Académique Documents

Professionnel Documents

Culture Documents

Financial Inclusion: Specifics From India

Transféré par

MohitAhujaDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Financial Inclusion: Specifics From India

Transféré par

MohitAhujaDroits d'auteur :

Formats disponibles

Research Paper Management Volume : 4 | Issue : 10 | October 2014 | ISSN - 2249-555X

Financial Inclusion: Specifics From India

Keywords Financial inclusion, Banks, Financial services, Inclusive growth.

Mohit Kumar Dr. Kushendra Mishra

Research scholar, Department of Rural Management, Head, Associate Professor,Department of Rural

School of Management Studies, Babasaheb Bhimrao Management, School of Management Studies,

Ambedkar University, Lucknow (A central University), Babasaheb Bhimrao Ambedkar University, Lucknow (A

Lucknow. central University), Lucknow.

ABSTRACT Financial inclusion has been instrumental in shaping up major policy decisions directed towards achieve-

ment of an all-inclusive society. It holds major cards for speeding up the engines of development of the

nation. Financial inclusion is a process which tries to secure the availability of financial products and services for the

weaker sections at a reasonable price in an unbiased manner by organized financial institutions. The basic idea is to

expand the reach of financial services to the large needysections of the society and achieve broad based improve-

ment in the living standards of all people. It intends to connect people to banks with consequential benefits. Ensur-

ing that the banks play their due role in promoting inclusive growth is a hard but a decisive task in the emerging

economy. The banking industry is making rapid strides with Information technology driven initiatives and has led to

expansion of financial services giving birth to the concept of Financial Inclusion. The paper is divided into three sec-

tions. The first section analyses the measures taken by the banks for financial inclusion. The second section gauges

the extent of financial inclusion. The paper highlights the problems encountered by banks in financial inclusion such as

high cost, more time consumption, heavy work load and improper repayment and suggests that banks should enhance

their reach by products like no frills account, awareness programs and similar campaigns.

Introduction Report of the Committee on Financial Inclusion in India

The concept of Financial Inclusion has gained a lot of (Chairperson C.Rangarajan) (2008) defines Financial Inclu-

momentum recently. More than half of the world’s popu- sion as “the process of ensuring access to financial ser-

lation lives on marginal lines of poverty and it becomes vices and timely and adequate credit where needed by

imperative their interests are protected and served in the vulnerable groups such as weaker sections and low income

best possible manner. There has been an ever increasing groups at an affordable cost.” RBI defines Financial Inclu-

realization of the fact that India still resides in rural areas sion as “a process of ensuring access to appropriate finan-

and development of India is not possible if the rural areas cial products and services needed by all sections of the

remain isolated. The paucity of appropriate and accessible society in general and vulnerable groups such as weaker

financial services at an affordable cost has always been a sections and low income groups in particular, at an afford-

hurdle in the road to economic growth. A significant pro- able cost in a fair and transparent manner by regulated

portion of rural population in Indiais still financially exclud- mainstream institutional players”. Hence the sole aim of

ed and RBI has reported that the financial exclusion in In- financial inclusion is to bring common man under one um-

dia leads to the loss of GDP to the extent of one per cent brella of financial services.

(RBI, Working Paper Series (DEPR): 8/2011). Most people

still depend upon unorganized financial system for meet- Measures taken

ing their daily needs and remain isolated from the benefits Simplified Branch Opening- Last few years have also seen

of subsidized inclusive policies. Hence, financial inclusion is a gradual relaxation form the side of RBI with respect to

an imperative especially for a country like India which suf- the guidelines and stipulations while opening a bank

fers from problems like poverty, social inequity and skewed branch. Banks now have the freedom to open a branch

income distribution. without much hassle in most cases especially in rural, semi

urban and north eastern states provided they also report

The idea behind financial inclusion is to extend financial the same. At the same time banks can open a branch in

services to the large non catered population of the coun- centers having population less than 50000 with much rela-

try to trigger its growth process. In addition, it strives to tive ease.

achieve broader and speedier inclusive growth by making

finance available to the rural poor in particular. Keeping ru- Simplification of Account Opening Form - The account

ral poor as a basic target group, the Government of India opening form has been made a simpler one doing away

has initiated a number of drives to ensure that the bene- with a lot of technicalities. This has been done to ensure

fits can reach far and wide in every nook and corner. The that it can be filled up by the common man who isn’t so

concept of Financial Inclusion has always been there in the educated with the terminology. Furthermore a system has

yearly plans and policies of the government of India but been made in place for a person to open an account on-

certainly it has gained a lot of light in recent years more line doing away with the need to visit a bank branch.

particularly due to the fact a lot of policies will be better

executed if the rural people are financially included. Lack Opening of Small Accounts or No-frills Accounts - One

of appropriate services and that too at affordable prices of the biggest hurdles in opening of the bank account is

are major challenges in the case of India with respect to its the minimum balance requirement as stated by most of

financial inclusion. the banks. Usually this amount is very high and a failure

INDIAN JOURNAL OF APPLIED RESEARCH X 349

Research Paper Volume : 4 | Issue : 10 | October 2014 | ISSN - 2249-555X

to keep up with the requirements draws heavy penalties. Number Num- Number Num- Bank

Considering the hard earned money of the rural people, it of Bank ber of of Bank ber of De- Bank

Branch- ATMs Branch- ATMs posits Credit

makes the rural people reluctantto open up the account. es es

This is because the minimum balance kept in the banks Country

usually goes wasted and unused from the perspective of

a rural man. Understanding this situation, RBI has asked all 1 India 30.43 25.43 10.64 8.9 68.43 51.75

banks to provide a no frills account whereby an account 2 China 1428.98 2975.05 23.81 49.56 433.96 287.89

could be opened without any minimum balance require- 3 Brazil 7.93 20.55 46.15 119.63 53.26 40.28

ment. The transaction charges are reasonable and small Indone-

overdrafts are also allowed. 4 8.23 15.91 8.52 16.47 43.36 34.25

sia

5 Korea 79.07 ... 18.8 ... 80.82 90.65

Financial Awareness Programs – A lot of programs have 6 Mauri- 104.93 210.84 21.29 42.78 170.7 77.82

been started by most banks and government to educate tius

the masses regarding the basics of money and bank ac- 7 Mexico 6.15 18.94 14.86 45.77 22.65 18.81

counts. These programs aim at inculcating basic financial Philip-

8 16.29 35.75 8.07 17.7 41.93 21.39

pines

knowledge with respect to newer facilities and services be-

ing provided by the banks and government of India. It is South

9 3.08 17.26 10.71 60.01 45.86 74.45

Africa

noteworthy that such programs are run not only to provide

education to the prospective clientele on the demand side 10 Sri 41.81 35.72 16.73 14.29 45.72 42.64

Lanka

but also on the supply side whereby the banks carry out

11 Thailand 12.14 83.8 11.29 77.95 78.79 95.37

special classroom classes to train their employees as to

12 Malaysia 6.32 33.98 10.49 56.43 130.82 104.23

how to approach differentiated banking services.

13 UK 52.87 260.97 24.87 122.77 406.54 445.86

Business Correspondents (BCs) and Business Facilitators 14 USA 9.58 ... 35.43 ... 57.78 46.83

(BFs) Model- Banks were asked to expand their reach via Switzer-

15 84.53 166.48 50.97 100.39 151.82 173.26

business facilitators or correspondents. Lead banks were land

also selected to coordinate with the state administration 16 France 40.22 106.22 41.58 109.8 34.77 42.85

for ensuring the successful rollout of benefits. Also, the

banks placed the opening of branches in rural areas as Source: World Bank, Financial Access Survey, 2010

their priority in next set of financial inclusion plan.

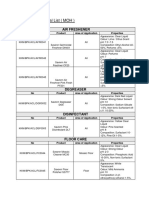

Current Status of Banking at All India Level

Branch Expansion/Coverage of villages- The RBI has pro- The following table shows that there has been a marked

vided with a blueprint as to how to achieve the inclusive growth in expansion of commercial banks and this has fa-

growth. The motto is to provide banking services in every cilitated better reach and better service. The number of

village with a population above 2,000. Villages, with popu- customers per banking branch has reduced and this has

lation above 2,000 being unbanked, are being meted out reduced the workload on the part of the banks. Further,

with various banking services. Now, the focus has been the customers are given proper attention and time while

shifted to villages having population less than 2000 and getting their queries serviced. Also, the customers don’t

which are still unbanked. need to travel a lot for reaching their banks and this has

provided more ease and comfort to the people.

Extent of Financial Inclusion

The measures taken by India in case of pursuit of financial

inclusion have been drastic and they certainly have proved Table: 2 - Geographical Outreach

to be effective. The results have been satisfactory if we

conduct a cross country analysis to begin with. Thepro- KEY INDICATORS 2004 2009 2012

gress of financial inclusion comparatively has been faster Commercial bank branches per 1,000 22.76 27.05 33.17

and has achieved relatively a deeper penetration as com- km2

pared to the other emerging economies of the world. The Credit union and financial cooperative 80.08 73.19 71.50

branches per 1,000 km2

progress of financial inclusion in India is found to be high-

er with respect to other developed and developing econo- All MFI branches per 1,000 km2 ... ... ...

mies. However considering the extent of rural population Commercial bank branches per 100,000 8.99 9.65 11.38

in the overall demographics, we still have a lot to achieve adults

Credit union and financial cooperative

and the scope for wider and broader perspective holds the 31.64 26.10 24.54

branches per 100,000 adults

priority. Several efforts have been made to gauge the ex-

All MFI branches per 100,000 adults ... ... ...

tent of financial inclusion in various countries by consider-

ing the parameters like the population per banking branch, ATMs per 1,000 km2 ... 14.90 32.67

the population served by a single ATM, the extent of de-

ATMs per 100,000 adults ... 5.31 11.21

posit credit ratio, and the extent to which varied financial

services are tapped by the common people. The follow-

ing table shows where India stands with respect to other Source: World Bank, Financial Access Survey, 2010

countries on certain parameters. India lags behind coun-

tries such as China, Mauritius,UK and France on important The table below points out that the number of commer-

parameters such as number of branches, number of ATMs, cial banks has increased over a period of time and more

Bank Deposits or Bank Credit. It however fairs better than and more offices are being set up in rural and semi urban

some other countries such as Thailand or Malaysia. centers.The credit and deposits placed with the bank in-

dicating that the turnover of the commercial banks have

Table: 1 -Financial Inclusion Indicators, 2011 increase. Also more and more people have been brought

under the hub of financial services suggesting that there is

a greater mobilization of savings.

350 X INDIAN JOURNAL OF APPLIED RESEARCH

Research Paper Volume : 4 | Issue : 10 | October 2014 | ISSN - 2249-555X

Table: 3 – Important Indicators population group-wise number of offices of all commercial

banks as on March 31, 2013. Also, it highlights the number

of branches opened in one last year stretching from April1,

IMPORTANT June March March 2012 to march 31, 2013. The table clearly depicts that the

March 2007

INDICATORS 1969 2004 2012

number of branches added by all banks have been almost

No. of Commer- twice or more than twice the number of branches added in

89 291 183 173

cial Banks urban areas. The most noticeable thing is the faster growth

Number of of the regional rural banks marking its specialty role in the

Offices of

Scheduled Com- 8262 67188 71839 98330 financial inclusion drive very apparent.

mercial Banks

in India ^ Conclusion:

(a) Rural 1833 32121 30551 36356 A lot can be construed from the above facts and figures

(b) Semi-Urban 3342 15091 16361 25797 suggesting that the approach from both the government

(c) Urban 1584 11000 12970 18781 and the reserve bank of India has been a measured one.

(d) Metropolitan 1503 8976 11957 17396 Financial inclusion definitely looks a possibility keeping

Population per in mind the blueprint and framework put into place for

office (in thou- 64.0 16.0 15.0 12.3 achieving the same. Much has been achieved if the pro-

sands) gress can be compared on a 10 year basis. But still a lot

Deposits of can be done with respect to prevailing financial literacy

Scheduled

Commercial 46.46 15422.84 & 26119.33 59090.82 among masses. Also, due emphasis must be placed on

Banks in India the growing need and importance of information and com-

(` Billion) munication technologies to speed up the pace of financial

Credit of Sched- inclusion. Much deliberation is still needed on finding bet-

uled Commer- ter ways to channelize the direct benefits to the genuine

35.99 8655.94 19311.89 46118.52

cial Banks in

India (` Billion) people since it is still facing from a lot of bureaucratic pro-

Deposits of cedures. The data reveals that India has gathered speed

Scheduled Com- on its road to achieve financial inclusion in last three years

mercial Banks 5.6 229.5 363.1 600.9 which is very good if studied in isolation. However, when

per office (`

Million) compared to other developing and developed nations, In-

Per Capita dia still needs to streamline its process and remove loads

Deposits of of administrative bottlenecks.

Scheduled Com- 88 14550 23468 48732

mercial Banks

(`)

Per Capita Cred-

it of Scheduled 68 8166 17355 38033

Commercial

Banks (`)

Credit Deposit 77.5 56.1 73.9 78.0

Ratio

Investment 29.3 43.8 30.3 29.4

Deposit Ratio

Cash Deposit 8.2 5.6 7.5 6.1

Ratio

Source: Report on Trend and Progress of Banking in India,

2013

As expected, the majority of the Indian banking is tilted

heavily in favor of urban and metropolitan cities. The rural

population still remains unbanked to a large extent. Same

could be said for semi urban centers. The table presents

REFERENCE Adhikary, M. L and Bagli, S. (2010), ‘Impact of SHGs on Financial Inclusion – A case Study in the District of Bankura’, Journal of Management

and Information Technology, Vol. 2, No.1, pp. 16-32. | 2. Chattopadhyay, S. K. (2011), ‘Financial Inclusion in India: A Case-study of West Bengal’,

RBI Working Paper Series (DEPR): 8/2011, | 3. GOI, Report of the Committee on Financial Inclusion, Published by Government of India, New Delhi,2008 | 4. Harun R

Khan, Issues and Challenges in Financial Inclusion: Policies, Partnerships, Processes & Products, Published by the Reserve Bank of India, Mumbai, 2012 | 5. Karmakar,

K.G. Banerjee, G.D. and Mohapatra, N.P. (2011) ‘Towards Financial Inclusion in India’, Sage Publications India Pvt. Ltd, New Delhi. | 6. RBI, Annual Report of the

Reserve Bank of India for Year of 2012-13. | 7. RBI, Report on Trend and Progress of Banking in India for the year ended June 30, 2013. |

INDIAN JOURNAL OF APPLIED RESEARCH X 351

Vous aimerez peut-être aussi

- Research Paper On Financial InclusionDocument36 pagesResearch Paper On Financial Inclusionimsarfrazkhan96% (28)

- Financial InclusionDocument3 pagesFinancial Inclusionputul6Pas encore d'évaluation

- Strategy Adopted For Financial InclusionDocument7 pagesStrategy Adopted For Financial Inclusionanmolsaini01Pas encore d'évaluation

- 4-MM 4C-Financial InclusionDocument24 pages4-MM 4C-Financial Inclusionsenthamarai krishnanPas encore d'évaluation

- Journal 4 PDFDocument159 pagesJournal 4 PDFnehaprakash028Pas encore d'évaluation

- Newxx PDFDocument159 pagesNewxx PDFnehaprakash028Pas encore d'évaluation

- Lucky - Financial InclusionDocument128 pagesLucky - Financial InclusionDinesh Nayak100% (1)

- 13 - Conclusion and SuggestionsDocument4 pages13 - Conclusion and SuggestionsjothiPas encore d'évaluation

- Financial Inclusion: Corporate Finance ProjectDocument16 pagesFinancial Inclusion: Corporate Finance ProjectPallavi AgrawallaPas encore d'évaluation

- Banking Sector in India - Challenges and OpportunitiesDocument6 pagesBanking Sector in India - Challenges and OpportunitiesDeepika SanthanakrishnanPas encore d'évaluation

- Ejessr Paper 5Document20 pagesEjessr Paper 5Abhishak SharmaPas encore d'évaluation

- Financial Inclusion: A Seminar Work ONDocument11 pagesFinancial Inclusion: A Seminar Work ONSaloni GoyalPas encore d'évaluation

- Market For Financial InclusionDocument13 pagesMarket For Financial InclusionVaibhav patelPas encore d'évaluation

- Business MGMT - Ijbmr - Financial Inclusion in India - Reetika BhattDocument8 pagesBusiness MGMT - Ijbmr - Financial Inclusion in India - Reetika BhattTJPRC PublicationsPas encore d'évaluation

- KSET - 2015 General Answer KeyDocument7 pagesKSET - 2015 General Answer KeyApooPas encore d'évaluation

- Adbi Financial Inclusion AsiaDocument151 pagesAdbi Financial Inclusion AsiaMarius AngaraPas encore d'évaluation

- Financial Inclusions: DEFINITION-According To The Definition Given by NABARD "The Process of Ensuring AccessDocument9 pagesFinancial Inclusions: DEFINITION-According To The Definition Given by NABARD "The Process of Ensuring AccessSmitaPathakPas encore d'évaluation

- Siva Sivani Institute of Management Kompally, SecunderabadDocument56 pagesSiva Sivani Institute of Management Kompally, Secunderabadshaiki32100% (1)

- Financial Inclusion: Dr. Pavitra Yadav Saloni GoyalDocument17 pagesFinancial Inclusion: Dr. Pavitra Yadav Saloni GoyalSaloni GoyalPas encore d'évaluation

- DT Pai ContentsDocument136 pagesDT Pai ContentsAnjali SharmaPas encore d'évaluation

- A Study On Financial Performance of HDFC BankDocument53 pagesA Study On Financial Performance of HDFC BankFelix BadigerPas encore d'évaluation

- Financial InclusionDocument96 pagesFinancial InclusionIcaii Infotech100% (6)

- Financial Inclusion in IndiaDocument7 pagesFinancial Inclusion in IndiaJessi MysPas encore d'évaluation

- Strategy and Efforts of A Public Sector Bank For Financial InclusionDocument10 pagesStrategy and Efforts of A Public Sector Bank For Financial InclusionKhushi PuriPas encore d'évaluation

- Rural Banking India (Finance)Document67 pagesRural Banking India (Finance)Rahul NishadPas encore d'évaluation

- Project Repot - Micro FinancingDocument141 pagesProject Repot - Micro FinancingAvinash VermaPas encore d'évaluation

- 07 - Chapter 2Document57 pages07 - Chapter 2sosteniblebusinessPas encore d'évaluation

- Fs - Financial InclusionDocument7 pagesFs - Financial InclusionWasim SPas encore d'évaluation

- Financial Inclusion: A Road India Needs To TravelDocument40 pagesFinancial Inclusion: A Road India Needs To TravelGourav PattnaikPas encore d'évaluation

- Financial Inclusion in India: Emerging Profitable ModelsDocument6 pagesFinancial Inclusion in India: Emerging Profitable ModelsSamuel GeorgePas encore d'évaluation

- Financial Inclusion or Inclusive Financing Is The Delivery ofDocument12 pagesFinancial Inclusion or Inclusive Financing Is The Delivery ofNeerajPas encore d'évaluation

- 100 % Financial Inclusion: A Challenging Task Ahead: Dr. Reena AgrawalDocument16 pages100 % Financial Inclusion: A Challenging Task Ahead: Dr. Reena AgrawalAashi Sharma100% (1)

- Cat - UploadNews - Greatlakesspeechfinal UBIDocument12 pagesCat - UploadNews - Greatlakesspeechfinal UBIBhanufso VennPas encore d'évaluation

- Financial Literacy GuideDocument36 pagesFinancial Literacy GuideAbhinay Kumar50% (2)

- Impact of Payment Banks in Indian Financial Inclusion: Dr.R.CHANDRASEKARAN, Assistant ProfessorDocument8 pagesImpact of Payment Banks in Indian Financial Inclusion: Dr.R.CHANDRASEKARAN, Assistant ProfessorSamil MusthafaPas encore d'évaluation

- A Research Paper On RBI Branch Licensing Policy: "Branching" The Gap Between FinancialDocument13 pagesA Research Paper On RBI Branch Licensing Policy: "Branching" The Gap Between Financialgayatrimohanty05Pas encore d'évaluation

- Financial InclusionDocument134 pagesFinancial InclusionvimalbakshiPas encore d'évaluation

- Indian Banking Sector Towards The Next OrbitDocument17 pagesIndian Banking Sector Towards The Next OrbitKalyan Raman VadlamaniPas encore d'évaluation

- Financial Inclusion - A Road India Needs To TravelDocument8 pagesFinancial Inclusion - A Road India Needs To Traveliysverya9256Pas encore d'évaluation

- What Is Financial InclusionDocument10 pagesWhat Is Financial InclusionSanjeev ReddyPas encore d'évaluation

- Financeinclusion - ShilmaDocument24 pagesFinanceinclusion - ShilmaAnkur SrivastavaPas encore d'évaluation

- What Is Financial InclusionDocument5 pagesWhat Is Financial InclusiondebasishpahiPas encore d'évaluation

- Research Paper On Financial InclusionDocument57 pagesResearch Paper On Financial InclusionChilaka Pappala0% (1)

- Financial Inclusion & Financial Literacy: SBI InitiativesDocument5 pagesFinancial Inclusion & Financial Literacy: SBI Initiativesprashaant4uPas encore d'évaluation

- A Study of Branchless Banking in AchieviDocument10 pagesA Study of Branchless Banking in AchieviMiftah AlfaridPas encore d'évaluation

- Financial InclusiionDocument37 pagesFinancial InclusiionPehoo ThakurPas encore d'évaluation

- Submitted To Parul Institute of Eng. & Technology: Prof - Bhavik MehtaDocument70 pagesSubmitted To Parul Institute of Eng. & Technology: Prof - Bhavik Mehtadkp_4437Pas encore d'évaluation

- Micro-Finance in The India: The Changing Face of Micro-Credit SchemesDocument11 pagesMicro-Finance in The India: The Changing Face of Micro-Credit SchemesMahesh ChavanPas encore d'évaluation

- Sana NTCCDocument40 pagesSana NTCCSana TrannumPas encore d'évaluation

- A Study On Awareness Towards Financial Inclusion Among Rural Areas With Special Reference To CoimbatoreDocument27 pagesA Study On Awareness Towards Financial Inclusion Among Rural Areas With Special Reference To CoimbatoreprathikshaPas encore d'évaluation

- Vignesh Total UnitsDocument60 pagesVignesh Total UnitsBnaren NarenPas encore d'évaluation

- Champatiray and Agarwal - Kiosk Banking Study Final ReportDocument53 pagesChampatiray and Agarwal - Kiosk Banking Study Final ReportMd Alive LivingPas encore d'évaluation

- Role of Payments BankDocument16 pagesRole of Payments BankAstik TripathiPas encore d'évaluation

- Need For Financial Inclusion and Challenges Ahead - An Indian PerspectiveDocument4 pagesNeed For Financial Inclusion and Challenges Ahead - An Indian PerspectiveInternational Organization of Scientific Research (IOSR)Pas encore d'évaluation

- A Study On Financial Inclusion Initiation by State Bank of IndiaDocument5 pagesA Study On Financial Inclusion Initiation by State Bank of IndiavmktptPas encore d'évaluation

- Financial Inclusion: Financial Inclusion Is The Delivery of Financial Services atDocument18 pagesFinancial Inclusion: Financial Inclusion Is The Delivery of Financial Services atnayakg66Pas encore d'évaluation

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)D'EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Pas encore d'évaluation

- Banking India: Accepting Deposits for the Purpose of LendingD'EverandBanking India: Accepting Deposits for the Purpose of LendingPas encore d'évaluation

- Access to Finance: Microfinance Innovations in the People's Republic of ChinaD'EverandAccess to Finance: Microfinance Innovations in the People's Republic of ChinaPas encore d'évaluation

- Chapter 1055Document17 pagesChapter 1055MohitAhujaPas encore d'évaluation

- Indian Institute of Banking & Finance: Advanced Wealth ManagementDocument13 pagesIndian Institute of Banking & Finance: Advanced Wealth ManagementMohitAhujaPas encore d'évaluation

- International Master IN Microfinance FOR Entrepreneurship - SDocument4 pagesInternational Master IN Microfinance FOR Entrepreneurship - SMohitAhujaPas encore d'évaluation

- Special: Online Teaching StrategiesDocument23 pagesSpecial: Online Teaching StrategiesMohitAhujaPas encore d'évaluation

- Unesco Covid 19 Ed Webinar 4 ResourcesDocument12 pagesUnesco Covid 19 Ed Webinar 4 ResourcesMohitAhujaPas encore d'évaluation

- Dr. A.P.J. Abdul Kalam Technical University Lucknow: Study, Evaluation Scheme & SyllabusDocument16 pagesDr. A.P.J. Abdul Kalam Technical University Lucknow: Study, Evaluation Scheme & SyllabusMohitAhujaPas encore d'évaluation

- 986-Article Text-2478-2-10-20190416Document24 pages986-Article Text-2478-2-10-20190416MohitAhujaPas encore d'évaluation

- Financial Decisions Case StudyDocument1 pageFinancial Decisions Case StudyMohitAhujaPas encore d'évaluation

- Model CurriculumDocument17 pagesModel CurriculumMohitAhujaPas encore d'évaluation

- PAPERFINALDocument14 pagesPAPERFINALMohitAhujaPas encore d'évaluation

- Research Publications:: Managerial Challenges (PP 85-92) - New Delhi: Excel India PublishersDocument1 pageResearch Publications:: Managerial Challenges (PP 85-92) - New Delhi: Excel India PublishersMohitAhujaPas encore d'évaluation

- SOP For Online Exam: StatementsDocument5 pagesSOP For Online Exam: StatementsMohitAhujaPas encore d'évaluation

- Department of Management Birla Institute of Technology, Mesra, Ranchi - 835215 (India)Document227 pagesDepartment of Management Birla Institute of Technology, Mesra, Ranchi - 835215 (India)MohitAhujaPas encore d'évaluation

- Rubric - Group AssignmentDocument1 pageRubric - Group AssignmentMohitAhujaPas encore d'évaluation

- MBA 2019 Course StructureDocument33 pagesMBA 2019 Course StructureMohitAhujaPas encore d'évaluation

- Context: Academic Skills, Employability Skills, and Technical, Career-Specific SkillsDocument3 pagesContext: Academic Skills, Employability Skills, and Technical, Career-Specific SkillsMohitAhujaPas encore d'évaluation

- Design Thinking AT PepsicoDocument11 pagesDesign Thinking AT PepsicoMohitAhuja100% (1)

- Student Development Program: Summer Internship Project (SIP)Document5 pagesStudent Development Program: Summer Internship Project (SIP)MohitAhujaPas encore d'évaluation

- 16 Appendix IDocument20 pages16 Appendix IMohitAhujaPas encore d'évaluation

- What Is Working Capital Loan?: Fixed Rate Term LoanDocument1 pageWhat Is Working Capital Loan?: Fixed Rate Term LoanMohitAhujaPas encore d'évaluation

- Awareness and Usage of Internet Banking Facilities in Sri LankaDocument18 pagesAwareness and Usage of Internet Banking Facilities in Sri LankaTharindu Thathsarana RajapakshaPas encore d'évaluation

- DND Homebrew Ideas V1 - The HomebreweryDocument3 pagesDND Homebrew Ideas V1 - The HomebreweryKalazans CardialPas encore d'évaluation

- Name Numerology Calculator - Chaldean Name Number PredictionsDocument2 pagesName Numerology Calculator - Chaldean Name Number Predictionsarunamurugesan7Pas encore d'évaluation

- Customizable Feature Based Design Pattern Recognition Integrating Multiple TechniquesDocument191 pagesCustomizable Feature Based Design Pattern Recognition Integrating Multiple TechniquesCalina Sechel100% (1)

- United States Court of Appeals, Third CircuitDocument1 pageUnited States Court of Appeals, Third CircuitScribd Government DocsPas encore d'évaluation

- Why Do Firms Do Basic Research With Their Own Money - 1989 - StudentsDocument10 pagesWhy Do Firms Do Basic Research With Their Own Money - 1989 - StudentsAlvaro Rodríguez RojasPas encore d'évaluation

- Research ProposalDocument18 pagesResearch ProposalIsmaelPas encore d'évaluation

- MAT2355 Final 2002Document8 pagesMAT2355 Final 2002bojie_97965Pas encore d'évaluation

- Nursing Care Plan: Pt.'s Data Nursing Diagnosis GoalsDocument1 pageNursing Care Plan: Pt.'s Data Nursing Diagnosis GoalsKiran Ali100% (3)

- Philosophy of Jnanadeva - As Gleaned From The Amrtanubhava (B.P. Bahirat - 296 PgsDocument296 pagesPhilosophy of Jnanadeva - As Gleaned From The Amrtanubhava (B.P. Bahirat - 296 PgsJoão Rocha de LimaPas encore d'évaluation

- PMS Past Paper Pakistan Studies 2019Document3 pagesPMS Past Paper Pakistan Studies 2019AsmaMaryamPas encore d'évaluation

- A Teacher Must Choose Five Monitors From A Class of 12 Students. How Many Different Ways Can The Teacher Choose The Monitors?Document11 pagesA Teacher Must Choose Five Monitors From A Class of 12 Students. How Many Different Ways Can The Teacher Choose The Monitors?Syed Ali HaiderPas encore d'évaluation

- A&P: The Digestive SystemDocument79 pagesA&P: The Digestive SystemxiaoPas encore d'évaluation

- British Citizenship Exam Review TestDocument25 pagesBritish Citizenship Exam Review TestMay J. PabloPas encore d'évaluation

- FMEA 4th BOOK PDFDocument151 pagesFMEA 4th BOOK PDFLuis Cárdenas100% (2)

- Research ProposalDocument45 pagesResearch ProposalAaliyah Marie AbaoPas encore d'évaluation

- 1E Star Trek Customizable Card Game - 6 First Contact Rule SupplementDocument11 pages1E Star Trek Customizable Card Game - 6 First Contact Rule Supplementmrtibbles100% (1)

- Equine PregnancyDocument36 pagesEquine Pregnancydrdhirenvet100% (1)

- Introduction To Instrumented IndentationDocument7 pagesIntroduction To Instrumented Indentationopvsj42Pas encore d'évaluation

- Case Blue Ribbon Service Electrical Specifications Wiring Schematics Gss 1308 CDocument22 pagesCase Blue Ribbon Service Electrical Specifications Wiring Schematics Gss 1308 Cjasoncastillo060901jtd100% (132)

- Public International Law Green Notes 2015Document34 pagesPublic International Law Green Notes 2015KrisLarr100% (1)

- Balezi - Annale Générale Vol 4 - 1 - 2 Fin OkDocument53 pagesBalezi - Annale Générale Vol 4 - 1 - 2 Fin OkNcangu BenjaminPas encore d'évaluation

- Joshua 24 15Document1 pageJoshua 24 15api-313783690Pas encore d'évaluation

- Challenges For Omnichannel StoreDocument5 pagesChallenges For Omnichannel StoreAnjali SrivastvaPas encore d'évaluation

- A Passage To AfricaDocument25 pagesA Passage To AfricaJames Reinz100% (2)

- Approved Chemical ListDocument2 pagesApproved Chemical ListSyed Mansur Alyahya100% (1)

- Origin of "ERP"Document4 pagesOrigin of "ERP"kanika_bhardwaj_2Pas encore d'évaluation

- Old San Agustin NHS MSISAR Sept 2021Document2 pagesOld San Agustin NHS MSISAR Sept 2021ERICSON SABANGANPas encore d'évaluation

- GB BioDocument3 pagesGB BiolskerponfblaPas encore d'évaluation

- GN No. 444 24 June 2022 The Public Service Regulations, 2022Document87 pagesGN No. 444 24 June 2022 The Public Service Regulations, 2022Miriam B BenniePas encore d'évaluation