Académique Documents

Professionnel Documents

Culture Documents

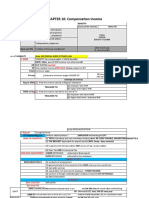

199A Income Tax Flowchart

Transféré par

Michael Auer0 évaluation0% ont trouvé ce document utile (0 vote)

27 vues1 pageIncome tax flowchart for 199A issue

Titre original

(7) 199A income tax flowchart

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentIncome tax flowchart for 199A issue

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

27 vues1 page199A Income Tax Flowchart

Transféré par

Michael AuerIncome tax flowchart for 199A issue

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

(7) 199A

1. What is " qualified 2. Deduction Amount 3. Apply after SD, in addition to it

business income?" Only 20% of QIB if other wages, too. (or BTL, if applicable).

Phase-In b/w

Income in Trade and 157,500 & 207,500

Business from sole (a) If significant other wages:

propreitorship PASS IFF Naughty List Deduct: 20% of QIB income (net

THROUGH taxation. -> Ie Uber (b) but TI is less income -> includes gains, losses,

driver. than 157,500 + minus expenses).

50k -> then.

Excludes:

(a) Income as employee; (1) Calculate "app.

(b) If insignificant wages:

percent". [(TI -

Deduct: 20% taxable income

(b) IF income is > $157k (314 157,500) /

(post BTL/SD).

married) -> phase in health, (50,000)].

law, accounting, actuarial, (2) Multiply QBI by

performing arts, consulting, the "app. percent."

athetics, financial services, (3) Take this Example A: Uber Example B: Uber

brokerage services, or other portio of driver makes $55k in driver makes

job where skill of 1 or more deduciton and cash; spends $5k on $55k in cash,

employees is principal asset continue. . gas/uber expenses. spends $5k on

Also makes 40k in gas/uber

(c) IF income > 207,500 (2x regular wages as expenses. Makes

for joint) then COMPLETLEY employee. no wages as

excluded as a "naughty lister" employee.

1. QIB = (55 - 5) =

[engineers and architechts are 50k; 1. QIB = (55 - 5)

fine]. 2. 199A = QIB x .2 = = 50k.

Full deduciton 10k; 2. 199A = QIB x

cannot be more 3. Taxable income = .2 =10k.

than 50% of W-2 Adjst Gross. (90k) - 3. TI = 50k - 12k

wages for these (12k) standard btl = = 38k

people. 78k. 4. TI x .2 = 7,600

4. TI x .2 = 15.6k. 5. 10k > 7.6k

High-Income Taxpayers 5. 10k < 15.6k. TAKE TAKE 7.6k. from

(naughty list $$ thres, but for 10k. from TI. TI.

all people) MUST have

employees or depreciable

property to take advantage of

this.

Vous aimerez peut-être aussi

- Accomplice Liability and Criminal Attempt ExplainedDocument60 pagesAccomplice Liability and Criminal Attempt ExplainedMichael AuerPas encore d'évaluation

- Jt20 ManualDocument201 pagesJt20 Manualweider11Pas encore d'évaluation

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument7 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaSARAVANAN PPas encore d'évaluation

- DMGT403 Accounting For Managers PDFDocument305 pagesDMGT403 Accounting For Managers PDFpooja100% (1)

- Trend Graphs - Sample AnswerDocument4 pagesTrend Graphs - Sample AnswerannieannsPas encore d'évaluation

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsD'EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsPas encore d'évaluation

- Labor Law Outline Fall 2014Document47 pagesLabor Law Outline Fall 2014Michael AuerPas encore d'évaluation

- Income-Tax-Calculator 2023-24Document8 pagesIncome-Tax-Calculator 2023-24AlokPas encore d'évaluation

- Iso 16399-2014-05Document52 pagesIso 16399-2014-05nadim100% (1)

- S 20A Specification Forms PDFDocument15 pagesS 20A Specification Forms PDFAlfredo R Larez0% (1)

- Organic Evolution (Evolutionary Biology) Revised Updated Ed by Veer Bala RastogiDocument1 212 pagesOrganic Evolution (Evolutionary Biology) Revised Updated Ed by Veer Bala RastogiTATHAGATA OJHA83% (6)

- ACCA MOCK FINANCIAL REPORTING MARCH 21 ANSWERSDocument15 pagesACCA MOCK FINANCIAL REPORTING MARCH 21 ANSWERSnoor ul anumPas encore d'évaluation

- Method Statement Pressure TestingDocument15 pagesMethod Statement Pressure TestingAkmaldeen AhamedPas encore d'évaluation

- TheSun 2008-11-04 Page16 Asian Stocks Rally Continues On Policy HopesDocument1 pageTheSun 2008-11-04 Page16 Asian Stocks Rally Continues On Policy HopesImpulsive collectorPas encore d'évaluation

- 2016-08-03 Iot Global Forecast Analysis 2015-2025Document65 pages2016-08-03 Iot Global Forecast Analysis 2015-2025Hoang ThanhhPas encore d'évaluation

- Corporate Tax Planning & Management Mid-Term AssessmentDocument3 pagesCorporate Tax Planning & Management Mid-Term AssessmentChirag JainPas encore d'évaluation

- Income Tax Volume 2 Answer KeyDocument137 pagesIncome Tax Volume 2 Answer KeyManish RajPas encore d'évaluation

- @ProCA - Inter Income Tax Book Vol 2 Solution May2022Document139 pages@ProCA - Inter Income Tax Book Vol 2 Solution May2022Indhuja MPas encore d'évaluation

- Direct Tax SolutionsDocument8 pagesDirect Tax SolutionsGaurav SoniPas encore d'évaluation

- Tax Computation - 2019 PDFDocument1 pageTax Computation - 2019 PDFJurex JustinianPas encore d'évaluation

- Assignment - Chapter 2 (Due 09.20.20)Document5 pagesAssignment - Chapter 2 (Due 09.20.20)Tenaj KramPas encore d'évaluation

- Corporate TaxDocument48 pagesCorporate TaxNidzSinghPas encore d'évaluation

- Add: Proposeddiv / Interim DivDocument2 pagesAdd: Proposeddiv / Interim DivOp BoyPas encore d'évaluation

- Developed By-Office Automation Division, IIT Kanpur Page No.1Document2 pagesDeveloped By-Office Automation Division, IIT Kanpur Page No.1Kishan OmarPas encore d'évaluation

- Chapter 3 PI and III In-Class SolutionsDocument7 pagesChapter 3 PI and III In-Class Solutionsjcnqcqbkv6Pas encore d'évaluation

- Understanding Compensation Income TaxationDocument78 pagesUnderstanding Compensation Income TaxationAnabel Lajara AngelesPas encore d'évaluation

- SS Tutorial 3 Sample ExamDocument4 pagesSS Tutorial 3 Sample ExamFeahRafeah KikiPas encore d'évaluation

- Tax Return Summary for Tony & Jeannie NelsonDocument24 pagesTax Return Summary for Tony & Jeannie Nelsonさくら樱花Pas encore d'évaluation

- T2 Revised Ans. (PS & ITA)Document8 pagesT2 Revised Ans. (PS & ITA)alvinmono.718Pas encore d'évaluation

- Assurance IP 1 Week 1Document1 pageAssurance IP 1 Week 1rui zhangPas encore d'évaluation

- Solution Test 1Document3 pagesSolution Test 1anis izzatiPas encore d'évaluation

- STT - Mock - Test - S-24 - Suggested AnswersDocument8 pagesSTT - Mock - Test - S-24 - Suggested AnswersabdullahPas encore d'évaluation

- Income Taxation Mcqs&ProblemsDocument14 pagesIncome Taxation Mcqs&ProblemsJayrald LacabaPas encore d'évaluation

- B.Com Capital Expenditure Decision Study MaterialDocument32 pagesB.Com Capital Expenditure Decision Study MaterialKRISHNENDU JASHPas encore d'évaluation

- Notes For Income tax-IIDocument10 pagesNotes For Income tax-IIDr.M.KAMARAJ M.COM., M.Phil.,Ph.D100% (1)

- Tax Assignment 1Document8 pagesTax Assignment 1Jiaxi WPas encore d'évaluation

- Cash Flow Estimations /how To Project Cash FlowsDocument18 pagesCash Flow Estimations /how To Project Cash FlowsShafqat RabbaniPas encore d'évaluation

- NPO Pp. 1182 1211Document30 pagesNPO Pp. 1182 1211Ralphjersy AlmendrasPas encore d'évaluation

- Calculating Relief Under Section 89(iDocument3 pagesCalculating Relief Under Section 89(issvrPas encore d'évaluation

- Illustration 1Document9 pagesIllustration 1Thanos The titanPas encore d'évaluation

- UNIT-4 - Income-From-BusinessDocument114 pagesUNIT-4 - Income-From-BusinessGuineverePas encore d'évaluation

- Inter CA DT Revision Notes For Nov 21Document126 pagesInter CA DT Revision Notes For Nov 21chalu account100% (2)

- F1 Kaplan ADocument46 pagesF1 Kaplan Alameck noah zuluPas encore d'évaluation

- Solution Test 2 (1) June 19Document5 pagesSolution Test 2 (1) June 19Nur Dina AbsbPas encore d'évaluation

- New Tax Rates vs Existing Tax Rates for IndividualsDocument2 pagesNew Tax Rates vs Existing Tax Rates for IndividualsCA Upendra Singh ThakurPas encore d'évaluation

- T2 Ans. (PS & ITA)Document8 pagesT2 Ans. (PS & ITA)KY LawPas encore d'évaluation

- Salaried Tax Calculator Ay 23-24Document2 pagesSalaried Tax Calculator Ay 23-24Proddut BasakPas encore d'évaluation

- Income Tax Calculator FY 2014 15Document2 pagesIncome Tax Calculator FY 2014 15atul bansalPas encore d'évaluation

- Tax implications of share listing for investment holding companyDocument15 pagesTax implications of share listing for investment holding companyFakhrul Azman NawiPas encore d'évaluation

- Fac2601-2013-6 - Answers PDFDocument9 pagesFac2601-2013-6 - Answers PDFcandicePas encore d'évaluation

- TaxationsDocument12 pagesTaxationsKansal AbhishekPas encore d'évaluation

- 5-Advanced Accounts Mock KeyDocument16 pages5-Advanced Accounts Mock Keydiyaj003Pas encore d'évaluation

- BCOE-142 December 2022Document12 pagesBCOE-142 December 2022SanjeetPas encore d'évaluation

- Model Solution: Page 1 of 6Document6 pagesModel Solution: Page 1 of 6ShuvonathPas encore d'évaluation

- Class 1 7th Feb OxygenDocument17 pagesClass 1 7th Feb OxygenAmit JainPas encore d'évaluation

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument8 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaGeetanjali BarejaPas encore d'évaluation

- DT May 23 in 50 PagesDocument15 pagesDT May 23 in 50 PagesShivaji hariPas encore d'évaluation

- How To Save Tax For Salary Above 20 LakhsDocument12 pagesHow To Save Tax For Salary Above 20 LakhsvijaytechskillupgradePas encore d'évaluation

- Example1 - Investment IncentiveDocument6 pagesExample1 - Investment IncentiveRaudhatun Nisa'Pas encore d'évaluation

- Inter Taxation 50 Important Questions 1676977237180910Document79 pagesInter Taxation 50 Important Questions 1676977237180910Tushar MittalPas encore d'évaluation

- The Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced TaxationDocument10 pagesThe Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced TaxationNarendra KumarPas encore d'évaluation

- Tutorial 2 (2) 1 (D)Document1 pageTutorial 2 (2) 1 (D)Shan JeefPas encore d'évaluation

- PT Finansia Multi Finance Employee Payslip for Aries RifaiDocument1 pagePT Finansia Multi Finance Employee Payslip for Aries RifaiDaniel Tommy PassarellaPas encore d'évaluation

- INTER CA DIRECT TAX IMPORTANT POINTSDocument4 pagesINTER CA DIRECT TAX IMPORTANT POINTSDaniel TerstegenPas encore d'évaluation

- 2-3mwi 2004 Dec ADocument13 pages2-3mwi 2004 Dec Aanga100% (1)

- Amt Deduction Debjani AnjaliDocument43 pagesAmt Deduction Debjani AnjaliMintuPas encore d'évaluation

- Salary 1Document32 pagesSalary 1Divyansh JalkharePas encore d'évaluation

- Tutorial 2 (3) 3 (E)Document2 pagesTutorial 2 (3) 3 (E)Shan JeefPas encore d'évaluation

- Exercises On Implementation of DCF ApproachDocument10 pagesExercises On Implementation of DCF ApproachVincenzoPizzulliPas encore d'évaluation

- SC2x W9L2 DCFAnalysis CLEANDocument68 pagesSC2x W9L2 DCFAnalysis CLEANvi tranPas encore d'évaluation

- Ac5a Week 4 Session 2Document13 pagesAc5a Week 4 Session 2RayaPas encore d'évaluation

- Itmzd Personal Deducts (BTL) INCOME TAXDocument1 pageItmzd Personal Deducts (BTL) INCOME TAXMichael AuerPas encore d'évaluation

- Purchase Option Lease SampleDocument4 pagesPurchase Option Lease SampleMichael AuerPas encore d'évaluation

- Guidelines To MAS Notice 626 April 2015Document62 pagesGuidelines To MAS Notice 626 April 2015Wr OngPas encore d'évaluation

- PronPack 5 Sample MaterialDocument13 pagesPronPack 5 Sample MaterialAlice FewingsPas encore d'évaluation

- Liebert PEX+: High Efficiency. Modular-Type Precision Air Conditioning UnitDocument19 pagesLiebert PEX+: High Efficiency. Modular-Type Precision Air Conditioning Unitjuan guerreroPas encore d'évaluation

- AP Biology Isopod LabDocument5 pagesAP Biology Isopod LabAhyyaPas encore d'évaluation

- High Volume InstrumentDocument15 pagesHigh Volume Instrumentcario galleryPas encore d'évaluation

- Reg OPSDocument26 pagesReg OPSAlexandru RusuPas encore d'évaluation

- Electronic Throttle ControlDocument67 pagesElectronic Throttle Controlmkisa70100% (1)

- European Heart Journal Supplements Pathophysiology ArticleDocument8 pagesEuropean Heart Journal Supplements Pathophysiology Articleal jaynPas encore d'évaluation

- ms360c Manual PDFDocument130 pagesms360c Manual PDFEdgardoCadaganPas encore d'évaluation

- Job Interview CV TipsDocument2 pagesJob Interview CV TipsCarlos Moraga Copier100% (1)

- Doohap supplier and customer segmentationDocument2 pagesDoohap supplier and customer segmentationPriyah RathakrishnahPas encore d'évaluation

- Chapter 20: Sleep Garzon Maaks: Burns' Pediatric Primary Care, 7th EditionDocument4 pagesChapter 20: Sleep Garzon Maaks: Burns' Pediatric Primary Care, 7th EditionHelen UgochukwuPas encore d'évaluation

- Big Data, Consumer Analytics, and The Transformation of MarketingDocument17 pagesBig Data, Consumer Analytics, and The Transformation of MarketingPeyush NenePas encore d'évaluation

- A-00 IndexDocument10 pagesA-00 IndexNizarHamrouniPas encore d'évaluation

- Gild PitchDocument19 pagesGild PitchtejabharathPas encore d'évaluation

- CSIR AnalysisDocument1 pageCSIR Analysisசெபா செல்வாPas encore d'évaluation

- WFP-Remote Household Food Security Survey Brief-Sri Lanka Aug 2022Document18 pagesWFP-Remote Household Food Security Survey Brief-Sri Lanka Aug 2022Adaderana OnlinePas encore d'évaluation

- Bylaw 16232 High Park RezoningDocument9 pagesBylaw 16232 High Park RezoningJamie_PostPas encore d'évaluation

- Chapter 9 Lease DecisionsDocument51 pagesChapter 9 Lease Decisionsceoji25% (4)

- MinistopDocument23 pagesMinistopAlisa Gabriela Sioco OrdasPas encore d'évaluation

- M and S Code of ConductDocument43 pagesM and S Code of ConductpeachdramaPas encore d'évaluation