Académique Documents

Professionnel Documents

Culture Documents

PYUA

Transféré par

PrasadCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

PYUA

Transféré par

PrasadDroits d'auteur :

Formats disponibles

Payroll Ukraine (PY-UA)

HR-CEECUA110_604

Document Version: 2.0 – 16.10.2012

Copyright

© Copyright 2012 SAP AG. All rights reserved.

SAP Library document classification: PUBLIC

No part of this publication may be reproduced or transmitted in any form or for any purpose

without the express permission of SAP AG. The information contained herein may be

changed without prior notice.

No part of this publication may be reproduced or transmitted in any form or for any purpose

without the express permission of SAP AG. The information contained herein may be

changed without prior notice.

Some software products marketed by SAP AG and its distributors contain proprietary

software components of other software vendors.

Microsoft, Windows, Excel, Outlook, PowerPoint, Silverlight, and Visual Studio are registered

trademarks of Microsoft Corporation.

IBM, DB2, DB2 Universal Database, System i, System i5, System p, System p5, System x,

System z, System z10, z10, z/VM, z/OS, OS/390, zEnterprise, PowerVM, Power Architecture,

Power Systems, POWER7, POWER6+, POWER6, POWER, PowerHA, pureScale, PowerPC,

BladeCenter, System Storage, Storwize, XIV, GPFS, HACMP, RETAIN, DB2 Connect, RACF,

Redbooks, OS/2, AIX, Intelligent Miner, WebSphere, Tivoli, Informix, and Smarter Planet are

trademarks or registered trademarks of IBM Corporation.

Linux is the registered trademark of Linus Torvalds in the United States and other countries.

Adobe, the Adobe logo, Acrobat, PostScript, and Reader are trademarks or registered

trademarks of Adobe Systems Incorporated in the United States and other countries.

Oracle and Java are registered trademarks of Oracle and its affiliates.

UNIX, X/Open, OSF/1, and Motif are registered trademarks of the Open Group.

Citrix, ICA, Program Neighborhood, MetaFrame, WinFrame, VideoFrame, and MultiWin are

trademarks or registered trademarks of Citrix Systems Inc.

HTML, XML, XHTML, and W3C are trademarks or registered trademarks of W3C®, World

Wide Web Consortium, Massachusetts Institute of Technology.

Apple, App Store, iBooks, iPad, iPhone, iPhoto, iPod, iTunes, Multi-Touch, Objective-C,

Retina, Safari, Siri, and Xcode are trademarks or registered trademarks of Apple Inc.

IOS is a registered trademark of Cisco Systems Inc.

(C) SAP AG HELPX.PYUA 2

RIM, BlackBerry, BBM, BlackBerry Curve, BlackBerry Bold, BlackBerry Pearl, BlackBerry

Torch, BlackBerry Storm, BlackBerry Storm2, BlackBerry PlayBook, and BlackBerry App

World are trademarks or registered trademarks of Research in Motion Limited.

Google App Engine, Google Apps, Google Checkout, Google Data API, Google Maps,

Google Mobile Ads, Google Mobile Updater, Google Mobile, Google Store, Google Sync,

Google Updater, Google Voice, Google Mail, Gmail, YouTube, Dalvik and Android are

trademarks or registered trademarks of Google Inc.

INTERMEC is a registered trademark of Intermec Technologies Corporation.

Wi-Fi is a registered trademark of Wi-Fi Alliance.

Bluetooth is a registered trademark of Bluetooth SIG Inc.

Motorola is a registered trademark of Motorola Trademark Holdings LLC.

Computop is a registered trademark of Computop Wirtschaftsinformatik GmbH.

SAP, R/3, SAP NetWeaver, Duet, PartnerEdge, ByDesign, SAP BusinessObjects Explorer,

StreamWork, SAP HANA, and other SAP products and services mentioned herein as well as

their respective logos are trademarks or registered trademarks of SAP AG in Germany and

other countries.

Business Objects and the Business Objects logo, BusinessObjects, Crystal Reports, Crystal

Decisions, Web Intelligence, Xcelsius, and other Business Objects products and services

mentioned herein as well as their respective logos are trademarks or registered trademarks of

Business Objects Software Ltd. Business Objects is an SAP company.

Sybase and Adaptive Server, iAnywhere, Sybase 365, SQL Anywhere, and other Sybase

products and services mentioned herein as well as their respective logos are trademarks or

registered trademarks of Sybase Inc. Sybase is an SAP company.

Crossgate, m@gic EDDY, B2B 360°, and B2B 360° Services are registered trademarks of

Crossgate AG in Germany and other countries. Crossgate is an SAP company.

All other product and service names mentioned are the trademarks of their respective

companies. Data contained in this document serves informational purposes only. National

product specifications may vary.

These materials are subject to change without notice. These materials are provided by SAP

AG and its affiliated companies ("SAP Group") for informational purposes only, without

representation or warranty of any kind, and SAP Group shall not be liable for errors or

omissions with respect to the materials. The only warranties for SAP Group products and

services are those that are set forth in the express warranty statements accompanying such

products and services, if any. Nothing herein should be construed as constituting an

additional warranty.

(C) SAP AG HELPX.PYUA 3

(C) SAP AG HELPX.PYUA 4

Icons in Body Text

Icon Meaning

Caution

Example

Note

Recommendation

Syntax

Additional icons are used in SAP Library documentation to help you identify different types of

information at a glance. For more information, see Help on Help General Information

Classes and Information Classes for Business Information Warehouse on the first page of any

version of SAP Library.

Typographic Conventions

Type Style Description

Example text Words or characters quoted from the screen. These include field names, screen

titles, pushbuttons labels, menu names, menu paths, and menu options.

Cross-references to other documentation.

Example text Emphasized words or phrases in body text, graphic titles, and table titles.

EXAMPLE TEXT Technical names of system objects. These include report names, program

names, transaction codes, table names, and key concepts of a programming

language when they are surrounded by body text, for example, SELECT and

INCLUDE.

Example text Output on the screen. This includes file and directory names and their paths,

messages, names of variables and parameters, source text, and names of

installation, upgrade and database tools.

Example text Exact user entry. These are words or characters that you enter in the system

exactly as they appear in the documentation.

<Example text> Variable user entry. Angle brackets indicate that you replace these words and

characters with appropriate entries to make entries in the system.

EXAMPLE TEXT Keys on the keyboard, for example, F2 or ENTER.

(C) SAP AG HELPX.PYUA 5

Table of Contents

Payroll Ukraine (PY-UA) ........................................................................................................ 9

Document Change History ............................................................................................... 10

Payroll in the SAP System ............................................................................................... 11

Payroll Basics (PY-XX-BS) ........................................................................................... 12

The Payroll Process ..................................................................................................... 13

Payroll in a Background Operation................................................................................ 14

Infotypes for Personnel Administration and Payroll ........................................................... 15

Infotypes of Personnel Administration and International Payroll..................................... 16

Infotypes for Payroll Ukraine ......................................................................................... 17

Personnel Actions: Ukraine-Specific Features ........................................................... 18

Documents and Certificates (Infotype 0290): Ukraine-Specific Features .................... 20

Tax and Social Insurance Payments (Infotype 0291): Ukraine-Specific Features ....... 21

Additional Social Insurance Data (Infotype 0292): Ukraine-Specific Features............. 22

Garnishment Orders (Infotype 0295): Ukraine-Specific Features ............................... 23

Garnishment Documents (Infotype 0296): Ukraine-Specific Features ........................ 24

Personnel Orders (Infotype 0298): Ukraine-Specific Features ................................... 26

Archiving of Personnel Orders ............................................................................... 28

Tax Privileges (Infotype 0299): Ukraine-Specific Features ......................................... 29

Absences (Infotype 2001): Ukraine-Specific Features ............................................... 30

Legal Properties (Infotype 1656) ............................................................................... 32

Relationship of Legal Entities in Organizational Management ................................ 34

Example: Structures of Company ....................................................................... 36

Payroll Basics for Payroll Ukraine .................................................................................... 38

Internal Tables for Payroll Ukraine ................................................................................ 39

Main Customizing Settings for Payroll Ukraine .............................................................. 40

Employee Status .......................................................................................................... 41

Determination of Employee Status ............................................................................ 42

Example: Recording Employee Status Changes .................................................... 44

Grouping of Personnel Assignments in Ukraine......................................................... 46

Evaluation of Payroll Data Using Employee Statuses ................................................ 49

Determination of Payroll Data After Rehiring Process ................................................... 51

Future Period Processing ............................................................................................. 53

Gross............................................................................................................................... 55

Wage Types ................................................................................................................. 57

Payments ..................................................................................................................... 58

Time Management Aspects in Payroll ........................................................................... 59

Wage Type Valuation ................................................................................................... 60

Technical Process of Average Processing (New) .......................................................... 61

(C) SAP AG HELPX.PYUA 6

Incentive Wages: Overview .......................................................................................... 64

Partial Period Remuneration (Factoring) ....................................................................... 65

Making of Indexation Payments .................................................................................... 66

Calculation of Indexation Amounts ............................................................................ 67

Personal Reduction in Indexation Amounts ............................................................... 69

Valuation of Employee Salary ................................................................................... 71

Calculation of Employee's Average Income .................................................................. 73

Continuation of Average Salary Following Transfer ................................................... 75

Absence Processing ........................................................................................................ 76

Calculation of Sick Pay ................................................................................................. 77

Calculation of Sick Pay for New Employees .............................................................. 79

Example: Linking Periods of Absence ....................................................................... 80

Calculation of Maternity Pay ......................................................................................... 82

Calculation of Vacation Pay .......................................................................................... 84

Limitation of Absence Pay ............................................................................................ 85

Example: Limitation of Sick Pay ................................................................................ 87

Net .................................................................................................................................. 88

Tax Classes ................................................................................................................. 89

Determination of Tax Classes ....................................................................................... 90

Income Tax .................................................................................................................. 91

Income Tax Calculation............................................................................................. 92

Example: Income Tax Calculation.......................................................................... 94

Privilege Processing for Income Tax ......................................................................... 96

Processing of Income Tax Discrepancies .................................................................. 97

Example: Processing of Income Tax Discrepancies ............................................... 99

Social Insurance ......................................................................................................... 101

Social Insurance Calculation ................................................................................... 102

Example: Social Insurance Contribution (ESV) .................................................... 104

Seniority Calculation ............................................................................................... 106

Garnishment Processing ............................................................................................ 108

Balances & Totals ...................................................................................................... 110

Loans ......................................................................................................................... 112

Off-Cycle Activities......................................................................................................... 113

Making Advance Off-Cycle Payments ......................................................................... 114

Additional Off-Cycle Payment (Infotype 0267) ............................................................. 115

Advance Payment Methods ........................................................................................ 117

Making Advance Payments Based on Monthly Salary ............................................. 118

Deduction Processing for Payments Based on Monthly Salary............................. 120

Making Off-Cycle Vacation Payments ..................................................................... 121

Making Off-Cycle Bonus Payments ......................................................................... 123

(C) SAP AG HELPX.PYUA 7

Off-Cycle Workbench ................................................................................................. 125

Payroll History......................................................................................................... 126

Off-Cycle Payroll ..................................................................................................... 127

Running Off-Cycle Payroll ................................................................................... 128

Reasons, Types and Categories for Off-Cycle Payroll .......................................... 129

Reversing Payroll Results.................................................................................... 131

Reversing the Payroll Result ............................................................................ 133

Effects of an Out-of-Sequence Reversal........................................................... 135

Making Mass Advance Off-Cycle Payments................................................................ 137

Preselecting Employees Requiring Master Data Records ........................................ 138

Employee Selection for Fast Data Entry .................................................................. 139

Creating Master Data Records ............................................................................ 140

Mass Generation of Records for Advance Off-Cycle Payments (HRUU0267) .......... 141

Completeness Check (HUAC0267)............................................................................. 143

Deductions and Calculation of the Bank Transfer Amount .............................................. 144

Example: Deductions Processing ............................................................................... 145

Example: Deductions Processing ............................................................................... 146

Subsequent Activities..................................................................................................... 147

Preliminary Program DME .......................................................................................... 148

Repeating a Payment Run ...................................................................................... 152

Wage and Salary Payments ....................................................................................... 153

Tools for the Salary / Remuneration Statement ........................................................... 154

Payroll Account (Report RPCKTOx0; HxxCKTO0) ...................................................... 155

Payroll Journal (RPCLJNx0; HxxCLJN0) .................................................................... 156

Posting to Accounting (PY-XX-DT) ............................................................................. 157

Reporting ....................................................................................................................... 158

Wage Type Reporter .................................................................................................. 159

Evaluating the Payroll Results Using ITs or the Logical Database ............................... 160

Personnel Administration Reports............................................................................... 161

Personnel Order Management Forms ..................................................................... 162

Form P-1 (HUAAORDP1) .................................................................................... 164

Form P-3 (HUAAORDP3) .................................................................................... 165

Form P-4 (HUAAORDP4) .................................................................................... 166

Payroll Reports........................................................................................................... 167

HR Process Workbench ................................................................................................. 168

Interface Toolbox for Human Resources (PX-XX-TL) ..................................................... 169

Glossary ........................................................................................................................ 170

(C) SAP AG HELPX.PYUA 8

Payroll Ukraine (PY-UA)

You use this component to run payroll for employees in Ukraine. In addition to the

international processes that apply to all countries, this component covers the specific

functions related to Ukraine and its legal environment.

This documentation contains some references to Russia and to Payroll Russia (PY-RU).

Unless stated otherwise, the corresponding functions are relevant for Ukraine too.

Integration

Components in Human Capital Management

The Payroll Ukraine (PY-UA) component is integrated with the Personnel Management (PA)

and Personnel Time Management (PT) components.

Other SAP Components

The Payroll Ukraine (PY-UA) component is integrated with the Financial Accounting (FI) and

Controlling (CO) components, which enable you to pay your employees and evaluate payroll

results respectively.

Features

This component allows you to carry out the following functions:

Generate and evaluate an employee’s net pay

Calculate contributions and taxes

Process garnishments

Create remuneration statements

Create reports for the State Tax Administration of Ukraine

Create reports for the Ukrainian pension fund

Prepare data for the Ministry of Statistics of Ukraine

Constraints

Multiple payroll calculations based on the Reference Personnel Number Priority infotype

(0121) are not supported, because the shipment does not contain a schema to process the

calculations.

(C) SAP AG HELPX.PYUA 9

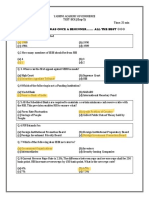

Document Change History

Versio

Date Comment

n

21/08/201 The document has been updated in accordance with the latest legal

2.0

2 requirements.

10/08/201

1.0 First version released.

1

(C) SAP AG HELPX.PYUA 10

Payroll in the SAP System

For general information, see SAP Help Portal at http://help.sap.com SAP Business Suite

SAP ERP SAP ERP Central Component SAP ERP Central Component SAP ERP

Central Component 6.0 SAP Library English SAP ERP Central Component Human

Resources Payroll (PY) Payroll Other Countries (PY-XX) Payroll in the SAP System .

(C) SAP AG HELPX.PYUA 11

Payroll Basics (PY-XX-BS)

For general information, see SAP Help Portal at http://help.sap.com SAP Business Suite

SAP ERP SAP ERP Central Component SAP ERP Central Component SAP ERP

Central Component 6.0 SAP Library English SAP ERP Central Component Human

Resources Payroll (PY) Payroll Other Countries (PY-XX) Payroll in the SAP System

Payroll Basics (PY-XX-BS) .

(C) SAP AG HELPX.PYUA 12

The Payroll Process

For general information, see SAP Help Portal at http://help.sap.com SAP Business Suite

SAP ERP SAP ERP Central Component SAP ERP Central Component SAP ERP

Central Component 6.0 SAP Library English SAP ERP Central Component Human

Resources Payroll (PY) Payroll Other Countries (PY-XX) Payroll in the SAP System

The Payroll Process .

(C) SAP AG HELPX.PYUA 13

Payroll in a Background Operation

For general information, see SAP Help Portal at http://help.sap.com SAP Business Suite

SAP ERP SAP ERP Central Component SAP ERP Central Component SAP ERP

Central Component 6.0 SAP Library English SAP ERP Central Component Human

Resources Payroll (PY) Payroll Other Countries (PY-XX) Payroll in the SAP System

Payroll in a Background Operation .

(C) SAP AG HELPX.PYUA 14

Infotypes for Personnel Administration and Payroll

This section contains international infotypes that apply to all country versions and country-

specific infotypes.

(C) SAP AG HELPX.PYUA 15

Infotypes of Personnel Administration and

International Payroll

For general information about the Personnel Administration infotypes and the Payroll

infotypes that are valid internationally, see SAP Help Portal at http://help.sap.com SAP

Business Suite SAP ERP SAP ERP Central Component SAP ERP Central Component

SAP ERP Central Component 6.0 SAP Library English SAP ERP Central Component

Human Resources Payroll (PY) Payroll Other Countries (PY-XX) Infotypes for

Personnel Administration and International Payroll Infotypes of Personnel Administration

and International Payroll .

(C) SAP AG HELPX.PYUA 16

Infotypes for Payroll Ukraine

This section contains documentation about infotypes that you need to meet business and

legal requirements in Ukraine.

(C) SAP AG HELPX.PYUA 17

Personnel Actions: Ukraine-Specific Features

A personnel action is a series of infotypes that are added, changed, completely or partially

deleted, or delimited in the Human Resources (HR) System for the reason specified, for

example, hiring, change of cost center, and leaving.

You use the following Ukraine-specific personnel actions to meet requirements for storing

employee data in Ukraine.

Since Ukrainian legislation stipulates that you store and print a special document to record

personnel actions, you must add the Personnel Orders (0298) infotype to all personnel

actions.

The following table shows Ukraine-specific personnel actions and the info groups that contain

the required infotypes for the personnel actions.

To enable the system to correctly process personnel actions for hiring, leaving, and

rehiring, you must specify the reason behind a particular personnel action type. You make

the setting in Customizing for Personnel Management under Personnel Administration

Personal Data Russia-Specific Settings Assign Action Types for Hiring and Leaving

.

Personnel

Personnel Info

Action Description

Action Group

Type

The international info group contains a user

Hiring 01 10

group for Ukraine-specific infotypes.

Organizational The international info group contains a user

02 82

Reassignment group for Ukraine-specific infotypes.

The international info group contains a user

group for Ukraine-specific infotypes.

To ensure that the leaving date is entered

correctly in the Time Quota Compensation

Leaving 10 84 (0416) infotype, you use a dynamic action to

create it from the Personnel Orders (0298)

infotype. For more information, see Personnel

Orders (Infotype 0298): Ukraine-Specific

Features [Page 26].

Shows an example of a personnel action that

Vacation contains the infotype for storing and printing

UV UV

registration personnel orders, the Personnel Orders

infotype (0298).

A dynamic action that contains the necessary

Recall from

UF - Ukraine-specific infotypes to store data when

vacation

you call back employees from vacation.

(C) SAP AG HELPX.PYUA 18

For a list of the infotypes that an info group contains, see Customizing for Personnel

Management Personnel Administration Customizing Procedures Actions Define

infogroups .

(C) SAP AG HELPX.PYUA 19

Documents and Certificates (Infotype 0290):

Ukraine-Specific Features

Contains data related to an employee's personal documents and certificates, such as his or

her passport.

You use this infotype to enter the data stored in each of the following documents, which are

represented as subtypes of this infotype:

Passport of Ukrainian citizens (subtype UAIC)

Taypayer’s identification card (subtype UAIN)

Social insurance certificate (subtype UASC)

If you need to store data for documents that are not listed above, you can create your

own subtypes to represent the additional document types. You create new subtypes in

Customizing for Personnel Management under Personnel Administration Personal

Data Russia-Specific Settings Documents and Certificates Define Document Types

The system uses the data that you enter in the Documents and Certificates (0290) infotype to

enter an employee’s data on official forms, for example, on form 1DF. To determine in which

order reports read the subtypes for an employee, you specify the priority of the subtypes for a

given report in Customizing. You make this setting in Customizing for Payroll Ukraine under

Reporting General Tools Determine Priorities of Documents for Reporting .

(C) SAP AG HELPX.PYUA 20

Tax and Social Insurance Payments (Infotype

0291): Ukraine-Specific Features

Contains data related to the tax and social insurance deductions for an employee.

If an employee is subject to taxes that are not part of the standard tax schema, you use this

infotype to determine which taxes the system deducts from an employee during the payroll

run. As part of this process, you can add taxes to the common tax schema or remove taxes

from the common tax schema.

You determine which tax types you can select in this infotype in Customizing for

Personnel Management under Personnel Administration Payroll Data Tax and

Social Insurance Payments (Russia) Define Subtypes for Tax and SI Payments

Infotype .

Integration

The data stored in the Residence Status (0048) infotype also influences the level and kind of

social insurance payments that you deduct for an employee.

(C) SAP AG HELPX.PYUA 21

Additional Social Insurance Data (Infotype 0292):

Ukraine-Specific Features

Contains data about the social insurance group and social insurance group modifier (see

Glossary [Page 170]). You can also view an employee’s seniority in this infotype.

The system uses the data stored in this infotype to calculate how much an employee is paid

when he or she is sick. The percentage of a month’s salary that an employee receives as sick

pay depends on the social insurance group, and if applicable, the social insurance group

modifier.

You determine which social groups and social insurance group modifiers you want to select in

this infotype in Customizing for Personnel Management under Personnel Administration

Personal Data Ukraine-Specific Settings Additional Social Insurance Data .

If you do not enter social insurance data in this infotype, the system uses an employee’s

seniority to determine the social insurance group and corresponding level of payment in

accordance with the sickness certificate.

Example

Your employee, Andriy Buday, has worked for seven years without interruption. Andriy

becomes sick and is unable to work for 10 days.

In the system, you assign Andriy to social insurance group >5<8 (between five and eight

years of uninterrupted work). For the period of sickness, you use absence type 0159. The

system calculates the amount of pay that Andriy receives during the period of sickness using

the employee’s average pay during the previous year. The social insurance group >5<8

determines that the payment is reduced to 80%.

If Andriy had been in continuous employment for more than eight years, that is, in social

insurance group >8, Vladimir would receive 100% of his regular pay during a period of

absence (absence type 0159).

(C) SAP AG HELPX.PYUA 22

Garnishment Orders (Infotype 0295): Ukraine-

Specific Features

A set of master data relating to a garnishment order, which is based on a garnishment

document.

You use garnishment orders to store the processing data for a garnishment request. For

example, you store the following data:

The initial balance of a claim

The details of periodic deductions

You make settings about the garnishment order types, such as alimony, and the

calculation rules that you want to use for garnishment orders in Customizing for

Personnel Management under Personnel Administration Personal Data Ukraine-

Specific Settings Garnishment Orders .

You can display details of garnishments that your employees have paid by using the

Garnishment History (HUACGARI) report. For more information, see the report documentation

in the system.

Integration

Before you create a garnishment order, you create a garnishment document. For more

information, see Garnishment Documents (Infotype 0296) [Page 24].

(C) SAP AG HELPX.PYUA 23

Garnishment Documents (Infotype 0296): Ukraine-

Specific Features

A set of master data relating to garnishment documents, for example, as follows:

General information, such as the status, important dates, priority, and category of

garnishment documents

Vendor information

Information about the originator of the garnishment document

Details about the garnishment release date

You use a garnishment document as the basis for a garnishment order. When you save a

garnishment document, the system opens the maintenance transaction for garnishment

orders.

If you have not already created the payees that are required for garnishments, you can create

payees directly from the maintenance screen for this infotype. As part of this process, you can

use payees that you create in Human Resources (HR) or payees that you create in Financial

Accounting (FI). You determine whether the system uses payees from HR or FI based on the

employee's organizational assignment and the settings in Customizing for Personnel

Management under Personnel Administration Personal Data Ukraine-Specific Settings

Garnishment Documents Payee Data Determine Default Payee Data .

You make settings related to the payee and other general settings for garnishment

documents in Customizing for Personnel Management under Personnel Administration

Personal Data Ukraine-Specific Settings Garnishment Documents .

Multiple Garnishment Documents

If the courts issue multiple garnishments related to the same executive document, for

example, the courts issue an additional garnishment as a penalty, you create more than one

record in this infotype. Since they are related to the same executive document from the

courts, the system links them together using the ExDoc.No. (Executive Document Number)

field.

The system processes payments for multiple garnishment documents based on the status

and priority of the garnishment documents, as specified by the courts. For more information,

see the following system documentation:

Processing of the Priorities and Deduction Group Tables (UAPRI) function

Summarize Deductions in Table AIT (UADL) personnel calculation rule

Process Garnishments According to Priorities (UADE) personnel calculation rule

Calculate Balance of Deductions (UADR) personnel calculation rule

You make settings to link together garnishment documents in Customizing for Personnel

Management under Personnel Administration Personal Data Ukraine-Specific

Settings Garnishment Documents Determine Special Parameters for Garnishments

.

(C) SAP AG HELPX.PYUA 24

Garnishment History

You can display details of garnishments that your employees have paid by using the

Garnishment History (HUACGARI) report. For more information, see the report documentation

in the system.

More Information

Garnishment Processing [Page 108]

(C) SAP AG HELPX.PYUA 25

Personnel Orders (Infotype 0298): Ukraine-Specific

Features

Contains data related to the documents you create when one of your employees is involved in

a personnel action.

Ukrainian legislation stipulates that when an employee is involved in a personnel action, you

must record this event in a document. For example, you create a personnel action when you

hire someone, when you fire an employee, or when you assign an employee to a different

organizational unit.

When you execute a personnel action, you store general data, such as the start date, action

type, and reason for a personnel action, in the Actions (0000) infotype. After you enter the

general data, you create a personnel order for each personnel action.

When you execute a personnel action, you store general data, such as the start date, action

type, and reason for a personnel action, in the Actions (0000) infotype. After you enter the

general data, you create a personnel order for each personnel action. The Personnel Orders

(0298) infotype allows you to record the number of the personnel order, when the employee

signs the personnel order, and if the employee’s manager has signed the personnel order.

Details About Personnel Actions

In addition to the reason for a particular personnel action that you enter in the Actions (0000)

infotype, the Personnel Orders (0298) infotype allows you to enter details for each reason

behind a personnel action.

You enter the possible details about reasons for personnel actions in Customizing for

Personnel Management under Personnel Administration Personal Data Russia-

Specific Settings Personnel Orders Specify Details About Reasons for Personnel

Actions . You select these reasons when you create a personnel order.

If necessary, you can enter more than one set of details about a given reason for a personnel

action.

You make the setting that allows you to enter multiple sets of details in Customizing for

Personnel Management under Personnel Administration Personal Data Russia-

Specific Settings Personnel Orders Set Parameters About Reasons for Personnel

Actions .

Numbering of Personnel Orders

If you want the system to assign a number to a personnel order automatically by using the

next available number in the designated number range, choose the AutoNumber pushbutton.

You set up this function in Customizing for Personnel Management under Personnel

Administration Personal Data Russia-Specific Settings Personnel Orders Determine

Defaults for Personnel Order Number Ranges and Determine Number Range Intervals for

Personnel Orders .

Printing of Personnel Orders

To meet legal requirements, you can print forms for both individual personnel orders and

group personnel orders. To print the forms, you can use the following options:

(C) SAP AG HELPX.PYUA 26

Use the print function in the maintenance transaction for the infotype

Use a dynamic action to print the forms automatically when you create a new record,

for example, in this infotype.

For more information about dynamic actions, see Customizing for Personnel

Management under Personnel Administration Customizing Procedures

Dynamic Actions .

Additional Documents

This infotype allows you to store information about various documents, which are represented

by the Personnel Order (Ukraine) (UAOR) subtype.

To store additional data about the subtypes in this infotype, you can create standard texts and

assign them to each subtype. You can include these texts in the output forms that you

generate on the basis of personnel orders. To assign standard texts to subtypes, in

Customizing for Payroll Russia under Reporting Personnel Administration Personnel

Order Management Assign Standard Texts to Infotypes .

Time Quota Compensation during Leaving Action

By default, during the leaving action, the system enters the day after leaving as default

starting date in all infotypes included in the action. To ensure that the starting date is entered

as the actual day of leaving in the Time Quota Compensation (0416) infotype, you use a

dynamic action to create the Time Quota Compensation (0416) infotype from the Personnel

Orders (0298) infotype. For more information, see SAP Note 1678669.

Integration

You use the data stored in this infotype in forms that you are obliged to keep for a given

period of time, as defined by Ukrainian legislation. For example, you store data about when

employees start work in form P-1.

For more information about the reports you can run to generate forms that contain data about

personnel orders, see Personnel Order Management Forms [Page 162].

More Information

Archiving of Personnel Orders [External]

(C) SAP AG HELPX.PYUA 27

Archiving of Personnel Orders

This function enables you to archive personnel orders in the system.

You archive personnel orders by selecting Archive as the storage mode in the print dialog box

when you print personnel orders.

For more information about printing personnel orders, see Printing of Personnel Orders in

Personnel Orders (Infotype 0298): Ukraine—Specific Features [Page 26].

After you archive a personnel order, the ArchDocument pushbutton appears on the

maintenance screen for the Personnel Orders infotype. You use this function to view or print

personnel orders that you have archived.

If you change personnel orders and want to retain copies of all versions, you can archive

each version of the personnel order. If you archive multiple versions of a personnel order,

when you choose ArchDocument, you can select the versions as follows:

Using a dialog box

To enable this option, you must enter parameter ID ARCHIVELINKHITLIST and

parameter value BDN in your user profile (see Maintaining User Defaults and

Options).

Directly in the Adobe-based form viewer

Prerequisites

You have made the following settings in Customizing for SAP NetWeaver under Application

Server Basis Services ArchiveLink Basic Customizing :

1. You have checked the settings for the content repository that you want to use to

archive personnel orders in the Customizing activity Define Content Repositories.

2. You have created an active link to the content repository in which you want to archive

personnel orders.

To do this, in the Customizing activity Edit Links, enter the following data and specify

the required content repository:

Object Type Document Type Status of Link Entry Relationship

PREL HRORUORDER X TOAHR

To archive multiple versions of a personnel order, you must have selected Archive Versions

for the corresponding print output program. You make this setting in Customizing for Payroll

Ukraine under Reporting Personnel Administration Personnel Order Management

Determine Print Output Programs for Personnel Orders .

(C) SAP AG HELPX.PYUA 28

Tax Privileges (Infotype 0299): Ukraine-Specific

Features

Contains data about the personal income tax privileges to which employees are entitled.

You use the data stored in this infotype to determine the personal privilege that an employee

receives and the tax class to which the privilege applies.

The tax classes to which privileges apply are stored as subtypes in this infotype. You

determine which tax classes you want to be available in this infotype in Customizing for

Personnel Management under Personnel Administration Payroll Data Tax and Social

Insurance Payments (Russia) Define Subtypes for Tax Privileges Infotype .

You use this infotype to store data related only to personal tax privileges, for example, the

tax privilege to which employees are entitled when they have children. These tax

privileges require confirmation from the relevant authorities, which the employee must

give to the employer. You can only use tax privileges for which the Personal Priv.

(Personal Privilege) checkbox is selected in Customizing for Payroll Russia under Tax

and Social Insurance Payments Maintain Tax Privileges .

(C) SAP AG HELPX.PYUA 29

Absences (Infotype 2001): Ukraine-Specific

Features

Contains data about paid and unpaid absences that your employees take.

The international infotype has been enhanced to enable you to meet legal requirements in

Ukraine. For more information about the international infotype, see SAP Library for ERP

Central Component on SAP Help Portal at http://help.sap.com SAP ERP Central

Component SAP ERP Central Component Human Resources Personnel Time

Management (PT) Time Data Recording and Administration Time Management Infotypes

Time Recording Absences Infotype (2001) .

The sections below describe the functions that are specific to Ukraine.

Linking Absences

To meet legal requirements in Ukraine, the infotype enables you to link previous absences

with a current absence.

To use this function, make the settings in Customizing for Payroll Ukraine under

Absences Absence Link .

The table below describes the scenarios in which you can link absences:

Requirement Entry in Absence Link Group Box

For some absence types, Ukrainian legislation

stipulates that you must use the same rate for

absences that lie in different payroll periods. To In the Abs. Link – Average

use the same rate, you link together two

(Absence Link for Average) field,

absences, which means that the rate from a select the start date of the previous

previous absence applies to the current absence. absence.

For more information, see Absence Processing

[Page 76].

In the Subs. Sickness (Subsequent

Sickness) field, select the absence

record with which you want to link

According to Ukrainian legislation, you must the current absence record.

process some adjacent periods of sickness as if

they were one continuous period of sickness.

For example, you link together periods of When you select a record in the

sickness if they are related and you must process Subs. Sickness field, the

them as one for the purposes of continued sick system enters the start date of

pay or sick pay supplements. the corresponding absence

record in the Abs. Link –

Average (Absence Link for

Average) field automatically..

In some legally defined scenarios, you have to In the Ev. Date – Avg. (Evaluation

calculate an employee’s average pay in a certain Date for Average Calculation) field,

period in the past. enter the date that falls after the end

of the legally defined period in

(C) SAP AG HELPX.PYUA 30

Requirement Entry in Absence Link Group Box

which the system calculates an

For example, according to Ukrainian legislation,

when an employee is absent immediately before employee’s average pay.

the current absence, you must not calculate the

employee’s average pay in the legally defined

period immediately before the current absence.

Instead, you must calculate the average pay in

the legally defined period before the absence that

precedes the current absence.

Processing Absences to Care for Family Members

To meet legal requirements in Ukraine, you record periods of absence when your employees

take leave to care for members of their family who are sick. The subtype that you select for an

absence determines whether you can enter the family member that your employees take

leave to care for. For example, assume that one of your employees has to stay home to care

for his or her sick child. You process the absence in the system by recording the data on the

sickness certificate that your employees submit to you in the Additional Information group box

in the Absences (2001) infotype.

Integration

To record the family members that your employees take leave to care for, you can only select

family members who you store in the employee's master data in the Family

Member/Dependents (0021) infotype. For more information, see SAP Library for ERP Central

Component on SAP Help Portal at http://help.sap.com SAP ERP Central Component

SAP ERP Central Component Human Resources Payroll Payroll Russia Infotypes

for Russian Payroll Family Members/Dependents (Infotype 0021): Russia-Specific Features

.

To determine which subtypes you can use to store absences for employees who take leave to

care for sick family members, you use the Screen (2033) Control for Infotype 2001 - Russia

(33ABS) feature. For more information, see the online documentation for the Screen (2033)

Control for Infotype 2001 - Russia (33ABS) feature.

Note that these Russia-specific features are relevant for Ukraine as well.

More Information

Absence Processing [Page 76]

SAP Library for ERP Central Component on SAP Help Portal at http://help.sap.com

SAP ERP Central Component SAP ERP Central Component Human

Resources Personnel Time Management (PT) Time Data Recording and

Administration Time Management Infotypes Time Recording Absences Infotype

(2001)

(C) SAP AG HELPX.PYUA 31

Legal Properties (Infotype 1656)

This organizational management infotype contains organizational data that is specific to the

legal entities of companies registered in Ukraine.

You use this infotype to store information about a company's legal entities that are relevant

for legal reporting. This information is necessary for submitting legal forms in one or more of

the following reporting areas:

Income tax

Pension fund

Social insurance

Statistics Committee

The system uses information that is stored in this infotype to group personnel assignments for

different payroll and reporting purposes. This information includes a unique four-character

identifier for the legal entity. The system uses this identifier as a grouping value for grouping

the personnel assignments.

You enter organizational information for legal entities as follows:

Information Specific to Legal Entity Reporting

General Data

Contact Data

Information Specific to Income Tax, Pension Fund, Social Insurance, and Statistical

Reporting

Information Specific to Legal Entity Reporting

Legal entities are responsible for submitting legal reports to the authorities. The types of

reports that a legal entity submits to the authorities depend on the type of the legal entity. You

specify the reporting responsibilities of your legal entity as one of the following:

Head unit

Head units are responsible for submitting legal forms to the authorities in all of the

reporting areas specified above. Therefore, if you have specified that your legal entity

is a head unit, the system selects all reporting areas, and you cannot change this

setting.

Detached subdivision

You must also specify for which reporting areas the subdivision is responsible. You

can select the corresponding checkboxes to specify one or more of the following

areas:

o Income tax

o Pension fund

o Social insurance

o Statistics Committee

(C) SAP AG HELPX.PYUA 32

General Data

You enter the official data that is relevant for all the legal reporting types for which this legal

entity is responsible. This data is printed on all legal forms that the legal entity submits to the

authorities. You also specify the tax authority to which the legal entity submits its tax reports.

Contact Data

You enter the company's contact details such as address, telephone number, fax number,

and e-mail address. You also enter the communication details of the contact persons for the

legal entity.

Information Specific to Income Tax, Pension Fund, Social Insurance,

and Statistical Reporting

You enter official information that is specific to these reporting areas. You also specify the

communication details for the contact persons who are responsible for the corresponding

reporting area.

If the legal entity is a detached subdivision, you can enter official data and contact

information just for the reporting areas that you have specified for this legal entity.

(C) SAP AG HELPX.PYUA 33

Relationship of Legal Entities in Organizational

Management

To fulfill requirements for legal reporting and payroll calculation in Ukraine, you must

represent your company structure from both an internal, organizational perspective and a

legal perspective. To reflect both perspectives, you must represent your company as a matrix

organization. Matrix organizations have two dimensional structures: the vertical dimension

represents the internal, organizational perspective, whilst the horizontal dimension represents

the legal perspective. The horizontal dimension comprises legally autonomous units called

legal entities. For information about the international payroll tables, see SAP Help Portal at

http://help.sap.com SAP ERP SAP ERP Central Component Human Resources

Personnel Management (PA) Organizational Management Organizational Plan Mode

Matrix Organization .

To set up the matrix organizational structure as described, you use standard objects and

relationships in Organizational Management together with the Legal Properties (1656)

infotype.

In Ukraine, the relationship of legal entities in a company determines the following:

The reporting areas for which the legal entity submits legal reports

The organizational units for which the legal entity submits its reports

The grouping of personnel assignments for payroll and reporting purposes

Legal entities are responsible for submitting legal reports in one or more of the following

reporting areas:

Income tax

Pension fund

Social insurance

Statistic Committee

The reporting areas for which legal entities are responsible are determined by the type of

legal entity. The types of legal entities are as follows:

Head unit of organization

A company can have only one head unit. Head units are responsible for submitting

legal reports in all the reporting areas listed above. Head units submit legal reports for

the head unit as well as for the whole company (including detached subdivisions).

Detached subdivision

A company can have one or more detached subdivisions. Detached subdivisions,

however, cannot have any subordinate detached subdivisions. Detached subdivisions

are responsible for submitting legal reports in one or more of the reporting areas

listed above. Detached subdivisions submit reports only in the reporting areas

specified for them in the Legal Properties (1656) infotype.

Note that head units retain responsibility for submitting reports for the whole company

(including detached subdivisions).

(C) SAP AG HELPX.PYUA 34

More Information

Example: Structures of Company [Page 36]

(C) SAP AG HELPX.PYUA 35

Example: Structures of Company

To fulfill requirements for legal reporting and payroll calculation in Ukraine, you are required to

represent your company structure from both an internal, organizational perspective and a

legal perspective. To reflect both perspectives, you define your company as a matrix

organization using standard objects and relationships in Organizational Management together

with the Legal Properties (1656) infotype. The following examples illustrate typical company

structures from both the legal and the internal, organizational perspectives.

Company Without Detached Subdivisions

The figure below illustrates the legal and organizational aspects of a Ukrainian company

without detached subdivisions and is followed by an explanation:

Legal Structure Organizational Structure

Company A Company A

(OR 33000001) (O 3301)

Production Sales

Department Department

(O 3302) (O 3303)

Relationship type B, Legend for Object Types

relationship 401 in Org.

O = Organizational unit

Management

OR = Legal entity

Company Without Detached Subdivisions

Company A has two organizational subunits; a production department and a sales

department. From an internal, organizational perspective, Company A is represented by the

Company A (O 3301) organizational unit; both the Production Department (O 3302) and the

Sales Department (O 3303) organizational subunits report to this organizational unit.

However, from a legal perspective, Company A and all its organizational units (the Company

A (O 3301) head unit, and both its production and sales departments) are represented by the

Company A (OR 33000001) legal entity.

Company With Detached Subdivisions

The figure below illustrates the legal and organizational aspects of a Ukraine company with

detached subdivisions and is followed by an explanation:

(C) SAP AG HELPX.PYUA 36

Organizational Structure

Company A

(O 50000200)

Production Sales

Headquarters

Department Department

(O 50000201)

(O 50000202) (O 50000203)

Lvov

Donetsk (O 50000207)

(O 50000206)

Donetsk Lvov

Kiev

(O 50000204) (O 50000205)

(O 50000208)

Legal Structure

Company A Relationship type B,

(OR 33000001) relationship 401 in Org.

Management

Det. Subdivision Det. Subdivision

Donetsk Lvov

(OR 33000002) (OR 33000003)

(Legal entity for income tax

and pension fund reporting)

k

(Legal entity for income tax

reporting)

Legend for Object Types

O = Organizational unit

OR = Legal entity

Company With Detached Subdivisions

Company A has a number of organizational units. For example, from an internal,

organizational perspective, the sales department has subunits in Donetsk (O 50000206), Kiev

(O 50000208) and Lvov (O 50000207). Similarly, the production department has subunits in

Donetsk (O 50000204) and Lvov (O 50000205).

Note that the same relationships exist between the Donetsk detached subdivision (OR

33000002) and its sales and production department subunits (OR 33000004 and OR

33000004) respectively as those between the Lvov subdivision and its sales and production

department subunits.

From a legal perspective, the Company A (OR 33000001) legal entity has two detached

subdivisions; one in Lvov (OR 33000003) and one in Donetsk (OR 33000002). These legal

entities are responsible for submitting statutory reports to the authorities.

For tax reporting purposes, for example, this means that the Lvov subdivision submits income

tax reports to the local tax office for employees who have personnel assignments in the sales

and production department subunits in Lvov.

Note that depending on the setup of your organization, an organizational unit can report to

different companies; one for the internal, organizational perspective and the other for the legal

perspective.

(C) SAP AG HELPX.PYUA 37

Payroll Basics for Payroll Ukraine

To run payroll correctly for employees in Ukraine, the system uses extensions to international

payroll functions and concepts that are specific to Payroll Ukraine.

The functions and concepts are as follows:

Internal Tables for Payroll Ukraine [Page 39]

Main Customizing Settings for Payroll Ukraine [Page 40]

Employee Status [Page 41]

Determination of Payroll Data After Rehiring Process [Page 51]

Future Period Processing [Page 53]

(C) SAP AG HELPX.PYUA 38

Internal Tables for Payroll Ukraine

The Ukraine-specific payroll cluster, UA, contains the international payroll structure and the

following tables that are specific to Ukraine:

Technical Name of

Contents

Table

UAAV Cumulation of average amounts

FUP Data for processing future periods

Ukrainian salary indexation details according to the consumer price

UAIND

index (see Glossary [Page 170])

UAILL Data to calculate sick pay based on sickness certificates

UAGRP Data about employee groupings based on organizational assignment

and data about employee statuses

TAX Ukrainian tax calculation details

For information about the international payroll tables, see SAP Help Portal at

http://help.sap.com SAP ERP SAP ERP Central Component Human Resources

Payroll (PY) Payroll Other Countries (PY-XX) Payroll in the SAP System Payroll

Basics (PY-XX-BS) Internal Tables for Payroll .

(C) SAP AG HELPX.PYUA 39

Main Customizing Settings for Payroll Ukraine

To be able to run payroll correctly for employees in Ukraine, you make settings in

Customizing for Payroll Ukraine under Basic Settings Basic Settings – Ukraine . The

Customizing settings comprise the following fundamental parts of Payroll Ukraine:

Technical switches

o You configure the payroll functions and operations that are required for

Ukraine.

o You specify additional parameters, for example, the payroll schema ID,

seniority processes for defining an employee’s default social group, and

vacation selection processes for processing off-cycle payroll runs.

Legally defined settings

o You enter amounts that are defined by law, for example, the living wage and

minimum wage, and the validity periods of these amounts.

o You determine how the system classifies employees when you hire them,

when you terminate their employment contracts, and when you rehire

employees.

o You enter the details of global salary increases, which apply to all employees

in your company.

(C) SAP AG HELPX.PYUA 40

Employee Status

The definition of an employee based on criteria that affect the way in which the system

evaluates payroll data for employees.

An employee’s status is determined by the contents of the following infotypes:

An employee’s assignment to a legal entity in the Legal Properties (1656) infotype

An employee’s challenge group in the Challenge (0004) infotype

An employee’s contract type in the Contract Elements (0016) infotype

The system uses the employee’s status to evaluate payroll data in line with legal

requirements and to determine which tax schema (see Glossary [Page 170]) the system

uses for an employee.

More Information

Determination of Employee Status [Page 42]

Grouping of Personnel Assignments in Ukraine [Page 46]

Evaluation of Payroll Data Using Employee Statuses [Page 49]

(C) SAP AG HELPX.PYUA 41

Determination of Employee Status

The system determines an employee’s status based on an employee's attributes in the

following infotypes:

The Legal Properties (1656) infotype

The Challenge (0004) infotype

The Contract Elements (0016) infotype

For more information about an employee’s status, see Employee Status [Page 41].

Prerequisites

You have portrayed your organizational structure in the system and created the required

relationships between the organizational units. For more information, see SAP Help Portal at

http://help.sap.com SAP ERP SAP ERP Central Component Human Resources

Personnel Management (PA) Organizational Management Organizational Plan Mode

Organizational Management .

For each head unit and detached subdivision in your company, you have created a record in

the Legal Properties (1656) infotype. For more information, see Legal Properties (Infotype

1656) [Page 32].

Features

Data Stored in Legal Properties (1656) Infotype

To determine the attributes of an employee’s status that are based on his or her

organizational assignment, the system uses the legal entity to which an employee is assigned

in the Legal Properties (1656) infotype. In the Legal Properties (1656) infotype, the system

uses grouping reasons to assign a grouping value to each category of data, for example,

social insurance contributions, for which a legal entity is responsible. Depending on an

employee’s organizational assignment, his or her status comprises one or more grouping

values at any given point in time.

Assume that the head unit in your organization is responsible for filing all legal reports

with the authorities, whereas one of the detached subdivisions is responsible for filing

income tax reports only. If an employee is assigned to the detached subdivision, his or

her employee status comprises two different grouping values: one grouping value for

income tax reporting (for the detached subdivision) and a different grouping value (for the

head unit) for all other reporting purposes.

The system uses the following grouping reasons to assign grouping values in the Legal

Properties (1656) infotype:

Category of Data Grouping Reason

Assignment to head unit in organization UAER

Pension fund contributions UAPF

(C) SAP AG HELPX.PYUA 42

Category of Data Grouping Reason

Social insurance contributions UASI

Income tax deductions UATX

Reporting to State Statistics Committee of Ukraine (see Glossary

UACS

[Page 170])

For more information about how the system groups personnel assignments, see

Grouping of Personnel Assignments in Ukraine [Page 46].

Data Stored in Challenge and Contract Elements Infotypes

To determine an employee's attributes based on the data stored in the Challenge (0004) and

Contract Elements (0016) infotypes, the system reads an employee’s challenge group and

contract type that are valid at a given point in time.

Further Processing

To use an employee’s status for further processing in payroll, the system stores the grouping

values for the legal entity to which an employee is assigned in the Legal Properties (1656)

infotype as well as the challenge group and contract type in a special payroll table. For more

information about how the system processes employee statuses, see Evaluation of Payroll

Data Using Employee Statuses [Page 49].

More Information

Legal Properties (Infotype 1656) [Page 32]

Example: Recording Employee Status Changes [Page 44]

(C) SAP AG HELPX.PYUA 43

Example: Recording Employee Status Changes

The following sample scenarios show how the system records changes to an employee’s

status.

Change in Challenge Status

Assume that one of your employees, Olena Petrova, is injured in an accident and is

registered disabled starting on March 20. You record the employee’s challenge status in the

Challenge (0004) infotype.

After you update Olena’s master data in the system, the system records Olena’s new

challenge status starting on March 20 in the Ukraine-specific payroll table, UAGRP, as follows:

Social

Head Pensio Incom Statisti

Star Insuran

Unit n Fund e Tax cs Contr Challen

t End ce

Groupi Groupi Groupi Groupi act ge

Dat Date Groupi

ng ng ng ng Type Group

e ng

Value Value Value Value

Value

Mar

ch March

1, 19, 0001 0001 0001 0001 0001 01 –

201 2010

0

Mar

ch Decem

20, ber 31, 0001 0001 0001 0001 0001 01 01

201 9999

0

Change in Organizational Assignment

Assume that one of your employees, Anton Ivanchuk, works as an HR clerk in your

company’s head office in Kiev. To cover for a colleague who is on maternity leave, you

transfer Anton to your detached subdivision in Lviv on April 5. Two weeks later, a new

position for an HR specialist in Lviv opens up, and Anton gets the job. He starts his new job

on April 19.

You update Anton’s organizational assignment in the Organizational Assignment (0001)

infotype. Since the Lviv office is responsible for filing its own income tax and social insurance

reports with the local authorities, Oleg’s new organizational assignment corresponds to

different records for income tax and social insurance data in the Legal Properties (1656)

infotype. The system assigns grouping value 0002 to the detached subdivision for income tax

and social insurance data.

Furthermore, Anton’s new job as an HR specialist requires a new type of employment

contract, which you enter in the Contract Elements (0016) infotype.

After you update Anton’s master data in the system, the system records Anton’s status

changes in the Ukraine-specific payroll table, UAGRP, as follows:

(C) SAP AG HELPX.PYUA 44

Social

Head Pensio Incom Statisti

Insura

Unit n Fund e Tax cs Contr Challe

Start End nce

Groupi Groupi Groupi Groupi act nge

Date Date Groupi

ng ng ng ng Type Group

ng

Value Value Value Value

Value

Janu

April 4,

ary 1, 0001 0001 0001 0001 0001 01 –

2010

2010

April April

5, 18, 0001 0001 0002 0002 0001 01 –

2010 2010

April Decem

19, ber 31, 0001 0001 0002 0002 0002 02 –

2010 9999

(C) SAP AG HELPX.PYUA 45

Grouping of Personnel Assignments in Ukraine

The system groups personnel assignments for different payroll and reporting purposes in

Ukraine using the following grouping features:

Grouping reason

Grouping reasons represent the business purpose for which personnel assignments

are grouped. They determine how the personnel assignments and the corresponding

data are processed. Each type of processing corresponds to a grouping reason as

described in the table below.

Grouping value

Grouping values are used to group personnel assignments. Each personnel

assignment is assigned a grouping value for each grouping reason. The system

groups personnel assignments that have the same grouping value for a specific

payroll or reporting purpose.

In Ukraine, grouping values are unique four-character identifiers. The system

attaches these identifiers to legal entities, such as company head units or detached

subdivisions, for a specific validity period. The system generates grouping values

when you create a record of the Legal Properties (1656) infotype for the legal entity,

and stores them in the infotype.

The following table lists the grouping reasons:

Descriptive Name

Grouping

of Grouping Type of Processing/Use

Reason

Reason

Payroll processing and the Sickness Certificate

Printing (HUAASIL0) report, used for processing

UAER Employer

assignments of head units and those of their detached

subdivisions together.

Legal Entity for

Payroll processing and the Form 1DF (HUAL1DF0)

UATX Income Tax

legal form for income tax reporting.

Reporting

Legal Entity for Payroll processing and the Pension Fund Declaration

UAPF Pension Fund

(HUALPFD0) report.

Reporting

Legal Entity for

UASI Social Insurance Payroll processing

Reporting

Legal Entity for

UACS Statistic Committee Payroll processing

Reporting

Features

Assignment of Grouping Values to Personnel Assignments

To group an employee's personnel assignments for any type of processing, the system

assigns grouping values to the personnel assignments according to the following:

(C) SAP AG HELPX.PYUA 46

The grouping reason for the type of processing in question

The legal perspective of the company structure

The system assigns a grouping value to a personnel assignment as follows:

1. For each personnel assignment that matches the selection criteria for the type of

processing that you use, the system determines to which organizational unit (object

type O in Organizational Management) it is assigned.

2. Starting from the organizational unit to which the personnel assignment is assigned,

the system finds the nearest legal entity in the organizational hierarchy (relationships

of type 002). For information about the international payroll tables, see SAP Help

Portal at http://help.sap.com SAP ERP SAP ERP Central Component Human

Resources Personnel Management (PA) Organizational Management Expert

Mode Organizational Management Organizational Plan Relationships (Infotype

1001) .

3. The system checks if the type of processing for which the system is grouping the

assignments is specified for this legal entity in the Legal Properties (1656) infotype.

For example, if the system groups assignments for an income tax report, it checks if

income tax is specified for this legal entity as a reporting area.

o If the system finds a match, it reads the grouping value of this legal entity

from the Legal Properties (1656) infotype, and assigns the value to the

personnel assignment.

o If the system does not find a match, it retrieves the company head unit using

the hierarchy of legal entities (relationships of type 400). Since company

head units are subject to all types of processing, the system finds a match

here. Therefore, the system assigns its grouping value to the personnel

assignment.

The system assigns grouping values based on their validity periods. The validity periods

of the values are the same as the validity periods of the records in the Legal Properties

(1656) infotype in which the grouping values are stored. Therefore, the system may

assign a grouping value or a set of grouping values with the corresponding validity

periods to a personnel assignment.

Use of Grouping Values for Payroll and Reporting

Grouping values are used to group personnel assignments for the following purposes:

Payroll

Reporting

Certain payroll and pension fund reports use these values to group personnel

assignments by legal entity as follows:

o Head unit (see Glossary [Page 170])

o Detached subdivision (see Glossary [Page 170])

o Head unit and all detached subdivisions (for the whole company)

(C) SAP AG HELPX.PYUA 47

Example

You run an income tax report for your company. Your company has a head unit (with

grouping value 0001) and two subdivisions, one of which is responsible for tax reporting.

The grouping process for this report is as follows:

The system uses the grouping reason UATX to group personnel assignments for tax

reporting purposes.

In the selection screen for the income tax report, you enter grouping value 0001 for

the head unit of the company. Note, the system allows you to enter only a grouping

value that corresponds to the grouping reason for tax reporting.

You also specify that you want to run the report for all employees of the head unit and

all its detached subdivisions. Since the company has a detached subdivision that is

responsible for tax reporting, the system uses its grouping value (0002) for grouping

in addition to that of the head unit.

For personnel assignment 1001, the nearest legal entity is a detached subdivision,

and its grouping value is 0002. This subdivision is responsible for submitting income

tax reports to the authorities, so the system assigns this grouping value to the

personnel assignment.

For personnel assignment 1002, the nearest legal entity is the head unit. Since the

head unit is also responsible for tax reporting, the system assigns this grouping value

to the personnel assignment.

Since the grouping values attached to the personnel assignments match the values that the

system uses for grouping, the system groups both personnel assignments for this tax report.

More Information

Legal Properties (Infotype 1656) [Page 32]

Relationship of Legal Entities in Organizational Management [Page 34]

(C) SAP AG HELPX.PYUA 48

Evaluation of Payroll Data Using Employee

Statuses

To meet legal reporting requirements in Ukraine, you must show the payroll data that applies

to an employee when he or she has a particular status. If an employee’s status changes in

the reporting period, Ukrainian legislation requires you to show the amounts and the rates of

income tax and social insurance contributions that apply at a given point in time.

The system also uses an employee’s status when it determines which rates for income

tax deductions and social insurance contributions apply to an employee. The system uses

the employee’s status to select the tax schema (see Glossary [Page 170]) that

comprises the required tax classes for an employee’s status.

Prerequisites

You have made the settings described in Determination of Employee Status [Page 42].

You have determined the work place/basic pay (WPBP) splits that you want to use in

Customizing for Payroll Ukraine under Basic Settings Basic Settings – Ukraine Set Up

WPBP Split and Create Starting Points .

Features

The system uses the validity period of an employee’s status to split the payroll results

according to the period of time when an employee’s status applies. To store an employee’s

payroll-related data based on an employee’s status, the system uses functions described

below.