Académique Documents

Professionnel Documents

Culture Documents

Break Up With Your Mega Bank Poster

Transféré par

Alina Aks0 évaluation0% ont trouvé ce document utile (0 vote)

18 vues1 pageBreak up with your mega bank!

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentBreak up with your mega bank!

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

18 vues1 pageBreak Up With Your Mega Bank Poster

Transféré par

Alina AksBreak up with your mega bank!

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

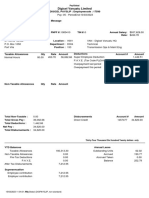

10 EASY STEPS FREQUENTLY

ASKED BREAK-UP

How to Break Up with Your Mega-Bank

QUESTIONS

Are accounts at these

smaller banks and credit

unions safe?

2 4 A: Yes, your accounts at

community development banks

Open your new Move your automatic deposits to

and credit unions are insured up

account. Keep your your new account. Ask your employer to

to $250,000 per depositor.

1 old account open as

you order checks, 3 transfer your direct deposit paychecks to

your new account. Do the same for Social 10 Do community

Choose your new bank debit cards, and Make a list of your Security and other deposits you receive. Encourage your house development banks

or credit union. While deposit slips. automatic payments Ask for the date on which deposits to of worship, alma and credit unions pay a

picking a local bank is a and withdrawals. your new account will take place. mater, workplace, and competitive rate of return?

good option, and a local community organizations A: Yes. Community

credit union an even to use a community development banks and credit

better option, moving your development bank unions pay a rate of return

accounts to a community or credit union. For comparable with that of banks

development bank or congregations, turn to and credit unions in general.

credit union is your best US SIF’s free Community They also provide better

bet to matching your Investing Toolkit for Faith customer service and have

banking with your values.

Find a Green America-

screened and -approved

5 Communities at ussif.org/

resources/pubs. Colleges

lower fees.

Move your automatic and universities can get What if a mega-bank holds

community development and withdrawals to your assistance from the Responsible my mortgage?

green bank or credit union

at GreenPages.org in the

new account, once you

know you’ll have sufficient

6 Endowment Coalition:

endowmentethics.org.

A: You may be able to

Get print or refinance your mortgage with a

“Financial--Banks and Credit funds in the account. Ask

electronic copies community development bank

Unions” category. for the date on which

payments from your new

account will begin. It’s wise

of statements and

canceled checks that 7 or credit union. If they are

offering a lower interest rate

you may later need Transfer the remaining

than you are currently paying,

to leave a small amount funds in your mega-bank

if you have only online this may be the time to move.

in your old account for account to your new

banking through your

a month after you’ve account after you have all How do I avoid ATM

mega-bank.

shifted your deposits and your automatic payments fees when I bank with a

withdrawals to your new and deposits transferred small bank without many

bank or credit union, just and any final checks have branches?

in case. cleared your old account.

A: A number of credit unions

will pay your ATM fees, or

they may belong to a larger

network that doesn’t charge

fees. Otherwise, you can keep

9 a small amount of cash in a free

savings account at a local bank

Inform your mega-bank

that gives you access to their

why you’re breaking up

ATM network for free. Then, do

8 with it. See a sample letter on

p. 16 and in our “Break Up with

the rest of your banking with a

Close your mega- community development bank

Your Mega-Bank Kit,” free at

bank account! Obtain FREE! or credit union.

GreenAmerica.org/go/BUWYBkit.

written confirmation Get our Break Up

that your account is With Your

closed. Mega-Bank Toolkit

REPRINTED FROM THE JANUARY/FEBRUARY 2012

online at

GREEN AMERICAN MAGAZINE, A PUBLICATION OF GreenAmerica.org/go/toolkit

GREEN AMERICA: 800/58-GREEN, GREENAMERICA.ORG

Vous aimerez peut-être aussi

- All About Credit Reports - Rev2Document8 pagesAll About Credit Reports - Rev2kabPas encore d'évaluation

- GC Chamber Tab PDFDocument20 pagesGC Chamber Tab PDFWatertown Daily TimesPas encore d'évaluation

- Financial Fitness Report: Customer NameDocument11 pagesFinancial Fitness Report: Customer NameDitto NadarPas encore d'évaluation

- 141966307cc1-1 Csat Abhyaas Test 1 4254 e 2023Document21 pages141966307cc1-1 Csat Abhyaas Test 1 4254 e 2023rsgamerz1144Pas encore d'évaluation

- Introduction To: BankingDocument56 pagesIntroduction To: BankingAbdirahman MohamedPas encore d'évaluation

- COMPUTER TRICKS, TWEAKS AND TUTORIALS - Amazing Short Notes of MGT 101 Account 23-45 - PDFDocument23 pagesCOMPUTER TRICKS, TWEAKS AND TUTORIALS - Amazing Short Notes of MGT 101 Account 23-45 - PDFakmal aliPas encore d'évaluation

- The Bank: Banking For AllDocument20 pagesThe Bank: Banking For AllYaswanth ChilukuriPas encore d'évaluation

- Co-Operative Bank 1Document14 pagesCo-Operative Bank 1aishu borsePas encore d'évaluation

- Top 50 Banking Interview Questions & Answers (2021 Update)Document38 pagesTop 50 Banking Interview Questions & Answers (2021 Update)LenardPas encore d'évaluation

- The Banking: Slideshow 12Document30 pagesThe Banking: Slideshow 12Mohammad Usman ArhanPas encore d'évaluation

- CUsBuyingBanks 1P V2Document2 pagesCUsBuyingBanks 1P V2Jared RossPas encore d'évaluation

- Commercial Bank - Definition, Function, Credit Creation and SignificancesDocument19 pagesCommercial Bank - Definition, Function, Credit Creation and SignificancesAhmar AbbasPas encore d'évaluation

- All About Banking For Grades 9, 10 and 11 and KS4 StudentsDocument21 pagesAll About Banking For Grades 9, 10 and 11 and KS4 StudentsDawn MaureemootooPas encore d'évaluation

- Debt RecoveryDocument5 pagesDebt RecoveryTanushree100% (1)

- Credit Builder ProductsDocument4 pagesCredit Builder ProductsOsborne StricklandPas encore d'évaluation

- Prepaid Case StudyDocument4 pagesPrepaid Case StudythalaPas encore d'évaluation

- Bankruption How Community Banking Can Survive Fint... - (Chapter 1 An Overview of The Bankruption)Document6 pagesBankruption How Community Banking Can Survive Fint... - (Chapter 1 An Overview of The Bankruption)Tamil LearningPas encore d'évaluation

- On Punjab National Bank by Manoj SinglaDocument21 pagesOn Punjab National Bank by Manoj SinglaManoj Singla0% (2)

- Small and Medium Enterprises As A Customer Group of Digital Banks in SingaporeDocument1 pageSmall and Medium Enterprises As A Customer Group of Digital Banks in SingaporeVarun MittalPas encore d'évaluation

- B1 Features of Financial InstitutionsDocument19 pagesB1 Features of Financial InstitutionsKanna MathikaranPas encore d'évaluation

- #280 BBB 03-25-10 119Document1 page#280 BBB 03-25-10 119bmoakPas encore d'évaluation

- Release Your Bad Credit Now: The Professional Do It Yourself Guide For Improving Your CreditD'EverandRelease Your Bad Credit Now: The Professional Do It Yourself Guide For Improving Your CreditPas encore d'évaluation

- Module 6 Consumer ProtectionDocument16 pagesModule 6 Consumer ProtectionJuan FrivaldoPas encore d'évaluation

- Planview - Identifyng Value StreamsDocument6 pagesPlanview - Identifyng Value StreamsOscar Diego Loaiza AguirrePas encore d'évaluation

- Debt Consolidation Sample LetterDocument34 pagesDebt Consolidation Sample LetterexplorethetruthPas encore d'évaluation

- Focus: Regulation & ComplianceDocument3 pagesFocus: Regulation & ComplianceBouabrePas encore d'évaluation

- Unit 14 BankingDocument6 pagesUnit 14 Bankingk62.2311585005Pas encore d'évaluation

- RBI Finance PDFDocument28 pagesRBI Finance PDFbiswashswayambhuPas encore d'évaluation

- NINI Bank Loan Consult 2021Document7 pagesNINI Bank Loan Consult 2021Maheswara Rao SubramanyanPas encore d'évaluation

- PAPER Analysis of Non-Performing Asset On Urban Cooperative Bank in IndiaDocument11 pagesPAPER Analysis of Non-Performing Asset On Urban Cooperative Bank in IndiaDr Bhadrappa HaralayyaPas encore d'évaluation

- Marketing Research of Low Mids GuaveeDocument5 pagesMarketing Research of Low Mids GuaveeAlex DelRioPas encore d'évaluation

- Banking AssignmentDocument5 pagesBanking AssignmentrichardPas encore d'évaluation

- POS Loans, Merchant Cash Advance, Loans Against Card Swipe, Apply Now - FlexiLoansDocument5 pagesPOS Loans, Merchant Cash Advance, Loans Against Card Swipe, Apply Now - FlexiLoansCissé AssanePas encore d'évaluation

- Customer FAQs - Amalgamation 20032020 PDFDocument9 pagesCustomer FAQs - Amalgamation 20032020 PDFBITAN DUTTAPas encore d'évaluation

- Operation Management in State Bank of IndiaDocument82 pagesOperation Management in State Bank of IndiaMayapati MishraPas encore d'évaluation

- #280 BBB 09-24-09 31Document1 page#280 BBB 09-24-09 31bmoakPas encore d'évaluation

- Consumer Credit 2021Document2 pagesConsumer Credit 2021Finn KevinPas encore d'évaluation

- This Study Resource Was: Topic 3 DQ 2Document1 pageThis Study Resource Was: Topic 3 DQ 2Oscar MosesPas encore d'évaluation

- BF Continuation 2Document6 pagesBF Continuation 2Clarisse PauyaPas encore d'évaluation

- SA20200717Document4 pagesSA20200717jaysonPas encore d'évaluation

- 7 Ways To Rasie Credit ScoresDocument14 pages7 Ways To Rasie Credit ScoresCreditPro Studio0% (2)

- 2021-Lesson 3 - Intermediaries - SDocument11 pages2021-Lesson 3 - Intermediaries - SHoang TrieuPas encore d'évaluation

- Credit Repair Made E-Z PDFDocument140 pagesCredit Repair Made E-Z PDFWill CrawfordPas encore d'évaluation

- Esl Finlit PDFDocument142 pagesEsl Finlit PDFAndreea Miu100% (1)

- EditedDocument3 pagesEditedluchePas encore d'évaluation

- World Financial Planning Day by SlidesgoDocument8 pagesWorld Financial Planning Day by Slidesgosyifa fuadiyahPas encore d'évaluation

- Why Our Company???: Bank of The CreedDocument2 pagesWhy Our Company???: Bank of The CreedGreg PeraltaPas encore d'évaluation

- Kleo 5Document62 pagesKleo 5Gregory SMithPas encore d'évaluation

- RDA in IndiaDocument4 pagesRDA in IndiaAnkush DasPas encore d'évaluation

- 27.3 The Role of Banks - Principles of EconomicsDocument14 pages27.3 The Role of Banks - Principles of EconomicsbPas encore d'évaluation

- Bank Reconciliation StatementDocument46 pagesBank Reconciliation Statementtjhunter077Pas encore d'évaluation

- Co Operative BankDocument19 pagesCo Operative BankritzchavanPas encore d'évaluation

- Corporate Banking Assign 4Document26 pagesCorporate Banking Assign 4Akshay RathiPas encore d'évaluation

- Credit Report 23Document13 pagesCredit Report 23loridzurnakwsb15Pas encore d'évaluation

- Supply Chain ManagementDocument6 pagesSupply Chain ManagementAmitPas encore d'évaluation

- Seatwork 2 - ALLAGONES, MERIELLE EDELLEDocument3 pagesSeatwork 2 - ALLAGONES, MERIELLE EDELLEMerdwindelle AllagonesPas encore d'évaluation

- FI-Access To Banking Services-BSBD - 10062019Document2 pagesFI-Access To Banking Services-BSBD - 10062019bhawani shankar SharmaPas encore d'évaluation

- CMS 18 OctDocument5 pagesCMS 18 OctAnshu KumarPas encore d'évaluation

- Services Marketing (Text & Cases) by Rajendra NargundkarDocument360 pagesServices Marketing (Text & Cases) by Rajendra NargundkarFarid Nawaz Khan100% (9)

- AnswerDocument4 pagesAnswerZati TyPas encore d'évaluation

- Payslip 10-03-23Document1 pagePayslip 10-03-23gmelenamuPas encore d'évaluation

- (Tax) Casino First PreboardDocument5 pages(Tax) Casino First PreboardNor-janisah PundaodayaPas encore d'évaluation

- Lesco - Web BillDocument1 pageLesco - Web Billnawaab saaabPas encore d'évaluation

- KINDERMUSIK (O.T. Wiggles and Giggles and I.T. See What I Saw) Fall RegistrationDocument1 pageKINDERMUSIK (O.T. Wiggles and Giggles and I.T. See What I Saw) Fall RegistrationSuzyQ262100% (1)

- Cir v. Cebu HoldingsDocument16 pagesCir v. Cebu HoldingsBeltran KathPas encore d'évaluation

- Bitumen Price List Wef 01-09-2015Document1 pageBitumen Price List Wef 01-09-2015P. Balaji Chakravarthy100% (2)

- Bill of LandingDocument2 pagesBill of LandingGorean TorviePas encore d'évaluation

- XINGUODU - NEXGO Company Profile 2022Document25 pagesXINGUODU - NEXGO Company Profile 2022Ibnu SaefullahPas encore d'évaluation

- PIAIC Student Portal PDFDocument2 pagesPIAIC Student Portal PDFmaria fatimaPas encore d'évaluation

- Jamshedpur ExpstmtDocument2 pagesJamshedpur ExpstmtRahul PalPas encore d'évaluation

- Your Financial Activities As of May 27, 2021Document3 pagesYour Financial Activities As of May 27, 2021Loan LoanPas encore d'évaluation

- Date Description Cheque No Debit Credit BalanceDocument2 pagesDate Description Cheque No Debit Credit BalanceDhivya BhaskaranPas encore d'évaluation

- R12 Bank Account Transfer Ver 1 0 PDFDocument644 pagesR12 Bank Account Transfer Ver 1 0 PDFram knlPas encore d'évaluation

- Voucher Type - Material Out (RM) : Out and Job Work in ProcessesDocument6 pagesVoucher Type - Material Out (RM) : Out and Job Work in ProcessesAnilPas encore d'évaluation

- A 06Document328 pagesA 06Ryan Lee DelremedioPas encore d'évaluation

- Tax Invoice: Original For RecipientDocument3 pagesTax Invoice: Original For RecipientS V ENTERPRISESPas encore d'évaluation

- ProofDocument8 pagesProofGlizette SamaniegoPas encore d'évaluation

- Objective Domains: Intuit Quickbooks Certification TestDocument2 pagesObjective Domains: Intuit Quickbooks Certification Testndsguy4realPas encore d'évaluation

- 2018-003-Annexure-TAN AO Code Master V 4.8Document105 pages2018-003-Annexure-TAN AO Code Master V 4.8RanjanPas encore d'évaluation

- SAP Accounts Payable Tables ListDocument3 pagesSAP Accounts Payable Tables ListJames WattsPas encore d'évaluation

- Fee Structure (2022-23)Document33 pagesFee Structure (2022-23)STUBBORN GAMINGPas encore d'évaluation

- Finacle - CommandDocument5 pagesFinacle - CommandvpsrnthPas encore d'évaluation

- How To Avoid Overdrafts and FeesDocument1 pageHow To Avoid Overdrafts and FeesPaul Tiberiu MandachePas encore d'évaluation

- Big Bang Edge Test 2022 - ResultDocument6 pagesBig Bang Edge Test 2022 - ResultSwetha MaguluriPas encore d'évaluation