Académique Documents

Professionnel Documents

Culture Documents

Wildcat LTD

Transféré par

vanya guptaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Wildcat LTD

Transféré par

vanya guptaDroits d'auteur :

Formats disponibles

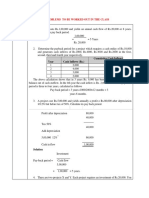

1. Wildcat Ltd, a manufacturing company sold a machinery for Rs 8 lacs at the year end.

The

company had purchased the machinery four years back for Rs 15 lacs and had depreciated the

same using written down value method of depreciation @ 20%. As an accounts executive of

Wildcat Ltd, calculate the WDV of the asset for the four years, accumulated depreciation for

four years and profit/loss on sale, if any.?

ANSWER:- Written Down Value method is a depreciation technique that applies a constant

rate of depreciation to the net book value of assets each year thereby recognizing

more depreciation expense in early years of the life of the asset and less depreciation in the

later years of the life of the asset.

WILDCAT LTD WHO IS A MANUFACTURER HAD BOUGHT THE MACHIENEY FOR 15 LACKS

DEPRICIATION FOR 1 YEAR IS I.E. FOR WRITTEN DOWN VALUE METHOD @20% IS:-

W.D.V = VALUE OF MACHIENERY X % OF DEPRICIATION

W.D.V = 15,00,000 X 20%

=3,00,000 SO DEPRICIATION FOR 1ST YEAR IS 3 LACKS

SO VALUE OF MACHINERY FOR 1ST YEAR IS =15LACK – 3 LACK = 12 LACK

DEPRICIATION FOR 2 YEAR FOR WRITTEN DOWN VALUE METHOD FOR MACHINERY WORTH

12 LACK @20% IS:-

W.D.V = 12,00,000 X 20%

=240000 DEPRICIATION FOR 2ND YEAR = 2.4 LACKS

SO VALUE OF MACHIENE AFTER 2ND YEAR =12,00,000 – 240000

=9,60,000

DEPRICIATION FOR 3RD YEAR FOR WRITTEN DOWN VALUE METHOD FOR MACHINERY

WORTH 9,60,000 @20% IS:-

W.D.V = 9,60,000 X 20%

= 1,92,000 DEPRICIAITION FOR 3RD YEAR IS 1.92 LACK

SO VALUE OF MACHIENE AFTER 3RD YEAR = 9,60,000 – 1,92,000

=7,68,000

SO VALUE OF MACHIENE AFTER 3RD YEAR IS 7,68,000

DEPRICIATION FOR 4TH YEAR FOR WRITTEN DOWN VALUE METHOD FOR MACHINERY

WORTH 7,68,000 @20% IS :-

W.D.V = 7,68,000 X 20%

= 1,53,600

SO VALUE OF MACHIENE AFTER 4TH YEAR = 768000-153600

= 6,14,400

SO VALUE OF MACHIENERY AFTER 4 YEARS IS = 6,14,400

** SALE OF MACHINERY AFTER 4 YEARS IS 8 LACKS (8,00,000)

BUT VALUE OF MACHIENERY AFTER 4 YEARS OF DEPRICIATION IS 6,14,400

SO PROFIT/LOSS AFTER SALE OF MACHINERY AFTER 4 YEARS IS

= SALE PRICE – VALUE OF MACHIENERY AFTER 4 YEARS

=8,00,000 - 6,14,400

=1,85,600 (PROFIT)

SO PROFIT AFTER SALE OF THE MACHINERY IS 1,85,600.

** ACCUMULATED DEPRICIATION = DEPRICIATION OF ( 1 YEAR+2 YEAR+3 YEAR+4 YEAR )

=3,00,000 + 2,40,000 + 1,92,000 + 1,53,600

=8,85,600 ANSWER

Vous aimerez peut-être aussi

- 1 Property, Plant and Equipment IAS 16 Slides 2022Document49 pages1 Property, Plant and Equipment IAS 16 Slides 2022Tuyakula ShipadiPas encore d'évaluation

- End-Of-Chapter Answers Chapter 9-1 PDFDocument16 pagesEnd-Of-Chapter Answers Chapter 9-1 PDFSiphoPas encore d'évaluation

- SM 300 Ee Semester Q&aDocument11 pagesSM 300 Ee Semester Q&aAnushka DasPas encore d'évaluation

- Depreciation and Its AccountingDocument4 pagesDepreciation and Its AccountingSatish SheoranPas encore d'évaluation

- ES19 Depreciation April 19,2023Document19 pagesES19 Depreciation April 19,2023angusdelosreyes23Pas encore d'évaluation

- Investment Appraisal Techniques 2Document24 pagesInvestment Appraisal Techniques 2Jul 480wesh100% (1)

- Final Economy 2010 SolutionDocument6 pagesFinal Economy 2010 SolutionValadez28Pas encore d'évaluation

- Engineering Economy 16th Edition Sullivan Test BankDocument9 pagesEngineering Economy 16th Edition Sullivan Test Bankjohnquyzwo9qa100% (31)

- Practice Problem - Answer Recapture (Terminal Loss) UCC For CCA Ending UCCDocument2 pagesPractice Problem - Answer Recapture (Terminal Loss) UCC For CCA Ending UCCSalman AliPas encore d'évaluation

- 8.rate of Return AnalysisDocument7 pages8.rate of Return AnalysisTiaraPas encore d'évaluation

- PPE2-sample - Debi Comia PPE2-sample - Debi ComiaDocument16 pagesPPE2-sample - Debi Comia PPE2-sample - Debi ComiaAngelica Pagaduan50% (2)

- Bajaj Finserv Investor Presentation - Q2 FY2018-19Document19 pagesBajaj Finserv Investor Presentation - Q2 FY2018-19AmarPas encore d'évaluation

- Ice PlantDocument14 pagesIce Plantx-robot100% (4)

- Chapter 9-1Document5 pagesChapter 9-1jou20220354Pas encore d'évaluation

- Post Training Test - AccountantsDocument2 pagesPost Training Test - AccountantsEsther AkpanPas encore d'évaluation

- Chapter12E2010 PDFDocument8 pagesChapter12E2010 PDFMahnooranjumPas encore d'évaluation

- Chapter 4 CB Problems - IDocument11 pagesChapter 4 CB Problems - IRoy YadavPas encore d'évaluation

- Financial Management: Methods of Capital Budgeting EvaluationDocument21 pagesFinancial Management: Methods of Capital Budgeting EvaluationHawazin Al-wasilaPas encore d'évaluation

- Sample Cases 1-11 With SolutionsDocument10 pagesSample Cases 1-11 With SolutionsJenina Rose SalvadorPas encore d'évaluation

- 3 Annual Worth MethodDocument29 pages3 Annual Worth MethodAngel NaldoPas encore d'évaluation

- Chapter 11Document10 pagesChapter 11Syed Sheraz AliPas encore d'évaluation

- AFM Individual Assignment 1Document5 pagesAFM Individual Assignment 1RajeswariRameshPas encore d'évaluation

- Unit 5Document46 pagesUnit 519-R-0503 ManogjnaPas encore d'évaluation

- Annai Therasa Arts and Science College: Model ExaminationDocument6 pagesAnnai Therasa Arts and Science College: Model ExaminationJayaram JaiPas encore d'évaluation

- Depreciation Unit 3 PDFDocument34 pagesDepreciation Unit 3 PDFPavan ChitragarPas encore d'évaluation

- UBS Capital BudgetingDocument19 pagesUBS Capital BudgetingRajas MahajanPas encore d'évaluation

- Chapter 4 CB Problems - FDocument11 pagesChapter 4 CB Problems - FAkshat SinghPas encore d'évaluation

- GoodwillDocument4 pagesGoodwillamansinghsodhi14Pas encore d'évaluation

- Today Agenda: What Is A Project?Document9 pagesToday Agenda: What Is A Project?Nouman SheikhPas encore d'évaluation

- Assignment-4 Full SolutionDocument15 pagesAssignment-4 Full SolutionashishPas encore d'évaluation

- CEP Engineering EcnomicsDocument5 pagesCEP Engineering Ecnomicsmr.wasifamjadPas encore d'évaluation

- ProblemSet Cash Flow EstimationQA-160611 - 021520Document25 pagesProblemSet Cash Flow EstimationQA-160611 - 021520Jonathan Punnalagan100% (2)

- ProblemSet Cash Flow EstimationQA 160611 021520 PDFDocument25 pagesProblemSet Cash Flow EstimationQA 160611 021520 PDFCucumber IsHealthy96Pas encore d'évaluation

- Chapter 9 Exercises - Plant AssetsDocument7 pagesChapter 9 Exercises - Plant Assetsmohammad khataybehPas encore d'évaluation

- Capital BudgetingDocument16 pagesCapital Budgetingjamn1979Pas encore d'évaluation

- Economics Depreciation ValueDocument4 pagesEconomics Depreciation ValueCeddi PamiPas encore d'évaluation

- Brigham Chap 11 Practice Questions Solution For Chap 11Document11 pagesBrigham Chap 11 Practice Questions Solution For Chap 11robin.asterPas encore d'évaluation

- DepreciationDocument54 pagesDepreciationDarkie Drakie0% (1)

- Date Account Title Debit Credit July 1Document5 pagesDate Account Title Debit Credit July 1David TPas encore d'évaluation

- Akuntansi Keuangan Menengah 1: Kelompok 5 1. Maya Putri Wijaya (142200210) 2. Muhammad Alfarizi (142200278) Kelas EA-IDocument14 pagesAkuntansi Keuangan Menengah 1: Kelompok 5 1. Maya Putri Wijaya (142200210) 2. Muhammad Alfarizi (142200278) Kelas EA-Imuhammad alfariziPas encore d'évaluation

- Replacement and RetentionDocument13 pagesReplacement and Retention18010 Yeash RahmanPas encore d'évaluation

- 10 - Breakeven AnalysisDocument19 pages10 - Breakeven Analysisengineeringhydrologyfa23Pas encore d'évaluation

- Breakeven 2022: MarkschemeDocument3 pagesBreakeven 2022: MarkschemeOmar El-BourinyPas encore d'évaluation

- Unit III-PROBLEMSDocument6 pagesUnit III-PROBLEMSPranav GaikwadPas encore d'évaluation

- Capital Budgeting: 2. Cost and Benefit AnalysisDocument12 pagesCapital Budgeting: 2. Cost and Benefit AnalysisIfraPas encore d'évaluation

- Capital Budgeting For MSC Finance Basic Revision SumsDocument5 pagesCapital Budgeting For MSC Finance Basic Revision SumskimjethaPas encore d'évaluation

- Chap. 6Document8 pagesChap. 6Khuram MaqsoodPas encore d'évaluation

- BreakevenDocument3 pagesBreakevenMae Florizel FalculanPas encore d'évaluation

- Unit of Production Depreciation (Manufacuring)Document14 pagesUnit of Production Depreciation (Manufacuring)lpetjaPas encore d'évaluation

- ENGT3600 HW 3 - Abdulrahman Aldawsari Fall 2023Document7 pagesENGT3600 HW 3 - Abdulrahman Aldawsari Fall 2023jearsonsanderPas encore d'évaluation

- Toaz - Info Elec 1 Capital Budgeting Exercise Dec 6 2020 Bsa2 Answer Key PRDocument9 pagesToaz - Info Elec 1 Capital Budgeting Exercise Dec 6 2020 Bsa2 Answer Key PRJasper Gerald Q. OngPas encore d'évaluation

- AK RevaluationDocument6 pagesAK RevaluationClaire Labiste IIPas encore d'évaluation

- Average Rate of Return ExampleDocument1 pageAverage Rate of Return Examplefxn fndPas encore d'évaluation

- 202E14Document22 pages202E14dubbs210% (1)

- GATLABAYAN - Activity #1 M3Document4 pagesGATLABAYAN - Activity #1 M3Al Dominic GatlabayanPas encore d'évaluation

- Acc 308-Week3 - 3-2 Homework Chapter 11Document7 pagesAcc 308-Week3 - 3-2 Homework Chapter 11Lilian LPas encore d'évaluation

- Cap Buget ProblemsDocument8 pagesCap Buget ProblemsramakrishnanPas encore d'évaluation

- Unit 2 Problem SheetDocument9 pagesUnit 2 Problem SheetTejas ArgulewarPas encore d'évaluation

- 100 MONEY MAKING IDEA: WITH & WITHOUT COLLEGE DEGREED'Everand100 MONEY MAKING IDEA: WITH & WITHOUT COLLEGE DEGREEPas encore d'évaluation

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionD'EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionPas encore d'évaluation

- Curriculum Vitae: Name: Ahmed Hallala Algerian Residence: Jijel - AlgeriaDocument6 pagesCurriculum Vitae: Name: Ahmed Hallala Algerian Residence: Jijel - AlgeriaXulfi KhanPas encore d'évaluation

- Contract of Agency: Analysing The Process of The Formation and Termination of AgencyDocument13 pagesContract of Agency: Analysing The Process of The Formation and Termination of AgencySOUNDARRAJ APas encore d'évaluation

- Hmt801-Travel Agency and Tour OperationDocument1 pageHmt801-Travel Agency and Tour Operationhemant patidar NkmwgcZCKvPas encore d'évaluation

- List of Ledgers and It's Under Group in TallyDocument5 pagesList of Ledgers and It's Under Group in Tallyrachel KujurPas encore d'évaluation

- HRM MCQ CilDocument6 pagesHRM MCQ CilUmeshkumar LangiyaPas encore d'évaluation

- Advanced Returns Management 2Document27 pagesAdvanced Returns Management 2Ranjeet Ashokrao UlhePas encore d'évaluation

- The Strategy For Chinese Brands: Part 1 - The Perception ChallengeDocument8 pagesThe Strategy For Chinese Brands: Part 1 - The Perception ChallengeAanal PrajapatiPas encore d'évaluation

- Corporate Strategy and Foreign Direct InvestmentDocument20 pagesCorporate Strategy and Foreign Direct InvestmentSammir MalhotraPas encore d'évaluation

- K04046 Building A Best-in-Class Finance Function (Best Practices Report) 20121112 PDFDocument106 pagesK04046 Building A Best-in-Class Finance Function (Best Practices Report) 20121112 PDFinfosahay100% (1)

- RMC No. 44-2022 Annex A (Manner of Filing of AITR)Document2 pagesRMC No. 44-2022 Annex A (Manner of Filing of AITR)wendy lynn amantePas encore d'évaluation

- HRM in Nishat MillsDocument6 pagesHRM in Nishat MillsSabaPas encore d'évaluation

- Part A ASEAN CG ScorecardDocument3 pagesPart A ASEAN CG ScorecardriskaPas encore d'évaluation

- Competitive Advantage Through Business Intelligence.Document15 pagesCompetitive Advantage Through Business Intelligence.Umar Mukhtar BandayPas encore d'évaluation

- Ford Fusion Engine 2 7l Ecoboost 238kw 324ps Repair ManualDocument22 pagesFord Fusion Engine 2 7l Ecoboost 238kw 324ps Repair Manualkimberlyweaver020888cwq100% (58)

- Screen (HTS) - WINPro 200 DocumentationDocument83 pagesScreen (HTS) - WINPro 200 DocumentationBob ClarksonPas encore d'évaluation

- Top 99 Wholesale Sources PDFDocument27 pagesTop 99 Wholesale Sources PDFAnonymous 8DYrvTUPas encore d'évaluation

- FsdfdsDocument6 pagesFsdfdsNico evans100% (1)

- Sample Problems On Relevant CostsDocument9 pagesSample Problems On Relevant CostsJames Ryan AlzonaPas encore d'évaluation

- Current Acc NEWDocument4 pagesCurrent Acc NEWSonu F1Pas encore d'évaluation

- Sanjay Routray: General Manager, 12Document4 pagesSanjay Routray: General Manager, 12Sanjaya RoutrayPas encore d'évaluation

- HRM & Finance-Jivraj TeaDocument88 pagesHRM & Finance-Jivraj TeaYash KothariPas encore d'évaluation

- ProjectReport PushpanjaliSinghDocument44 pagesProjectReport PushpanjaliSinghShikha KumariPas encore d'évaluation

- Parker Economic Regulation Preliminary Literature ReviewDocument37 pagesParker Economic Regulation Preliminary Literature ReviewTudor GlodeanuPas encore d'évaluation

- Unicredit International Bank (Luxembourg) S.ADocument126 pagesUnicredit International Bank (Luxembourg) S.AViorel GhineaPas encore d'évaluation

- Felix Amante Senior High School San Pablo, Laguna: The Purple Bowl PHDocument8 pagesFelix Amante Senior High School San Pablo, Laguna: The Purple Bowl PHcyrel ocfemiaPas encore d'évaluation

- Esdc Lab1058Document2 pagesEsdc Lab1058Kavinda BandaraPas encore d'évaluation

- BLOCKCHAINDocument9 pagesBLOCKCHAINMorricce KashPas encore d'évaluation

- Financial Accounting For Managers Author: Sanjay Dhamija Financial Accounting For Managers Author: Sanjay DhamijaDocument23 pagesFinancial Accounting For Managers Author: Sanjay Dhamija Financial Accounting For Managers Author: Sanjay Dhamijashweta sarafPas encore d'évaluation

- Module 5 - Possible Products and Services Based On Viability Profitability and Customer Requirement PDFDocument51 pagesModule 5 - Possible Products and Services Based On Viability Profitability and Customer Requirement PDFJuliana Maaba Tay-isPas encore d'évaluation