Académique Documents

Professionnel Documents

Culture Documents

Fin Model Class9 Merger Model Using DCF Methodology

Transféré par

Gel viraTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Fin Model Class9 Merger Model Using DCF Methodology

Transféré par

Gel viraDroits d'auteur :

Formats disponibles

Taesong,Inc. wishes to make a tender offer for the Goodman Air Conditioning Corp.

, a business that is strategically attractive to Taesong

If acquired, Goodman will continue to operate as a stand alone busness due to the uniqueness of its operations.

Hence Taesong's valuation of Goodman wil be based on Goodman's cost of capital.

We wish to calculate the intrinsic value of Goodman's operations ( the target firm).

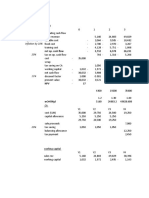

INPUT FOR WACC CALCULATION:

Bidder Target

Taesong Goodman

input--- > YTM: R(d) 6.00% 7.00%

input--- > Tax Rate,T 40.00% 40.00%

After Tax Cost of Debt: R(d)*(1-T) 3.60% 4.20%

input--- > Beta 1.50 2.00

input--- > MRP : R(m) - R(f) 7.00% 7.00%

input--- > 10 Year T-Bond, R(f) 5.00% 5.00%

Cost of equity,R(e),use CAPM 15.50% 19.00%

input--- > Debt weight ,W(d) 35% 40%

input--- > Equity weight,W(e) 65% 60%

WACC: r, calculation 11.34% 13.08%

INPUT FOR TARGET FIRM :

input--- > Revenue Growth <= 5 yrs 5.00%

input--- > Perpetual Constant Growth > 5 yrs 3.50%

input--- > COGS as % of Revenue 60.00%

input--- > Operating Expense as % of Revenue 18.00%

input--- > Depreciation (st. line) 850

WACC (Target Firm) 13.08%

Tax rate 40.00%

input--- > Operating Working Capital as % of Revenue 20.00%

input--- > CAPEX per year 1,500.0

Time = 0 1 2 3 4 5

Revenue 9,434 9,906 10,401 10,921 11,467 12,040

COGS 5,943 6,241 6,553 6,880 7,224

Gross Profit 3,962 4,160 4,368 4,587 4,816

Operating Expense 1,783 1,872 1,966 2,064 2,167

Depreciation (st. line) 850 850 850 850 850

EBIT 1,329 1,438 1,553 1,673 1,799

CAPEX 1,500 1,500 1,500 1,500 1,500

Tax 532 575 621 669 720

OWC 1,887 1,981 2,080 2,184 2,293 2,408

∆OWC (94) (99) (104) (109) (115)

Unlevered Free Cash Flow: UFCF 53 114 178 244 315

note: UFCF= EBIT +DEPREC + ∆OWC-CAPEX-TAX

Present Value from T = 1 to 5 years= $ 579

Terminal Value (PV @ T+5 of perpetuity) $ 3,400

Present Value of Terminal Value= $ 1,839 DATATABLE TWO-WAY: EFFECT OF WACC AND PERPETUAL GROWTH RATE ON EV

Enterprise Value = $ 2,417 Perpetual Growth Rate

EFFECT OF WACC & LT_GROWTH ON EV

note: intrinsic value of Target Operations $ 2,417 2.50% 3.00% 3.50% 4.00% 4.50% 2,000

1,900

11.00% 1,800

1,700

Remark: 12.00% 1,600

1,500

Often in a merger, the capital structure of Target will change , especially during first few years after the merger WACC= 13.08% 1,400

1,300

This will cause the WACC to not be a constant, but instead will change from year to year 14.00% 1,200

1,100

1,000

If capital structure is not constant then valuation model needs to enable a dynamic WACC variable 15.00% 2.50% 3.00% 3.50% 4.00% 4.50%

GROWTH RATE

WACC_11% WACC_12% WACC_13% WACC_14% WACC_15%

% CHANGE FROM BASE ESTIMATE

Perpetual Growth Rate

2.50% 3.00% 3.50% 4.00% 4.50%

11.00% #VALUE! #VALUE! #VALUE! #VALUE! #VALUE!

12.00% #VALUE! #VALUE! #VALUE! #VALUE! #VALUE!

WACC= 13.08% #VALUE! #VALUE! #VALUE! #VALUE! #VALUE!

14.00% #VALUE! #VALUE! #VALUE! #VALUE! #VALUE!

15.00% #VALUE! #VALUE! #VALUE! #VALUE! #VALUE!

Vous aimerez peut-être aussi

- Equity Valuation: Models from Leading Investment BanksD'EverandEquity Valuation: Models from Leading Investment BanksJan ViebigPas encore d'évaluation

- Corporate Valuation: Group - 2Document6 pagesCorporate Valuation: Group - 2RiturajPaulPas encore d'évaluation

- E&FB ABP HandoutsDocument10 pagesE&FB ABP HandoutsAishwarya HetawalPas encore d'évaluation

- Quiz # 6Document2 pagesQuiz # 6arslan mumtazPas encore d'évaluation

- Class 1 7th Feb OxygenDocument17 pagesClass 1 7th Feb OxygenAmit JainPas encore d'évaluation

- Variable Costs R/tonneDocument3 pagesVariable Costs R/tonneChemEngGirl89Pas encore d'évaluation

- 1cr4dm8kl 930744Document4 pages1cr4dm8kl 930744DGLPas encore d'évaluation

- Dashboard - SAI - PreviewReports - 2011Document73 pagesDashboard - SAI - PreviewReports - 2011Oh Oh OhPas encore d'évaluation

- Sampa Video Solution Harvard Case Solution 1Document10 pagesSampa Video Solution Harvard Case Solution 1Héctor SilvaPas encore d'évaluation

- Valuasi InvestasiDocument1 pageValuasi Investasizilaratul ziahPas encore d'évaluation

- EVA Vyaderm Case QDocument14 pagesEVA Vyaderm Case QMANSI SHARMAPas encore d'évaluation

- Flujos de Expansi N. Simulador. 2019 Unidad 1Document6 pagesFlujos de Expansi N. Simulador. 2019 Unidad 1yoki cortezPas encore d'évaluation

- To Calculate Equity Value Through DCF Analysis: DATA INPUTS - Those Highlighted Are Those GivenDocument4 pagesTo Calculate Equity Value Through DCF Analysis: DATA INPUTS - Those Highlighted Are Those GivenYash ModiPas encore d'évaluation

- Acf Final Manish 42987Document24 pagesAcf Final Manish 42987Raman SrinivasanPas encore d'évaluation

- Investment and Portfolio ManagementDocument3 pagesInvestment and Portfolio ManagementHAMZA WAHEEDPas encore d'évaluation

- Income StatementDocument2 pagesIncome StatementChille Nchimunya BwalyaPas encore d'évaluation

- Petroleum EconomicsDocument37 pagesPetroleum Economicsaa100% (1)

- Docshare - Tips - Sampa Video Solution Harvard Case Solution PDFDocument10 pagesDocshare - Tips - Sampa Video Solution Harvard Case Solution PDFnimarPas encore d'évaluation

- Power Plant Financial AnalysisDocument16 pagesPower Plant Financial AnalysisGaurav BasnyatPas encore d'évaluation

- Daily Revenue Report DT Business Bay: 02 March 2021Document1 pageDaily Revenue Report DT Business Bay: 02 March 2021Jeric VendiolaPas encore d'évaluation

- FM09 CH 10 Im PandeyDocument19 pagesFM09 CH 10 Im PandeyJack mazePas encore d'évaluation

- 7-Basic - Model - FSA - 2 (Tax) - Rev-5Document14 pages7-Basic - Model - FSA - 2 (Tax) - Rev-5kIkiPas encore d'évaluation

- A. CF - 500 Tine 5 Years Discount Rate 10% PV $310.46 B. PV $1,895.39 C. Time 50 Years PV $4,957.41 D. Time 100 Years PV $4,999.64Document11 pagesA. CF - 500 Tine 5 Years Discount Rate 10% PV $310.46 B. PV $1,895.39 C. Time 50 Years PV $4,957.41 D. Time 100 Years PV $4,999.64Hoàng QuânPas encore d'évaluation

- Basic Assumptions: Particulars ($000) 2001 2002 E 2003 EDocument7 pagesBasic Assumptions: Particulars ($000) 2001 2002 E 2003 EMuskan ValbaniPas encore d'évaluation

- Case01 02Document24 pagesCase01 02Sakshi SharmaPas encore d'évaluation

- Final CaseDocument25 pagesFinal CaseSakshi SharmaPas encore d'évaluation

- Assignment 2. Estimating Adidas' Equity ValueDocument4 pagesAssignment 2. Estimating Adidas' Equity Valuefasihullah1995Pas encore d'évaluation

- A&f - Group Assignment - Assignment 2Document8 pagesA&f - Group Assignment - Assignment 2lavaniaPas encore d'évaluation

- Allied Sugar Company!!: Financial SummaryDocument2 pagesAllied Sugar Company!!: Financial SummaryFawad Ejaz BhattíPas encore d'évaluation

- MFA Test 1 SolutionDocument4 pagesMFA Test 1 SolutionMuhammad ImranPas encore d'évaluation

- The Bussines TempleyDocument41 pagesThe Bussines TempleyJUNIORS B7 “JUNIORS B7”Pas encore d'évaluation

- Project 1Document5 pagesProject 1Avengers HeroesPas encore d'évaluation

- Kim's Value Profit and Loss Account Notes Operating Capacity 1 2 3Document10 pagesKim's Value Profit and Loss Account Notes Operating Capacity 1 2 3sulthanhakimPas encore d'évaluation

- Advanced Corporate Finance Case 2Document3 pagesAdvanced Corporate Finance Case 2Adrien PortemontPas encore d'évaluation

- Airthread Acquisition: Income StatementDocument31 pagesAirthread Acquisition: Income StatementnidhidPas encore d'évaluation

- SharathDocument7 pagesSharathRiturajPaulPas encore d'évaluation

- The Bell 07 October 2010Document3 pagesThe Bell 07 October 2010Khawaja UsmanPas encore d'évaluation

- All Equity Financing: Particulars ($000) 2001 2002 E 2003 E 2004E 2005E 2006 EDocument7 pagesAll Equity Financing: Particulars ($000) 2001 2002 E 2003 E 2004E 2005E 2006 EMuskan ValbaniPas encore d'évaluation

- Apple RatiosDocument19 pagesApple RatiosJims Leñar CezarPas encore d'évaluation

- LBO Valuation - Working File CV2Document5 pagesLBO Valuation - Working File CV2Ayushi GuptaPas encore d'évaluation

- Bajaj Auto Project TestDocument61 pagesBajaj Auto Project TestSauhard Sachan0% (1)

- Group Project 2 Sabry Zamato SolutionDocument5 pagesGroup Project 2 Sabry Zamato SolutionSyafahani SafiePas encore d'évaluation

- Hola-Kola: Section: E05 Group Number: G04 Name of ParticipantsDocument7 pagesHola-Kola: Section: E05 Group Number: G04 Name of ParticipantsSuvinay SethPas encore d'évaluation

- Excel Showing Demonstration After Liquidity CalculationsDocument12 pagesExcel Showing Demonstration After Liquidity CalculationsGLORIA GUINDOS BRETONESPas encore d'évaluation

- Calculations of LiquidityDocument10 pagesCalculations of LiquidityGLORIA GUINDOS BRETONESPas encore d'évaluation

- Analisa Eva WaccDocument14 pagesAnalisa Eva WaccNur Maulidyah AzizahPas encore d'évaluation

- Fund Raising Financials 2020 (Updated)Document24 pagesFund Raising Financials 2020 (Updated)Abhishek SinghPas encore d'évaluation

- 23 Nov 2018 Mixed Questions With Solutions PDFDocument9 pages23 Nov 2018 Mixed Questions With Solutions PDFLaston MilanziPas encore d'évaluation

- Valuations Chapter 05 ProblemsDocument6 pagesValuations Chapter 05 Problemsdakis cherishjoyfPas encore d'évaluation

- Confusion Plcs SolutionsDocument8 pagesConfusion Plcs SolutionsJen Hang WongPas encore d'évaluation

- Income Statement: Period Ending December Actual Estimated RevenueDocument5 pagesIncome Statement: Period Ending December Actual Estimated RevenueengyPas encore d'évaluation

- Cost Sheet - GenX - Team 4 .2Document7 pagesCost Sheet - GenX - Team 4 .2sanketmistry32Pas encore d'évaluation

- Business Reports of The Sector: Period: 3Document5 pagesBusiness Reports of The Sector: Period: 3Shivran RoyPas encore d'évaluation

- Checklist - Roto Pumps Limited FY 18-19Document6 pagesChecklist - Roto Pumps Limited FY 18-19Shubham SinuPas encore d'évaluation

- Larsen & Toubro: On TrackDocument9 pagesLarsen & Toubro: On TrackalparathiPas encore d'évaluation

- Puzzle + Accounting AssignmentDocument6 pagesPuzzle + Accounting AssignmentAli RebbajPas encore d'évaluation

- AssignmentDocument6 pagesAssignmentAnkita KumariPas encore d'évaluation

- Assumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4Document2 pagesAssumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4PranshuPas encore d'évaluation

- All Workings Are in $'000 Inflation by 8% Sales Revenue Inflation by 4% Variable Cost Inflation by 10% Fixed CostDocument2 pagesAll Workings Are in $'000 Inflation by 8% Sales Revenue Inflation by 4% Variable Cost Inflation by 10% Fixed CostWafa ObaidPas encore d'évaluation

- Class1 Class2 Balance Sheet SlidesDocument15 pagesClass1 Class2 Balance Sheet SlidesGel viraPas encore d'évaluation

- Fin Model Class10 Portfolio Optimization Sharpe Ratio Solver AnalysisDocument10 pagesFin Model Class10 Portfolio Optimization Sharpe Ratio Solver AnalysisGel viraPas encore d'évaluation

- Fin Model Class10 Portfolio Optimization Sharpe Ratio Solver AnalysisDocument10 pagesFin Model Class10 Portfolio Optimization Sharpe Ratio Solver AnalysisGel viraPas encore d'évaluation

- Fin Model Class9 Regression Examples LR MLR NLRDocument69 pagesFin Model Class9 Regression Examples LR MLR NLRGel viraPas encore d'évaluation

- Fin Model Class4 Optimal Capital BudgetingDocument25 pagesFin Model Class4 Optimal Capital BudgetingGel viraPas encore d'évaluation

- Fin Model Class7 Financial Statement Connections SlidesDocument8 pagesFin Model Class7 Financial Statement Connections SlidesGel viraPas encore d'évaluation

- Fin Model Class6 Stock Selection Portfolio Model AnswerDocument5 pagesFin Model Class6 Stock Selection Portfolio Model AnswerGel viraPas encore d'évaluation

- Class1 Class2 Cash Flow Statement SlidesDocument10 pagesClass1 Class2 Cash Flow Statement SlidesGel viraPas encore d'évaluation

- Fin Model Class7 Verizon Model DCF AnswerDocument15 pagesFin Model Class7 Verizon Model DCF AnswerGel viraPas encore d'évaluation

- Fin Model Class6 Using Excel Financial Functions Part 1 RevisedDocument357 pagesFin Model Class6 Using Excel Financial Functions Part 1 RevisedGel viraPas encore d'évaluation

- Fin Model Class4 Walmart Datatable Proj Cfo Sensitivity To Rev Cogs.Document10 pagesFin Model Class4 Walmart Datatable Proj Cfo Sensitivity To Rev Cogs.Gel vira0% (1)

- Fin - Model - Class7 - Financial - Ratios - SlidesDocument12 pagesFin - Model - Class7 - Financial - Ratios - SlidesGel viraPas encore d'évaluation

- Fin Model Class4 Walmart Proj Revenue Eps Cfo SimulationDocument16 pagesFin Model Class4 Walmart Proj Revenue Eps Cfo SimulationGel viraPas encore d'évaluation

- Fin Model Class4 Optimal Capital Budget Merck HomeworkDocument4 pagesFin Model Class4 Optimal Capital Budget Merck HomeworkGel viraPas encore d'évaluation

- Class1 Class2 Balance Sheet SlidesDocument15 pagesClass1 Class2 Balance Sheet SlidesGel viraPas encore d'évaluation

- Fin Model Class6 Verizon Model DCF HomeworkDocument16 pagesFin Model Class6 Verizon Model DCF HomeworkGel viraPas encore d'évaluation

- Class1 Class2 Cash Flow Statement SlidesDocument10 pagesClass1 Class2 Cash Flow Statement SlidesGel viraPas encore d'évaluation

- Fin Model Class6 Valuation SlidesDocument29 pagesFin Model Class6 Valuation SlidesGel viraPas encore d'évaluation

- Fin Model Class11 Efficient Frontier Sharpe Optimization AnswerDocument7 pagesFin Model Class11 Efficient Frontier Sharpe Optimization AnswerGel viraPas encore d'évaluation

- Fin Model Class1 Class3 Using Excel Financial Functions Part 1Document357 pagesFin Model Class1 Class3 Using Excel Financial Functions Part 1Gel viraPas encore d'évaluation

- Class1 Class2 Balance Sheet SlidesDocument15 pagesClass1 Class2 Balance Sheet SlidesGel viraPas encore d'évaluation

- Class1 Class2 Income Statement SlidesDocument14 pagesClass1 Class2 Income Statement SlidesGel viraPas encore d'évaluation

- Midterm Exam GFGB 6005 003 Fall 2019 Excel Problems QuestionsDocument55 pagesMidterm Exam GFGB 6005 003 Fall 2019 Excel Problems QuestionsGel viraPas encore d'évaluation

- Fin Model Class12 Tracking Risk OptimizationDocument8 pagesFin Model Class12 Tracking Risk OptimizationGel viraPas encore d'évaluation

- Fin Model Class5 Cash Statement Cfa Exam Mult Choice ReviewDocument17 pagesFin Model Class5 Cash Statement Cfa Exam Mult Choice ReviewGel viraPas encore d'évaluation

- Midterm Exam GFGB 6005 003 Fall 2019 Answer Doc FileDocument13 pagesMidterm Exam GFGB 6005 003 Fall 2019 Answer Doc FileGel viraPas encore d'évaluation

- Fin Model Class11 Efficient Frontier Using Market ModelDocument5 pagesFin Model Class11 Efficient Frontier Using Market ModelGel vira100% (1)

- Fin Model Class5 Cash Statement Cfa Exam Mult Choice ReviewDocument17 pagesFin Model Class5 Cash Statement Cfa Exam Mult Choice ReviewGel viraPas encore d'évaluation

- Fin Model Class3 Excel Problem Review AnswersDocument4 pagesFin Model Class3 Excel Problem Review AnswersGel viraPas encore d'évaluation

- Fin Model Class13 Logistic Regression QuestionDocument12 pagesFin Model Class13 Logistic Regression QuestionGel viraPas encore d'évaluation

- Qwest Communication: By: Keyrane. KDocument14 pagesQwest Communication: By: Keyrane. KKEYRANE KOUAMEPas encore d'évaluation

- Argus Coalindo Indonesian Coal Index Report PDFDocument2 pagesArgus Coalindo Indonesian Coal Index Report PDFEko RubiartantoPas encore d'évaluation

- Determinantsof Capital Structure Evidencefrom JordanDocument14 pagesDeterminantsof Capital Structure Evidencefrom JordanFaycal BenhalimaPas encore d'évaluation

- Century 21 Broker Properti Jual Beli Sewa Rumah IndonesiaDocument2 pagesCentury 21 Broker Properti Jual Beli Sewa Rumah IndonesiaAyunk SyahPas encore d'évaluation

- Non-Resident Alien Engaged in Business in The Phil: Income Tax RR2Document8 pagesNon-Resident Alien Engaged in Business in The Phil: Income Tax RR2Jm CruzPas encore d'évaluation

- GCU Technical Approach and MethodologyDocument13 pagesGCU Technical Approach and Methodologyqsultan100% (2)

- Hedging Strategies Using FuturesDocument43 pagesHedging Strategies Using Futuresnischal mathurPas encore d'évaluation

- Certified Credit Research Analyst (CCRA) : Syllabus Section 1Document2 pagesCertified Credit Research Analyst (CCRA) : Syllabus Section 1Aniket VarshneyPas encore d'évaluation

- The New Government Accounting System Manual For Local Government Units Chapter 1. IntroductionDocument34 pagesThe New Government Accounting System Manual For Local Government Units Chapter 1. IntroductionaisahPas encore d'évaluation

- Review SchedDocument6 pagesReview SchedVince AbabonPas encore d'évaluation

- Admissionado 50 MBA Essays That Worked 1 PDFDocument86 pagesAdmissionado 50 MBA Essays That Worked 1 PDFmurariPas encore d'évaluation

- Devyani ArDocument313 pagesDevyani ArAnirudh AgarwalPas encore d'évaluation

- Company Accounts Statutory BooksDocument21 pagesCompany Accounts Statutory BooksChandru SivaPas encore d'évaluation

- Bab 2Document6 pagesBab 2Elsha Cahya Inggri MaharaniPas encore d'évaluation

- Taxation Case Digest2Document242 pagesTaxation Case Digest2Kevin LavinaPas encore d'évaluation

- Company Law 23 NotesDocument15 pagesCompany Law 23 NotesChirag8076Pas encore d'évaluation

- Om - Schemes.scams - And.swindles - Ebook EEnDocument187 pagesOm - Schemes.scams - And.swindles - Ebook EEnGjuro14Pas encore d'évaluation

- E-Marketing of Financial Product & Services: Summer Training Project ReportDocument112 pagesE-Marketing of Financial Product & Services: Summer Training Project Reportsanjay kumarPas encore d'évaluation

- Lecture On Shareholders' EquityDocument3 pagesLecture On Shareholders' EquityevaPas encore d'évaluation

- Abm-11 Organization-And-management q1 w3 Mod3Document12 pagesAbm-11 Organization-And-management q1 w3 Mod3Edsel EscoberPas encore d'évaluation

- VSR CalculatorDocument7 pagesVSR Calculatorgharavii2063Pas encore d'évaluation

- Ra 7653Document17 pagesRa 7653Sherna Adil100% (2)

- Price Action Trading Introduction - Learn To TradeDocument8 pagesPrice Action Trading Introduction - Learn To Tradeimamitohm75% (4)

- #87071239Document4 pages#87071239Anonymous in4fhbdwkPas encore d'évaluation

- Section 1. Venue of Real ActionsDocument12 pagesSection 1. Venue of Real ActionsPnp KaliboPas encore d'évaluation

- AP 004 D.1 Audit If Investments Prob. 1Document1 pageAP 004 D.1 Audit If Investments Prob. 1Loid Gumera LenchicoPas encore d'évaluation

- Vertical Balance SheetDocument14 pagesVertical Balance Sheetabhi82% (11)

- Investment Banks, Hedge Funds and Private Equity: The New ParadigmDocument16 pagesInvestment Banks, Hedge Funds and Private Equity: The New ParadigmPrashantKPas encore d'évaluation

- Euro Tunnel Delay and Cost Overruns 230311Document3 pagesEuro Tunnel Delay and Cost Overruns 230311Ayomiku SowemimoPas encore d'évaluation

- ch12 - Debt FinancingDocument60 pagesch12 - Debt Financingsongvuthy100% (1)