Académique Documents

Professionnel Documents

Culture Documents

Img 20191208 0006 PDF

Transféré par

Johanna VidadTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Img 20191208 0006 PDF

Transféré par

Johanna VidadDroits d'auteur :

Formats disponibles

ReSA, Review School Inc.

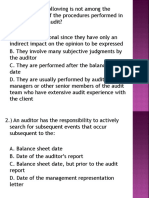

Auditing Problem IITENEO/ESPENTLIA

Quizzer 6 Solution Guide

66. Ac. A.

Share from rc-t income (p2.5M*3ar./o) 750,000

UndeEtatemmt in Depr: (360,C0,. ,yr) t72.000)

Invstmqt iImre - p&L f 6?8861

67. Are. D-

Inv6tment income - P&t 67g,000

Share jrom Unrealized tnlding lms - O:L (p50OK*3Oo/o) (1SO,OOO)

I{et amount to be reportcd in th.; SCI f..Eo61

68./\6. lt.

Acquisition.ost 6,000.000

Share frc,m dividsds (p8O0,O0OJ3C%) (240,000)

Share from n€t inconte 678,000

Share fronr OCL (P500,000*30o/o) (150-000)

Carrying yalw, ,.2/ 3!/ 14 l-6zffi-l

69, AN. B.

Bdore Dil. After Dil. Decrue

Number of shars owred 300.000

Total outsrarding shares

_3bm

Share frcr, the increde in lvhite'-c cpiial as a r6ult of share ise:

00, *P3

(2 0 )' 25 o,'o

00s h 0

1,500,000

CV of inv€tment dsmecl sclJ:

(P 6,22 8,

0O A* Gqo B 0o/o)) (1.048.000)

Dilution oain before Hycling of G_L 452,000

Rrycling of CCL (P150,000*( so./o/j 0olo) )

70. AG.

Afiustd dilution

B-

gain (True Sale)

f=zE r25.000 )

Share from the incms in rl/hite,s ,_apiial as a rsult of share rs$e:

(200,000sh*P30)*25o,'o 1,5OO,OOO

CV of investment, excluding good!\ il ciemed sold:

(P6/228,000-P600,000)*(5c,i,/,rrl9/o)

{948,000)

Dilubon qain before recyclinq of o L_ 552,000

Rsycling of OCL (P150,000* (5o/o tt, O9o ))

Adjusted dalution qain

71. AB. C.

Before Css. After C6s.

Number of shares owred 300,000 180.000

Total outstanding shaB 1,000,000 1_000_000

30 o/o

18o/o

Realized Unrealized Total

Proceeds frcm poriton sold (120,0,:rCslE16*p3O) 3,600.000 , 3,600,000

FMV of remainirE portion to be ra,:isified to FA at FMV

5,400,000 5,400,000

Ls: CV of grrtion sold (D6,229,0.;X*12O//3OO) (2,s15,200) (2,s1s,200)

CV of portion Htassified (p6,t28,000*1gO/300) (3.772,8001 (3.772.5OO\

C6sation g€in/16 hrefde isyciinil ef -..

1,084,800

Recycling of OCL:

alCI,/L 7,627,200 2,7t2,@O

Portion sold (P150,000*120/:0C) (60,000) (60,000)

Portion re.lassified (p1 50,OOil * 1 8O/,300)

Adjsuted ce*tion gain

72. Ans. A.

C6e 1: "Cost-Bascd Appffih, witir CitcF-up Adjustffit,,:

73. Ans. D-

Sfrare from Net inmme, Jan i-o lun, i.015 (p30O,OO0'1Oo/o)

Share from Net lrcome, Aug to De, . ZC15 (p200,000*4oqo)

Sharc from Nd Incom in 2ols

74. Ans. A.

January 1, 2014 Cct (10%) 700,000

' Share from NIet Ircome, 2014 (P.10i,,00C*1Co/o) 40,000

share f..om Dividends, Oct. 1" 2014 ( 10,000*pO.9O)

Carrying value, 1,2/31174 had equi.:y m€thod been ued

_-_l10ogt

731,O00

Share from Flet inmme. Jan to lun, 2015 (p300,000*1oo/o) 30,000

Share from Dividends, Apr. 1, 2015 lt C,0O0*p1.10) (1 1,000)

Additional invstment, luly 1,2015 (30o/o) 2,400,000

Share from Dividencrs, Oct. 1, 201.5 i4O,OO0*p1.35) (54,000)

Share frorn Net lrcome, Aug io D€c, 2015 (p2OO,OOO.4Oolo) 80.000

Carrying valre, 12l31./2(,15 3,176,()(]'()

Ca* 2: "Cct-Baxd Appreilh, withoul Cltclr.up Adjustmnt,,:

75. Ac- c. jl I

Dividends Income, April 1, 2015 ( t tl,000*p1.10)

Share from l.let lrcome, Aug to De' 2C15 (P200,000*409o) ri

Sharc lrom N€t l[colrc if, 2()15

76. Ac. B.

lanuary 1, 2014 Original Cost (10qt) 700,000

Additicnal invEtment, July 1, 201:, i30%l 2,400,000

Share from Dividends. Oct. 1, 2015 (4J,000*P1.35) (s4,000)

Share from l.let lrcome, Aug to De(., 2015 (P20O,OO0*409o) _!_q,aq0

C.arrying valre, 12l31/2O1.5 3.126.fiX)

CasG 3: ""Fair tllrkct Valuc Approach. without Catch-up Adjuctrrcnt" I

77. Ans. C.

Dividends Income, April 1, 2015 (iC,Ool]*P1.10) 1 1,000

Share from l.let Ineome, Aug to Ds. 2C15 (P200,000*409o)

Inorc

___ 80.000 i

Sharc frcm NGc in 2015 I elooo I

I'il

i,

6ofB

Vous aimerez peut-être aussi

- Sps. Noynay Vs Citihomes G.R. No. 204160, September 22, 2014 PDFDocument12 pagesSps. Noynay Vs Citihomes G.R. No. 204160, September 22, 2014 PDFJohanna VidadPas encore d'évaluation

- Mas Chapter 6 PDFDocument33 pagesMas Chapter 6 PDFJohanna Vidad100% (1)

- Magalona vs. Pesayco, GR No. L-39607, February 6, 1934 (59 Phil 453) PDFDocument2 pagesMagalona vs. Pesayco, GR No. L-39607, February 6, 1934 (59 Phil 453) PDFJohanna VidadPas encore d'évaluation

- Gam Weak 2Document16 pagesGam Weak 2Johanna VidadPas encore d'évaluation

- Gam Chap 3Document9 pagesGam Chap 3Johanna VidadPas encore d'évaluation

- Chap 3 PDFDocument8 pagesChap 3 PDFJohanna VidadPas encore d'évaluation

- Receivables and Related RevenuesDocument7 pagesReceivables and Related RevenuesJohanna VidadPas encore d'évaluation

- Ap 8505 PDFDocument6 pagesAp 8505 PDFJohanna VidadPas encore d'évaluation

- Inventories and Related Expenses Inventories and Related ExpensesDocument7 pagesInventories and Related Expenses Inventories and Related ExpensesJohanna VidadPas encore d'évaluation

- Investments in Financial Instruments: Problem 1Document10 pagesInvestments in Financial Instruments: Problem 1Johanna Vidad100% (1)

- Solutions - Chapter 7 Non-Current Operating Assets Solutions - Chapter 7 Non-Current Operating AssetsDocument9 pagesSolutions - Chapter 7 Non-Current Operating Assets Solutions - Chapter 7 Non-Current Operating AssetsJohanna VidadPas encore d'évaluation

- Ap 8506 PDFDocument6 pagesAp 8506 PDFJohanna VidadPas encore d'évaluation

- Ap 8507 PDFDocument6 pagesAp 8507 PDFJohanna VidadPas encore d'évaluation

- AFAR 8605 - Corporate Liquidation PDFDocument4 pagesAFAR 8605 - Corporate Liquidation PDFJohanna VidadPas encore d'évaluation

- AFAR 8608 - Franchise PDFDocument4 pagesAFAR 8608 - Franchise PDFJohanna VidadPas encore d'évaluation

- HR Case StudyDocument1 pageHR Case StudyJohanna VidadPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- FM - Chapter 9Document5 pagesFM - Chapter 9sam989898Pas encore d'évaluation

- GP Investments: Annual ReportDocument54 pagesGP Investments: Annual ReportLicaBorgesPas encore d'évaluation

- Factors Affecting Investors Preference For Mutual Funds in IndiaDocument52 pagesFactors Affecting Investors Preference For Mutual Funds in Indiaanuragmehta1985100% (15)

- Lakshmi MittalDocument20 pagesLakshmi MittalSaumil ShahPas encore d'évaluation

- Simplex Annual Report 2018-19Document296 pagesSimplex Annual Report 2018-19John AbrahamPas encore d'évaluation

- Products of NBPDocument4 pagesProducts of NBPusamaali12Pas encore d'évaluation

- FAChapter 12Document3 pagesFAChapter 12zZl3Ul2NNINGZzPas encore d'évaluation

- Plaintiff-Appellant Vs Vs Defendants-Appellees C.W. Ney O'Brien and de Witt, Ortigas FisherDocument12 pagesPlaintiff-Appellant Vs Vs Defendants-Appellees C.W. Ney O'Brien and de Witt, Ortigas Fisherpinkblush717Pas encore d'évaluation

- Chapter 12 - : Cost of CapitalDocument32 pagesChapter 12 - : Cost of CapitalRobinvarshney100% (1)

- The Fundamentals of SecuritiesDocument8 pagesThe Fundamentals of Securitiesattyjecky100% (1)

- Jeff Saut Raymond James 12 28Document5 pagesJeff Saut Raymond James 12 28marketfolly.comPas encore d'évaluation

- Spice Land CH 12 InvestmentDocument23 pagesSpice Land CH 12 InvestmentTuongVNguyenPas encore d'évaluation

- Nestor Ching V Subic Bay Golf and Country Club G.R. 174353Document8 pagesNestor Ching V Subic Bay Golf and Country Club G.R. 174353Dino Bernard LapitanPas encore d'évaluation

- 118 Pool v. Pool, Et. Al. (Castro)Document2 pages118 Pool v. Pool, Et. Al. (Castro)AlexandraSoledadPas encore d'évaluation

- Presentation 1 Auditing TheoDocument21 pagesPresentation 1 Auditing TheoMhegan ManarangPas encore d'évaluation

- Sohn Canada Presentation - Oct. 2014Document33 pagesSohn Canada Presentation - Oct. 2014ValueWalk50% (2)

- Equity Research Module AdvanceDocument14 pagesEquity Research Module AdvanceVIRAL VAULTPas encore d'évaluation

- Specialists Test Your Knowledge by Richard NeyDocument10 pagesSpecialists Test Your Knowledge by Richard Neyaddqdaddqd67% (3)

- Risk Management Framework For MCX (Stock Exchange)Document4 pagesRisk Management Framework For MCX (Stock Exchange)Anuj GoyalPas encore d'évaluation

- Religare Enterprises Limited 09 10Document1 pageReligare Enterprises Limited 09 10Akash MahagaonkarPas encore d'évaluation

- Corporation Law Notes by AquinoDocument3 pagesCorporation Law Notes by Aquinopinky paroliganPas encore d'évaluation

- Company Law ProjectDocument6 pagesCompany Law ProjectKumar HarshPas encore d'évaluation

- Credit Rating AgencyDocument3 pagesCredit Rating AgencyJaved KhanPas encore d'évaluation

- Project On IPODocument24 pagesProject On IPOmysticalmana8100% (2)

- Increase of Author Is Ed Share Capital ProcedureDocument3 pagesIncrease of Author Is Ed Share Capital ProcedureSai Charan GvPas encore d'évaluation

- Manual Form Registered PV Service Providers DirectoryDocument7 pagesManual Form Registered PV Service Providers DirectoryKoh Siew KiemPas encore d'évaluation

- BLack BookDocument65 pagesBLack Bookabhishek mohitePas encore d'évaluation

- LG Annual Report 2017 enDocument44 pagesLG Annual Report 2017 enjunaid sumra100% (1)

- Problem 4-7 - BVPS Lets Analyze - Pabres - ACC221Document3 pagesProblem 4-7 - BVPS Lets Analyze - Pabres - ACC221Jeric TorionPas encore d'évaluation

- Divedend Stks 15 102018Document2 pagesDivedend Stks 15 102018ShanmugamPas encore d'évaluation