Académique Documents

Professionnel Documents

Culture Documents

Real Estate Appraisal Reviewer

Transféré par

venturistaCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Real Estate Appraisal Reviewer

Transféré par

venturistaDroits d'auteur :

Formats disponibles

Real Estate Appraisal Forces that effect value (SEPP)

Appraisal or Valuation 1. Social – Population growth and decline, changes in family size

– an estimate or opinion of value concerning real estate or other 2. Economic – Availability of money and credit, price levels,

property interest rates, tax burden, employment, wage levels

– process of developing an estimate of value of an adequately 3. Political – Government regulations, rent controls, building

identified and described property as of specified and described codes, police and fire regulations

property as of specified date, supported by logical presentation 4. Physical – Forces created by man or nature, climate and

of factual and relevant data primarily based on personal topography, mineral resources, flood control, community factors

inspection of the property such as transportation, school, parks and recreation areas

Objectives of Appraisal Valuation Principles

Primary Purpose of Property Appraisal for Banks/ Financial 1. Anticipation – value tends to be set by the present worth of

Institutions: the future benefits or income that may be derived from the

1. Establish a Fair Market Value for the collateral offered in order ownership of the property

to arrive at a sound credit decision 2. Change – tomorrow will be different

2. Ensure a satisfactory return to the bank in the event of 3. Competition – profit creates competition

foreclosure and sale of acquired asset 4. Conformity – maximum value of a property is realized when a

reasonable degree of sociological, architectural and economic

Other Purposes: homogeneity is present

1. Sale and Disposition 5. Contribution – the value of the land is dependent on the

2. Taxation amount of net returns on investment on the building

3. Condemnation Proceedings 6. Highest and Best Use

4. Basis for Insurance 7. Substitution – equally desirable substitute property

5. Accounting and Property Records 8. Supply and Demand – interplay of economic forces affecting

market value

PRICE, COST and VALUE

Price Cost Value Legal Considerations in Appraisal (6)

Factual figures that are considered as Ownership of real estate is a direct function of constitutional

indicators of value guarantees.

-Actual amount -Actual amount -Relationship 1. Fundamental def

paid in a particular spent to build or between a thing

transaction put a property into desired and

-Term used for the being potential purchaser

amount asked, -Total cost of the -Economic concept

offered, or paid for property includes referring to price

a good or service all direct and most likely to be

-Generally an indirect costs concluded by the

indication of a -The amount of buyers and sellers

relative value money required to -Hypothetical price

placed upon goods create or produce

or services the good or service

Fair Market Value

Highest price in terms of money which a property will bring

if exposed for sale in the open market

A price that a willing seller would sell and a willing buyer

would buy, neither being under abnormal pressure

Sellers are pressured to sell under the following circumstances:

a. Expopriation

b. Foreclosure

Factors that create value (DUST)

1. Desirability – property must arouse the desire of buyer

2. Utility – must be useful to have value

3. Scarcity – object must have limited supply

4. Transferability – ownership of an object must be tranferrable

Vous aimerez peut-être aussi

- 3.6 Basic REA For REBDocument107 pages3.6 Basic REA For REBgore.solivenPas encore d'évaluation

- Basic Appraisal For Real Estate BrokersDocument4 pagesBasic Appraisal For Real Estate Brokersbea100% (1)

- Alawa Cresar 2015 Basic Appraisal For RebDocument52 pagesAlawa Cresar 2015 Basic Appraisal For RebRheneir MoraPas encore d'évaluation

- Mock Exam Part 1Document25 pagesMock Exam Part 1Rheneir MoraPas encore d'évaluation

- Test Exam AppraisalDocument4 pagesTest Exam AppraisalJay ElizanPas encore d'évaluation

- Real Estate Brokerage PracticeDocument67 pagesReal Estate Brokerage PracticeLeslie Anne De JesusPas encore d'évaluation

- 01 REA Mock 250 ItemsDocument31 pages01 REA Mock 250 ItemsRECEPTION AND DIAGNOSTIC CENTER RDC MEDICAL SECTIONPas encore d'évaluation

- Concepts Fundamental To Valuation PrinciplesDocument9 pagesConcepts Fundamental To Valuation PrinciplesDiwaPas encore d'évaluation

- Basic Appraisal For Real Estate BrokerDocument7 pagesBasic Appraisal For Real Estate BrokerJosue Sandigan Biolon SecorinPas encore d'évaluation

- Republic Act No. 7279Document25 pagesRepublic Act No. 7279Sharmen Dizon GalleneroPas encore d'évaluation

- 3.09 Set 3 Mock Exam ReaDocument5 pages3.09 Set 3 Mock Exam Reabhobot riveraPas encore d'évaluation

- Urban Review Center Notes For Rea Board ExamDocument183 pagesUrban Review Center Notes For Rea Board ExamRenz Jason SevillaPas encore d'évaluation

- 015 June 10, 2023 Problem Solving PRCDocument20 pages015 June 10, 2023 Problem Solving PRCPrince EG DltgPas encore d'évaluation

- Philippine Valuation StandardsDocument45 pagesPhilippine Valuation StandardsAl MarzolPas encore d'évaluation

- Professional Practice Tugue With AnswersDocument22 pagesProfessional Practice Tugue With AnswersZoey AlexaPas encore d'évaluation

- Group 9Document18 pagesGroup 9Sasha Braus100% (1)

- REB SAMPLE ONLY 10 Items Mock Exam 1 General and FundamentalsDocument2 pagesREB SAMPLE ONLY 10 Items Mock Exam 1 General and FundamentalsYen055Pas encore d'évaluation

- Real Estate PracticeDocument5 pagesReal Estate PracticeDa Yani ChristeenePas encore d'évaluation

- A. EconomicsDocument19 pagesA. EconomicsChristopher Gutierrez CalamiongPas encore d'évaluation

- Appraisal of PMEDocument37 pagesAppraisal of PMELuningning CariosPas encore d'évaluation

- Real Estate Finance and Economics-ExamDocument20 pagesReal Estate Finance and Economics-ExamLina Michelle Matheson Brual100% (1)

- Comprehensive Reviewer On Appraiser Examjen PDFDocument110 pagesComprehensive Reviewer On Appraiser Examjen PDFDionico O. Payo Jr.Pas encore d'évaluation

- MCQ Re EconomicsDocument4 pagesMCQ Re EconomicsAB AgostoPas encore d'évaluation

- 3.091 Set 2 Mock Exam ReaDocument17 pages3.091 Set 2 Mock Exam Reabhobot riveraPas encore d'évaluation

- A.2 Usprcp Rec CodeDocument25 pagesA.2 Usprcp Rec Codebhobot riveraPas encore d'évaluation

- Back-Up AgriculturalDocument32 pagesBack-Up AgriculturalMarkein Dael VirtudazoPas encore d'évaluation

- 3 REB Practice QuestionsDocument27 pages3 REB Practice QuestionsPrince EG DltgPas encore d'évaluation

- Real Estate Broker Board ExamDocument2 pagesReal Estate Broker Board ExamTheSummitExpressPas encore d'évaluation

- Fundamental of Property OwnershipDocument5 pagesFundamental of Property OwnershipJosue Sandigan Biolon SecorinPas encore d'évaluation

- Taxation WorkshopDocument83 pagesTaxation WorkshopLaw_Portal100% (1)

- Philippine Association of Realty Appraisers, IncDocument12 pagesPhilippine Association of Realty Appraisers, IncLuningning CariosPas encore d'évaluation

- Overview of The Brokerage Process For Producers RealtyDocument2 pagesOverview of The Brokerage Process For Producers RealtyadobopinikpikanPas encore d'évaluation

- CRES Compilation With Answer KeyDocument7 pagesCRES Compilation With Answer KeyANGIE BERNALPas encore d'évaluation

- 1.4 Real-Estate-Taxation With Problems and Answers - REBDocument82 pages1.4 Real-Estate-Taxation With Problems and Answers - REBgore.solivenPas encore d'évaluation

- Day 9 Fundamentals of REA ExamDocument10 pagesDay 9 Fundamentals of REA ExamKijiPas encore d'évaluation

- Broker Reviewer 2022Document8 pagesBroker Reviewer 2022Janzel SantillanPas encore d'évaluation

- All True: (Many Here Are Past Examination Questions On True or False Before) Subdivision, Condominium, Land ManagementDocument7 pagesAll True: (Many Here Are Past Examination Questions On True or False Before) Subdivision, Condominium, Land Managementkimdao100% (1)

- 6.1 Condominium ConceptDocument3 pages6.1 Condominium ConceptShangrila Homes TarlacPas encore d'évaluation

- ReviewerDocument160 pagesReviewerGDLT ytPas encore d'évaluation

- Answer - Hidden Ep Quiz 15Document13 pagesAnswer - Hidden Ep Quiz 15Reymond IgayaPas encore d'évaluation

- Special & TechnicalDocument6 pagesSpecial & TechnicalJuan Carlos NocedalPas encore d'évaluation

- SAMPLE ONLY Topic - Legal Aspect of Sales, Mortgage and LeaseDocument3 pagesSAMPLE ONLY Topic - Legal Aspect of Sales, Mortgage and LeaseJoshua Armesto100% (2)

- Legal Aspect of Sales, Mortgage and LeaseDocument15 pagesLegal Aspect of Sales, Mortgage and LeaseErika Lusterio100% (1)

- Part 1 Mock ExamDocument201 pagesPart 1 Mock ExamKristin MatubisPas encore d'évaluation

- 2020REBLicensure ExaminationDocument68 pages2020REBLicensure Examinationraimol gensan100% (1)

- PRBRES ResolutionsDocument1 pagePRBRES ResolutionsDexterPas encore d'évaluation

- Real Estate Brokerage & PracticeDocument3 pagesReal Estate Brokerage & PracticeMarisseAnne Coquilla100% (1)

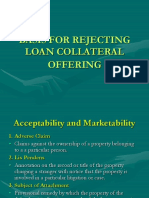

- When To Reject Loan Collateral OffersDocument6 pagesWhen To Reject Loan Collateral OffersLuningning CariosPas encore d'évaluation

- Hlurb Clup2014Document101 pagesHlurb Clup2014Law_PortalPas encore d'évaluation

- Reviewer RebDocument11 pagesReviewer RebKylie MayʚɞPas encore d'évaluation

- REB Mock Exam - Legal Aspects of SalesDocument6 pagesREB Mock Exam - Legal Aspects of SalesYen055Pas encore d'évaluation

- Simulation 1 With Answer KeyDocument9 pagesSimulation 1 With Answer KeyREB2020100% (2)

- OF Appraisal Formula A) Compounded Interest Future Value of Single InvestmentDocument21 pagesOF Appraisal Formula A) Compounded Interest Future Value of Single Investmentbhobot riveraPas encore d'évaluation

- Condo and Brokerage ReviewerDocument16 pagesCondo and Brokerage ReviewerJanzel SantillanPas encore d'évaluation

- Chapter 6-Income ApproachDocument37 pagesChapter 6-Income ApproachHosnii QamarPas encore d'évaluation

- Odilio Pelenio: Odpels Real Estate Broker ReviewerDocument33 pagesOdilio Pelenio: Odpels Real Estate Broker ReviewerRossy MorandartePas encore d'évaluation

- Appraisal Feasibility Study Ethics Business Valuation ConsultancyD'EverandAppraisal Feasibility Study Ethics Business Valuation ConsultancyPas encore d'évaluation

- 1.1 Real Estate Appraisal Notes Converted - Docx 1Document20 pages1.1 Real Estate Appraisal Notes Converted - Docx 1acexkthvPas encore d'évaluation

- Reconstitution of TitleDocument1 pageReconstitution of TitleventuristaPas encore d'évaluation

- Introduction To Property ManagementDocument3 pagesIntroduction To Property Managementventurista100% (1)

- REM 111 - Case Study DetailsDocument3 pagesREM 111 - Case Study DetailsventuristaPas encore d'évaluation

- Project SellingDocument6 pagesProject SellingventuristaPas encore d'évaluation

- Documentation of OwnershipDocument12 pagesDocumentation of OwnershipventuristaPas encore d'évaluation

- Rem 111 - Case Study - For SubmissionDocument25 pagesRem 111 - Case Study - For SubmissionventuristaPas encore d'évaluation

- Valuation of Merger ProposalDocument21 pagesValuation of Merger ProposalKARISHMAATA2100% (2)

- Assignment # 2Document4 pagesAssignment # 2IznaPas encore d'évaluation

- Varian9e LecturePPTs Ch12Document72 pagesVarian9e LecturePPTs Ch12王琦Pas encore d'évaluation

- Prelim Examination - Attempt 62% FMGDocument12 pagesPrelim Examination - Attempt 62% FMGjrence100% (1)

- OM27 Sesions1-4Document39 pagesOM27 Sesions1-4Sai KPas encore d'évaluation

- Chapter 4 - Exchange Rate Determinations.Document28 pagesChapter 4 - Exchange Rate Determinations.Pháp Nguyễn100% (1)

- Taxation Law FD 8th Sem.Document25 pagesTaxation Law FD 8th Sem.Mukul Singh RathorePas encore d'évaluation

- Business Studies IgcseDocument115 pagesBusiness Studies IgcsexPas encore d'évaluation

- The 1929 Stock Market CrashDocument12 pagesThe 1929 Stock Market Crashvbansal100% (2)

- MANAGERIAL ECONOMICS Notes Unit I & II PDFDocument41 pagesMANAGERIAL ECONOMICS Notes Unit I & II PDFrudypatil67% (6)

- Horna, Hernan - The Fish Industry of PeruDocument15 pagesHorna, Hernan - The Fish Industry of PeruTheMaking2Pas encore d'évaluation

- Biologicla Assets PDFDocument2 pagesBiologicla Assets PDFMjhayePas encore d'évaluation

- Customer ValueDocument24 pagesCustomer Valuearv2326Pas encore d'évaluation

- Money Lesson Plan FinalDocument17 pagesMoney Lesson Plan Finalapi-271049245Pas encore d'évaluation

- Eco Project GulshanDocument21 pagesEco Project GulshanAman BajajPas encore d'évaluation

- The Impact of Internal Marketing On Service Quality, Perceived Value, Consumer Satisfaction and Loyalty in The Service SectorDocument10 pagesThe Impact of Internal Marketing On Service Quality, Perceived Value, Consumer Satisfaction and Loyalty in The Service SectorInternational Journal of Multidisciplinary Research and AnalysisPas encore d'évaluation

- CHAPTER 11 Breakeven and Sensitivity AnalysisDocument20 pagesCHAPTER 11 Breakeven and Sensitivity AnalysisAlexPas encore d'évaluation

- From Haqq To Gharar:RibaDocument14 pagesFrom Haqq To Gharar:RibaNughmana MirzaPas encore d'évaluation

- Economics (I)Document19 pagesEconomics (I)Alexandru MazurPas encore d'évaluation

- Summary Operations Management Midterm Exam Review and NotesDocument47 pagesSummary Operations Management Midterm Exam Review and NotesMahmoudElbehairy0% (1)

- Introducing Marxist EconomicsDocument24 pagesIntroducing Marxist Economicspastetable100% (1)

- EECH 1& 2pdfDocument52 pagesEECH 1& 2pdfTarekegnPas encore d'évaluation

- Lewin, P. (2015) - Entrepreneurial Opportunity As The Potential To Create Value. The Review of Austrian Economics, 28, 1-15Document15 pagesLewin, P. (2015) - Entrepreneurial Opportunity As The Potential To Create Value. The Review of Austrian Economics, 28, 1-15Shady SamhanPas encore d'évaluation

- 12 Ipsas 12 Inventories 1Document19 pages12 Ipsas 12 Inventories 1Hastings KapalaPas encore d'évaluation

- Social EntrepreneurshipDocument64 pagesSocial EntrepreneurshipTabrej Khan100% (4)

- HRA Models - Value Based ModelsDocument53 pagesHRA Models - Value Based ModelsAshish Dhania100% (4)

- Evolution of Money (ESSAY)Document3 pagesEvolution of Money (ESSAY)Quynh Anh HoangPas encore d'évaluation

- Arkwright - Water Frame RulesDocument36 pagesArkwright - Water Frame RulestobymaoPas encore d'évaluation

- Preboard Question Paper BST 2020-21Document8 pagesPreboard Question Paper BST 2020-21Joanna Garcia25% (4)

- Group 3 - Supply Chain Analysis (8H)Document13 pagesGroup 3 - Supply Chain Analysis (8H)Qema Jue100% (1)