Académique Documents

Professionnel Documents

Culture Documents

CH 01

Transféré par

Albert CruzTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

CH 01

Transféré par

Albert CruzDroits d'auteur :

Formats disponibles

CHAPTER 1 SOLUTIONS

Solutions to Questions for Review and Discussion

1. The result of forecasting and planning is a budget, which is an expected level of performance

for a future time period. When the time period becomes history and actual results are known,

this budget or plan becomes the basis for evaluating the actual results. This is performance

evaluation. Performance evaluation is an important part of the plan, act, and evaluate

management process and is the last step in the decision-making process.

2. Forecasting and planning create a plan of action for future periods and form a basis for

evaluating actual results.

Performance evaluation compares planned results to actual results. This is helpful in

evaluating the manager of the business segment.

Cost determination, pricing, and cost management deal with measuring the resources

used to complete an activity, determining the price to charge for it, and improving

processes to make them more cost efficient.

Operations control and improvement examine every aspect of a firm's processes to

increase efficiency, reduce costs, and produce higher quality.

Incremental decision-making is the process of formulating a decision based only on relevant

revenues and costs.

Financial reporting focuses on providing information on the results of the firm's activities to

all users of financial information including managers, shareholders, creditors, tax

authorities, and investment analysts.

Motivation of managers occurs when accounting information is used to encourage managers

to work toward the goals of the organization.

3. The budget for Customer Support: Focus is on next year's activities and financial plans and,

therefore, involves the forecasting and planning process.

Status of improvements to management reporting system: Elements of all decision areas. A

new reporting system undoubtedly will include the planning process, the evaluation

process, improvements in costing, improvements in processes and their control, better

data for incremental decision making, higher quality financial report preparation, and

improvements to managerial communications.

Customer pricing: In meeting with the marketing vice-president, Sarah will use costs in setting

prices and making decisions for new business.

Customer contract wording for a new product: She will need to look at the forecasts for the

product, including its cost and price estimations and other key product decision variables.

September’s actual versus budget comparison: Sarah is evaluating performance based on

budgets. The financial reports will be part of the review.

Cost-volume-profit study: Sarah will be using incremental decision-making processes. Also,

previous budgets, actual results, and cost determination will be used to measure the cost-

volume-profit relationships.

E-mail questions about product costs and operating expenses: These require a look at old

budgets and actual results. Also, cost determination and management are needed.

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 1, Page 1-1

Operations control and improvement are necessary if the goal is process improvement or

cost reduction.

Serious cost overrun problem: The forecast and budget need to be reviewed with actual

results. Decisions about the product or the design process may be needed. Improvement

of the process and the operation' s controls will be sought. Furthermore, cost

management will be utilized to reduce inefficiency.

Presentation on cash flows: Forecasting and planning include strategic planning. Cash-flow

forecasts are part of the long-range planning process.

Memo on marketing spending: To support the advertising expenditure, an incremental

decision will be made to determine if the cash outlay is worth its expected benefits.

Note: Depending how each issue is addressed, it is possible that each item could use all the

decision-making areas.

4. Cost determination (also known as product costing or income determination) deals with

measuring the total amount of resources used for some cost objective. The most common

cost objective is costing a product or service. This can also include such items as contracts, a

play, a building or a piece of equipment, or a convention. The primary focus of cost

determination is the linkage between costs incurred, resources used, and outputs produced.

Cost determination assists in attaching costs to cost objectives.

Cost management is the process of controlling the activities that cause costs to be incurred.

Therefore, the emphasis is on identifying, planning, and evaluating the activities that cause or

drive costs. These actions imply managing both the activities and the costs associated with

those activities. We identify costs with activities, trace those costs to processes, and,

subsequently, associate those costs with products and services. Cost management has an

ultimate goal of managing activities more efficiently to reduce costs.

5. Top management generally faces unstructured or semi-structured problems that are resolved

through strategic planning. These problems deal with product or service markets, the

economy, competitors, availability of resources, financial conditions, and other outside factors

that affect the company. For this reason, some of the information used is from external

resources. Top management's accounting information is usually highly summarized,

encompasses longer time periods, is future oriented, and deals with numerous variables. It

must be available on an irregular or ad hoc basis.

Lower management faces semi-structured or structured problems that deal with specific tasks.

Each manager typically has authority to operate within a particular department or category of

work. The types of decisions needed are usually known, and the required information and

decision rules are usually identified explicitly, perhaps in an operating manual. Lower

management needs information that is detailed, accurate, short term in nature, and provided

frequently and routinely. Managers obtain such information mainly from sources within the

organization, such as existing information systems and reports.

6. All systems use data from and give data to the accounting files.

Order entry system: customer database

Cash receipts system: customer database

Purchases system: vendor, product, and logistics databases

Production planning and control system: vendor, product, and logistics databases

Cash payments system: vendor and employee databases

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 1, Page 1-2

Personnel system: employee database

General accounting system: information from all databases

7. A value chain looks strategically at each part of the firm's operations and asks what key

contribution each part makes to the competitive strength of the firm as a whole. Each link

should add value to the firm's operations.

Value added is the increase in the value of the firm, its products, and its activities from a

particular activity or process. The absence of value added is a sign of noncompetitiveness or

inefficiency.

Nonvalue-added activity is essentially wasted effort. It represents a task such as moving

inventory from one location to another or inspecting something that has been produced

in an error-free environment. By deleting the activity resources are saved and no harm is

caused or no value is lost.

8. TQM stands for total quality management. It is complete dedication to a high-quality and low-

cost environment. Quality in this context includes customer service. To achieve this goal,

many activities and processes are used, including quality circles, statistical quality control, and

continuous improvement programs. Also, total quality management includes JIT and CIM.

Just-in-time (JIT) is a method of management that stresses delivery of goods or services when

needed – not before or after. The most apparent benefit to JIT is the reduction in inventory

costs since inventory is eliminated. However, JIT creates a management attitude that

expands to greater coordination and integration of processes throughout the firm. JIT also

leads to the discovery of problems that inventories hide. Included in these problems are poor

quality, high defect rates, late deliveries, and poor scheduling.

Computer-integrated manufacturing (CIM) brings engineering, production planning, and

production processes into one system. It increases throughput from production resources.

This brings down barriers across organizational functions and allows teamwork. A benefit is

shorter lead times to get the product to the customer.

9. World-class manufacturing emphasizes higher quality, lower investment in inventories, faster

and higher throughput, greater flexibility, automation, organizational flexibility to meet

changing needs, and information technology. Many business people view companies with

world-class manufacturing as pioneers on the "cutting edge” of productivity in manufacturing,

distribution, and management. Companies on the cutting edge have overcome quality issues

and have eliminated wasted time through just-in-time inventory systems.

10. Focused production attempts to decrease the variety of products that a facility makes and

tries to focus on producing the products with the highest contribution margins. Equipment and

personnel are dedicated to certain products or product lines.

Flexible manufacturing attempts to increase the variety of products that a single machine or

group of machines and workers can produce. The purpose is to reduce setup costs and the

necessary investment required to satisfy the customer.

Finally, computer-integrated manufacturing is the integration of engineering, production

planning, and production processes into one function. This knocks down departmental walls,

increases communication, and reduces lead time. Changes in products, production

processes, and production schedules can be implemented through computer technology.

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 1, Page 1-3

11. Many not-for-profit and service organizations may be more concerned about providing a

service to the public or promoting some idea for the common good of some group. Thus, the

manager may be seeking to maximize the organization's main objective, which is unrelated to

any profit motive.

Also, managers in all organizations seek to achieve their personal objectives of wealth,

satisfaction, security, self-realization, and so forth. Thus, assisting the linking of managers

and organization's goals is a key decision area. If these are not congruent, managers may be

working at counter purposes to the firm's goals. However, in for-profit firms, regardless of

what the manager's personal objectives are, the profit concept may still be used to motivate

and evaluate the manager.

12. 1. Defining the issue

2. Specifying the decision objective and decision rule

3. Identifying the alternatives

4. Collecting relevant data on the alternatives

5. Formatting and analyzing the data on the alternatives

6. Making the decision

7. Implementing the decision

8. Evaluating the results of the decision

Steps 4, 5, and 8 are primarily concerned with information handling. Collecting data in many

cases is pulling relevant data from the many transaction systems that exist in the firm.

Information is collected about a decision until time runs out or the cost of obtaining additional

information exceeds the benefit. Formatting and analyzing the information are concerned

primarily with rearranging the data found and turning it into meaningful information. Collecting

actual results data and reporting the results to management are a major accounting system

responsibilities. Actual results are recorded in various transaction systems and are pulled

together in accounting systems to prepare accounting reports .

13. Often, collecting the most relevant data is the most time consuming. It is also the most

difficult in that the time available and the cost of collecting data are usually constraints.

Turning the data into information is most important since this will influence how decisions are

made. Therefore, considerable time and expertise are required to be sure it is done right.

Often, time and cost are directly related.

Depending on the decision problem, any one step could be the most time consuming or the

most expensive.

The most difficult analytical step might be defining the issue initially (determining the real

problem), specifying the decision objective (deciding what we really want to accomplish),

identifying the alternatives (specifying the reasonable routes to the objective), making the

decision (selecting from several possible outcomes), or evaluating the results (getting a clear

picture of what really happened).

14. Groups outside an organization that use the organization's financial statements include

owners, investors, creditors, taxing authorities, regulatory agencies, and industry associations.

Even though financial accounting primarily serves outsiders, managers and employees within

a company also have an interest in the information provided.

Owners and investors: Owners and investors use accounting reports to assist them in

deciding whether to continue as owners and investors. Also, potential owners and

investors use reports to help in selecting the most promising use of their money given the

risks and returns present in marketplaces.

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 1, Page 1-4

Creditors: Financial statements help lenders and suppliers assess whether the firm will be

able to meet its obligations.

Taxing authorities: Taxes are often based on accounting information submitted by the

taxpayer. Taxes are collected by school districts, cities, counties, states, port authorities,

and the federal government.

Regulatory agencies: Local, state, and federal agencies regulate a substantial portion of

businesses in the United States. Although many facets of regulated activity are

nonfinancial, much of the regulation is implemented through or involves accounting

reports.

Industry associations: Most industries have one or more associations that gather important

statistics about the national and international industry. Financial statements from

companies within the industry allow associations to help assess the health, stability, and

direction of the industry.

Managers: The interest of a manager depends somewhat on the manager's position within

the organization. At the higher levels, managers are influenced by incentive programs,

often based on profitability. Promotions and recognition are often based on financial

success.

Employees: Based on financial statements and other information, employees make

decisions about continued employment, union wage and contract negotiations, adequacy

of pension plans, and viability of employee stock purchase programs, savings plans, and

profit sharing plans.

15. Three differences between managerial accounting and financial accounting are:

1. Managerial accounting is not subject to the same rules, regulations, and principles as is

financial accounting. No generally accepted accounting principles are promulgated for

managerial accounting.

2. Financial accounting relies on accounting principles structured around the accounting

equation – assets equal liabilities plus owners equity. Financial statements reflect either a

point in time or some change over time with respect to the accounting equation.

Managerial reports, on the other hand, must have a structure which satisfies an individual

manager's needs. These reports will often use estimates, be more narrow in scope, and

seldom be useful for anything other than their original purpose.

3. Managerial accounting focuses on segments of the organization as well as on the whole

organization. The primary interest of financial accounting is the company as a whole. In

managerial accounting, however, the segment is of primary importance. Segments may

be products, individual activities, divisions, plants, operations, tasks, or any other

responsibility centers or cost centers. The necessity for dividing the costs, revenues,

assets, and liabilities among segments creates important allocation issues in managerial

accounting that are not needed when the focus is the organization in total, as is the case

for financial accounting.

Two similarities between managerial accounting and financial accounting are:’

1. The accounting information system that accumulates and classifies information and

generates financial statements is the same system used for many of the managerial

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 1, Page 1-5

accounting reports. Therefore, when the system classifies and accumulates information, it

should do so in formats that accommodate both types of accounting.

2. The manner in which accountants measure the components of cost, assign costs to

accounting periods, and allocate costs to segments is similar for both managerial and

financial accounting. Many of the concepts developed for financial accounting for

measuring and assigning costs are based on a rationale that is also appropriate for

managerial accounting. When financial accounting develops a principle or concept that

proves useful for managerial accounting, it is adopted for internal reporting.

16. The treasurer receives information concerning credit evaluations, collection and disbursement

of funds, and the purchase of long-term funds. The controller receives information from all the

accounting and information departments. These include such departments as budgeting,

billings, accounts payable and receivable, cost accounting, payroll, information systems, and

general accounting.

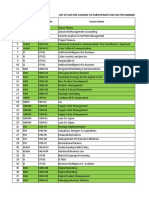

17. System Responsible Department

Order entry Order processing

Cash receipts Treasurer

Purchases Purchasing

Production planning and control Production Planning

Cash disbursements Treasurer

Personnel Personnel and payroll

General accounting Controller

18. The following five characteristics distinguish between manufacturing and service

organizations:

1. A manufacturer puts out a tangible product, while a service organization's "product" is

often intangible.

2. For a service organization the customer is often present when the service is being

performed. In contrast, customers rarely view the processing of manufactured products.

3. In service organizations, production and consumption of services are often simultaneous.

With manufacturing, the product may be used by the customer long after it has been

produced.

4. Many services are perishable. A manufactured product can usually sit on the

manufacturer's shelves for some time period.

5. Services are generally less homogeneous than manufactured products.

19. Examples for each of the following services are as follows:

business services – law firm

trade services – print shop

infrastructure services – airline

social services – hospital

recreation services – golf course

personal services – beauty shop

public services – military

20. A management accountant has the responsibilities to maintain the accounting records,

prepare financial statements, generate the many specialized managerial reports, and

coordinate budgeting and reporting efforts as part of the planning and decision making,

performance evaluation and control, and cost management processes. However, a controller,

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 1, Page 1-6

who is a management accountant, must oversee the accounting function by selecting ways to

process accounting data, by presenting information in the accounting reports, and also by

managing the people within the accounting function. The controller is frequently an advisor to

other decision makers in the firm. The controller's experience and financial management

expertise are valuable resources to other managers. In many firms, team management is

becoming common. Part of that team is the controller, who has significant knowledge about

the decisions being made.

21. The controller prepares the responsibility reports that compare the budgets for various

departments, operations, and so forth with the manager's actual performance. This gives the

controller direct contact with all levels of management. The controller's office prepares

detailed analyses of each area. It may appear that the controller understands the operations

of each subunit better than the line manager responsible for that unit. If an investigation of

variances is needed, the controller usually has an accountant perform such a task. Therefore,

managers interface with accountants on critical matters that determine how a manager will

ultimately be evaluated by his or her superior. The controller must be careful not to violate line

management relationships or to assume that accounting knowledge is more important than

the functional knowledge of the line managers.

22. Management accountants must maintain integrity and ethical behavior on their own behalf

and must make top management aware of unethical behavior on the part of other people

within the organization. This does not mean the management accountant is a policeperson.

Rather, the management accountant promotes and encourages ethical behavior in all aspects

of business life. Controls are designed and implemented to encourage ethical behavior.

Operationalizing these controls is often the responsibility of the controller.

The Statement on Ethical Conduct developed by the IMA requires management accountants

to comply with the established policies of that organization. These policies relate to the

personal characteristics of the management accountant. This Statement defines four

categories by outlining the key elements of each: be competent, maintain confidentiality,

possess integrity, and exhibit objectivity.

23. In the absence of codes of ethics, each employee must exercise appropriate judgment when

faced with ethical problems. A corporate code of ethics provides with a common base for

making ethical decisions. It raises the consciousness level of all employees -- making them

aware that a behavior standard has been set and is expected of them.

Because resolving ethical issues is complex, employees need a basis on which to rely. The

payoff for a code of ethics is that management provides the baseline for managers to use in

decision making and in evaluating compliance.

24. Sources of finding a solution to an ethical dilemma include the following:

(1) Personal values,

(2) Corporate policies and ethical statements,

(3) Laws,

(4) Professional standards, and

(5) Supervisors, internal auditors, and other company officials.

A last resort, recognizing that it violates confidentiality guidelines, is:

(6) Counselors from outside the organization.

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 1, Page 1-7

25. Objective reporting: Certain transactions require judgment before they are recorded. To

make a balance sheet look stronger, a manager may disregard reporting a contingent

liability that should probably be footnoted. Estimates used in managerial accounting can

be overstated or understated to serve the purposes of the manager providing the

estimates. Combining a positive and a negative to avoid attention being directed to the

negative number could involve unethical behavior.

Colleague behavior: When traveling, one might notice a colleague spending company funds

on unauthorized items and still charging them as business expenses. Other examples

include using company property for personal use, perpetual lateness, and inappropriate

actions to get a sales order.

Confidentiality: You overhear confidential information about a competitor that provides you

with an opportunity to hurt the competitor and to gain personally. Bragging about your

company’s plans to a poker group and talking about a colleague's confidential

conversation with you to other company personnel are ethical issues.

Tax evasion: To decrease taxable income, an inventory manager might understate inventory

on the balance sheet and expense more than should be allowed. Reclassifying certain

meals expenses as transportation costs to allow a larger tax deduction is illegal and

unethical.

Personal advancement: An overheard comment might provide information that is not known

to the public and could be used in the stock market for personal gain. A rumor about a

colleague could decrease that person's promotion prospects and benefit your prospects.

26. Order entry system: To record sales orders and to bill customers.

Cash receipts system: To record cash receipts from customers and to assure that cash

receipts are handled properly.

Purchases and production system: In retail firms, to record merchandise orders, receipts,

and inventory additions. In manufacturing firms, to record materials acquisitions. In

manufacturing firms, production plans are created; schedules are set; purchases made;

materials, labor, and equipment scheduled; and production is monitored.

Cash payments system: To make and record all payments for purchases and any other

activities.

Personnel system: To record events related to hiring, firing, benefits, employee evaluations,

and payroll activities.

General accounting system: To bring together transaction data from all other systems.

Management and financial reports are generated, and budget reports are processed.

27. Customer file: sales histories, accounts receivable data, and customer characteristics.

Vendor file: purchases histories, accounts payable data, and vendor characteristics.

Product file: inventory data, product cost and price data, and product specifications.

Logistics file: production requirements, capacity data, and distribution data.

Employee file: payroll records, personnel data, and employee benefits data.

Accounting file: general ledger records, budgeting data, and subsidiary files that support

various balance sheet accounts.

28. This is like asking a mother which of her children she loves most. There is no answer. Each

of the decision areas is needed to be successful over the long term. Each area could be

ignored without disastrous results in the short run. But lack of attention to any one area could

cause serious negative impacts on the health of the organization. The activities in these

decision areas are so intertwined that a serious weakness in any one of the areas can create

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 1, Page 1-8

major problems for the firm in total. No one area can stand ahead of another.

Solutions to Exercises

1-1. The preferred course of action would be to ignore that you ever heard the information.

However, depending on what was said, it may be very difficult to disregard the conservation.

Perhaps, your company's code of ethics or conduct will address this situation. You might seek

counsel from superiors or an ombudsperson within your company. If the problem is serious,

you might want to consult your company attorney. Notifying the competitor may be one

recourse after adequate review, discussion, and precautions within your firm.

1-2. It would be highly unethical to change company plans to save your friend's job. This could

lead to poor decisions being made, which could more adversely affect the company later.

Furthermore, mentioning the situation to your friend and influencing him to transfer is unfair to

the rest of the employees of the company. This situation is more complicated in that your

friend is about to buy a new house. If severe and unexpected financial difficulties are

imminent to your friend, the circumstances should be mentioned to your superiors to

determine your best course of action.

1-3.

(a) It is never too late to learn what should and should not be done. Furthermore, strict

enforcement of rules and regulations can persuade individuals to learn at any time in life. The

absence of formal attention to ethics may imply that no one cares and that any action is fair.

Many people have not thought about ethics issues. By "teaching" or discussing ethics,

attention is brought to the topic. People should be confronted by the issues, provided with a

approach to think through dilemmas, and given a structured approach to make ethical

judgments. This structure can be taught and learned. A person's moral standards may not be

changed, but at least the person is made aware of expectations and approaches to ethical

decision making.

(b) Unfortunately, ethics and legality are often assumed to be the same. Again, a structured

approach to ethical dilemmas may include legal considerations, but the basic question rests

on the ethical merits of the dilemma. Ethical behavior generally rises above the legality of the

issue. Clearing a legal hurdle is certainly a positive but is only a start in ethical evaluation.

(c) Many ethical dilemmas contain gray areas where disagreement can exist between two

“ethical” individuals. This another reason for developing, discussing, and implementing a

code of ethics within a firm. Having a common understanding of ethical standards, how they

are imposed, and how exceptions to these standards are handled prevents "holier than thou”

and "if I were you" scenarios. Differences in ethical views must be approached in a structured

way, where stakeholders (who benefits and who loses) are identified, courses of action are

defined, and alternatives evaluated.

(d) Often this is true. The same action might be okay in one circumstance but wrong in another.

However, the reason we consider an action unethical or ethical will never change. That is, the

same questions should be asked. The structure of ethical decision making may allow

difference outcomes for similar issues. The danger is that "situational ethics" can be bent to

approve almost any action or outcome we prefer. We must situationalize based on criteria

that are clear, supportable, and independent of personalities involved, of benefits to be

gained, of the level of visibility, and of other situation dependent facts.

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 1, Page 1-9

(e) The same has been said about quality. In the early eighties, many U.S. companies could not

justify total quality management and continual improvement. They believed it was too costly.

However, Japanese industry proved that these procedures could actually lead to long-run

savings and competitiveness. In the long run, high ethical standards will pay off. However,

we must recognize that certain business will be lost to less ethical persons. Personal and firm

reputation is built on high quality and on high ethical standards.

(f) This is a terrible justification for being unethical. No substance to this argument exists. It

recognizes that a problem exists but labels the unethical action as acceptable based on a

popularity basis. And, not everyone does do it.

1-4.

(a) Read the software copyright agreement. Understand its limits. Allowing Stan to try the

software on your machine in your office would be satisfactory. But giving the software to Stan

to install on his machine would likely violate the software copyright agreement. The software

vendor or dealer may provide test software for prospective buyers. Often, firms can arrange a

site license with the software firm for multiple purchases. The dilemma here involves a

friendship.

(b) Again, using the same software on a different machine probably violates the terms of the

software contract. Careful reading of the software agreement may clarify the propriety of this

action. The dilemma here involves only your own sense of right and wrong.

(c) This is again probably a violation of the software copyright. But the problem here is that it

involves an unethical request from a superior, your boss. The limits of the copyright should be

made known to Mary. The entire package could be transferred from your machine to Mary’s

machine. But complying with her request would probably not be appropriate.

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 1, Page 1-10

Vous aimerez peut-être aussi

- CH 04Document26 pagesCH 04Albert CruzPas encore d'évaluation

- CH 12Document33 pagesCH 12Albert CruzPas encore d'évaluation

- CH 07Document50 pagesCH 07Albert CruzPas encore d'évaluation

- Chapter 15 Solutions: Solutions To Questions For Review and DiscussionDocument28 pagesChapter 15 Solutions: Solutions To Questions For Review and DiscussionAlbert CruzPas encore d'évaluation

- Chapter 8 Solutions: Solutions To Questions For Review and DiscussionDocument37 pagesChapter 8 Solutions: Solutions To Questions For Review and DiscussionAlbert CruzPas encore d'évaluation

- CH 03Document38 pagesCH 03Albert CruzPas encore d'évaluation

- Chapter 2 Solutions: Solutions To Questions For Review and DiscussionDocument31 pagesChapter 2 Solutions: Solutions To Questions For Review and DiscussionAlbert CruzPas encore d'évaluation

- Introduction To The Solutions ManualDocument2 pagesIntroduction To The Solutions ManualAlbert CruzPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Territory Sales Manager Consumer Goods in Buffalo NY Resume Brian BogartDocument2 pagesTerritory Sales Manager Consumer Goods in Buffalo NY Resume Brian BogartBrianBogartPas encore d'évaluation

- Module 8 Total Quality ManagementDocument9 pagesModule 8 Total Quality ManagementMary Joy Morallon CalaguiPas encore d'évaluation

- The P&G-Godrej AllianceDocument17 pagesThe P&G-Godrej AllianceYaso Thar100% (1)

- A.lalitha Bhavani FolderDocument9 pagesA.lalitha Bhavani FolderAshok Kumar SatuluriPas encore d'évaluation

- Criticality Analysis Process ModelDocument94 pagesCriticality Analysis Process ModelsarifinPas encore d'évaluation

- Alex Windle - Resume - 3Document1 pageAlex Windle - Resume - 3api-401022598Pas encore d'évaluation

- Self Assessment: Text VersionDocument9 pagesSelf Assessment: Text VersionfischertPas encore d'évaluation

- Elective Courses List For Epgp-14 BatchDocument7 pagesElective Courses List For Epgp-14 BatchAbirami NarayananPas encore d'évaluation

- LBSIM PPT 2julyDocument15 pagesLBSIM PPT 2julySaurabh PrabhakarPas encore d'évaluation

- Brief Contents: Strategy Evaluation 284Document8 pagesBrief Contents: Strategy Evaluation 284Abigail RodriguezPas encore d'évaluation

- Job Analysis: Global Edition 12eDocument42 pagesJob Analysis: Global Edition 12eMohamed SulubPas encore d'évaluation

- COP-WFP-APD-04-2013-v1 WFP RulesDocument9 pagesCOP-WFP-APD-04-2013-v1 WFP RulesAbdul AzizPas encore d'évaluation

- ASEABROWNBOVERIDocument5 pagesASEABROWNBOVERIfoglaabhishekPas encore d'évaluation

- CH 1 PSC Lecture Slides Student VersionDocument57 pagesCH 1 PSC Lecture Slides Student VersionsanjeeisherePas encore d'évaluation

- Strategic Framework For CRM - Payne and Frow - JM '05 PDFDocument11 pagesStrategic Framework For CRM - Payne and Frow - JM '05 PDFMaria ZakirPas encore d'évaluation

- No.2 Activity Based CostingDocument20 pagesNo.2 Activity Based CostinganuradhaPas encore d'évaluation

- Gearing Up For A Pharmacovigilance Audit Using A Risk Based ApproachDocument2 pagesGearing Up For A Pharmacovigilance Audit Using A Risk Based ApproachVijay Venkatraman Janarthanan100% (1)

- Ch2 - Basic Cost Management Concepts - OutlineDocument8 pagesCh2 - Basic Cost Management Concepts - OutlineirquadriPas encore d'évaluation

- Faculty of Higher Education: This Cover Sheet Must Be Submitted With Your AssignmentDocument7 pagesFaculty of Higher Education: This Cover Sheet Must Be Submitted With Your AssignmentDivya JoshiPas encore d'évaluation

- Final PaperDocument2 pagesFinal Paperliu920619Pas encore d'évaluation

- GCC Business Development & Marketing Director Resume 2023 PDFDocument5 pagesGCC Business Development & Marketing Director Resume 2023 PDFdoctora ranaPas encore d'évaluation

- Francis Nicholson, Richard Meek, Andrew Sherratt CIM Coursebook Managing MarketingDocument284 pagesFrancis Nicholson, Richard Meek, Andrew Sherratt CIM Coursebook Managing MarketingRicky FernandoPas encore d'évaluation

- Business Intelligence Manager Resume Samples - JobHeroDocument6 pagesBusiness Intelligence Manager Resume Samples - JobHeroSajjad Bin SiddiquePas encore d'évaluation

- SOP SACHIN NottinghamDocument2 pagesSOP SACHIN NottinghamSachin S 037CTMPas encore d'évaluation

- Isa 88Document29 pagesIsa 88re_289100% (1)

- Employee Engagement: A Comparative Study On Telecom Sector in Telenagana StateDocument3 pagesEmployee Engagement: A Comparative Study On Telecom Sector in Telenagana StatevadanamaPas encore d'évaluation

- Pabrik KertasDocument7 pagesPabrik KertasTristanisme EmpatSatoePas encore d'évaluation

- Educational AdministrationDocument32 pagesEducational AdministrationYuliana Sari100% (2)

- Elroy - Wintas: Makalah Bahasa InggrisDocument6 pagesElroy - Wintas: Makalah Bahasa InggrisDevi Eka IIPas encore d'évaluation