Académique Documents

Professionnel Documents

Culture Documents

Entrepreneurship by Hisrich Chapter 9 Mcqs

Transféré par

ToobaDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Entrepreneurship by Hisrich Chapter 9 Mcqs

Transféré par

ToobaDroits d'auteur :

Formats disponibles

Entrepreneurship

By: Robert D. Hisrich, Michael P. Peters, Dean A Shepherd

MCQs For Chapter 9

1. The management team of a new venture:

A) is encouraged to operate the business as a sideline.

B) must operate the business full-time.

C) can expect to draw a large salary.

D) should be employed elsewhere to assure adequate income.

2. Some customers prefer to do business with a _______________ because this form of

business is sometimes viewed as a more stable form than the others.

A) proprietorship

B) limited partnership

C) full partnership

D) corporation

3. _____________ have unlimited liability for the actions of the business.

A) General partners

B) Corporate shareholders

C) Limited liability company members

D) Limited partners

4. In a limited partnership, the limited partners:

A) are liable only for the amount of their capital contributions.

B) share the amount of personal liabilities equally.

C) have only insurance as protection against liability suits.

D) are allowed to decide on the amount of individual liabilities.

5. Liability is one of the most critical reasons for establishing a:

A) corporation.

B) limited liability company.

C) partnership.

D) sole proprietorship

6. In a limited liability partnership (LLP) death or withdrawal of a partner:

A) results in automatic transfer of ownership to surviving partner(s).

B) may result in problems trying to find a market for the shares.

C) always results in termination of the partnership.

D) has no effect on the partnership.

7. Which of the following types of ownership has the most continuity?

A) Corporation

B) General partnership

C) Limited partner

D) Sole proprietorship

8. Sole proprietorships:

A) have no time limit on how long they may exist.

B) are perpetual.

C) continue even upon the death of the owner.

D) allow a member of the deceased partner’s family take over as a partner.

9. In which of the legal forms of ownership is transferability of interest the easiest?

A) Sole proprietorship

B) Limited partnership

C) General partnership

D) Corporation

10. In an S corporation, the transfer of interest can occur:

A) only with the consent of the other shareholders.

B) only if there is a charter provision for doing so.

C) only as long as the buyer is an individual.

D) depending on the agreement.

11. The legal form of business with the most alternatives for raising capital is the:

A) proprietorship.

B) corporation.

C) limited partnership.

D) full partnership.

12. Bonds can be used to raise capital in which form of ownership?

A) Sole proprietorship

B) Limited partnership

C) General partnership

D) Corporation

13. In which form of organization does the owner have greatest control?

A) Sole proprietorship

B) Limited partnership

C) General partnership

D) Corporation

14. When it comes to decision making, in a limited partnership:

A) there is no separation of ownership and control.

B) limited partners have no control over business decisions.

C) limited partners have an equal say, but no liability.

D) the partners have control based on invested capital.

15. Corporations distribute profits to owners through:

A) bonds.

B) taxes.

C) dividends.

D) interest.

16. Organization costs in a proprietorship are:

A) amortizable over a period of 60 months.

B) amortizable over a period of 45 months.

C) not amortizable.

D) amortizable for a period of a year.

17. Which of the following statements is (are) true?

A) Corporates are not able to take deductions and expenses available to the

proprietorship or partnership.

B) Distribution of dividends is taxed once, as income of the corporation.

C) Bonuses, incentives,and profit sharing are allowable ways to distribute income of

the corporation.

D) Corporate tax may be higher than the individual rate.

18. Which of the following ways of distributing the income of corporations is taxed

twice?

A) Bonus

B) Salary

C) Dividends

D) Profit sharing

19. A limited liability corporation:

A) has unlimited liability.

B) is automatically taxed as a partnership.

C) is decreasing in popularity among venture capitalists.

D) had been the most popular choice of organization structure by new ventures and

small businesses.

20. S corporation status means:

A) shareholders do not have limited liability.

B) the corporation is subject to a minimum tax of 34 percent.

C) consent by a majority of shareholders is required for the election of this form of

business.

D) the corporation pays no tax.

21. In an S corporation:

A) gains or losses of the business are separate from the personal income of the

shareholder.

B) shareholders retain unlimited liability.

C) only one class of stock is permitted.

D) most fringe benefits for shareholders can be deducted.

22. In a limited liability company:

A) owners are called shareholders.

B) members may transfer their interests at any time.

C) members are not allowed to share income, profit, expense, deduction, loss and

credit among themselves.

D) laws governing its formation differ from state to state.

23. As an organization grows, submanagers are hired to coordinate the various aspects

of

the business. The text describes this as:

A) Stage 1.

B) Management Phase.

C) Stage 2.

D) Organizing Phase.

24. Our text tells us that much of an entrepreneur's time during start-up is spent:

A) delegating.

B) negotiating.

C) putting out fires.

D) allocating resources.

25. To build a successful organization culture the entrepreneur:

A) should focus and not try out different things.

B) needs to remember that it is easier to change a person’s attitude than it is to

change the person’s behavior.

C) should spend extra time in the hiring process.

D) must create a workplace where communication from the top down is encouraged.

26. The board of directors:

A) lacks voting authority.

B) has responsibilities to represent all shareholders.

C) is less objective than the entrepreneur.

D) are always volunteers and need not be compensated.

27. The _________ imposes oversight responsibilities on members of the board of

directors.

A) Social Security Act

B) Fair Labor Practices Act

C) Sarbanes-Oxley

D) Taft-Hartley Act

28. The difference between a board of directors and a board of advisors is that:

A) the board of advisors meets less frequently.

B) the board of directors lacks voting authority.

C) the board of directors is subject to less pressure of litigation.

D) the board of advisors are compensated.

1 2 3 4 5 6 7 8 9 10 11 12 13 14

B D A A A D A D D C B D A B

15 16 17 18 19 20 21 22 23 24 25 26 27 28

C C C C B D C D C C C B C A

Vous aimerez peut-être aussi

- Entrepreneurship by Hisrich, Shepherd, Peters Chapter 2Document6 pagesEntrepreneurship by Hisrich, Shepherd, Peters Chapter 2Tooba100% (2)

- ENTREPRENEURSHIP by Hisrich MCQS CHAPTER 11Document1 pageENTREPRENEURSHIP by Hisrich MCQS CHAPTER 11Tooba0% (2)

- Entrepreneurship by Hisrich Chapter 6 MCQsDocument4 pagesEntrepreneurship by Hisrich Chapter 6 MCQsTooba100% (3)

- Sanple Questions For EntrepreneurshipDocument3 pagesSanple Questions For EntrepreneurshipAntonio KovačevićPas encore d'évaluation

- Entrepreneurship by Hisrich Chapter 2 Questions OnlyDocument2 pagesEntrepreneurship by Hisrich Chapter 2 Questions OnlyToobaPas encore d'évaluation

- Quiz Barringer Chapter 02Document3 pagesQuiz Barringer Chapter 02Deriven Teweng100% (2)

- Chapter 7 The Business Plan: Creating andDocument9 pagesChapter 7 The Business Plan: Creating andbeargreat100% (4)

- Entrepreneurship by Hisrich, Shepherd, Peters Chapter 1 MCQs and QuestionsDocument6 pagesEntrepreneurship by Hisrich, Shepherd, Peters Chapter 1 MCQs and QuestionsTooba100% (5)

- Chapter 3 MCQsDocument3 pagesChapter 3 MCQsmadihaadnan160% (5)

- Ed MCQDocument42 pagesEd MCQHoney Amaan0% (1)

- SOLVED PAST PAPERS (Short Questions Only)Document5 pagesSOLVED PAST PAPERS (Short Questions Only)Zain LauPas encore d'évaluation

- Chapter 4 MCQsDocument3 pagesChapter 4 MCQsprince ahenkoraPas encore d'évaluation

- Entrepreneurship Sample ExamDocument34 pagesEntrepreneurship Sample ExamKidane KenenisaPas encore d'évaluation

- Quiz Barringer Chapter 03Document3 pagesQuiz Barringer Chapter 03Deriven Teweng100% (3)

- Entrepreneurship MCQ 1Document14 pagesEntrepreneurship MCQ 1dinesh brother (UNSOLVED of MJP)Pas encore d'évaluation

- 5 6143228707155738981Document73 pages5 6143228707155738981Rohan SinghPas encore d'évaluation

- Chapter 4 MCQsDocument3 pagesChapter 4 MCQsmadihaadnan1100% (2)

- MCQ On Business Ethics BbaDocument7 pagesMCQ On Business Ethics BbaMaida TanweerPas encore d'évaluation

- Entrepreneurship Multiple Choice QuestionsDocument21 pagesEntrepreneurship Multiple Choice Questionssijan bista100% (1)

- Enterprenship MCQDocument19 pagesEnterprenship MCQPRIYABRATA JENAPas encore d'évaluation

- PDF MCQS Question Bank No.1 For TY BBA Subject - Entrepreneurship DevelopmentDocument12 pagesPDF MCQS Question Bank No.1 For TY BBA Subject - Entrepreneurship DevelopmentManish50% (2)

- Ed Question BankDocument16 pagesEd Question BankpavandongrePas encore d'évaluation

- Test Bank For Essentials of Entrepreneurship Small Business Management, 7th Edition Norman M. ScarboroughDocument27 pagesTest Bank For Essentials of Entrepreneurship Small Business Management, 7th Edition Norman M. ScarboroughDeborah100% (3)

- 109 - Entrepreneurship Development MCQ QUESTIONSDocument71 pages109 - Entrepreneurship Development MCQ QUESTIONSNikita Rekhate100% (3)

- Chapter 1 - Entrepreneurship Quiz Successfully Launching New Ventures 4e BarringerDocument4 pagesChapter 1 - Entrepreneurship Quiz Successfully Launching New Ventures 4e BarringerKayla Rae Amiri100% (5)

- Multiple Choice Questions: Innovation and EntrepreneurshipDocument22 pagesMultiple Choice Questions: Innovation and Entrepreneurshiprishika rsh100% (1)

- MCQ Business PlanDocument1 pageMCQ Business PlanDrSachin Srivastava100% (2)

- Chapter 10 MCQsDocument3 pagesChapter 10 MCQsmadihaadnan1100% (2)

- MCOM Business Ethics CSR MCQDocument18 pagesMCOM Business Ethics CSR MCQSiddhesh Sawant0% (1)

- Test Bank For EntrepreneurshipDocument14 pagesTest Bank For EntrepreneurshipMohd ArifPas encore d'évaluation

- Edc Past Questions & AnswersDocument5 pagesEdc Past Questions & AnswersJon snowPas encore d'évaluation

- Unit 1 McqsDocument5 pagesUnit 1 McqsArun Soman0% (4)

- MCQDocument23 pagesMCQNiket RaikangorPas encore d'évaluation

- Basics of Marketing (105) MCQ: 2019 Pattern: Chapter 1 - Introduction To MarketingDocument8 pagesBasics of Marketing (105) MCQ: 2019 Pattern: Chapter 1 - Introduction To MarketingTushar VasuPas encore d'évaluation

- Chapter 1 MCQsDocument3 pagesChapter 1 MCQsMuluken Mulat67% (3)

- Entrepreneurship MCQDocument111 pagesEntrepreneurship MCQSurendra Babu Koganti100% (2)

- MCQ For SNVM Startup and New Venture ManagementDocument24 pagesMCQ For SNVM Startup and New Venture ManagementSuyog Rane50% (2)

- Entreprenuership Management MCQDocument7 pagesEntreprenuership Management MCQzaru1121Pas encore d'évaluation

- Strategic Management Multiple Choice QuestionsDocument53 pagesStrategic Management Multiple Choice QuestionsJiya LelePas encore d'évaluation

- MCQ Questions On StrategyDocument9 pagesMCQ Questions On Strategyy100% (1)

- Strategic Management MCQDocument20 pagesStrategic Management MCQDR. INDRAJEET BHAGAT100% (1)

- Chapter 3 Test Bankk Creativity and InnovationDocument25 pagesChapter 3 Test Bankk Creativity and InnovationHASNA KHAMIRI100% (2)

- Chapter 06 Assessment of Entrepreneurial Opportunities: TruefalseDocument19 pagesChapter 06 Assessment of Entrepreneurial Opportunities: TruefalseLara FloresPas encore d'évaluation

- Question Bank - Start Up and New Venture ManagementDocument2 pagesQuestion Bank - Start Up and New Venture Managementanuradhakampli100% (2)

- MCQ International BusinessDocument27 pagesMCQ International BusinessDivyesh0% (1)

- EntrepreneurshipDocument32 pagesEntrepreneurshipVivek Kumar Singh100% (2)

- MCQ 1 PDFDocument19 pagesMCQ 1 PDFPravin SamalPas encore d'évaluation

- Principles of Marketing Chapter 5 Test Bank PDFDocument45 pagesPrinciples of Marketing Chapter 5 Test Bank PDFmira chehabPas encore d'évaluation

- EntrepreneurshipDocument14 pagesEntrepreneurshipMansoor QureshiPas encore d'évaluation

- Test Bank For Entrepreneurship, 9th Edition HisrichDocument10 pagesTest Bank For Entrepreneurship, 9th Edition HisrichemmmaPas encore d'évaluation

- Quiz3 A102Document4 pagesQuiz3 A102Wan Norhayati Wan AhmadPas encore d'évaluation

- Multiple Choice QuestionsDocument13 pagesMultiple Choice QuestionsVictor CharlesPas encore d'évaluation

- MCQ On Entrepreneurship DevelopmentDocument10 pagesMCQ On Entrepreneurship DevelopmentTIEG Take It EGPas encore d'évaluation

- Business Organisation MCQS PDFDocument24 pagesBusiness Organisation MCQS PDFSami Jee100% (1)

- MCQS Strategic Management Concepts and Cases and Business Policy Chapter 6 9Document13 pagesMCQS Strategic Management Concepts and Cases and Business Policy Chapter 6 9Conrado Canto Jr.100% (1)

- Multiple Choice Questions On Business StrategyDocument18 pagesMultiple Choice Questions On Business StrategyDr.Ashok Kumar Panigrahi71% (17)

- MGT-503 - Business Ethics and Corporate Social Responsibility - BBADocument8 pagesMGT-503 - Business Ethics and Corporate Social Responsibility - BBAUsama Ch100% (1)

- Marketing Multiple Choice Questions With Answers.Document43 pagesMarketing Multiple Choice Questions With Answers.Mujeeb Alam79% (63)

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocument8 pagesMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionnatashaPas encore d'évaluation

- Ross12e Chapter01 TBDocument12 pagesRoss12e Chapter01 TBHải YếnPas encore d'évaluation

- Dependency TheoryDocument2 pagesDependency TheoryToobaPas encore d'évaluation

- Topic: Feminism: Short Questions. X2Document1 pageTopic: Feminism: Short Questions. X2ToobaPas encore d'évaluation

- Marketing Management 5Document8 pagesMarketing Management 5ToobaPas encore d'évaluation

- D) PersonalityDocument4 pagesD) PersonalityToobaPas encore d'évaluation

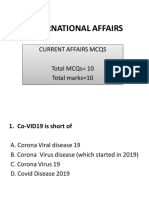

- International Affairs: Current Affairs Mcqs Total Mcqs 10 Total Marks 10Document11 pagesInternational Affairs: Current Affairs Mcqs Total Mcqs 10 Total Marks 10ToobaPas encore d'évaluation

- CSS International Relations Solved MCQs With Explanation (Set-II)Document10 pagesCSS International Relations Solved MCQs With Explanation (Set-II)ToobaPas encore d'évaluation

- Zikmund Testing of Hypotheses %%%%%%%Document14 pagesZikmund Testing of Hypotheses %%%%%%%ToobaPas encore d'évaluation

- Entrepreneurship Chapter 13 - Strategies For GrowthDocument2 pagesEntrepreneurship Chapter 13 - Strategies For GrowthSoledad Perez100% (1)

- Entrepreneurship Chapter 4 - Creativity and The Business IdeaDocument4 pagesEntrepreneurship Chapter 4 - Creativity and The Business IdeaSoledad Perez69% (13)

- ZIKMUND - CHP 7 - Qualitative Research ToolsDocument2 pagesZIKMUND - CHP 7 - Qualitative Research ToolsToobaPas encore d'évaluation

- Entrepreneurship Chapter 10 - The Financial PlanDocument2 pagesEntrepreneurship Chapter 10 - The Financial PlanSoledad Perez100% (5)

- Entrepreneurship Chapter 8 - The Marketing PlanDocument2 pagesEntrepreneurship Chapter 8 - The Marketing PlanSoledad Perez57% (7)

- Business Research Methods Zikmund CHP 20Document32 pagesBusiness Research Methods Zikmund CHP 20ToobaPas encore d'évaluation

- Zikmund Business Research Methods Chapter 1Document19 pagesZikmund Business Research Methods Chapter 1ToobaPas encore d'évaluation

- BRM - Zikmund, CHP 3 - Theory BuildingDocument32 pagesBRM - Zikmund, CHP 3 - Theory BuildingToobaPas encore d'évaluation

- BRM - Zikmund - CHP 8 - Secondary DataDocument40 pagesBRM - Zikmund - CHP 8 - Secondary DataToobaPas encore d'évaluation

- Entrepreneurship by Hisrich, Shepherd, Peters Chapter 1 MCQs and QuestionsDocument6 pagesEntrepreneurship by Hisrich, Shepherd, Peters Chapter 1 MCQs and QuestionsTooba100% (5)

- Ans 1Document1 pageAns 1Rajvi ChatwaniPas encore d'évaluation

- Basic Theory of PartnershipDocument3 pagesBasic Theory of PartnershipANTECPas encore d'évaluation

- Mortgage Loan DefinitionDocument65 pagesMortgage Loan DefinitionAnonymous iyQmvDnHnCPas encore d'évaluation

- Undue InfluenceDocument18 pagesUndue InfluenceNaina ReddyPas encore d'évaluation

- RTI - Contract - Qual - EN - Giu 013 PDFDocument6 pagesRTI - Contract - Qual - EN - Giu 013 PDFgmolguinpPas encore d'évaluation

- Notes For Midterm ObliConDocument8 pagesNotes For Midterm ObliConmichelle_calzada_1Pas encore d'évaluation

- Chapter 2 - Nature and Effects of ObligationDocument11 pagesChapter 2 - Nature and Effects of ObligationR ApigoPas encore d'évaluation

- Lecture Notes: Common Law Contracts Lecture Ii: Defences, Damages and Remedies Dr. Wilder, University of BonnDocument15 pagesLecture Notes: Common Law Contracts Lecture Ii: Defences, Damages and Remedies Dr. Wilder, University of BonnNur Un NaharPas encore d'évaluation

- Restraint of TradeDocument16 pagesRestraint of TradeABHISHEK SAADPas encore d'évaluation

- Yun Kwan Byung v. PAGCOR 608 SCRA 107 2009 DigesDocument1 pageYun Kwan Byung v. PAGCOR 608 SCRA 107 2009 DigesZusmitha SalcedoPas encore d'évaluation

- Annexure Ii Standardised Format For BGDocument5 pagesAnnexure Ii Standardised Format For BGNishit Marvania100% (1)

- Law Case StudyDocument6 pagesLaw Case StudyHaya AwanPas encore d'évaluation

- JKR PWD 75 Gen. Cond. of Contract (Ver 2021)Document88 pagesJKR PWD 75 Gen. Cond. of Contract (Ver 2021)Bernardine BenedictPas encore d'évaluation

- Option Trading StrategiesDocument79 pagesOption Trading Strategiesasifanis100% (1)

- Companies Act PDFDocument9 pagesCompanies Act PDFRajan GondwalePas encore d'évaluation

- (CHAPTER-3) (Independent Director, Woman Director & Corporate Governance)Document3 pages(CHAPTER-3) (Independent Director, Woman Director & Corporate Governance)SANDIP ROYPas encore d'évaluation

- Master Services AgreementDocument12 pagesMaster Services AgreementGuillermo AlvarezPas encore d'évaluation

- Diamond Farms Inc. Vs Southern Federation of Labor WorkersDocument3 pagesDiamond Farms Inc. Vs Southern Federation of Labor WorkersRuss Tuazon100% (2)

- Unit 9 Contracts in ParticularDocument5 pagesUnit 9 Contracts in ParticularÁlvaro Vacas González de EchávarriPas encore d'évaluation

- Dwnload Full Calculus Early Transcendentals 8th Edition Stewart Test Bank PDFDocument22 pagesDwnload Full Calculus Early Transcendentals 8th Edition Stewart Test Bank PDFthiesfeldrolandaus100% (13)

- Bankster in Dishonour - Updated: Notice of Acceptance For ValueDocument56 pagesBankster in Dishonour - Updated: Notice of Acceptance For ValueKNOWLEDGE SOURCE100% (4)

- 0 - Study Material - Clerical To OfficerDocument241 pages0 - Study Material - Clerical To OfficerRituja MishraPas encore d'évaluation

- Competiton Act 2002Document3 pagesCompetiton Act 2002yash panwarPas encore d'évaluation

- Dragnet ClauseDocument2 pagesDragnet ClauseAlarm GuardiansPas encore d'évaluation

- 2R DTC - Operativ - 55-45Document16 pages2R DTC - Operativ - 55-45hesamPas encore d'évaluation

- Definitions Companies Act 2013 - Akanksha BohraDocument23 pagesDefinitions Companies Act 2013 - Akanksha BohraAkanksha BohraPas encore d'évaluation

- Binaya Kumar Parida EMBA-2020-21, 1 Semester Business and Corporate Laws Assignment Roll No-16Document7 pagesBinaya Kumar Parida EMBA-2020-21, 1 Semester Business and Corporate Laws Assignment Roll No-16binay kumar ParidaPas encore d'évaluation

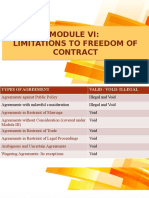

- Module VI - Limitations As To Freedom of ContractDocument55 pagesModule VI - Limitations As To Freedom of ContractAadhitya NarayananPas encore d'évaluation

- TPA - Important SectionsDocument2 pagesTPA - Important SectionsRitesh AroraPas encore d'évaluation

- Ip Due DiligenceDocument13 pagesIp Due DiligenceyoshimgamtPas encore d'évaluation

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorD'EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorÉvaluation : 4.5 sur 5 étoiles4.5/5 (132)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingD'EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingÉvaluation : 4.5 sur 5 étoiles4.5/5 (97)

- The SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsD'EverandThe SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsPas encore d'évaluation

- Ben & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooD'EverandBen & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooÉvaluation : 5 sur 5 étoiles5/5 (2)

- Public Finance: Legal Aspects: Collective monographD'EverandPublic Finance: Legal Aspects: Collective monographPas encore d'évaluation

- Introduction to Negotiable Instruments: As per Indian LawsD'EverandIntroduction to Negotiable Instruments: As per Indian LawsÉvaluation : 5 sur 5 étoiles5/5 (1)

- AI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersD'EverandAI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersPas encore d'évaluation

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorD'EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorÉvaluation : 4.5 sur 5 étoiles4.5/5 (63)

- Contract Law in America: A Social and Economic Case StudyD'EverandContract Law in America: A Social and Economic Case StudyPas encore d'évaluation

- The Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorseD'EverandThe Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorsePas encore d'évaluation

- Indian Polity with Indian Constitution & Parliamentary AffairsD'EverandIndian Polity with Indian Constitution & Parliamentary AffairsPas encore d'évaluation

- The Streetwise Guide to Going Broke without Losing your ShirtD'EverandThe Streetwise Guide to Going Broke without Losing your ShirtPas encore d'évaluation

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsD'EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsÉvaluation : 5 sur 5 étoiles5/5 (24)

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementD'EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementÉvaluation : 4.5 sur 5 étoiles4.5/5 (20)

- International Business Law: Cases and MaterialsD'EverandInternational Business Law: Cases and MaterialsÉvaluation : 5 sur 5 étoiles5/5 (1)

- The Startup Visa: U.S. Immigration Visa Guide for Startups and FoundersD'EverandThe Startup Visa: U.S. Immigration Visa Guide for Startups and FoundersPas encore d'évaluation

- LLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessD'EverandLLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessÉvaluation : 5 sur 5 étoiles5/5 (1)

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseD'EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CasePas encore d'évaluation