Académique Documents

Professionnel Documents

Culture Documents

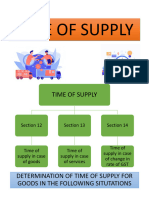

GST - Time of Supply of Goods (Summary)

Transféré par

Saksham Kathuria0 évaluation0% ont trouvé ce document utile (0 vote)

29 vues1 pageGat

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentGat

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

29 vues1 pageGST - Time of Supply of Goods (Summary)

Transféré par

Saksham KathuriaGat

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

5.

20 INDIRECT TAXES

The provisions relating to time of supply of goods as contained in section 12

are summarised in the diagram given below

Time of supply of goods Time of supply of goods Time of supply of vouchers

under forward charge under reverse charge exchangeable for goods

Date of issue/ due date of Date of issue of voucher, if the

issue of tax invoice under Date of receipt of goods supply is identifiable at that

section 31 point

Date of recording the payment

Date of recording the payment in the books of accounts of Date of redemption of voucher

in the books of accounts of the recipient of goods in other cases

the supplier

Date on which payment is

Date on which payment is debited from the bank account

credited in the bank account of the recipient of goods

of the supplier

31st day from supplier’s

whichever is earlier invoice

whichever is earlier

No GST on advances received

for supply of goods: GST to

be paid on date of issue/due If the above events are

date of issue of tax invoice UNASCERTAINABLE

under section 31 Time of supply = Date of entry of good in

books of account of recipient of goods

Residual case (If all Due date of periodical return

the above do not work Time of supply OR

for a situation) In any other case, the date on

which tax is paid

Addition in value by

way of interest, late

fee/penalty for delayed

payment of Date on which the supplier

Time of supply

consideration for receives such addition in value

goods

© The Institute of Chartered Accountants of India

Vous aimerez peut-être aussi

- Banking Domain Knowledge For TestersDocument9 pagesBanking Domain Knowledge For TestersAniket SinghPas encore d'évaluation

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeD'Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeÉvaluation : 1 sur 5 étoiles1/5 (1)

- Example Transition Project Plan ExcelDocument65 pagesExample Transition Project Plan Excelஅனுஷ்யா சார்லஸ்100% (1)

- Q: What Is The Difference Between These Administrative and Judicial Remedies?Document11 pagesQ: What Is The Difference Between These Administrative and Judicial Remedies?Kharen ValdezPas encore d'évaluation

- A Top Bloodline of The Black Nobility (Odescalchi)Document11 pagesA Top Bloodline of The Black Nobility (Odescalchi)karen hudes100% (2)

- Ebook: Blockchain Technology (English)Document25 pagesEbook: Blockchain Technology (English)BBVA Innovation Center100% (2)

- Vessel Registration GuideDocument30 pagesVessel Registration GuideeltioferdiPas encore d'évaluation

- 5cs CreditDocument6 pages5cs CreditiftikharchughtaiPas encore d'évaluation

- Uncommon GST TopicsDocument36 pagesUncommon GST TopicsEugeniePaxtonPas encore d'évaluation

- Gold Monetization Scheme: Research ReportDocument9 pagesGold Monetization Scheme: Research ReportVarun MaggonPas encore d'évaluation

- GST For Nov 2022 & May 2023 Exams (GST Time of Supply of ServicesDocument1 pageGST For Nov 2022 & May 2023 Exams (GST Time of Supply of ServicesVikasPas encore d'évaluation

- 5 Time of SupplyDocument18 pages5 Time of SupplyDhana SekarPas encore d'évaluation

- Levy in GST S.No Particulars 1 Time of SupplyDocument7 pagesLevy in GST S.No Particulars 1 Time of SupplyAnonymous ikQZphPas encore d'évaluation

- Time of SupplyDocument31 pagesTime of SupplyNalin KPas encore d'évaluation

- Chapter 6 - Time of SupplyDocument7 pagesChapter 6 - Time of SupplyDrafts StoragePas encore d'évaluation

- Time of SupplyDocument28 pagesTime of SupplySam RockerPas encore d'évaluation

- Time of Supply: CMA Bhogavalli Mallikarjuna GuptaDocument5 pagesTime of Supply: CMA Bhogavalli Mallikarjuna Guptagurusha bhallaPas encore d'évaluation

- Time of Supply PDFDocument1 pageTime of Supply PDFjayanitrivedi03Pas encore d'évaluation

- Time of Supply PDFDocument16 pagesTime of Supply PDFNaveed AnsariPas encore d'évaluation

- Time & Value of SupplyDocument2 pagesTime & Value of SupplyRahul NegiPas encore d'évaluation

- UNIT 2 (4) Time of SupplyDocument15 pagesUNIT 2 (4) Time of SupplySania KhanPas encore d'évaluation

- Time of Supply: General Time Limit For Raising InvoicesDocument4 pagesTime of Supply: General Time Limit For Raising InvoicesPrasanthPas encore d'évaluation

- New PPTX PresentationDocument9 pagesNew PPTX PresentationdataprotaxPas encore d'évaluation

- Time of Supply of ServicesDocument10 pagesTime of Supply of ServicesShiwang AgrawalPas encore d'évaluation

- Time of Supply: When Invoice Is Issued Within Statutory Period (30 Days or 45 Days)Document3 pagesTime of Supply: When Invoice Is Issued Within Statutory Period (30 Days or 45 Days)DebaPas encore d'évaluation

- 4 Time of SupplyDocument43 pages4 Time of SupplynashwauefaPas encore d'évaluation

- All The Due Dates and Time Limits in GSTDocument10 pagesAll The Due Dates and Time Limits in GST2d77gp69kzPas encore d'évaluation

- Time of Supply INTERDocument20 pagesTime of Supply INTERKaylee WrightPas encore d'évaluation

- 4 GST Time and Value of Supply NotesDocument6 pages4 GST Time and Value of Supply NotesMurali Krishnan RPas encore d'évaluation

- Invoice InterDocument10 pagesInvoice InterKaylee WrightPas encore d'évaluation

- Time of SupplyDocument6 pagesTime of SupplygriefernjanPas encore d'évaluation

- Time of SupplyDocument4 pagesTime of SupplyAarushi GuptaPas encore d'évaluation

- S. 16: Eligibility & Conditions: Receipt of Document Forward Charge Cases (FCM)Document3 pagesS. 16: Eligibility & Conditions: Receipt of Document Forward Charge Cases (FCM)MANU SHANKARPas encore d'évaluation

- Tax Points - Reference Material: Pro Forma InvoicesDocument2 pagesTax Points - Reference Material: Pro Forma Invoicesanon_178447188Pas encore d'évaluation

- Time and Value of Supply-4Document73 pagesTime and Value of Supply-4Muhammad MehrajPas encore d'évaluation

- Idt 3Document10 pagesIdt 3manan agrawalPas encore d'évaluation

- Value of Supply: A. Supply To Unrelated Persons Where Price Is The Sole Consideration ForDocument19 pagesValue of Supply: A. Supply To Unrelated Persons Where Price Is The Sole Consideration ForPrasanthPas encore d'évaluation

- Bill of SupplyDocument3 pagesBill of SupplyAnas QasmiPas encore d'évaluation

- Basic Concepts of Transition & Invoice I20177804Document28 pagesBasic Concepts of Transition & Invoice I20177804vishalPas encore d'évaluation

- Time of SupplyDocument7 pagesTime of SupplyTushar MadanPas encore d'évaluation

- Chapter 5 WhentoPayTaxonSupplyofGoods ServicesDocument24 pagesChapter 5 WhentoPayTaxonSupplyofGoods ServicesDR. PREETI JINDALPas encore d'évaluation

- Prompt Payment To MSME VendorsDocument3 pagesPrompt Payment To MSME VendorsAmit MantryPas encore d'évaluation

- Time of Supply-20Document44 pagesTime of Supply-20Sidhant GoyalPas encore d'évaluation

- Time of Supply-IDocument50 pagesTime of Supply-IVaibhav GawadePas encore d'évaluation

- Time Value of Goods and SupplyDocument4 pagesTime Value of Goods and SupplyAnshuman ThatoiPas encore d'évaluation

- 12 List of Clarifications - Editorial Amendments - PSSCOCDocument2 pages12 List of Clarifications - Editorial Amendments - PSSCOCAlvin KangPas encore d'évaluation

- Time of Supply Under Goods and Service Tax ActDocument8 pagesTime of Supply Under Goods and Service Tax ActNarayan KabraPas encore d'évaluation

- E Flier Credit Notes in GSTDocument2 pagesE Flier Credit Notes in GSTSneha AgarwalPas encore d'évaluation

- Transitional Provisions in GST S.No Particulars 1 Transitional ProvisionsDocument8 pagesTransitional Provisions in GST S.No Particulars 1 Transitional ProvisionsAnonymous ikQZphPas encore d'évaluation

- REMEDIES by J. DimaampaoDocument2 pagesREMEDIES by J. DimaampaoJeninah Arriola CalimlimPas encore d'évaluation

- GST PPT (Group 5)Document20 pagesGST PPT (Group 5)Hanna GeorgePas encore d'évaluation

- GST1Document25 pagesGST1DeepikaPas encore d'évaluation

- GST 5.1Document46 pagesGST 5.1Raghav TiwariPas encore d'évaluation

- 7 Input Tax CreditDocument16 pages7 Input Tax CreditinstainstantuserPas encore d'évaluation

- Sop BrochureDocument6 pagesSop BrochurePhonemyat MoePas encore d'évaluation

- Tos & Vos PDFDocument42 pagesTos & Vos PDFRatulPas encore d'évaluation

- GST Seminar: Hosted By:-Akola Branch of WICASA of ICAIDocument40 pagesGST Seminar: Hosted By:-Akola Branch of WICASA of ICAINavneetPas encore d'évaluation

- Bric T&C'sDocument2 pagesBric T&C'sDavidPas encore d'évaluation

- Government RemediesDocument3 pagesGovernment RemediesShan ElisPas encore d'évaluation

- Average Due DateDocument19 pagesAverage Due DatePriyanshuPas encore d'évaluation

- Invoicing Under Goods and Service TAXDocument37 pagesInvoicing Under Goods and Service TAXAmit GuptaPas encore d'évaluation

- GST - Tax Invoice, Debit or Credit Notes, Returns, Payment of Tax PDFDocument78 pagesGST - Tax Invoice, Debit or Credit Notes, Returns, Payment of Tax PDFSapna MalikPas encore d'évaluation

- Bills of ExchangeDocument8 pagesBills of ExchangeAnonymous MhCdtwxQIPas encore d'évaluation

- Transitional ProvisionsDocument21 pagesTransitional ProvisionsRahul AkellaPas encore d'évaluation

- Debit or Credit NoteDocument6 pagesDebit or Credit Noteamolisrivastava8Pas encore d'évaluation

- CH-04 Input Tax Credit Under GST ReturnsDocument10 pagesCH-04 Input Tax Credit Under GST ReturnsSanket MhetrePas encore d'évaluation

- Tax InvoiceDocument52 pagesTax InvoicesidhantPas encore d'évaluation

- Auditors Report For NBFCDocument9 pagesAuditors Report For NBFCamidclPas encore d'évaluation

- Master Minds: No.1 For CA/CWA & MEC/CECDocument8 pagesMaster Minds: No.1 For CA/CWA & MEC/CECr_s_kediaPas encore d'évaluation

- Policy ScheduleDocument4 pagesPolicy ScheduleacrajeshPas encore d'évaluation

- Antara Bijak Sdn. BHD.: Company No: 669691 PDocument17 pagesAntara Bijak Sdn. BHD.: Company No: 669691 PIkhmil FariszPas encore d'évaluation

- PartDocument29 pagesPartPrakash KhemalapurPas encore d'évaluation

- How To Enforce Judgments Under The Civil Proceeding in MalaysiaDocument3 pagesHow To Enforce Judgments Under The Civil Proceeding in MalaysiaDevika SuppiahPas encore d'évaluation

- International Payment SystemsDocument2 pagesInternational Payment SystemsPrerna SharmaPas encore d'évaluation

- US Internal Revenue Service: 2005p1212 Sect I-IiiDocument168 pagesUS Internal Revenue Service: 2005p1212 Sect I-IiiIRSPas encore d'évaluation

- Arbitrage Calculator 3Document4 pagesArbitrage Calculator 3Eduardo MontanhaPas encore d'évaluation

- 4 Profit Planning Budgeting PDFDocument85 pages4 Profit Planning Budgeting PDFNadie LrdPas encore d'évaluation

- United States Bankruptcy Court For The District of DelawareDocument9 pagesUnited States Bankruptcy Court For The District of DelawareChapter 11 DocketsPas encore d'évaluation

- Personal Financial Statement: Section 1-Individual InformationDocument3 pagesPersonal Financial Statement: Section 1-Individual InformationAndrea MoralesPas encore d'évaluation

- Fund Flow Statement TheoryDocument3 pagesFund Flow Statement TheoryprajaktadasPas encore d'évaluation

- GST - ReturnsDocument30 pagesGST - ReturnsAniket Rastogi100% (2)

- Secretary 'S Certificate Incorporating The Board Resolution "A"Document18 pagesSecretary 'S Certificate Incorporating The Board Resolution "A"hellojdeyPas encore d'évaluation

- Name - Revati Tapaskar Roll No - 2k181175 Specialization - Finance Porter's Five Force Model of Air IndiaDocument2 pagesName - Revati Tapaskar Roll No - 2k181175 Specialization - Finance Porter's Five Force Model of Air Indiarevati tapaskarPas encore d'évaluation

- Monte Carlo - Cash Budget Models Outline and CorrelationsDocument13 pagesMonte Carlo - Cash Budget Models Outline and CorrelationsphanhailongPas encore d'évaluation

- India's Journey Towards Cashless Economy-A Study: K. Sai Pavan KumarDocument9 pagesIndia's Journey Towards Cashless Economy-A Study: K. Sai Pavan KumarSai PavanPas encore d'évaluation

- GSRTC 9-12-17.Document1 pageGSRTC 9-12-17.Nilay GandhiPas encore d'évaluation

- Bailment ContractDocument8 pagesBailment Contractadi_gupta19100% (1)

- IBA Suggested Solution First MidTerm Taxation 12072016Document9 pagesIBA Suggested Solution First MidTerm Taxation 12072016Syed Azfar HassanPas encore d'évaluation

- National General Insurance - CARFDocument2 pagesNational General Insurance - CARFCP TewPas encore d'évaluation