Académique Documents

Professionnel Documents

Culture Documents

Final Paper 7: Direct Tax Laws: Practice Questions

Transféré par

Rajbir SinghDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Final Paper 7: Direct Tax Laws: Practice Questions

Transféré par

Rajbir SinghDroits d'auteur :

Formats disponibles

ct Final Paper 7: Direct Tax Laws

Practice Questions

Question 1

An appeal was preferred by the assessee to the Commissioner (Appeals) against the order of

assessment made by the Assessing Officer. The appeal was allowed by the Commissioner

(Appeals). The assessee later found that he was entitled to a certain deduction, which was neither

claimed by him nor allowed by the Assessing Officer in the course of assessment. The issue of

deduction was not raised by the assessee in the appeal before the Commissioner (Appeals) and

was not considered by the Commissioner (Appeals). Examine the power of the Commissioner to

revise under section 264 the order of assessment in order to allow such deduction on an application

by the assessee.

Question 2

The assessment of Ashok for assessment year 2016-17 was completed under section 143(3) on 15th

January, 2018. The Commissioner acting under section 263 directed the Assessing Officer to add a

certain amount appearing in the Balance Sheet in the total income of Ashok.

Ashok did not challenge the order of the Commissioner under section 263 by filing appeal to the

Tribunal. The Assessing Officer passed a fresh assessment order on 1st October, 2018 including the

said amount in the total income of Ashok pursuant to the order of the Commissioner.

Ashok disputed the fresh assessment order in appeal to Commissioner (Appeals) under Section

246A. The Commissioner (Appeals) dismissed the appeal on the ground that the Assessing Officer

only complied with direction of the Commissioner under section 263, which was not disputed by

Ashok in appeal to Tribunal. Examine the correctness of the stand taken by the Commissioner

(Appeals).

Question 3

Examine the following propositions:

(i) The Income Tax Appellate Tribunal cannot admit additional evidence during the hearing of the

appeal.

(ii) The Commissioner of Income-tax can revise an order during the pendency of an appeal before

the First Appellate Authority.

(iii) The Commissioner of Appeals cannot admit an appeal filed beyond 30 days from the date of

receipt of order by an assessee.

Question 4

The assessment of South West Bank Limited for Assessment Year 2014-15 was made under section

© The Institute of Chartered Accountants of India

18.2 DIRECT TAX LAWS

143(3) on 30th November, 2015 allowing deduction under section 36(1)(viia) on account of provision

for doubtful debts and deduction in respect of foreign exchange rate difference as claimed in the

return of income. Subsequently, the Assessing Officer initiated reassessment proceeding under

section 147 in respect of deduction under section 36(1)(viii) for special reserve created by the bank.

The order under section 147 was passed on 31st December, 2017. Later, the Principal

Commissioner, after examining the record of assessment, initiated revisionary proceeding under

section 263 by issue of show cause notice to the bank and passed an order under section 263 on

31st August, 2018 for disallowing in part deduction under section 36(1)(viia) and deduction for foreign

exchange rate difference. The bank claims that the order passed by the Principal Commissioner

under section 263 is barred by limitation.

Examine the correctness or otherwise of the claim of the bank.

Question 5

Can Commissioner (Appeals) refuse to admit an appeal even though such appeal is filed within

time? Examine.

Question 6

M, an individual, had let out his building on a monthly rent of ` 20,000. The tenant deducted tax

under section 194-I from the rent paid to M, but did not remit such tax to the credit of the Central

Government. M filed his return of income for the assessment year 2018-19 including therein the

rental income from the said building and paid the balance tax on his total income after taking credit

for tax deducted at source by the tenant. The Assessing Officer has called upon M to pay the tax to

the extent of tax deducted at source. Is the Assessing Officer justified in doing so?

Question 7

A sum of ` 60,000 was paid to Mr. Dastur, an advocate, on 1st July, 2017 towards fees for his

professional services without deducting tax at source. Later on, a further sum of ` 70,000 was due

to him on 28th February, 2018 from which tax of ` 13,000 was deducted at source. The tax so

deducted was deposited on 25th June, 2018. Compute interest payable by the deductor under section

201(1A).

Question 8

The Assessing Officer within his jurisdiction surveyed a popular Cyber Café at 12 o’clock in night for

the purpose of collecting information which may be useful for the purposes of the Income-tax Act,

1961. The Cyber Café is kept open for business every day between 2 p.m. and 2 a.m. The owner

of the Cyber Café claims that the Assessing Officer could not enter the café in late night. The

Assessing Officer wanted to take away with him the books of account kept at the Cyber Café.

Examine the validity of the claim made by the owner and the proposed action of the Assessing

Officer.

Question 9

© The Institute of Chartered Accountants of India

T, an individual, filed his return of income for the assessment year 2018-19 on 18.10.2018 declaring

a total income of ` 1,20,000. He later discovered that he had not claimed a particular deduction

amounting to ` 2,10,000 while computing his business income in the said return. He filed a revised

return on 29.3.2019 declaring a total loss of ` 90,000. The Assessing Officer proposes to disallow

the claim of T for carry forward of the business loss under section 72(1) amounting to ` 90,000 for

the reason that the revised return declaring loss for the first time was filed beyond the time prescribed

under section 139(3). Examine the validity of the proposed action of the Assessing Officer.

Question 10

EIH Private Ltd.’s assessment for assessment year 2011-12 was completed under section 143(3)

on 31st August, 2012. The company went in appeal to the Commissioner (Appeals) and the appeal

was decided on 16th August, 2013 and the appeal effect was duly given by the Assessing Officer on

25th August, 2013. Thereafter, on 1st September, 2017 the Assessing Officer noticed a mistake in

calculation of depreciation on a particular block of assets, which reduced the income excessively by

` 1.10 lacs. The Assessing Officer issued notice under section 154 for the purpose of rectifying the

mistake. Is such rectification permissible?

© The Institute of Chartered Accountants of India

Vous aimerez peut-être aussi

- Additional Claim at Assessement StageDocument4 pagesAdditional Claim at Assessement StageRajeshkumar RabidasPas encore d'évaluation

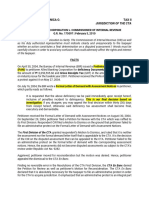

- 2020 P T D Trib 614Document8 pages2020 P T D Trib 614haseeb AhsanPas encore d'évaluation

- Stay ApplicationsDocument8 pagesStay ApplicationsSHIVJEE yadavPas encore d'évaluation

- Professional Updates 1Document25 pagesProfessional Updates 1Nitin Mohan KashyapPas encore d'évaluation

- Swati Malove Divetiavs Income Tax OfficerDocument4 pagesSwati Malove Divetiavs Income Tax OfficerAnandd BabunathPas encore d'évaluation

- 148d 50 LAC Cost ImposedDocument36 pages148d 50 LAC Cost ImposedNeena BatlaPas encore d'évaluation

- TAX Appellant Memo Blkul FinalDocument15 pagesTAX Appellant Memo Blkul FinalSapna KawatPas encore d'évaluation

- CaselawsDocument5 pagesCaselawsRam PrasadPas encore d'évaluation

- In The High Court at Calcutta Special Jurisdiction (Income-Tax) (Original Side)Document14 pagesIn The High Court at Calcutta Special Jurisdiction (Income-Tax) (Original Side)Mintu SahuPas encore d'évaluation

- Case 10. Oceanic Wireless Network Inc Vs CIRDocument2 pagesCase 10. Oceanic Wireless Network Inc Vs CIRAl-MakkiHasanPas encore d'évaluation

- Weekly Updates 16th Apr 2023 To 22nd Apr 2023Document7 pagesWeekly Updates 16th Apr 2023 To 22nd Apr 2023Swathi JainPas encore d'évaluation

- STAY - SC OrderDocument3 pagesSTAY - SC OrdermvsarmaPas encore d'évaluation

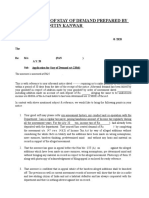

- DRAFT Stay of Demand by CA NITIN KANWARDocument13 pagesDRAFT Stay of Demand by CA NITIN KANWARAmandeep Vats91% (11)

- MTP 7Document17 pagesMTP 7Deepsikha maitiPas encore d'évaluation

- Case CommentaryDocument7 pagesCase CommentaryHritik KashyapPas encore d'évaluation

- TaxationBarQ26A TaxRemediesDocument32 pagesTaxationBarQ26A TaxRemediesjuneson agustinPas encore d'évaluation

- Assessment and AuditDocument6 pagesAssessment and AuditRohit KasbePas encore d'évaluation

- Session Paper - 6 (Questions & Answers), For Overall Discussion On Principles of Taxation of CLDocument3 pagesSession Paper - 6 (Questions & Answers), For Overall Discussion On Principles of Taxation of CLProgga MehnazPas encore d'évaluation

- STATE TAX OFFICER CaseDocument31 pagesSTATE TAX OFFICER Casedevanshi jainPas encore d'évaluation

- Commissionerof Income Tax, Chennaivs Vummudi AmarendranDocument7 pagesCommissionerof Income Tax, Chennaivs Vummudi AmarendranKaran GannaPas encore d'évaluation

- Shri Vedavyas Co Operative Credit Society LTD Vs Income Tax Officer 6aeaa3c543bd92250fef9d363c6aa9 DocumentDocument8 pagesShri Vedavyas Co Operative Credit Society LTD Vs Income Tax Officer 6aeaa3c543bd92250fef9d363c6aa9 Documentbharath289Pas encore d'évaluation

- 2017-18 Tax Case DigestDocument2 pages2017-18 Tax Case DigestRay Marvin Anor Palma100% (1)

- JHC 491832Document11 pagesJHC 491832Kunal NawalePas encore d'évaluation

- Lascona Land Vs CIRDocument3 pagesLascona Land Vs CIRKM MacPas encore d'évaluation

- Application For Compounding OffencesDocument7 pagesApplication For Compounding OffencesKaRan K KHetaniPas encore d'évaluation

- Appeal Effect Order Has To Be Passed Within 3 Months of Passing Appeal Order - Taxguru - inDocument2 pagesAppeal Effect Order Has To Be Passed Within 3 Months of Passing Appeal Order - Taxguru - inAkashPas encore d'évaluation

- TaxationBarQ26A TaxRemediesDocument32 pagesTaxationBarQ26A TaxRemediesCire Gee100% (1)

- Fox Mandal Tax Newsletter Tax Inform AugustDocument24 pagesFox Mandal Tax Newsletter Tax Inform AugustVarshaPas encore d'évaluation

- National Company Law Appellate Tribunal (From New Delhi) (F.B.)Document5 pagesNational Company Law Appellate Tribunal (From New Delhi) (F.B.)ashutosh srivastavaPas encore d'évaluation

- ITA No.298SRT2023AY.2017-18Document11 pagesITA No.298SRT2023AY.2017-18ys9874145Pas encore d'évaluation

- In The High Court of Judicature at BombayDocument23 pagesIn The High Court of Judicature at BombayAjmera HarshalPas encore d'évaluation

- Lascona vs. CIR (TAX)Document4 pagesLascona vs. CIR (TAX)Teff QuibodPas encore d'évaluation

- 2023 153 Taxmann Com 686 Punjab Haryana 01 03 2023 Mahavir Rice Mills Vs CommissioDocument7 pages2023 153 Taxmann Com 686 Punjab Haryana 01 03 2023 Mahavir Rice Mills Vs CommissioThe Chartered Professional NewsletterPas encore d'évaluation

- Allied Bank v. CIR Case DigestDocument4 pagesAllied Bank v. CIR Case DigestCareenPas encore d'évaluation

- Per Rajpal Yadav, Judicial MemberDocument5 pagesPer Rajpal Yadav, Judicial MemberSrijan MishraPas encore d'évaluation

- AJK TEVTA Vs Commissioner Inland RevenueDocument11 pagesAJK TEVTA Vs Commissioner Inland RevenueRashid Hussain TunioPas encore d'évaluation

- Versus: Efore R Rora Hairman AND Ajiv Isra Ember DministrativeDocument7 pagesVersus: Efore R Rora Hairman AND Ajiv Isra Ember DministrativeshailjaPas encore d'évaluation

- 1971 82 ITR 363 SC 17-08-1971 Kedarnath Jute MFG Co LTD Vs Commissioner of IncomeDocument5 pages1971 82 ITR 363 SC 17-08-1971 Kedarnath Jute MFG Co LTD Vs Commissioner of IncomeAnanya SPas encore d'évaluation

- Lascona Land Vs CIRDocument2 pagesLascona Land Vs CIRJesstonieCastañaresDamayo100% (1)

- (Rajasthan) / (2022) 447 ITR 698 (Rajasthan) (29-06-2022)Document6 pages(Rajasthan) / (2022) 447 ITR 698 (Rajasthan) (29-06-2022)rigiyanPas encore d'évaluation

- Virdichand Bawandas Huf Karta of Huf Pawankumar Virdhichand Agrawal Versus The National E-Assessment Centre - 2022 (8) Tmi 91 - Gujarat High CourtDocument9 pagesVirdichand Bawandas Huf Karta of Huf Pawankumar Virdhichand Agrawal Versus The National E-Assessment Centre - 2022 (8) Tmi 91 - Gujarat High CourtSrichPas encore d'évaluation

- Illustration:-Mr. Samarathmal Tanted Assests And: Rohit BilloreDocument18 pagesIllustration:-Mr. Samarathmal Tanted Assests And: Rohit BilloreJenny MillerPas encore d'évaluation

- Before The Commissioner Inland Revenue (Appeal-Iii) KarachiDocument6 pagesBefore The Commissioner Inland Revenue (Appeal-Iii) Karachiiqbal sheikhPas encore d'évaluation

- MTP 2 (Extra MCQ) - Question PaperDocument13 pagesMTP 2 (Extra MCQ) - Question PaperDeepsikha maitiPas encore d'évaluation

- Assessment Procedure-1Document16 pagesAssessment Procedure-1Manohar LalPas encore d'évaluation

- Sri Vasavi Polymers P. Ltd.-ITAT - VisakhapatnamDocument7 pagesSri Vasavi Polymers P. Ltd.-ITAT - VisakhapatnamNiileshPas encore d'évaluation

- R.kasi Vishwanathan & Bros. V Assist CIt (2014) 42 Taxmann - Com 176 Section 139 (5) - It 475-11 28.3.2016Document7 pagesR.kasi Vishwanathan & Bros. V Assist CIt (2014) 42 Taxmann - Com 176 Section 139 (5) - It 475-11 28.3.2016Prabhash ChandPas encore d'évaluation

- 2022LHC4885Document8 pages2022LHC4885Shah Meer GichkiPas encore d'évaluation

- G.R. No. 171251 March 5, 2012 LASCONA LAND CO., INC., Petitioner, Commissioner of Internal Revenue, RespondentDocument5 pagesG.R. No. 171251 March 5, 2012 LASCONA LAND CO., INC., Petitioner, Commissioner of Internal Revenue, RespondentWayne ViernesPas encore d'évaluation

- PDR Tax Forum 2016 Recent Court Decisions On Tax - FinalDocument144 pagesPDR Tax Forum 2016 Recent Court Decisions On Tax - FinalFender Boyang100% (1)

- Petitioner Vs Vs Respondent: First DivisionDocument13 pagesPetitioner Vs Vs Respondent: First DivisionRalph H. VillanuevaPas encore d'évaluation

- आयकर अपीलीय अिधकरण " यायपीठ पुणे म । (Through Virtual Court)Document8 pagesआयकर अपीलीय अिधकरण " यायपीठ पुणे म । (Through Virtual Court)Saksham ShrivastavPas encore d'évaluation

- 2014 S C M R 907Document4 pages2014 S C M R 907haseeb AhsanPas encore d'évaluation

- A. Assessment B. Collection: Remedies of The GovernmentDocument10 pagesA. Assessment B. Collection: Remedies of The GovernmentGianna CantoriaPas encore d'évaluation

- Law On Physical Verification Under CGSTDocument4 pagesLaw On Physical Verification Under CGSTteamPas encore d'évaluation

- Cygnus - 13.12.2023 OrderDocument59 pagesCygnus - 13.12.2023 OrderNikhil MaanPas encore d'évaluation

- 213 Tax - Republic v. Hizon, 320 SCRA 574Document2 pages213 Tax - Republic v. Hizon, 320 SCRA 574Brandon BanasanPas encore d'évaluation

- 45 VST 9Document9 pages45 VST 9Abhay DesaiPas encore d'évaluation

- 166919-2012-Lascona Land Co. Inc. v. Commissioner ofDocument7 pages166919-2012-Lascona Land Co. Inc. v. Commissioner ofBeatrice AquinoPas encore d'évaluation

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionD'EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionPas encore d'évaluation

- Agtarap V Agtarap Case DigestDocument2 pagesAgtarap V Agtarap Case Digestevreynoso100% (1)

- Affidavit and Affidavit of Loss - Andres (Cessation and Bir Documents)Document2 pagesAffidavit and Affidavit of Loss - Andres (Cessation and Bir Documents)Antonio J. David II80% (5)

- Entores V Miles Far EastDocument4 pagesEntores V Miles Far EastEugenia MokPas encore d'évaluation

- Land Rights of AdivasisDocument202 pagesLand Rights of Adivasisnizamuddin100% (3)

- The Way of The ThiefDocument98 pagesThe Way of The Thiefjosi1986100% (9)

- WHK Truck V Green Square Investments.i3124-09.Botes, Aj.3dec10Document12 pagesWHK Truck V Green Square Investments.i3124-09.Botes, Aj.3dec10André Le RouxPas encore d'évaluation

- Jerome Frank - Legal RealismDocument4 pagesJerome Frank - Legal RealismVaibhav SinghPas encore d'évaluation

- 2017 Case Digests - Remedial LawDocument208 pages2017 Case Digests - Remedial Lawedrea50% (2)

- Weinstein v. PVA I, LP, Et Al - Document No. 64Document7 pagesWeinstein v. PVA I, LP, Et Al - Document No. 64Justia.comPas encore d'évaluation

- Corporate Warranty DeedDocument2 pagesCorporate Warranty Deedkatherine lillyPas encore d'évaluation

- New York Ex Rel. Rosevale Realty Co. v. Kleinert, 268 U.S. 646 (1925)Document4 pagesNew York Ex Rel. Rosevale Realty Co. v. Kleinert, 268 U.S. 646 (1925)Scribd Government DocsPas encore d'évaluation

- Pay Fixation Rules FR PDFDocument47 pagesPay Fixation Rules FR PDFNaveen SainiPas encore d'évaluation

- Diona vs. Balangue, 688 SCRA 22, January 07, 2013Document18 pagesDiona vs. Balangue, 688 SCRA 22, January 07, 2013TNVTRLPas encore d'évaluation

- Income From House Property-6Document9 pagesIncome From House Property-6s4sahithPas encore d'évaluation

- ADR Cases MediationDocument19 pagesADR Cases Mediationchappy_leigh118Pas encore d'évaluation

- Rules For The Certification of Welders of Polyethylene Pipes and FittingsDocument7 pagesRules For The Certification of Welders of Polyethylene Pipes and FittingsprokulisPas encore d'évaluation

- Doctrine of Part PerformanceDocument25 pagesDoctrine of Part Performancekashyap0% (1)

- Mutual Nda TemplateDocument2 pagesMutual Nda Templateapi-50446167Pas encore d'évaluation

- PCNCDocument4 pagesPCNCHerzl Hali V. HermosaPas encore d'évaluation

- Wills and Succession SyllabusDocument11 pagesWills and Succession SyllabusRoberts SamPas encore d'évaluation

- Contract Act 1872Document69 pagesContract Act 1872Vishal GattaniPas encore d'évaluation

- 620-626 1 Macacua Ronquillo Vs RocoDocument1 page620-626 1 Macacua Ronquillo Vs RocoAlviaAisaMacacuaPas encore d'évaluation

- Akhbar e Jehan 23-29 December 2019Document197 pagesAkhbar e Jehan 23-29 December 2019Hina Naz100% (1)

- BanagDocument3 pagesBanagEnnavy Yongkol100% (1)

- Omission EssayDocument5 pagesOmission EssayBernard HuiPas encore d'évaluation

- Puchong Puteri 12 RA - Membership Application FormDocument3 pagesPuchong Puteri 12 RA - Membership Application Formpuchongputeri12Pas encore d'évaluation

- Accident Waiver and Release Liability Form: Printed Name & SignatureDocument1 pageAccident Waiver and Release Liability Form: Printed Name & SignatureNNobSaibotPas encore d'évaluation

- Digest: Woodhouse Vs HaliliDocument2 pagesDigest: Woodhouse Vs HaliliAngelette BulacanPas encore d'évaluation

- Bicol Vs Guinhawa DigestDocument2 pagesBicol Vs Guinhawa DigestCarol JacintoPas encore d'évaluation

- Petitioner Vs Vs Respondent Intervenor: First DivisionDocument10 pagesPetitioner Vs Vs Respondent Intervenor: First DivisionChristian Edward CoronadoPas encore d'évaluation