Académique Documents

Professionnel Documents

Culture Documents

Advanced Financial Management

Transféré par

Akshay KapoorCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Advanced Financial Management

Transféré par

Akshay KapoorDroits d'auteur :

Formats disponibles

Introduction

Tata Consultancy Services is an Indian Multinational Information Technology

Services, Consulting and Business Solution company headquarter in Mumbai,

Maharashtra

It is the world's Tenth largest IT Service provider measured by the revenue

Placed amongst big 4 most valuable IT Services provider worldwide

Financing Decisions of TCS

Financial decision deals with the decisions regarding the arrangement of funds and

finances for a company.

C-suite leaders expect the finance function to play a more strategic

role in the organisation’s future, especially as new regulations, fast-

pace market change, disruptive business models and intense

competition heighten the need for accurate, real-time finance

inputs for strategic decisions. It means that chief financial officer

must be enabled with fast, high-quality data to advise the

organisation’s moves.

Imagine a finance and accounting function that does just that

through automated transactions and workflows, running

harmonized, integrated, efficient, and business-aligned. A single

financial system manages the enormous volume of finance-related

transaction data feeding into it from multiple source systems (ie:

across lines of business, decentralized business units) and at

granular level manages all relevant data in a centralized location. It

enables real-time, accurate and consolidated visibility into

operational and commercial positions, making for better audits and

financial closing, more efficient regulatory compliance, and well-

informed business decisions on parameters such as working capital,

cash flow position, investments and risk mitigation. The

organization also gains exceptionally fast cycle time for aggregating

core financial transactions and reducing effort invested in data

consolidation.

The financial data for the company TCS is as follows-

TCS INCOME DATA

Net Sales Rs m 818,094 946,484 1,086,460 1,179,660 1,231,040

Other income Rs m 16,367 32,299 30,840 42,210 36,420

Total revenues Rs m 834,461 978,783 1,117,300 1,221,870 1,267,460

Gross profit Rs m 251,528 244,817 306,770 323,110 325,160

Depreciation Rs m 13,492 17,987 18,880 19,870 20,140

Interest Rs m 385 1,042 330 320 520

Profit before tax Rs m 254,019 258,087 318,400 345,130 340,920

Minority Interest Rs m -1,680 -2,075 0 0 0

Prior Period Items Rs m 0 0 0 0 0

Extraordinary Inc (Exp) Rs m 0 4,898 0 0 0

TCS INCOME DATA

Tax Rs m 60,700 62,388 75,020 81,560 82,120

Profit after tax Rs m 191,639 198,522 243,380 263,570 258,800

Gross profit margin % 30.7 25.9 28.2 27.4 26.4

Effective tax rate % 23.9 24.2 23.6 23.6 24.1

Net profit margin % 23.4 21.0 22.4 22.3 21.0

Investment Decisions

The investment decisions refer to the decisions of a firm in relation

to the various investments that it has to make. The investment

decision represents the ability of the firm to generate sales from

the investments that it has made in fixed assets and short term

assets. The ratio of the investment decision is calculated by

comparing the amount of investment made in fixed assets to the

amount of sales generated. The short term investment ratio is

calculated by comparing the amount of the investment made in

short term assets to the amount of sales generated.

The investment decision of the firm in relation to the long term

assets, that the firm owns and or the new assets of the firm. The

investment decisions of the firm are often influenced by the interest

rates that are available to the firm. This means that the firm would

like to invest more if it is receiving a higher rate of interest on the

investment made. The firm in order to maximise its profits and

revenues would like to invest in maximisation schemes and would

like to avoid the investment schemes wherein the firm gets a lower

rate of interest on the investment made.

The balance sheet of the firm for the three consecutive years is as

follows-

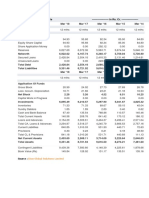

Balance Sheet of Tata Consultancy Services ------------------- in Rs. Cr. -------------------

Mar '18 Mar '17 Mar '16 Mar '15 Mar '14

12 mths 12 mths 12 mths 12 mths 12 mths

Sources Of Funds

Total Share Capital 191.00 197.00 197.00 195.87 195.87

Equity Share Capital 191.00 197.00 197.00 195.87 195.87

Reserves 75,675.00 77,825.00 64,816.00 45,220.57 43,856.01

Networth 75,866.00 78,022.00 65,013.00 45,416.44 44,051.88

Secured Loans 39.00 44.00 162.00 64.13 88.64

Unsecured Loans 181.00 200.00 1.00 186.14 1.05

Total Debt 220.00 244.00 163.00 250.27 89.69

Total Liabilities 76,086.00 78,266.00 65,176.00 45,666.71 44,141.57

Mar '18 Mar '17 Mar '16 Mar '15 Mar '14

12 mths 12 mths 12 mths 12 mths 12 mths

Application Of Funds

Gross Block 20,338.00 18,698.00 9,080.00 14,095.04 11,220.11

Less: Accum. Depreciation 10,898.00 9,467.00 0.00 6,098.75 5,290.92

Net Block 9,440.00 9,231.00 9,080.00 7,996.29 5,929.19

Capital Work in Progress 1,238.00 1,477.00 1,640.00 2,706.94 3,047.53

Investments 37,259.00 42,930.00 24,159.00 3,398.70 5,832.42

Inventories 25.00 21.00 9.00 12.34 8.57

Sundry Debtors 18,882.00 16,582.00 19,058.00 17,036.76 14,471.89

Cash and Bank Balance 3,487.00 1,316.00 4,806.00 16,502.50 12,566.26

Total Current Assets 22,394.00 17,919.00 23,873.00 33,551.60 27,046.72

Loans and Advances 20,725.00 18,201.00 18,665.00 15,411.77 15,748.33

Total CA, Loans & Advances 43,119.00 36,120.00 42,538.00 48,963.37 42,795.05

Current Liabilities 14,773.00 11,387.00 12,086.00 10,252.33 7,355.18

Provisions 197.00 105.00 155.00 7,146.26 6,107.44

Total CL & Provisions 14,970.00 11,492.00 12,241.00 17,398.59 13,462.62

Net Current Assets 28,149.00 24,628.00 30,297.00 31,564.78 29,332.43

Total Assets 76,086.00 78,266.00 65,176.00 45,666.71 44,141.57

Contingent Liabilities 8,355.00 10,149.00 19,695.42 9,161.54 10,880.43

Book Value (Rs) 396.31 395.96 329.94 231.87 224.90

Dividend Decisions

The dividend decisions of the firm “TCS”,

TCS has been returning cash to shareholders consistently from the

time of listing, through interim dividends every quarter, final

dividends at the year-end and an occasional special dividend.

Fiscal Year Quarter Type of Dividend Record Date Actual

Dividend Amount per Payment Date

share (INR) *

2017-18 Q4 Final 29.00 2-Jun-18 19-Jun-18

2017-18 Q3 Interim 7.00 23-Jan-18 31-Jan-18

2017-18 Q2 Interim 7.00 26-Oct-17 01-Nov-17

2017-18 Q1 Interim 7.00 25-Jul-17 01-Aug-17

2016-17 Q4 Final 27.50 14-Jun-17 23-Jun-17

2016-17 Q3 Interim 6.50 24-Jan-17 01-Feb-17

2016-17 Q2 Interim 6.50 25-Oct-16 02-Nov-16

2016-17 Q1 Interim 6.50 26-Jul-16 2-Aug-16

2015-16 Q4 Final 27.00 7-Jun-16 24-Jun-16

2015-16 Q3 Interim 5.50 22-Jan-16 29-Jan-16

2015-16 Q2 Interim 5.50 26-Oct-15 30-Oct-15

2015-16 Q1 Interim 5.50 21-Jul-15 03-Aug-15

The dividend decisions include the decisions related to the payment

of dividend to the shareholders. The firm has to decide how much

dividend it has to pay and the frequency of the dividend payments

to the debenture holders in order to make them happy and invest

more in the company.

The dividend is that part of the profits of the firm, which the firm

distributes amongst its debenture holders in order to make them

happy and mmotivaate them to invest more in their company. The

firms often engage in dividend distribution to their debenture

holders, paying them a part of the firms profits as dividends. At the

time of maturity of debentures, the debenture holders also have the

option of either continuing with their investment in the firm or

converting their debentures into equity shares of the firm. The

shareholders have the option of converting either their whole share

of debentures into equity or a part of them into equity or they may

want to hold debentures instead of equity. The debenture holders

do not have any voting rights in the firm, but when the debentures

are converted into equity shares of the company, the debenture

holders get the voting right as they become a part of the owners of

the company.

The dividend function of the company is calculated as-

The

Vous aimerez peut-être aussi

- Bemd RatiosDocument12 pagesBemd RatiosPRADEEP CHAVANPas encore d'évaluation

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineD'EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LinePas encore d'évaluation

- Masters of Business Administration-Intelligent Data Science Academic Year: 2019-20Document21 pagesMasters of Business Administration-Intelligent Data Science Academic Year: 2019-20Tania PoddarPas encore d'évaluation

- What is Business Environment and How it Affects CompaniesDocument7 pagesWhat is Business Environment and How it Affects CompaniesAyush Kumar Vishwakarma88% (17)

- Cash Flow of ICICI Bank - in Rs. Cr.Document12 pagesCash Flow of ICICI Bank - in Rs. Cr.Neethu GesanPas encore d'évaluation

- 11 - Eshaan Chhagotra - Maruti Suzuki Ltd.Document8 pages11 - Eshaan Chhagotra - Maruti Suzuki Ltd.rajat_singlaPas encore d'évaluation

- Sbi Banlce SheetDocument1 pageSbi Banlce SheetANIKET VISHWANATH KURANEPas encore d'évaluation

- Profitability Test: Profit/Net Sales Pat-Pref Div/ No of Eq Shares (Pat-Pref Div) / Eqty FundDocument7 pagesProfitability Test: Profit/Net Sales Pat-Pref Div/ No of Eq Shares (Pat-Pref Div) / Eqty FundJatin AroraPas encore d'évaluation

- Company Info - Print Financials - P&LDocument1 pageCompany Info - Print Financials - P&LUtkarshPas encore d'évaluation

- Tech MahindraDocument11 pagesTech MahindraDakshPas encore d'évaluation

- Reliance Industries - Standalone Balance Sheet Refineries Standalone Balance Sheet of Reliance Industries - BSE: 500325, NSE: RELIANCEDocument2 pagesReliance Industries - Standalone Balance Sheet Refineries Standalone Balance Sheet of Reliance Industries - BSE: 500325, NSE: RELIANCEAkshat Parekh100% (1)

- ITM MaricoDocument8 pagesITM MaricoAdarsh ChaudharyPas encore d'évaluation

- Balance SheetDocument2 pagesBalance Sheetprathamesh tawarePas encore d'évaluation

- Balance SheetDocument1 pageBalance SheetMCOM 2050 MAMGAIN RAHUL PRASADPas encore d'évaluation

- Money ControlDocument2 pagesMoney ControlsuryaaPas encore d'évaluation

- Financial StatementsDocument14 pagesFinancial Statementsthenal kulandaianPas encore d'évaluation

- Wipro Balance Sheet and Financial Statements from 2006-2010Document17 pagesWipro Balance Sheet and Financial Statements from 2006-2010Rekha RaoPas encore d'évaluation

- Adani Power Balance Sheet Data for 5 YearsDocument2 pagesAdani Power Balance Sheet Data for 5 YearsPriyankar RaiPas encore d'évaluation

- Balance Sheet of Indiabulls - in Rs. Cr.Document3 pagesBalance Sheet of Indiabulls - in Rs. Cr.MubeenPas encore d'évaluation

- Update Date: 15/03/2023 Unit: Million Dong: Balance Sheet - BKG 2018 2019 2020 2021Document9 pagesUpdate Date: 15/03/2023 Unit: Million Dong: Balance Sheet - BKG 2018 2019 2020 2021The Meme ReaperPas encore d'évaluation

- Five Year Balance Sheet and Profit & Loss Data for CompanyDocument20 pagesFive Year Balance Sheet and Profit & Loss Data for Companytanuj_mohantyPas encore d'évaluation

- Housing - PandL PDFDocument1 pageHousing - PandL PDFAbdul Khaliq ChoudharyPas encore d'évaluation

- Data of BhartiDocument2 pagesData of BhartiAnkur MehtaPas encore d'évaluation

- Financial Performance: Hindalco (Aditya Birla Group) An Overview of Financial PerformanceDocument10 pagesFinancial Performance: Hindalco (Aditya Birla Group) An Overview of Financial Performancenishant170888Pas encore d'évaluation

- Ratio Analysis For Maruti Suzuki BY, Abhigna M.P Section C Group 7 PROV/MBA-7-21/079Document10 pagesRatio Analysis For Maruti Suzuki BY, Abhigna M.P Section C Group 7 PROV/MBA-7-21/079AbhignaPas encore d'évaluation

- Vodafone Idea Limited: PrintDocument1 pageVodafone Idea Limited: PrintPrakhar KapoorPas encore d'évaluation

- HZL Balance SheetDocument6 pagesHZL Balance SheetPratyush Kumar JhaPas encore d'évaluation

- IciciDocument9 pagesIciciChirdeep PareekPas encore d'évaluation

- Previous YearsDocument6 pagesPrevious YearsAnonymous 6JMZk9mNPas encore d'évaluation

- Marico Combined FinalDocument9 pagesMarico Combined FinalAbhay Kumar SinghPas encore d'évaluation

- ICICI Bank Is IndiaDocument6 pagesICICI Bank Is IndiaHarinder PalPas encore d'évaluation

- Akash Cost AssignmentDocument10 pagesAkash Cost AssignmentAkash HedaooPas encore d'évaluation

- JSW Steel LimitedDocument35 pagesJSW Steel LimitedNeha SinghPas encore d'évaluation

- 29 - Tej Inder - Bharti AirtelDocument14 pages29 - Tej Inder - Bharti Airtelrajat_singlaPas encore d'évaluation

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsPreethaPas encore d'évaluation

- Marico BSDocument6 pagesMarico BSAbhay Kumar SinghPas encore d'évaluation

- Corporate Finance: Assignment - 1Document12 pagesCorporate Finance: Assignment - 1Ashutosh SharmaPas encore d'évaluation

- SohoDocument4 pagesSohoTiara Ayu PratamaPas encore d'évaluation

- 17 - Manoj Batra - Hero Honda MotorsDocument13 pages17 - Manoj Batra - Hero Honda Motorsrajat_singlaPas encore d'évaluation

- Reliance Industries LTD.: Assignment 2Document27 pagesReliance Industries LTD.: Assignment 2Vishal RajPas encore d'évaluation

- HCL Technologies Consolidated Balance SheetDocument2 pagesHCL Technologies Consolidated Balance SheetSachin SinghPas encore d'évaluation

- Renata Limited Financial Position and PerformanceDocument12 pagesRenata Limited Financial Position and PerformanceHM FarhanPas encore d'évaluation

- Period Ended 2/1/2020 2/2/2019 2/3/2018: Diluted Shares OutstandingDocument4 pagesPeriod Ended 2/1/2020 2/2/2019 2/3/2018: Diluted Shares Outstandingso_levictorPas encore d'évaluation

- Consolidated Balance Sheet: Wipro TCS InfosysDocument4 pagesConsolidated Balance Sheet: Wipro TCS Infosysvineel kumarPas encore d'évaluation

- Financial Accounting Company: Tata Consultancy Services LTDDocument13 pagesFinancial Accounting Company: Tata Consultancy Services LTDSanJana NahataPas encore d'évaluation

- Balance Sheet of Tata MotorsDocument2 pagesBalance Sheet of Tata MotorsPRIYAM XEROXPas encore d'évaluation

- Financial Modelling CIA 2Document45 pagesFinancial Modelling CIA 2Saloni Jain 1820343Pas encore d'évaluation

- Tata Power Balance SheetDocument2 pagesTata Power Balance Sheetakankshakhushi12Pas encore d'évaluation

- Vedanta Balance Sheet and Profit & Loss AnalysisDocument8 pagesVedanta Balance Sheet and Profit & Loss AnalysisShubham SarafPas encore d'évaluation

- Bharti Airtel: PrintDocument1 pageBharti Airtel: Printvivek singhPas encore d'évaluation

- Hindustan Unilever LTD.: Executive Summary: Mar 2010 - Mar 2019: Non-Annualised: Rs. MillionDocument4 pagesHindustan Unilever LTD.: Executive Summary: Mar 2010 - Mar 2019: Non-Annualised: Rs. Millionandrew garfieldPas encore d'évaluation

- Annexure Fm-IiDocument35 pagesAnnexure Fm-IiNeha SinghPas encore d'évaluation

- Balance Sheet: Hindalco IndustriesDocument20 pagesBalance Sheet: Hindalco Industriesparinay202Pas encore d'évaluation

- Top Companies in Oil and Natural Gas SectorDocument24 pagesTop Companies in Oil and Natural Gas SectorSravanKumar IyerPas encore d'évaluation

- Bibliography and Ane KumaranDocument6 pagesBibliography and Ane KumaranG.KISHORE KUMARPas encore d'évaluation

- Tata Motors DCFDocument11 pagesTata Motors DCFChirag SharmaPas encore d'évaluation

- Assignment of Accounting For ManagersDocument17 pagesAssignment of Accounting For ManagersGurneet KaurPas encore d'évaluation

- TCS LIMITED ACCOUNTS ASSIGNMENT-converted-compressedDocument7 pagesTCS LIMITED ACCOUNTS ASSIGNMENT-converted-compressedALEN AUGUSTINEPas encore d'évaluation

- Maruti-SuzukiDocument20 pagesMaruti-Suzukihena02071% (7)

- MGT602 Technical Article Theme 12Document7 pagesMGT602 Technical Article Theme 12Ishmal RizwanPas encore d'évaluation

- Understanding The 3 Financial Statements 1653805473Document11 pagesUnderstanding The 3 Financial Statements 1653805473RaikhanPas encore d'évaluation

- Altman Z-ScoreDocument30 pagesAltman Z-Scoreshikhakalani_19100% (1)

- Idea FinalDocument482 pagesIdea Finalsatwinder sidhuPas encore d'évaluation

- Chapter 4 Reviewer in OmDocument2 pagesChapter 4 Reviewer in Omelle gutierrezPas encore d'évaluation

- Topic 1Document59 pagesTopic 1SarannyaRajendraPas encore d'évaluation

- Meija KariukiDocument2 pagesMeija KariukiPeter Kibelesi KukuboPas encore d'évaluation

- m3m Noida 1Document33 pagesm3m Noida 1Nitin AgnihotriPas encore d'évaluation

- Quarterly Sales and Expenses Cash BudgetDocument3 pagesQuarterly Sales and Expenses Cash BudgetLynnard Philip Panes100% (1)

- Statement of Cash Flows: Learning ObjectivesDocument49 pagesStatement of Cash Flows: Learning ObjectivesPrima Rosita AriniPas encore d'évaluation

- Project Selection and Portfolio ManagementDocument28 pagesProject Selection and Portfolio Management胡莉沙Pas encore d'évaluation

- Chapter 9Document39 pagesChapter 9Thảo Thiên ChiPas encore d'évaluation

- Pilipinas Shell Vertical and Horizontal AnalysisDocument7 pagesPilipinas Shell Vertical and Horizontal Analysismaica G.Pas encore d'évaluation

- Direct Tax Ca FinalDocument10 pagesDirect Tax Ca FinalGaurav GaurPas encore d'évaluation

- Mutual Fund Tracker IndiaDocument979 pagesMutual Fund Tracker IndiaMahesh NaikPas encore d'évaluation

- Solution to Derivatives Markets: SOA Exam MFE and CAS Exam 3 FEDocument30 pagesSolution to Derivatives Markets: SOA Exam MFE and CAS Exam 3 FEKamy ZhuPas encore d'évaluation

- Hartalega Holdings Berhad (5168) PDFDocument3 pagesHartalega Holdings Berhad (5168) PDFGiddy YupPas encore d'évaluation

- CapitalCube - GBDC - GBDC US Company Reports - 4 PagesDocument4 pagesCapitalCube - GBDC - GBDC US Company Reports - 4 PagesSagar PatelPas encore d'évaluation

- 2021 Q1 Investor Letter Desert Lion Capital Non LPsDocument10 pages2021 Q1 Investor Letter Desert Lion Capital Non LPsYog MehtaPas encore d'évaluation

- ISSUE OF DEBENTURES REVISION QUESTIONS - SolnDocument18 pagesISSUE OF DEBENTURES REVISION QUESTIONS - Solnlalitha sureshPas encore d'évaluation

- Philippine Management Review 2020, Vol. 27, 17-36Document20 pagesPhilippine Management Review 2020, Vol. 27, 17-36stephen_palmer_uy6978Pas encore d'évaluation

- Overview of Financial Management and The Financial EnvironmentDocument27 pagesOverview of Financial Management and The Financial EnvironmentsoochwelfarePas encore d'évaluation

- ProbssDocument10 pagesProbssKlysh SalvezPas encore d'évaluation

- Think or Swim ManualDocument0 pageThink or Swim ManualpkattulaPas encore d'évaluation

- Syllabus Ba114.12012syllabusDocument9 pagesSyllabus Ba114.12012syllabusRyan SanitaPas encore d'évaluation

- Perception of Investors Towards Indian Commodity Derivative Market With Inferential Analysis in Chennai CityDocument10 pagesPerception of Investors Towards Indian Commodity Derivative Market With Inferential Analysis in Chennai CitySanjay KamathPas encore d'évaluation

- Ronin 2Document2 pagesRonin 2Arvind SinghPas encore d'évaluation

- Msci India Value Index (Inr) : Cumulative Index Performance - Price Returns Annual PerformanceDocument3 pagesMsci India Value Index (Inr) : Cumulative Index Performance - Price Returns Annual Performancekishore13Pas encore d'évaluation

- ECO231Document11 pagesECO231Jesse QuartPas encore d'évaluation

- CRM AssignmentDocument32 pagesCRM AssignmentRajdeep PradhaniPas encore d'évaluation

- Outliers by Malcolm Gladwell - Book Summary: The Story of SuccessD'EverandOutliers by Malcolm Gladwell - Book Summary: The Story of SuccessÉvaluation : 4.5 sur 5 étoiles4.5/5 (17)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistD'EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistÉvaluation : 4.5 sur 5 étoiles4.5/5 (73)

- The PMP Project Management Professional Certification Exam Study Guide PMBOK Seventh 7th Edition: The Complete Exam Prep With Practice Tests and Insider Tips & Tricks | Achieve a 98% Pass Rate on Your First AttemptD'EverandThe PMP Project Management Professional Certification Exam Study Guide PMBOK Seventh 7th Edition: The Complete Exam Prep With Practice Tests and Insider Tips & Tricks | Achieve a 98% Pass Rate on Your First AttemptPas encore d'évaluation

- EMT (Emergency Medical Technician) Crash Course with Online Practice Test, 2nd Edition: Get a Passing Score in Less TimeD'EverandEMT (Emergency Medical Technician) Crash Course with Online Practice Test, 2nd Edition: Get a Passing Score in Less TimeÉvaluation : 3.5 sur 5 étoiles3.5/5 (3)

- Radiographic Testing: Theory, Formulas, Terminology, and Interviews Q&AD'EverandRadiographic Testing: Theory, Formulas, Terminology, and Interviews Q&APas encore d'évaluation

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaD'EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (14)

- Finance Basics (HBR 20-Minute Manager Series)D'EverandFinance Basics (HBR 20-Minute Manager Series)Évaluation : 4.5 sur 5 étoiles4.5/5 (32)

- The NCLEX-RN Exam Study Guide: Premium Edition: Proven Methods to Pass the NCLEX-RN Examination with Confidence – Extensive Next Generation NCLEX (NGN) Practice Test Questions with AnswersD'EverandThe NCLEX-RN Exam Study Guide: Premium Edition: Proven Methods to Pass the NCLEX-RN Examination with Confidence – Extensive Next Generation NCLEX (NGN) Practice Test Questions with AnswersPas encore d'évaluation

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanD'EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanÉvaluation : 4.5 sur 5 étoiles4.5/5 (79)

- Joy of Agility: How to Solve Problems and Succeed SoonerD'EverandJoy of Agility: How to Solve Problems and Succeed SoonerÉvaluation : 4 sur 5 étoiles4/5 (1)

- Product-Led Growth: How to Build a Product That Sells ItselfD'EverandProduct-Led Growth: How to Build a Product That Sells ItselfÉvaluation : 5 sur 5 étoiles5/5 (1)

- 2023/2024 ASVAB For Dummies (+ 7 Practice Tests, Flashcards, & Videos Online)D'Everand2023/2024 ASVAB For Dummies (+ 7 Practice Tests, Flashcards, & Videos Online)Pas encore d'évaluation

- Value: The Four Cornerstones of Corporate FinanceD'EverandValue: The Four Cornerstones of Corporate FinanceÉvaluation : 4.5 sur 5 étoiles4.5/5 (18)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisD'EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisÉvaluation : 5 sur 5 étoiles5/5 (6)

- Improve Your Global Business English: The Essential Toolkit for Writing and Communicating Across BordersD'EverandImprove Your Global Business English: The Essential Toolkit for Writing and Communicating Across BordersÉvaluation : 4 sur 5 étoiles4/5 (14)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsD'EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsPas encore d'évaluation

- Nursing School Entrance Exams: HESI A2 / NLN PAX-RN / PSB-RN / RNEE / TEASD'EverandNursing School Entrance Exams: HESI A2 / NLN PAX-RN / PSB-RN / RNEE / TEASPas encore d'évaluation

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityD'EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityÉvaluation : 4.5 sur 5 étoiles4.5/5 (4)

- Medical Records Clerk: Passbooks Study GuideD'EverandMedical Records Clerk: Passbooks Study GuidePas encore d'évaluation

- EMT (Emergency Medical Technician) Crash Course Book + OnlineD'EverandEMT (Emergency Medical Technician) Crash Course Book + OnlineÉvaluation : 4.5 sur 5 étoiles4.5/5 (4)

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000D'EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Évaluation : 4.5 sur 5 étoiles4.5/5 (86)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaD'EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaÉvaluation : 3.5 sur 5 étoiles3.5/5 (8)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelD'Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelPas encore d'évaluation

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)D'EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Évaluation : 4.5 sur 5 étoiles4.5/5 (4)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialD'EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialPas encore d'évaluation

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursD'EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursÉvaluation : 4.5 sur 5 étoiles4.5/5 (34)