Académique Documents

Professionnel Documents

Culture Documents

Economy Budget 2020 Preview

Transféré par

Anonymous gMgeQl1SndCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Economy Budget 2020 Preview

Transféré par

Anonymous gMgeQl1SndDroits d'auteur :

Formats disponibles

20 September 2019

A likely expansionary Budget 2020, mainly from higher DE

Economic Update

Budget 2020 likely to include measures to sustain private consumption

The 2020 Malaysian Budget will be presented on 11 October 2019, with the

theme “Shared Prosperity: Sustainable and Inclusive Growth Towards High Malaysia-

Income Economy.” The upcoming 2020 Budget is crucial as it will be the final

budget under the Eleven Malaysia Plan (11MP) for the 2016-2020 period.

Similarly, the strategies on the Budget proposals should be seen in the context

Budget 2020

of ensuring a transition to the development plan of the Twelve Malaysia Plan

(12MP) for the 2021-2025 period, as well as setting out the directions and right

Preview

strategies for Malaysia to become a high-income economy.

Despite widely expected to be an expansionary budget to stimulate domestic

demand amid the global economic uncertainty in 2020, we believe the Federal

Government will remain focused on fiscal discipline, incurring a slightly lower

budget deficit of 3.2% of GDP in 2020, compared with a deficit of 3.4% of GDP

in 2019E, slightly higher than the initial official target of 3.0% of GDP (see Fig 1).

The increase in the budgetary allocation for operating expenditure will be

gradual, but allocation for development expenditure (DE) will likely be increased

in Budget 2020. Based on our estimate, we believe the Government’s operating

expenditure will be slightly higher by 2.6% to RM235.9bn in 2020 (RM222.9bn

in 2019E). We believe development expenditure plays an important role to

sustain the country’s economic growth, where the expansionary impact will help

to preserve the Government's revenue source (i.e., direct taxation) generated

by economic activities.

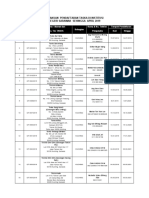

Fig 1: Federal Government Finance (Affin Hwang’s own estimates)

RM billion

2017 2018 2019E 2019E* 2020F

Total revenue 220.4 232.9 261.8 231.8 238.8

Operating expenditure 217.7 231.0 259.9 230.0 235.9

Current balance 2.7 1.9 2.0 2.0 2.8

Gross development expenditure 44.9 56.1 54.7 54.7 55.7

Less: Loan recoveries 1.9 0.8 0.7 0.7 0.7

Net development expenditure 43.0 55.3 54.0 54.0 55.0

Overall balance -40.3 -53.4 -52.1 -52.1 -52.2

% of GDP -3.0 -3.7 -3.4 -3.4 -3.2

E: Budget 2019 estimate

E*: Adjusted for one-off tax refunds

F: Affin Hwang's forecast

Our estimate forecasts development expenditure to be higher at RM55.7bn in

2020 as compared to RM54.7bn in 2019E. This move is intentional as

development expenditure on construction-related projects generally has a

higher multiplier impact on the economy relative to operating expenditure, see

Fig 2.

Fig 2: Output Multiplier by Sector

2010 2015

Agriculture, Fishing & Forestry 1.52 1.35

Mining & Quarrying 1.20 1.29

Manufacturing 1.79 1.95

Utilities 1.56 1.69

Construction 1.90 2.03

Wholesale & Retail Trade 1.54 1.58

Accommodation and Food & Bevrages 1.85 1.85

Transportation & Storage and Information & Communication 1.93 1.85

Finance & Insurance 1.83 1.49 Alan Tan

Real estate & Ownership of Dwellings 1.58 1.40 Research Team

Business & Private Services 1.60 1.71 (603) 2146 7540

Government Services 1.51 1.69 alan.tan@affinhwang.com

Source: DOSM

Affin Hwang Investment Bank Bhd (14389-U) www.affinhwang.com

Page 1 of 9

20 September 2019

We expect the Government revenue to still outpace that of operating

expenditure to register a substantial operating surplus of RM2.8bn in 2020

(RM2.0bn in 2019E), remaining in surplus for 33 years in a row since 1987.

Similarly, based on historical trends, it is evident that allocation of development

expenditure will be higher in the last year of the five-year plan. The Government

had proposed and revised development expenditure under the mid-term review

of the Eleven Malaysia Plan (11MP) to RM220bn. Based on our estimate,

development expenditure is expected to be substantial at around RM55.7bn in

2020, as compared to RM54.7bn estimated for 2019. In the first four years

(2016-2019) of the 11MP, the Federal Government has disbursed about 89.9%

or RM198bn of the total RM220bn.

Fig 3: Development expenditure under the 5-year Malaysia Plans

RMbn

(% yoy) First four years average Final year

70 55.7

52.8

60 (6.6%) 49.4 (1.8%)

42.2 43.8 (8.1%)

40.8

50 (12.9%) (-6.9%)

34.9 (3.2%)

40 (2.7%) 30.5

27.9

(5.8%)

(23.6%)

30 17.8

(12.9%)

20

10

0

1996-2000 2001-2005 2006-2010 2011-2015 2016-2020F

7MP 8MP 9MP 10MP 11MP

Source: MOF

2020 budget may be based on oil assumption of US$70 per barrel

We believe the crude oil price assumption in preparing and tabling for the

Malaysia’s Budget 2020 has been revised higher from an initial figure of US$60-

65 per barrel to US$70 per barrel, following the Saudi Arabia oil attacks.

Fig 4: Higher crude oil price assumption

75.00

70.00

65.00

60.00

55.00

50.00

12-Mar-19

26-Mar-19

9-Apr-19

1-Jan-19

12-Feb-19

26-Feb-19

4-Jun-19

16-Jul-19

30-Jul-19

23-Apr-19

7-May-19

13-Aug-19

27-Aug-19

10-Sep-19

15-Jan-19

29-Jan-19

21-May-19

18-Jun-19

2-Jul-19

Source: Bloomberg

Saudi Arabia oil attacks a turning point leading to higher global oil prices

The drone attack over the past weekend on Saudi Arabia's Abqaiq refinery and

oil processing facility and Khurais oil field has impacted production by around

5.7mmbpd, lowering current production from 9.8mmbpd to 4.1mmbpd, as

reported. This represents a significant 58% of its own production and 19% of

OPEC’s total production as of August 2019, which made up 5% of world supply.

Since the attack on 15 September 2019, the price of Brent crude oil has risen

sharply by around 15% from US$60 per barrel to US$68 per barrel currently.

Affin Hwang Investment Bank Bhd (14389-U) www.affinhwang.com

Page 2 of 9

20 September 2019

While Saudi Arabia had initially guided for full production resumption early this

week, Saudi turned less optimistic about a full recovery and currently only

expects to restore one-third of the lost production in the near term. It is uncertain

at this juncture how long the global outrage will last.

However, we believe the US strategic petroleum reserve may be used to

mitigate the shortfall. President Trump has earlier guided that it will tap into US

oil reserves to ensure that there is no sharp increase in global oil prices. Higher

oil prices will likely be bad for the US economy, especially prior to his upcoming

presidential election. We currently maintain our 2H19 Brent oil price assumption

at US$65-70/bbl, but there could be upward bias to our current assumption in

the short term depending on the timeline of production resumption. Our view

reflects the current uncertainty on global crude oil supplies.

Federal Government’s revenue to benefit from oil price gain

From a macro perspective, based on an earlier estimate, for every US$10 per

barrel increase in the price of global crude oil, the Federal Government’s

revenue will likely translate into a gain of about RM3.0bn a year. While the

expected additional revenue can help cover for the Government’s subsidy bill

from rising domestic petrol prices, we believe the upcoming proposed

implementation of the targeted fuel subsidy scheme will also lower the subsidy

amount allocated by the Government for petrol (RON95) and diesel. There will

be some windfall from subsidy savings to provide for possible contingency

measures (such as additional allocation for development expenditure or cash

assistance through BSH), to cushion the negative impact from the global trade

war tensions.

Lower subsidy bill from the upcoming targeted fuel subsidy scheme

As guided, with the proposed targeted fuel subsidy scheme, the price cap on

RON95 petrol (currently at RM2.08 per litre) may soon be gradually removed.

Based on an earlier calculation from last year’s Budget, the targeted subsidy is

expected to cost the Government only RM2bn for 2019, with the oil price

assumption of US$70 per barrel. While the Government may still be subsidizing

RM0.30 sen for every litre of RON95 petrol as well as every litre of diesel, the

authority will likely provide a timeframe for phasing out the current system and

introduce a targeted fuel subsidy scheme for 2020, which may include proposals

such as cash assistance directly given to lower-income households.

As such, we believe the increase in the price of global oil will improve Malaysia’s

revenue from the contribution of oil-related revenue including PITA, Petronas

dividends, petroleum royalties and other oil-related income (such as export

duties on petroleum/crude oil and income from exploration of O&G), which is

expected to support Malaysia’s fiscal position.

Fig 5: Contribution of BR1M/BSH supportive of private consumption

Private consumption (% GDP) BR1M Disbursement (RM'bn)

56.0% 7

54.0% 6.3 6.1 6

52.0% 5.4 5.4

5

50.0%

4

48.0% 3.7

2.9 3

46.0%

2.1 2

44.0%

42.0% 1

40.0% 0

2010

2005

2006

2007

2008

2009

2011

2012

2013

2014

2015

2016

2017

2018

Source: Various sources

Affin Hwang Investment Bank Bhd (14389-U) www.affinhwang.com

Page 3 of 9

20 September 2019

Government to continue with measures to support private consumption

To address the socio-economic conditions from a higher cost of living, we

believe the Budget 2020 to continue with its targeted incentives for households

under the B40 category. The Government has been assisting the B40 group

through cash assistance, such as Bantuan Sara Hidup (BSH), and this will likely

be continued in 2020 to support their well-being. Apart from BSH, the budget

allocation for the tourism sector will also be another focus in the budget for the

2020 Visit Malaysia Year campaign. In tandem with the event, Tourism Malaysia

is targeting 30 million tourist arrivals in 2020 and tourist receipts of RM100bn

(28.1 million tourists in 2019E and RM92.2bn in 2019E, respectively). We

believe the Government will likely provide additional allocation for the Visit

Malaysia 2020 Year campaign, possibly a higher allocation than 2019, to grants

for international marketing and promotional programmes.

Fig 6: Tourism arrival and tourist receipts

th person % yoy

Tourist Arrival Tourist Arrival Growth (RHS)

35,000 60

30,000 50

40

25,000

30

20,000 20

15,000 10

0

10,000

-10

5,000 -20

0 -30

2019F

2020F

2005

2001

2002

2003

2004

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

Source: Tourism Malaysia

Cut in corporate income tax on hold to preserve revenue streams

The Finance Minister already guided that the 2020 Budget is not expected to

introduce new tax measures targeting the corporate sector and investment

community (which may be referring to capital gains tax on shares and

inheritance tax). Nevertheless, while we believe the positive upside surprise to

the Budget measures will be from an across-the-board 1%-point cut in taxes on

corporate income earned, the Government will likely leave its corporate tax rate

unchanged in 2020 to preserve revenue streams from direct taxation.

Corporate income tax accounts for 51.1% of direct tax and 38.2% of total

Government revenue. We believe any cut in the corporate tax rate will only be

implemented from 2021 onwards, after Government revenue starts to increase

more steadily. Recently, Indonesia has proposed a reduction in the corporate

income tax (CIT) rate to 20% in 2022, from 25% currently, starting in 2021.

Need measures to support economy from uncertain global economy

Going into 2020, the global economy still faces substantial downside risks

emanating from the global trade war. The International Monetary Fund (IMF), in

its latest issue of the World Economic Outlook (WEO), downgraded its growth

forecast on the world economy by 0.1 percentage point to 3.5% for 2020 (3.2%

in 2019).

The global manufacturing PMI remained in contraction for the fourth consecutive

month at 49.5 in August from 49.3 July. Global semiconductor sales contracted

for the seventh consecutive month in July by 15.5% yoy, albeit at a slower pace

compared to 16.8% in June. With recent weak external data, as reflected in the

global PMI, this may suggest that manufacturers will remain cautious on new

orders and international trade going forward.

Affin Hwang Investment Bank Bhd (14389-U) www.affinhwang.com

Page 4 of 9

20 September 2019

According to the IMF’s latest assessment of the impact of the trade war, based

on a simulation, the recently announced tariffs by the US and China will lead to

a 0.3 percentage point reduction in global GDP growth in 2020, where more than

half of the impact will be due to lower business confidence and negative financial

market sentiment. Assuming that further tariffs are implemented, this may lower

global growth by 0.8 percentage points in 2020, with the IMF’s global GDP

growth possibly falling below the 3% level next year.

Growth in Malaysia’s private investment is highly correlated with external

conditions, where slower growth is likely from some postponement and delay in

the actual implementation of investment in the manufacturing and services

sectors, due to the global slowdown. Nevertheless, we believe the country's

domestic demand, especially private consumption, will sustain its growth

momentum, possibly benefitting from Budget 2020 measures.

The Government is likely to project the country’s real GDP growth to average

around 4.5-5.0% for 2020, against our expectation of 4.5% (4.7% estimated for

2019). However, in the event that the external environment deteriorates sharply

and if there is a need to introduce additional fiscal stimulus, we believe the

Government will allow its fiscal deficit target to be flexible to shore up economic

growth, whereby the fiscal deficit may be slightly higher than the deficit target set

and revert to the fiscal consolidation path once the global economic environment

stabilises.

Fig 7: Real GDP growth and 2019/2020 forecast

2018 2019F 2020F 2018 2019 2020F 2018 2019F 2020F

%yoy % of GDP % contribution point to GDP growth

GDP by Expenditure Components

Total Consumption 7.1 6.5 5.7 69.4 70.6 71.4 4.8 4.5 4.0

Private consumption expenditure 8.0 7.3 6.5 57.0 58.4 59.5 4.4 4.2 3.8

Public consumption expenditure 3.3 2.6 2.0 12.5 12.2 11.9 0.4 0.3 0.2

Total Investment 1.4 -0.1 1.4 24.6 23.5 22.8 0.3 0.0 0.3

Private investment expenditure 4.3 2.8 3.5 17.3 17.0 16.8 0.7 0.5 0.6

Public investment expenditure -5.0 -7.0 -4.0 7.4 6.5 6.0 -0.4 -0.5 -0.3

Domestic Demand 5.5 4.7 4.6 94.1 94.1 94.2 5.2 4.4 4.4

Net exports 11.4 3.5 1.6 7.0 6.9 6.7 0.8 0.2 0.1

Exports 2.2 0.9 0.8 67.6 65.1 62.8 1.5 0.6 0.5

Imports 1.3 0.6 0.7 60.6 58.2 56.1 0.8 0.4 0.4

GDP (2015 real prices) 4.7 4.7 4.5 100.0 100.0 100.0 4.7 4.7 4.5

GDP By Kind of Economic Activity

Agriculture, Forestry and Fishing 0.1 4.0 2.0 7.3 7.3 7.1 0.0 0.3 0.1

Mining and Quarrying -2.6 0.5 0.4 7.6 7.3 7.0 -0.2 0.0 0.0

Manufacturing 5.0 4.3 4.2 22.4 22.3 22.2 1.1 1.0 0.9

Construction 4.2 2.0 4.0 4.9 4.7 4.7 0.2 0.1 0.2

Services 6.8 5.9 5.6 56.7 57.3 57.9 3.8 3.3 3.2

GDP (2015 real prices) 4.7 4.7 4.5 100.0 100.0 100.0 4.7 4.7 4.5

Source: Affin Hwang’s forecast

Likely sectoral budget strategies and measures

On a sectoral basis, for the construction sector, we expect the Government to

likely revive some of the large-scale infrastructure projects (at reduced cost and

longer implementation timeline) such as the MRT3 and Pan Borneo Highway

Sabah (PBH) projects. We believe the MRT3 will enhance the public

transportation system in Klang Valley, while PBH will improve road connectivity

in Sabah and Sarawak.

According to our construction analyst, other projects such as the Penang

Transport Master Plan (PTMP) and HSR could be implemented based on a

public-private partnership concept. However, the decision on whether the HSR

will be revived is unlikely to be announced during the Budget 2020

announcement since the deadline agreed between the Malaysia and Singapore

governments is May 2020.

Affin Hwang Investment Bank Bhd (14389-U) www.affinhwang.com

Page 5 of 9

20 September 2019

Affordable housing will remain a key area of focus

We expect initiatives on affordable housing to continue in Budget 2020. This

will be in line with the recent measures by Bank Negara Malaysia (BNM),

where the eligibility criteria for its RM1bn Fund for Affordable Homes which

began in January 2019, was raised effective from 1 September 2019. The

maximum household income eligible is now RM4,360 from RM2,300, while

the maximum property price is now RM300,000 from RM150,000. The Fund

will be available for two years from 2 January 2019 or until the RM1bn fund

is fully utilised. Benefiting the construction sector, we expect the

Government’s development expenditure to emphasise building new hospitals,

water and sewerage systems, and rural roads to improve the lives of the people

in towns and rural areas under the Government’s concept of shared prosperity.

Fig 8: Potential large-scale infrastructure projects to kick off in 2019-2020

Project Cost (RMbn)

Penang Transport Master Plan (PTMP) 32

Bandar Malaysia infrastructure 21

Klang Valley MRT Line 3 - Circle Line (MRT3) 20

KL-Singapore High Speed Rail - Fast Train 20

Pan Borneo Highway Sabah (PBH) 13

East Coast Rail Link subcontracts 8

Sarawak Coastal Highway 5

Sarawak Second Trunk Road 6

Sarawak Water Grid Phase 1 8

Labuan Bridge 4

Johor BRT 3

Kota Kinabalu Water Supply Scheme 3

Total 142

Source: Affin Hwang

As for the property sector, we believe the Government will continue or expand

on incentives to assist first-time house buyers, as affordability remains an issue

for the B40 and low M40 groups, such as stamp-duty exemptions and mortgage

guarantees by Cagamas inclusive of down-payment support. There are some

reports noting that the minimum property price for foreigners to purchase local

residential properties (currently at least RM1m but some states impose a

minimum price of RM2m for landed properties) may possibly be reduced to help

clear the unsold units.

For the financial sector, potentially additional tax incentives may be given to

banks which adopt sustainable financing practices (i.e., green tech, renewable

energy) and fund new technology adoption initiated by start-ups (self-driving

cars, Prop Tech, Con Tech, Fintech).

As for the gaming sector (i.e., casinos), we believe that there will likely be no

increase in gaming taxes or licensing fees after the steep hike in Budget 2019,

as company profitability may still be negatively impacted by the hike. Post the

hike, Malaysia has one of the highest gaming taxation rates in Asia, which

significantly limits casinos’ ability to compete against regional peers for the VIP

and Premium-Mass clients. Both gaming volume and margin have are already

recorded a significant decline in 2019.

As for the consumer sector, on sin taxes, we believe that the risk of excise-duty

hikes on the brewers is less pronounced, with Malaysia’s existing taxation on

malt liquor already amongst the highest in the world. The last excise-duty

revision in March 2016 constituted a change in the excise-duty structure – from

RM7.40/litre plus 15% ad valorem tax, to a flat RM175 per 100% volume per

litre of alcohol – rather than a direct hike, and was then preceded by 10 years’

absence of duty hikes.

Affin Hwang Investment Bank Bhd (14389-U) www.affinhwang.com

Page 6 of 9

20 September 2019

Moreover, a sales tax of 10% and on-trade service tax of 6% had been already

imposed in 2018 following the abolishment of GST. In the event of a duty hike,

we expect the brewers’ volumes to be negatively impacted over the short term,

should they decide to pass on the cost to consumers – representing a fourth

round of price hikes since last year.

For the tobacco players, we do not foresee any excise-duty hikes to materialise

in Budget 2020. This is due to the unresolved illicit cigarettes trade situation

constituting 60% of the market since the Government’s aggressive spate of duty

hikes from 22sen/stick in 2013 to 40sen/stick in 2015, which has been further

exacerbated by the rise of cigarettes sold with fake tax stamps, alongside

unregulated vape products retailed at relatively more affordable prices than legal

cigarettes. We believe any possible revisions to the excise-duty structure would

be more likely to occur following the enactment of the MOH’s new Tobacco Act,

which is guided to be tabled in Parliament by March 2020 and encompass a

broader spectrum of regulations on the usage of tobacco, vape, e-cigarettes and

shisha.

For the auto sector, we see several potential initiatives for the sector in the

Budget 2020, such as 1) the possible higher allocation or study grants to further

strengthen the local workforce (via technical and vocational education training).

For instance, the new ‘national car’ definition in the upcoming National

Automotive Policy (NAP) 2019 requires the carmakers to use up to 98% local

workers in its workforce; 2) higher market development grant/allocation to spur

the rate of exports for component manufacturers; 3) possible allocation for the

establishment of charging stations, batteries production and management

systems for the upcoming ‘next-generation vehicle’, to prepare Malaysia on

becoming an energy-efficient carmaker; 4) incentives may be provided in the

form of tax breaks/exemptions for carmakers that are keen to expand research

and development and higher localisation efforts in Malaysia; and 6) special

incentives for first-time national car buyers that may help with affordability among

young adults.

As for the healthcare sector, we believe the Government will likely continue with

a higher allocation for healthcare, given the Government’s growing emphasis on

providing quality healthcare and social welfare protection as well as increasing

accessibility to health services. In addition, we believe that the Government

might potentially reintroduce the reinvestment allowance for pharmaceutical

manufacturers in Budget 2020, which was not renewed in Budget 2019.

As for the insurance sector, we expect continuous tax relief for annual EPF and

insurance/Takaful contributions, as well as possible tax incentives for insurance

firms, which subsidize insurance coverage for the B40 group / single mothers.

As for the plantation sector, we believe that there could be potential allocation

by the Government in the Budget for FELDA developments, as well as potential

allocation by the Government for development and replanting of palm-oil/

marketing programmes to assist smallholders.

For the telco sector, we expect the Government to highlight the recently

launched National Fiberisation and Connectivity Plan (NFCP). Spearheaded by

the Communications and Multimedia Ministry, the NFCP is a five-year plan

(2019-2023) with an investment cost of about RM21.6bn, to be funded by the

Universal Service Provider (USP) fund (RM10bn-11bn) and the private sector.

The NFCP is expected to create 20,000 job opportunities. Overall, we expect

the potential high investment expenditure to benefit the telco contractors and

equipment suppliers.

Affin Hwang Investment Bank Bhd (14389-U) www.affinhwang.com

Page 7 of 9

20 September 2019

Focus Charts

Chart 1: Malaysia GDP forecast Chart 2: Revenue and expenditure

Chart 3: Annual oil-related revenue vs Brent oil Chart 4: OE surplus

Chart 5: Malaysia budget deficit to GDP Chart 6: Companies and individuals income tax revenue

Source: All data for charts sourced from CEIC, DoS, BNM and Affin Hwang forecasts

Affin Hwang Investment Bank Bhd (14389-U) www.affinhwang.com

Page 8 of 9

20 September 2019

Equity Rating Structure and Definitions

BUY Total return is expected to exceed +10% over a 12-month period

HOLD Total return is expected to be between -5% and +10% over a 12-month period

SELL Total return is expected to be below -5% over a 12-month period

NOT RATED Affin Hwang Investment Bank Berhad does not provide research coverage or rating for this company. Report is intended as information only and not as a

recommendation

The total expected return is defined as the percentage upside/downside to our target price plus the net dividend yield over the next 12 months.

OVERWEIGHT Industry, as defined by the analyst’s coverage universe, is expected to outperform the KLCI benchmark over the next 12 months

NEUTRAL Industry, as defined by the analyst’s coverage universe, is expected to perform inline with the KLCI benchmark over the next 12 months

UNDERWEIGHT Industry, as defined by the analyst’s coverage universe is expected to under-perform the KLCI benchmark over the next 12 months

This report is intended for information purposes only and has been prepared by Affin Hwang Investment Bank Berhad (14389-U) (“the Company”) based on sources believed to be

reliable and is not to be taken in substitution for the exercise of your judgment. Such sources have not been independently verified by the Company, and as such the Company does

not give any guarantee, representation or warranty (expressed or implied) as to the adequacy, accuracy, reliability or completeness of the information and/or opinion provided or

rendered in this report. You should obtain independent financial, legal, tax or such other professional advice, when making your independent assessment, review and evaluation of

the company/entity covered in this report and the risks involved, before investing or participating in any of the securities or investment strategies or transactions discussed in this

report. Facts, information, estimates, views and/or opinion presented in this report have not been reviewed by, may not reflect information known to, and may present a differing view

expressed by other business units within the Company, including investment banking personnel and the same are subject to change without notice. Under no circumstances shall the

Company, be liable in any manner whatsoever for any consequences (including but are not limited to any direct, indirect or consequential losses, loss of profit and damages) arising

from the use of or reliance on the information and/or opinion provided or rendered in this report. Under no circumstances shall this report be construed as an offer to sell or a

solicitation of an offer to buy any securities. The Company its directors, its employees and their respective associates may have positions or financial interest in the securities

mentioned in this report. The Company, its directors, its employees and their respective associates may also act as market maker, may have assumed an underwriting commitment,

deal with such securities and may also perform or seek to perform investment banking services, advisory and other services relating to the subject company/entity mentioned in this

report, and may also make investment decisions or take proprietary positions that are inconsistent with the recommendations or views in this report. The Company, its directors, its

employees and their respective associates, may provide, or have provided in the past 12 months investment banking, corporate finance or other services and may receive, or may

have received compensation for the services provided from the subject company/entity covered in this report. No part of the research analyst’s compensation or benefit was, is or will

be, directly or indirectly, related to the specific recommendations or views expressed in this report. Employees of the Company may serve as a board member of the subject

company/entity covered in this report.

Third-party data providers make no warranties or representations of any kind relating to the accuracy, completeness, or timeliness of the data they provide and shall not have any

liability for any damages of any kind relating to such data.

This report, or any portion thereof may not be reprinted, sold or redistributed without the written consent of the Company.

This report is printed and published by:

Affin Hwang Investment Bank Berhad (14389-U)

A Participating Organisation of Bursa Malaysia Securities Berhad

22nd Floor, Menara Boustead,

69, Jalan Raja Chulan,

50200 Kuala Lumpur, Malaysia.

T : + 603 2146 3700

F : + 603 2146 7630

research@affinhwang.com

www.affinhwang.com

Affin Hwang Investment Bank Bhd (14389-U) www.affinhwang.com

Page 9 of 9

Vous aimerez peut-être aussi

- Group - 6 PDFDocument13 pagesGroup - 6 PDFRami ahmedPas encore d'évaluation

- Budget Analysis: 2009-2010Document11 pagesBudget Analysis: 2009-2010Waseem IshfaqPas encore d'évaluation

- Solid, Stable and Consistent: BOC Hong Kong (Holdings) LimitedDocument4 pagesSolid, Stable and Consistent: BOC Hong Kong (Holdings) LimitedRalph SuarezPas encore d'évaluation

- Blue Chip JulyDocument1 pageBlue Chip JulyPiyushPas encore d'évaluation

- Report Ind Morning 11 Nov 2021Document9 pagesReport Ind Morning 11 Nov 2021PT SKSPas encore d'évaluation

- Report Ind Morning 11 Nov 2021 EditedDocument9 pagesReport Ind Morning 11 Nov 2021 EditedPT SKSPas encore d'évaluation

- Report Ind Morning 11 Nov 2021 EditedDocument9 pagesReport Ind Morning 11 Nov 2021 EditedPT SKSPas encore d'évaluation

- Uol Group 1H2021RESULTS 1 2 A U G U S T 2 0 2 1Document26 pagesUol Group 1H2021RESULTS 1 2 A U G U S T 2 0 2 1Pat KwekPas encore d'évaluation

- Programme Book KLIFF2021Document102 pagesProgramme Book KLIFF2021Van AshcrofPas encore d'évaluation

- Capital Growth FundDocument1 pageCapital Growth FundHimanshu AgrawalPas encore d'évaluation

- SyngeneDocument12 pagesSyngeneIndraneel MahantiPas encore d'évaluation

- Tech Mahindra Valuation Report FY21 Equity Inv CIA3Document5 pagesTech Mahindra Valuation Report FY21 Equity Inv CIA3safwan hosainPas encore d'évaluation

- ARM Factsheets JanuaryDocument10 pagesARM Factsheets JanuaryJon RolexPas encore d'évaluation

- Fund 8322 Black Rock Us Equity IndexDocument1 pageFund 8322 Black Rock Us Equity IndexMikePas encore d'évaluation

- Eco AssignmentDocument28 pagesEco AssignmentBPMN 3134Pas encore d'évaluation

- Kotak Infrastructure and Economic Reform FundDocument14 pagesKotak Infrastructure and Economic Reform FundArmstrong CapitalPas encore d'évaluation

- SGL Carbon H1 2021 EN 12 08 2021 SDocument32 pagesSGL Carbon H1 2021 EN 12 08 2021 SAhmed ZamanPas encore d'évaluation

- Diversified JulyDocument1 pageDiversified JulyPiyushPas encore d'évaluation

- HDFC BlueChip FundDocument1 pageHDFC BlueChip FundKaran ShambharkarPas encore d'évaluation

- Course Name Course Code Student Name Student ID DateDocument7 pagesCourse Name Course Code Student Name Student ID Datemona asgharPas encore d'évaluation

- Term Valued CFDocument14 pagesTerm Valued CFEl MemmetPas encore d'évaluation

- Indonesia: The Delta Variant and Lagging Vaccination Have Set Back The RecoveryDocument4 pagesIndonesia: The Delta Variant and Lagging Vaccination Have Set Back The RecoveryTopan ArdiansyahPas encore d'évaluation

- Generali 2021 Results PresentationDocument63 pagesGenerali 2021 Results PresentationAmal SebastianPas encore d'évaluation

- Summative Assessment: Financial Performance ManagementDocument24 pagesSummative Assessment: Financial Performance ManagementAshley WoodPas encore d'évaluation

- Uol Group Fy2020 Results 26 FEBRUARY 2021Document33 pagesUol Group Fy2020 Results 26 FEBRUARY 2021Pat KwekPas encore d'évaluation

- Evaluation of Digital Realty Trust IncDocument18 pagesEvaluation of Digital Realty Trust Incwafula stanPas encore d'évaluation

- VinaCapital 2021 Outlook PublicDocument13 pagesVinaCapital 2021 Outlook PublicTùng HoàngPas encore d'évaluation

- 712-Ratio AnalysisDocument13 pages712-Ratio AnalysisAnarPas encore d'évaluation

- Kirk Fulford - AASB PresentationDocument33 pagesKirk Fulford - AASB PresentationTrisha Powell CrainPas encore d'évaluation

- Revenue Stream: Advisory and Project Management 35%Document4 pagesRevenue Stream: Advisory and Project Management 35%razPas encore d'évaluation

- Post Budget UoP 2019Document49 pagesPost Budget UoP 2019Shafeeq GigyaniPas encore d'évaluation

- Unit-Linked Fund: Balancer II (Open Fund)Document1 pageUnit-Linked Fund: Balancer II (Open Fund)sandeepPas encore d'évaluation

- Infrasturcture ProjectDocument17 pagesInfrasturcture ProjectAbdul AzzisPas encore d'évaluation

- HDFC Diversified Equity FundDocument1 pageHDFC Diversified Equity FundMayank RajPas encore d'évaluation

- Everbright Greentech Research Report 05.12.21Document4 pagesEverbright Greentech Research Report 05.12.21Ralph SuarezPas encore d'évaluation

- Just Group Research Report 05.15.21Document4 pagesJust Group Research Report 05.15.21Ralph SuarezPas encore d'évaluation

- Middle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsD'EverandMiddle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsPas encore d'évaluation

- Economic AssignmentDocument13 pagesEconomic AssignmentZhomePas encore d'évaluation

- Vincom Retail Joint Stock Company 2020 Performance and 2021 OutlookDocument28 pagesVincom Retail Joint Stock Company 2020 Performance and 2021 OutlookNeil NguyenPas encore d'évaluation

- 1 Energy SDCC by DKKim Rev 15mar2017Document13 pages1 Energy SDCC by DKKim Rev 15mar2017Butch D. de la Cruz100% (2)

- YYH (KWSP) - EPF Records RM34.05 Billion in Investment Income For 1H 2021Document4 pagesYYH (KWSP) - EPF Records RM34.05 Billion in Investment Income For 1H 2021Calvin YeohPas encore d'évaluation

- Tyson Foods Inc Class A TSN: Growth Rates (Compound Annual)Document1 pageTyson Foods Inc Class A TSN: Growth Rates (Compound Annual)garikai masawiPas encore d'évaluation

- Management Discussion and Analysis For The Financial YearDocument6 pagesManagement Discussion and Analysis For The Financial Yearziaa senPas encore d'évaluation

- H1 2022 Results PresentationDocument28 pagesH1 2022 Results PresentationUday KiranPas encore d'évaluation

- Government Debt Management in KoreaDocument17 pagesGovernment Debt Management in KoreaAsian Development Bank - Event DocumentsPas encore d'évaluation

- Cushman & Wakefield - Presentation - THE ROLE OF SOUTHERN VIETNAM IN GLOBAL SUPPLY CHAINS - ENDocument28 pagesCushman & Wakefield - Presentation - THE ROLE OF SOUTHERN VIETNAM IN GLOBAL SUPPLY CHAINS - ENTrang DaoPas encore d'évaluation

- KBSL - Consensus Budget ExpectationDocument44 pagesKBSL - Consensus Budget ExpectationRahulPas encore d'évaluation

- 10 Mop Q4 20 Q1 21 Second Wave of COVID 19 Pandemic Delays Economic RecoveryDocument30 pages10 Mop Q4 20 Q1 21 Second Wave of COVID 19 Pandemic Delays Economic Recoverymisamakarenko6Pas encore d'évaluation

- FPTS Outlook 2022 No04 KeepFaithDocument16 pagesFPTS Outlook 2022 No04 KeepFaithLinh TRAN Thi AnhPas encore d'évaluation

- Chile's Public Finances in The Context of The Pandemic July 2021Document24 pagesChile's Public Finances in The Context of The Pandemic July 2021Ian Carrasco TufinoPas encore d'évaluation

- Italy Brochure 2024 EN Low2Document12 pagesItaly Brochure 2024 EN Low2theutzu15Pas encore d'évaluation

- Govt FinDocument9 pagesGovt Finshovon mukitPas encore d'évaluation

- Executive Summary: Philippines Construction CompanyDocument7 pagesExecutive Summary: Philippines Construction CompanyVon Ulysses CastilloPas encore d'évaluation

- Pertamina 1H 2021 PerformanceDocument18 pagesPertamina 1H 2021 PerformanceMuhamad Luthfi azizPas encore d'évaluation

- Group Information: Dien Quang Lamp Joint Stock Company Công ty Cổ phần Bóng đèn Điện Quang (DQC)Document8 pagesGroup Information: Dien Quang Lamp Joint Stock Company Công ty Cổ phần Bóng đèn Điện Quang (DQC)BonBonPas encore d'évaluation

- Materi SmartCity Nusantara UKPBJ Jatim 2019Document56 pagesMateri SmartCity Nusantara UKPBJ Jatim 2019iapi jatimPas encore d'évaluation

- USAA Growth and Tax Strategy Fund - 2Q '22Document2 pagesUSAA Growth and Tax Strategy Fund - 2Q '22ag rPas encore d'évaluation

- Group 6 Project MADocument32 pagesGroup 6 Project MAPhạm Kỳ DuyênPas encore d'évaluation

- Diversified Equity FundDocument1 pageDiversified Equity FundHimanshu AgrawalPas encore d'évaluation

- Product Snapshot: DSP 10Y G-Sec FundDocument2 pagesProduct Snapshot: DSP 10Y G-Sec FundManoj SharmaPas encore d'évaluation

- SPA Circular 2 of 2021Document1 pageSPA Circular 2 of 2021Anonymous gMgeQl1SndPas encore d'évaluation

- Precision 15 7520 Laptop Owner's Manual en UsDocument84 pagesPrecision 15 7520 Laptop Owner's Manual en UsMligo ClemencePas encore d'évaluation

- Master Taska Di InstitusiDocument4 pagesMaster Taska Di InstitusiAnonymous gMgeQl1SndPas encore d'évaluation

- PDF 5dce08d437cf5 PDFDocument14 pagesPDF 5dce08d437cf5 PDFSazali YatimanPas encore d'évaluation

- Precision 15 7520 Laptop Owner's Manual en UsDocument84 pagesPrecision 15 7520 Laptop Owner's Manual en UsMligo ClemencePas encore d'évaluation

- T U B A (A P - 3 0 0 8 - F H) : Air PurifierDocument1 pageT U B A (A P - 3 0 0 8 - F H) : Air PurifierAnonymous gMgeQl1SndPas encore d'évaluation

- Precision 15 7520 Laptop Owner's Manual en UsDocument84 pagesPrecision 15 7520 Laptop Owner's Manual en UsMligo ClemencePas encore d'évaluation

- Precision 15 7520 Laptop Owner's Manual en UsDocument84 pagesPrecision 15 7520 Laptop Owner's Manual en UsMligo ClemencePas encore d'évaluation

- Guide For Better Public ToiletsDocument106 pagesGuide For Better Public ToiletsElisha SorianoPas encore d'évaluation

- AVK Couplings AdaptorsDocument16 pagesAVK Couplings AdaptorsJaveed KhanPas encore d'évaluation

- Lombok 3 Sales HandoutDocument1 pageLombok 3 Sales HandoutAnonymous gMgeQl1SndPas encore d'évaluation

- CAPTAIN (AP-1717A) : Air PurifierDocument1 pageCAPTAIN (AP-1717A) : Air PurifierAnonymous gMgeQl1SndPas encore d'évaluation

- Sharp Inverter Washing Machine BrochureDocument4 pagesSharp Inverter Washing Machine BrochureAnonymous gMgeQl1SndPas encore d'évaluation

- Schedule of Rates For Building Works in Sarawak 2018 PDFDocument56 pagesSchedule of Rates For Building Works in Sarawak 2018 PDFHayatoPas encore d'évaluation

- ATLAS - Ti 8 Windows Importing and Exporting Code ListsDocument4 pagesATLAS - Ti 8 Windows Importing and Exporting Code ListsAnonymous gMgeQl1SndPas encore d'évaluation

- ATLAS - Ti 8 Windows Importing and Exporting Code ListsDocument4 pagesATLAS - Ti 8 Windows Importing and Exporting Code ListsAnonymous gMgeQl1SndPas encore d'évaluation

- Cherry, Almond & Pecan BreadDocument2 pagesCherry, Almond & Pecan BreadAnonymous gMgeQl1SndPas encore d'évaluation

- Bure User - Manual EngDocument8 pagesBure User - Manual EngAnonymous gMgeQl1SndPas encore d'évaluation

- Egg Enriched White Bread RecipeDocument2 pagesEgg Enriched White Bread RecipeAnonymous gMgeQl1SndPas encore d'évaluation

- Abcd Eÿ GH Ij KLM No Kkÿ Ao Kbpÿ Qked RKDocument2 pagesAbcd Eÿ GH Ij KLM No Kkÿ Ao Kbpÿ Qked RKAnonymous gMgeQl1SndPas encore d'évaluation

- 2020 Budget SnapshotsDocument8 pages2020 Budget SnapshotsAnonymous gMgeQl1SndPas encore d'évaluation

- ATLAS - Ti Project Data Exchange PathsDocument6 pagesATLAS - Ti Project Data Exchange PathsAnonymous gMgeQl1SndPas encore d'évaluation

- ATLAS - Ti 8 Windows Quick TourDocument66 pagesATLAS - Ti 8 Windows Quick TourAnonymous gMgeQl1SndPas encore d'évaluation

- Bs 2020Document88 pagesBs 2020limmingjunPas encore d'évaluation

- Range RoverDocument96 pagesRange RoverAnonymous gMgeQl1Snd100% (1)

- Tropics City BrochureDocument11 pagesTropics City BrochureAnonymous gMgeQl1SndPas encore d'évaluation

- TaXavvy Budget 2020 Part 1Document29 pagesTaXavvy Budget 2020 Part 1Anonymous gMgeQl1SndPas encore d'évaluation

- Take5 Budget2020 Malaysia 12oct2019Document15 pagesTake5 Budget2020 Malaysia 12oct2019Anonymous gMgeQl1SndPas encore d'évaluation

- PFDocument19 pagesPFAnonymous gMgeQl1SndPas encore d'évaluation

- 2018 Hilux MaxcheckDocument10 pages2018 Hilux MaxcheckAnonymous gMgeQl1SndPas encore d'évaluation

- Roger Rabbit:, Forest Town, CA 90020Document3 pagesRoger Rabbit:, Forest Town, CA 90020Marc TPas encore d'évaluation

- Case 2:09-cv-02445-WBS-AC Document 625-1 Filed 01/21/15 Page 1 of 144Document144 pagesCase 2:09-cv-02445-WBS-AC Document 625-1 Filed 01/21/15 Page 1 of 144California Judicial Branch News Service - Investigative Reporting Source Material & Story Ideas100% (2)

- Merenstein Gardners Handbook of Neonatal Intensive Care 8Th Edition Sandra Lee Gardner Brian S Carter Mary I Enzman Hines Jacinto A Hernandez Download PDF ChapterDocument52 pagesMerenstein Gardners Handbook of Neonatal Intensive Care 8Th Edition Sandra Lee Gardner Brian S Carter Mary I Enzman Hines Jacinto A Hernandez Download PDF Chapterrichard.martin380100% (16)

- Taguig City University: College of Information and Communication TechnologyDocument9 pagesTaguig City University: College of Information and Communication TechnologyRay SenpaiPas encore d'évaluation

- Internship ReportDocument2 pagesInternship ReportFoxyPas encore d'évaluation

- MODULE-1-EU111 Univeristy and IDocument8 pagesMODULE-1-EU111 Univeristy and IAbzchen YacobPas encore d'évaluation

- Pabon v. NLRCDocument4 pagesPabon v. NLRCHaniyyah FtmPas encore d'évaluation

- 1a. Create Your Yosemite Zone USB DriveDocument9 pages1a. Create Your Yosemite Zone USB DriveSimon MeierPas encore d'évaluation

- ProEXR ManualDocument44 pagesProEXR ManualSabine BPas encore d'évaluation

- Thermister O Levels Typical QuestionDocument4 pagesThermister O Levels Typical QuestionMohammad Irfan YousufPas encore d'évaluation

- Package Contents: Ariadni DivaDocument4 pagesPackage Contents: Ariadni DivaShadi AbdelsalamPas encore d'évaluation

- Pathfinder House RulesDocument2 pagesPathfinder House RulesilililiilililliliI100% (1)

- Appendix 24 - QUARTERLY REPORT OF REVENUE AND OTHER RECEIPTSDocument1 pageAppendix 24 - QUARTERLY REPORT OF REVENUE AND OTHER RECEIPTSPau PerezPas encore d'évaluation

- Programa de Formacion: English Dot Works 2Document4 pagesPrograma de Formacion: English Dot Works 2Juan GuerreroPas encore d'évaluation

- HPDocument71 pagesHPRazvan OracelPas encore d'évaluation

- Project Execution and Control: Lunar International College July, 2021Document35 pagesProject Execution and Control: Lunar International College July, 2021getahun tesfayePas encore d'évaluation

- Annexure 3 Courtesy Car AgreementDocument3 pagesAnnexure 3 Courtesy Car AgreementManishPas encore d'évaluation

- Helicoil Plus en 0100Document56 pagesHelicoil Plus en 0100Khổng MạnhPas encore d'évaluation

- Ats1811 MLDocument16 pagesAts1811 MLWathPas encore d'évaluation

- KACE SeDocument63 pagesKACE SeAbdul RahimPas encore d'évaluation

- Testing Template - Plan and Cases CombinedDocument3 pagesTesting Template - Plan and Cases Combinedapi-19980631Pas encore d'évaluation

- Istqb Agile Tester Learning Objectives SingleDocument3 pagesIstqb Agile Tester Learning Objectives SingleSundarPas encore d'évaluation

- Bilal CVDocument3 pagesBilal CVShergul KhanPas encore d'évaluation

- 358 IG Fashion Pack PDFDocument4 pages358 IG Fashion Pack PDFbovsichPas encore d'évaluation

- Cambridge International Advanced Subsidiary and Advanced LevelDocument4 pagesCambridge International Advanced Subsidiary and Advanced Leveljunk filesPas encore d'évaluation

- Ariando Purba: Nov 2017-: CV. Mulia Abadi (Knitto Textiles) - Present System Development and ImplementationDocument3 pagesAriando Purba: Nov 2017-: CV. Mulia Abadi (Knitto Textiles) - Present System Development and ImplementationariandoPas encore d'évaluation

- Reversible Motors: Additional InformationDocument36 pagesReversible Motors: Additional InformationAung Naing OoPas encore d'évaluation

- BDA Guide To Successful Brickwor1kDocument259 pagesBDA Guide To Successful Brickwor1kMudassar AhmadPas encore d'évaluation

- Writing Case StudyDocument2 pagesWriting Case Studyerankit.sapPas encore d'évaluation

- NHW Beg 4E Unit Tests - 3a PDFDocument2 pagesNHW Beg 4E Unit Tests - 3a PDFabeer24Pas encore d'évaluation