Académique Documents

Professionnel Documents

Culture Documents

Market Economy - How The Sun Is Shutting Down The Bull Run (Again)

Transféré par

kat perezTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Market Economy - How The Sun Is Shutting Down The Bull Run (Again)

Transféré par

kat perezDroits d'auteur :

Formats disponibles

Market Economy– How the Sun Is Shutting Down the Bull Run (Again)

Any trend in the global market economy is significantly attributed to the bull and bear market

cycles. Bull and bear markets are traditional economic indicators where investors could enhance

their investment strategies and understand the economic movements in every country. People

should know that under the bull market, the economic activity is characterised by growth, profit

and optimism while in bear market it is associated with the general sense of decline and

pessimism which tends to put fear in the minds of stockholders. Looking at the current economy

today, we can see that the market is slowly showing signs of weakness.

My Observation of the Stock Market

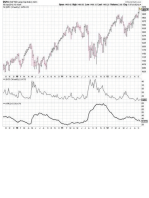

10 years, I’ve observed how the capital and business competition – consequently mass

psychology – relate to what WD Gann referred to as “Natural Law”, or, the “Law of Vibration”.

About 9 years into my study of time, I started to see dots connecting like string between crime

scene photos in some CSI detective show. Everything started lining up and emerging.

One of my first public verifications – was in fact a prediction I’d made for the last total solar

eclipse. I’d gone back and studied over 20 years of the event in question, and noticed that in

almost every instance, the market put in a very distinct “w” pattern, and rose due to the positive

economic growth from the lower leg of the “w” up past the highs after the eclipse.

Here’s a link to that video, if you’re interested in the study. You can go back and see for yourself

what happened the day after the eclipse – and compare it to my findings .

I Find Market Economy Patterns, All The Time

In my last YouTube video about the AUDUSD, I showed years of patterns – market economy

cycles that people and the society just forget to look for … and what to expect “vibrationally”.

I went back to the early 2000’s and marked everywhere there’s been an eclipse and where

modern economic reforms were not yet introduced. That’s nearly 20 years of eclipses.

I’VE GOT A VERY IMPORTANT CLASS FOR YOU TO DOWNLOAD AND WATCH

If you’re interested in understanding this economic theory being related to one of the biggest

market economy cycles of them all … the one that precedes every large recession and global

conflict … this class is for you.

This is not the “evangelist claims the end of the world” type stuff.

The kind of cycles that banks watch – and arguably start with their financial, social and political

influence.

Here’s the class – I gave it earlier this summer in my annual Las Vegas trading conference.

The market economy has been following the pattern I described in the video – identically since

then, you may look upon the pattern's advantages and disadvantages.

Just like the AUDUSD, just like the solar eclipse patterns.

Note: You MUST DOWNLOAD the file to view it on your PC. Dropbox is not a video player –

but will preview the video for a few minutes.

I promise this video will benefit you as this is based on science and cycles you can point to

factually.

Events that happen over and over and over again – if you’re watching.

I taught the class to 10 people. I’m giving you the opportunity to view this without fear of

violating any intellectual property rights – and share with as many people as you can before this

move happens.

Don’t say you weren’t warned.

Want to Know More about What We’ve Developed for the Trading Community?

Click HERE to take a video demo of the concepts behind our products source and resources –

and get on our newsletter list where we’ll send you free without any costs the intraday

predictions each week for popular futures and forex in financial institutions.

If you’d like to take a look at some of our end of day predictive software for traders like you – as

well as our line of intraday predictive TIME-based tools – please sign up for one of our webinars

and experience the exciting life of a trader.

WE HAVE DEMONSTRATION WEBINARS EACH WEEK:

Stocks and options /longer term swing trades (Meets every Tuesday)

https://attendee.gotowebinar.com/register/6385063425639321345

Intraday predictive signals for futures, equities, and Forex (Meets every Thursday)

https://attendee.gotowebinar.com/register/300000000004294770

You can also learn a lot about the flow of wealth in the different types of economies by

subscribing to our YouTube channel…

https://www.youtube.com/user/BackToTheFutureTradi

Thank you for your time – and remember – the market you trade is not random.

Conclusion

Investors could do much better if they knew what the future holds in the world economic trade

but we all know that stock and money market prices rise and fall unpredictably. By learning and

studying the past bull and bear cycles, investors will be alerted and be attuned to the market

economy as it changes. While we can’t know what lies ahead, knowledge on these economic

cycles would give investor a certain advantage in getting odds on their favor. This article has

provided the basic resources and references that will teach you the recurring patterns happened in

mixed economies, what causes their rise or fall, and therefore avoiding any material investment

losses.

For more on futures, read more articles here.

Market Economy– How the Sun Is Shutting Down the Bull Run (Again)

Any trend in the global market economy is significantly attributed to the bull and bear market

cycles. Bull and bear markets are traditional economic indicators where investors could enhance

their investment strategies and understand the economic movements in every country. People

should know that under the bull market, the economic activity is characterised by growth, profit

and optimism while in bear market it is associated with the general sense of decline and

pessimism which tends to put fear in the minds of stockholders. Looking at the current economy

today, we can see that the market is slowly showing signs of weakness.

My Observation of the Stock Market

10 years, I’ve observed how the capital and business competition – consequently mass

psychology – relate to what WD Gann referred to as “Natural Law”, or, the “Law of Vibration”.

About 9 years into my study of time, I started to see dots connecting like string between crime

scene photos in some CSI detective show. Everything started lining up and emerging.

One of my first public verifications – was in fact a prediction I’d made for the last total solar

eclipse. I’d gone back and studied over 20 years of the event in question, and noticed that in

almost every instance, the market put in a very distinct “w” pattern, and rose due to the positive

economic growth from the lower leg of the “w” up past the highs after the eclipse.

Here’s a link to that video, if you’re interested in the study. You can go back and see for yourself

what happened the day after the eclipse – and compare it to my findings .

I Find Market Economy Patterns, All The Time

In my last YouTube video about the AUDUSD, I showed years of patterns – market economy

cycles that people and the society just forget to look for … and what to expect “vibrationally”.

I went back to the early 2000’s and marked everywhere there’s been an eclipse and where

modern economic reforms were not yet introduced. That’s nearly 20 years of eclipses.

I’VE GOT A VERY IMPORTANT CLASS FOR YOU TO DOWNLOAD AND WATCH

If you’re interested in understanding this economic theory being related to one of the biggest

market economy cycles of them all … the one that precedes every large recession and global

conflict … this class is for you.

This is not the “evangelist claims the end of the world” type stuff.

The kind of cycles that banks watch – and arguably start with their financial, social and political

influence.

Here’s the class – I gave it earlier this summer in my annual Las Vegas trading conference.

The market economy has been following the pattern I described in the video – identically since

then, you may look upon the pattern's advantages and disadvantages.

Just like the AUDUSD, just like the solar eclipse patterns.

Note: You MUST DOWNLOAD the file to view it on your PC. Dropbox is not a video player –

but will preview the video for a few minutes.

I promise this video will benefit you as this is based on science and cycles you can point to

factually.

Events that happen over and over and over again – if you’re watching.

I taught the class to 10 people. I’m giving you the opportunity to view this without fear of

violating any intellectual property rights – and share with as many people as you can before this

move happens.

Don’t say you weren’t warned.

Want to Know More about What We’ve Developed for the Trading Community?

Click HERE to take a video demo of the concepts behind our products source and resources –

and get on our newsletter list where we’ll send you free without any costs the intraday

predictions each week for popular futures and forex in financial institutions.

If you’d like to take a look at some of our end of day predictive software for traders like you – as

well as our line of intraday predictive TIME-based tools – please sign up for one of our webinars

and experience the exciting life of a trader.

WE HAVE DEMONSTRATION WEBINARS EACH WEEK:

Stocks and options /longer term swing trades (Meets every Tuesday)

https://attendee.gotowebinar.com/register/6385063425639321345

Intraday predictive signals for futures, equities, and Forex (Meets every Thursday)

https://attendee.gotowebinar.com/register/300000000004294770

You can also learn a lot about the flow of wealth in the different types of economies by

subscribing to our YouTube channel…

https://www.youtube.com/user/BackToTheFutureTradi

Thank you for your time – and remember – the market you trade is not random.

Conclusion

Investors could do much better if they knew what the future holds in the world economic trade

but we all know that stock and money market prices rise and fall unpredictably. By learning and

studying the past bull and bear cycles, investors will be alerted and be attuned to the market

economy as it changes. While we can’t know what lies ahead, knowledge on these economic

cycles would give investor a certain advantage in getting odds on their favor. This article has

provided the basic resources and references that will teach you the recurring patterns happened in

mixed economies, what causes their rise or fall, and therefore avoiding any material investment

losses.

For more on futures, read more articles here.

Vous aimerez peut-être aussi

- The Dark Side of DeficitsDocument10 pagesThe Dark Side of Deficitsrichardck50Pas encore d'évaluation

- Socio FreePass - Elliott Wave InternationalDocument5 pagesSocio FreePass - Elliott Wave InternationalAmi KhazaPas encore d'évaluation

- Wyckoff Strategies Techniques Free ChaptersDocument8 pagesWyckoff Strategies Techniques Free Chaptersdorky0% (3)

- Wyckoff Strategies Techniques Free ChaptersDocument8 pagesWyckoff Strategies Techniques Free ChaptersMicaela Seisas0% (1)

- Dow Theory - From Bear Markets T - Michael YoungDocument21 pagesDow Theory - From Bear Markets T - Michael Youngtrader123100% (2)

- Script - When Is The Best Time To InvestDocument4 pagesScript - When Is The Best Time To InvestMayumi AmponPas encore d'évaluation

- The WSJ Guide to the 50 Economic Indicators That Really Matter: From Big Macs to "Zombie Banks," the Indicators Smart Investors Watch to Beat the MarketD'EverandThe WSJ Guide to the 50 Economic Indicators That Really Matter: From Big Macs to "Zombie Banks," the Indicators Smart Investors Watch to Beat the MarketÉvaluation : 4.5 sur 5 étoiles4.5/5 (13)

- Beginner's Guide to Understanding the Stock MarketDocument7 pagesBeginner's Guide to Understanding the Stock MarketTaif KhanPas encore d'évaluation

- Just a Trade a Day: Simple Ways to Profit from Predictable Market MovesD'EverandJust a Trade a Day: Simple Ways to Profit from Predictable Market MovesPas encore d'évaluation

- Cours 2011-2012 FinalDocument131 pagesCours 2011-2012 FinaljuldvxPas encore d'évaluation

- What Has QE Wrought?Document10 pagesWhat Has QE Wrought?richardck61Pas encore d'évaluation

- 2016 9 IceCap Global Market OutlookDocument18 pages2016 9 IceCap Global Market OutlookZerohedgePas encore d'évaluation

- PD - RMDocument13 pagesPD - RMLionel CayoPas encore d'évaluation

- Sam Perdue - Secrets of EW & Fibo Ratios RevealedDocument13 pagesSam Perdue - Secrets of EW & Fibo Ratios RevealedGabriel FooPas encore d'évaluation

- Dark Numbers Report, Nicola DelicDocument17 pagesDark Numbers Report, Nicola DelicmarozzottoPas encore d'évaluation

- Dow Theory - From Bear Markets T - Michael YoungDocument25 pagesDow Theory - From Bear Markets T - Michael YoungYigermal FantayePas encore d'évaluation

- Dividend Investing: The Beginner's Guide to Create Passive Income (Use the Power of Dividend Growth to Create a Winning Portfolio)D'EverandDividend Investing: The Beginner's Guide to Create Passive Income (Use the Power of Dividend Growth to Create a Winning Portfolio)Pas encore d'évaluation

- How To Avoid The Next Stock Market Crash (Liberated Stock Trader - Effective Investor Series Book 1)Document54 pagesHow To Avoid The Next Stock Market Crash (Liberated Stock Trader - Effective Investor Series Book 1)MAHIPas encore d'évaluation

- Forex Trading: 10 Golden Steps and Forex Investing Strategies to Become Profitable Trader in a Matter of Week! Used for Swing Trading, Momentum Trading, Day Trading, Scalping, Options, Stock Market!D'EverandForex Trading: 10 Golden Steps and Forex Investing Strategies to Become Profitable Trader in a Matter of Week! Used for Swing Trading, Momentum Trading, Day Trading, Scalping, Options, Stock Market!Évaluation : 4 sur 5 étoiles4/5 (1)

- Graham Sept1946Feb1947 CurrentProblemsinSecurityAnalysis Lecture1Document9 pagesGraham Sept1946Feb1947 CurrentProblemsinSecurityAnalysis Lecture1meenasureshkPas encore d'évaluation

- Welcome To The Exponential AgeDocument50 pagesWelcome To The Exponential AgeAJ Singh100% (1)

- Stock Market Investing for Beginners: The Keys to Protecting Your Wealth and Making Big Profits In a Market CrashD'EverandStock Market Investing for Beginners: The Keys to Protecting Your Wealth and Making Big Profits In a Market CrashPas encore d'évaluation

- A Case Study of SuccessDocument3 pagesA Case Study of SuccessHkStocksPas encore d'évaluation

- 10 Lessons EbookDocument20 pages10 Lessons EbookelisaPas encore d'évaluation

- Elliott Wave - Fibonacci High Probability Trading: Master The Wave Principle And Market Timing With Proven StrategiesD'EverandElliott Wave - Fibonacci High Probability Trading: Master The Wave Principle And Market Timing With Proven StrategiesÉvaluation : 4.5 sur 5 étoiles4.5/5 (9)

- "A CRIME STORY LIKE NO OTHER IN HISTORY" Inside JobDocument12 pages"A CRIME STORY LIKE NO OTHER IN HISTORY" Inside Jobgedankenverbrecher2009Pas encore d'évaluation

- WykoffDocument48 pagesWykoffNavin Ratnayake100% (1)

- The Meltdown Years: The Unfolding of the Global Economic CrisisD'EverandThe Meltdown Years: The Unfolding of the Global Economic CrisisPas encore d'évaluation

- Maximum Adverse ExcursionDocument169 pagesMaximum Adverse ExcursionEriz50% (2)

- FINANCIAL MARKETS The Best Beginner’s Guide: How to Master Bonds, Cryptocurrency, Options, Stocks and Achiving your Financial GoalsD'EverandFINANCIAL MARKETS The Best Beginner’s Guide: How to Master Bonds, Cryptocurrency, Options, Stocks and Achiving your Financial GoalsPas encore d'évaluation

- Könyvek - Jenkins & Gann - Complete Stock Market TradingDocument307 pagesKönyvek - Jenkins & Gann - Complete Stock Market TradingTőzsdeOkosságok92% (79)

- The Economic Singularity: by John MauldinDocument10 pagesThe Economic Singularity: by John Mauldinrichardck61Pas encore d'évaluation

- Recession-Proof Real Estate Investing: How to Survive (and Thrive!) During Any Phase of the Economic CycleD'EverandRecession-Proof Real Estate Investing: How to Survive (and Thrive!) During Any Phase of the Economic CycleÉvaluation : 5 sur 5 étoiles5/5 (3)

- Stock Trading: Dos And Don’ts To Make Stock Trading Profitable Even In Economic UncertaintiesD'EverandStock Trading: Dos And Don’ts To Make Stock Trading Profitable Even In Economic UncertaintiesÉvaluation : 4.5 sur 5 étoiles4.5/5 (3)

- Understanding Asset Allocation - Victor CantoDocument337 pagesUnderstanding Asset Allocation - Victor CantoSunghoo Yang100% (1)

- Fifty Economic Fallacies Exposed (Revised)D'EverandFifty Economic Fallacies Exposed (Revised)Évaluation : 4 sur 5 étoiles4/5 (1)

- VSL 1 - A Financial Market StrategyDocument7 pagesVSL 1 - A Financial Market StrategyJoão Vitor Albuquerque BezerraPas encore d'évaluation

- Stock Market Investing for Beginners: How to Successfully Invest in Stocks, Guarantee Your Fair Share Returns, Growing Your Wealth, and Choosing the Right Day Trading Strategies for the Long RunD'EverandStock Market Investing for Beginners: How to Successfully Invest in Stocks, Guarantee Your Fair Share Returns, Growing Your Wealth, and Choosing the Right Day Trading Strategies for the Long RunPas encore d'évaluation

- 10 "The Rediscovered Benjamin Graham"Document6 pages10 "The Rediscovered Benjamin Graham"X.r. GePas encore d'évaluation

- Why Financial Markets Rise Slowly but Fall Sharply: Analysing market behaviour with behavioural financeD'EverandWhy Financial Markets Rise Slowly but Fall Sharply: Analysing market behaviour with behavioural financePas encore d'évaluation

- Trading Mastery School 2 - Laurens BensdorpDocument38 pagesTrading Mastery School 2 - Laurens Bensdorphenryjove33Pas encore d'évaluation

- Coffee With Oecds GsDocument21 pagesCoffee With Oecds GskpontiosPas encore d'évaluation

- Part I Kris Matthews The Gestalt ShiftDocument12 pagesPart I Kris Matthews The Gestalt ShiftOlamide Afolabi AyodejiPas encore d'évaluation

- Hither and WhenceDocument13 pagesHither and WhenceHmt NmslPas encore d'évaluation

- 2022-09-08 - Hward Marks Memo - Illusion-of-KnowledgeDocument14 pages2022-09-08 - Hward Marks Memo - Illusion-of-KnowledgeappujisPas encore d'évaluation

- How The SEC Subsidizes StocksDocument5 pagesHow The SEC Subsidizes StocksJeffery ScottPas encore d'évaluation

- Manipulating the World Economy: The Rise of Modern Monetary Theory & the Inevitable Fall of Classical Economics — Is there an Alternative?D'EverandManipulating the World Economy: The Rise of Modern Monetary Theory & the Inevitable Fall of Classical Economics — Is there an Alternative?Évaluation : 5 sur 5 étoiles5/5 (2)

- 1997 - Maximum Adverse Excursion - John SweeneyDocument169 pages1997 - Maximum Adverse Excursion - John SweeneyCarlosPas encore d'évaluation

- The Blue Chip Report: Important - Variation in ResultsDocument7 pagesThe Blue Chip Report: Important - Variation in Resultsanalyst_anil14Pas encore d'évaluation

- Armstrong Economics Manual ModelsDocument93 pagesArmstrong Economics Manual ModelsLotus NagaPas encore d'évaluation

- Reflection Paper - FINMARDocument2 pagesReflection Paper - FINMAREidel PantaleonPas encore d'évaluation

- Understanding Market CyclesDocument7 pagesUnderstanding Market CyclesAndyPas encore d'évaluation

- Market Cycle Timing and Forecast 2016 2017 PDFDocument22 pagesMarket Cycle Timing and Forecast 2016 2017 PDFsravanPas encore d'évaluation

- Market Cycle Timing and Trend Direction are Keys to Trading SuccessDocument22 pagesMarket Cycle Timing and Trend Direction are Keys to Trading SuccesspravinyPas encore d'évaluation

- 2022 HO 47 Chairs Cases Labor LawDocument21 pages2022 HO 47 Chairs Cases Labor Lawkat perezPas encore d'évaluation

- B.PQF - Annex B - ADMINDocument2 pagesB.PQF - Annex B - ADMINkat perezPas encore d'évaluation

- HSAC INFO For IEC 2Document23 pagesHSAC INFO For IEC 2kat perez100% (1)

- MC 2023 01 NpoDocument4 pagesMC 2023 01 Npokat perezPas encore d'évaluation

- Daily Tribune March 23 2023 newsDocument4 pagesDaily Tribune March 23 2023 newskat perezPas encore d'évaluation

- MC 2021 PDFDocument16 pagesMC 2021 PDFkat perezPas encore d'évaluation

- Memo - Automatic Extension of The 30 Day Grace PeriodDocument2 pagesMemo - Automatic Extension of The 30 Day Grace Periodkat perezPas encore d'évaluation

- Assignment Preference Form (Apf) - Part 1Document2 pagesAssignment Preference Form (Apf) - Part 1kat perezPas encore d'évaluation

- MC 2023 02 NpoDocument12 pagesMC 2023 02 Npokat perezPas encore d'évaluation

- MC2011 04 Legal Interpretation of Art 42 of The Phil Coop Code of 2008 (RA9520)Document3 pagesMC2011 04 Legal Interpretation of Art 42 of The Phil Coop Code of 2008 (RA9520)Hazel Toledo MartinezPas encore d'évaluation

- MC 2023 04 NpoDocument5 pagesMC 2023 04 Npokat perezPas encore d'évaluation

- MC 2021 PDFDocument16 pagesMC 2021 PDFkat perezPas encore d'évaluation

- Sample Letter of Complaint About InsuranpeceDocument1 pageSample Letter of Complaint About InsuranpecesivaPas encore d'évaluation

- C:/Users/User/Documents/Letters/Outgoing/Memo Circular/Mc - Utilization of CDFDocument2 pagesC:/Users/User/Documents/Letters/Outgoing/Memo Circular/Mc - Utilization of CDFkat perezPas encore d'évaluation

- ART. 86. Order of Distribution. - The Net Surplus of Every Cooperative ShallDocument3 pagesART. 86. Order of Distribution. - The Net Surplus of Every Cooperative Shallkat perez100% (1)

- Manual On DLCDDocument43 pagesManual On DLCDQhyle MiguelPas encore d'évaluation

- Final (Cda) - MC 2021-003Document22 pagesFinal (Cda) - MC 2021-003kat perezPas encore d'évaluation

- Envelope HearingDocument1 pageEnvelope Hearingkat perezPas encore d'évaluation

- Policy Change Form v2 Final FormDocument2 pagesPolicy Change Form v2 Final Formkat perezPas encore d'évaluation

- Policy Change Form v2 Final FormDocument2 pagesPolicy Change Form v2 Final Formkat perezPas encore d'évaluation

- IPCR BlankDocument5 pagesIPCR Blankkat perezPas encore d'évaluation

- Enroll Sibling's Account for LoanDocument1 pageEnroll Sibling's Account for Loankat perezPas encore d'évaluation

- Ateneo Law School 2018 Pre-Bar Review ProgramDocument1 pageAteneo Law School 2018 Pre-Bar Review Programmarmiedyan9517Pas encore d'évaluation

- Sample Order To Show CauseDocument3 pagesSample Order To Show CauseChe TolentinoPas encore d'évaluation

- Ra 9520Document2 pagesRa 9520kat perezPas encore d'évaluation

- Gms Family Fund Payroll Deduction FormDocument1 pageGms Family Fund Payroll Deduction Formkat perezPas encore d'évaluation

- New Applicants PDFDocument6 pagesNew Applicants PDFStella LynPas encore d'évaluation

- Poli Bar Exam 2018Document9 pagesPoli Bar Exam 2018kat perezPas encore d'évaluation

- BAR Requirement Form (Repeater) PDFDocument6 pagesBAR Requirement Form (Repeater) PDFAlhaimah MadzamanPas encore d'évaluation

- Provident Fund - SampleDocument1 pageProvident Fund - Samplekat perezPas encore d'évaluation

- Agile Integrated Facilities MaintenanceDocument8 pagesAgile Integrated Facilities MaintenanceCarlos Ernesto Flores AlbinoPas encore d'évaluation

- Apr 21Document1 pageApr 21pavan kumarPas encore d'évaluation

- AIA CES Provider Audit GuideDocument6 pagesAIA CES Provider Audit GuideRoland CepedaPas encore d'évaluation

- Case 1Document4 pagesCase 1nisha gauchanPas encore d'évaluation

- Government of Rajasthan Public Health Engineering Department (Rajasthan)Document29 pagesGovernment of Rajasthan Public Health Engineering Department (Rajasthan)ashutoshpower2007Pas encore d'évaluation

- Company Law Course Outline 2023Document8 pagesCompany Law Course Outline 2023Louisa Hasford100% (1)

- RoutledgeHandbooks 9780203713303 Chapter3Document57 pagesRoutledgeHandbooks 9780203713303 Chapter3samyghallabPas encore d'évaluation

- Industrial Relations and Labour LawDocument123 pagesIndustrial Relations and Labour LawResham SoniPas encore d'évaluation

- Essai - Officialstatistic - 19611155 - M.paris Ramdoni Rasantaka - DDocument6 pagesEssai - Officialstatistic - 19611155 - M.paris Ramdoni Rasantaka - DParis RamdaniPas encore d'évaluation

- Chapter 2Document22 pagesChapter 2Hiếu NguyễnPas encore d'évaluation

- CAIIB-ABM-FORMULADocument3 pagesCAIIB-ABM-FORMULAVasimPas encore d'évaluation

- Employee Retention Strategies in Indian Hotel SectorDocument56 pagesEmployee Retention Strategies in Indian Hotel SectorsalmanPas encore d'évaluation

- #46. Linton Commercial Co., Inc. v. Hellera, G.R. No. 163147, October 10, 2007Document2 pages#46. Linton Commercial Co., Inc. v. Hellera, G.R. No. 163147, October 10, 2007delantar.john31Pas encore d'évaluation

- Effective Resume: The First Step Toward Landing Your JobDocument23 pagesEffective Resume: The First Step Toward Landing Your JobDhaval VikamseyPas encore d'évaluation

- Full Package - New Driver Aplication PDFDocument11 pagesFull Package - New Driver Aplication PDFdina junu100% (1)

- Partnership or Power Play? How Europe Should Bring Development Into Its Trade Deals With African, Caribbean, and Pacific CountriesDocument49 pagesPartnership or Power Play? How Europe Should Bring Development Into Its Trade Deals With African, Caribbean, and Pacific CountriesOxfamPas encore d'évaluation

- Potential Failure Mode and Effects Analysis (Fmea) Reference Manual Fourth Edition (Pdfdrive)Document150 pagesPotential Failure Mode and Effects Analysis (Fmea) Reference Manual Fourth Edition (Pdfdrive)Filip MoravčíkPas encore d'évaluation

- Business Plan For Kingdom Kids Day CareDocument9 pagesBusiness Plan For Kingdom Kids Day CareJeremy OrtegaPas encore d'évaluation

- 1 - SAP Extended Warehouse ManagementDocument45 pages1 - SAP Extended Warehouse ManagementMahesh Mokashi100% (2)

- Roles and Functions of Housekeeping PersonnelDocument26 pagesRoles and Functions of Housekeeping PersonnelEni Syafina RoslanPas encore d'évaluation

- Chapter - 5 Time & Value of SupplyDocument16 pagesChapter - 5 Time & Value of SupplyRaja BahlPas encore d'évaluation

- SAP S4 HANA FunctionalitiesDocument3 pagesSAP S4 HANA FunctionalitiesEduardo Padilla100% (1)

- Massachusetts - ITS55 - IBM Passport Advantage Software Pricing 05-10-2022 Vrs2Document4 994 pagesMassachusetts - ITS55 - IBM Passport Advantage Software Pricing 05-10-2022 Vrs2Justice MapangaPas encore d'évaluation

- Job JD Graphic Designer 15dec22Document1 pageJob JD Graphic Designer 15dec22Anil KumarPas encore d'évaluation

- Moa PascualDocument2 pagesMoa PascualChie LouPas encore d'évaluation

- Math-Third Summative Testq1Document2 pagesMath-Third Summative Testq1LORNA CABALUPas encore d'évaluation

- MGP 2024 Cohort 4 Half Length Test 16 Sol HindiDocument18 pagesMGP 2024 Cohort 4 Half Length Test 16 Sol Hindiphoenix7732678Pas encore d'évaluation

- The Financial System and The Role of Money in The Society Activity 1Document5 pagesThe Financial System and The Role of Money in The Society Activity 1Bascos Ryean ColeenPas encore d'évaluation

- Accounts QN PaperDocument8 pagesAccounts QN PaperNandhini ShanmugamPas encore d'évaluation

- CA Inter Advanced Accounting Full Test 1 May 2023 Unscheduled Test Paper 1674112111Document20 pagesCA Inter Advanced Accounting Full Test 1 May 2023 Unscheduled Test Paper 1674112111pari maheshwariPas encore d'évaluation