Académique Documents

Professionnel Documents

Culture Documents

Sample Vertical Analysis - BS

Transféré par

Maribel ZafeDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Sample Vertical Analysis - BS

Transféré par

Maribel ZafeDroits d'auteur :

Formats disponibles

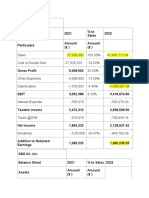

VERTICAL ANALYSIS

2017 2018

ASSETS

Current Assets

Cash 1,191.00 3.14% 2,030.50 4.26%

Marketable Securities 4,002.00 10.54% 2,636.00 5.53%

Accounts Receivable 4,383.50 11.55% 4,704.00 9.87%

Allowance for doubtful accounts -208.5 -0.55% -224 -0.47%

Inventories 18,384.50 48.44% 23,520.50 49.36%

Prepaid expenses 379.5 1.00% 256 0.54%

Total Current Assets 28,132.00 74.12% 32,923.00 69.09%

Property, Plant and Equipment

Land 405.5 1.07% 405.5 0.85%

Buildings and leasehold

5,964.00 15.71% 9,136.50

improvements 19.17%

Equipment 6,884.00 18.14% 10,761.50 22.58%

13,253.50 34.92% 20,303.50 42.61%

Less: accumulated depreciation

-3,765.00 -9.92% -5,764.00

and amortization -12.10%

Net Property, plant and

9,488.50 25.00% 14,539.50

equipment 30.51%

Other Assets 334 0.88% 186.5 0.39%

TOTAL ASSETS 37,954.50 100.00% 47,649.00 100.00%

LIABILITIES AND EQUITY

Current Liabilities

Accounts payable 3,795.50 10.00% 7,147.00 15.00%

Notes payable – banks 3,006.00 7.92% 2,807.00 5.89%

Current maturities of long term

758 2.00% 942

debt 1.98%

Accrued Liabilities 2,656.50 7.00% 2,834.50 5.95%

Total current liabilities 10,216.00 26.92% 13,730.50 28.82%

Deferred Income Taxes 317.5 0.84% 421.5

0.88%

Long-term Debt 8,487.50 22.36% 10,529.50 22.10%

TOTAL LIABILITIES 19,021.00 50.12% 24,681.50 51.80%

Equity

Ordinary shares,par value P1, 2,297.00 6.05% 2,401.50 5.04%

authorized 10,000,000 shares,

issued 2,297,000 shares in 2017

and 2,401,500 shares in 2018

Additional Paid-In Capital 455 1.20% 478.5 1.00%

Retained Earnings 16,181.50 42.63% 20,087.50 42.16%

TOTAL EQUITY 18,933.50 49.88% 22,967.50 48.20%

TOTAL LIABILITIES & EQUITY 37,954.50 100.00% 47,649.00 100.00%

0.00 0.00

Vous aimerez peut-être aussi

- Schaum's Outline of Basic Business Mathematics, 2edD'EverandSchaum's Outline of Basic Business Mathematics, 2edÉvaluation : 5 sur 5 étoiles5/5 (1)

- DR Lal Path Labs Financial Model - Ayushi JainDocument45 pagesDR Lal Path Labs Financial Model - Ayushi JainTanya SinghPas encore d'évaluation

- AirThreads Valuation SolutionDocument20 pagesAirThreads Valuation SolutionBill JoePas encore d'évaluation

- SRC HandoutDocument8 pagesSRC HandoutmangpatPas encore d'évaluation

- FABM1 Lesson-14 Accounting EquationDocument16 pagesFABM1 Lesson-14 Accounting EquationBP CabreraPas encore d'évaluation

- INDEMNITY BOND For Issue of Duplicate Share CertificateDocument4 pagesINDEMNITY BOND For Issue of Duplicate Share CertificatePiyush AgrawalPas encore d'évaluation

- Overview of MSRP System and Expenditure Process in UNHCRDocument18 pagesOverview of MSRP System and Expenditure Process in UNHCRchaxonePas encore d'évaluation

- Discounted Cash Flow: A Theory of the Valuation of FirmsD'EverandDiscounted Cash Flow: A Theory of the Valuation of FirmsPas encore d'évaluation

- ACCA Financial Management - Mock Exam 1 - 1000225 PDFDocument25 pagesACCA Financial Management - Mock Exam 1 - 1000225 PDFrash D100% (1)

- Forex U Turn - Manual PDFDocument59 pagesForex U Turn - Manual PDFDaniel NespriasPas encore d'évaluation

- A Report On - Npa in BankingDocument120 pagesA Report On - Npa in Bankingsachin99% (129)

- Financial Case Study Written ReportDocument7 pagesFinancial Case Study Written ReportYuna-chan Katsura100% (2)

- A Study On Investor Perception Towards Mutual FundsDocument68 pagesA Study On Investor Perception Towards Mutual FundsTom Salunkhe0% (1)

- Nestle Group FS AnalisysDocument7 pagesNestle Group FS Analisysablay logene50% (2)

- BF Financial ReportDocument19 pagesBF Financial ReportEryllPas encore d'évaluation

- Sample Trend AnalysisDocument2 pagesSample Trend AnalysisMaribel ZafePas encore d'évaluation

- NPV Function: Discount Rate Time Periods 2 3 4 Cash Flows NPV $35.9Document11 pagesNPV Function: Discount Rate Time Periods 2 3 4 Cash Flows NPV $35.9Ali Hussain Al SalmawiPas encore d'évaluation

- Oil and Natural Gas CorporationDocument43 pagesOil and Natural Gas CorporationNishant SharmaPas encore d'évaluation

- Working File - SIMDocument7 pagesWorking File - SIMmaica G.Pas encore d'évaluation

- Financial Table Analysis of ZaraDocument9 pagesFinancial Table Analysis of ZaraCeren75% (4)

- NilkamalDocument14 pagesNilkamalNandish KothariPas encore d'évaluation

- Financial Ration AnalysisDocument14 pagesFinancial Ration Analysisaq.dhonyPas encore d'évaluation

- FM FS For GlobeDocument5 pagesFM FS For GlobeIngrid garingPas encore d'évaluation

- PHILEX - V and H AnalysisDocument8 pagesPHILEX - V and H AnalysisHilario, Jana Rizzette C.Pas encore d'évaluation

- Financials WorksheetDocument3 pagesFinancials WorksheetSiddharthPas encore d'évaluation

- Horizontal Analaysis GLOBEDocument2 pagesHorizontal Analaysis GLOBEjerameelnacalaban1Pas encore d'évaluation

- Common Size Balance Sheet AnalysisDocument7 pagesCommon Size Balance Sheet AnalysisMuhammad AdnanPas encore d'évaluation

- FA Balance SheetDocument15 pagesFA Balance SheetPrakash BhanushaliPas encore d'évaluation

- KPR MillsDocument32 pagesKPR MillsSatyam1771Pas encore d'évaluation

- Titan Company TemplateDocument18 pagesTitan Company Templatesejal aroraPas encore d'évaluation

- Credit Memo For Gas Authority of IndiaDocument15 pagesCredit Memo For Gas Authority of IndiaKrina ShahPas encore d'évaluation

- Fsa B-32Document24 pagesFsa B-32Pihu MouryaPas encore d'évaluation

- Horizontal Analysis 2017 2016 Increase (Decrease) % of Change AssetsDocument20 pagesHorizontal Analysis 2017 2016 Increase (Decrease) % of Change AssetschenlyPas encore d'évaluation

- KPR Phase - 1Document23 pagesKPR Phase - 1Satyam1771Pas encore d'évaluation

- IFFCO Financial Statement AnalysisDocument2 pagesIFFCO Financial Statement AnalysisSuprabhat SealPas encore d'évaluation

- Lincoln Electric Itw - Cost Management ProjectDocument7 pagesLincoln Electric Itw - Cost Management Projectapi-451188446Pas encore d'évaluation

- FA of ItcDocument18 pagesFA of ItcSriya GuptaPas encore d'évaluation

- Phil HealthDocument9 pagesPhil Healthlorren ramiroPas encore d'évaluation

- Powergrid: Yash Bhuthada SAP ID - 74011919001Document32 pagesPowergrid: Yash Bhuthada SAP ID - 74011919001YASH BHUTADAPas encore d'évaluation

- AssessmentTask1 FinancialManagementDocument5 pagesAssessmentTask1 FinancialManagementChristian Paul LloverasPas encore d'évaluation

- 17pgp216 ApolloDocument5 pages17pgp216 ApolloVamsi GunturuPas encore d'évaluation

- BrelDocument5 pagesBrelAlfi NiloyPas encore d'évaluation

- Abbott Laboratories (Pakistan) Limited-1Document9 pagesAbbott Laboratories (Pakistan) Limited-1Shahrukh1994007Pas encore d'évaluation

- Review of Financial Statement Preparation Analysis and Interpretation Pt.8Document6 pagesReview of Financial Statement Preparation Analysis and Interpretation Pt.8ADRIANO, Glecy C.Pas encore d'évaluation

- VERTICAL ANALYSIS OF INCOME STATEMENT of Toyota 2022-2021Document8 pagesVERTICAL ANALYSIS OF INCOME STATEMENT of Toyota 2022-2021Touqeer HussainPas encore d'évaluation

- SUNDARAM CLAYTONDocument19 pagesSUNDARAM CLAYTONELIF KOTADIYAPas encore d'évaluation

- Final Task in Fundamentals of Accountancy, Business, and Management 2Document11 pagesFinal Task in Fundamentals of Accountancy, Business, and Management 2Apply Ako Work EhPas encore d'évaluation

- Relaxo Footwear - Updated BSDocument54 pagesRelaxo Footwear - Updated BSRonakk MoondraPas encore d'évaluation

- Balaji TelefilmsDocument23 pagesBalaji TelefilmsShraddha TiwariPas encore d'évaluation

- Hindustan Unilever LTD.: Executive Summary: Mar 2010 - Mar 2019: Non-Annualised: Rs. MillionDocument4 pagesHindustan Unilever LTD.: Executive Summary: Mar 2010 - Mar 2019: Non-Annualised: Rs. Millionandrew garfieldPas encore d'évaluation

- Apollo Hospitals Enterprise LimitedDocument10 pagesApollo Hospitals Enterprise LimitedHemendra GuptaPas encore d'évaluation

- Group AssignmentDocument6 pagesGroup Assignmentmai bannPas encore d'évaluation

- Minicase 2Document2 pagesMinicase 2TompelGEDE GTPas encore d'évaluation

- Liquidity RatioDocument10 pagesLiquidity RatioNadia ZahraPas encore d'évaluation

- Ha GSMDocument1 pageHa GSMVenus PalmencoPas encore d'évaluation

- Creative Sports Solution-RevisedDocument4 pagesCreative Sports Solution-RevisedRohit KumarPas encore d'évaluation

- Riel Corporation Comparative Statements of Financial Position December 31, 2015Document2 pagesRiel Corporation Comparative Statements of Financial Position December 31, 2015Rocel DomingoPas encore d'évaluation

- STI Education Systems Holdings Inc.: (Amount in Philippine Pesos)Document20 pagesSTI Education Systems Holdings Inc.: (Amount in Philippine Pesos)chenlyPas encore d'évaluation

- DCF TVSDocument17 pagesDCF TVSSunilPas encore d'évaluation

- Common Size AnalysisDocument8 pagesCommon Size AnalysisNadia ZahraPas encore d'évaluation

- ColgateDocument32 pagesColgateapi-3702531Pas encore d'évaluation

- Company: JK Tyre & Industries LTD: Common Size Balance Sheet (Rs in CRS)Document33 pagesCompany: JK Tyre & Industries LTD: Common Size Balance Sheet (Rs in CRS)Sowmya NamburuPas encore d'évaluation

- CH 32Document2 pagesCH 32Mukul KadyanPas encore d'évaluation

- IM ProjectDocument24 pagesIM ProjectDäzzlîñg HärîshPas encore d'évaluation

- Balance Sheet (Crore)Document10 pagesBalance Sheet (Crore)MOHAMMED ARBAZ ABBASPas encore d'évaluation

- Sbi Banlce SheetDocument1 pageSbi Banlce SheetANIKET VISHWANATH KURANEPas encore d'évaluation

- Assessment WorkbookDocument7 pagesAssessment WorkbookMiguel Pacheco ChicaPas encore d'évaluation

- REACTION PAPER - Strategic ManagementDocument2 pagesREACTION PAPER - Strategic ManagementMaribel ZafePas encore d'évaluation

- Alternative Modes of ProcurementDocument1 pageAlternative Modes of ProcurementMaribel ZafePas encore d'évaluation

- Advantages and Disadvantages of LeasingDocument1 pageAdvantages and Disadvantages of LeasingMaribel ZafePas encore d'évaluation

- Docu 1Document1 pageDocu 1Maribel ZafePas encore d'évaluation

- Assignment - Allied Food ProductDocument2 pagesAssignment - Allied Food ProductMaribel ZafePas encore d'évaluation

- Financial Ratio Analysis ProblemDocument6 pagesFinancial Ratio Analysis ProblemMaribel ZafePas encore d'évaluation

- NIB Bank 2011 PDFDocument190 pagesNIB Bank 2011 PDFzafarPas encore d'évaluation

- Bodie8ce FormulaSheet PDFDocument24 pagesBodie8ce FormulaSheet PDFSandini Dharmasena PereraPas encore d'évaluation

- Example:: Basis Assets LiabilitiesDocument23 pagesExample:: Basis Assets LiabilitiesAmbika Prasad ChandaPas encore d'évaluation

- Detailed Study On Hedging, Arbitrage and SpeculationDocument247 pagesDetailed Study On Hedging, Arbitrage and SpeculationSumit NamdevPas encore d'évaluation

- Due Diligence Planning, Questions, IssuesDocument224 pagesDue Diligence Planning, Questions, IssueshowierdPas encore d'évaluation

- L3 The Arbitrage Approach of Bond PricingDocument52 pagesL3 The Arbitrage Approach of Bond PricingVy HàPas encore d'évaluation

- Work Trial Invite 1Document2 pagesWork Trial Invite 1Mohseen MutvalliPas encore d'évaluation

- Assignment: Financial Management: Dividend - MeaningDocument4 pagesAssignment: Financial Management: Dividend - MeaningSiddhant gudwaniPas encore d'évaluation

- Gitman 4e Ch. 2 SPR - SolDocument8 pagesGitman 4e Ch. 2 SPR - SolDaniel Joseph SitoyPas encore d'évaluation

- Jurnal Terdahulu Audit DelayDocument3 pagesJurnal Terdahulu Audit DelayTutik Setia WatiPas encore d'évaluation

- Capital Market ProjectDocument81 pagesCapital Market ProjectMridul ChandraPas encore d'évaluation

- Docshare - Tips - Cash and Cash Equivalents PDFDocument10 pagesDocshare - Tips - Cash and Cash Equivalents PDFAMANDA0% (1)

- FINC600 Homework Template Week 3 Jan2013Document16 pagesFINC600 Homework Template Week 3 Jan2013joePas encore d'évaluation

- IA2 20 Shareholders' EquityDocument61 pagesIA2 20 Shareholders' EquityLawrence NarvaezPas encore d'évaluation

- Techcombank - The Leading Joint Stock Bank in VietnamDocument17 pagesTechcombank - The Leading Joint Stock Bank in VietnamkimishiPas encore d'évaluation

- 2013 Mar 19 - Glanbia PLCDocument19 pages2013 Mar 19 - Glanbia PLCalan_s1Pas encore d'évaluation

- 002 MAS FS Analysis Rev00 PDFDocument5 pages002 MAS FS Analysis Rev00 PDFCyvee Joy Hongayo OcheaPas encore d'évaluation

- Struktur OrganisasiDocument1 pageStruktur OrganisasiRoudaPas encore d'évaluation

- Global Money Dispatch: Credit Suisse EconomicsDocument3 pagesGlobal Money Dispatch: Credit Suisse EconomicsJay ZPas encore d'évaluation

- JPM US Market Intelligence Morning Briefing Futs HigherDocument25 pagesJPM US Market Intelligence Morning Briefing Futs HigherLuanPas encore d'évaluation

- MGT 4160 Fall 2012 Assignment 1Document3 pagesMGT 4160 Fall 2012 Assignment 1sirocco87Pas encore d'évaluation

- INF090I01569 - Franklin India Smaller Cos FundDocument1 pageINF090I01569 - Franklin India Smaller Cos FundKiran ChilukaPas encore d'évaluation