Académique Documents

Professionnel Documents

Culture Documents

K & S

Transféré par

obaidCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

K & S

Transféré par

obaidDroits d'auteur :

Formats disponibles

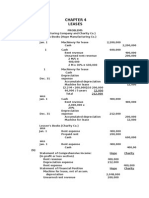

JS BANK

FINANCIAL POSITION

VERTICAL ANALYSIS

2018 % 2017 % 2016

ASSETS

cash and balances 32111 7.0% 17334 4.4% 156509

balances with other banks 969 0.2% 1034 0.3% 753

lending of financial instit 1937 0.4% 3116 0.8% 11334

investments 148690 32.6% 169612 43.3% 133727

advance nets 251991 55.2% 184140 47.0% 93794

operating fix assets 8415 1.8% 7113 1.8% 5837

deffereed tax assets net 287 0.1% 0 0.0% 0

other assets 12354 2.7% 9131 2.3% 6490

TOTAL ASSET 456754 100.0% 391479 100.0% 267444

LIABILITIES

bills payable 3520 0.8% 3824 1.0% 2544

borrowings 96559 21.1% 64557 16.5% 10320

deposits and other accounts 321413 70.4% 290078 74.1% 226099

subordinated loans 7497 1.6% 4999 1.3% 3000

differted tax liabilities 0 0.0% 797 0.2% 1205

other liabilities 12148 2.7% 10555 2.7% 7626

TOTAL LIABILITIES 441137 96.6% 374810 95.7% 250794

EQUITY

share capital 12975 2.8% 10725 2.7% 10725

discount on shares -2855 -0.6% -2105 -0.5% -2105

preferrence shares 0 0.0% 1500 0.4% 1500

resserves 1712 0.4% 1541 0.4% 1334

acc/profit or loss 4821 1.1% 4519 1.2% 3973

surplus -1036 -0.2% 490 0.1% 1223

TOTAL EQUITY 15617 3.4% 16669 4.3% 16650

EQUITY &LIABILITY 456754 100.0% 391479 100.0% 267444

% 2015 % 2014 %

58.5% 11159 5.1% 9041 5.1%

0.3% 584 0.3% 412 0.2%

4.2% 3581 1.6% 11080 6.3%

50.0% 116030 53.1% 84258 47.7%

35.1% 76666 35.1% 62433 35.3%

2.2% 4574 2.1% 3767 2.1%

0.0% 0 0.0% 0 0.0%

2.4% 5882 2.7% 5726 3.2%

100.0% 218476 100.0% 176717 100.0%

1.0% 1609 0.7% 1380 0.8%

3.9% 54638 25.0% 50538 28.6%

84.5% 141840 64.9% 108740 61.5%

1.1% 0 0.0% 0 0.0%

0.5% 1695 0.8% 445 0.3%

2.9% 2724 1.2% 2535 1.4%

93.8% 202508 92.7% 163637 92.6%

4.0% 10725 4.9% 10725 6.1%

-0.8% -2105 -1.0% -2105 -1.2%

0.6% 1500 0.7% 1500 0.8%

0.5% 919 0.4% 514 0.3%

1.5% 2529 1.2% 1071 0.6%

0.5% 2401 1.1% 1376 0.8%

6.2% 15968 7.3% 13080 7.4%

100.0% 218476 100.0% 176717 100.0%

JS BANK

FINANCIAL POSITION

HORIZONTAL ANALYSIS

2018 % 2017 % 2016 %

ASSETS

cash and balances 32111 355.2% 17334 191.7% 15509 171.5%

balances with other banks 969 235.2% 1034 251.0% 753 182.8%

lending of financial instit 1937 17.5% 3116 28.1% 11334 102.3%

investments 148690 176.5% 169612 201.3% 133727 158.7%

advance nets 251991 403.6% 184140 294.9% 93794 150.2%

operating fix assets 8415 223.4% 7113 188.8% 5837 155.0%

deffereed tax assets net 287 100.0% 0 0.0% 0 0.0%

other assets 12354 215.8% 9131 159.5% 6490 113.3%

TOTAL ASSET 456754 258.5% 391479 221.5% 267444 151.3%

LIABILITIES

bills payable 3520 255.1% 3824 277.1% 2544 184.3%

borrowings 96559 191.1% 64557 127.7% 10320 20.4%

deposits and other accounts 321413 295.6% 290078 266.8% 226099 207.9%

subordinated loans 7497 249.9% 4999 166.6% 3000 100.0%

differted tax liabilities 0 0.0% 797 179.1% 1205 270.8%

other liabilities 12148 479.2% 10555 416.4% 7626 300.8%

TOTAL LIABILITIES 441137 269.6% 374810 229.0% 250794 153.3%

EQUITY

share capital 12975 121.0% 10725 100.0% 10725 100.0%

discount on shares -2855 135.6% -2105 100.0% -2105 100.0%

preferrence shares 0 0.0% 1500 100.0% 1500 100.0%

resserves 1712 333.1% 1541 299.8% 1334 259.5%

acc/profit or loss 4821 450.1% 4519 421.9% 3973 371.0%

surplus -1036 -75.3% 490 35.6% 1223 88.9%

TOTAL EQUITY 15617 119.4% 16669 127.4% 16650 127.3%

EQUITY &LIABILITY 456754 258.5% 391479 221.5% 267444 151.3%

2015 % 2014 %

11159 123.4% 9041 100.0%

584 141.7% 412 100.0%

3581 32.3% 11080 100.0%

116030 137.7% 84258 100.0%

76666 122.8% 62433 100.0%

4574 121.4% 3767 100.0%

0 0.0% 0 0.0%

5882 102.7% 5726 100.0%

218476 123.6% 176717 100.0%

1609 116.6% 1380 100.0%

54638 108.1% 50538 100.0%

141840 130.4% 108740 100.0%

0 0.0% 0 0.0%

1695 380.9% 445 100.0%

2724 107.5% 2535 100.0%

202508 123.8% 163637 100.0%

10725 100.0% 10725 100.0%

-2105 100.0% -2105 100.0%

1500 100.0% 1500 100.0%

919 178.8% 514 100.0%

2529 236.1% 1071 100.0%

2401 174.5% 1376 100.0%

15968 122.1% 13080 100.0%

218476 123.6% 176717 100.0%

JS BANK

FINANCIAL POSITION

YEAR TO YEAR ANALYSIS

2018 % 2017 % 2016 %

ASSETS

cash and balances 32111 85.2% 17334 11.8% 15509 39.0%

balances with other banks 969 -6.3% 1034 37.3% 753 28.9%

lending of financial instit 1937 -37.8% 3116 -72.5% 11334 216.5%

investments 148690 -12.3% 169612 26.8% 133727 15.3%

advance nets 251991 36.8% 184140 96.3% 93794 22.3%

operating fix assets 8415 18.3% 7113 21.9% 5837 27.6%

deffereed tax assets net 287 100.0% 0 0.0% 0 0.0%

other assets 12354 35.3% 9131 40.7% 6490 10.3%

TOTAL ASSET 456754 16.7% 391479 46.4% 267444 22.4%

LIABILITIES

bills payable 3520 -7.9% 3824 50.3% 2544 58.1%

borrowings 96559 49.6% 64557 525.6% 10320 -81.1%

deposits and other accounts 321413 10.8% 290078 28.3% 226099 59.4%

subordinated loans 7497 50.0% 4999 66.6% 3000 100.0%

differted tax liabilities 0 -100.0% 797 -33.9% 1205 -28.9%

other liabilities 12148 15.1% 10555 38.4% 7626 180.0%

TOTAL LIABILITIES 441137 17.7% 374810 49.4% 250794 23.8%

EQUITY

share capital 12975 21.0% 10725 0.0% 10725 0.0%

discount on shares -2855 35.6% -2105 0.0% -2105 0.0%

preferrence shares 0 -100.0% 1500 0.0% 1500 0.0%

resserves 1712 11.1% 1541 15.5% 1334 45.2%

acc/profit or loss 4821 6.7% 4519 13.7% 3973 57.1%

surplus -1036 -311.4% 490 -59.9% 1223 -49.1%

TOTAL EQUITY 15617 -6.3% 16669 0.1% 16650 4.3%

EQUITY &LIABILITY 456754 16.7% 391479 46.4% 267444 22.4%

2015 % 2014 %

11159 23.4% 9041 0.0%

584 41.7% 412 0.0%

3581 -67.7% 11080 0.0%

116030 37.7% 84258 0.0%

76666 22.8% 62433 0.0%

4574 21.4% 3767 0.0%

0 0.0% 0 0.0%

5882 2.7% 5726 0.0%

218476 23.6% 176717 0.0%

1609 16.6% 1380 0.0%

54638 8.1% 50538 0.0%

141840 30.4% 108740 0.0%

0 0.0% 0 0.0%

1695 280.9% 445 0.0%

2724 7.5% 2535 0.0%

202508 23.8% 163637 0.0%

10725 0.0% 10725 0.0%

-2105 0.0% -2105 0.0%

1500 0.0% 1500 0.0%

919 78.8% 514 0.0%

2529 136.1% 1071 0.0%

2401 74.5% 1376 0.0%

15968 22.1% 13080 0.0%

218476 23.6% 176717 0.0%

JS BANK

INCOME STATEMENT (IN MILLION)

VERTICAL ANALYSIS

2018 % 2017 %

MARK-UP RETURN 29997 93.3% 20381 83.4%

FEE,COMMI SSION 2669 8.3% 2124 8.7%

GAIN ON SALE OF SECURITIES -1434 -4.5% 1236 5.1%

INCOME FROM DEALING IN FOREIGN CURRENC 688 2.1% 357 1.5%

DIVIDEND INCOME 109 0.3% 167 0.7%

OTHER INCOME 109 0.3% 169 0.7%

TOTAL GROSS INCOME 32138 100.0% 24434 100.0%

MARK-UP EXPENSE 21188 65.9% 14139 57.9%

PROVISION AGINST LOAN & ADVANCE 405 1.3% 203 0.8%

PROVISSION IN VALUE OF INVESTMENT -220 -0.7% 123 0.5%

NON-MARKUP / INTEREST EXPENSE 9859 30.7% 8347 34.2%

TOTAL OPERATING EXPENSE 31233 97.2% 22812 93.4%

PROFIT BEFORE TAXATION 905 2.8% 1621 6.6%

TAXATION 342 1.1% 647 2.6%

PROFIT AFTER TAX 562 1.7% 973 4.0%

JS BANK

INCOME STATEMENT (IN MILLION)

HORIZONTAL ANALYSIS

2018 % 2017 %

MARK-UP RETURN 29997 269.9% 20381 183.4%

FEE,COMMI SSION 2669 319.6% 2124 254.4%

GAIN ON SALE OF SECURITIES -1434 -94.7% 1236 81.6%

INCOME FROM DEALING IN FOREIGN CURRENC 688 252.9% 357 131.3%

DIVIDEND INCOME 109 80.7% 167 123.7%

OTHER INCOME 109 -66.1% 169 -102.4%

TOTAL GROSS INCOME 32138 234.5% 24434 178.3%

MARK-UP EXPENSE 21188 291.9% 14139 194.8%

PROVISION AGINST LOAN & ADVANCE 405 61.6% 203 30.9%

PROVISSION IN VALUE OF INVESTMENT -220 -136.6% 123 76.4%

NON-MARKUP / INTEREST EXPENSE 9859 245.4% 8347 207.8%

TOTAL OPERATING EXPENSE 31233 258.2% 22812 188.6%

PROFIT BEFORE TAXATION 905 56.3% 1621 100.8%

TAXATION 342 62.4% 647 118.1%

PROFIT AFTER TAX 562 53.0% 973 91.8%

JS BANK

INCOME STATEMENT (IN MILLION)

HORIZONTAL ANALYSIS

2018 % 2017 %

MARK-UP RETURN 29997 47.2% 20381 35.1%

FEE,COMMI SSION 2669 25.7% 2124 48.8%

GAIN ON SALE OF SECURITIES -1434 -216.0% 1236 -58.3%

INCOME FROM DEALING IN FOREIGN CURRENC 688 92.7% 357 14.1%

DIVIDEND INCOME 109 -34.7% 167 70.4%

OTHER INCOME 109 -35.5% 169 186.4%

TOTAL GROSS INCOME 32138 31.5% 24434 22.5%

MARK-UP EXPENSE 21188 49.9% 14139 51.2%

PROVISION AGINST LOAN & ADVANCE 405 99.5% 203 -417.2%

PROVISSION IN VALUE OF INVESTMENT -220 -278.9% 123 -70.4%

NON-MARKUP / INTEREST EXPENSE 9859 18.1% 8347 21.9%

TOTAL OPERATING EXPENSE 31233 36.9% 22812 37.8%

PROFIT BEFORE TAXATION 905 -44.2% 1621 -52.2%

TAXATION 342 -47.1% 647 -50.7%

PROFIT AFTER TAX 562 -42.2% 973 -53.2%

NK

NT (IN MILLION)

NALYSIS

2016 % 2015 % 2014 %

15081 75.6% 15328 82.3% 11113 81.1%

1427 7.2% 1124 6.0% 835 6.1%

2965 14.9% 1799 9.7% 1514 11.0%

313 1.6% 288 1.5% 272 2.0%

98 0.5% 85 0.5% 135 1.0%

59 0.3% -6 0.0% -165 -1.2%

19942 100.0% 18618 100.0% 13704 100.0%

9353 46.9% 9738 52.3% 7259 53.0%

-64 -0.3% 675 3.6% 658 4.8%

415 2.1% 141 0.8% 161 1.2%

6848 34.3% 4890 26.3% 4017 29.3%

16552 83.0% 15444 83.0% 12095 88.3%

3390 17.0% 3174 17.0% 1608 11.7%

1313 6.6% 1148 6.2% 548 4.0%

2077 10.4% 2026 10.9% 1060 7.7%

NK

NT (IN MILLION)

ANALYSIS

2016 % 2015 % 2014 %

15081 135.7% 15328 137.9% 11113 100.0%

1427 170.9% 1124 134.6% 835 100.0%

2965 195.8% 1799 118.8% 1514 100.0%

313 115.1% 288 105.9% 272 100.0%

98 72.6% 85 63.0% 135 100.0%

59 -35.8% -6 3.6% -165 100.0%

19942 145.5% 18618 135.9% 13704 100.0%

9353 128.8% 9738 134.2% 7259 100.0%

-64 -9.7% 675 102.6% 658 100.0%

415 257.8% 141 87.6% 161 100.0%

6848 170.5% 4890 121.7% 4017 100.0%

16552 136.8% 15444 127.7% 12095 100.0%

3390 210.8% 3174 197.4% 1608 100.0%

1313 239.6% 1148 209.5% 548 100.0%

2077 195.9% 2026 191.1% 1060 100.0%

NK

NT (IN MILLION)

ANALYSIS

2016 % 2015 % 2014 %

15081 -1.6% 15328 37.9% 11113 0.0%

1427 27.0% 1124 34.6% 835 0.0%

2965 64.8% 1799 18.8% 1514 0.0%

313 8.7% 288 5.9% 272 0.0%

98 15.3% 85 -37.0% 135 0.0%

59 -1083.3% -6 -96.4% -165 0.0%

19942 7.1% 18618 35.9% 13704 0.0%

9353 -4.0% 9738 34.2% 7259 0.0%

-64 -109.5% 675 2.6% 658 0.0%

415 194.3% 141 -12.4% 161 0.0%

6848 40.0% 4890 21.7% 4017 0.0%

16552 7.2% 15444 27.7% 12095 0.0%

3390 6.8% 3174 97.4% 1608 0.0%

1313 14.4% 1148 109.5% 548 0.0%

2077 2.5% 2026 91.1% 1060 0.0%

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Invest in France AgencyDocument34 pagesInvest in France AgencyGaurav MalikPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- MY UNIVERSE Terms - ConditionDocument17 pagesMY UNIVERSE Terms - ConditionparveencarePas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- SGX-Listed InnoTek Disposes Stakes in Two Subsidiaries Resources Re-Allocated To Move Up Value Chain Prepare For Investment in New BusinessDocument3 pagesSGX-Listed InnoTek Disposes Stakes in Two Subsidiaries Resources Re-Allocated To Move Up Value Chain Prepare For Investment in New BusinessWeR1 Consultants Pte LtdPas encore d'évaluation

- Insurance Company in BD Term PaperDocument19 pagesInsurance Company in BD Term PaperHabibur RahmanPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Financial Services BBM NotesDocument44 pagesFinancial Services BBM Notesmanjunatha TKPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Ethics PPT FinalDocument17 pagesEthics PPT Finalsaikiran0% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Case Analysis - Arundel PartnersDocument4 pagesCase Analysis - Arundel PartnersEduardo Mira25% (4)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Finman 1-4 SummaryDocument8 pagesFinman 1-4 SummaryEliePas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Saa Group Acca P4 Mock 2011Document9 pagesSaa Group Acca P4 Mock 2011afzal_abjaniPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Sara's Options AnalysisDocument14 pagesSara's Options AnalysisGaurav ThakurPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Sarfaesi Act, 2002Document15 pagesSarfaesi Act, 2002Sanjay VaishyPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- BCRDocument13 pagesBCRAnca MahaleanPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Financial Accounting 2 Chapter 4Document27 pagesFinancial Accounting 2 Chapter 4Elijah Lou ViloriaPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- KPJ - 180817 - 2Q18 - AdbsDocument5 pagesKPJ - 180817 - 2Q18 - AdbsMohdRizalFitriPas encore d'évaluation

- Project Report Portfolio Management ServicesDocument4 pagesProject Report Portfolio Management ServicesmanshimakatiPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Meaning and Definition of AccountingDocument13 pagesMeaning and Definition of AccountingArjun SrinivasPas encore d'évaluation

- Product Sails5nwudeDocument10 pagesProduct Sails5nwuderakeshraj mahakudPas encore d'évaluation

- 40 'Invaluable' Investing Lessons From Tony DedenDocument20 pages40 'Invaluable' Investing Lessons From Tony DedenCGrenga100Pas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- S&C - Volume, The Forgotten Oscillator PDFDocument6 pagesS&C - Volume, The Forgotten Oscillator PDFAntonio Zikos100% (1)

- AAII-My Investment Letter Words of Advice For My GrandchildrenDocument5 pagesAAII-My Investment Letter Words of Advice For My Grandchildrenbhaskar.jain20021814Pas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- IGNOU Elements of Income Tax Question Paper Free Download B.com June 2017Document4 pagesIGNOU Elements of Income Tax Question Paper Free Download B.com June 2017Rainy GoodwillPas encore d'évaluation

- Collapse of The Thai BahtDocument5 pagesCollapse of The Thai BahtShakil AlamPas encore d'évaluation

- OptionsMDSystem (MD)Document13 pagesOptionsMDSystem (MD)Andreas0% (1)

- Lecture16 DerivativeMarketsDocument17 pagesLecture16 DerivativeMarketsRubeenaPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Overview of Underground Gas Storage in The WorldDocument16 pagesOverview of Underground Gas Storage in The WorldSuvam PatelPas encore d'évaluation

- Acknowledgement: MANISHA SIKKA - I Would Also Like To Express My Thanks To My Guide in ThisDocument77 pagesAcknowledgement: MANISHA SIKKA - I Would Also Like To Express My Thanks To My Guide in ThisAnil BatraPas encore d'évaluation

- Manpreet Kaur: MJR Invest & Financial RemediesDocument2 pagesManpreet Kaur: MJR Invest & Financial Remediesmaakabhawan26Pas encore d'évaluation

- Definition of TermsDocument8 pagesDefinition of TermsMark Luigi DeTomas RosarioPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Theresa Wulff ResumeDocument3 pagesTheresa Wulff ResumemomnpopPas encore d'évaluation

- Methods of Research FINALDocument54 pagesMethods of Research FINALCarmela TeodoroPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)