Académique Documents

Professionnel Documents

Culture Documents

Projected Balancesheet For Three Years - Apple: 2018 (In MILLION Usd) 2019 (In MILLION Usd) 2020 (In MILLION Usd)

Transféré par

srn318Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Projected Balancesheet For Three Years - Apple: 2018 (In MILLION Usd) 2019 (In MILLION Usd) 2020 (In MILLION Usd)

Transféré par

srn318Droits d'auteur :

Formats disponibles

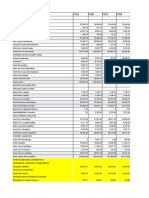

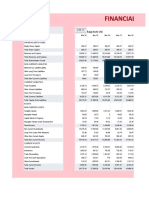

PROJECTED BALANCESHEET FOR THREE YEARS - APPLE

2018 ( In MILLION 2019 ( In MILLION 2020 ( In MILLION

USD) USD) USD)

Cash-in-Hand -

Temporary Investment 61,481.70 65,170.60 69,732.54

Cash and Temporary investment 70,512.75 74,743.52 79,975.56

Trade Receivables-Net 16,541.70 17,534.20 18,761.60

Total Receivables, Net 30,763.95 32,609.79 34,892.47

Total Stock 2,238.60 2,372.92 2,539.02

Total Other Current Assets 8,697.15 9,218.98 9,864.31

Total Current Assets 112,212.45 118,945.20 127,271.36

Total Gross Plant&Machinery 64,307.25 68,165.69 72,937.28

Total Accumulated Depreciation -35,946.75 (38,103.56) (40,770.80)

Net Goodwill 5,684.70 6,025.78 6,447.59

Net Intangible Asset 3,366.30 3,568.28 3,818.06

Long Term Investments 178,951.50 189,688.59 202,966.79

Total Other Long Term Investments 9,194.85 9,746.54 10,428.80

Total Assets 337,770.30 358,036.52 383,099.07

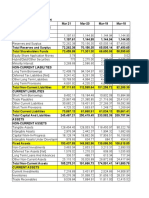

Total Trades Payable 39,158.70 41,508.22 44,413.80

Outstanding Expenses 21,998.55 23,318.46 24,950.76

Short Term Debt 8,510.25 9,020.87 9,652.33

Capital Lease 3,675.00 3,895.50 4,168.19

Total Other Current Liabilities 9,613.80 10,190.63 10,903.97

Total Current Liabilities 82,956.30 87,933.68 94,089.04

Long Term Debt 79,198.35 83,950.25 89,826.77

Total Long Term Debt 79,198.35 83,950.25 89,826.77

Total Debt 91,383.60 96,866.62 103,647.28

Deferred Taxes 27,319.95 28,959.15 30,986.29

Total Other Liabilities 13,634.25 14,452.31 15,463.97

Total Liabilities 203,108.85 215,295.38 230,366.06

Total Common Stock 32,813.55 34,782.36 37,217.13

Retained Earnings 101,182.20 107,253.13 114,760.85

Total Other Equity 625.80 663.35 709.78

Total Equity 134,661.45 142,741.14 152,733.02

Total Liabilities & Equity 337,770.30 358,036.52 383,099.07

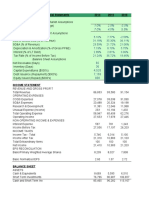

PROJECTED INCOME STATEMENT FOR THREE YEARS- APPLE

2018 (In Million USD) 2019 (In Million 2020 (In Million USD)

USD)

Income 226,420.95 240,006.21 256,806.64

Total Income 226,420.95 240,006.21 256,806.64

Cost of Sales 137,944.80 146,221.49 156,456.99

Gross Profit 88,476.15 93,784.72 100,349.65

Selling & Administration 14,903.70 15,797.92 16,903.78

expenses

R&D Expenses 10,547.25 11,180.09 11,962.69

Total Operating Expense 163,395.75 173,199.50 185,323.46

Operating Income 63,025.20 66,806.71 71,483.18

Net ,Other -1,254.75 (1,330.04) (1,423.14)

Income Before Tax 64,440.60 68,307.04 73,088.53

Income After Tax 47,971.35 50,849.63 54,409.11

Net Income before extra 47,971.35 50,849.63 54,409.11

expenses

Net Income 47,971.35 50,849.63 54,409.11

INTERPRETATION

The projected balance sheet for the upcoming three years of Apple has been provided above in details.

As per the projected balance sheet, the company is having high potential of growth in future. Based on

the data, there have been around five percentages to seven percentages growth in the respective future

periods of the company. It will definitely help the company to have more expansion and investment in

future. Also there are enough liquidity position in the hands of company. Because there are more than

current assets available against all current liabilities. The current ratio is more than one and will be good

for the company. Also the solvency position of the company is so good. There are more assets available

for the company’s liabilities and debts. This will attract more stakeholders towards the company and

they will be more comfortable to have long term relationship with company.

The projected income statement of the company for the coming three years has been given in detail

above. Based on the projected income statement, the company is having high performance in terms of

profit. From the historical data, it is clear that there have been five percentages of increase of profit in

2018. Then in the coming two years, it has been increasing by one percentages respectively. The

stakeholders of the company will be happier as the company is having high profits. The investors will

have more income per share from the profit. The employees will get benefited with more incentives and

bonuses from the company. The banks can easily provide loans and other financial assistances without

any effort.

Vous aimerez peut-être aussi

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionD'EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionPas encore d'évaluation

- 5 Year Comparative NTPCDocument11 pages5 Year Comparative NTPCShivanshi SharmaPas encore d'évaluation

- Bemd RatiosDocument12 pagesBemd RatiosPRADEEP CHAVANPas encore d'évaluation

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachD'EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachÉvaluation : 3 sur 5 étoiles3/5 (3)

- Tata Steel Valuation by BKMNDocument12 pagesTata Steel Valuation by BKMNKp PatelPas encore d'évaluation

- Microsoft Corporation: Financial Analyis and ForecastDocument40 pagesMicrosoft Corporation: Financial Analyis and ForecastPrabhdeep DadyalPas encore d'évaluation

- Schaum's Outline of Basic Business Mathematics, 2edD'EverandSchaum's Outline of Basic Business Mathematics, 2edÉvaluation : 5 sur 5 étoiles5/5 (1)

- Balance Sheet (Crore)Document10 pagesBalance Sheet (Crore)MOHAMMED ARBAZ ABBASPas encore d'évaluation

- HindalcoDocument13 pagesHindalcosanjana jainPas encore d'évaluation

- Tata SteelDocument14 pagesTata Steeldevansh kakkarPas encore d'évaluation

- Akash Cost AssignmentDocument10 pagesAkash Cost AssignmentAkash HedaooPas encore d'évaluation

- Tata Motors - Strategy - DataDocument17 pagesTata Motors - Strategy - DataSarvesh SmartPas encore d'évaluation

- 02 06 BeginDocument6 pages02 06 BeginnehaPas encore d'évaluation

- FinancialsDocument26 pagesFinancials崔梦炎Pas encore d'évaluation

- This Statement Should Be Read in Conjunction With The Accompanying NotesDocument4 pagesThis Statement Should Be Read in Conjunction With The Accompanying NotesKim Patrick VictoriaPas encore d'évaluation

- Stock PitchDocument8 pagesStock PitchRaksha ShettyPas encore d'évaluation

- 02 04 EndDocument6 pages02 04 EndnehaPas encore d'évaluation

- Havells Balance Sheet (4 Years)Document15 pagesHavells Balance Sheet (4 Years)Tamoghna MaitraPas encore d'évaluation

- Sub: Financial Accounting Sub: Financial AccountingDocument14 pagesSub: Financial Accounting Sub: Financial AccountingMilan PateliyaPas encore d'évaluation

- I. Assets: 2018 2019Document7 pagesI. Assets: 2018 2019Kean DeePas encore d'évaluation

- Bharat Petroleum Corporation Limited: Company's ProfileDocument7 pagesBharat Petroleum Corporation Limited: Company's ProfileTanushree LamarePas encore d'évaluation

- Donam Corporate FinanceDocument9 pagesDonam Corporate FinanceMAGOMU DAN DAVIDPas encore d'évaluation

- Particulars Absolute Amounts 2018-19 2019-20 2018-19 2019-20 Rs. (In Lakhs) Rs. (In Lakhs) (%) (%) Percentage of Net SalesDocument6 pagesParticulars Absolute Amounts 2018-19 2019-20 2018-19 2019-20 Rs. (In Lakhs) Rs. (In Lakhs) (%) (%) Percentage of Net SalesPrafful VyasPas encore d'évaluation

- Tvs Motor 2019 2018 2017 2016 2015Document108 pagesTvs Motor 2019 2018 2017 2016 2015Rima ParekhPas encore d'évaluation

- UltraTech Financial Statement - Ratio AnalysisDocument11 pagesUltraTech Financial Statement - Ratio AnalysisYen HoangPas encore d'évaluation

- Last Five Years Financial Performance 2021Document1 pageLast Five Years Financial Performance 2021Md AzizPas encore d'évaluation

- Bharat Heavy ElectricalsDocument7 pagesBharat Heavy ElectricalsPrajwal kumarPas encore d'évaluation

- Group 10 - Apollo Tyre ModelDocument34 pagesGroup 10 - Apollo Tyre ModelJAY SANTOSH KHOREPas encore d'évaluation

- Financial Statements - TATA - MotorsDocument6 pagesFinancial Statements - TATA - MotorsSANDHALI JOSHI PGP 2021-23 BatchPas encore d'évaluation

- Comprehensive Income (2017-2018)Document12 pagesComprehensive Income (2017-2018)Lee SuarezPas encore d'évaluation

- Financial Analysis of Sun PharmaDocument7 pagesFinancial Analysis of Sun PharmahemanshaPas encore d'évaluation

- Final Project Report - Excel SheetDocument24 pagesFinal Project Report - Excel SheetrajeshPas encore d'évaluation

- Ratio Analysis of Engro Vs NestleDocument24 pagesRatio Analysis of Engro Vs NestleMuhammad SalmanPas encore d'évaluation

- Tata Motors DCFDocument11 pagesTata Motors DCFChirag SharmaPas encore d'évaluation

- DCF ModelingDocument12 pagesDCF ModelingTabish JamalPas encore d'évaluation

- Abbott Laboratories (Pakistan) Limited-1Document9 pagesAbbott Laboratories (Pakistan) Limited-1Shahrukh1994007Pas encore d'évaluation

- AbhimanyuDocument46 pagesAbhimanyuMaurya KPas encore d'évaluation

- STC FS 2016Document3 pagesSTC FS 2016ehackwhitePas encore d'évaluation

- Apple 10k 2023-1 ClassworkDocument132 pagesApple 10k 2023-1 ClassworkmarioPas encore d'évaluation

- FMUE Group Assignment - Group 4 - Section B2CDDocument42 pagesFMUE Group Assignment - Group 4 - Section B2CDyash jhunjhunuwalaPas encore d'évaluation

- Balance Sheet: Hindalco IndustriesDocument20 pagesBalance Sheet: Hindalco Industriesparinay202Pas encore d'évaluation

- Project 3 - Ratio AnalysisDocument2 pagesProject 3 - Ratio AnalysisATANU GANGULYPas encore d'évaluation

- Steel Authority - DCFDocument12 pagesSteel Authority - DCFPadmavathi shivaPas encore d'évaluation

- Bibliography and Ane KumaranDocument6 pagesBibliography and Ane KumaranG.KISHORE KUMARPas encore d'évaluation

- Answer To The Question No 1 (I) ACI Group of Company Balance Sheet (Vertical Analysis) For The Years Ended June 30, 2019Document4 pagesAnswer To The Question No 1 (I) ACI Group of Company Balance Sheet (Vertical Analysis) For The Years Ended June 30, 2019Estiyak JahanPas encore d'évaluation

- Group Project - ACCDocument17 pagesGroup Project - ACCLovie GuptaPas encore d'évaluation

- ISC Commerce Project Swot Analysis of Tata MotersDocument7 pagesISC Commerce Project Swot Analysis of Tata MotersAyush Kumar Vishwakarma88% (17)

- HDFC Bank - FM AssignmentDocument9 pagesHDFC Bank - FM AssignmentaditiPas encore d'évaluation

- Assingment SCM SEM4 - 1Document17 pagesAssingment SCM SEM4 - 1KARTHIYAENI VPas encore d'évaluation

- Tata Steel FinancialsDocument8 pagesTata Steel FinancialsManan GuptaPas encore d'évaluation

- 29 - Tej Inder - Bharti AirtelDocument14 pages29 - Tej Inder - Bharti Airtelrajat_singlaPas encore d'évaluation

- Deven Rawat (FM)Document7 pagesDeven Rawat (FM)devenrawat.03Pas encore d'évaluation

- Ratio Analysis of TATA MOTORSDocument8 pagesRatio Analysis of TATA MOTORSmr_anderson47100% (8)

- Bank of BarodaDocument22 pagesBank of BarodaShivane SivakumarPas encore d'évaluation

- Green Zebra ComputationsDocument14 pagesGreen Zebra ComputationsJessie FranzPas encore d'évaluation

- Group 4 - TATA PowerDocument26 pagesGroup 4 - TATA PowerSaMyak JAinPas encore d'évaluation

- Tata SteelDocument10 pagesTata SteelSakshi ShahPas encore d'évaluation

- Annextures Balance Sheet of Larsen & Toubro From The Year 2011 To The Year 2015Document3 pagesAnnextures Balance Sheet of Larsen & Toubro From The Year 2011 To The Year 2015vandv printsPas encore d'évaluation

- Intro To MA Aug 2013Document14 pagesIntro To MA Aug 2013Nakul AnandPas encore d'évaluation

- Module 1 - ACCT 4005Document29 pagesModule 1 - ACCT 4005yahye ahmedPas encore d'évaluation

- Insurance Bar Review New Code. 2014Document465 pagesInsurance Bar Review New Code. 2014Ed NerosaPas encore d'évaluation

- Cash Flow Estimation and Capital BudgetingDocument29 pagesCash Flow Estimation and Capital BudgetingShehroz Saleem QureshiPas encore d'évaluation

- Nestle India Valuation ReportDocument10 pagesNestle India Valuation ReportSIDDHANT MOHAPATRAPas encore d'évaluation

- Value Drivers - What Makes An Organisation ValuableDocument3 pagesValue Drivers - What Makes An Organisation ValuablePatrick Ow100% (1)

- AR 2009 EngDocument252 pagesAR 2009 EngmorgunovaPas encore d'évaluation

- MhaDocument35 pagesMhaDhananjay SainiPas encore d'évaluation

- Banco CompartamosDocument4 pagesBanco Compartamosarnulfo.perez.pPas encore d'évaluation

- ISA 315 & ISA 240 (Fraud and Risk)Document54 pagesISA 315 & ISA 240 (Fraud and Risk)Joe SmithPas encore d'évaluation

- CH 07Document3 pagesCH 07ghsoub777Pas encore d'évaluation

- MT 199 Maribel Gonzalez 27 06 22Document2 pagesMT 199 Maribel Gonzalez 27 06 22ULRICH VOLLERPas encore d'évaluation

- LESSON 8 - Purpose of BanksDocument5 pagesLESSON 8 - Purpose of BanksChirag HablaniPas encore d'évaluation

- Ratio Analysis of Shree Cement and Ambuja Cement Project Report 2Document7 pagesRatio Analysis of Shree Cement and Ambuja Cement Project Report 2Dale 08Pas encore d'évaluation

- Corporate Governance in MalaysiaDocument19 pagesCorporate Governance in Malaysiakhorteik100% (1)

- Societe GeneraleDocument42 pagesSociete GeneraleMakuna NatsvlishviliPas encore d'évaluation

- Multiple Choice: Theory 1 Theory 2 Problems 1 Problems 2Document2 pagesMultiple Choice: Theory 1 Theory 2 Problems 1 Problems 2Vivienne Rozenn LaytoPas encore d'évaluation

- 4449b8b1-0f05-4bd3-be90-44b82775ee5eDocument2 pages4449b8b1-0f05-4bd3-be90-44b82775ee5eFawzar SabirPas encore d'évaluation

- Mahindra Sona R 22102013Document3 pagesMahindra Sona R 22102013ukalPas encore d'évaluation

- A Case Study of Luntian Multi-Purpose Cooperative in Barangay Lalaig, Tiaong, Quezon, Philippines: A Vertical Integration ApproachDocument8 pagesA Case Study of Luntian Multi-Purpose Cooperative in Barangay Lalaig, Tiaong, Quezon, Philippines: A Vertical Integration ApproachJedd Virgo100% (2)

- Cover Cek MaybankDocument2 pagesCover Cek MaybankArifa HasnaPas encore d'évaluation

- Interim ReportDocument20 pagesInterim ReportanushaPas encore d'évaluation

- Financial Reporting and Analysis: - Session 2-Professor Raluca Ratiu, PHDDocument87 pagesFinancial Reporting and Analysis: - Session 2-Professor Raluca Ratiu, PHDDaniel YebraPas encore d'évaluation

- Executive Assistant Office Manager in Washington DC Resume Jane GiordanoDocument2 pagesExecutive Assistant Office Manager in Washington DC Resume Jane GiordanoJaneGiordanoPas encore d'évaluation

- Accounting Grade 9: Balance SheetDocument2 pagesAccounting Grade 9: Balance SheetSimthandile NosihlePas encore d'évaluation

- 1) SEBI Issue of Capital and Disclosure Requirements (ICDR) Regulations 2009Document12 pages1) SEBI Issue of Capital and Disclosure Requirements (ICDR) Regulations 2009Shasha GuptaPas encore d'évaluation

- Patrice R. Barquilla 12 Gandionco Business Finance CHAPTER 2 ASSIGNMENTDocument12 pagesPatrice R. Barquilla 12 Gandionco Business Finance CHAPTER 2 ASSIGNMENTJohnrick RabaraPas encore d'évaluation

- 2 Full 5-4a 5-4bDocument82 pages2 Full 5-4a 5-4banurag sonkarPas encore d'évaluation

- Amalgmation, Absorbtion, External ReconstructionDocument12 pagesAmalgmation, Absorbtion, External Reconstructionpijiyo78Pas encore d'évaluation

- 2016 ObliconDocument2 pages2016 ObliconKarla KatPas encore d'évaluation

- Getting to Yes: How to Negotiate Agreement Without Giving InD'EverandGetting to Yes: How to Negotiate Agreement Without Giving InÉvaluation : 4 sur 5 étoiles4/5 (652)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!D'EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Évaluation : 4.5 sur 5 étoiles4.5/5 (14)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)D'EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Évaluation : 4.5 sur 5 étoiles4.5/5 (15)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineD'EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlinePas encore d'évaluation

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindD'EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindÉvaluation : 5 sur 5 étoiles5/5 (231)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesD'EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesPas encore d'évaluation

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsD'EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsÉvaluation : 5 sur 5 étoiles5/5 (1)

- Financial Accounting For Dummies: 2nd EditionD'EverandFinancial Accounting For Dummies: 2nd EditionÉvaluation : 5 sur 5 étoiles5/5 (10)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)D'EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Évaluation : 4 sur 5 étoiles4/5 (33)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)D'EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Évaluation : 4.5 sur 5 étoiles4.5/5 (5)

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingD'EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingÉvaluation : 4.5 sur 5 étoiles4.5/5 (760)

- Project Control Methods and Best Practices: Achieving Project SuccessD'EverandProject Control Methods and Best Practices: Achieving Project SuccessPas encore d'évaluation

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsD'EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsPas encore d'évaluation

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsD'EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsÉvaluation : 4 sur 5 étoiles4/5 (7)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeD'EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeÉvaluation : 4 sur 5 étoiles4/5 (21)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCD'EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCÉvaluation : 5 sur 5 étoiles5/5 (1)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItD'EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (14)

- Controllership: The Work of the Managerial AccountantD'EverandControllership: The Work of the Managerial AccountantPas encore d'évaluation

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookD'EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookPas encore d'évaluation

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessD'EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessÉvaluation : 4.5 sur 5 étoiles4.5/5 (28)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsD'EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsÉvaluation : 4 sur 5 étoiles4/5 (4)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetD'EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetÉvaluation : 4.5 sur 5 étoiles4.5/5 (14)