Académique Documents

Professionnel Documents

Culture Documents

Vat

Transféré par

John Derek GarreroCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Vat

Transféré par

John Derek GarreroDroits d'auteur :

Formats disponibles

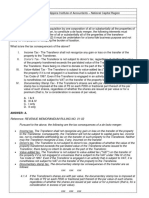

TAXATION: Value Added Tax

JVR

SAN CARLOS COLLEGE

COLLEGE OF ACCOUNTANCY

ACCOUNTING ENHANCEMENT

TAXATION

Not Subject to Business Tax:

1. Related Activities of a Non-Stock Non-Profit Organization

2. Government Functions of the national and foreign government, government agencies or instrumentalities

3. Businesses considered as principally for subsistence or livelihood (those with gross sales/gross receipts not

exceeding P100,000 annually)

4. Directors of a Corporation are not considered doing business for purposes of imposing business taxes

5. Compensation income from employment is not considered as income from business

6. Sale, Lease or Use of Properties or Goods which are not used in business or not intended to be used in

business

7. Casual Services (those services done without any intention of making them habitual)

8. Privilege stores (those set up during occasions for a maximum of 15 days)

NOTE: Unregistered businesses are taxable.

Destination Principle or Cross Border Doctrine

Those goods/properties/services to be consumed outside the Philippines are not covered by the regular VAT system.

Persons Liable to VAT

Statutory Taxpayer Who shoulders VAT

Local Sale

Importation

Sale of PEZA-registered to entities

located at customs territory

Exempt Importations

Absolutely Exempted

(a)Importation of agricultural and marine food products in their original state, livestock and poultry of a kind

generally used as, or yielding or producing foods for human consumption; and breeding stock and genetic materials

therefor.

(b)Importation of fertilizers, seeds, seedlings and fingerlings, fish, prawn, livestock and poultry feeds, including

ingredients, whether locally produced or imported, used in the manufacture of finished feeds (except specialty feeds

for race horses, fighting cocks, aquarium fish, zoo animals and other animals generally considered as pets);

(c) Importation of personal and household effects belonging to residents of the Philippines returning from abroad and

non-resident citizens coming to resettle in the Philippines; Provided, that such goods are exempt from customs

duties under the Tariff and Customs Code of the Philippines;

(d) Importation of professional instruments and implements, wearing apparel, domestic animals, and personal

household effects (except any vehicle, vessel, aircraft, machinery and other goods for use in the manufacture of

merchandise of any kind in commercial quantity) belonging to persons coming to settle in the Philippines, for their

own use and not for sale, barter or exchange, accompanying such persons, or arriving within ninety (90) days before

or after their arrival, upon the production of evidence satisfactory to the Commissioner of Internal Revenue, that

such persons are actually coming to settle in the Philippines and that the change of residence is bonafide;

(e) Importation of books and any newspaper, magazine, review, or bulletin which appears at regular intervals with

fixed prices for subscription and sale and which is not devoted principally to the publication of paid advertisements;

Exempt Importation by Exempt Persons

(a) Importation by agricultural cooperatives duly registered and in good standing with the Cooperative Development

Authority (CDA) of direct farm inputs, machineries and equipment, including spare parts thereof, to be used directly

and exclusively in the production and/or processing of their produce;

(b)Importation of passenger or cargo vessels and aircraft, including engine, equipment and spare parts thereof for

domestic or international transport operations;

Provided, that the vessels to be imported shall comply with the age limit requirement, at the time of acquisition

counted from the date of the vessel’s original commissioning, as follows:

for passenger and/or cargo vessels, the age limit is fifteen (15) years old,

for tankers, the age limit is ten (10) years old, and

For high-speed passenger crafts, the age limit is five (5) years old

(c) Importation of fuel, goods and supplies by persons engaged in international shipping or air transport operations;

Provided, that the said fuel, goods and supplies shall be used exclusively or shall pertain to the transport of goods

and/or passenger from a port in the Philippines directly to a foreign port without stopping at any other port in the

Philippines;

Illustration A

Assuming POGI Cooperative, an agricultural cooperative imported fertilizers, pesticides and tractors to be used in

production of its own products to be sold to its members. Some fertilizers, pesticides and tractors are to be sold

directly to members. Determine the VAT consequence of the importation

For use in productions For sale

Fertilizers

Pesticides

Tractors

Illustration B

Assuming POGI Corporation, a domestic carrier of passengers by air, imported the following:

To be Used for:

Domestic Operations Foreign Operations

Fuel 1,000,000 2,000,000

Goods and supplies 500,000 700,000

Spareparts of its aircraft 2,000,000 3,000,000

Required: Determine the items subject to VAT on importation

TAX by Jonas POGI Reyes, CPA Page 1

TAXATION: Value Added Tax

For Domestic Operations For Foreign Operations

Fuel

Goods and supplies

Spareparts

Illustration C

Determine if Exempt Importation or VATABLE Importation:

Native Chicken to be used as breeding stocks

Feeds for Native Chicken

Ingredients for manufacturing of feeds for native chicken

Genetic materials for breeding native chicken

Ingredients for manufacturing of feeds for native

chicken, determined as available for human consumption

Dressed Native Chicken with advanced packaging

Bamboo Poles

Bamboo Shoots

Orchids

White Kelso cock and hen to be used as breeding stocks

Feeds for White Kelso

Ingredients for manufacturing of feeds for White Kelso

Marinated Chicken

Canned Sardines

Fertilizers

Seeds

Shrimps

Chow Chow dogs

Racehorse

Dried Fish

Salted Fish

Smoked Meat

Roasted Coffee Beans

Rattan

rattlesnake

goldfish

Goldfish bowl

Exempt Sale of Goods or Properties

(a) Sale of agricultural and marine food products in their original state, livestock and poultry of a kind generally used

as, or yielding or producing foods for human consumption; and breeding stock and genetic materials therefor.

(b) Sale of fertilizers, seeds, seedlings and fingerlings, fish, prawn, livestock and poultry feeds, including ingredients,

whether locally produced or imported, used in the manufacture of finished feeds (except specialty feeds for race

horses, fighting cocks, aquarium fish, zoo animals and other animals generally considered as pets);

“Specialty feeds” refers to non-agricultural feeds or food for race horses, fighting cocks, aquarium fish, zoo animals

and other animals generally considered as pets.

(c) Sales by agricultural cooperatives duly registered and in good standing with the Cooperative Development

Authority (CDA) to their members, as well as sale of their produce, whether in its original state or processed

form, to non-members;

Sales to Members Sales to Non-members

Own Produce

Purchased products

(d) Sales by non-agricultural, non-electric and non-credit cooperatives duly registered with and in good standing

with the CDA; Provided, That the share capital contribution of each member does not exceed Fifteen Thousand Pesos

(P15,000.00) and regardless of the aggregate capital and net surplus ratably distributed among the members.

Transaction w/ Members Transaction w/ non members

Related Activities

Unrelated Activities

Assuming that the accumulated savings and undivided net surplus exceeds P10M:

Transaction w/ Members Transaction w/ non members

Related Activities

Unrelated Activities

(e) Export sales by persons who are not VAT-registered;

(f) Sale of real properties not primarily held for sale to customers or held for lease in the ordinary course of trade or

business – capital assets

(g) Sale of real properties utilized for low-cost housing (P750,000 ceiling)

(h) Sale of real properties utilized for socialized housing (P450,000 ceiling)

(i) Sale of residential lot valued at (P1,919,500.00) and below, or house & lot and other residential dwellings valued

at (P3,199,200.00) and below

(j) Sale of books and any newspaper, magazine, review, or bulletin which appears at regular intervals with fixed

prices for subscription and sale and which is not devoted principally to the publication of paid advertisements;

(k) Sale of passenger or cargo vessels and aircraft, including engine, equipment and spare parts thereof for domestic

or international transport operations;

Provided, that the vessels to be imported shall comply with the age limit requirement, at the time of acquisition

counted from the date of the vessel’s original commissioning, as follows:

for passenger and/or cargo vessels, the age limit is fifteen (15) years old,

for tankers, the age limit is ten (10) years old, and

For high-speed passenger crafts, the age limit is five (5) years old

TAX by Jonas POGI Reyes, CPA Page 2

TAXATION: Value Added Tax

(l) Sale of goods or properties other than the transactions mentioned in the preceding paragraphs, the gross annual

sales and/or receipts do not exceed the amount of (P1,919,500.00);

(m) Sale to senior citizens and Persons with Disabilities (PWDs)

VAT-Exempt Sales of Services

(a) Services subject to percentage tax

(b) Services by agricultural contract growers and milling for others of palay into rice, corn into grits, and sugar cane

into raw sugar;

“Agricultural contract growers” refers to those persons producing for others poultry, livestock or other agricultural

and marine food products in their original state.

Illustration - Miller

Mang Juan is a miller of rice and coffee. He had the following results of operation for taxable year 2017:

Sale of milled rice to loyal customers 3,000,000

Gross receipts from rice milling services rendered to different warehouses 2,000,000

Sale of milled coffee beans 2,500,000

Gross receipts from coffee milling services rendered to clients 4,000,000

Determine if subject to 12% VAT, 3% Percentage Tax or Exempt.

(c) Medical, dental, hospital and veterinary services, except those rendered by professionals.

Laboratory services are exempted. If the hospital or clinic operates a pharmacy or drug store, the sale of drugs and

medicine is subject to VAT.

Illustration - Hospital

Assume the following results of a hospital operation for taxable year 2017:

Gross receipts from admitted patients 3,000,000

Gross receipts from laboratory services 2,000,000

Gross sales from medicines sold to patients 1,000,000

Dr. Amoor had P1,000,000 professional receipts for rendering services to patients.

Determine if subject to 12% Vat, 3% Percentage Tax or Exempt.

(d) Educational services rendered by private educational institutions duly accredited by the Department of Education

(DepED), the Commission on Higher Education (CHED) and the Technical Education and Skills Development

Authority (TESDA) and those rendered by government educational institutions;

“Educational services” shall refer to academic, technical or vocational education provided by private educational

institutions duly accredited by the DepED, the CHED and TESDA and those rendered by government educational

institutions and it does not include seminars, in-service training, review classes and other similar services rendered

by persons who are not accredited by the DepED, the CHED and/or the TESDA;

Receipts by a private school accredited by CHED VATABLE or Exempt

Tuition Fee

Miscellaneous Fee

Rent

Trainings and Seminars

(e) Services rendered by individuals pursuant to an employer-employee relationship;

(f) Services rendered by regional or area headquarters established in the Philippines by multinational corporations

which act as supervisory, communications and coordinating centers for their affiliates, subsidiaries or branches in the

Asia Pacific Region and do not earn or derive income from the Philippines;

(g) Gross receipts from lending activities by credit or multi-purpose cooperatives duly registered and in good

standing with the Cooperative Development Authority,

Transaction w/ Members Transaction w/ Non-Members

Lending Activities

Unrelated Activities

(h) Export sales by persons who are not VAT-registered;

(i) Printing or publication of books and any newspaper, magazine, review, or bulletin which appears at regular

intervals with fixed prices for subscription and sale and which is not devoted principally to the publication of paid

advertisements;

(j) Lease of passenger or cargo vessels and aircraft, including engine, equipment and spare parts thereof for

domestic or international transport operations;

Provided, that the vessels to be imported shall comply with the age limit requirement, at the time of acquisition

counted from the date of the vessel’s original commissioning, as follows:

for passenger and/or cargo vessels, the age limit is fifteen (15) years old,

for tankers, the age limit is ten (10) years old, and

For high-speed passenger crafts, the age limit is five (5) years old

(k) Lease of residential units with a monthly rental per unit not exceeding (P12,800.00), regardless of the amount of

aggregate rentals received by the lessor during the year;

Assume taxable year 2017 for the following illustrations, determine if Exempt, Subject to 12% VAT or subject to 3%

Percentage Tax:

Illustration 1: A lessor rents his 15 residential units for P12,000 per month. During the taxable year, his

accumulated gross receipts amounted to P2,160,000.

Illustration 2: A lessor rents his 15 residential units for P13,000 per month. During the taxable year, his

accumulated gross receipts amounted to P2,340,000.

Illustration 3: A lessor rents his 10 residential units for P13,000 per month. During the taxable year, his

accumulated gross receipts amounted to P1,560,000.

Illustration 4: A lessor rents his 2 commercial and 10 residential units for monthly rent of P60,000 and P12,800

per unit, respectively. During the taxable year, his accumulated gross receipts amounted to P2,976,000

(P1,440,000 from commercial units and P1,536,000 from residential units).

Illustration 5: A lessor rents his 2 commercial and 10 residential units for monthly rent of P60,000 and P13,000

per unit, respectively. During the taxable year, his accumulated gross receipts amounted to P3,000,000

(P1,440,000 from commercial units and P1,560,000 from residential units).

TAX by Jonas POGI Reyes, CPA Page 3

TAXATION: Value Added Tax

Illustration 6: A lessor rents his 2 commercial and 20 residential units for monthly rent of P60,000 and P13,000

per unit, respectively. During the taxable year, his accumulated gross receipts amounted to P3,000,000

(P1,440,000 from commercial units and P3,120,000 from residential units).

(l) Services of banks, non-bank financial intermediaries performing quasi-banking functions, and other non-bank

financial intermediaries subject to percentage tax under Secs. 121 and 122 of the Tax Code, such as money

changers and pawnshops; and

(m) Lease of goods or properties or the performance of services other than the transactions mentioned in the

preceding paragraphs, the gross receipts do not exceed the amount of (P1,919,500.00);

(n) Sale of service to Senior Citizens and Persons with Disabilities (PWDs)

Zero-Rated Sales of Goods or Properties

(a) Export sales. – “Export Sales” shall mean:

(1) The sale and actual shipment of goods from the Philippines to a foreign country, paid for in acceptable foreign

currency or its equivalent in goods or services, and accounted for in accordance with the rules and regulations of the

Bangko Sentral ng Pilipinas (BSP);

(2) The sale of raw materials or packaging materials to a non-resident buyer for delivery to a resident local export-

oriented enterprise to be used in manufacturing, processing, packing or repacking in the Philippines of the said

buyer’s goods, paid for in acceptable foreign currency, and accounted for in accordance with the rules and

regulations of the BSP;

(3) The sale of raw materials or packaging materials to an export-oriented enterprise whose export sales exceed

seventy percent (70%) of total annual production;

(4) Sale of gold to the BSP; and

(5) Transactions considered export sales under Executive Order No. 226, otherwise known as the Omnibus

Investments Code of 1987, and other special laws.

“Considered export sales under Executive Order No. 226” shall mean:

- Philippine port F.O.B. value determined from invoices, bills of lading, inward letters of credit, landing

certificates, and other commercial documents, of export products exported directly by a registered export

producer, or the

- net selling price of export products sold by a registered export producer to another export producer, or to an

export trader that subsequently exports the same; Provided, That sales of export products to another

producer or to an export trader shall only be deemed export sales when actually exported by the latter, as

evidenced by landing certificates or similar commercial documents;

Constructive Exportations under E.O. 226:

- sales to bonded manufacturing warehouses of export-oriented manufacturers;

- sales to export processing zones;

- sales to registered export traders operating bonded trading warehouses supplying raw materials in the

manufacture of export products under guidelines to be set by the Board in consultation with the Bureau of

Internal Revenue (BIR) and the Bureau of Customs (BOC);

- sales to diplomatic missions and other agencies and/or instrumentalities granted tax immunities, of locally

manufactured, assembled or repacked products whether paid for in foreign currency or not.

For purposes of zero-rating, the export sales of registered export traders shall include commission income. The

exportation of goods on consignment shall not be deemed export sales until the export products consigned are in

fact sold by the consignee; and Provided, finally, that sales of goods, properties or services made by a VAT-

registered supplier to a BOI-registered manufacturer/producer whose products are 100% exported are considered

export sales.

(6) The sale of goods, supplies, equipment and fuel to persons engaged in international shipping or international air

transport operations

Effectively Zero-Rated Sales

Sales of goods or property to persons or entities who are tax exempt under special laws, e.g. (1) sales to enterprises

duly registered and accredited with the Subic Bay Metropolitan Authority (SBMA), (2) sales to enterprises duly

registered and accredited with the Philippine Economic Zone Authority (PEZA) or international agreements to which

the Philippines is signatory, such as, Asian Development Bank (ADB), International Rice Research Institute (IRRI),

shall be effectively subject to VAT at zero-rate.

Zero-Rated Sale of Services

(1) Processing, manufacturing or repacking goods for other persons doing business outside the Philippines, which

goods are subsequently exported, where the services are paid for in acceptable foreign currency and accounted for

in accordance with the rules and regulations of the BSP;

(2) Services other than processing, manufacturing or repacking rendered to a person engaged in business conducted

outside the Philippines or to a non-resident person not engaged in business who is outside the Philippines when the

services are performed, the consideration for which is paid for in acceptable foreign currency and accounted for in

accordance with the rules and regulations of the BSP;

(3) Services rendered to persons or entities whose exemption under special laws or international agreements to

which the Philippines is a signatory effectively subjects the supply of such services to zero percent (0%) rate;

(4) Services rendered to persons engaged in international shipping or air transport operations, including leases of

property for use thereof; Provided, however, that the services referred to herein shall not pertain to those made to

common carriers by air and sea relative to their transport of passengers, goods or cargoes from one place in the

Philippines to another place in the Philippines, the same being subject to 12% VAT under Sec. 108 of the Tax Code;

(5) Services performed by subcontractors and/or contractors in processing, converting, or manufacturing goods for

an enterprise whose export sales exceed seventy percent (70%) of the total annual production;

(6) Transport of passengers and cargo by domestic air or sea carriers from the Philippines to a foreign country.

Gross receipts of international air carriers doing business in the Philippines and international sea carriers doing

business in the Philippines are still liable to a percentage tax of three percent (3%) based on their gross receipts as

provided for in Sec. 118 of the Tax Code but shall not to be liable to VAT; and

(7) Sale of power or fuel generated through renewable sources of energy such as, but not limited to, biomass, solar,

wind, hydropower, geothermal and steam, ocean energy, and other emerging sources using technologies such as

fuel cells and hydrogen fuels; Provided, however, that zero-rating shall apply strictly to the sale of power or fuel

generated through renewable sources of energy, and shall not extend to the sale of services related to the

maintenance or operation of plants generating said power.

TAX by Jonas POGI Reyes, CPA Page 4

TAXATION: Value Added Tax

VAT on Importation of Goods

Pro-forma Computation for VAT Basis for Importation

Dutiable Value xxxxx

Add: (1) Custom’s duty xxxxx

(2) Excise Tax, if any xxxxx

(3) Other Charges xxxxx

Landed Cost xxxxx

Multiply by VAT Rate x 12%

VAT on Importation xxxxx

Dutiable Value is equal to the:

(1) amount actually paid or payable for the imported goods when sold for export to the Philippines; adjusted by

adding the following:

(2) Commissions and brokerage fees (except buying commissions)

(3) Cost of containers

(4) Cost of packing (whether for labor or materials)

(5) Royalties and license fees related to the goods

(6) Value of the following goods and services: materials, components, parts incorporated in the imported goods;

tools; dies; moulds used in production of imported goods; materials consumed in production of imported goods; and

engineering, development, artwork, design work and plans and sketches undertaken abroad and necessary for the

production of imported goods

(7) value of any part of the proceeds of any subsequent resale, disposal or use of the imported goods that accrues to

the seller

(8) transportation cost from port of exportation to port of entry in the Philippines

(9) Loading, unloading, handling charges associated with transport of goods from port of exportation to port of entry

in the Philippines

(10) cost of insurance

Other BOC charges and fees:

1. Harbor Fees

2. Wharfage dues

3. Berthing dues

4. Storage dues

5. Arrastre dues

6. Tonnage dues

7. Other fees like DST and processing fee

Payment of VAT on Importation

VAT on Importation should be due and payable to the Bureau of Customs.

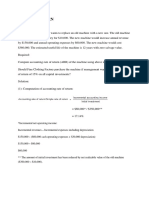

Illustration D

POGI imported an article from USA. The invoice value of the imported article was $7000 ($1:P50). The following

were incurred in relation with the importation:

Insurance P15,000

Freight P10,000

Postage P5,000

Wharfage P7,000

Arrastre Charges P8,000

Brokerage fee P25,000

Facilitation Fee P3,000

The imported article is subject to 10% custom duty and P30,000 excise tax. A spent P5,000 for trucking from the

customs warehouse to its warehouse in Quezon City. The Vat on importation is:

VAT on Sale of Goods or Properties

VAT is imposed and collected on (1) every sale, barter or exchange, or (2) transactions “deemed sale” of taxable

goods or properties at the rate of 12% of the gross selling price or gross value in money of the goods or properties

sold, bartered, or exchanged, or deemed sold in the Philippines.

Transactions Deemed Sale. –

(1) Transfer, use or consumption not in the course of business of goods or properties originally intended for sale or

for use in the course of business. Transfer of goods or properties not in the course of business can take place when

VAT-registered person withdraws goods from his business for his personal use;

(2) Distribution or transfer to:

a. Shareholders or investors share in the profits of VAT-registered person;

b. Creditors in payment of debt or obligation.

(3) Consignment of goods if actual sale is not made within 60 days following the date such goods were consigned.

Consigned goods returned by the consignee within the 60-day period are not deemed sold;

(4) Retirement from or cessation of business with respect to all goods on hand, whether capital goods, stock-in-

trade, supplies or materials as of the date of such retirement or cessation, whether or not the business is continued

by the new owner or successor. The following circumstances shall, among others, give rise to transactions “deemed

sale” for purposes of this Section;

a. Change of ownership of the business. There is a change in the ownership of the business when a single

proprietorship incorporates; or the proprietor of a single proprietorship sells his entire business.

b. Dissolution of a partnership and creation of a new partnership which takes over the business.

The Commissioner of Internal Revenue shall determine the appropriate tax base in cases

a. where a transaction is deemed a sale, barter or exchange of goods or properties, or

b. where the gross selling price is unreasonably lower than the actual market value.

The gross selling price is unreasonably lower than the actual market value if it is lower by more than 30% of the

actual market value of the same goods of the same quantity and quality sold in the immediate locality on or nearest

the date of sale.

Tax Basis for Output VAT in case of Deemed Sales

In the case of retirement or cessation of business: ___________________________

Other Cases of Deemed Sale: ____________________________

TAX by Jonas POGI Reyes, CPA Page 5

TAXATION: Value Added Tax

Change or Cessation of Status as VAT-registered Person. –

VAT registered ----> Non-Vat registered

Not subject to output tax

The VAT shall not apply to goods or properties existing as of the occurrence of the following:

(1) Change of control of a corporation by the acquisition of the controlling interest of such corporation by another

stockholder or group of stockholders.

Illustration E

POGI Corporation is a merchandising concern and has an inventory of goods for sale amounting to Php1 million.

Jonas Corporation, a real estate developer, exchanged its real estate properties for the shares of stocks of POGI

Corporation resulting to the acquisition of corporate control.

- The inventory of goods owned by POGI Corporation (Php1 million worth) is not subject to output tax despite

the change in corporate control because the same corporation still owns them.

- However, the exchange of real estate properties held for sale or for lease, for shares of stocks, whether

resulting to corporate control or not, is subject to VAT.

(2) Change in the trade or corporate name of the business;

(3) Merger or consolidation of corporations. The unused input tax of the dissolved corporation, as of the date of

merger or consolidation, shall be absorbed by the surviving or new corporation.

Illustration F

Assuming X and Y Corporation entered into a merger resulting to Y Corporation being dissolved. X had inventories of

goods amounting to P1,000,000; and Y had P600,000. Assuming the input tax unused by X and Y are P100,000 and

P50,000 respectively. In this case, there will be no deemed sale for either X or Y. However, Y’s unused input tax of

P50,000 will be absorbed by X Corporation.

“Sale of Real Properties”

Illustration G

POGI, a real estate dealer has the following sales data for 2017:

Lot A Lot B Lot C

Selling Price 1,000,000 2,000,000 1,000,000

Cost of the Property 500,0001,000,000 500,000

Mortgage assumed by buyer 600,0001,100,000 500,000

Downpayment – November 2017 100,000500,000 100,000

First Installment – December 2017 50,000 100,000100,000

Zonal Value 1,200,000 1,800,000 900,000

Assessed Value 1,100,000 1,900,000 1,000,000

Required: Determine the Output Vat for November and December.

VAT on the Sale of Services and Use or Lease of Properties. – Sale or exchange of services, as well as the use

or lease of properties shall be subject to VAT, equivalent to 12% of the gross receipts (excluding VAT).

INPUT TAXES

Treatment of Input Taxes

Exempt Sales Zero Rated Sales 12% VATABLE Sales

Cost or expense Maybe claimed for: Tax Credit to arrive at VAT Payable

(1) Refund

(2) Tax Credit Certificate

If not claimed, carry over to next

quarter/s

NOTES:

(1) Purchase of goods/properties must be evidenced by VAT invoice

(2) Purchase of service must be evidenced by Official Receipt

(3) Purchase must be from a VAT-registered person

Credits For Input Tax

Any input tax on the following transactions evidenced by a VAT invoice or official receipt issued by a VAT-registered

person shall be creditable against the output tax:

(a) Purchase or importation of goods

For sale; or

For conversion into or intended to form part of a finished product for sale, including packaging materials; or

For use as supplies in the course of business; or

For use as raw materials supplied in the sale of services; or

For use in trade or business for which deduction for depreciation or amortization is allowed under the Tax

Code, (Amortized Input VAT)

(b) Purchase of real properties for which a VAT has actually been paid;

(c) Purchase of services in which a VAT has actually been paid;

(d) Transactions “deemed sale”;

(e) Transitional input tax;

(f) Presumptive input tax;

(g) Standard Input VAT

(h) Input VAT Carry-Over

(i) Advance Payment of VAT

Persons Who Can Avail of the Input Tax Credit

The input tax credit on importation of goods or local purchases of goods, properties or services by a VAT registered

person shall be creditable:

(a) To the importer upon payment of VAT prior to the release of goods from customs custody;

(b) To the purchaser of the domestic goods or properties upon consummation of the sale; or

(c) To the purchaser of services or the lessee or licensee upon payment of the compensation, rental, royalty or fee.

Illustration H

Assuming the following data for POGI Corporation, a VAT-registered taxpayer:

November 2017:

TAX by Jonas POGI Reyes, CPA Page 6

TAXATION: Value Added Tax

Purchase of raw materials, P100,000 unpaid 500,000

Professional fees expense, P200,000 unpaid 600,000

Importation of raw materials, P100,000 not yet released by BOC 1,000,000

Assuming the supplier of raw materials, as well as the service provider are all VAT-registered.

How much is the creditable input tax for November?

Claim for Input Tax on Depreciable Goods

Illustration I

POGI Corporation sold capital goods on installment on October 1, 2017. It is agreed that the selling price, including

the VAT, shall be payable in five (5) equal monthly installments.

The data pertinent to the sold assets are as follows:

Selling Price (exclusive of VAT) - P 5,000,000.00

Passed-on VAT - 600,000.00

Original Cost of Asset - 3,000,000.00

Accumulated Depreciation at the time of sale - 1,000,000.00

Unutilized Input Tax (Sold Asset) - 100,000.00

Complete the table below:

SELLER

Output VAT

Input VAT

VAT Payable

How much is the input tax of buyer in November 2017?_____________________

Transitional/Presumptive Input Tax Credits

Illustration J

Assuming POGI Corporation is not VAT-registered up to 2016. In 2017, POGI opted to register under the VAT

system. Assuming the following information in January 2017:

Beginning Inventory, as reported in the ITR last year:

From VAT-registered person 1,000,000

From Non-VAT person 800,000

Exempt Agricultural products in original state 200,000

Actual Input VAT paid, allocable to beginning inventory 220,000

Depreciable Goods or Capital Goods, Book Value 2,000,000

Unused Input VAT on capital goods 240,000

How much is the transitional input VAT?

Illustration K

Assuming POGI Corporation is a manufacturer of sardines. POGI has the following information in 2017:

Purchase of fish in original state 2,000,000

Purchase of tomatoes in original state 1,000,000

Purchase of pesticides for pest-control purposes 3,000,000

Purchase of onions and garlics as ingredients 500,000

How much is the presumptive input tax?

Withholding of VAT

Any sale of goods, properties or service to the government, including its agencies/instrumentalities, local

government units and government owned and controlled corporations will be subject to Final VAT of 5% to be

withheld by the government buyer.

To illustrate, assuming POGI sold goods for P100,000, net of VAT to the Philippine government. Assuming the

actual input VAT is P8,000. Determine VAT payable. _______________________

Input VAT carry over

Excess input VAT may be carried over to the next month/s or next quarter/s.

Illustration L

Excess input tax from 2nd quarter of 2017 ending May 31 is P5,000.

Data for June, July and August

June July August

Output VAT 100,000110,000130,000

Input VAT 99,000 109,000100,000

Determine the VAT payable each month.

June July August

Output VAT

Less: Input VAT

Input tax carry over

VAT due (Excess input tax)

Rules in Carry over:

1. Excess input tax from previous quarter may be carried over to the first month of next quarter and the last

month of the next quarter.

2. Excess input tax from first month may be carried over to the second month

3. Excess input tax from first and second month cannot be carried over to the last month of the quarter, since

the reporting is cumulative.

Input VAT on Deemed Sales

Illustration M

“A”, at the time of retirement, had 1,000 pieces of merchandise which was deemed sold at a value of P20,000.00

with an output tax of P2,400.00. After retirement, “A” sold to “B”, 500 pieces for P12,000.00. In the contract of sale

TAX by Jonas POGI Reyes, CPA Page 7

TAXATION: Value Added Tax

or invoice, “A” should state the sales invoice number wherein the output tax on “deemed sale” was imposed and the

corresponding tax paid on the 500 pieces is P1,200.00, which is included in the P12,000.00, or he should indicate it

separately as follows:

Gross selling price - 10,800.00

VAT previously paid on “deemed sale” - 1,200.00

Total - 12,000.00

Apportionment of Input Tax on Mixed Transactions

Illustration N

POGI Corporation has the following sales during the month:

Sale to private entities subject to 12% - 100,000.00

Sale to private entities subject to 0% - 100,000.00

Sale of exempt goods - 100,000.00

Sale to gov’t. subjected to 5% final VAT Withholding - 100,000.00

Total sales for the month - P400,000.00

The following input taxes were passed on by its VAT suppliers:

Input tax on taxable goods (12%) - 5,000.00

Input tax on zero-rated sales - 3,000.00

Input tax on sale of exempt goods - 2,000.00

Input tax on sale to government - 4,000.00

Input tax on depreciable capital good

not attributable to any specific activity - 20,000.00

(monthly amortization for 60 months)

Determine the VAT payable.

Claims for Refund/Tax Credit Certificate of Input Tax

1. Zero-rated and Effectively Zero-rated Sales of Goods, Properties or Services

The application should be filed within two (2) years after the close of the taxable quarter when such sales

were made.

2. Cancellation of VAT registration

The application should be filed within two (2) years from the date of cancellation

Period within which refund or tax credit certificate/refund of input taxes shall be made

In proper cases, the Commissioner of Internal Revenue shall grant a tax credit certificate/refund for creditable input

taxes within one hundred twenty (120) days from the date of submission of complete documents by the

taxpayer.

When to file an appeal to the Court of Tax Appeals

(1) In case of full or partial denial of the claim for tax credit certificate/refund as decided by the Commissioner

of Internal Revenue, the taxpayer may appeal to the Court of Tax Appeals (CTA) within thirty (30) days

from the receipt of said denial, otherwise the decision shall become final.

(2) If no action on the claim for tax credit certificate/refund has been taken by the Commissioner of Internal

Revenue after the one hundred twenty (120) day period from the date of submission of the application with

complete documents, the taxpayer may appeal to the CTA within 30 days from the lapse of the 120-day

period.

Consequences of Issuing Erroneous VAT Invoice or VAT Official Receipt

(A) Issuance of a VAT Invoice or VAT Receipt by a non-VAT person

Illustration P

Assuming A Corporation, a non-VAT person, sold P1,000 worth of merchandise to B Corporation, imposing 12% VAT

in the amount of P120. In the VAT invoice, the total amount reflected is P1,120. Assuming A Corporation paid 3%

percentage tax of 300 (1,000 x 3%), how much is the additional tax liability of A Corporation?

(B) Issuance of a VAT Invoice or VAT Receipt on an Exempt Transaction by a VAT-registered Person

____________________-

Filing of Return and Payment of VAT

BIR Form Due DATE

Monthly VAT Return 2550M Within 20 days after the month

Quarterly VAT Return 2550Q Within 25 days after the end of

taxable quarter

VAT registrable persons are required to file 2550Q only.

Suspension of business operations

The Commissioner of Internal Revenue or his duly authorized representative may order suspension or closure of a

business establishment for a period of not less than five (5) days for any of the following violations:

(1) Failure to issue receipts and invoices.

(2) Failure to file VAT return.

(3) Understatement of taxable sales or receipts by 30% or more of his correct taxable sales or receipt for the taxable

quarter.

(4) Failure of any person to register if their gross sales/gross receipts exceeded the VAT threshold.

Review Questions

1. Which of the following shall be subject to VAT?

a. Sale of a residential house and lot c. Sales of private car by its owner

b. Sale of an apartment house d. All of the above

2. Buhakag is a CPA. She applied for work and was hired by a firm which is engaged in Business Process

Outsourcing business handling accounting work for US entities. She was paid for his services. How will she treat

such payment for business tax purposes?

TAX by Jonas POGI Reyes, CPA Page 8

TAXATION: Value Added Tax

a. Subject to 12% VAT

b. Subject to percentage tax

c. Exempt from VAT and percentage tax

d. It is a zero rated transaction

3. A person engaged in trading business of goods, and employed also, sold and received the following:

Sales of goods held for sale P200,000

Sale of personal car 300,000

Sale of investment in bonds 500,000

Sale of land used in business 300,000

Sale of principal residence 600,000

Compensation income 800,000

Sale of shares of stocks 300,000

Director’s fee 400,000

How much is subject to business tax?

a. 1,300,000 b. 2,100,000 c. 200,000 d. 500,000

4. As of August 2016, Mr. POGI had the following gross receipts and gross sales in the immediately preceding

months:

Gross receipts from food business 300,000

Gross receipts from professional practice 1,100,000

Gross sales from privilege store 200,000

Gross sales of wife’s business 400,000

How much will be subject to VAT assuming Mr. POGI is not VAT-registered?

a. 1,400,000 b. 1,100,000 c. 1,800,000 d. nil

5. POGI Group of Companies, non VAT registered had the following information for 2016:

Gross Sales

POGI-parent company 1,900,000

Subsidiary 1 1,500,000

Subsidiary 2 1,400,000

Subsidiary 3 2,100,000

Which is correct?

a. The parent company should file a consolidated VAT return

b. Subsidiary 1, 2 and 3 should file a consolidated VAT return

c. Subsidiary should file a percentage tax return, if the parent files the same

d. Parent Company should file a percentage tax return

6. Mr. POGI is a security dealer. He had the following information:

Sales of securities in own portfolio 1,200,000

Commission income from trading stocks 700,000

Sale of bonds 100,000

Sale of vacant lot 1,500,000

Which is correct?

a. Mr. POGI should file a percentage tax return only

b. Mr. POGI should file a VAT return only

c. Mr. POGI should file a percentage tax return and an income tax return

d. Mr. POGI should file a VAT return and an income tax return and capital gains tax return

7. Mr. POGI received the following from employment, and professional practice:

Employment Professional Practice

Gross Salaries 1,200,000 Professional fees 1,000,000

Less: Withholding tax (360,000) Less: Creditable withholding tax (150,000)

SSS,HDMF,Philhealth (200,000) Net pay 850,000

Union dues (100,0000

Net pay 540,000

How much will be subject to VAT, if POGI is not VAT-registered?

a. 1,390,000 b. 2,200,000 c. 0 d. 1,000,000

8. POGI, a seller of goods, had the following transactions:

Cash sales 300,000

Credit Sales 400,000

Installment Sales(30% collected) 500,000

Shipping fee charged to customers 50,000

Excise Tax 20,000

Sales returns and allowances 100,000

Volume discount and rebates 10,000

Consignment Sales(30% commission) 100,000

Trade discount 120,000

How much is gross selling price?

a. 1,140,000 b. 1,030,000 c. 1,080,000 d. 1,070,000

9. POGI, a professional, received the following:

Collection from professional fees(10% CWT) 450,000

Collection in advance (10% CWT) 180,000

In addition, a customer cancelled POGI’s obligation amounting to P400,000, as a result of professional services

provided by POGI. A corporation where POGI is a shareholder also cancelled his obligation amounting to

P100,000.

What is the gross receipts of POGI?

a. 1,030,000 b. 1,200,000 c. 1,100,000 d. 700,000

10. POGI Car Shop had the following transactions:

Cash collection from clients 800,000

Reimbursements for transportation cost from office to client’s office 100,000

TAX by Jonas POGI Reyes, CPA Page 9

TAXATION: Value Added Tax

Reimbursement for spareparts paid by POGI 200,000

Proceeds of insurance 300,000

Receipt of loan from BPI 500,000

Receipt of money from a friend’s client 600,000

How much is the gross receipts of POGI?

a. 1,400,000 b. 900,000 c. 1,500,000 d. 1,100,000

11. A VAT taxpayer billed a client for P200,000 as a consideration for services. How much should the client pay,

assuming the professional income is subject to 10% creditable withholding tax?

a. 180,000 b. 160,714 c. 182,143 d. 204,000

12. Which of the following is exempt from VAT?

a. Export sale by non VAT individuals

b. Foreign currency denominated sale

c. Sale of services to entities duly registered with PEZA

d. Sale to Ramon Magsaysay Awards Foundation

13. Floyd Mayweather arrives in the Philippines with an immigration visa. He had with him the following:

Clothing, shoes and other personal apparels P200,000

Professional instruments and implements 300,000

Personal car 500,000

Compute the total amount subject to VAT on importation?

a. 1,000,000 b. 500,000 c. 0 700,000

14. POGI Shipping imported the following:

Fuels and supplies 5,000,000

Goods 2,000,000

POGI designated 30% of fuels and supplies for domestic use and 70% for international operations. He used all

the goods for international operations.

How much is the VAT on importation?

a. 660,000 b. 840,000 c. 600,000 d. 180,000

15. Petbest is a manufacturer of feeds to be consumed by pigs and fighting cocks. In 2016, Petbest imported

P2,000,000, net of VAT worth of ingredients to be used in the production. ¾ of these will be used for production

of feeds for fighting cocks. During the year, Petbest had sales, net of VAT, amounting to P4,000,000. Half of this

came from sale of feeds for fighting cocks. How much is the total VAT on importation to be paid by Petbest in

2016?

a. 60,000 b. 240,000 c. 180,000 d. nil

16. POGI Hospital, a private hospital, had the following gross sales/receipts during the month:

Revenue from in-patients 2,000,000

Revenue from consulting patients 1,000,000

X-ray revenues 500,000

ECG revenues 1,000,000

Revenue from hospital pharmacy 1,000,000

How much is the total amount subject to VAT?

a. 1,000,000 b. 4,500,000 c. 5,500,000 d. 4,000,000

17. POGI Bookstore reported the following:

Sales of books 1,000,000

Sales of newspapers 500,000

Sales of whiteboard 100,000

Sales of markers 100,000

Sales of foreign books (30% commission) 200,000

How much is the Output VAT?

a. 31,200 b. 48,000 c. 7,200 d. 228,000

18. POGI Airliner, an international carrier, had the following receipts during the month:

Passengers Cargoes Baggages

Outgoing flights 20,000,000 10,000,000 5,000,000

Incoming flights 10,000,000 4,000,000 2,000,000

How much is subject to VAT?

a. 35,000,000 b. 30,000,000 c. 21,000,000 d. zero

19. Assuming in the above problem (disregard incoming flights) that POGI Airliner is a domestic carrier and 30% of

each receipts came from domestic operations, how much is Output VAT?

a. 4,200,000 b. 1,800,000 c. 1,260,000 d. 6,120,000

20. A business establishment had the following transactions:

Sales to senior citizen 1,000,000

Sales to persons with disabilities 1,000,000

Sales to regular customers 1,000,000

If the business is VAT-registered, how much is Output VAT?

a. 216,000 b. 120,000 c. 240,000 d. 312,000

21. A VAT-registered restaurant sold goods to senior citizen for a total invoice price of P4,480. The senior citizen is

accompanied by three regular customers. How much is the amount that the restaurant should bill the senior

citizen?

a. 4,480 b. 4,000 c. 3,680 d. 4,160

22. Assuming in the above problem that the restaurant is not VAT-registered, and the amount is net of VAT, how

much will be the billing amount?

a. 4,480 b. 3,680 c. 4,256 d. 4,000

23. 1st statement: Standard input VAT is allowed for sales of goods or services to government or any of its political

subdivisions, instrumentalities or agencies including GOCC.

2nd statement: Standard input VAT is in lieu of the actual input VAT directly attributable or ratably apportioned to

sales to government or any of its political subdivisions, instrumentalities or agencies including GOCCs.

TAX by Jonas POGI Reyes, CPA Page 10

TAXATION: Value Added Tax

a. Both statements are correct c. Only the first statement is correct

b. Both statements are incorrect d. Only the second statement is correct

24. In case of sales to government or its political subdivisions, instrumentalities or agencies including GOCCs which

of the following is correct?

I – Should actual input VAT exceed five percent of gross payments, the excess may form part of the seller’s

expenses or cost

II – If the actual input VAT is less than five percent of the gross payment, the difference must be closed to

expensive or cost

a. Both statements are correct c. Only the first statement is correct

b. Both statements are incorrect d. Only the second statement is correct

25. VAT taxpayers including corporations use calendar quarters for VAT purposes

Withholding of VAT is done only when the buyer is the Government or any of its political subdivisions.

a. Both are correct

b. Both are incorrect

c. Only the first statement is correct

d. Only the second statementis correct

26. The input taxes on zero rated sales of goods may at the option of the VAT registered person be, except:

a. Refunded

b. Converted to tax credit certificates

c. Carried over to the next quarter

d. Used as payment of other internal revenue tax, except, withholding tax

27. Which of the following statements is INCORRECT?

a. A zero-rated sale of goods or properties (by a VAT-registered person) is a taxable transaction for VAT

purposes, but shall not result in any output tax

b. the input tax on purchases of goods, properties or services, related to zero-rated sales, shall be available as

tax credit only in accordance with the Regulations

c. For purposes of zero-rating, the export sales of registered export traders shall include commission income

d. The exportation of goods on consignment shall not be deemed export sales until the export products are in

fact sold by the consignee

28. Statement 1: All export sales are not subject to 12% Output VAT

Statement 2: All export sales are zero-rated transactions.

a. Only statement 1 is correct

b. Only statement 2 is correct

c. Both statements are correct

d. Both statements are incorrect

29. A non-VAT person reported the following during the year:

Domestic sales P 1,000,000

Export sales 600,000

Importation of goods 500,000

Transaction deemed sales 100,000

Its total amount subject to 12% VAT would be:

a. P1,600,000 b. P1,100,000 c. P500,000 d. P1,700,000

30. Mr. POGI, VAT-registered real estate dealer, transferred a parcel of land held for sale to his son as gift on

account of his graduation. For VAT purposes, the transfer is:

a. not subject to VAT because it is a gift

b. subject to VAT because it is a deemed sale transaction

c. not subject to VAT because it is subject to gift tax

d. subject to VAT because it is considered an actual sale

31. 1st statement: If the gross selling price is based on the zonal value or market value of the property, the zonal

or market value shall be deemed inclusive of VAT.

2nd statement: If the VAT is not billed separately, the selling price stated in the sales document shall be

deemed to be inclusive of VAT

a. Both statements are correct c. Only the first statement is correct

b. Both statements are incorrect d. Only the second statement is correct

32. Which of the following circumstance shall give rise to transactions “deemed sale” for purposes of VAT?

I – Change of ownership of the business (i.e., single proprietorship incorporates; or the proprietor of a sole

proprietorship sells his entire business)

II – Dissolution of a partnership and creation of a new partnership which takes over the business

a. Both I and II b. Neither I nor II c. I only d. II only

33. 1st statement: The Commissioner shall determine the appropriate tax base in cases where a transaction is

deemed a sale, barter or exchange of goods or properties or where the gross selling price is unreasonably lower

than the actual market value

2nd statement: The gross selling price is unreasonably lower than the actual market value if it is lower by more

than 30% of the actual market value of the same goods of the same quantity and quality sold in the immediate

locality on or nearest the dale of sale

a. Both statements are correct c. Only the first statement is correct

b. Both statements are incorrect d. Only the second statement is correct

34. 1st statement: VAT withheld and paid for the non-resident recipient which VAT is passed on to the resident

withholding agent by the non-resident recipient of the income, may be claimed as input tax by said VAT-

registered withholding agent upon filling his own VAT Return

2nd statement: If the resident withholding agent is a non-VAT, said passed-on VAT by the non-resident recipient

of the income, evidenced by duly filed BIR form no. 1600, shall form part of the cost of purchased services,

which may be treated either as an asset of expense, whichever is applicable of the resident withholding agent.

a. Both statements are correct c. Only the first statement is correct

b. Both statements are incorrect d. Only the second statement is correct

TAX by Jonas POGI Reyes, CPA Page 11

TAXATION: Value Added Tax

35. ABS Corporation provided the following data for the first quarter of 2012, its year as VAT registered person:

Cash sales, total value P336,000

Open account sales 112,000

Consignment made (exclusive of VAT):

January 1 - P200,000

February 15 - P150,000

Purchases of materials, net of VAT 80,000

Value of inventory as of Jan 1, of the year:

Purchased from VAT registered person 40,000

Purchased from non-VAT registered person 200,000

Purchases of VAT exempt goods 60,000

VAT paid on the above inventory 4,000

Goods distributed to a creditor as payment of debt, net 20,000

The VAT due is:

a. P56,400

b. P45,200

c. P57,600

d. P60,000

36. A building contractor provided the following data (all figures are net of VAT)

Contract price P5,000,000

Amount received from building 1 (net of P200,000 retention cost) 800,000

Advances received from building 2 400,000

Amount received from building 3 800,000

Receivable from building 4 1,000,000

Disbursements:

Services of contractors 500,000

Materials for construction 700,000

Imported materials, landed cost 200,000

Other general and operating expenses 100,000

Note: the imported material was also subjected to P120,000 excise taxes.

The VAT due is:

a. P81,600

b. P60,000

c. P69,600

d. P57,600

37. A VAT registered person has the following data:

Export sales, total invoice amount P3,000,000

Domestic sales, total invoice amount 6,720,000

Purchase of raw materials, used to manufacture goods for export

And domestic sales, VAT inclusive 616,000

Supplies used for both export and domestic sales, VAT inclusive 448,000

Purchase of equipment used in the manufacture of goods for export

And domestic sale, VAT exclusive ` 300,000

The amount of input tax which can be refunded or converted into tax credit certificates at the option of the VAT

registered person is:

a. P120,000

b. P118,800

c. P39,600

d. P50,000

38. Extramadura Refining Company manufactures refined sugar. It had the following data during the first quarter of

2013:

Sale of refined sugar, net of VAT 2,000,000

Purchases of sugar cane 500,000

Purchases of packaging materials, gross of VAT 224,000

Purchase of labels, net of VAT 100,000

Unpaid professional fees net of VAT 100,000

Payments to a foreign firm for management

Advisory engagement 300,000

The VAT payable is:

a. 160,000

b. 112,000

c. 172,000

d. 148,000

39. Griem Inc, a building contractor, showed to you the following data for the month of August 2013:

Cash received, gross of VAT 2,240,000

Receivables, net of VAT 3,000,000

Advances on other contracts still unearned(w/o VAT) 1,000,000

Unpaid purchases:

For materials, VAT excluded 500,000

For supplies, VAT excluded 100,000

For services of sub-contractors(VAT included) 1,848,000

Payments for purchases made in July:

Materials, gross of VAT 369,600

Services of subcontractors, net of VAT 495,000

How much is the value added tax payable?

a. 360,000

b. 228,600

c. 330,000

d. 90,000

TAX by Jonas POGI Reyes, CPA Page 12

TAXATION: Value Added Tax

TRAIN LAW PROVISIONS ON VAT

The following shall be subject to 12%:

1. Foreign Currency Denominated Sales

2. Sales to export-oriented enterprise

3. Export Sales under Omnibus Investment Code

4. Processing, manufacturing or repacking goods for other persons doing business outside the Philippines, which

goods are subsequently exported, where the services are paid for in acceptable foreign currency

Conditions are:

1. Enhancement of VAT refund period from 120 days to 90 days

2. All pending VAT refund claims as of Dec. 31, 2017 shall be paid in full by December 31, 2019

Sale of electricity generated through renewable sources of energy will be subject to 12% VAT

VAT exempt Transactions:

Importation of professional instruments and implements, tools of trade, occupation or employment, wearing

apparel, domestic animals, and personal and household effects belonging to persons coming to settle in the

Philippines or Filipinos or their families and descendants who are now residents or citizens of other countries

Lease of residential units threshold will be P15,000

Exchanges in pursuance of plan of merger or consolidation:

1. Exchange of property solely for stock of another corporation

2. Exchange of stocks for stocks of another corporation

3. Exchange of securities for stocks of another corporation

Exchange of property for stock gaining control of the corporation

Association dues, membership fees, and other assessments and charges collected on a purely reimbursement

basis by homeowners’ associations and condominium corporations

Sale of gold to the Bangko Sentral ng Pilipinas

Sale of drugs and medicines prescribed for diabetes, high cholesterol, and hypertension beginning January 1,

2019 as determined by the Department of Health

VAT Threshold - P3,000,000

If the individual taxpayer opted to use 8% preferential income tax, he will be exempt from 3% Percentage Tax

TAX by Jonas POGI Reyes, CPA Page 13

Vous aimerez peut-être aussi

- LawDocument43 pagesLawMARIAPas encore d'évaluation

- Chapter 14Document47 pagesChapter 14daryllePas encore d'évaluation

- Long Problems For Prelim'S Product: Case 1Document7 pagesLong Problems For Prelim'S Product: Case 1Mae AstovezaPas encore d'évaluation

- Audit of IntangiblesDocument2 pagesAudit of IntangiblesJaycee FabriagPas encore d'évaluation

- Master Budget-WPS OfficeDocument12 pagesMaster Budget-WPS OfficeRean Jane EscabartePas encore d'évaluation

- Correction of Errors: Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesCorrection of Errors: Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionmaurPas encore d'évaluation

- Acctg 303Document9 pagesAcctg 303Anonymous IsEZYR1Pas encore d'évaluation

- Kasus 1Document2 pagesKasus 1ViePas encore d'évaluation

- Confidential: Section A - 20 Marks Scenario A. (3 Questions)Document4 pagesConfidential: Section A - 20 Marks Scenario A. (3 Questions)Otherr HafizPas encore d'évaluation

- Charlwin Lee Cup NFJPIA NCR Taxation Questions Elimination RoundDocument26 pagesCharlwin Lee Cup NFJPIA NCR Taxation Questions Elimination RoundKenneth RobledoPas encore d'évaluation

- Recourse Obligation.: RequiredDocument55 pagesRecourse Obligation.: RequiredJude SantosPas encore d'évaluation

- Rfbt1 Oblico Lecture NotesDocument40 pagesRfbt1 Oblico Lecture NotesGizel BaccayPas encore d'évaluation

- Chapter 1Document13 pagesChapter 1Ella Marie WicoPas encore d'évaluation

- Pineda, Maricar R. CBET-01-502A: Internal FactorsDocument5 pagesPineda, Maricar R. CBET-01-502A: Internal FactorsMaricar PinedaPas encore d'évaluation

- Strategic Business Analysis: ASSIGNMENT #5: Analyzing Resources and CapabilitiesDocument5 pagesStrategic Business Analysis: ASSIGNMENT #5: Analyzing Resources and CapabilitiesJonas Avanzado TianiaPas encore d'évaluation

- Audit ReviewDocument9 pagesAudit ReviewephraimPas encore d'évaluation

- A Government Employee May Claim The Tax InformerDocument3 pagesA Government Employee May Claim The Tax InformerYuno NanasePas encore d'évaluation

- AC 3101 Discussion ProblemDocument1 pageAC 3101 Discussion ProblemYohann Leonard HuanPas encore d'évaluation

- Chapter 8Document7 pagesChapter 8Yenelyn Apistar CambarijanPas encore d'évaluation

- Sample Midterm PDFDocument9 pagesSample Midterm PDFErrell D. GomezPas encore d'évaluation

- MA PresentationDocument6 pagesMA PresentationbarbaroPas encore d'évaluation

- MAS - Group 5Document7 pagesMAS - Group 5beleky watersPas encore d'évaluation

- 2018 - 2019 MAS 01 70mcqDocument30 pages2018 - 2019 MAS 01 70mcqMarc Allen Anthony GanPas encore d'évaluation

- Colegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityDocument5 pagesColegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityJhomel Domingo GalvezPas encore d'évaluation

- This Study Resource Was: Assignment 1 - Overview of Financial Markets and Interest RatesDocument2 pagesThis Study Resource Was: Assignment 1 - Overview of Financial Markets and Interest RatesArjay Dela PenaPas encore d'évaluation

- Audit of Investments - Set ADocument4 pagesAudit of Investments - Set AZyrah Mae SaezPas encore d'évaluation

- p1 IaDocument1 pagep1 IaLeika Gay Soriano OlartePas encore d'évaluation

- CE On Agriculture T1 AY2020-2021Document2 pagesCE On Agriculture T1 AY2020-2021Luna MeowPas encore d'évaluation

- Module 5&6Document29 pagesModule 5&6Lee DokyeomPas encore d'évaluation

- Factory OverheadDocument2 pagesFactory OverheadKeanna Denise GonzalesPas encore d'évaluation

- Review QuestionairesDocument18 pagesReview QuestionairesAngelica DuartePas encore d'évaluation

- Exercise DrillDocument6 pagesExercise DrillAbigail Ann PasiliaoPas encore d'évaluation

- 17002Document2 pages17002Alvin YercPas encore d'évaluation

- Answer: Cost Flow Equation: BB + TI TO + EB Computer Chips: $600,000 + $1,600,000 $1,800,000 + EBDocument8 pagesAnswer: Cost Flow Equation: BB + TI TO + EB Computer Chips: $600,000 + $1,600,000 $1,800,000 + EBkmarisseePas encore d'évaluation

- 6 ACCT 2A&B C. OperationDocument10 pages6 ACCT 2A&B C. OperationShannon Mojica100% (1)

- DeductionsDocument4 pagesDeductionsDianna RabadonPas encore d'évaluation

- Auditing Problem (Modules 7-10)Document6 pagesAuditing Problem (Modules 7-10)Serena Van der WoodsenPas encore d'évaluation

- FarDocument19 pagesFarsarahbeePas encore d'évaluation

- VI. 80% Owned-Subsidiary: Cost Model - Full Goodwill Approach Downstream and Upstream of Property, Unrealized Gain and Realized Gain On SaleDocument3 pagesVI. 80% Owned-Subsidiary: Cost Model - Full Goodwill Approach Downstream and Upstream of Property, Unrealized Gain and Realized Gain On SaleMa'arifa HussainPas encore d'évaluation

- Chapter 13 Audit of Long LiDocument37 pagesChapter 13 Audit of Long LiKaren Balibalos100% (1)

- The Responsibility For The Detection and Prevention of Errors, Fraud and Noncompliance With Laws and Regulations Rests With A. AuditorDocument2 pagesThe Responsibility For The Detection and Prevention of Errors, Fraud and Noncompliance With Laws and Regulations Rests With A. Auditoraccounts 3 lifePas encore d'évaluation

- Chapter 9 - Input VatDocument1 pageChapter 9 - Input VatPremium AccountsPas encore d'évaluation

- What Is The Correct Amount of Inventory?: SolutionDocument3 pagesWhat Is The Correct Amount of Inventory?: SolutionSofia LaoPas encore d'évaluation

- Handout No. 3Document6 pagesHandout No. 3Villena Divina VictoriaPas encore d'évaluation

- OPT QuizDocument5 pagesOPT QuizAngeline VergaraPas encore d'évaluation

- FM 225 Kulang 4Document4 pagesFM 225 Kulang 4Karen AlonsagayPas encore d'évaluation

- Managerial AccountingMid Term Examination (1) - CONSULTADocument7 pagesManagerial AccountingMid Term Examination (1) - CONSULTAMay Ramos100% (1)

- Prepare The Current Liabilities Section of The Statement of Financial Position For The Layla Company As of December 31, 2020Document1 pagePrepare The Current Liabilities Section of The Statement of Financial Position For The Layla Company As of December 31, 2020versPas encore d'évaluation

- Review - Practical Accounting 1Document2 pagesReview - Practical Accounting 1Kath LeynesPas encore d'évaluation

- Cost of Capital: By: Judy Ann G. Silva, MBADocument21 pagesCost of Capital: By: Judy Ann G. Silva, MBAAnastasha GreyPas encore d'évaluation

- Vat 2Document4 pagesVat 2Allen KatePas encore d'évaluation

- Department of Accountancy: Page - 1Document16 pagesDepartment of Accountancy: Page - 1NoroPas encore d'évaluation

- Midterm Exam No. 2Document1 pageMidterm Exam No. 2Anie MartinezPas encore d'évaluation

- Audit Prob InvestmentDocument5 pagesAudit Prob InvestmentANGIE BERNAL100% (1)

- Homework Number 4Document8 pagesHomework Number 4ARISPas encore d'évaluation

- Case Analysis - BalderosaDocument3 pagesCase Analysis - BalderosajenPas encore d'évaluation

- 90,000 40,000 102,000 Correct Answer 110,000 100,000 300,000 312,000 314,000Document11 pages90,000 40,000 102,000 Correct Answer 110,000 100,000 300,000 312,000 314,000Hazel Grace PaguiaPas encore d'évaluation

- ReportDocument4 pagesReportryan angelica allanicPas encore d'évaluation

- TAX-302 (VAT-Exempt Transactions) PDFDocument5 pagesTAX-302 (VAT-Exempt Transactions) PDFclara san miguelPas encore d'évaluation

- AtDocument6 pagesAtJohn Derek GarreroPas encore d'évaluation

- Cost Accounting: "Backflush Costing"Document40 pagesCost Accounting: "Backflush Costing"John Derek GarreroPas encore d'évaluation

- Capital Budgeting FM2 AnswersDocument17 pagesCapital Budgeting FM2 AnswersMaria Anne Genette Bañez89% (28)

- Cost Accounting: "Backflush Costing"Document40 pagesCost Accounting: "Backflush Costing"John Derek GarreroPas encore d'évaluation

- Audit Evidence and Documentation An Audit: Summary: "Coverd" (I.e Covered But Misspelled)Document7 pagesAudit Evidence and Documentation An Audit: Summary: "Coverd" (I.e Covered But Misspelled)Kyll MarcosPas encore d'évaluation

- MAS QuizzerDocument37 pagesMAS QuizzerJohn Carlo PeruPas encore d'évaluation

- TB Ch01Document14 pagesTB Ch01CGPas encore d'évaluation

- Registration of An NGO in IndiaDocument6 pagesRegistration of An NGO in IndiaAman D SharanPas encore d'évaluation

- Sample Business Proposal/ PlanDocument13 pagesSample Business Proposal/ PlanUmma Mie ZY100% (1)

- Jadav ChennaiDocument1 pageJadav ChennaiANISH SHAIKHPas encore d'évaluation

- Adarsh Credit Co-Operative Society LTDDocument7 pagesAdarsh Credit Co-Operative Society LTDdeepakPas encore d'évaluation

- US AMAZON Cerebro B09CRNPZWFDocument8 pagesUS AMAZON Cerebro B09CRNPZWFAmalPas encore d'évaluation

- G.R. No. 192391Document7 pagesG.R. No. 192391JeremiahN.CaballeroPas encore d'évaluation

- Irc ViDocument265 pagesIrc VihenrydpsinagaPas encore d'évaluation

- Czech RepublicDocument12 pagesCzech RepublicFilippe OliveiraPas encore d'évaluation

- Dusters Total Solutions Services PVT - LTD.: Amount Deductions Earned AllowanceDocument52 pagesDusters Total Solutions Services PVT - LTD.: Amount Deductions Earned Allowancerishichauhan25Pas encore d'évaluation

- Chap 1 Basis of Malaysian Income Tax 2022Document7 pagesChap 1 Basis of Malaysian Income Tax 2022Jasne OczyPas encore d'évaluation

- Administration of Central ExciseDocument22 pagesAdministration of Central ExciseSubhasish ChatterjeePas encore d'évaluation

- Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument1 pageCopy B-To Be Filed With Employee's FEDERAL Tax ReturnJoshua WagonerPas encore d'évaluation

- Fisher Vs Trinidad DigestDocument3 pagesFisher Vs Trinidad DigestKT100% (1)

- In Voice Od 428288969064989100Document1 pageIn Voice Od 428288969064989100sandeepsm321Pas encore d'évaluation

- ATPTCC Circular 18 001.finalDocument2 pagesATPTCC Circular 18 001.finalJanry De LeonPas encore d'évaluation

- Illustration On Special Revenue FundDocument2 pagesIllustration On Special Revenue FundJichang Hik0% (1)

- Link: HTTPS://WWW - Dti.gov - Ph/resources/downloadable-FormsDocument2 pagesLink: HTTPS://WWW - Dti.gov - Ph/resources/downloadable-FormsAyvz Martija LambioPas encore d'évaluation

- 2015 Bar Questions On Taxation Gen Pri and IncomeDocument2 pages2015 Bar Questions On Taxation Gen Pri and IncomeSheena PalmaresPas encore d'évaluation

- Minsky PDFDocument51 pagesMinsky PDFDulceVillarrealPas encore d'évaluation

- Document 1517 6758Document52 pagesDocument 1517 6758rubyhien46tasPas encore d'évaluation

- Conceptual Issues by CA. Naveen ND GuptaDocument23 pagesConceptual Issues by CA. Naveen ND GuptaTapas PurwarPas encore d'évaluation

- Ferlin Acol Quiz 2 Gross Estate Part 1Document3 pagesFerlin Acol Quiz 2 Gross Estate Part 1Julienne UntalascoPas encore d'évaluation

- M5 - Deductions From Gross Estate - Students'Document33 pagesM5 - Deductions From Gross Estate - Students'micaella pasionPas encore d'évaluation

- Income Statement Company A Percent Company B Percent RevenueDocument4 pagesIncome Statement Company A Percent Company B Percent RevenueLina Levvenia RatanamPas encore d'évaluation

- Cambridge IGCSE™: Business Studies 0450/11 May/June 2021Document21 pagesCambridge IGCSE™: Business Studies 0450/11 May/June 2021Imran Ali100% (1)

- Tax Planning - Tax Avoidance - Tax EvasionDocument4 pagesTax Planning - Tax Avoidance - Tax EvasionDr Linda Mary Simon67% (3)

- Proceeding International Conference On Governance 2014Document100 pagesProceeding International Conference On Governance 2014NurrochmanPas encore d'évaluation

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Manish JaiswalPas encore d'évaluation

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)cOnnectOrTR 12Pas encore d'évaluation

- Income Statement AccountDocument17 pagesIncome Statement Accountmaria cacaoPas encore d'évaluation