Académique Documents

Professionnel Documents

Culture Documents

Chapter 6-Forever Young Case Solution-Update

Transféré par

YUSHIHUITitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Chapter 6-Forever Young Case Solution-Update

Transféré par

YUSHIHUIDroits d'auteur :

Formats disponibles

Chapter 6—Forever Young Solution

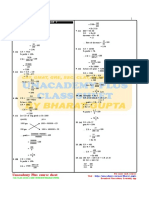

1. The decision tree for Forever Young is as follows:

D = 1,210

E = 7.16625

0.5 0.5

D = 1,210

0.5 0.5 E = 6.48375

0.5 0.5 D = 990

D = 1,100 E = 7.16625

E = 6.825

0.5 0.5 0.5 0.5

0.5 0.5 0.5 0.5 D = 990

E = 6.48375

D = 1,100 0.5 0.5

0.5 0.5

0.5 0.5

E = 6.175

0.5 0.5 D = 1,210

D = 1,000 E = 5.86625

0.5 0.5

E = 6.50 D = 900

0.5 0.5

E = 6.825 0.5 0.5

D = 990

0.5 0.5

E = 5.86625

0.5 0.5 D = 900 0.5 0.5

E = 6.175 D = 810

0.5 0.5 E = 7.16625

0.5 0.5

D = 810

E = 6.48375

0.5 0.5

D = 810

E = 5.86625

Copyright © 2019 Pearson Education, Inc.

2. All details of the analysis are contained in the spreadsheet Chapter 6-Forever Young-Case

Solution. The NPV of expected profit for the onshoring and offshoring options are as follows:

Onshoring (see worksheet Onshoring)

If the company onshores production, the period 2 analysis is as follows (Given that production is

onshored it stays at $10 and is not affected by exchange rate fluctuations. Revenue stays at $20 per unit

for each period):

The period 1 analysis is as follows:

When discounted to the present, the onshoring discounted profits are $17,355.

Copyright © 2019 Pearson Education, Inc.

Copyright © 2019 Pearson Education, Inc.

Offshoring (see worksheet Offshoring)

If production is offshored, the yuan exchange rate comes into play because costs are now incurred in

yuan. Revenue stays $20 per unit. Period 2 results are as follows (it is best for Forever Young to order

990 units for period 2):

Period 1 analysis is as follows (it is best for Forever Young to preorder 1100 units for period 1):

When discounted to the present, offshoring profits are $19,361.

It is better to offshore production if the choice is between onshoring and offshoring.

Copyright © 2019 Pearson Education, Inc.

3. The analysis of the hybrid approach is as follows:

Hybrid Sourcing (see worksheet Hybrid Sourcing)

In this case, the strategy is to order a base load of 900 units from China for each period and make up any

difference from the onshore source (at $11 / unit). Period 2 results are as follows:

Period 1 analysis is as follows:

The discounted Period 0 results for the hybrid strategy results in profits of $19,331. Thus, the offshoring

option (with different order quantities for the two periods) is the best option unless the cost of

onshoring in the hybrid option can be reduced to $10.84 (set cell B4 in hybrid sourcing to 10.84).

If hybrid sourcing can be used with a base load order in period 2 of 810 (set cell B7 in hybrid sourcing to

810) and period 1 of 900, the expected profit increases to $19,350. In this case, the hybrid strategy is

more profitable if the onshoring cost for the hybrid option can be lowered to $10.95.

Copyright © 2019 Pearson Education, Inc.

Vous aimerez peut-être aussi

- You Are The Reason PDFDocument1 pageYou Are The Reason PDFLachlan CourtPas encore d'évaluation

- FINC2011 Tutorial 5Document10 pagesFINC2011 Tutorial 5suitup100100% (4)

- Forever Young-Case SolutionDocument8 pagesForever Young-Case SolutionYUSHIHUIPas encore d'évaluation

- Hankinson - Location Branding - A Study of The Branding Practices of 12 English CitiesDocument16 pagesHankinson - Location Branding - A Study of The Branding Practices of 12 English CitiesNatalia Ney100% (1)

- Feng Shui GeneralDocument36 pagesFeng Shui GeneralPia SalvadorPas encore d'évaluation

- Forever Young Case StudyDocument1 pageForever Young Case StudyAsmat AbidiPas encore d'évaluation

- Manhole DetailDocument1 pageManhole DetailchrisPas encore d'évaluation

- 19-Microendoscopic Lumbar DiscectomyDocument8 pages19-Microendoscopic Lumbar DiscectomyNewton IssacPas encore d'évaluation

- Sikap Sari SariDocument3 pagesSikap Sari SariJuliet Lobrino Rozos100% (5)

- GBS Group 7 - Blue Ridge SpainDocument16 pagesGBS Group 7 - Blue Ridge SpainAnurag YadavPas encore d'évaluation

- Universiti Utara Malaysia Master of Business Administration (MBA)Document16 pagesUniversiti Utara Malaysia Master of Business Administration (MBA)Sherene Dharshinee100% (1)

- Teoria PDFDocument3 pagesTeoria PDFAna CamargoPas encore d'évaluation

- Asset-V1 MITx+14.100x+2T2020+type@asset+block@Lecture 9 HandoutDocument10 pagesAsset-V1 MITx+14.100x+2T2020+type@asset+block@Lecture 9 HandoutcamirandamPas encore d'évaluation

- Asset-V1 MITx+14.100x+2T2020+Type@Asset+Block@Lecture 9 HandoutDocument10 pagesAsset-V1 MITx+14.100x+2T2020+Type@Asset+Block@Lecture 9 HandoutcamirandamPas encore d'évaluation

- 4 61 60603 MQGM Prel SM 3E 08Document11 pages4 61 60603 MQGM Prel SM 3E 08Zacariah SaadiehPas encore d'évaluation

- 35 Practice MCQ Solutions For Website - UPDATEDDocument7 pages35 Practice MCQ Solutions For Website - UPDATEDBaher WilliamPas encore d'évaluation

- Extra Practice 2Document2 pagesExtra Practice 2eslamahmed.mcPas encore d'évaluation

- Form 4: Chapter 19 (Probability Distributions) SPM Practice Fully-Worked SolutionsDocument5 pagesForm 4: Chapter 19 (Probability Distributions) SPM Practice Fully-Worked SolutionsOng TengjiePas encore d'évaluation

- Experiment Report 4 - Old VerDocument5 pagesExperiment Report 4 - Old VerCuber HCPas encore d'évaluation

- EZDocument3 pagesEZumrumrumrPas encore d'évaluation

- Derivative Markets Solutions PDFDocument30 pagesDerivative Markets Solutions PDFPeter HuaPas encore d'évaluation

- BMA 12e SM CH 04 FinalDocument14 pagesBMA 12e SM CH 04 FinalShyamal VermaPas encore d'évaluation

- I. Time Value of Money: PortfolioDocument7 pagesI. Time Value of Money: PortfoliocarlaPas encore d'évaluation

- Grade 6 Fractions To Percents CDocument2 pagesGrade 6 Fractions To Percents CKishanPas encore d'évaluation

- Profit and Loss Sheet SolutionDocument23 pagesProfit and Loss Sheet SolutionSahil GuptaPas encore d'évaluation

- Module 3 ActivityDocument3 pagesModule 3 ActivityLezi WooPas encore d'évaluation

- Thi Nghiem Lys 4Document3 pagesThi Nghiem Lys 4Hoang Anh PhamPas encore d'évaluation

- ProblemsDocument2 pagesProblemsOrangePas encore d'évaluation

- Solutions To Selected End-Of-Chapter 4 Problem Solving QuestionsDocument10 pagesSolutions To Selected End-Of-Chapter 4 Problem Solving QuestionsVân Anh Đỗ LêPas encore d'évaluation

- Mendoza 1 1 ProbSet5Document8 pagesMendoza 1 1 ProbSet5Marilyn M. MendozaPas encore d'évaluation

- Temp Vs DHDocument6 pagesTemp Vs DHJoseph Liev Barraza DiazPas encore d'évaluation

- Dividend Decisions SolutionsDocument13 pagesDividend Decisions SolutionsHarsha VardhanPas encore d'évaluation

- w2 Chapter-02Document11 pagesw2 Chapter-02FirstX.Pas encore d'évaluation

- QII.W6.D3.Annuity DueDocument16 pagesQII.W6.D3.Annuity DueSophia GalagarPas encore d'évaluation

- Chapter 6 Math of FinanceDocument10 pagesChapter 6 Math of FinanceEmmanuel Santos IIPas encore d'évaluation

- Ross12e - CHAPTER 4 - NMIMS - Practice Problems and Solutions For ClassDocument8 pagesRoss12e - CHAPTER 4 - NMIMS - Practice Problems and Solutions For Classwander boyPas encore d'évaluation

- Excercises and Answers Chapter 2Document22 pagesExcercises and Answers Chapter 2MerlePas encore d'évaluation

- Experiment Report 4 - NewDocument5 pagesExperiment Report 4 - NewCuber HCPas encore d'évaluation

- Menghitung Jumlah Titik Lampu Tiap Ruangan: A. Teras Depan E. Dapur I. Lorong DapurDocument4 pagesMenghitung Jumlah Titik Lampu Tiap Ruangan: A. Teras Depan E. Dapur I. Lorong DapurMarini FaniaPas encore d'évaluation

- TVM ManualDocument19 pagesTVM Manualmuzamil BhuttaPas encore d'évaluation

- FinanceDocument4 pagesFinancethantoolwin2002Pas encore d'évaluation

- Time Value of MoneyDocument15 pagesTime Value of MoneyJann Aldrin PulaPas encore d'évaluation

- The Value of Common StocksDocument14 pagesThe Value of Common StocksAalo M ChakrabortyPas encore d'évaluation

- Grade 5 Fractions To Decimals Proper FDocument2 pagesGrade 5 Fractions To Decimals Proper FTanja LazovaPas encore d'évaluation

- April 2014 MLC Multiple Choice Solutions: L L L L L L D Q L L LDocument9 pagesApril 2014 MLC Multiple Choice Solutions: L L L L L L D Q L L LHông HoaPas encore d'évaluation

- 1 980 2 825 3 760 4 650 5 Who Give Answers Without Calculation Will Be Given Low Marks/no MarksDocument2 pages1 980 2 825 3 760 4 650 5 Who Give Answers Without Calculation Will Be Given Low Marks/no MarksImran AliPas encore d'évaluation

- A Student's Guide To Cost-Benefit AnalysisDocument2 pagesA Student's Guide To Cost-Benefit AnalysisAlbyziaPas encore d'évaluation

- Converting Fractions To Decimals: Grade 6 Fraction WorksheetDocument2 pagesConverting Fractions To Decimals: Grade 6 Fraction WorksheetshilpaPas encore d'évaluation

- Chapter 3 The Rest of It Chapter 4 StartDocument28 pagesChapter 3 The Rest of It Chapter 4 StartGfeyPas encore d'évaluation

- Cailin Chen Question 9: (10 Points)Document5 pagesCailin Chen Question 9: (10 Points)Manuel BoahenPas encore d'évaluation

- Time Value of Money: Aman KhediaDocument7 pagesTime Value of Money: Aman KhediaSairam KhondPas encore d'évaluation

- Math Fundamentals: For Capital MarketsDocument26 pagesMath Fundamentals: For Capital MarketsRamen ACCAPas encore d'évaluation

- Quiz 3 SolDocument54 pagesQuiz 3 SolBekpasha DursunovPas encore d'évaluation

- Chapter 7 - Engineering Economic Analysis, 2nd Canadian EditionDocument46 pagesChapter 7 - Engineering Economic Analysis, 2nd Canadian EditionSamPas encore d'évaluation

- MathsDocument11 pagesMathsRangePas encore d'évaluation

- Engineering Economics (MS-291) : Lecture # 11Document27 pagesEngineering Economics (MS-291) : Lecture # 11samadPas encore d'évaluation

- Input Data: Exterior Spans Interior SpansDocument6 pagesInput Data: Exterior Spans Interior SpansAmmad AlizaiPas encore d'évaluation

- s226 2013 Spring HW CVP SolDocument15 pagess226 2013 Spring HW CVP SolChristine CalimagPas encore d'évaluation

- Tutorial-1 2012 Mba 680 Solutions1Document5 pagesTutorial-1 2012 Mba 680 Solutions1Pratheek MedipallyPas encore d'évaluation

- Lecture3 Economic EquivalenceDocument22 pagesLecture3 Economic EquivalenceGanda GandaPas encore d'évaluation

- CFIN 4 4th Edition Besley Solutions Manual DownloadDocument10 pagesCFIN 4 4th Edition Besley Solutions Manual DownloadElizabeth Mcmullen100% (22)

- CH 17Document22 pagesCH 17Arslan Qadir100% (1)

- Data Sheet 095036 0150n StabilusDocument1 pageData Sheet 095036 0150n StabilusBolívar EspinozaPas encore d'évaluation

- Briannie HWK #6Document3 pagesBriannie HWK #6BRIANNIE ASRI VIVASPas encore d'évaluation

- Ugba103 - Mid01a - F2015 - SDocument3 pagesUgba103 - Mid01a - F2015 - Shira malikPas encore d'évaluation

- Internal Rules of Procedure Sangguniang BarangayDocument37 pagesInternal Rules of Procedure Sangguniang Barangayhearty sianenPas encore d'évaluation

- Is Electronic Writing or Document and Data Messages Legally Recognized? Discuss The Parameters/framework of The LawDocument6 pagesIs Electronic Writing or Document and Data Messages Legally Recognized? Discuss The Parameters/framework of The LawChess NutsPas encore d'évaluation

- ACSRDocument3 pagesACSRWeber HahnPas encore d'évaluation

- Kutune ShirkaDocument11 pagesKutune ShirkaAnonymous CabWGmQwPas encore d'évaluation

- Ahts Ulysse-Dp2Document2 pagesAhts Ulysse-Dp2IgorPas encore d'évaluation

- Grope Assignment 1Document5 pagesGrope Assignment 1SELAM APas encore d'évaluation

- Novedades Jaltest CV en 887Document14 pagesNovedades Jaltest CV en 887Bruce LyndePas encore d'évaluation

- Astm D1895 17Document4 pagesAstm D1895 17Sonia Goncalves100% (1)

- 1b SPC PL Metomotyl 10 MG Chew Tab Final CleanDocument16 pages1b SPC PL Metomotyl 10 MG Chew Tab Final CleanPhuong Anh BuiPas encore d'évaluation

- Approach To A Case of ScoliosisDocument54 pagesApproach To A Case of ScoliosisJocuri KosoPas encore d'évaluation

- Tesmec Catalogue TmeDocument208 pagesTesmec Catalogue TmeDidier solanoPas encore d'évaluation

- Result 1st Entry Test Held On 22-08-2021Document476 pagesResult 1st Entry Test Held On 22-08-2021AsifRiazPas encore d'évaluation

- Haloperidol PDFDocument4 pagesHaloperidol PDFfatimahPas encore d'évaluation

- Unit 3 RequirementsDocument4 pagesUnit 3 Requirementsravioli kimPas encore d'évaluation

- Pasahol-Bsa1-Rizal AssignmentDocument4 pagesPasahol-Bsa1-Rizal AssignmentAngel PasaholPas encore d'évaluation

- Phylogenetic Tree: GlossaryDocument7 pagesPhylogenetic Tree: GlossarySab ka bada FanPas encore d'évaluation

- MEAL DPro Guide - EnglishDocument145 pagesMEAL DPro Guide - EnglishkatlehoPas encore d'évaluation

- Journal Entry EnrepDocument37 pagesJournal Entry Enreptherese lamelaPas encore d'évaluation

- Img - Oriental Magic by Idries Shah ImageDocument119 pagesImg - Oriental Magic by Idries Shah ImageCarolos Strangeness Eaves100% (2)

- DH 0507Document12 pagesDH 0507The Delphos HeraldPas encore d'évaluation

- Diva Arbitrage Fund PresentationDocument65 pagesDiva Arbitrage Fund Presentationchuff6675Pas encore d'évaluation

- Positive Accounting TheoryDocument47 pagesPositive Accounting TheoryAshraf Uz ZamanPas encore d'évaluation

- August 2023 Asylum ProcessingDocument14 pagesAugust 2023 Asylum ProcessingHenyiali RinconPas encore d'évaluation

- A List of Run Commands For Wind - Sem AutorDocument6 pagesA List of Run Commands For Wind - Sem AutorJoão José SantosPas encore d'évaluation

- Prof. Monzer KahfDocument15 pagesProf. Monzer KahfAbdulPas encore d'évaluation