Académique Documents

Professionnel Documents

Culture Documents

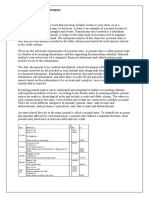

Operating Income: Gross Profit Total Sales Cogs

Transféré par

Beth Guiang0 évaluation0% ont trouvé ce document utile (0 vote)

47 vues2 pagesOperating costs include expenses associated with maintaining and running a business day-to-day like cost of goods sold and overhead expenses. Operating costs are deducted from revenue to calculate operating income on a company's income statement. Income is money received in exchange for goods/services or investments, and is used for daily business expenses. Most income is taxed. Profit is financial benefit realized when revenue exceeds expenses/costs and is what remains for a business's owners. Consistently earning profit is a business goal. Gross, operating, and net profit provide different views of profitability by looking at earnings after direct, operating, and all expenses respectively.

Description originale:

Entrepreneurship

Grade 9 (K-12)

Titre original

Operating Costs

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentOperating costs include expenses associated with maintaining and running a business day-to-day like cost of goods sold and overhead expenses. Operating costs are deducted from revenue to calculate operating income on a company's income statement. Income is money received in exchange for goods/services or investments, and is used for daily business expenses. Most income is taxed. Profit is financial benefit realized when revenue exceeds expenses/costs and is what remains for a business's owners. Consistently earning profit is a business goal. Gross, operating, and net profit provide different views of profitability by looking at earnings after direct, operating, and all expenses respectively.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

47 vues2 pagesOperating Income: Gross Profit Total Sales Cogs

Transféré par

Beth GuiangOperating costs include expenses associated with maintaining and running a business day-to-day like cost of goods sold and overhead expenses. Operating costs are deducted from revenue to calculate operating income on a company's income statement. Income is money received in exchange for goods/services or investments, and is used for daily business expenses. Most income is taxed. Profit is financial benefit realized when revenue exceeds expenses/costs and is what remains for a business's owners. Consistently earning profit is a business goal. Gross, operating, and net profit provide different views of profitability by looking at earnings after direct, operating, and all expenses respectively.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

Operating costs are expenses associated with the maintenance and

administration of a business on a day-to-day basis. The total operating cost for a

company includes the cost of goods sold, operating expenses as well as

overhead expenses. The operating cost is deducted from revenue to arrive

at operating income and is reflected on a company’s income statement.

Income is money (or some equivalent value) that an individual or business

receives in exchange for providing a good or service or through investing capital.

Income is used to fund day-to-day expenditures.

income can refer to a company's remaining revenues after paying all expenses

and taxes. In this case, income is referred to as "earnings.” Most forms of income

are subject to taxation.

Profit is a financial benefit that is realized when the amount of revenue gained

from a business activity exceeds the expenses, costs, and taxes needed to

sustain the activity. Any profit that is gained goes to the business's owners, who

may or may not decide to spend it on the business. Profit is calculated as

total revenue less total expenses.

Profit is the money a business makes after accounting for all expenses.

Regardless of whether the business is a couple of kids running a lemonade stand

or a publicly traded multinational company, consistently earning profit is every

company's goal. As a result, much of business performance is based on

profitability in its various forms.

The first level of profitability is gross profit. Gross profit is sales minus the cost of

goods sold. Sales are the first line item on the income statement, and the cost of

goods sold (COGS) is generally listed just below it. For example, if Company A

has $100,000 in sales and a COGS of $60,000, it means the gross profit is

$40,000, or $100,000 minus $60,000. Divide gross profit by sales for the gross

profit margin, which is 40%, or $40,000 divided by $100,000.

Gross Profit=Total Sales−COGs

The second level of profitability is operating profit. Operating profit is calculated

by deducting operating expenses from gross profit. Gross profit looks at

profitability after direct expenses, and operating profit looks at profitability after

operating expenses. These are things like selling, general, and administrative

costs (SG&A). If Company A has $20,000 in operating expenses, the operating

profit is $40,000 minus $20,000, equaling $20,000. Divide operating profit by

sales for the operating profit margin, which is 20%.

Operating Profit=Gross Profit−Operating Expenses

Operating Profit Margin=Operating Profit/Total Sales

The third level of profitably is net profit. Net profit is the income left over after all

expenses, including taxes and interest, have been paid. If interest is $5,000 and

taxes are another $5,000, net profit is calculated by deducting both of these from

operating profit. In the example of Company A, the answer is $20,000 minus

$10,000, which equals $10,000. Divide net profit by sales for the net profit

margin, which is 10%.

Net Profit=Operating Profit−Taxes & Interest

Vous aimerez peut-être aussi

- Understanding Financial Statements (Review and Analysis of Straub's Book)D'EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Évaluation : 5 sur 5 étoiles5/5 (5)

- The Goal of A Maximum Profit Profit MaximizationDocument2 pagesThe Goal of A Maximum Profit Profit MaximizationKaila100% (1)

- TAX - LEAD BATCH 3 - Preweek 2Document13 pagesTAX - LEAD BATCH 3 - Preweek 2Josiah ZeusPas encore d'évaluation

- Far 4Document9 pagesFar 4Sonu NayakPas encore d'évaluation

- RoarDocument19 pagesRoarFrank HernandezPas encore d'évaluation

- Expense - Expense Is A Type of Expenditure Which Go Through The Income Statement, ItDocument5 pagesExpense - Expense Is A Type of Expenditure Which Go Through The Income Statement, ItDanielPas encore d'évaluation

- Income StatementDocument3 pagesIncome StatementMamta LallPas encore d'évaluation

- PAT and EBITDADocument2 pagesPAT and EBITDATravel DiaryPas encore d'évaluation

- Gross ProfitDocument3 pagesGross ProfitRafeh2Pas encore d'évaluation

- Income StatementsDocument5 pagesIncome StatementsAdetunbi TolulopePas encore d'évaluation

- Profitability RatioDocument11 pagesProfitability Ratiosuhrudkishor dasPas encore d'évaluation

- Profitability RatioDocument11 pagesProfitability RatioAbhisek sawPas encore d'évaluation

- Example Income Statement:: Gross SalesDocument2 pagesExample Income Statement:: Gross Salesabdirahman YonisPas encore d'évaluation

- Contabilitate COURSE 4Document47 pagesContabilitate COURSE 4Raluca TonePas encore d'évaluation

- Principles of Accounting: Income StatementDocument5 pagesPrinciples of Accounting: Income StatementAhmad GraphicsPas encore d'évaluation

- Income StatementDocument1 pageIncome StatementHabib Ul HaqPas encore d'évaluation

- Key Performance IndicesDocument38 pagesKey Performance IndicesSuryanarayana TataPas encore d'évaluation

- Understanding The Income StatementDocument4 pagesUnderstanding The Income Statementluvujaya100% (1)

- Income StatementDocument8 pagesIncome StatementDanDavidLapizPas encore d'évaluation

- Inc StatmentDocument3 pagesInc StatmentDilawarPas encore d'évaluation

- Income StatementDocument36 pagesIncome StatementTiffany VinzonPas encore d'évaluation

- Financial Accounting: Salal Durrani 2020Document12 pagesFinancial Accounting: Salal Durrani 2020Rahat BatoolPas encore d'évaluation

- FABM 2 Module 3 Statement of Comprehensive IncomeDocument10 pagesFABM 2 Module 3 Statement of Comprehensive IncomebabyjamskiePas encore d'évaluation

- Profit Margin PDFDocument2 pagesProfit Margin PDFbungaPas encore d'évaluation

- Finals - Fina 221Document14 pagesFinals - Fina 221MARITONI MEDALLAPas encore d'évaluation

- Left Column For Inner Computation - Right Column For Totals - Peso Sign at The Beginning Amount and at Final Answer TwoDocument6 pagesLeft Column For Inner Computation - Right Column For Totals - Peso Sign at The Beginning Amount and at Final Answer Twoamberle smithPas encore d'évaluation

- RevenueAccountsWithDefinition, TypesAndExamplesIndeed - Comindia 1710866202575Document7 pagesRevenueAccountsWithDefinition, TypesAndExamplesIndeed - Comindia 1710866202575williamseugine2008Pas encore d'évaluation

- Profit and Loss AccountDocument2 pagesProfit and Loss AccountameliarosminiPas encore d'évaluation

- Total Income - Total Expenses Net ProfitDocument5 pagesTotal Income - Total Expenses Net ProfitViñas, Diana L.Pas encore d'évaluation

- MBA5002 Week 3 Discussion ParticipationDocument2 pagesMBA5002 Week 3 Discussion ParticipationRabia BhardwajPas encore d'évaluation

- Ratio AnalysisDocument32 pagesRatio AnalysisVignesh NarayananPas encore d'évaluation

- Financial Statement DefinitionsDocument4 pagesFinancial Statement Definitionsj_osire7483Pas encore d'évaluation

- Statement of Retained Earings and Its Components HandoutDocument12 pagesStatement of Retained Earings and Its Components HandoutRitesh LashkeryPas encore d'évaluation

- VU Lesson 8Document5 pagesVU Lesson 8ranawaseem100% (1)

- 3-Computing Gross ProfitDocument5 pages3-Computing Gross ProfitAquisha MicuboPas encore d'évaluation

- Terms of Share MarketDocument6 pagesTerms of Share Marketsearchanirban6474Pas encore d'évaluation

- Financial Accounting & AnalysisDocument5 pagesFinancial Accounting & AnalysisSourav SaraswatPas encore d'évaluation

- MHRDIR-504 Lecture 5Document15 pagesMHRDIR-504 Lecture 5SsssPas encore d'évaluation

- Profit and LossDocument17 pagesProfit and LossannePas encore d'évaluation

- Financial Ratio & LeverageDocument25 pagesFinancial Ratio & Leverageankushrasam700Pas encore d'évaluation

- Net Revenue and Net ProfitDocument2 pagesNet Revenue and Net ProfitZahid5391Pas encore d'évaluation

- Profit and Loss: The Basic of Buy and Sell BusinessDocument8 pagesProfit and Loss: The Basic of Buy and Sell Businessraven villanuevaPas encore d'évaluation

- 5.3 Income StatementsDocument3 pages5.3 Income StatementsannabellPas encore d'évaluation

- What Is The Income Statement?Document3 pagesWhat Is The Income Statement?Mustaeen DarPas encore d'évaluation

- EntrepDocument33 pagesEntrepArianne TañanPas encore d'évaluation

- Revenue: From Wikipedia, The Free EncyclopediaDocument3 pagesRevenue: From Wikipedia, The Free EncyclopediaAshok KumarPas encore d'évaluation

- Computation of Gross ProfitDocument18 pagesComputation of Gross ProfitJan PlazaPas encore d'évaluation

- Cost Volume Profit AnalysisDocument1 pageCost Volume Profit AnalysisReika OgaliscoPas encore d'évaluation

- Revenue and ExpenseDocument2 pagesRevenue and Expensemuneeb.naseemPas encore d'évaluation

- Accounting DocumentsDocument6 pagesAccounting DocumentsMae ArogantePas encore d'évaluation

- ENTREPRENEURSHIP QUARTER 2 MODULE 10 Computation-of-Gross-ProfitDocument11 pagesENTREPRENEURSHIP QUARTER 2 MODULE 10 Computation-of-Gross-Profitrichard reyesPas encore d'évaluation

- Module 8 and 9 EntrepDocument16 pagesModule 8 and 9 EntrepmarieenriquezsalitaPas encore d'évaluation

- Business Studies: 5.3 - Income StatementsDocument9 pagesBusiness Studies: 5.3 - Income StatementsUpasana ChaubePas encore d'évaluation

- Statement of Comprehensive IncomeDocument8 pagesStatement of Comprehensive IncomeSalvie Angela Clarette UtanaPas encore d'évaluation

- Kelompok 1Document13 pagesKelompok 1difarafi97Pas encore d'évaluation

- Income Statement: Profit and LossDocument7 pagesIncome Statement: Profit and LossNavya NarulaPas encore d'évaluation

- Income Statement Week 3Document10 pagesIncome Statement Week 3Dendy RosmanPas encore d'évaluation

- Income Statement Account TitlesDocument16 pagesIncome Statement Account Titlesmaria cacaoPas encore d'évaluation

- Inc StatDocument9 pagesInc StatAleem JafferyPas encore d'évaluation

- Income Statement: Profit/Loss Account Dr. Satish Jangra (2009A229M)Document14 pagesIncome Statement: Profit/Loss Account Dr. Satish Jangra (2009A229M)Dr. Satish Jangra100% (1)

- ICT 9 Exam FinalDocument4 pagesICT 9 Exam FinalBeth GuiangPas encore d'évaluation

- DLP TemplateDocument8 pagesDLP TemplateBeth GuiangPas encore d'évaluation

- SHS Test Paper TemplateDocument8 pagesSHS Test Paper TemplateBeth Guiang100% (1)

- Designation Deaprtment HeadDocument1 pageDesignation Deaprtment HeadBeth GuiangPas encore d'évaluation

- CHAPTER IV and VDocument15 pagesCHAPTER IV and VBeth GuiangPas encore d'évaluation

- EPTDocument13 pagesEPTRose Dumayac100% (1)

- (LET REVIEWER) BSED Social Studies MajorDocument29 pages(LET REVIEWER) BSED Social Studies MajorBeth GuiangPas encore d'évaluation

- Franz Josef Haydn: Ludwig Van BeethovenDocument3 pagesFranz Josef Haydn: Ludwig Van BeethovenBeth GuiangPas encore d'évaluation

- Attachment To Cs Form WorksheetDocument2 pagesAttachment To Cs Form WorksheetBeth GuiangPas encore d'évaluation

- Unit 2 - Capital GainsDocument16 pagesUnit 2 - Capital GainsRakhi DhamijaPas encore d'évaluation

- Obamacare Mandate ExemptionsDocument2 pagesObamacare Mandate Exemptionssamu2-4uPas encore d'évaluation

- IRN: D26305b0b65f1f587ebdDocument3 pagesIRN: D26305b0b65f1f587ebdDeependraAgarwalPas encore d'évaluation

- Solved Phyllis Sued Martin S Estate and Won A 65 000 SettlementDocument1 pageSolved Phyllis Sued Martin S Estate and Won A 65 000 SettlementAnbu jaromiaPas encore d'évaluation

- Instruments of Tax SavingDocument10 pagesInstruments of Tax Savinganilpipaliya117Pas encore d'évaluation

- Income Taxation: Tabian, Jieza Syra A. 2018-017-4883Document30 pagesIncome Taxation: Tabian, Jieza Syra A. 2018-017-4883WAYNEPas encore d'évaluation

- 1701Q Jan 2018 Final Rev2Document2 pages1701Q Jan 2018 Final Rev2Balot EspinaPas encore d'évaluation

- Pay Slip: Salary Slip - APR 2018 (Noida)Document1 pagePay Slip: Salary Slip - APR 2018 (Noida)rahul tyagiPas encore d'évaluation

- File 1Document1 pageFile 1Aum MangalPas encore d'évaluation

- Different Types of AllowancesDocument4 pagesDifferent Types of AllowancesYoga Guru100% (1)

- Lally Automobiles DelHCDocument12 pagesLally Automobiles DelHCShivinder SinglaPas encore d'évaluation

- Principles of TaxationDocument32 pagesPrinciples of TaxationAndrea WaganPas encore d'évaluation

- VA - Sankalp Parihar - 142Document13 pagesVA - Sankalp Parihar - 142Sankalp PariharPas encore d'évaluation

- Cost Sheet Ground Floor - CLPDocument1 pageCost Sheet Ground Floor - CLPSatish Khola (Rewari)Pas encore d'évaluation

- Voice Manzoor WHT 291123-8Document3 pagesVoice Manzoor WHT 291123-8Sam MonuPas encore d'évaluation

- CH 10 CsolDocument47 pagesCH 10 Csolxuzhu5Pas encore d'évaluation

- Revenue DetailsDocument1 pageRevenue Detailsviratkant143Pas encore d'évaluation

- Profit & Loss (Standard) : Resa Harisma 195154024Document1 pageProfit & Loss (Standard) : Resa Harisma 195154024Bikin OrtubanggaPas encore d'évaluation

- Navasakam Grievance Application: Family DetailsDocument2 pagesNavasakam Grievance Application: Family DetailsmANOHARPas encore d'évaluation

- GST ProjectDocument53 pagesGST Projectafaque khan0% (1)

- Cir Vs Pineda 21 Scra 105Document4 pagesCir Vs Pineda 21 Scra 105Atty JV AbuelPas encore d'évaluation

- Case A Case B Case CDocument2 pagesCase A Case B Case Ckhiladi883Pas encore d'évaluation

- Digest Contex Corp V CIR GR 151135Document3 pagesDigest Contex Corp V CIR GR 151135Timothy Joel CabreraPas encore d'évaluation

- Billing Address: Tax InvoiceDocument1 pageBilling Address: Tax InvoicePratheeksha ShettyPas encore d'évaluation

- D-3949A Information Referral 072717Document3 pagesD-3949A Information Referral 072717niruhtPas encore d'évaluation

- Quiz-2 With AnswersDocument3 pagesQuiz-2 With AnswersErika BernardinoPas encore d'évaluation

- Entity Tax ExamDocument7 pagesEntity Tax ExamWesley JacksonPas encore d'évaluation

- E-Filing of Returns (Income Tax Online Filing)Document23 pagesE-Filing of Returns (Income Tax Online Filing)Prashant Jadhav0% (1)

- 3 CIR vs. AlgueDocument2 pages3 CIR vs. AlguemaggiPas encore d'évaluation