Académique Documents

Professionnel Documents

Culture Documents

Schedule of Charges For Nri Accounts Prime

Transféré par

Sonam SharmaDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Schedule of Charges For Nri Accounts Prime

Transféré par

Sonam SharmaDroits d'auteur :

Formats disponibles

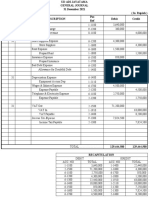

SIMPLIFIED NRI SAVINGS ACCOUNT TARRIF STRUCTURE w.e.

f April 01, 2019

BALANCE MAINTENANCE CRITERIA

NRI Prime Savings Accounts – NREPM , NROPM

Monthly Average Location / Branch Fees in case AMB/TRV not

Accounts

Balance Category maintained

Rs. 10 per Rs.100 of shortfall from

All Savings and Current Metro/Urban Monthly Average Balance

Rs. 25,000 Accounts within the same /Semi Urban / Requirement OR Rs. 500, whichever

customer ID Rural is lower with a minimum charge of

Rs.100

NRI Prime Salary Accounts – NRISL

Metro/Urban

Waived Salary Account Only /Semi Urban / NA

Rural

DEBIT CARD FEES

Titanium Prime Visa Classic Mariner

RuPay Classic Domestic

International International International

(NROPM, NROMA)

(NREPM) (NRISL) (NREMA, SBMIA)

Issuance Fees Nil Rs. 150/- Nil Rs. 150/-

Annual Fees Rs. 150/- Rs. 150/- Rs. 150/- Rs. 150/-

Replacement Fees Rs. 300/- Rs. 300/- Rs. 300/- Rs. 300/-

My Design Card Issuance Fee As per Card variant + Rs. 150/- My design Card

(applicable only for NRE A/c variants) fees

Issuance Fees – Rs. 500/-

Online Rewards Debit Card

Annual Fees – Rs. 500/-

(applicable only for NREPM, NRISL, NREMA & SBMIA A/c)

Replacement Fees – Rs 300/-.

Issuance Fees – Rs. 999/-

Display Debit Card Fee

Annual Fees – Rs. 500/-

(applicable only for NRE A/c variants)

Replacement Fees – Rs 999/-.

CHEQUE BOOK FEES

One multicity Cheque Books Free per quarter

Cheque Book Free Limit

(20 leaves)

Cheque book Issuance Fees beyond Free Limit, if Any (Refer

Rs. 60/- per cheque book

Table)

ACCOUNT CLOSURE FEES

Account closed <= 14 days or > 1 Year from the date of

Nil

account opening

Account closed >14 Days to <= 1 Year from the date of

Rs. 500/-

account opening

INTERNET BANKING HARDWARE TOKEN

Netsecure with 1 Touch Rs. 800/- (Issuance), Rs. 500/- (Replacement)

TRANSACTION FEES

Cash Transaction Fees

Cash Transaction Free Limit (Metro/Urban/ Semi Urban

First 5 Transactions or 5 Lakhs whichever is earlier**

/ Rural)

Post free limit, Rs. 5/- per Rs. 1000/- on the Cash deposit / withdrawal amount or Rs. 150/- whichever is higher

shall be charged

In addition to the above mentioned fees, GST shall be charged and payable by the customer as per Government

Rules and Regulations. Fees shall not be applicable on Cash Transactions at Axis Bank ATMs.

** Value of Transaction will include both cash withdrawals and deposits. Cash deposits are not allowed in NRE

accounts.

DD/PO Fees

Free Limit 2 DD / PO per month

Up to Rs.10,000 - Rs.50

DD/PO Fees above free limit, if any Above Rs.10,000 - Rs.5 per 1000 (min Rs.75/-max

Rs.10,000)

Other Fees

Up to Rs. 5000/- : Rs. 25/-

Rs. 5,001 - Rs. 10,000 /- : Rs. 50/-

Outstation Cheque Collection Fees

Rs. 10,001 - Rs. 1 Lakh : Rs. 100/-

Above Rs. 1 Lakh : Rs. 200/-

Online : Nil

Branch:

RTGS Fees

Rs. 2 Lac - Rs. 5 Lac - Rs. 25 per transaction

Above 5 Lac - Rs. 50 per transaction

Online : Nil

Branch:

Up to Rs. 10,000 - Rs. 2.5 per transaction

NEFT Fees

Rs. 10,000 - Rs. 1 Lac - Rs. 5 per transaction

Rs. 1 Lac - Rs. 2 Lac - Rs. 15 per transaction

Above 2 Lac - Rs. 25 per transaction

Free up to cheque amount of Rs. 1 lakh

Speed Clearing Fees

Above 1 Lakh - Rs. 150

Axis Bank ATM Fees Nil

In India

Non- Axis Bank Free ATM Transaction Limit 10 transactions per month (NREPM, NROPM)

5 per month (NRISL)

Financial Transactions : Rs.20 per transaction

Non- Axis Bank ATM Fees Beyond Free Limit Fees:

Non-Financial Transactions : Rs. 8.50 per transactions

International Cash Withdrawal Fees Rs. 125/- per transaction

International Balance Inquiry Fees Rs. 25/- per transaction

Surcharge on Railway Tickets purchased with Debit

As per IRCTC

Card

Fuel Surcharge As per card variant

Cross Currency Mark-up on International Debit Card

3.5% of the transaction amount

Transactions

TRANSACTION FAILURE FEES

Rs.150/- per cheque

Outward Cheque Return

w.e.f 1st June 2019, Rs.200/- per cheque

Inward Cheque Return Rs.500/- per cheque

Outstation Cheque Return Rs.150/- per cheque

ECS Debit Failure Rs.500/- per instance

Auto Debit Failure Rs. 250/- per instance

Standing Instruction Failure

Rs. 250/- per instance

(Loan Repayments / Credit Card Payment)

SI Failure charges for RD/MF SIP bounce Rs 50 per instance of RD/MF SIP bounce

CONVENIENCE FEES

Duplicate Pin issuance (on IVR) Free

Duplicate Pin issuance (non- IVR) Rs. 100 /- per instance

Duplicate Account Statement Rs. 100 /- per instance

Rs. 100 /- per cheque with maximum of Rs. 200/-

Stop Payment Instructions : Cheques

irrespective of number of Cheques

Stop Payment Instructions : ECS Rs. 100 /- per instance

DD/PO Cancellation Rs. 100 /- per DD/PO

Duplicate DD/PO Issuance Rs. 100 /- per DD/PO

DD/PO Revalidation Rs. 100 /- per DD/PO

Address Confirmation Rs. 100 /- per request

Photo Attestation Rs. 100 /- per request

Account Balance Certificate Rs. 100 /- per request

Signature Verification / Attestation Rs. 100 /- per request

REMITTANCE FEES

Outward Remittances

Wire Transfer / TT / Swift Rs. 1000 /- per instance

Foreign Currency Demand Draft Rs. 2.50 /- per Rs. 1000/-

Inward Remittances

FIRC Fees 100/- per Certificate

Foreign Currency Deposit at Branch Rs. 25 /- per instance

Foreign Currency Cheque Collection Fees

Collection Charges for all Currencies Rs. 2.50 /- per Rs. 1000/-

Postage Rs. 100 /- per instance

In addition to the above mentioned fees, Correspondent Bank charges & other charges shall be charged and

payable by the customer.

Please note the following:

1. All fees and charges mentioned above are exclusive of applicable taxes. The charges indicated

above are subject to periodic revision.

2. With effect from 1st April, 2014, Monthly Average Balances of all NRI Savings and Current

accounts held under one Customer ID will be consolidated for calculation of Fees to be levied

for that particular month (Balances held in NREPI & NROPI i.e. PIS accounts, will not be

considered for Customer ID level consolidation).

3. In case multiple accounts under the same Customer ID are held across different segments, the

threshold Average Balance for the highest segment will be considered and the corresponding

services charges would be applicable.

4. With Effect from 1st April 2014, balance maintenance criteria for Savings Segments will move

from 15th to 14th of the Quarter to 1st to end of the Calendar Month.

5. The changes in the other charge cycles will also move to calendar monthly/quarterly charge

cycle as applicable. For example: Other fees that are currently levied for transactions executed

between 15th to 14th cycle will move to calendar month/quarter. Eg. Cash, DD/PO & Cheque

book charges beyond fee limit which is currently under broken quarter 15th-14th of

quarter/month will move to calendar month/quarter for Non-Salary segments.

6. GST as applicable will be levied on all fees

7. NRI Schemes out of scope of the balance maintenance criteria: NRI Salary (NRISL), NRE Zero

(NREZR), NRO Zero (NROZR), Mariners Account (SBMIA), Foreign National Account-NRO

(NROFN), Foreign National Account -Resident (SBFRN), Resident Foreign Currency (SBRFC), NRE

Staff (NREST) and NRO Staff (NROST)

8. Salary Segment – Discounts/waivers on any other fees will be as per the relationship

/agreement with the bank.

For more details visit www.axisbank.com/support or contact our NRI International Toll Free

Numbers:

India : 18001085577 (toll free) / +91 40 67174100 (paid number from anywhere in the world)

USA : 1855-205-5577 (toll-free)

UAE : 8000-3570-3218 (toll-free, from Du & Etisalat service providers)

UK : 0808-178-5040 (toll-free)

Australia : 1800153861 (toll-free, from Optus, Telestra, Reach, Vodafone & Fixed Lines)

Saudi Arabia : 800-850-0000 (toll-free, from Mobily, Zain, GO telecom service providers)

Qatar : 00-800-100 348 (toll-free, from Qtel telecom service provider)

Canada : 1855 436 0726 (toll-free)

Singapore : 800-1206-355 (toll-free)

Bahrain : 800-11-300 (toll-free, from Zain, Viva, Batelco & Mena telecom service providers)

Disclaimer:

The information contained in this page is subject to change. Axis Bank Limited does not warrant the accuracy, adequacy or completeness of

this information and expressly disclaims liability for errors or omissions in this information.

Vous aimerez peut-être aussi

- Nri Schedule of ChargesDocument4 pagesNri Schedule of ChargesRishiPas encore d'évaluation

- Schedule of Charges For Nri PriorityDocument4 pagesSchedule of Charges For Nri PriorityAnnuRawatPas encore d'évaluation

- Schedule of Charges Edge Business 1st Feb 20 PDFDocument2 pagesSchedule of Charges Edge Business 1st Feb 20 PDFRavie S DhamaPas encore d'évaluation

- Soc Edge Business Prime Business Exclusive Business Wef 1st April23 PDFDocument2 pagesSoc Edge Business Prime Business Exclusive Business Wef 1st April23 PDFJella RamakrishnaPas encore d'évaluation

- Description of Charge/Feature: Param VisheshDocument4 pagesDescription of Charge/Feature: Param Visheshgaurav_p_9Pas encore d'évaluation

- Grace Period Granted - 1 Month As Per RBI Guidelines To Restore MABDocument2 pagesGrace Period Granted - 1 Month As Per RBI Guidelines To Restore MABprasanPas encore d'évaluation

- Common Service ChargesDocument3 pagesCommon Service ChargesatharvxunoPas encore d'évaluation

- Schedule of Charges - Retail (India)Document2 pagesSchedule of Charges - Retail (India)John PeterPas encore d'évaluation

- Super Savings Account: Common Service ChargesDocument2 pagesSuper Savings Account: Common Service ChargesSantosh ThakurPas encore d'évaluation

- Core Bundled Savings AccountDocument2 pagesCore Bundled Savings AccountSweta MistryPas encore d'évaluation

- Effective From 1st April, 2020Document2 pagesEffective From 1st April, 2020SundarPas encore d'évaluation

- Changes in Upcoming Schedule of Charges (Jan-Jun-2019) : ADC ServicesDocument1 pageChanges in Upcoming Schedule of Charges (Jan-Jun-2019) : ADC ServicesAhsan IqbalPas encore d'évaluation

- Current Account For CSC - VLE W.E.F 1st September 2016: Monthly Average Balance NILDocument1 pageCurrent Account For CSC - VLE W.E.F 1st September 2016: Monthly Average Balance NILKulwinder Singh MayaanPas encore d'évaluation

- Issuance Fee (Personalised Debit Card) Rs.150/-: Grace Period Granted - 1 Month As Per RBI Guidelines To Restore MABDocument2 pagesIssuance Fee (Personalised Debit Card) Rs.150/-: Grace Period Granted - 1 Month As Per RBI Guidelines To Restore MABSäñtôsh Kûmãr PrâdhäñPas encore d'évaluation

- Core Savings Account - IDBIDocument2 pagesCore Savings Account - IDBIprasanPas encore d'évaluation

- Jubilee Plus Savings Account: (January 01,2020)Document2 pagesJubilee Plus Savings Account: (January 01,2020)Ruthvik TMPas encore d'évaluation

- Services ProvidedDocument15 pagesServices ProvidedParul AroraPas encore d'évaluation

- Changes in Upcoming Schedule of Charges (Jan-Jun-2021) : Sno. Description Existing Charges Revised Charges Adc ServicesDocument1 pageChanges in Upcoming Schedule of Charges (Jan-Jun-2021) : Sno. Description Existing Charges Revised Charges Adc ServicesNawaz SharifPas encore d'évaluation

- NeekiDocument2 pagesNeekiRamPas encore d'évaluation

- Core Savings AccountDocument2 pagesCore Savings AccountVarshaPas encore d'évaluation

- Pca 14 6Document2 pagesPca 14 6Arora MathewPas encore d'évaluation

- "Being Me" Savings Account (January 01,2021) : Issuance Fee (Personalised Debit Card) Rs.150Document2 pages"Being Me" Savings Account (January 01,2021) : Issuance Fee (Personalised Debit Card) Rs.150Sweta MistryPas encore d'évaluation

- Being MeDocument2 pagesBeing Metharun venkatPas encore d'évaluation

- Being MeDocument2 pagesBeing MeVarshaPas encore d'évaluation

- Soc Ca 01.01.22Document4 pagesSoc Ca 01.01.22Abhishek ShivappaPas encore d'évaluation

- Theory MojskshajajahbilityDocument2 pagesTheory Mojskshajajahbilityßtylish Murthuja ValiPas encore d'évaluation

- Service Charges As Per Rbi GuidelinesDocument10 pagesService Charges As Per Rbi Guidelineskrunal3726Pas encore d'évaluation

- Notice To SB CA OD Account Customer Annexure IIIDocument4 pagesNotice To SB CA OD Account Customer Annexure IIIratnesh singhPas encore d'évaluation

- 9114 Accts-SERVICE CHARGhjgjgnj)Document5 pages9114 Accts-SERVICE CHARGhjgjgnj)Girish KumarPas encore d'évaluation

- Parameter Au Samriddhi Current AccountDocument2 pagesParameter Au Samriddhi Current Accounthiteshmohakar15Pas encore d'évaluation

- Axis Bank Service ChargesDocument4 pagesAxis Bank Service ChargesRanjith MeelaPas encore d'évaluation

- NRENROBeingMeaccountApril 012019Document2 pagesNRENROBeingMeaccountApril 012019KxhsujsnsPas encore d'évaluation

- Revision of Service Charges - DepositDocument10 pagesRevision of Service Charges - DepositThe QuintPas encore d'évaluation

- Savings - Account - Mar - 2019 - 20190325104947Document4 pagesSavings - Account - Mar - 2019 - 20190325104947Manish kumar yadavPas encore d'évaluation

- SBI Site Upload-Service Charges-2017 June 2017 (REVISED)Document1 pageSBI Site Upload-Service Charges-2017 June 2017 (REVISED)NDTVPas encore d'évaluation

- Casil Soc 01 07 23Document2 pagesCasil Soc 01 07 23rishisiliveri95Pas encore d'évaluation

- Basic Saving Account With Complete KYCDocument2 pagesBasic Saving Account With Complete KYCVarsha100% (1)

- AnnexA-SoC Comfort01062014Document4 pagesAnnexA-SoC Comfort01062014satyabrataPas encore d'évaluation

- Branch)Document3 pagesBranch)Jeyavel NagarajanPas encore d'évaluation

- Baroda Apex Academy, Gandhinagar: S. No Commission Per TransactionDocument1 pageBaroda Apex Academy, Gandhinagar: S. No Commission Per TransactionJitenPas encore d'évaluation

- General Charges of Kotak BankDocument2 pagesGeneral Charges of Kotak BankSarafraj BegPas encore d'évaluation

- RBI SBI Demand Draft Exchange RatesDocument11 pagesRBI SBI Demand Draft Exchange RatesJithin VijayanPas encore d'évaluation

- DownloadDocument2 pagesDownloadGazzu GazaliPas encore d'évaluation

- HDFC Vs IciciDocument10 pagesHDFC Vs IciciRahulPas encore d'évaluation

- Titanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowDocument2 pagesTitanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowGaurav Singh RathorePas encore d'évaluation

- Service Charges Annexure-A Revised 18-7-11Document28 pagesService Charges Annexure-A Revised 18-7-11Dhaliwal JassiePas encore d'évaluation

- Service Charges - BoB - As On 6.11.17Document63 pagesService Charges - BoB - As On 6.11.17Praneta pandeyPas encore d'évaluation

- Preferred AccountDocument2 pagesPreferred AccountaurummaangxinchenPas encore d'évaluation

- Annexure2 PDFDocument2 pagesAnnexure2 PDFMukeshPas encore d'évaluation

- Revised Schedule of ChargesDocument2 pagesRevised Schedule of ChargesChandhan ReddyPas encore d'évaluation

- Istartup 2 0Document3 pagesIstartup 2 0fatrag amloPas encore d'évaluation

- Revised Schedule of ChargesDocument2 pagesRevised Schedule of Chargesmayankmehta052Pas encore d'évaluation

- Schedule of Charges Unity Classic Saving AcDocument4 pagesSchedule of Charges Unity Classic Saving Acpunitrai28111Pas encore d'évaluation

- IDBI Royale Plus Account Sep 01 2018Document2 pagesIDBI Royale Plus Account Sep 01 2018Sumit KumarPas encore d'évaluation

- Sba 2 0 Ivy PDFDocument2 pagesSba 2 0 Ivy PDFChandan SahPas encore d'évaluation

- Service ChargesDocument64 pagesService ChargesAmrutaPas encore d'évaluation

- ICICI Bank Service ChargesDocument7 pagesICICI Bank Service ChargesRanjith MeelaPas encore d'évaluation

- Soc ChangesDocument1 pageSoc ChangesMuhammad NadeemPas encore d'évaluation

- Au Digital Savings Account - 31 - MarchDocument5 pagesAu Digital Savings Account - 31 - MarchZach KingPas encore d'évaluation

- Indas 2Document28 pagesIndas 2Ranjan DasguptaPas encore d'évaluation

- An Analysis of Security Management Strategies of Banks in Nigeria and Its Role in Banking Performance (A Case Study of Gtbank PLC)Document37 pagesAn Analysis of Security Management Strategies of Banks in Nigeria and Its Role in Banking Performance (A Case Study of Gtbank PLC)samson naantongPas encore d'évaluation

- BUS670 O GradyDocument5 pagesBUS670 O GradyIndra ZulhijayantoPas encore d'évaluation

- Chatham Lodging TrustDocument5 pagesChatham Lodging Trustpresentation111Pas encore d'évaluation

- Data Science in Finance Credit Risk AnalysisDocument4 pagesData Science in Finance Credit Risk AnalysisAde AdePas encore d'évaluation

- Forex Management AgreementDocument5 pagesForex Management Agreementapi-34208217883% (6)

- 09SKCMA002Document91 pages09SKCMA002Ammu PKPas encore d'évaluation

- Advantages of Each Source of Finance and Their DisadvantagesDocument8 pagesAdvantages of Each Source of Finance and Their DisadvantagesfelixPas encore d'évaluation

- Nestle India Submitted By: GARIMA BHATTDocument2 pagesNestle India Submitted By: GARIMA BHATTakshayPas encore d'évaluation

- The Sharing EconomyDocument60 pagesThe Sharing EconomyRaul Velazquez Collado100% (1)

- Louw11 (Completing The Audit 1)Document24 pagesLouw11 (Completing The Audit 1)ClaraPas encore d'évaluation

- Philippine Stock ExchangeDocument11 pagesPhilippine Stock ExchangeJyasmine Aura V. AgustinPas encore d'évaluation

- CBDCs and AMMDocument19 pagesCBDCs and AMMGopal DubeyPas encore d'évaluation

- Toshiba Fraud CaseDocument23 pagesToshiba Fraud CaseShashank Varma100% (1)

- Part 2 Working Capital Management Qs PDFDocument15 pagesPart 2 Working Capital Management Qs PDFAnuar LoboPas encore d'évaluation

- Commission Invoice: Del Corso Family SRL Calea Bogdanestilor, Nr. 18 300611 Timisoara RomaniaDocument2 pagesCommission Invoice: Del Corso Family SRL Calea Bogdanestilor, Nr. 18 300611 Timisoara RomaniaLorena NegreaPas encore d'évaluation

- Standard, The Conceptual Framework Overrides That StandardDocument6 pagesStandard, The Conceptual Framework Overrides That StandardwivadaPas encore d'évaluation

- Unit V Responsibility Accounting: Prepared by Dr. Arvind Rayalwar Assistant Professor Department of Commerce, SSM BeedDocument13 pagesUnit V Responsibility Accounting: Prepared by Dr. Arvind Rayalwar Assistant Professor Department of Commerce, SSM BeedArvind RayalwarPas encore d'évaluation

- Paccar LeasingDocument11 pagesPaccar LeasingJennifer67% (3)

- Document From VandanaDocument39 pagesDocument From VandanaVandana SharmaPas encore d'évaluation

- Profile PartnersDocument20 pagesProfile PartnersSunita AgarwalPas encore d'évaluation

- NYU's Memo Opposing Merkin Motion To DismissDocument31 pagesNYU's Memo Opposing Merkin Motion To DismissDealBook100% (11)

- 2022 BIR Form 2316 - 2013650Document1 page2022 BIR Form 2316 - 2013650erik skiPas encore d'évaluation

- Groww Nifty Total Market Index Fund KIMDocument37 pagesGroww Nifty Total Market Index Fund KIMG1 ROYALPas encore d'évaluation

- Jawaban Ajp Unit Ud Adi Jayatamaa AciiiiiiiiDocument4 pagesJawaban Ajp Unit Ud Adi Jayatamaa AciiiiiiiiASRI HANDAYANIPas encore d'évaluation

- Marriott International COPORATE STRATEGYDocument5 pagesMarriott International COPORATE STRATEGYYasir Jatoi100% (1)

- Chhattisgarh State Electricity Regulatory Commission Raipur: CSERC Tariff Order FY 2023-24Document284 pagesChhattisgarh State Electricity Regulatory Commission Raipur: CSERC Tariff Order FY 2023-24eepocapsldcPas encore d'évaluation

- Forbes USA - 24 January 2017Document116 pagesForbes USA - 24 January 2017Carlos PanaoPas encore d'évaluation

- Tactical Analysis Strategy and SetupDocument116 pagesTactical Analysis Strategy and SetupAdi Podosu100% (2)

- Tan FinalDocument89 pagesTan FinalAjit singhPas encore d'évaluation