalysisDocument2 pagesLZC Ltd Financial Statement AnalysisIQRAsummers 2021Pas encore d'évaluation

- Manatad - Accounting 14NDocument5 pagesManatad - Accounting 14NJullie Carmelle ChattoPas encore d'évaluation

- Cash Flow Statement Test Paper IIDocument2 pagesCash Flow Statement Test Paper IIRaman SachdevaPas encore d'évaluation

- Relax CompanyDocument7 pagesRelax CompanyRegine CalipusanPas encore d'évaluation

- This Study Resource Was: Balance Sheet - ProblemsDocument3 pagesThis Study Resource Was: Balance Sheet - Problemsvenice cambryPas encore d'évaluation

- Statements of Financial Position As at 30 June 20X8 20X7Document4 pagesStatements of Financial Position As at 30 June 20X8 20X7Nguyễn Ngọc HàPas encore d'évaluation

- 2, Questions and Answers 2, Questions and AnswersDocument35 pages2, Questions and Answers 2, Questions and AnswersCarlos John Talania 1923Pas encore d'évaluation

- Week 4 PDF FreeDocument5 pagesWeek 4 PDF FreeM. Gibran KhalilPas encore d'évaluation

- Let'S Check: PROBLEM 1 Garliet CompanyDocument5 pagesLet'S Check: PROBLEM 1 Garliet Companymaica G.Pas encore d'évaluation

- Transactions: Balance Sheet Income StatementDocument5 pagesTransactions: Balance Sheet Income StatementKothari InvestmentsPas encore d'évaluation

- CHAPTER 15 17 InvestmentsDocument38 pagesCHAPTER 15 17 InvestmentsJinkyPas encore d'évaluation

- Lecture No 2Document4 pagesLecture No 2Avia Chelsy DeangPas encore d'évaluation

- Here are the requirements:1. Total current assets CA2. Total noncurrent assets NCA3. Total current liabilities CL4. Total noncurrent liabilities NCLDocument4 pagesHere are the requirements:1. Total current assets CA2. Total noncurrent assets NCA3. Total current liabilities CL4. Total noncurrent liabilities NCLBrit NeyPas encore d'évaluation

- ProblemDocument30 pagesProblemJenika AtanacioPas encore d'évaluation

- Far320 Capital Reduction ExercisesDocument7 pagesFar320 Capital Reduction ExercisesALIA MAISARA MD AKHIRPas encore d'évaluation

- Generate Funds StatementDocument9 pagesGenerate Funds Statementjaydeep kriplaniPas encore d'évaluation

- Exemplar Company - Fortunado PDFFDocument1 pageExemplar Company - Fortunado PDFFmitakumo uwuPas encore d'évaluation

- MR BALIKDocument7 pagesMR BALIKGAMES EMPIREPas encore d'évaluation

- Chapter 8 CFAS Problem 8-1 Page 162Document6 pagesChapter 8 CFAS Problem 8-1 Page 162Rhoda Claire M. GansobinPas encore d'évaluation

- ACFrOgCXlqyBubUO 0k2 oqedP7h-nBYz6kyTwIOUtsM8YzGP85yKUDWiFtg8sxBlV4Hw82Zrv8Ha9zgsOOJOU6tLz838EivSxvzOqilLjimAlle6rnKpoa8Bur97ErTWtcl mZnrslLoC3IU KDocument2 pagesACFrOgCXlqyBubUO 0k2 oqedP7h-nBYz6kyTwIOUtsM8YzGP85yKUDWiFtg8sxBlV4Hw82Zrv8Ha9zgsOOJOU6tLz838EivSxvzOqilLjimAlle6rnKpoa8Bur97ErTWtcl mZnrslLoC3IU KStefanie Jane Royo PabalinasPas encore d'évaluation

- Post-Closing Trial BalanceDocument1 pagePost-Closing Trial BalanceCamelliaPas encore d'évaluation

- What Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Document12 pagesWhat Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Nguyễn HoàngPas encore d'évaluation

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionD'EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionÉvaluation : 2.5 sur 5 étoiles2.5/5 (2)

- Equity Valuation: Models from Leading Investment BanksD'EverandEquity Valuation: Models from Leading Investment BanksJan ViebigPas encore d'évaluation

- LAW LectureDocument5 pagesLAW LectureCamie YoungPas encore d'évaluation

- Risk AssessmentDocument7 pagesRisk AssessmentCamie YoungPas encore d'évaluation

- Sale by DescriptionDocument2 pagesSale by DescriptionCamie YoungPas encore d'évaluation

- Kant's EthicsDocument4 pagesKant's EthicsAreej AhalulPas encore d'évaluation

- P St. Thomas Aquainas Natural LawDocument4 pagesP St. Thomas Aquainas Natural LawCamie YoungPas encore d'évaluation

- Aud330 CompilationDocument15 pagesAud330 CompilationCamie YoungPas encore d'évaluation

- FL Assignment Sentence ConstructionDocument10 pagesFL Assignment Sentence ConstructionCamie YoungPas encore d'évaluation

- NP Cultural RelativismDocument3 pagesNP Cultural RelativismCamie YoungPas encore d'évaluation

- NP Normative Perspectives On Acctg EthicsDocument6 pagesNP Normative Perspectives On Acctg EthicsCamie YoungPas encore d'évaluation

- Plato's EthicsDocument5 pagesPlato's EthicsAreej AhalulPas encore d'évaluation

- Some Questions On Morality: "The Unexamined Life Is Not Worth Living" SocratesDocument9 pagesSome Questions On Morality: "The Unexamined Life Is Not Worth Living" SocratesCamie YoungPas encore d'évaluation

- P Business EthicsDocument1 pageP Business EthicsCamie YoungPas encore d'évaluation

- Cost Concept and Estimation Definition of Cost and Other Cost-Related TermsDocument8 pagesCost Concept and Estimation Definition of Cost and Other Cost-Related TermsCamie YoungPas encore d'évaluation

- NP Ethical Questions Re Social NetworkingDocument1 pageNP Ethical Questions Re Social NetworkingCamie YoungPas encore d'évaluation

- Aristotle: The Life of Virtue: Aristotle's Ethics in GeneralDocument5 pagesAristotle: The Life of Virtue: Aristotle's Ethics in GeneralAreej AhalulPas encore d'évaluation

- LAW LectureDocument1 pageLAW LectureCamie YoungPas encore d'évaluation

- 2 Changes in Estimates (p333) - Treated Prospectively 3 & Errors Change in Depreciation Method (Prospective Adjustment)Document2 pages2 Changes in Estimates (p333) - Treated Prospectively 3 & Errors Change in Depreciation Method (Prospective Adjustment)Camie YoungPas encore d'évaluation

- Of Dissolution-Continue Apply Issuance: Verified Declaration of Dissolution-Needed (Includes Separate Paper)Document2 pagesOf Dissolution-Continue Apply Issuance: Verified Declaration of Dissolution-Needed (Includes Separate Paper)Camie YoungPas encore d'évaluation

- Philo Report HardDocument2 pagesPhilo Report HardCamie YoungPas encore d'évaluation

- Ias 1 Edition: MonopolyDocument1 pageIas 1 Edition: MonopolyCamie YoungPas encore d'évaluation

- UtilitarianismDocument3 pagesUtilitarianismHeeya OheyasssPas encore d'évaluation

- MGT Ix TeamworkDocument1 pageMGT Ix TeamworkCamie YoungPas encore d'évaluation

- Loss of Life and Destruction PropertyDocument1 pageLoss of Life and Destruction PropertyCamie YoungPas encore d'évaluation

- Orange PaperDocument5 pagesOrange PaperCamie YoungPas encore d'évaluation

- Partnership For Recit by Group Part 1Document2 pagesPartnership For Recit by Group Part 1Camie YoungPas encore d'évaluation

- Auditing SitesDocument1 pageAuditing SitesCamie YoungPas encore d'évaluation

- Cost and Cost ConceptsDocument2 pagesCost and Cost ConceptsCamie YoungPas encore d'évaluation

- Preparation of Financial StatetementDocument2 pagesPreparation of Financial StatetementCamie YoungPas encore d'évaluation

- Ecomprehensiveexam eDocument12 pagesEcomprehensiveexam eDominic SociaPas encore d'évaluation

- Fundamentals of Accountancy, Business and Management 1 Accounting Cycle of A Merchandising BusinessDocument15 pagesFundamentals of Accountancy, Business and Management 1 Accounting Cycle of A Merchandising BusinessVenicePas encore d'évaluation

- FABM KEY POINTS manufacturing costsDocument4 pagesFABM KEY POINTS manufacturing costsSaimon SarmientoPas encore d'évaluation

- True/False: Variable Costing: A Tool For ManagementDocument174 pagesTrue/False: Variable Costing: A Tool For ManagementKiannePas encore d'évaluation

- 01 Investment in Equity Securities - V2 With AnswersDocument17 pages01 Investment in Equity Securities - V2 With AnswersJEFFERSON CUTE71% (7)

- GROUP 6 Problem 3 7 To 3 9Document24 pagesGROUP 6 Problem 3 7 To 3 9Hans ManaliliPas encore d'évaluation

- SL. NO Particulars L.F DEBIT (RS) Credit (RS)Document23 pagesSL. NO Particulars L.F DEBIT (RS) Credit (RS)DibyashreeMohantyPas encore d'évaluation

- Analyze financial statements with ratios and analysesDocument40 pagesAnalyze financial statements with ratios and analysesPhương Anh VũPas encore d'évaluation

- FRA ProjectDocument63 pagesFRA ProjectRisa SahaPas encore d'évaluation

- Differential Cost AnalysisDocument7 pagesDifferential Cost AnalysisSalman AzeemPas encore d'évaluation

- FINANCE FOR MANAGER TERM PAPERxxxDocument12 pagesFINANCE FOR MANAGER TERM PAPERxxxFrank100% (1)

- Tech Mahindra Company: A Project Report OnDocument55 pagesTech Mahindra Company: A Project Report OnBhuvaneswari karuturiPas encore d'évaluation

- ACC501 Solved MCQsDocument6 pagesACC501 Solved MCQsMuhammad aqeeb qureshiPas encore d'évaluation

- Show That The Accounting Equation Is Satisfied After Taking Into Consideration Each of The Following Transactions in The Books of MRDocument3 pagesShow That The Accounting Equation Is Satisfied After Taking Into Consideration Each of The Following Transactions in The Books of MRLysss Epssss0% (2)

- Since 1977: Inventory CostsDocument8 pagesSince 1977: Inventory CostsCV CVPas encore d'évaluation

- GL, TB - D. MaputimDocument11 pagesGL, TB - D. MaputimJasmine Acta67% (3)

- Dwnload Full Horngrens Accounting The Financial Chapters 12th Edition Miller Nobles Test Bank PDFDocument36 pagesDwnload Full Horngrens Accounting The Financial Chapters 12th Edition Miller Nobles Test Bank PDFduongnujl33q100% (8)

- Home Work 1 QuestionsDocument17 pagesHome Work 1 QuestionsprasannakumarPas encore d'évaluation

- The Role of Financial Information in Valuation and Credit Risk AssessmentDocument8 pagesThe Role of Financial Information in Valuation and Credit Risk AssessmentHassan AliPas encore d'évaluation

- Partnership Liquidation ProblemsDocument3 pagesPartnership Liquidation ProblemsErma Caseñas50% (2)

- Aftr Uts - MK 2 - KreditDocument22 pagesAftr Uts - MK 2 - KreditamoyyPas encore d'évaluation

- ARW Online Long Exam Part 3 PDFDocument12 pagesARW Online Long Exam Part 3 PDFMansour HamjaPas encore d'évaluation

- Review of RatiosDocument5 pagesReview of RatiosJames AlievPas encore d'évaluation

- Chapter 8Document66 pagesChapter 8Jamaica Rose Salazar0% (1)

- Accounting for Inventory CostsDocument16 pagesAccounting for Inventory CostsLemma Deme ResearcherPas encore d'évaluation

- Individual Assingment Case 5 and Case 6 - FInancial Report and Control - Mohammad Alfian Syah Siregar - DILEMBA 1 - 29322150Document7 pagesIndividual Assingment Case 5 and Case 6 - FInancial Report and Control - Mohammad Alfian Syah Siregar - DILEMBA 1 - 29322150iancroott100% (1)

- Installment SalesDocument3 pagesInstallment SalesIryne Kim PalatanPas encore d'évaluation

- Financial Accounting: Tools For Business Decision Making: Chapter OutlineDocument218 pagesFinancial Accounting: Tools For Business Decision Making: Chapter Outline20073201 Nguyễn Thị Ngọc LanPas encore d'évaluation

- CFAS4 - PAS 1 - Presentation of Financial StatementsDocument17 pagesCFAS4 - PAS 1 - Presentation of Financial Statementspamelajanmea2018Pas encore d'évaluation

- SAR-MAR-210422-1227PM - RR - 034-COPY 1.editedDocument12 pagesSAR-MAR-210422-1227PM - RR - 034-COPY 1.editedJishnu ChaudhuriPas encore d'évaluation