Académique Documents

Professionnel Documents

Culture Documents

Basic Concept of Taxation: Created by Cs Rozy Jain

Transféré par

Giri SukumarTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Basic Concept of Taxation: Created by Cs Rozy Jain

Transféré par

Giri SukumarDroits d'auteur :

Formats disponibles

BASIC CONCEPT OF TAXATION

CREATED BY CS ROZY JAIN 1

WHAT IS TAX?

Tax is a compulsory contribution to state

revenue, levied by the government on

workers' income and business profits, or

added to the cost of some goods, services,

and transactions.

CREATED BY CS ROZY JAIN 2

TAX

DIRECT TAX INDIRECT

TAX

CREATED BY CS ROZY JAIN 3

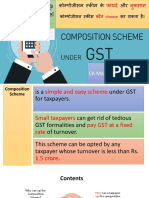

INDIRECT TAX

GOODS & SERVICE TAX

CUSTOM DUTY

EXISE

SECURITIES TRANSACTION TAX

ETC

CREATED BY CS ROZY JAIN 4

DIRECT TAX

INCOME TAX

CREATED BY CS ROZY JAIN 5

CHARGE INCOME TAX

Income tax is charged in assessment year at

rates specified by the Finance Act applicable

on 1st April of the relevant assessment year.

It is charged on the total income of every

person for the previous year.

Total Income is to be computed as per the

provisions of the Act.

Income tax is to be deducted at source or paid

in advance wherever required under the

provision of the Act.

CREATED BY CS ROZY JAIN 6

IMPORATANT DEFINATION

Person u/s 2(31) includes,

a. An Individual

b. Hindu Undivided Family (HUF)

c. A Company

d. A Firm

e. An Association of Persons(AOP) or Body of Individuals (BOI)

f. A Local Authority

g. Every other Artificial Juridical Person

Assessment Year u/s 2(9) means, the period of 12 months commencing on the 1st

April every year. It is the year (just after previous year) in which income is earned is

charged to tax.

Previous Year u/s 2(34) means, the year in which income is earned.

CREATED BY CS ROZY JAIN 7

RESIDENTIAL STATUS

NOT

NON

RESIDENT ORDINARY

RESIDENT

RESIDENT

CREATED BY CS ROZY JAIN 8

Residential Status of

Individual

Assessee Basic Condition Additional Condition

RESIDENT He must satisfy at one of Not required.

the basic conditions.

Not Ordinarily Resident He must satisfy at least He must satisfy either

one of the basic one or both the

conditions. additional conditions

given u/s 6(6).

Non-Resident Should not satisfy any of Not required.

the basic conditions.

CREATED BY CS ROZY JAIN 9

CONTI….

Basic Conditions u/s 6(1):

i. He must be in India for a period of 182 days or more

during the previous year; or

ii. He must be in India for a period of 60 days or more

during the previous year and 365 days or more during

the four years immediately preceding the previous

year.

Additional Conditions u/s 6(6):

He must be a non-resident in India in nine out of the

ten previous years preceding that year; or

He must be in India during 7 preceding previous years

for aggregate period of 729 days or less.

CREATED BY CS ROZY JAIN 10

RESIDENTIAL STATUS OF OTHERS

According to section 6(3) an Indian Company is always

Resident in India. A foreign Company will be resident in

India if Control or Management of its affairs is wholly

situated in India.

Residential Status of a firm or AOP or other person

depends upon control and management of its affairs.

Resident: If the control and management of the affairs of a firm

or AOP or other person is situated wholly or partly in India then

such a firm or AOP or other person is said to be resident in India.

Non-Resident: If the control and management of the affairs of a

firm or AOP or other person is situated outside India then such a

firm or AOP or other person is said to be non-resident in India.

CREATED BY CS ROZY JAIN 11

INDIVIDUAL & HUF AGE <60 YEARS

tax rate for FY 2018-19

INCOME TAX SLAB TAX RATE HEALTH & EDUCATION

CESS

Income up to Rs NO TAX

2,50,000*

Income from Rs 2,50,000 5% 4% of Income Tax

– Rs 5,00,000

Income from Rs 5,00,000 20% 4% of Income Tax

– 10,00,000

Income more than Rs 30% 4% of Income Tax

10,00,000

Surcharge: 10% of tax where total income exceeds Rs. 50 lakh

15% of tax where total income exceeds Rs. 1 crore

CREATED BY CS ROZY JAIN 12

SENIOR CITIZENS 60 -80 YEARS

tax rate for FY 2018-19 .

INCOME TAX SLAB TAX RATE HEALTH & EDUCATION

CESS

Income up to Rs NO TAX

300,000*

Income from Rs 3,00,000 5% 4% of Income Tax

– Rs 5,00,000

Income from Rs 5,00,000 20% 4% of Income Tax

– 10,00,000

Income more than Rs 30% 4% of Income Tax

10,00,000

Surcharge: 10% of tax where total income exceeds Rs. 50 lakh

15% of tax where total income exceeds Rs. 1 crore

CREATED BY CS ROZY JAIN 13

SUPER SENIOR CITIZENS 80 YEARS

ABOVE

INCOME TAX SLAB TAX RATE HEALTH & EDUCATION

CESS

Income up to Rs NO TAX

500,000*

Income from Rs 5,00,000 20% 4% of Income Tax

– 10,00,000

Income more than Rs 30% 4% of Income Tax

10,00,000

Surcharge: 10% of tax where total income exceeds Rs. 50 lakh

15% of tax where total income exceeds Rs. 1 crore

CREATED BY CS ROZY JAIN 14

DOMESTIC COMPANIES tax rate

for F.Y.2018-19

• Gross turnover upto 250 Cr. in the previous

year 25%

• Gross turnover exceeding 250 Cr. in the

previous year 30%

Surcharge:

7% of tax where total income exceeds Rs. 1 Crore

12% of tax where total income exceeds Rs. 10

Crore

Health & Education cess: 4% of tax plus

surcharge

CREATED BY CS ROZY JAIN 15

DEDUCTION IN RESPECT OF

INVESTMENTS

Section 80C provides for a deduction of

savings in specified modes of Investments

form gross total income. It is available only to

an Individual or HUF. The Maximum

permissible deduction is Rs.1.5 lakh along

with deduction u/s 80CCC & 80CCD.

CREATED BY CS ROZY JAIN 16

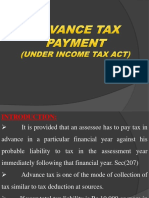

ADVANCE TAX

If your total tax liability is Rs 10,000 or more

in a financial year, you have to pay advance

tax. Advance tax applies to all taxpayers,

salaried, freelancers, and businesses. Senior

citizens, who are 60 years or older but do not

run a business, are exempt from paying

advance tax.

CREATED BY CS ROZY JAIN 17

DUE DATES OF PAYING ADVANCE TAX

FY 2018-19 FOR BOTH INDIVIDUAL & CORPORATE TAXPAYERS

Due Date Advance Tax Payable

On or before 15th June 15% of advance tax less advance tax already

paid

On or before 15th September 45% of advance tax less advance tax already

paid

On or before 15th December 75% of advance tax less advance tax already

paid

On or before 15th March 100% of advance tax less advance tax already

paid

Due Date for presumptive taxation scheme

by 15th March 100% of advance tax

CREATED BY CS ROZY JAIN 18

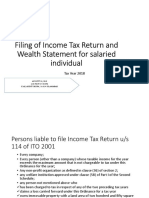

When to file income tax

return?

Status of taxpayer Due date

All individuals/assessees whose accounts are not required to be

audited (individuals, HUFs, Association of Persons, Body of 31st July of the

Individuals etc.) relevant

assessment year

Following persons whose accounts are required to be audited

A company

An individual or other entities whose accounts are required 30th September of

to be audited (like proprietorship, firm etc.) the relevant

A working partner of a firm assessment year

An assessee who is required to furnish report under section 92E

*Report under section 92E is submitted when a taxpayer has

undertaken international transactions during the relevant

financial year. Source: Tax2win.in. November 30 of the

relevant

CREATED BY CS ROZY JAIN 19

assessment year

Penalty for late filing

return

After 31st July but before 31st December Rs.

5000

1st January to March 31 Rs. 10000

For small taxpayers whose total income does

not exceed Rs 5 lakh, the maximum late fee

amount will not exceed Rs 1,000 irrespective

of when it is filed, i.e., before March 31

CREATED BY CS ROZY JAIN 20

Vous aimerez peut-être aussi

- Taxation: Unit 1: Income Tax Basic Concepts Residential Status and Incidence of TaxDocument32 pagesTaxation: Unit 1: Income Tax Basic Concepts Residential Status and Incidence of TaxnikkiPas encore d'évaluation

- Supplementary Paper 7 16 June2020 - RevisedDocument30 pagesSupplementary Paper 7 16 June2020 - RevisedINFO ACCPas encore d'évaluation

- Income From Salaries & House PropertyDocument59 pagesIncome From Salaries & House PropertyKuldeep SinghPas encore d'évaluation

- Income Tax in India - Wikipedia, The Free EncyclopediaDocument13 pagesIncome Tax in India - Wikipedia, The Free EncyclopediaAnonymous utfuIcnPas encore d'évaluation

- Income Tax Law & PracticeDocument60 pagesIncome Tax Law & Practicesebastianks94% (17)

- Supplementary Paper 7 16 June2020Document24 pagesSupplementary Paper 7 16 June2020avneetPas encore d'évaluation

- Income TaxDocument156 pagesIncome TaxApoorv90% (10)

- Income Tax Calculator Calculate Income Tax For FY 2022-23Document1 pageIncome Tax Calculator Calculate Income Tax For FY 2022-23Vivek LakkakulaPas encore d'évaluation

- Basics of Income TaxDocument21 pagesBasics of Income TaxAvPas encore d'évaluation

- Income Tax Act 1961Document17 pagesIncome Tax Act 1961Gaurav SharmaPas encore d'évaluation

- Senior Citizens and Super Senior Citizens For AY 2022-2023 - Income Tax DepartmentDocument10 pagesSenior Citizens and Super Senior Citizens For AY 2022-2023 - Income Tax DepartmentsudheeralladiPas encore d'évaluation

- Definition of Income TaxDocument14 pagesDefinition of Income Taxms_ssachinPas encore d'évaluation

- Direct Tax Study & Overview": Project Report On "Document28 pagesDirect Tax Study & Overview": Project Report On "Ashish SinghPas encore d'évaluation

- Income Tax Consultants in HyderabadDocument51 pagesIncome Tax Consultants in Hyderabadav consaltansPas encore d'évaluation

- Bba Income TaxDocument156 pagesBba Income TaxSalman Ansari100% (1)

- Tax Structure of Pakistan: (A Bird Eye View)Document16 pagesTax Structure of Pakistan: (A Bird Eye View)Kiran AliPas encore d'évaluation

- Unit-1 IT 2023-24Document11 pagesUnit-1 IT 2023-24avinashhpv7785Pas encore d'évaluation

- Introduction To Taxation - Student GuideDocument25 pagesIntroduction To Taxation - Student GuideRevankar B R ShetPas encore d'évaluation

- Taxation Flow PresentationDocument73 pagesTaxation Flow PresentationMohan ChoudharyPas encore d'évaluation

- Individual Taxation (Ay 2019-20)Document29 pagesIndividual Taxation (Ay 2019-20)Mudit SinghPas encore d'évaluation

- IPCC - FAST TRACK MATERIAL - 35e PDFDocument69 pagesIPCC - FAST TRACK MATERIAL - 35e PDFKunalKumarPas encore d'évaluation

- Note On Budget Proposals-2020Document4 pagesNote On Budget Proposals-2020Dhananjai SharmaPas encore d'évaluation

- Income Tax Basics in IndiaDocument5 pagesIncome Tax Basics in IndiaashankarPas encore d'évaluation

- CA Inter Short Notes 2019 20 PDFDocument89 pagesCA Inter Short Notes 2019 20 PDFPrashant KumarPas encore d'évaluation

- Taxation ProjectDocument23 pagesTaxation ProjectAkshata MasurkarPas encore d'évaluation

- Individual Txation FY 2019 20 With Demo of Return FilingDocument73 pagesIndividual Txation FY 2019 20 With Demo of Return FilingGanesh PPas encore d'évaluation

- Income From SalaryDocument103 pagesIncome From SalaryNAVEEN ROYPas encore d'évaluation

- Project Topic: Income Tax Systems in Pakistan, India & UKDocument53 pagesProject Topic: Income Tax Systems in Pakistan, India & UKAfzal RocksxPas encore d'évaluation

- Ajit Kumar SatapathyDocument32 pagesAjit Kumar Satapathyajitkumarsatapathy3Pas encore d'évaluation

- Unit I .II TAXDocument42 pagesUnit I .II TAXArpit MadaanPas encore d'évaluation

- Income Tax Calculations On Salaries and Other Income For The Assessment Year 2024Document20 pagesIncome Tax Calculations On Salaries and Other Income For The Assessment Year 2024ManoharanR Rajamanikam0% (1)

- Income Tax ReturnDocument57 pagesIncome Tax ReturnMalik WasimPas encore d'évaluation

- Income Tax On SalaryDocument23 pagesIncome Tax On SalarySarvesh MishraPas encore d'évaluation

- Chapter - 2 - 3 - TaxDocument17 pagesChapter - 2 - 3 - TaxAshek AHmedPas encore d'évaluation

- Direct Tax Chapter 1 To 10 AmendedDocument45 pagesDirect Tax Chapter 1 To 10 AmendedAsad RizviPas encore d'évaluation

- Introduction of Tax Sections Under It Act 1961 & Tax Slabs: SsignmentDocument19 pagesIntroduction of Tax Sections Under It Act 1961 & Tax Slabs: SsignmentRtr Sandeep ShekharPas encore d'évaluation

- DT AmendmentsDocument32 pagesDT AmendmentsDharshini AravamudhanPas encore d'évaluation

- Income TaxDocument19 pagesIncome TaxAkash VisputePas encore d'évaluation

- Corporate Tax ConceptsDocument20 pagesCorporate Tax ConceptsVandana ChambyalPas encore d'évaluation

- Charge of Income TaxDocument7 pagesCharge of Income TaxYuvi SinghPas encore d'évaluation

- Income Tax: Basic Concepts and TermsDocument17 pagesIncome Tax: Basic Concepts and TermsSahitya Kumar SheePas encore d'évaluation

- Income Tax Slabs & Rates For Assessment Year 2013-14Document37 pagesIncome Tax Slabs & Rates For Assessment Year 2013-14Jigar RavalPas encore d'évaluation

- UNIT 1 A Basics of Income TaxDocument43 pagesUNIT 1 A Basics of Income TaxWinsomeboi HoodlegendPas encore d'évaluation

- Volume 1 - 100 Pages May-Nov 21Document100 pagesVolume 1 - 100 Pages May-Nov 21ca shahPas encore d'évaluation

- 01 Important DefinitionsDocument7 pages01 Important DefinitionsmijjinPas encore d'évaluation

- TaxDocument508 pagesTaxCherry DuldulaoPas encore d'évaluation

- Portal Investment Proof Verification Guidelines 2022 23Document11 pagesPortal Investment Proof Verification Guidelines 2022 23yfiamataimPas encore d'évaluation

- Income Tax LawsDocument47 pagesIncome Tax LawsBhaskar MajumderPas encore d'évaluation

- Individual Txation FY 203 24Document44 pagesIndividual Txation FY 203 24Smarty ShivamPas encore d'évaluation

- ITP Exam Preparation GuideDocument46 pagesITP Exam Preparation GuideMyjudulPas encore d'évaluation

- Income Tax EXPLAINATIONDocument11 pagesIncome Tax EXPLAINATIONVishwas AgarwalPas encore d'évaluation

- C SinterDocument74 pagesC SinterSitaraman RamasamyPas encore d'évaluation

- Income Tax QuestionsDocument56 pagesIncome Tax Questionsridalo9588Pas encore d'évaluation

- Tax Deduction - DR Sajjad Wani JKASDocument26 pagesTax Deduction - DR Sajjad Wani JKASMohmad Yousuf100% (1)

- Indian Taxation SystemDocument15 pagesIndian Taxation SystemassatputePas encore d'évaluation

- Income Tax - IT Returns, E Filing, Tax Saving, Income Tax Slabs, Rules & Laws - All About Income TaxDocument6 pagesIncome Tax - IT Returns, E Filing, Tax Saving, Income Tax Slabs, Rules & Laws - All About Income TaxLAKSHMANARAO P100% (1)

- Law of Taxation ShivaniDocument29 pagesLaw of Taxation ShivaniShivani Singh ChandelPas encore d'évaluation

- Incoem Tax Final PDFDocument138 pagesIncoem Tax Final PDFRam IyerPas encore d'évaluation

- Paper 11 NEW GST PDFDocument399 pagesPaper 11 NEW GST PDFsomaanvithaPas encore d'évaluation

- GST Icai Volumeii 01012018 PDFDocument499 pagesGST Icai Volumeii 01012018 PDFGiri SukumarPas encore d'évaluation

- New Microsoft Office Excel WorksheetDocument1 pageNew Microsoft Office Excel WorksheetGiri SukumarPas encore d'évaluation

- GST Icai Volumeii 01012018 PDFDocument499 pagesGST Icai Volumeii 01012018 PDFGiri SukumarPas encore d'évaluation

- GST Icai Volumeii 01012018 PDFDocument499 pagesGST Icai Volumeii 01012018 PDFGiri SukumarPas encore d'évaluation

- GST Flyer 51 PDFDocument468 pagesGST Flyer 51 PDFGiri SukumarPas encore d'évaluation

- CFI Financial Modeling Best Practices 2018 Case ChampionshipsDocument84 pagesCFI Financial Modeling Best Practices 2018 Case Championshipshvsboua67% (6)

- IT & GST Ready ReckonerDocument43 pagesIT & GST Ready ReckonerNishant Sipani100% (1)

- Charge OF GST: After Studying This Chapter, You Will Be Able ToDocument49 pagesCharge OF GST: After Studying This Chapter, You Will Be Able ToGiri SukumarPas encore d'évaluation

- Accounting Entries Under GSTDocument43 pagesAccounting Entries Under GSTladmohanPas encore d'évaluation

- IT & GST Ready ReckonerDocument43 pagesIT & GST Ready ReckonerNishant Sipani100% (1)

- Refresher Course On GSTDocument144 pagesRefresher Course On GSTGiri SukumarPas encore d'évaluation

- IT & GST Ready ReckonerDocument43 pagesIT & GST Ready ReckonerNishant Sipani100% (1)

- Provisions of GST Effective From 1St April 2019Document3 pagesProvisions of GST Effective From 1St April 2019Giri SukumarPas encore d'évaluation

- Cbic 3rd Edition Faq December 15 2018 PDFDocument561 pagesCbic 3rd Edition Faq December 15 2018 PDFGiri SukumarPas encore d'évaluation

- Cbic 3rd Edition Faq December 15 2018 PDFDocument561 pagesCbic 3rd Edition Faq December 15 2018 PDFGiri SukumarPas encore d'évaluation

- Charge OF GST: After Studying This Chapter, You Will Be Able ToDocument49 pagesCharge OF GST: After Studying This Chapter, You Will Be Able ToGiri SukumarPas encore d'évaluation

- FAQs and MCQs On GST Sep18 PDFDocument523 pagesFAQs and MCQs On GST Sep18 PDFGiri SukumarPas encore d'évaluation

- CA Final GST QB Part IDocument72 pagesCA Final GST QB Part IAejaz MohamedPas encore d'évaluation

- Projected Profit and Loss, BISDocument13 pagesProjected Profit and Loss, BISGiri SukumarPas encore d'évaluation

- Scope of IncomeDocument46 pagesScope of IncomeSHRIKANT SAHUPas encore d'évaluation

- Provisions Before 1st Feb 2019Document3 pagesProvisions Before 1st Feb 2019Giri SukumarPas encore d'évaluation

- GST Entries For Every Month SalesDocument3 pagesGST Entries For Every Month SalesGiri Sukumar100% (1)

- GST Free Class: View GST Lecture at My Youtube ChannelDocument18 pagesGST Free Class: View GST Lecture at My Youtube ChannelGiri SukumarPas encore d'évaluation

- Paper 11 NEW GST PDFDocument399 pagesPaper 11 NEW GST PDFsomaanvithaPas encore d'évaluation

- 40 Tax Audit in Tally Erp 9Document15 pages40 Tax Audit in Tally Erp 9Giri SukumarPas encore d'évaluation

- Note On GST Input Tax Credit CA Yashwant KasarDocument32 pagesNote On GST Input Tax Credit CA Yashwant KasarGiri SukumarPas encore d'évaluation

- Model Agreement of Sale of Immovable PropertyDocument3 pagesModel Agreement of Sale of Immovable PropertyGiri SukumarPas encore d'évaluation

- 40 Tax Audit in Tally Erp 9Document15 pages40 Tax Audit in Tally Erp 9Giri SukumarPas encore d'évaluation

- Bond For Export of Goods or Services Without Payment of Integrated TaxDocument1 pageBond For Export of Goods or Services Without Payment of Integrated TaxGiri SukumarPas encore d'évaluation

- 80GDocument4 pages80GmahamayaviPas encore d'évaluation

- Investment Declaration Form FY 2019-20 v2Document5 pagesInvestment Declaration Form FY 2019-20 v2Rehan ElectronicsPas encore d'évaluation

- Tax Calculator StatementDocument1 pageTax Calculator Statementsanjoy2301Pas encore d'évaluation

- TAX - IPCC Amendment For Nov, 2013 Attempt (Carocks - Wordpress.com)Document84 pagesTAX - IPCC Amendment For Nov, 2013 Attempt (Carocks - Wordpress.com)Dushyant SinghaniaPas encore d'évaluation

- Tax Planning For SalaryDocument31 pagesTax Planning For SalaryAjit SwainPas encore d'évaluation

- Chapter 1 - Basic Concepts of Income Tax - AY - 20-21 PDFDocument16 pagesChapter 1 - Basic Concepts of Income Tax - AY - 20-21 PDFAbhishek VermaPas encore d'évaluation

- HR ProjectDocument55 pagesHR ProjectRakshit BhardwajPas encore d'évaluation

- Chapter 20 Income Tax AuthoritiesDocument15 pagesChapter 20 Income Tax AuthoritiesMohammed AathifPas encore d'évaluation

- Filing of Income Tax Return & Valuation of Assets in KAILASH SUSHIL & ASSOCIATESDocument52 pagesFiling of Income Tax Return & Valuation of Assets in KAILASH SUSHIL & ASSOCIATESSneha KumarPas encore d'évaluation

- Kotaka Form16 41970Document4 pagesKotaka Form16 41970sai_gsrajuPas encore d'évaluation

- Appeals Proceedings and Revision Under Income Tax ActDocument8 pagesAppeals Proceedings and Revision Under Income Tax ActmanikaPas encore d'évaluation

- Itr-V: Income Tax Return Verification Form IndianDocument1 pageItr-V: Income Tax Return Verification Form Indianapi-25886395Pas encore d'évaluation

- .Paper - V - Sec.I - Direct Taxes PDFDocument238 pages.Paper - V - Sec.I - Direct Taxes PDFMichelle MarkPas encore d'évaluation

- 53.income Tax Compliance Check ListDocument5 pages53.income Tax Compliance Check ListmercatuzPas encore d'évaluation

- CS Executive Tax Laws Suggested Answers-1Document21 pagesCS Executive Tax Laws Suggested Answers-1nehaPas encore d'évaluation

- SRB 25022019 CW 108462016Document16 pagesSRB 25022019 CW 108462016vsprajanPas encore d'évaluation

- FD - Form 15 - G - Oct 2015Document6 pagesFD - Form 15 - G - Oct 2015mohantamilPas encore d'évaluation

- Income Tax Calculator F.Y.12-13Document4 pagesIncome Tax Calculator F.Y.12-13reamer27Pas encore d'évaluation

- Advance Tax PaymentDocument12 pagesAdvance Tax Paymentsheetal100% (1)

- Cma Tax PaperDocument760 pagesCma Tax Paperritesh shrinewarPas encore d'évaluation

- Amity Global Business School: MBA, Semester 3 Corporate Tax Planning Ms. Kirandeep KaurDocument14 pagesAmity Global Business School: MBA, Semester 3 Corporate Tax Planning Ms. Kirandeep KaurAditya SinghPas encore d'évaluation

- Apfpm0726b 2019-20 (1527)Document2 pagesApfpm0726b 2019-20 (1527)Basant Kumar MishraPas encore d'évaluation

- Ac Group TreeDocument113 pagesAc Group TreeSabyasachiPas encore d'évaluation

- Scope of Total Income Under Section 5 - A General PerspectiveDocument15 pagesScope of Total Income Under Section 5 - A General PerspectiveAJAY BHATTPas encore d'évaluation

- Mylan Laboratories Limited: Payslip For The Month of APRIL 2017Document1 pageMylan Laboratories Limited: Payslip For The Month of APRIL 2017vediyappanPas encore d'évaluation

- Penalty Under Section 2711c Version 1.2 PDFDocument35 pagesPenalty Under Section 2711c Version 1.2 PDFSaurabhPas encore d'évaluation

- 42 Implementation of Tds in Tallyerp 9Document171 pages42 Implementation of Tds in Tallyerp 9P VenkatesanPas encore d'évaluation

- Assessment Under The It ActDocument34 pagesAssessment Under The It ActbhanumaaaPas encore d'évaluation

- Introduction To Income TaxDocument7 pagesIntroduction To Income Taxsipabow760Pas encore d'évaluation

- Form ITR-V and Acknowledgement FinalDocument4 pagesForm ITR-V and Acknowledgement FinalHarish100% (1)