Académique Documents

Professionnel Documents

Culture Documents

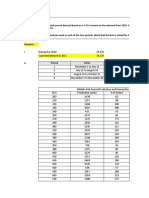

Labor Standards - Midterm Transcript 2013 - Print - Saver - Version

Transféré par

Zachary BañezTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Labor Standards - Midterm Transcript 2013 - Print - Saver - Version

Transféré par

Zachary BañezDroits d'auteur :

Formats disponibles

Labor Standards – Midterm Transcript

AY 2013-2014

Labor Standards – Midterm Transcription Q: What is the basis for the enactment of Labor Laws? Cite (1)

(AY 2013-2014) A: (1) Social Justice – Giving a person his due in the society. If a person

works for a specified number of hours, he should be compensated

Atty. Jefferson Marquez accordingly. “Those who have less in life should have more in law –

Ramon Magsaysay”

NOTE: Answers presented in the transcript are the direct answers to The law is geared towards the concern of labor because our legislators

the questions of Atty. Marquez from classmates’ answers sa orals, realize that social and economic imbalance between the employer and

notes, reviewers and from Atty. Marquez himself. Ako lang gi-short-cut employee.

for easy studying/reviewing. Some questions might be redundant so Q: Can you think of a law that was enacted by congress on the basis

bear with me nlng. If you see “X X X” it means nga naa pay sumpay of Social Justice?

pero wla lang nko g-include because puno2x lang xa sa katas and some A (Ivar): RA 7610 (Anit-Child Abuse Act) as amended by RA 9231

were not included in the orals. It sought to regulate the work/employment of children below age 15,

REMINDER: Atty. Marquez prefers answers in complete sentences. since they do not stand on equal footing with adults. The law protects

the rights of children, they do not exert an equal amount of physical

June 18, 2013 and mental skill as compared to adults.

Atty: It makes sense! (Tiene Sentido! )

TOPIC 1: THE APPLICABLE LAWS You can also use the “Retirement Pay law” under the Labor Code as a

piece of social legislation that illustrates Social Justice. Retired

Q: When is Labor Day?

employees cannot anymore earn, so they are provided with retirement

A (Ivar): May 1 (Every Year)

pay which they can use during their twilight years.

Q: What law can we find the Labor Code of the Philippines?

Q: Give another basis for the enactment of Labor laws.

(Complete your answer)

A (Arfel):

A: PD 442

(2) Police Power - Inherent power of the state to enact legislations that

Q: When did PD 442 take effect?

may interfere with personal liberty or property in order to promote the

A: Nov. 1, 1974

general welfare of the people. (General Welfare clause)

Q: What is meant by Labor?

Example:

A (Ivar): Labor could either be physical toil or application of skill.

Atty’s Discussion: Article 263 LC

Labor may also refer to a job, work or service; (g) When, in his opinion, there exists a labor dispute causing or likely to

Exertion by a human being of his physical or mental effort or both cause a strike or lockout in an industry indispensable to the national

towards production of goods and services; interest, the Secretary of Labor and Employment (SOLE) may assume

May also refer to the working class in society; jurisdiction over the dispute and decide it or certify the same to the

Q: What is the end result of the performance of Labor?

Commission for compulsory arbitration…

A: The production of goods and services.

Q: What is the counterpart of Labor? Reason: SOLE may compel the employer to admit the employees and

A: Capital (labor and capital are not the same) the employees to return to their work.

Atty’s Discussion:

Q: Does Labor and Capital stand on equal footing? Art 263 (g): when there is a labor dispute likely to cause of causes a

A (Ivar): They stand on equal footing in Communism, but the strike in an industry indispensable to national interest, the SOLE can

Philippines is a democracy and a capitalist country so they don’t stand assume jurisdiction.

on equal footing. The striking workers are required to return to work whether they like it

It is on the part of the Gov’t to institute policies to raise the status of or not. As much as they want to exercise their right to strike and self-

Labor thru police power to equalize the relationship between Labor organization, it can be interfered. Any interference is Constitutionally

and Capital (L&C). valid under Police Power.

Atty’s Discussion: Q: Is Police Power found in the Constitution?

“Capital will never agree to be on equal footing with labor.” A: there is no specific provision in the Constitution, it is inherent. Police

Atty: Do you think it would be possible for the government to equalize power is not written in the constitution.

L&C? Q: Give a third basis for the enactment of labor laws?

Ivar: not perfectly, but the state could give labor a fighting chance. A: (3) Protection to Labor –

Ideally labor and capital should be in harmony. Article XIII, Section 3, 1987 Constitution. The State shall afford full

Atty: If we put L&C on equal footing then we don’t need to study Labor protection to labor, local and overseas, organized and unorganized,

Standards anymore. and promote full employment and equality of employment

Since they don’t stand on equal footing, the Constitution provide for opportunities for all.

the protection of Labor and the Labor Code was enacted to primarily Reason: Employer stands in a higher footing than the employee

protect labor and not capital. because of economic dependence of the employee on the employer

We study Labor Standards to identify existing laws that extend to the

and the greater supply of labor than the demand of it.

protection of our workers because of the recognition of the socio-

economic imbalance between L&C. Example: Migrant Worker’s Act

Compiled by MFLH – Exclusive for EH405

Page 1

Labor Standards – Midterm Transcript

AY 2013-2014

Q: What does the Capital (Employer) have that makes the employee If this were to happen now, we apply labor laws (labor relations) and

economically dependent? the state will intervene in order to protect the public with regards to

A: it has the resources whether financial, physical (building, their obligation to provide education to children.

workplace), ___. Q: Is there any other basis for the enactment of Labor Laws aside

Atty’s Discussion: from Police Power, Social Justice and Protection to Labor?

The Constitution also provides protection to Capital, under the A: (Stephanie)

constitutional clause, “every enterprise has the right to a fair and

reasonable return of their investments” (4) Doctrine of Incorporation –

Note: but protection must be extended more on labor because of

economic dependence.

Article 2, Section 2, 1987 Constitution. - The Philippines renounces war

Labor law only covers Employees. If a person does not fall under the

as an instrument of national policy, adopts the generally accepted

classification of an employee then he/she is covered by the Civil Code

principles of international law (GAPIL) as part of the law of the land

of the Philippines under civil contracts.

and adheres to the policy of peace, equality, justice, freedom,

Q: How does the Civil Code describe the relation between Capital and

cooperation, and amity with all nations.

Labor?

Atty’s Discussion:

Art. 1700, Civil Code. The relations between capital and labor are

not merely contractual. They are so impressed with public interest

The state enters into an international agreement especially in labor

that labor contracts must yield to the common good. Therefore,

laws, those agreements shall form part of the laws of the land.

such contracts are subject to the special laws on labor unions,

collective bargaining, strikes and lockouts, closed shop, wages,

Example of a law enacted by Congress in accordance with an

working conditions, hours of labor and similar subjects. International Agreement (Stephanie):

(Andrew):

There are 4 parties to an employment contract: RA 7610 Anti-Child abuse law.

1. Employer

2. Employee Protection from Child Labor.

3. State – enacts and enforces labor laws

4. Public Under the anti-child abuse law, it contains the prohibition of

Labor disputes also affect the state and the public at large if employees employment for children below 15 years of age unless under the

are engaged in strike or other concerted activities. supervision of their parents in accordance with the guidelines of DOLE.

Situational Question:

If USC hires teachers and then pays them below the minimum wage Atty’s Discussion:

and provides them oppressive terms and conditions of employment,

who will be the aggrieve party?

(Atty M): Yeah that’s correct.

The teachers will be the aggrieved party and seek grievances with the

proper courts.

Teachers not paid the right wages might exercise their right to self- We have many International Conventions. Aside from that mentioned

organization and form a union. by (Stephanie), also included are the:

(Emphasis on how the state and the public will be affected in an

employment contract) a. International convention on the right to self-organization

(Andrew): b. International convention on the right to collective bargaining

If the teachers are underpaid, they will form a union and the union will

stage a strike. The Philippine Congress enacted the laws that embody those

If the union stages a strike, the operations of the school will be International Agreements; the right to self-organization and the right

affected where the students and the parents will be prejudiced in a to CBA are found black in white under the existing labor laws in the

way where their children will no longer be able to receive proper Philippines.

education.

(Atty. M):

Why are we discussing these topics? (Atty M is referring to the 4 basis

It will prejudice the public. Just imagine if the teachers stage a strike

of enacting labor laws)

and there will be a temporary stoppage of work and the parents

already paid the tuition fees.

It is harmful to the public and must be regulated.

In short, an employment contract is not merely contractual but is

impressed with public interest and must yield to the common good.

Compiled by MFLH – Exclusive for EH405

Page 2

Labor Standards – Midterm Transcript

AY 2013-2014

It’s because when you become a Congressman and you want to enact a A: (Grace) Congress cannot enact laws wherein it states that the

labor law, you have to use as basis any/all of these (4) principles: employer can have the unbridled discretion to dismiss an employee

without just cause.

1. Police Power Atty’s Discussion:

2. Social Justice When an employee attempts to kill the employer, you cannot

3. Protection to Labor clause summarily dismiss the employee without due process. No law can be

4. Doctrine of Incorporation passed along that line, otherwise it would be unconstitutional.

You don’t enact a law based on your own personal interest otherwise Q: Other limitations.

you are a bad politician. A: (April)

Q: If you are a Congressman, are you subject to certain limitations in (4) Prohibition Against Involuntary Servitude –

the enactment of labor laws? Article III, Section 18(2). No involuntary servitude in any form shall exist

A (Stephanie): except as a punishment for a crime whereof the

Yes, there are limitations. One of which is the party shall have been duly convicted.

(1) Non-Impairment Clause – (e.g. anti‐trafficking in persons act, forced labor, slavery)

Article III, Section 10. No law impairing the obligation of contracts shall Q: What is meant by Involuntary Servitude?

be passed. A: No person may be compelled to work against his will

Q: Is there any provision in the Revised Penal Code that prohibits

(Example by Stephanie)

Involuntary Servitude?

The company states in the employment contract that they shall

Art. 272. Slavery. The penalty of prision mayor and a fine of not

provide the employee a sack of rice “daily”…monthly. Then congress

exceeding 10,000 pesos shall be imposed upon anyone who shall

would enact a law that companies should not give benefits other than

purchase, sell, kidnap or detain a human being for the purpose of

those mandated by law.

enslaving him.

The employees would be prejudiced by the law because they would be

XXX

deprived of their one sack of rice.

Under the labor code, there is no mandatory one sack of rice.

Art. 274. Services rendered under compulsion in payment of debt.

Atty. M: You can use that logic in the interpretation of the limitation

The penalty of arresto mayor in its maximum period to prision

Q: Is there another limitation to the enactment of labor laws?

correccional in its minimum period shall be imposed upon any person

A: (Grace)

who, in order to require or enforce the payment of a debt, shall

(2) Equal Protection Clause –

compel the debtor to work for him, against his will, as household

Article III, Section 1. No person shall be deprived of life, liberty, or

servant or farm labourer.

property without due process of law, nor shall any person be denied

the equal protection of the laws.

Q: What are the 4 Systems of Labor?

Equality among equals; Individuals similarly situated must be treated

1. Slavery

equally under the law

2. Serfdom

There should be equal opportunities and equal working standards

3. Free Artisan (Independent Contractor)

among the same classification of workers.

4. Wage System

For example, Congress cannot pass a law prohibiting women from Q: Which among the 4 are prohibited under our Constitution?

becoming mechanical engineers. Even though men usually venture into

A: Slavery and Serfdom

this line of work, women should be given the same opportunity.

Q: What is Slavery?

Atty’s Discussion: A: Refers to the extraction of work or services from any person by

We have the Magna carta for women by Pia Cayetano. Under this law, means of enticement, violence, intimidation or threat, use of force or

it provides for equal job/employment opportunities for women.

coercion, including deprivation of freedom, abuse of authority or moral

Pia Cayetano must have read the Labor Code which prohibits women

ascendancy, debt

from working at night. Under the magna carta for woman, congress

bondage or deception. (DO 65--‐04 S2004)

considered the prohibition as discriminatory against women for being

The worker is owned by another at his free disposal.

violatory of the equal protection clause.

Q: What is Serfdom?

Why disallow women and allow men from working at night when

A: Worker, by customary right to his Lord, owes certain service.

women can stand on equal footing with men with regards to night

Enforced labor of serfs on the fields of the landowners, in return for

work. Ex. BPO’s (Call centers) protection and the right to work on their leased fields.

Q: Is there any other limitation, aside from the Equal Protection

While working on the field of another, but the produce does not

Clause?

belong to him but belongs to the land owner.

A: (Grace)

(3) Due Process Clause –

Q: What is the prohibition in the Philippines against Serdom?

(Refer to: Article III, Section 1)

A: Art. 274. Services rendered under compulsion in payment of debt.

The essence of due process is that it gives the employee an

opportunity to be heard.

Q: What can Congress NOT DO, which would otherwise violate Due

Process? Give an example.

Compiled by MFLH – Exclusive for EH405

Page 3

Labor Standards – Midterm Transcript

AY 2013-2014

Q: What is the Wage system? A: Department of Labor and Employment (DOLE), under their quasi-

A: A person offers his services to another under an employment legislative power or also known as their RULE MAKING POWER.

contract for which such service is paid by wages. [IF MAG MULTIPLE CHOICE SI ATTY, HE WOULD GIVE US CHOICES,

SINCE THERE ARE NO MORE MULTIPLE CHOICE QUESTIONS, HE WILL

The same with modern employer-employee system where there is an

BE ASKING US “WHAT POWER DOES THE DOLE EXERCISE?”]

employee under the control and supervision of an employer as to the

DOLE is expressly concurred with the power to implement rules and

means, manner or method of which the work is to be accomplished

regulations.

including the result thereof and is paid for the work done in terms of

wage.

Q: What is the purpose of issuing Rules and Regulations when there is

Atty’s Discussion: already a law (Labor Code)?

If USC hires me as a teacher and USC fixes my schedule of work and A: DOLE issues rules and regulations to interpret and implement the

gives me a specific load. I cannot teach any subject other than Labor law.

Standards, and I cannot teach at any time that is convenient to me, I Q: Are these rules and regulations considered laws?

cannot teach anything that is contrary to law. A: Rules and regulations have the force and effect of law, provided

they do not expand the law or strip the law. Otherwise, under the rules

So there is degree of control. on statutory construction, these will be considered void.

If the dean wants me to submit a course outline in a prescribed form, I If Rules and regulations are intended to interpret the laws then they

must follow. are merely advisory.

If they are intended to implement then they have the force and effect

The system of labor that exists between me and the school is the Wage of laws, but not withstanding, they cannot expand and unduly restrict

System. the scope and effect of the law.

Q: What is Independent Contractorship (Free Artisan)? Q: Aside from rules and regulations we also have decisions of the SC,

A: There is lesser degree of control. The employer does not have what can you say about judicial decisions?

control over the means, manner, and method of doing the work, he A: Art. 8, New Civil Code - Judicial decisions applying or interpreting the

has control only as to the result thereof. laws or the Constitution shall form a part of the legal system of the

Ex. If I hire a CPA and I tell the CPA to prepare a financial report and he Philippines.

must submit it within the week, I only have control over the result. (Ericka):

Q: What are the (2) Chief characteristics of an employee? Judicial decisions, also known as jurisprudence can serve as a basis for

1. Economic Dependence - Employee cannot bargain the terms interpreting the laws and the manner on how the SC applied the said

and conditions of employment. law.

2. Subordination in Work Relation (Subject to Control) - They are not laws, but they form part of the legal system.

Employer exercises control not only the means, manner and Q: Being part of the Legal System of the Phil, are the citizens

methods but also the results thereof. expected to comply and obey the decisions of the high court?

*Emphasis on: MEANS and MANNER A: Yes, just like the laws of the land we have respect, obey and comply

Q: In an Independent Contractorship, does the independent with judicial decisions.

contractor have the liberty to fix the compensation that he wants to Q: Applying it to Labor Standards, do the decisions of the NLRC, Labor

be paid? Arbiter, Regional Director form part of the Legal System?

A: Yes. The determination of the amount of compensation lies Atty: Ex. If I am underpaid by USC and I sue the school. And there is a

exclusively with the independent contractor. decision by DOLE finding USC guilty of underpayment of wages and it is

There is no economic dependence on the part of the independent found in the decision.

contractor. Does that not form part of the legal system such that everyone has to

Atty’s Discussion: obey it?

Ex. If you are a lawyer in the exercise of your profession, you can fix A: (Ericka)

your compensation at Php 25,000, but of course the client can No, these decisions are considered Administrative decisions under

negotiate. their quasi-judicial function, and do not form part of the legal system;

Note: A lawyer may also be an employee. If you are employed as a however the parties involved in the dispute are obliged to follow the

Dean in USC, then you are paid as a Dean and not as a lawyer. You are decisions, so in this case, USC has to obey it.

employed as an employee and not as an independent contractor. Q: In what instance, if any, does Administrative Decisions form part

Q: Is the Independent Contractor subject to control by the employer? of legal system?

Give an example. A: When that administrative decision is affirmed on appeal by the

A: No. Ex. If a lawyer is hired to draft a contract, the client has control Supreme Court, applying Art 8 of the NCC. Until then, it is not part of

only with the results and not the means and manner. the legal system of the Philippines.

So there is absence of control in Independent Contractorship

compared to an employee.

Q: Aside from studying the Labor Code, we also mentioned on the

course outline that our studies involve rules and regulations issued

by what Dept? under what power?

Compiled by MFLH – Exclusive for EH405

Page 4

Labor Standards – Midterm Transcript

AY 2013-2014

Q: What is the (2) Tiered Test?

June 25, 2013 A: (Joanne)

1. The putative employer’s power to control the employee with

TOPIC 2: BASIC PRINCIPLES respect to the means and manner by which the work is to be

Q: What are the (2) aspects of Labor Standards? accomplished;

A: 2. The underlying economic realities of the activity or

1. Meliorative Labor Standards – intended to expand the flow relationship. (Economic Reality Test)

of income or benefits to the workingman that are required Q: How to determine that a person is economically dependent?

for a decent living. (E.g. overtime pay, premium pay) A:

2. Protective Labor Standards – intended to protect harsh and 1. Number of years in the company;

oppressive conditions of work that inimical to health, safety 2. Reported to SSS (good indicator of treating him as an

and well-being of the workers. (e.g. protect the health safety employee;

and well-being of the workers, prescribed hours of work) 3. Registered in the patrol;

Q: How do we know if a certain contractual relationship is one of 4. Identification card;

Employer-Employee and not Independent Contractorship? 5. Company uniform.

A: (Jo) Atty’s Discussion:

We use the (4) Fold Test: (por-pold test ) The Two-Tiered test is usually applied only when there is doubt

1. Selection and engagement of employees; whether the relationship is actually an employer-employee

2. Payment of wages; relationship, or if there is no written employment contract.

3. Power of dismissal; If you have a written employment contract then there is no question

4. Power of control over employee’s conduct and over the that you are an employee.

means and manner by which the work is to be accomplished. Q: What are the Chief characteristics of an employee? (A review)

(Most controlling test) A: (1) Economic Dependence; (2) Subordination in Work Relation.

Q: If I go to Ayala to look for a dentist and I see a Dental Clinic with a

dentist and asked him to examine my teeth. The dentist then TOPIC 3: RIGHT TO HIRE

examined my teeth and found out that one tooth needs to be Atty M: Going back to the (4) Fold test, the first one is the “Selection

extracted and I agreed. After that, he charged me a fee for his and Engagement of Employees” or Hiring. This belongs to the

services. employer.

Applying the (4) Fold test, is there an Employer-Employee Q: Is the power of Selection and Engagement an absolute right of the

relationship? employer?

A: (Jo) No, even if you engage or hire the services of the dentist, the A: No, it is a Management Prerogative.

patient was not in control of the means and manner of extracting the Management Prerogative - It is an act of the employer according to his

tooth. Lacks the element of control; there is control only as to the own judgment or discretion to regulate his business. This includes

results thereof. hiring, transfer, dismissal, etc.

Q: Why can’t I control the means and manner of the work of the Since it is not an absolute right, it is subject to limitations, such as:

dentist? a. Laws/Special Laws;

A: The dentist is an independent contractor. b. Collective Bargaining Agreement (CBA)or the Contract;

Employee vs Independent Contractor (IC) c. Principles of equity, fair play and justice.

The distinction says that aside from engaging in the business LEGAL LIMITATIONS/PROHIBITIONS PRIOR TO HIRING

separately distinct from the principal, the performed job, work, or Q: Are there limitations on hiring provided by the Labor Code?

services is according to his own means and methods free from the Mention one Article.

control and direction of the principal except as to the results thereof. A: (Joanne)

Q: Among the (4) Fold test, which element is missing in an Art 139. Minimum Employable Age:

Independent Contractorship? a) No child below fifteen (15) years of age shall be employed, except

A: No. 4 Control, there is absence of control as to the means and when he works directly under the sole responsibility of his parents or

manner except as to the results thereof. guardian, and his employment does not in any way interfere with his

Q: Does the Labor Code apply to an Independent Contractor? schooling.

A: No, the Civil Code applies. b) Any person between fifteen (15) and eighteen (18) years of age may

Q: Does an Independent Contractor depend on a particular person for be employed for such number of hours and such periods of the day as

his income? determined by the Secretary of Labor and Employment in appropriate

A: No. His income depends on the number of patients that he has and regulations.

not dependent on one particular person. c) The foregoing provisions shall in no case allow the employment of a

Q: If you are an employee, do you perform specialize service? person below eighteen (18) years of age in an undertaking which is

A: No. hazardous or deleterious in nature as determined by the Sec. of Labor.

Q: Does a dentist perform a specialize service?

A: Yes, dental services.

Compiled by MFLH – Exclusive for EH405

Page 5

Labor Standards – Midterm Transcript

AY 2013-2014

Atty’s Situation: "(4) Work which, by its nature or the circumstances in which it is

If I am a foreign investor and I would like to consult you of possible carried out, is hazardous or likely to be harmful to the health, safety or

investments in Cebu. I would like to know if there are limitations on my morals of children, such that it:

prerogative to hire Filipinos to work in my establishment.

I would like to hire 15 year old individual because I know that they are Sec. 16. Penal Provisions

energetic.

Joanne: I would advise you to look into the working conditions of the

"b) Any person who violates the provision of Section 12-D of this act or

workplace, whether or not your establishments are hazardous or non-

the employer of the subcontractor who employs, or the one who

hazardous.

facilitates the employment of a child in hazardous work, shall suffer

Q: Can I hire an individual 15 years old to work in my establishment?

the penalty of a fine of not less than One hundred thousand pesos

A: it depends, if the establishment is classified as a hazardous

(P100,000.00) but not more than One million pesos (P1,000,000.00), or

workplace then the establishment is not allowed to hire an individual

imprisonment of not less than twelve (12) years and one (1) day to

15 years old.

twenty (20) years, or both such fine and imprisonment at the

Q: Is there a law that prohibits me from employing a person 15 years

discretion of the court.

of age in a hazardous work place?

Q: What kind of child abuse is employing children below 18 qualified?

A: Yes,

A: The worst forms of Child Labor.

a. Art 139. Minimum Employable Age – Labor Code:

XXX

c. the forgoing provision shall in no case allow the Sec 12. …….

employment of a person below 18 years of age in an

undertaking which is hazardous or deleterious in nature as "(4) Work which, by its nature or the circumstances in which it is

determined by the SOLE.; carried out, is hazardous or likely to be harmful to the health, safety

Q: Is there a law or existing regulation that classifies a workplace as or morals of children, such that it:

hazardous?

A: Department Order No. 004-99: "a) Debases, degrades or demeans the intrinsic worth and

Sec. 3 dignity of a child as a human being; or

XXX

1. Work which exposes children to physical, psychological or

sexual abuse, such as in: "b) Exposes the child to physical, emotional or sexual abuse,

a) lewd shows (stripteasers, burlesque dancers, and or is found to be highly stressful psychologically or may

the like) prejudice morals; or

b) cabarets

c) bars (KTV, karaoke bars) . . . . . . . . . (naa pay sumpay pero gipaundang nan i sir og

d) dance halls enumerate, read the law if you want to see more)

e) bath houses and massage clinics Atty M: that’s enough, DOLE has already classified those instances.

f) escort service This settles the issue that it is a criminal offense for an employer to

g) gambling halls and places hire children below 18 to work in hazardous environments.

Q: Give another provision in the Labor Code that is a limitation on

XXX hiring.

DOLE was the one who classified these work places as Hazardous. A: (Connie)

In these types of establishments persons under 18 are not allowed to Labor Code:

be employed with or without parental supervision. Art. 136. Prohibition Against Stipulation of Marriage

This is a Department Order by DOLE pursuant to their rule making It shall be unlawful for an employer to require as a condition of

power. Remember that Department Order’s are not laws. employment or continuation of employment that a woman

employee shall not get married or to stipulate expressly or tacitly

Q: Is it criminal if you employ children below 18 in hazardous work that upon getting married, a woman employee shall be deemed

places? separated, or to actually dismiss, discharge, discriminate or

A: Yes, it is criminal under RA 9231. otherwise prejudice a woman employee merely by reason of her

marriage.

RA 9231

The employer cannot require a woman, who applies for a job, to agree

that she should not get married or that getting married is a basis for

Sec. 12-D. Prohibition Against Worst Forms of Child Labor. - No child termination.

shall be engaged in the worst forms of child labor. The phrase "worst Atty’s Discussion:

forms of child labor" shall refer to any of the following: If I say, Ms. Jane Doe, I will hire you provided that you do not get

married because I do not like married people. (this is VOID for being a

violation)

Compiled by MFLH – Exclusive for EH405

Page 6

Labor Standards – Midterm Transcript

AY 2013-2014

Q: What is wrong with the stipulation of marriage in hiring? or why is can be efficiently performed by a person with only one arm?

it prohibited? Hypothetically, how will he knock on the door?!

What will happen to the woman who wants to get married but Is he then qualified? (is he qualified in the sense that he is similar to an

cannot because otherwise she would not be employed? able bodied person if he does the job)

How is married treated under the Constitution and in our laws? (Russel): No, because he cannot effectively perform his job.

A: (daghan wah katubag) So in this case, you can deny him employment because of his disability.

Atty’s Discussion: But if he were a qualified disabled person, for example: his job is to

Family Code count the number of people in the establishment, he does not need an

Article 1. Marriage is a special contract of permanent union arm to do that, he only needs his eyes.

between a man and a woman entered into in accordance with law Q: Another limitation on hiring.

A: (Russel)

for the establishment of conjugal and family life. It is the foundation

Labor Code:

of the family and an inviolable social institution whose nature, Art. 248. Unfair Labor Practices of Employers

consequences, and incidents are governed by law and not subject It shall be unlawful for an employer to commit any of the following

to stipulation, except that marriage settlements may fix the unfair labor practice:

property relations during the marriage within the limits provided by (b) To require as a condition of employment that a person or an

this Code. employee shall not join a labor organization or shall withdraw from

Atty M’s Situation: one to which he belongs.

If I am the employer and I tell you, “Ms. Jane Doe, I will hire you

provided that you will not get married.” And you have a boyfriend and Situation:

you plan to get married but you really need the job. You then agreed Oh you are applying for a job. Well, I will only hire you provided that

to the stipulation and you keep yourself free from marriage but still you will not join any union or labor organization. And then you say,

continue with your relationship with your boyfriend without the “OK”. This is not valid!

benefit of marriage. Art 248 prohibits an employer from imposing as a condition for

This type of relationship is a “common law” relationship. If you decide employment that a person should not join any labor

to have a family your children would become illegitimate. unions/organizations.

As far as the Catholic Church is concerned, the church does not Q: What is so important in joining a Labor Union?

tolerate this kind of relationship. This is considered as immoral. A: Joining a labor union is one of the Constitutional Rights of Workers

These are the evils sought to be avoided by the prohibition. to Self Organization. Prohibiting employees from joining unions is what

Employers don’t like their employees getting married because we call, “unfair labor practices”

eventually they will have children and if you are a woman, having Q: Other Limitations: On Sexual Harassment

children means you have to go on maternity leave with pay, and if the A: (Russel)

woman undergoes surgery (CS) then she will have an extended 2 RA 7877 (Anti-Sexual Harassment Act)

month leave with pay. This would result in no one being at work which An employer is prohibited from asking sexual favours as a condition for

is bad for business. employment.

Q: Give a 3rd limitation on hiring employees. Situation: I will hire you, but we must have sex first.

A: (Cemi) The gravamen of sexual harassment is the abuse of power.

RA 7277 Q: Other Limitations Prior to Hiring:

Title 3, Chapter 1 A:

(Magna Carta for Disabled Persons) RA 8791 (Gen. Banking Laws of 2000)

Sec 32. Discrimination on Employment. No entity, public or Sec. 55.4 No bank shall employ casual or non‐regular personnel or too

private, should discriminate against qualified disabled person in lengthy probationary personnel in the conduct of its business involving

terms of job application procedures, hiring, promotion, discharge, deposits.

compensation and other benefits.

Q: What is the reason behind the Gen. Banking law?

An employer is prohibited from discriminating against a qualified A: For casual employees, they do not enjoy security of tenure since

disabled person with regards to hiring by reason of his disability. they can be terminated whenever the bank wants. Hiring casual

Atty’s Situation: employees for too lengthy a time compromises the bank and threatens

A job applicant comes to me for a job but he only has one arm and the national security because banks are essential to the economy.

job available is a messenger. (to be continued below)

I say “oh you only have one arm, I will not hire you because you only

have one arm. How can you deliver messages with only one arm.” The (July 2, 2013)

rule is I cannot discriminate on reason of his disability. … Continued from last meeting

But the question is, for a job of a messenger, is a person with only one (Jorj) Casual employees do not enjoy security of tenure compared to

arm qualified to be a messenger? Do you think the job of a messenger regular employees.

Compiled by MFLH – Exclusive for EH405

Page 7

Labor Standards – Midterm Transcript

AY 2013-2014

With lengthy casual employment handling bank deposits there is a

threat to Bank Secrecy where leakage of information is highly possible. The employer is prohibited from stipulating, requiring, influencing any

Ex. There is leakage of account information as to the Billions of pesos applicant to subject himself/herself to sterilization or to use or not to

you have in your account; consequently this may make you prone to use modern methods of family planning as condition for employment.

kidnapping, etc. Discrimination on the number of children is also illegal.

Atty’s Discussion: Family planning is every individual’s choice, whether he is a job

Non-regular employees come and go. When they go they sometimes applicant or not.

carry with them account informations. So in order to prevent this from

happening, this guarantees outmost bank secrecy in the accounts of

the depositors. The law does not say that this will happen, but just in TOPIC 4: WAGE and WAGE FIXING

order to prevent this from happening, there is such a prohibition. Now that we know that hiring is a prerogative of the employer, and

If there is no Bank Secrecy then people will not deposit their money in now that we know that there are limitations under the Labor Code

banks. and Special Laws as regards to the prerogative of the employer to

When money is deposited in the bank, some people loan money from hire an employee. And we might as well proceed to hire one.

the bank to establish businesses. If there are no more people

depositing in banks because of lack of Bank Secrecy then the bank Q: What is meant by an employee and what is meant by an

cannot extend loans. If they cannot extend loans then there will be no employer?

businesses, if there are no businesses then it would not be good for A: (Mike)

the economy. Employer – includes any person directly or indirectly in the interest of

So we have to maintain or Bank Secrecy laws, and one way of an employer in relation to an employee and shall include the

removing those threats is to prohibit lengthy probationary period for Government and all its branches, subdivision and instrumentalities, all

casual employees. government‐owned or controlled corporations and institutions, as well

I’m not saying that banks cannot hire casual employees. Only that they as non-profit private institutions, or organizations. (Art 97b, Labor

cannot handle bank deposits. Code)

Q: Any other restrictions: HIV/AIDS The employer has control over the employee.

A: (Jorj) Employee – includes any individual employed by an employer. (Art

RA 8504 97c, Labor Code)

(Philippine AIDS Prevention and Control Act of 1998) Q: What is the 2nd in the Four Fold Test?

A: Payment of Wages.

Sec. 35. Discrimination in the Workplace --‐ Discrimination in any Q: What is meant by wage?

from pre--‐employment to post--‐employment, including hiring, A: (Mike) Compensation for manual labor given to an employee by the

promotion or assignment, based on the actual, perceived or employer.

suspected HIV status of an individual is prohibited. Termination from

Labor Code

work on the sole basis of actual, perceived or suspected HIV status is

deemed unlawful. Art. 97.6 "Wage" paid to any employee shall mean the

remuneration or earnings, however designated, capable of

Situation: An applicant approaches you for a job and he has HIV/AIDS. being expressed in terms of money, whether fixed or

The job available is an Accountant. You say, “I will not hire you because

ascertained on a time, task, piece, or commission basis, or

you have HIV/AIDS.” (This is illegal)

Q: Why is such discrimination prohibited? other method of calculating the same, which is payable by an

A: (Jorj) because mere acquisition of HIV does not hinder the employer to an employee under a written or unwritten

performance of ones work. contract of employment for work done or to be done, or for

HIV/AIDS is transmitted thru sharing of needles, sex, etc. Being an services rendered or to be rendered and includes the fair and

accountant does not involve any of these.

reasonable value, as determined by the Secretary of Labor and

Q: Any other Special law on limitations on hiring?

RA 10354 Employment, of board, lodging, or other facilities customarily

(Responsible Parenthood and Reproductive Health Act) furnished by the employer to the employee. "Fair and

reasonable value" shall not include any profit to the employer,

SEC. 23. Prohibited Acts. – The following acts are prohibited:

or to any person affiliated with the employer.

XXX

(c) Any employer who shall suggest, require, unduly influence or

cause any applicant for employment or an employee to submit Atty’s Discussion:

himself/herself to sterilization, use any modern methods of family There are (2) components in wages:

planning, or not use such methods as a condition for employment, 1. cash (remuneration of earnings); and

continued employment, promotion or the provision of employment 2. fair and reasonable value of the facilities.

benefits. Further, pregnancy or the number of children shall not be a If you look at the definition under Art 97, it does not only include

ground for non-hiring or termination from employment; payment of services rendered in cash or in legal tender, but also in kind

in the form of facilities.

Compiled by MFLH – Exclusive for EH405

Page 8

Labor Standards – Midterm Transcript

AY 2013-2014

Q: Is Wage the same as Salary? Why? Salary – denotes a higher degree of employment or a superior grade of

A: As so far as the Labor Code of the Philippines is concerned, Wage services, and implies a position or office; suggestive of a larger and

and Salary mean the same and can be used interchangeably. more permanent or fixed compensation for more important service.

The distinction is purely semantics according to the Supreme Court (White Collar Jobs)

(CASE: Equitable Bank vs Sadac). Atty’s Discussion:

Q: In what instance is it important to know the distinction between Exemption applies to WAGE only.

Wage and Salary? Exemption does NOT APPLY to SALARY.

A: (Mike) under Art 1708, Civil Code The compensation for salary is much higher than that of wage. The

Civil Code protection is extended as so far as labourers are concerned and as so

Art. 1708. The laborer’s wage shall not be subject to execution or far as wages are concerned. The protection does not extend to

attachment, except for debts incurred for food, shelter, clothing and employees receiving salary.

medical attendance. Q: Do workers need to be remunerated for services rendered?

Q: Who incurs the debt? A: (Mike) Yes, their remuneration comes in the form of wage or salary.

A: the labourer. Food, shelter, etc are basic necessities of the labourer. Q: Who fixes the employees wage or salary?

Atty’s Discussion: A: The employer, it is his prerogative.

The worker works and earns his wage. Sometimes his wage is not that Q: Is there a limitation provided by law for the fixing of the

much and it may happen that he might need food, clothing, medical employee’s salary?

attendance. A: Yes, there is s prescribed statutory minimum wage under the labor

If you read the law, for debts incurred by the labourer, his wages shall code. The employer cannot pay his workers below the prescribed

be exempt from execution or attachment. In other words, if he obtains minimum wage.

a debt and the creditor sues him and obtains a judgement, that Q: Who fixes the minimum wage? And under what law?

judgement is usually enforced by the creditor by garnishing his A: Regional Tripartite Wages and Productivity Boards (RTWPB), under

property by executing on his property for satisfying the judgement. the Wage Rationalization Act (RA 6727)

If you buy food from me on credit basis then I am your creditor and Q: Under the Wage Rationalization Act, which (2) Principal

you have to pay me. Sometimes you cannot pay, so what the creditor Government Agencies are involved in the fixing of the minimum

does is he goes to court and files a collection of a sum of money. You wage?

cannot deny that you owe me, so there will be a judgement against A: (1) National Wages and Productivity Commission; (2) Regional

you. Tripartite Wages and Productivity Boards

The court will ask you ex. Judge Seville will ask you to satisfy the Q: What is the composition of the RTWPB?

judgement but you have no money. But then I see that you have other A: (RC)

properties, so I tell the sheriff to execute the judgement by running Art 122 LC (As amended by Republic Act No. 6727, June 9, 1989).

after your properties. (so that is attachment) 1. Chairman – Regional Director of DOLE;

Q: What does this situation tell us? How does the law protect the 2. (2) Vice-Chairman - Regional Director of NEDA & Regional

labourer? Director of DTI;

A: (Mike) the law protects the labourer by exempting his wages from 3. (2) members each from workers and employers sectors –

attachment or execution. appointed by the President upon recommendation of the

Atty’s Discussion: SOLE, to be made on the basis of the list of nominees

Remember that a labourer has to work to earn his wage (unless submitted by the workers and employers sectors,

syndicato yan). That wage is the product of hard labor/hard work. respectively.

And then here comes the employer/creditor. Imagine without the Q: According to Wage Order in Region 7, Wage order # RO7-17. In so

protection, you owe the creditor Php 5,000 and your daily wage is just far as the cities of Mandaue, Lapu-lapu and Cebu (which sir is only

Php 300. The sheriff will get his wage, and if there is no more wage concerned of), how much is the minimum wage for Non-Agricultural

then the labourer cannot meet his basic necessities and his children employees only?

will starve to death. A: Non-Agricultural Employees in Mandaue, Lapu2x and Cebu – Php

Q: So what is the distinction between salary and wage in relation to 327 per day

ART 1708? Atty’s Nice to Know:

A: (Mike) it is stated in the provision that the laborer’s wage is exempt Notice the representative of the private sector in the wage order, Atty.

from execution or attachment, HOWEVER, the laborer’s salary is NOT Pascual – a former faculty member of USC-Law.

EXEMPT from execution or attachment. Q: What is the composition of the NWPC?

Q: What did the SC say about the distinction between Wage and A: (RC)

Salary? Art 121 LC (As amended by Republic Act No. 6727, June 9, 1989).

A: (Mike) 1. Ex-officio Chairman – Secretary of DOLE;

Wage – applies to compensation for manual labor, skilled or unskilled, 2. Ex-officio Vice-Chairman – Director General of NEDA;

paid at stated times, and measured by the day, week, month, or 3. (2) members each from Worker and Employer Sectors –

season; indicates inconsiderable pay for a lower and less responsible appointed by the President upon recommendation of the

character of employment. (Blue Collar Jobs) SOLE, to be made on the basis of the list of nominees

Compiled by MFLH – Exclusive for EH405

Page 9

Labor Standards – Midterm Transcript

AY 2013-2014

submitted by the workers and employers sectors, minimum standards of living necessary for the health, efficiency and

respectively. general well-being of the workers within the framework of national

Atty’s Discussion: economic and social development goals.

Notice that there’s always a trilateral arrangement in both XXX

compositions of the NWPC & RTWPB; (1) Government, (2)

Employer/Private Sector, & (3) Labor/Public Sector. This data can be made available to the board thru the respective

Moving on. representatives of the DTI and NEDA. That’s why they are members of

The RTWPB has 2 Principal Powers; (1) power to fix the minimum the board.

wage; (2) power to grant exemptions from the minimum wage. Q: What are the factors considered in the employer’s side?

Q: (1) Power to fix the minimum wage: Do we have an existing rules A: A wage that is too high and not affordable, the employer might lose

of procedure on minimum wage fixing? And what agency of all their money. The board must consider the fair and reasonable

government promulgated these rules? return of investments of the employers.

A: (RC) Yes, NWPC promulgated the rules of procedure. The NWPC is When employers don’t gain profit then they may close their business.

higher than the RTWPB and has the power to promulgate rules and These criteria must be weighed by the board and consider these

regulations. factors to maintain balance between employer and employee.

Atty’s Discussion: If the application is granted then the board issues a “Wage Order”

Notice under the rules, the board may Motu Proprio or upon Q: How is the wage order defined under the Labor Code?

application of the proper party fix the minimum wage. A: (n) Wage Order - refers to the Order promulgated by the Board

RULE II: Minimum Wage Fixing pursuant to its wage fixing authority.

Section 3. Procedures in Minimum Wage Fixing. Wage orders become effective (15) days after publication in a

(a) Motu Proprio by the Board; newspaper of general circulation. If it becomes effective then the

XXX employer must follow it.

(b) By virtue of a Petition filed;

XXX Q: If the labor Organization is not happy with the Wage Order

because it wanted Php20 increase, but instead they got Php10

Q: Who is considered a proper party to file an application for increase, can they file another petition for a wage increase?

minimum wage fixing? A: No, the wage order cannot be disturbed within 12 months from the

A: (RC) there are 2 proper parties, (1) Employees Sector; (2) date of effectively of the wage order.

Workers/Labor Sector – can only be filed thru a legitimate and However, exemption is when there are supervening events such as

registered Labor Union/Organization. increased prices of basic commodities, high prices of oil. In these cases,

Atty’s Discussion: the board will allow a petition for wage increase.

Usually the labor sector files the application thru their labor unions. In Atty’s Discussion:

Region 7, the most prominent labor union is the ALU-TUCP. For example: the board already issued a wage order and after one

Simplified Procedure for filing an application for minimum wage month there was a war in the middle-east and oil prices went up

fixing by Atty. Marquez making basic commodities very expensive. The board would not wait

Interested parties shall file an application with the board. for one year for another increase to entertain a petition or the board

The board under the rules of procedure will publish the petition once itself can Motu Prorio decide on a wage increase.

in a newspaper of general circulation. In the publication, the board will If the exemption does not apply then the 12 month prohibition

also set the date of hearing. governs.

It must be held thru a Public Hearing because it involves the public Imagine, if there is no prohibition, the board would always be very

when either there is a wage increase or no increase. busy entertaining petitions every day and the employers would not be

Here in Cebu, the hearing is done in the Capitol where interested able to maintain an increase in minimum wage every month.

parties may appear and participate therein. Oppositors may also Q: What are the Advantages and Disadvantages of Minimum Wage?

participate and oppose the petition for wage increase. Advantages:

Not just anybody can attend the hearing; you must be an interested 1. Protects the fair employers against competition from

party or a representative of the parties. “unfair” ones;

The public hearing will be presided by the board and all the members 2. The law acts as an incentive to the low-wage employers to

should be there and they will hear the petitioner as well as the improve methods in their plants and possibly to introduce

oppositionists and at the end of the day, the board will deliberate and technological changes to conform to the demand of

try to decide whether to grant the petition or deny it. minimum wage rate;

Q: What are standards/criteria that needs to be considered in fixing 3. Promotes workers living standards;

the minimum wage? 4. A national minimum wage is an index to economic stability;

A: (RC) minimum wage lend help to provide the purchasing power

RULE II: Minimum Wage Fixing necessary to take all the goods of the market;

Section 2. Standards/Criteria for Minimum Wage Fixing. 5. Promotes industrial peace and order in the sense that

The minimum wage rates to be established by the Board shall be as dissatisfactions are reduced, increases the morale of the

nearly adequate as is economically feasible to maintain the employee;

Compiled by MFLH – Exclusive for EH405

Page 10

Labor Standards – Midterm Transcript

AY 2013-2014

6. May be subject to increase at collective bargaining table; SECTION 1. Petition for certiorari. When any tribunal, board or

7. Reduces the evils of the “sweating system” –exploitation of officer exercising judicial or quasi--‐judicial functions has acted

workers at wages so low as to be insufficient to meet the without or in excess of its or his jurisdiction, or with grave abuse of

bare cost of living. discretion amounting to lack or excess of jurisdiction, and there is no

Disadvantages: appeal, or any plain, speedy, and adequate remedy in the ordinary

1. May lead to unemployment; course of law, a person aggrieved thereby may file a verified petition

2. It would pauperize the worker, destroy their self-respect and in the proper court, alleging the facts with certainty and praying that

make them miserable; judgment be rendered annulling or modifying the proceedings of

3. Brings depression and thus impoverish the nation; such tribunal, board or officer, and granting such incidental reliefs as

4. Constitutes infringement to the worker’s right to labor as he law and justice may require. The petition shall be accompanied by a

could not dispose of the same under terms and conditions he certified true copy of the judgment, order or resolution subject

may see fit; thereof, copies of all pleadings and documents relevant and

5. Will tend to be the maximum, employers will tend not to pertinent thereto, and a sworn certification of non--‐forum shopping

increase the salary and stick to the minimum wage; as provided in the third paragraph of section 3, Rule 46. (1a)

6. It causes wage distortion.

Q: If there is a Wage Order issued, and the petitioner is not happy. If further remedy is required, it shall be forwarded to the Supreme

Does the aggrieved party have a remedy from a Wage Order? Court.

A: (RL) they can appeal to the NWPC. RULE 45

Q: On what grounds? APPEAL BY CERTIORARI TO THE SUPREME COURT

A: (RL)

a. Non-conformity with the prescribed guidelines and/or SECTION 1. Filing of petition with Supreme Court. A party desiring

procedures on exemption; to appeal by certiorari from a judgment, final order or resolution of

b. Prima facie evidence of grave abuse of discretion; the Court of Appeals, the Sandiganbayan, the Court of Tax Appeals,

c. Questions of law. the Regional Trial Court or other courts whenever authorized by law,

Q: What is the reglementary period for appeal? may file with the Supreme Court a verified petition for review on

A: (RL) not later than 10 days from the publication of the wage order. certiorari. The petition may include an application for a writ of

Atty’s Discussion: preliminary injunction or other provisional remedies and shall raise

So now the NWPC will study the appeal to find out if the wage order only questions of law which must be distinctly set forth. The

was issued right or wrong. petitioner may seek the same provisional remedies by verified

If they find out that the board committed an error in issuing the wage motion filed in the same action or proceeding at any time during its

order then they will set aside the order. pendency. (as amended by A.M. 07-7-12-SC)

But if there is nothing wrong with the order then they will just simply

affirm the wage order. So now, another power of the board is to (2) Grant Exemptions.

Q: If an employer appeals the Wage Order, does it stop the Q: What establishments are eligible to apply for exemption from the

implementation of the order? wage order?

A: (RL) No, the order will still be implemented. REVISED GUIDELINES ON EXEMPTION FROM WAGE ORDERS

(NWPC GUIDELINES NO.01, SERIES OF 1996)

Q: Is there an exception where an appeal made by the employer can Section 2, NWPC Guidelines No. 01, Series of 1996:

stop temporarily the implementation of the wage order? 1. Distressed establishments;

A: Yes, if the employer posts a bond equivalent to the prescribed wage 2. New business enterprises (NBEs);

rate multiplied by the number of employees. 3. Retail/Service establishments employing not more than ten

Atty’s Discussion: (10) workers;

The bond should be enough to cover the wage of the workers in case 4. Establishments adversely affected by natural calamities.

the order is affirmed as valid. So at least if the bond is there and the Q: Is there a person, employer or establishment exempted from the

employer loses in the appeal, the government can use the bond to pay wage order by operation of law? (this means he did not apply for

his workers. This is to prevent the employer from delay of payment to exemption)

the employees. A: (RL)

So from the appeal, it stops from the NWPC which would have to make Labor Code

the order final and executory. Art 98. Application of Title. This title [Wages] shall not apply to farm

Q: Is there a remedy from the NWPC in case they commit grave abuse tenancy or leasehold, domestic service and persons working in their

of discretion or non-conformity with guidelines or etc? respective homes in needle work or in any cottage industry duly

A: An appeal can be made to the Court of Appeals. registered in accordance with law.

SPECIAL CIVIL ACTIONS Exempted:

RULE 65 1. Farm tenancy or leasehold;

CERTIORARI, PROHIBITION AND MANDAMUS 2. Domestic service;

3. Persons working in their respective homes in needle work

Compiled by MFLH – Exclusive for EH405

Page 11

Labor Standards – Midterm Transcript

AY 2013-2014

4. Persons working in any cottage industry duly registered in A: The establishment is considered unorganized if there is no certified

accordance with law. or recognized bargaining union or CBA.

You do not need to pay them Php327 a day. House helpers or domestic

helpers are provided a minimum wage under the “Kasambahay Law.” (July 9, 2013)

Q: If you apply for exemption, what agency of gov’t has the power to … Continued from last meeting

process and approve the exemption? Q: What solution is provided by law for Wage Distortion in an

A: (RL) RTWPB Organized Establishments? The Step by step procedure.

Q: In case the board denies it, what are the remedies? A:

A: Appeal to the NWPC. (Same procedure as before) Step 1: The union and the employer will try to resolve the issue among

Atty’s Situation: So right now we have Wage Order RO7-17 setting themselves.

the minimum wage to Php327. Step 2: If the parties will not be able to resolve the issue by

I have an establishment and I have an organizational setup composed themselves, then they will refer it to the “Grievance Machinery” and

of rank and file employees, supervisors and managers. I pay my rank procedure incorporated under their CBA.

and file minimum wage (327), I pay my supervisors 500/day and I pay Grievance Machinery and Procedure – provides for a step by step

my managers 1000/day. procedure under their CBA where disputes are to be resolved by the

Let’s say 2 weeks from now there is a new wage order fixing the parties.

minimum wage to Php500/day. Example of a Grievance Machinery: first they will submit the issue to

Is there Wage Distortion? the first-level manager; second submit to the middle-level managers;

A: There is a wage distortion between rank and file employees and and finally to the top-level managers.

supervisors, both receiving 500/day. The supervisor is the aggrieved Step 3: If all steps are exhausted under the Grievance Machinery and

party in this situation. the dispute still remains unsettled, the parties will then refer the

Q: What is “Wage Distortion”? matter to “Voluntary Arbitration.”

A: Voluntary Arbitration here refers to a voluntary arbitrator as defined

ART. 124. Standards/Criteria for minimum wage fixing. by Art 260, 261, 262 & 263 of the Labor Code.

XXX As used herein, a Wage Distortion shall mean a situation where Q: Differentiate Voluntary Arbitration with Compulsory Arbitration.

an increase in prescribed wage rates results in the elimination or A: Voluntary Arbitration – is not compulsory (duh!); a contractual

severe contraction of intentional quantitative differences in wage or proceeding whereby the parties to any dispute or controversy in order

salary rates between and among employee groups in an to obtain a speedy and inexpensive final disposition of the matter,

establishment as to effectively obliterate the distinctions embodied select a judge of their own choice and by consent, submit their

in such wage structure based on skills, length of service, or other controversy to him for determination;

logical bases of differentiation. XXX (As amended by Republic Act They will be given a list of voluntary arbitrators from which they will

No. 6727, June 9, 1989). pick out those which they have chosen to be the arbitrators.

Q: What are the (4) Elements of Wage Distortion enumerated by SC? The labor arbiter in voluntary arbitration is chosen by the parties.

A: Elements of Wage Distortion: Compulsory Arbitration – (jurisdiction of the labor arbiter is under Art

1. An existing hierarchy of positions with corresponding salary 217 of the Labor Code.)

rates. Process of settlement of labor disputes by a government agency (or by

2. A significant change in the salary rate of a lower pay class other means provided by the government) which has the authority to

without a concomitant increase in the salary rate of a higher investigate and to make award which is binding on all the parties.

one. The labor arbiter in compulsory arbitration is chosen by the state.

3. Elimination of the distinction between the two levels. Step 4: If a decision is rendered by the Voluntary Arbitrator and one of

4. Existence of the distortion in the same region of the country. the parties is not satisfied with the decision, the remedy is to file a

Q: Are all elements in the above situation present? Petition for Review to CA under Rule 43, Rules of Court, within 15 days

A: Yes, (1) There is a hierarchy of positions, rank and file, supervisors & from notice of the award, judgement, final order or resolution. (no

managers with salary rates 327, 500 & 1000 respectively; (2) there is a appeal shall be brought to the NLRC in this stage, remedy is rule 43)

significant change in the salary of the rank and file employees with an Step 5: If still unresolved, Appeal by Certiorari to the Supreme Court

increase to Php500/day and no increase in the salary of the under Rule 45, Rules of Court.

supervisors; (3) the distinction between the rank and file and the (Atty M: we will not discuss these steps in detail because this will be

supervisors are eliminated because both are receiving the same salary covered under Remedial Law.)

of Php500; (4) –the 4th element is not so clear in the situation. [Atty. Marquez forgot to ask about the steps in resolving wage

In the situation, the supervisors are the aggrieved parties because they distortion in Unorganized Establishments]

cannot allow the rank and file employees to be receiving the same Step 1: The employer and the employees will try to resolve the issue

salary as them. among themselves.

Q: If there exist a wage distortion, does the law provide a solution? Step 2: There are (2) Possible Scenarios:

A: Yes, the law provides Methods of Resolving Wage Distortion which Either they will:

would depend on whether the establishment is an Organized or an 1. Refer to Voluntary arbitration (the same steps ang e-

Unorganized Establishment. follow parehas sa organized est.)

Q: When is an establishment considered Unorganized?

Compiled by MFLH – Exclusive for EH405

Page 12

Labor Standards – Midterm Transcript

AY 2013-2014

2. Conciliation under the NCMB (since mana man tas Commission (NLRC) within 5 days from the receipt of the copy of the

Scenario#1, focus tah ani sa Scenario#2) decision.

NCMB – National Conciliation and Mediation Board Q: Since the judgement contains a monetary award, what are the

NCMB will try to settle the dispute through amicable settlement. The requirements to perfect the appeal?

NCMB can forward the case to Voluntary Arbitration or refer the A: (Marvin) In case of a judgment involving a monetary award, an

matter to NLRC for Compulsory Arbitration. appeal by the employer may be perfected only upon the posting of a

Step 3: If no settlement is arrived, the dispute shall be brought to the cash or surety bond issued by a reputable bonding company duly

appropriate branch of the NLRC for Compulsory Arbitration. accredited by the Commission in the amount equivalent to the

Step 4: If the parties are not satisfied, they can Appeal to the NLRC. monetary award in the judgment appealed from, excluding damages

Step 5: If unresolved, Petition for Certiorari with CA under Rule 65, from Attorney’s fees. (Art 223)

Rules of Court. From the decision of the NLRC, an appeal can be made to the CA in

Step 6: If still unresolved, Petition for Certiorari with SC under Rule 45, the form of a Special Civil action under Rule 65, Rules of Court. (Note:

Rules of Court. Not an ordinary Appeal!)

After CA, there’s no other way to appeal than to the SC under Rule 45,

TOPIC 6: WAGE ENFORCEMENT & RECOVERY Rules of Court.

(Ni skip si Atty. M sa Topic 5, basa lang gihapon gamay) Q: What is Art 128 of the Labor Code?

Q: What are the (2) Enforcement Tools under our Labor Code which A: (JP)

the government can use for the recovery of wages? Article 128. Visitorial and enforcement power.

A: (Tara) Enforcement Tools: The Secretary of Labor and Employment or his duly authorized

1. Art 128. Visitorial and Enforcemnet Power of the Secretary representatives, including labor regulation officers, shall have access

of Labor or his duly authorized representative. to employer’s records and premises at any time of the day or night

2. Art 129. Recovery of wages, Simple money claims and other whenever work is being undertaken therein, and the right to copy

benefits. therefrom, to question any employee and investigate any fact,

condition or matter which may be necessary to determine violations

or which may aid in the enforcement of this Code and of any labor

Q: What are the (4) Requisites for the Regional Director of DOLE to law, wage order or rules and regulations issued pursuant thereto.

exercise jurisdiction under Art 129? The SOLE or his duly authorized representatives can visit the

A: (Tara) Requisites: (Remember this!) establishment when regular work is being undertaken.

1. The claimant is an employee, household/domestic worker; Purpose: to determine if there are any violations of the Labor Code,

2. The claim arises from employer-employee relationship (may any labor law, wage orders or rules and regulations issued by the SOLE

involve non-payment/underpayment of wages; non- pursuant thereto.

payment/underpayment of overtime pay; non- Q: The law speaks of Visitorial and Enforcement. Are they both the

payment/underpayment of holiday pay, etc); same?

3. The claimant who is no longer employed does not seek A: (JP) No.

reinstatement; Visitorial – this is when the SOLE or his duly authorized representative

4. The claim does not exceed Php 5,000. has access to the employers records and premises at any time.

Atty’s Situation: Enforcement – this is when the SOLE or his rep will ask the employer to

If you have a domestic worker and you are paying her 3,000/month. In comply with the findings or violations the employer may have incurred.

one instance, you did not pay her salary and then she left you. Of Ex. If the employer did not comply with the minimum wage order, the

course she cannot forget the 3,000 salary you owe her, so she filed a SOLE or his rep will issue a compliance order to the employer to pay

complaint (simple money claim) with the Regional Dir of DOLE and sue the underpaid wages.

you and ask for the recovery of the 3,000. Atty’s Discussion:

Taken from the situation: The visitorial power would not be effective without the enforcement.

1. The claimant is a domestic helper (employee); That’s why it’s called “Visitorial &Enforcement Power.”

2. The claim is only 3,000 (did not exceed 5,000); Take Note: Since the SOLE is only one, he would not have time to

3. The claim arose from employer-employee rel.; inspect 1000+ establishments all over the country. In the Philippines,

4. The claimant, who is no longer employed, does not want to the DOLE has established Regional Offices nationwide; we also have an

be reinstated. office in Cebu City. In these Regional Offices they have a “Labor

So the Regional Director (RD) will try, hear and resolve, and he will Standard and Enforcement Division” (LSED), this is where we find the

determine if the claimant is entitled to his/her unpaid salary. Labor Inspectors, because the Regional Director cannot also do the

If RD will say yes, then he will make a decision in favour of the inspection himself, although he can do it, but he can also delegate the

claimant; If RD will say no, he will dismiss the complaint. power to the Labor Inspectors.

Q: If there is a decision rendered by the RD under Art 129, what is the So the SOLE delegates the power to the Regional Director (RD); The RD

remedy of the aggrieved party? delegates the power to the Labor Insp. So the Labor Inspector in most

A: (Marvin) They can file an Appeal (not a motion for reconsideration) cases would be the authorized rep of the SOLE and the RD, to inspect

under Art 223 of the Labor Code, with the National Labor Relations the establishments.

Compiled by MFLH – Exclusive for EH405

Page 13

Labor Standards – Midterm Transcript

AY 2013-2014

These labor inspectors are Civil Service employees (Gov’t Employees), In these cases, the SOLE can no longer exercise visitorial &

they will visit the establishments and present an ID and an “Inspection enforcement powers because ART 128 par. 2 clearly states “in cases

Authority”, signed by the RD. The Inspection Authority will tell you the where the relationship of employer-employee STILL EXISTS.. XXX”

name of the establishment and the date of inspection; it writes down Take Note: Here, the SOLE no longer has jurisdiction, but in cases

the parameters of the inspection. where violations are found, he will not proceed with the enforcement

By virtue of ART 128, they have access to the premises and the but he will have to refer the matter to the appropriate branch of the

employer’s records with the power to Copy the records, at any time of NLRC.

the day or night. (Some establishments are open at night, ex. Bars, Atty’s Discussion:

BPO’s) Another instance where there is no more employer-employee

Visitorial & Enforcement must be done during working hours. If the relationship is when in the first place no such relationship ever

establishment is closed, who will show them the records, the Security existed, applying the (4) Fold Test.

Guard!?? Of course Not! Q: Assuming the Employer-Employee relationship still exists. In what

Q: So there is access to employment records. What is a good example piece of document will the labor inspector appropriate his findings?

of an employment record for the inspector to know whether the A: (Jefferson) It will be embodied in the “Notice of Inspection Result”.

employer complied with the law or not? So he bases his inspection on the employee records and interviews the

A: (JP) employees at random and in private (does not interview the

(1) Payroll; employer), at the end of the day after the inspection, he will have to

IRR Labor Code, Book III, Chapter X: confront the employer and say ex. “Mr. Employer, you have not

Section 6. Payrolls. — (a) Every employer shall pay his employees complied with #1 Minimum wage… #2.. and so on….”

by means of a payroll wherein the following information and data After that, the Notice of Inspection Result will be placed in a

shall be individually shown: conspicuous place (ex. Entrance) for the employees to see and read for

1. Length of time to be paid; them to know the findings of the inspection.

2. The rate of pay per month, week, day or hour piece, etc.; A copy of the Notice will be given to the employer and the employer

3. The amount due for regular work; will be given (5) days to raise any questions or concern over the

4. The amount due for overtime work; findings.

5. Deductions made from the wages of the employees; and If he does not raise any questions, the Regional Director will issue a

6. Amount actually paid. “Compliance Order” or “Order of Compliance”, directing the employer

XXX to comply with the violations.

The law requires an employer to keep and maintain a payroll. Q: In case the employer does not agree with the findings of the

If the labor inspector looks at the payroll and there is a discrepancy, it Notice of Inspection Result, what is his remedy?

is a reliable proof to make a finding that there was a violation. (JEPPERSON!!!!) [we have the same name eh, na-mental block siya so I

Ex. If there were deductions not authorized by law then the inspector had to startle him.. ]

can put it in his findings and he may order the employer to comply. A: The employer will contest the notice, under ART 128 Par. (b).

Art 128, (b)

(2) Employment Contracts of the workers; XXX except in cases where the employer contests the findings

(3) Service Agreements (ex. Security Agency, Janitors). of the labor employment and enforcement officer and raises

All these employee records under the law, must be kept and issues supported by documentary proofs which were not

maintained by the employer in the Main Office of the company or considered in the course of inspection.

Branch Office or the worksite where the employees are regularly Note: The remedy of the employer is to present other documentary

assigned to work. proof not considered or not inspected.

So if you go to an office and there are Security Guards and Janitors Testimonial proof is NOT considered.

there who are not employees in the establishment, the law requires Q: If the employer contests the Notice of Inspection Result but not in

that your agreement (Service Agreement) with them, must be kept and the manner prescribed by law. What will the Regional Director do?

maintained in the place where they are working or where they are A: (Jefferson) The RD will still issue a Compliance Order.

regularly assigned. Q: If a compliance order is issued by the RD, ordering the employer to