Académique Documents

Professionnel Documents

Culture Documents

FM Merger and Aques

Transféré par

Mayank Singh Rawat0 évaluation0% ont trouvé ce document utile (0 vote)

32 vues6 pagesMerger And Acquisition Of Jaypee By Ultratech

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentMerger And Acquisition Of Jaypee By Ultratech

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

32 vues6 pagesFM Merger and Aques

Transféré par

Mayank Singh RawatMerger And Acquisition Of Jaypee By Ultratech

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 6

DOON BUSINESS

SCHOOL

DEHRADUN, UTTARAKHAND

ASSIGNMENT OF FM

REPORT

ACQUISITION OF JAYPEE BY

ULTRATECH CEMENT

SUBMITTED TO: SUBMITTED BY:

DR. SHALINI SINGH MAYANK SINGH RAWAT

SHASHWAT VIKRAM SINGH

MBA-BASE-2ND SEM

UltraTech Cement-Jaypee Group

Deal size: Rs 16,189 crore

UltraTech Cement completed the USD 2.54 billion acquisition of Jaiprakash Associates' six

integrated cement plants and five grinding units, having a capacity of 21.2 million tonnes last

year. Post-acquisition, UltraTech has become the fourth largest cement player globally,

excluding Chinese players. The deal has also helped Jaypee Group, which can reduce its debt

that runs into thousands of crores of rupees.

Strategic move by Ultratech cement Acquisition of Jaypee Cement Gujarat unit by Ultratech

is one of the largest domestic M&A deals of recent times. Aditya Birla group has acquired

the Jaypee Cement Corporation’s (JCCL) Gujarat unit for Rs 3800 crores. The Deal The deal

was finalized on 12th September 2013. It is to be completed in seven to nine months and it

will give Ultratech entry into Gujarat. For the Jaypee group, it will help cut a portion of its

Rs. 55,000 crores debt. Ultratech will take over all assets and liabilities of the Gujarat unit at

closing and the consideration will be the enterprise value less liability taken over. Birla, has

planned to finance the acquisition through equity of Rs.150 crores, debts worth Rs.2000 crore

and the reminder of Rs.1650 crore through internal accruals. Rationale of the deal the

chairman of Ultratech Cement Kumar Mangalam Birla announced that with this acquisition

of 4.8 million tonnes capacity, their installed capacity will increase to 59 million tonnes per

annum. With new expansion plans in Karnataka, Rajasthan and Madhya Pradesh set to go on

stream by 2015, Ultratech’s capacity is expected to touch 70mtpa, thus further strengthening

their market leadership. The deal will give a stronger production base to Ultratech in Gujarat

to serve the local market; the deal will also strengthen their coastal footprint, enabling them

to cater to other regions as well as exports. Ultratech will also benefit from the Rs.350-380

crores unrealized depreciation and tax set-off against the losses incurred by Jaypee Cement.

For Jaypee associations, this may be only the first of the moves to trim the Rs55,000 crore

debt it carried on its books as of March this year. Jaypee Cement had Rs.350 crores of carry

forward losses. The sale of the Gujarat Cement plant will reduce Jaypee group’s debt by

Rs.3650 crore. I perceive the deal as the important move for Ultratech in its expansion

strategy. Operational synergies are expected from this deal. Before this acquisition Ultratech

was country’s 2nd largest cement company. This acquisition will not dilute the ranking for

the company but it seems to provide advantage to Ultratech in competitive positioning. The

deal is equally significant for JP cement, it will help company cut its debt by 6.63%. If we

compare the valuation of Jaypee Cement with its peer, this restructuring plan seems to be a

distress sale for the company. Looking at top 5 cement companies in India in terms of

production capacity, ACC Ltd head the list followed by Ultratech Cement, Jaypee Cement,

Ambuja Cement and India Cement. After the transaction the Jaypee Group’s Cement will

come down to 33 million tonnes and it will continue to be the 3rd largest cement

manufacturer in the country.

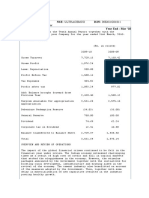

Balance sheet of UltraTech Cement before and after Merger is Given

below

Mar 17 Mar 16

12 months 12 mths

Equity Share Capital 274.51 274.43

Total Share Capital 274.51 274.43

Reserves and Surplus 23,666.50 21,357.40

Total Reserves and Surplus 23,666.50 21,357.40

Total Shareholders’ Funds 23,941.01 21,631.83

Long Term Borrowings 4,200.12 2,667.89

Deferred Tax Liabilities [Net] 2,773.56 2,431.99

Other Long-Term Liabilities 37.27 7.98

Long Term Provisions 270.73 252.73

Total Non-Current Liabilities 7,281.68 5,360.59

Short Term Borrowings 1,015.84 2,338.75

Trade Payables 1,713.80 1,581.46

Other Current Liabilities 5,169.33 7,216.08

Short Term Provisions 159.43 161.86

Total Current Liabilities 8,058.40 11,298.15

Total Capital and Liabilities 39,281.09 38,290.57

Tangible Assets 22,898.23 22,376.71

Intangible Assets 333.53 310.83

Capital Work-In-Progress 877.76 1,414.48

Intangible Assets Under Development 0.63 1.08

Fixed Assets 24,110.15 24,103.10

Non-Current Investments 2,002.72 3,433.20

Long Term Loans and Advances 55.53 65.89

Other Non-Current Assets 637.64 952.93

Total Non-Current Assets 26,806.04 28,555.12

Current Investments 5,405.95 2,359.98

Inventories 2,224.99 2,277.61

Trade Receivables 1,276.17 1,414.89

Cash and Cash Equivalents 2,217.74 2,235.20

Short Term Loans and Advances 123.95 118.99

Other Current Assets 1,226.25 1,328.78

Total Current Assets 12,468.35 9,721.00

Total Assets 39,281.09 38,290.57

Contingent Liabilities 6,180.58 4,531.96

Raw Materials 0.00 0.00

Stores, Spares and Loose Tools 0.00 0.00

Capital Goods 0.00 0.00

Expenditure in Foreign Currency 0.00 0.00

Dividend Remittance in Foreign Currency - -

FOB Value of Goods - -

Other Earnings - -

Bonus Equity Share Capital - -

Non-Current Investments Quoted Market Value 605.90 408.34

Non-Current Investments Unquoted Book Value 1,396.82 3,024.86

Current Investments Quoted Market Value 109.16 10.36

Current Investments Unquoted Book Value 5,296.79 2,349.62

Impact of the deal on UltraTech:

With this acquisition of 4.8 mtpa capacity, installed capacity of UltraTech will

increase to 59 mtpa, which would further strengthen the market leadership of

UltraTech in Indian cement sector.

The acquisition would meet the need of UltraTech to enhance capacity in

Gujarat:

Cement market in Gujarat grew at 11.7 per cent in the last seven years;

also, Gujarat is strategically well located from the point of view of exports;

Existing plant of UltraTech in Saurashtra, Gujarat is presently operating at 95%

capacity and they need optimal volumes to feed into Mumbai, Kochi and Sri

Lanka where they have grinding units. UltraTech required additional volume to

serve local, coastal & export markets.

UltraTech lost volume in Gujarat post disposal of Shree Digvijay Cement Co.

Ltd.;

UltraTech had built capacities in all zones, except Gujarat region;

Access to a jetty would also enable UltraTech to ship cement to new markets

UltraTech proposes to increase the capacity utilisation at the JCCL plants from

62% to 85% in the coming years. With this along with other measures such as

increase in operational efficiency, increase in the proportion of blended cement

from current 15%, increase in trade sales from current 35% and with conversion

of Jaypee brand into the UltraTech brand, UltraTech anticipate to increase the

operational performance of acquired unit.

UltraTech is expecting synergy gain of approx. Rs 30-40 core a year from this

deal on account of manufacturing, marketing and supply chain synergies.

UltraTech has an existing plant in Saurashtra, Gujarat and now with the

acquired assets of JCCL in Kutch, synergistic benefits will increase on

increased coastal and clinker movement.

The grinding units of JCCL will help UltraTech cut its logistics expenses due to

proximity to key markets.

With around 5479 hectares of land and 500MT of mining reserves, there is a

potential for UltraTech to double the capacity at the acquired cement unit in the

near future. In view of this, UltraTech believe that the transaction will be value

accretive in the next three years.

Acquisition comprised of the high quality recently commissioned cement plant

with latest technology with immediate cash generation potential.

UltraTech will also benefit from the tax perspective on account of carried

forward business losses and unabsorbed depreciation of the acquired unit of

approx. Rs 350 crore.

Impact of the deal on Jaypee Group:

After the transaction, the Jaypee Group’s cement capacity will come down to

33 mtpa and it will continue to be the third-largest cement manufacturer in the

country after Aditya Birla Group and Holcim Group.

The deal will help Jaypee Group pare its mounting debt of Rs 55,000 crore by

around Rs 3650 crore.

Vous aimerez peut-être aussi

- Guidebook for Demand Aggregation: Way Forward for Rooftop Solar in IndiaD'EverandGuidebook for Demand Aggregation: Way Forward for Rooftop Solar in IndiaPas encore d'évaluation

- ..Balance Sheet and Profit & Loss Account Top 5 Cement Comapanies in India .Document14 pages..Balance Sheet and Profit & Loss Account Top 5 Cement Comapanies in India .Pranav JoshiPas encore d'évaluation

- Introduction:-: Mission & VisionDocument10 pagesIntroduction:-: Mission & Visionzalaks100% (5)

- Director ReportDocument3 pagesDirector ReportZeeshan AzizPas encore d'évaluation

- Ultratech Cement Bse: 532538 Nse: Ultracemco Isin: Ine481G01011 Industry: Cement - Major Directors Report Year End: Mar '10Document7 pagesUltratech Cement Bse: 532538 Nse: Ultracemco Isin: Ine481G01011 Industry: Cement - Major Directors Report Year End: Mar '10Anushree Harshaj GoelPas encore d'évaluation

- Nagrajuna Construction CompanyDocument7 pagesNagrajuna Construction CompanyMeghna SamarthPas encore d'évaluation

- Performance Evaluation and Ratio Analysis - Meghna Cement - R1Document11 pagesPerformance Evaluation and Ratio Analysis - Meghna Cement - R1Sayed Abu Sufyan100% (1)

- School of Law Faculty of Mittal School of Business Name of The Faculty Member LIPIKA DHINGRADocument19 pagesSchool of Law Faculty of Mittal School of Business Name of The Faculty Member LIPIKA DHINGRAKathuria AmanPas encore d'évaluation

- Balance Sheet of Jindal Steel and Power Limited As On 31 ST March 2019Document8 pagesBalance Sheet of Jindal Steel and Power Limited As On 31 ST March 2019Chirag SinghPas encore d'évaluation

- Annual Report 2022 23Document176 pagesAnnual Report 2022 23Avinash ChauhanPas encore d'évaluation

- Escorts Kubota Limited FinalDocument23 pagesEscorts Kubota Limited FinalRidhi BagariPas encore d'évaluation

- Balance Sheet of GTL: Unsecured LoansDocument7 pagesBalance Sheet of GTL: Unsecured LoansMeryl FernsPas encore d'évaluation

- Lucky Cement Merge With Dadabhoy CementDocument9 pagesLucky Cement Merge With Dadabhoy CementMuhammad NaveedPas encore d'évaluation

- Electrosteel Steels Limited - Annual Report 2018-19Document88 pagesElectrosteel Steels Limited - Annual Report 2018-19dilip kumarPas encore d'évaluation

- FAC Project ReportDocument16 pagesFAC Project Reportmini nivalPas encore d'évaluation

- Fra Project Report-Bajaj Auto Ltd. Vs Hero Motocorp Ltd. (Group-X)Document10 pagesFra Project Report-Bajaj Auto Ltd. Vs Hero Motocorp Ltd. (Group-X)Shaurya Jaiswal100% (1)

- Mergers & Acquisition: As A Strategic Concept: Submitted To: Prof. Rajan GDocument51 pagesMergers & Acquisition: As A Strategic Concept: Submitted To: Prof. Rajan GRam AgrawalPas encore d'évaluation

- BEMLDocument7 pagesBEMLdurgesh varunPas encore d'évaluation

- Berger Paints India Limited: Public AnnouncementDocument16 pagesBerger Paints India Limited: Public Announcement563vasuPas encore d'évaluation

- Financial Management Assignment: Capital Structure of Maruti SuzukiDocument9 pagesFinancial Management Assignment: Capital Structure of Maruti SuzukiDelson VazhappillyPas encore d'évaluation

- Boc Annual Report 2008Document70 pagesBoc Annual Report 2008luv_y_kush3575Pas encore d'évaluation

- 219680Document22 pages219680wajahatwajahat07Pas encore d'évaluation

- Financial Statement Analysis of Kohat Cement Company LimitedDocument67 pagesFinancial Statement Analysis of Kohat Cement Company LimitedSaif Ali Khan BalouchPas encore d'évaluation

- Analysis of Financial Statement of Tata MotorsDocument16 pagesAnalysis of Financial Statement of Tata MotorsErya modiPas encore d'évaluation

- 2023 q1 Consolidated Audit Report enDocument61 pages2023 q1 Consolidated Audit Report enduyhuynhworkkPas encore d'évaluation

- Ajmera Realty and Infra LTD Analyst MeetingDocument7 pagesAjmera Realty and Infra LTD Analyst Meetingarunohri2017Pas encore d'évaluation

- US GAAP - Financials Dec'2021Document50 pagesUS GAAP - Financials Dec'2021ashokdb2kPas encore d'évaluation

- Financial Accounting: Group-1 Industry - Cement Lead Company-Ultratech Cement LTDDocument19 pagesFinancial Accounting: Group-1 Industry - Cement Lead Company-Ultratech Cement LTDArpita GuptaPas encore d'évaluation

- Byco Data PDFDocument32 pagesByco Data PDFMuiz SaddozaiPas encore d'évaluation

- University of Central Punjab: Project Appraisal & Credit ManagementDocument6 pagesUniversity of Central Punjab: Project Appraisal & Credit ManagementMisha ButtPas encore d'évaluation

- Dandotdec 08Document9 pagesDandotdec 08studioad324Pas encore d'évaluation

- Fin 200 Assignment Premier Cement Ltd.Document11 pagesFin 200 Assignment Premier Cement Ltd.414shohed140Pas encore d'évaluation

- Institute of Rural Management Anand: 1. Non-Current AssetsDocument5 pagesInstitute of Rural Management Anand: 1. Non-Current AssetsDharampreet SinghPas encore d'évaluation

- Metal Industry ReportDocument22 pagesMetal Industry ReportRajan BaaPas encore d'évaluation

- LGE - 23 1Q - Consolidated - F - SignedDocument85 pagesLGE - 23 1Q - Consolidated - F - Signedramannamj4Pas encore d'évaluation

- Financial Results Q1 August 2018Document40 pagesFinancial Results Q1 August 2018shakeelahmadjsrPas encore d'évaluation

- Project Source: Funding ProposalDocument29 pagesProject Source: Funding Proposalheena23Pas encore d'évaluation

- SCC StatementsDocument18 pagesSCC StatementsSai PhyoPas encore d'évaluation

- Beneish M ScoreDocument45 pagesBeneish M ScoreAnshu RaiPas encore d'évaluation

- Rolex Rings LTD - IPO Note - July'2021Document8 pagesRolex Rings LTD - IPO Note - July'2021chinna raoPas encore d'évaluation

- Financial Management - Case - Sealed AirDocument7 pagesFinancial Management - Case - Sealed AirAryan AnandPas encore d'évaluation

- OF Minor Project: "Tata Motors"Document20 pagesOF Minor Project: "Tata Motors"Navneet NadhaniPas encore d'évaluation

- Notes 2008-09Document17 pagesNotes 2008-09Avinash BagadePas encore d'évaluation

- KFin Technologies - Flash Note - 12 Dec 23Document6 pagesKFin Technologies - Flash Note - 12 Dec 23palakPas encore d'évaluation

- Sushrut Yadav PGFB2156 IMDocument15 pagesSushrut Yadav PGFB2156 IMAgneesh DuttaPas encore d'évaluation

- Ongc Company AnalysisDocument34 pagesOngc Company AnalysisApeksha SaggarPas encore d'évaluation

- History of The CompanyDocument5 pagesHistory of The CompanyAkshata HadimaniPas encore d'évaluation

- Tata Motors Financial Anlysis Project Report 2021Document19 pagesTata Motors Financial Anlysis Project Report 2021Karan Jadhav100% (1)

- Term Paper of Financial ManagementDocument27 pagesTerm Paper of Financial ManagementAshish PandeyPas encore d'évaluation

- KIRTIMAAN SINGH 21214416 - CIA 3 (Market-Based Project) Due Date - 02.11.2022Document14 pagesKIRTIMAAN SINGH 21214416 - CIA 3 (Market-Based Project) Due Date - 02.11.2022Rohit GoyalPas encore d'évaluation

- FIN302 FinalDocument17 pagesFIN302 FinalMohsin KhanPas encore d'évaluation

- Ultratech Cement Event Update - 120914Document8 pagesUltratech Cement Event Update - 120914Roushan KumarPas encore d'évaluation

- Company 1Document5 pagesCompany 1purvimahajan027Pas encore d'évaluation

- Market Outlook Market Outlook: Dealer's DiaryDocument15 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingPas encore d'évaluation

- 1st Quarter 2014Document20 pages1st Quarter 2014khanbaba1998Pas encore d'évaluation

- TusharDocument15 pagesTusharkaka singhPas encore d'évaluation

- Q1. Define Leasing Companies and How Many Companies Are Working in Pakistan?Document7 pagesQ1. Define Leasing Companies and How Many Companies Are Working in Pakistan?Rashid ShahzadPas encore d'évaluation

- Financial Statement Analysis: Draft For ReviewDocument21 pagesFinancial Statement Analysis: Draft For ReviewDisha RupaniPas encore d'évaluation

- Guidebook for Utilities-Led Business Models: Way Forward for Rooftop Solar in IndiaD'EverandGuidebook for Utilities-Led Business Models: Way Forward for Rooftop Solar in IndiaPas encore d'évaluation

- FIN221: Lecture 2 Notes Securities Markets: - Initial Public Offerings Versus Seasoned New IssuesDocument6 pagesFIN221: Lecture 2 Notes Securities Markets: - Initial Public Offerings Versus Seasoned New Issuestania_afaz2800Pas encore d'évaluation

- VA23 OutputDocument2 pagesVA23 Outputtushar2001Pas encore d'évaluation

- Globtec Investment Group Announces $170 Million Investment in Public Infrastructure and Real Estate Projects in The Visegrád StatesDocument3 pagesGlobtec Investment Group Announces $170 Million Investment in Public Infrastructure and Real Estate Projects in The Visegrád StatesPR.comPas encore d'évaluation

- CSTR - Group ProjectDocument6 pagesCSTR - Group ProjectShobhit SaxenaPas encore d'évaluation

- Due Diligence Planning, Questions, IssuesDocument224 pagesDue Diligence Planning, Questions, IssueshowierdPas encore d'évaluation

- Unsolicited ProposalDocument52 pagesUnsolicited ProposalJun KhoPas encore d'évaluation

- Understanding Commercial Real Estate CDOs 9.50amDocument23 pagesUnderstanding Commercial Real Estate CDOs 9.50amKaran Malhotra100% (1)

- Receivable Financing CH14 by LailaneDocument30 pagesReceivable Financing CH14 by LailaneEunice BernalPas encore d'évaluation

- Capital Budgeting of ITC Company LimitedDocument12 pagesCapital Budgeting of ITC Company LimitedRama Sardesai50% (2)

- Abhijit Deshmukh, CFA: PROFESSIONAL EXPERIENCE - Financial Markets / BankingDocument2 pagesAbhijit Deshmukh, CFA: PROFESSIONAL EXPERIENCE - Financial Markets / BankingVishnu GautamPas encore d'évaluation

- Iag Narrative ReportDocument16 pagesIag Narrative ReportHoely SaintPas encore d'évaluation

- Prs Ra SebiDocument644 pagesPrs Ra Sebisonali0% (1)

- QBE at A Glance FactsheetDocument2 pagesQBE at A Glance FactsheetQBE European Operations Risk ManagementPas encore d'évaluation

- Sapm - Fifth (5) Sem BBIDocument156 pagesSapm - Fifth (5) Sem BBIRasesh ShahPas encore d'évaluation

- Karvy Company ProfileDocument17 pagesKarvy Company ProfileSubhadeep Basu64% (14)

- Hikkaduwa Beach AR 2012-13Document52 pagesHikkaduwa Beach AR 2012-13samaan100% (1)

- Caltex v. COA - 208 SCRA 726 (1992)Document7 pagesCaltex v. COA - 208 SCRA 726 (1992)Nikki Estores GonzalesPas encore d'évaluation

- 10 - Foreign Exchange Derivative MarketDocument53 pages10 - Foreign Exchange Derivative MarkethidaPas encore d'évaluation

- Depreciation Accounting Part 2 PDFDocument37 pagesDepreciation Accounting Part 2 PDFShihab MonPas encore d'évaluation

- Annual Report GMDocument290 pagesAnnual Report GMclemyncePas encore d'évaluation

- Wal-Mart Shaken by Bribery Probe, Shares Plunge: Related ContentDocument12 pagesWal-Mart Shaken by Bribery Probe, Shares Plunge: Related ContentyuritabascoPas encore d'évaluation

- IRDADocument5 pagesIRDAKirti ChotwaniPas encore d'évaluation

- Business: Learn Accounting Through An ExampleDocument6 pagesBusiness: Learn Accounting Through An ExampleKunal SajnaniPas encore d'évaluation

- Film Financing in IndiaDocument5 pagesFilm Financing in IndiaAnkur VoraPas encore d'évaluation

- Reserve Bank of IndiaDocument14 pagesReserve Bank of IndiaJAYANTHI BPas encore d'évaluation

- Form A2: AnnexDocument7 pagesForm A2: AnnexRavi Singh RathorePas encore d'évaluation

- The Accounting Rate of Return - (ARR)Document2 pagesThe Accounting Rate of Return - (ARR)Kathlaine Mae ObaPas encore d'évaluation

- QAU Bulletin: No. 1 Series of 2016Document34 pagesQAU Bulletin: No. 1 Series of 2016Stephn GrayPas encore d'évaluation

- Jurnal Dyer & Mchugh 1975Document17 pagesJurnal Dyer & Mchugh 1975Dyah Putu Puspandari100% (1)

- Venture Capital in INDIADocument83 pagesVenture Capital in INDIAnawaz100% (2)