Académique Documents

Professionnel Documents

Culture Documents

Chapter 1 The Study of Global Political Economy

Transféré par

Ana GogoladzeTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Chapter 1 The Study of Global Political Economy

Transféré par

Ana GogoladzeDroits d'auteur :

Formats disponibles

lOMoARcPSD|3783498

Chapter 1 - The study of global political economy

International Business (Edith Cowan University)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by Ana Gogoladze (ana.gogoladze@gmail.com)

lOMoARcPSD|3783498

CHAPTER 1

THE STUDY OF GLOBAL POLITICAL ECONOMY

I. Great Recession of 2008-9

II. The World Economy Pre-1914

III. The World Economy in the Inter-War Period

IV. The World Economy Post-1945

V. The Study of Global Political Economy

1. Great Recession of 2008-9

The American financial service firm, Lehman brothers was the largest bankruptcy in U.S. The effect of the

bankruptcy soon spread around the world. This make the start of what became known as the great recession, in

2009.

World output fell by 0.8%

World trade declined by 12%

FDI dropped by 40%

EU falling by 4% ad U.S along 3.2%

Worst affected are counties which depend on international business, such as Singapore, Taiwan

Oil price decline by 36% and 19% decline in non-fuel commodities

On the other hand China and India grow strongly

IMF written down of bad debts, total around $ 3.4Trillion

One reason for the severity (Harshness) of the recession that began in 2008 was that, unlike the previous post-

war downturns, all regions of the world were in economic decline simultaneously.

The second consequence was the complexity of the new financial instruments. This create the problem of panic

because of the uncertainty created in transaction among financial institution. Institutions had the trouble of

recognizing their liabilities.

A striking feature of the early governmental response to recession was the acknowledgement of the inadequacy

of previous policy approaches, particularly in the area of financial sector regulation.

The recession prompted unprecedented (first time) policy interventions at the national and global levels, and

produced significant changes in global governance, with emergence of the G20 as the principle

intergovernmental body for global economic management.

1|Page

Downloaded by Ana Gogoladze (ana.gogoladze@gmail.com)

lOMoARcPSD|3783498

2. World Economy Pre-1914

The modern economy came to existent in 15 th century. In the era of Mercantilism Political power

equated with wealth, and vice versa. Wealth in the form of bullion (Precious metal) generated by trade

surpluses or seized from enemies.

New concertation of military power could be projected both internally and externally to extract

further resources.

Most part of the world were enmeshed (trapped) in a Eurocentric economy as suppliers of raw

materials and luxury goods.

However this did not bring a noticeable growth to the global wealth.

The steam power revolutionized the transportation both internally and internationally. Introducing

the refrigerated ships contributed to shrinking of the world.

This deepen the international division of labour.

Tariff continued to constitute a significant barrier to international trade to protect their domestic

producers from the international competition

Thought the barriers are high for the movements of goods in the 2 nd part of the 19th century, the capital

and people moved freely. This facilitated by the transportation and communication

No significant institutionalization of international trade or finance.

The rapid growth of economic integration was facilitated by the international adoption of gold standard.

Countries fixed the value of its national currency in terms of gold.

– Each country had a fixed exchange rate

– Reduced uncertainty and risks with foreign exchange

– Relied on the commitment of governments

– Undermined by increasing democratization and popular demands

3. World Economy in the Inter-War Period

The outbreak of the 1 st world war was devastating blow to cosmopolitan liberalism. It destroyed the

credibility of the liberal argument that economic interdependence in itself would be sufficient. WW-I

bought the end of unprecedented economic interdependence among leading industrial countries.

The most fundamental problem was the inability of states to construct a viable international financial

system.

Governments disagreed on measures to restore international economic stability

Gold standard broke down. Misalignment of currencies contribute to the problems of economic

adjustment. Abandonment in 1931

States did not negotiate any significant institutionalization of international economic relation in the

inter-war period

4. The World Economy Post-1945

2|Page

Downloaded by Ana Gogoladze (ana.gogoladze@gmail.com)

lOMoARcPSD|3783498

The economy emerge after the WW-II was qualitatively different from before. Two fundamental

principles that that distinguish the post-war economy from its predecessors (Previous version).

Embedded liberalism

Multilateralism

Embedded liberalism refer to the compromise that the government made by safeguarding their

domestic objectives and opening up the domestic economy to allow for the restoration of the

international trade.

The embedding of the commitment to economic openness within the domestic objectives was attained

through inclusion of provisions in the rules of international trade and finance that would allow the

government to opt-out (Choose).

The Institutionalization of international economic cooperation is another fundamental change in

international economic relation. Multilateralism (Bretton Woods institutions-IMF, World Bank)

Multilateralism involves collaboration among 3 or more nations, not only the number but qualitative

elements.

Coordination of relation is on the basis of generalized’ principles of conduct. An example most-favored

nation (MFN) principle. With this all the partners must be treated in the same way regardless the

countries involved.

The unprecedented rate of economic growth achieved after 1945 attest to the success of the pursuit of

multilateral economic collaboration. Global GDP at 5%

Moreover, world trade grew faster than the world production. Export expanded by 8%.

The gap between rich and poor widened substantially. The absolute gap between the industrialized

economies and the rest of the world continued to widen. Few east Asian counties showed progress in

closing the gap

Africa detached from the globalizing economy. Poor export result in fall in per capita income.

Another characteristic of post 1945 international economy was the growth in the number of

Transnational Corporation (TNCs). These were primarily trading companies such as East India

Company. This has become key actor in the globalizing economy. Global FDI amounted about 15Tn and

the value added by TNC subsidiaries equal 10% of the world GDP

TNCs have transformed the nature of the international trade fundamentally. In particular the

composition of the trade.

Since 1980 less developed countries have also been integrated in to the international production

network led by TNCs. Developing countries have changed their tariff to give preference to the processing

and assembling components.

As the colonies of European countries have gained the independence, the number of states and in the

diversity of the international community become more than double. Collaboration became increasingly

complex.

This growth in developing counties also brought institutional change such as United Nation Conference

on Trade Development (UNCTAD) in 1964

Another characteristic was vast expansion of NGOs which were focused on the alleviation (mitigation)

of poverty.

5. The Study of Global Political Economy

3|Page

Downloaded by Ana Gogoladze (ana.gogoladze@gmail.com)

lOMoARcPSD|3783498

5.1 The Emergence of International Political Economy As A Distinct Subfield

International most often describes interaction between nations, or encompassing two or more nations,

constituting a group or association having members in two or more nations, or generally reaching beyond

national boundaries.

The rise of technology has allowed our environment to be characterized as a global one. ― The global

economy" gave business the ability to market products and services all over the globe. It has also allowed them

to develop partnerships and alliances throughout the world.

Ex: as an international relationship, SL build a relationship with china or India. But when it comes to the global,

when SL creating better relationship with China, India may not like it much.

In the 1970 IPE had developed as a significant subfield in the study of international relation. During this

period global economy entered a period of turbulence.

Commodity price had risen substantially

Westerners started concern about the future availability of raw materials and this result in forming

OPEC

5.2 What is IPE?

Is a subject matter whose central focus is the interrelationship between public and private power in

the allocation of scare resources. It is not a specific approach (a theory) to studying this subject

matter.

IPE seeks to answer the classis question such as who gets what, when and how? It also point the

importance of power.

Power in two forms: defined in terms of relationship, the capacity of one actor to change the

behaviour of the other. Also exercised in the capacity of actor to set agendas and to structure the

rules in various areas, as to privilege some actors and disadvantage others.

Ex: As U.S being the largest economy, being able to exercise relational power to force changes behavior

of other countries.

The rule of international financial regime (Administration) have also been structured so that they

privileged more economically developed states and not only the industrialized economies enjoy more

votes within the IMF and World Bank.

Basic votes assigned equally to all the members. Much larger number, Weighted Votes that are linked

directly to the money members subscribed to the two institution. G7 industrialized countries still control

45% of the voting of the IMF.

Early IPE work concerned centrally in two elements. That is, in the distribution of power within the

global economy and potential for state to engage in collaboration.

The theory of hegemonic stability suggests that international economic collaboration in pursuit of an

open (liberal) economic order is more likely to occur when the global economy is dominated by a single

power. (In the 19th century the British was the hegemonic power and US dominance from 1945-1971)

5.3 Approaches To The Study Of Global Political Economy

4|Page

Downloaded by Ana Gogoladze (ana.gogoladze@gmail.com)

lOMoARcPSD|3783498

Approaches to the study of IPE have conventionally been divided in to the 3 categories. Liberalism,

nationalism and Marxism. Of these labels, only liberalism has been used universally in other

categorization.

Statism, mercantilism, realism or economic nationalism are substitutes for nationalism.

Marxism have variously been identified as radical, critical, structuralist, dependency, underdevelopment

and world system.

The use of a variety of labels points to one of the problems with the trichotomous categorization of

approached to the study of IPE. Trichotomous categorization does not capture the wealth of

methodological and theoretical approaches used in the contemporary studies.

Most of the contemporary work in IPE focus on theory, that is, attempting to explain why things happen,

rather than on policy prescription

Additional Notes:

World Bank (July 1944, Washington, D.C)

The World Bank is an international financial institution that provides loans to developing countries for capital

programs. It comprises two institutions:

The International Bank for Reconstruction and Development (IBRD) - 189 countries

The International Development Association (IDA) - 173 countries

The World Bank is a component of the World Bank Group, which is part of the United Nations system. The World

Bank's stated official goal is the reduction of poverty. However, according to its Articles of Agreement, all its

decisions must be guided by a commitment to the promotion of foreign investment and international trade and

to the facilitation of Capital investment.

International Monetary Fund (189 countries, 1945)

Purpose:

Working to foster global monetary cooperation, secure financial stability, facilitate international trade,

promote high employment and sustainable economic growth, and reduce poverty around the world.

Formed in 1944 at the Bretton Woods Conference primarily by the ideas of Harry White and John

Keynes. It came into formal existence in 1945 with 29 member countries and the goal of reconstructing the

international payment system.

It now plays a central role in the management of balance of payments difficulties and international financial

crises. Countries contribute funds to a pool through a quota system from which countries experiencing balance

of payments problems can borrow money.

Through the fund, and other activities such as statistics-keeping and analysis, surveillance of its members'

economies and the demand for particular policies, the IMF works to improve the economies of its member

countries.

Special Drawing Rights (SDR) are supplementary foreign exchange reserve assets defined and maintained

by the IMF. The XDR is the unit of account for the IMF, and is not a currency per se. XDRs instead represent a

claim to currency held by IMF member countries for which they may be exchanged. The XDR was created in

1969 to supplement a shortfall of preferred foreign exchange reserve assets, namely gold and the U.S. dollar.

The Balance Of Payments

5|Page

Downloaded by Ana Gogoladze (ana.gogoladze@gmail.com)

lOMoARcPSD|3783498

The balance of payments of a country is the record of all economic transactions between the residents of the

country and the rest of the world in a particular period. These transactions are made by individuals, firms and

government bodies. Thus the balance of payments includes all external visible and non-visible transactions of a

country. The balance of payments provides detailed information concerning the demand and supply of a

country's currency. These transactions can be broadly categorized into two types –

International trade and payments (current account)

Imports and exports of goods

Imports and exports of services (Financial, legal, medical, travel)

Income on financial assets. (If a U.S. invests in a Mexican company, the dividends will be recorded in the

current account

Transfers between countries. (Foreign aid, remittances, and international gifts)

International investment (financial account)

Foreign direct investment

Portfolio investment

World Trade Organization (1995, Geneva, Switzerland)

The World Trade Organization (WTO) is an intergovernmental organization which regulates international

trade. Replace the General Agreement on Tariffs and Trade (GATT).

The WTO deals with regulation of trade between participating countries by providing a framework for

negotiating trade agreements and a dispute resolution process aimed at enforcing participants' adherence to

WTO agreements, which are signed by representatives of member governments and ratified by their

parliaments.

G20 (19 individual countries & EU

An international forum for the governments and central bank governors from 20 major economies. It was

founded in 1999 with the aim of studying, reviewing, and promoting high-level discussion of policy issues

pertaining to the promotion of international financial stability. Purpose is to bring together systemically

important industrialized and developing economies to discuss key issues in the global economy.

It seeks to address issues that go beyond the responsibilities of any one organization. The G20 heads of

government or heads of state have periodically conferred at summits since their initial meeting in 2008, and the

group also hosts separate meetings of finance ministers and central bank governors.

G7 (France, West Germany, Italy, Japan, the U.K and U.S PLUS European Union)

These countries are the seven major advanced economies as reported by the I.M.F. the G7 countries represent

more than 64% of the net global wealth.

The organization was originally founded to facilitate shared macroeconomic initiatives by its members in

response to the collapse of the exchange rate 1971, during the time of the Nixon Shock, the 1970s energy crisis

and the ensuing recession. Its goal was fine tuning of short term economic policies among participant countries

to monitor developments in the world economy and assess economic policies

Most Favored Nation (MFN)

6|Page

Downloaded by Ana Gogoladze (ana.gogoladze@gmail.com)

lOMoARcPSD|3783498

In international economic relations and international politics, "most favored nation" (MFN) is a status or level

of treatment accorded by one state to another in international trade. The term means the country which is the

recipient of this treatment must, nominally, receive equal trade advantages as the "most favored nation" by the

country granting such treatment. (Trade advantages include low tariffs or high import quotas.)

Benefits

Increases trade creation and decreases trade diversion. A country that grants MFN on imports will have

its imports provided by the most efficient supplier if the most efficient supplier is within the group of

MFN. Otherwise, that is, if the most efficient producer is outside the group of MFN and additionally, is

charged higher rates of tariffs, then it is possible that trade would merely be diverted from this most

efficient producer to a less efficient producer within the group of MFN

MFN allows smaller countries to participate in the advantages that larger countries often grant to each

other

Granting MFN has domestic benefits: having one set of tariffs for all countries simplifies the rules and

makes them more transparent.

As MFN clauses promote non-discrimination among countries, they also tend to promote the objective of free

trade in general.

7|Page

Downloaded by Ana Gogoladze (ana.gogoladze@gmail.com)

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Circulating CounterfeitDocument304 pagesCirculating CounterfeitThales GayeanPas encore d'évaluation

- KYC Quiz HandoutDocument7 pagesKYC Quiz HandoutBhagyanath MenonPas encore d'évaluation

- EMV OverviewDocument51 pagesEMV OverviewManish ChofflaPas encore d'évaluation

- UtkarshAnan (17425580440) - Batch 41 IDocument77 pagesUtkarshAnan (17425580440) - Batch 41 IUTKARSH ANANDPas encore d'évaluation

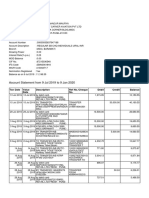

- Account Statement From 9 Jul 2019 To 9 Jan 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument4 pagesAccount Statement From 9 Jul 2019 To 9 Jan 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancemauryapiaePas encore d'évaluation

- PWC Clarifying The RulesDocument196 pagesPWC Clarifying The RulesCA Sagar WaghPas encore d'évaluation

- Credit Case DigestDocument20 pagesCredit Case DigestMhayBinuyaJuanzon100% (1)

- 60 Amada Resterio Vs PeopleDocument2 pages60 Amada Resterio Vs PeopleGSS100% (1)

- Project On Axis BankDocument36 pagesProject On Axis Bankratandeepjain86% (7)

- What To See and Do English Abu DhabiDocument144 pagesWhat To See and Do English Abu DhabiSarisha HarrychundPas encore d'évaluation

- RPT CPSPM 12321640 25753 PDFDocument6 pagesRPT CPSPM 12321640 25753 PDFsandeep pinnintiPas encore d'évaluation

- Merchant Banking - Black Book ProjectDocument102 pagesMerchant Banking - Black Book ProjectHarsh Doshi50% (2)

- Ebrd ContractDocument18 pagesEbrd ContractAna GogoladzePas encore d'évaluation

- Oatley - Chapter 1 - Ideologies-8-12Document5 pagesOatley - Chapter 1 - Ideologies-8-12Ana GogoladzePas encore d'évaluation

- საპარლამენტო საქმიანობის შეფასებაDocument59 pagesსაპარლამენტო საქმიანობის შეფასებაAna GogoladzePas encore d'évaluation

- OSGF-Women in Georgian PoliticsDocument8 pagesOSGF-Women in Georgian PoliticsAna GogoladzePas encore d'évaluation

- Preparatory Course in CommerceDocument16 pagesPreparatory Course in Commerceneeraj61289Pas encore d'évaluation

- BUSN1001 S2 2011 Mid Semester Exam Questions Released On WattleDocument11 pagesBUSN1001 S2 2011 Mid Semester Exam Questions Released On Wattleb393208Pas encore d'évaluation

- PayPal Raises Fees For Most Domestic Transaction Types To 3.49% + $0.49 - Hacker NewsDocument18 pagesPayPal Raises Fees For Most Domestic Transaction Types To 3.49% + $0.49 - Hacker NewsabcPas encore d'évaluation

- What Is INMOTION - AIRPORT ORD CHICAGO IL - Scam ChargeDocument4 pagesWhat Is INMOTION - AIRPORT ORD CHICAGO IL - Scam ChargeVictor NercioPas encore d'évaluation

- RBA APU PPT - OJK 16 April 2018Document46 pagesRBA APU PPT - OJK 16 April 2018BunnyPas encore d'évaluation

- Online Non Bank Finance LandscapeDocument116 pagesOnline Non Bank Finance LandscapeCrowdfundInsiderPas encore d'évaluation

- SHOCKER: Internal Emails Reveal Florida Legislative Staff Asked Payday Industry For Approval of Changes To New Lending BillDocument9 pagesSHOCKER: Internal Emails Reveal Florida Legislative Staff Asked Payday Industry For Approval of Changes To New Lending BillAllied ProgressPas encore d'évaluation

- Credita CompayDocument6 pagesCredita CompayasdPas encore d'évaluation

- Form A Scss Ac Opening Form 28 Nov 2016Document3 pagesForm A Scss Ac Opening Form 28 Nov 2016Suraj KumarPas encore d'évaluation

- November 2010 India DailyDocument147 pagesNovember 2010 India DailymitbanPas encore d'évaluation

- T7 Payment SystemsDocument4 pagesT7 Payment Systemskhongst-wb22Pas encore d'évaluation

- November 2019 ComricaDocument4 pagesNovember 2019 Comricaproemail632Pas encore d'évaluation

- OTM Debit Mandate Form NACH/ ECS/ Direct Debit: Unit Holder InformationDocument6 pagesOTM Debit Mandate Form NACH/ ECS/ Direct Debit: Unit Holder InformationTirthGanatraPas encore d'évaluation

- AR Invoice InterfaceDocument4 pagesAR Invoice InterfaceprinjurpPas encore d'évaluation

- GSAA Home Equity Trust 2005-15 - Purchased Property 3 Years After Closing Date From US BankDocument7 pagesGSAA Home Equity Trust 2005-15 - Purchased Property 3 Years After Closing Date From US BankTim BryantPas encore d'évaluation

- Fmch05 (1) Time Value RevisedDocument76 pagesFmch05 (1) Time Value RevisedMañuel É PrasetiyoPas encore d'évaluation

- Punjab National BankDocument4 pagesPunjab National BankRicky KishorePas encore d'évaluation

- SDCVDocument6 pagesSDCVKrishnadeep GuptaPas encore d'évaluation