Académique Documents

Professionnel Documents

Culture Documents

CWLP IRP Update

Transféré par

NewsTeam200 évaluation0% ont trouvé ce document utile (0 vote)

2K vues9 pagesCWLP IRP Update

Copyright

© © All Rights Reserved

Formats disponibles

PDF ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentCWLP IRP Update

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

2K vues9 pagesCWLP IRP Update

Transféré par

NewsTeam20CWLP IRP Update

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 9

CITY OF SPRINGFIELD, ILLINOIS

James O. LANGFELDER, Mayor

Dove Brown, CHIEF UTILITY ENGINEER

FAQs: CWLP IRP UPDATE

December 11th, 2019 Public Utilities Committee Meeting

The City of Springfield began a process for an Integrated Resource Plan (IRP), which would identify the best

resource options for CWLP to provide reliable and competitively priced electrical power to meet Springfield's

future energy needs. The Bnergy Authority, Inc. (TEA) conducted the IRP by compiling and analyzing

‘economic data of CWLP’s existing electric resources along with the economic data of other options such as

wind, solar, and natural gas combustion turbine

1. Why did CWLP need an IRP?

CWL?'s mission as a public power utility and operator of its own generation resources has long been to

responsibly provide affordable and reliable electric service to its customer-owners. With an aging

generation fleet, and a changing energy market and regulatory climate, it was necessary to conduct an in

depth analysis to study the cost ofthe uliity’s current eleetri¢ resources, against what other options are

available, The IRP was tasked with determining the best mix of electric resources, which are low cast

and low tisk for CWLP customers’ future energy needs.

2. Which plants were considered in the IRP analysis?

‘The IRP considered all of CWLP's generating assets.

DALLMANSIg. | COAL aw 1968 if

DALLMAN 32, COAL eimw 1972

; DALLMAN 337°" | COAL 172 MW ‘i978 29

UNITA ‘COAL 207 MW 2009

REYNOLDS, FUEL OIE Tuw | eas} 1970

FACTORY FUEL OIL 17 MW 1973

INTERSTATE FUEL OL & TOMW.,.- 1997,

io NATURAL GAS) s

3. What did TEA recommend from IRP results?

'EA from its IRP study recommended retirement of Dallman 31, 32 and 33 in 2020; and keeping

Unit 4 and the smaller combustion turbine units, Reynolds, Factory and Interstate, I also

recommended issuing a Request for Proposal (RFP) for renewable energy, issuing a REP for energy

and capacity to buy market power for a Purchase Power Agreement (PPA) and expanding energy

efficiency programs at CWLP Bnorgy Services. Over the ong run, the IRP indicates CWLP will see a

shrinking coal fleet with increased reliance of PPAs supplemented with existing combustion turbines

and an ever-increasing mix of renewables.

Why Is coal-fired generation more costly than other sources?

In TEA’s IRP analysis of what would be the best and least cost energy resources to meet CWLP

customers’ future electricity needs, Dallman 31, 32 and 33 generating units were found to be more

costly compared to other energy resources available. ‘The lower efficiency and age of the units, 1968,

1972 and 1978, and regulatory costs, make these plants not cost competitive in today’s energy market.

Dallman 31, 32 and 33 are operating 30% less than expected this year since they are not competitive in

the market. Energy prives are lower largely from the decline in natural gas costs, which is the primary

driver of the energy market

5. Will retiring Dallman 31, 32, and 33 affect CWLP’s ability to supply

electricity?

Unit 4 and the combustion turbines ean cover all of CWLP customer load nearly 100 percent of

the time, CWLP customers would experience no difference in their electric service t due

to retiring units with the ability to import power as already done through market purchases and

with @ Purchase Power Agrecment (PPA). Upgrades to the transmission system would be made

prior to retiring Dallman 33 to improve import capability

6. Is there risk to buying market power instead of relying on CWLP’s own

power generation?

‘The IRP identified purchasing power from the market is less risky and costly than operating Dallman

31, 32 and 33. The IRP studied the effects of many variables on the future price of energy and

determined prices in the market for long-term Purchase Power Agreements (PAs) are lower and will

remain lower than it costs to operate Daliman 31, 32 and 33. Energy prices would have to double and

‘capacity prices would have to triple in order for these units to become viable in the market again.

7. How much will it cost to retire the power plants?

‘The cost to retire Dallman Units 31 and 32 is estimated at $700,000, which includes the

decommissioning costs for lube oil work and clesning, plus installing new building heat. In contrast,

the savings compared to market prices from not operating Dallman 31 and 32 is $10M to $12M

annually, Additional savings from retiring these units is $40M over the next five years for various

work including dry ash conversion, boiler repairs, turbine overhauls and other major maintenance.

‘The costs associated with retiring Dallman 33 are estimated to be around 2M, which includes

‘raasmission upgrades, plus decommissioning costs for lube oil work and cleaning, In contrast, the

savings from not operating Dallman 33 is $13M to $16M annually. Additional savings from retiring

this unit is $29M over the next five years for various work including dry ash conversion, boiler

repairs, and other major maintenance.

8. What is the plan for affected employees?

Minimizing the impact to our employees continues to be a primary concern. Our plant employees

represent one of our most valued and specielized skill groups, which has been key to such a vital

setviee to the city for so many years, Discussions have begun to see that we implement a timeline

that is fair and that reorganization and transition to other jobs can happen where possible. Options

for severance and retirement incentives are being considered as well

9. What are CWLP’s next steps? What if plant retirements are delayed?

Retiring Dallman 31 and 32 and beginning the planning and transition process for employees

assigned to those units, is CWLP"s preferred first step to implementing some of the IRP

recommendations, Beyond not being cost competitive in the energy market (610M-$12M annual

loss), upcoming capital expenditures for Dallmen 31 and 32 to comply with a number of

‘environmental regulations and maintenance is expected to be S40M over next $ years and should be

avoided for these smaller, older units, For Dallman 33, dates for its retirement and decommissioning

need to be finalized for short-term and long-term planning by the endl of January 2020 to avoid a

number of significant costs for environmental compliance and maintenance proj

algo operates ata loss to market ($13M-$16M annvally) and similarly faces upcor

expenditures for compliance and maintenance projects, $29M over the next § years.

More Information: www.cwlp.com/IRP

CITY OF SPRINGFIELD, ILLINOIS

JAMES O. LANGFELDER, MAYOR

DoUG BROWN, CHIEF UTILITY ENGINEER

DECEMBER 11%, 2019 PUBLIC UTILITIES COMMITTEE MEETING

Plant Retirement/Retainment Consideration:

Retain Unit 4 &

Combustion Turbines

+ Unit 4

¥ Most efficient and economical

Y Lowers Risk

+ Combustion Turbine Units

Y Factory, Reynolds & Interstate

Cover Peak if needed

Retain Dallman 33

+ Incur $29M in Costs over next 5 years

¥ Coal Ash Regulations

¥ Boiler Repairs

¥- Major Maintenance

Y Excludes $ for ELG FGD Blowdown

'13-L6M/year loss vs Market

* Reiain Jobs

tart Dry Fly Ash Engineering

* Start New FGD Blowdown ‘Treatment

Facility Engineering

+ Provides backup to Unit 4 but at large cost

Retire Dallman 31 & 32

+ Avoid $40M in Costs in next 5 years

¥ Coal Ash Regulations

Y Boiler Repairs

¥ Turbine Overhauls

¥ Major Maintenance

+ Avoid $10-12M/year loss vs Market

+ Decommissioning cost $700k

Y Lube Oil, Cleaning, Building Heat

+ 15 employees would be transitioned. Attrition

and not filling vacancies has lowered the

impact from 25 total positions

Retire Dallman 33

+ Avoid § 29M in Costs in next 5 years

¥ Coal Ash Regulations

Y Boiler Repairs

Major Maintenance

Avoid $13-16M/year loss vs Market

Decommissioning cost $2M

'¥ Transmission Upgrades, Lube Oil and

Cleaning

+ 50 employees would be transitioned. Attrition

can lower the impact.

+ No Earlier Retirement than Fall of 2021

+ No Later Retirement than Fall of 2023,

Reliability, Risk & Other Financial Considerations

environmental compliance costs and other major capital expenses for

repairs and major maintenance, if Dallman Units 31, 32 & 33 retired, consider:

+ CWLP customer load! is covered with Unit 4 and combustion turbines almost 100% of the time.

+ ‘Transmission upgrades will improve ability to import power when additional capacity needed,

+ CWLP Energy & Capacity Revenue keeps decreasing

¥ Energy Prices need to double in order to make Dallman 31, 32 and 33 viable.

Capacity Prices need to triple in order to make Dallman 31, 32 and 33 viable.

Y Units are running 30% less and revenues are $2M less than expected through October FY20.

+ CWLP can seok Energy & Capecity Purchases

¥ Lowest Cost is the market

¥ Purchase Power Agreements, Bi-lateral Transactions, Real Time/Day Ahead

+ Detnolition of Dallman Units 31, 32 and 33 is a sunk cost ($7.5M-$10M) and not recommended

singe complex is still used for offices and inventory space.

Decommissioning

Plan

November 2019

Table of Contents

+ Plan Overview

+ Project Objectives

+ Planning Approach

+ Planning Guidelines

+ Roles and Accountabilties

+ Decommissioning Pian Summary

* Next Steps

®

12/11/2019

Decommissioning Plan Overview

Daliman Units 1, 2, and 3 are economically stressed due to

deteriorating market conditions and relatively high capital and

operating costs

+ Arecent IRP recommended shutting down these units

+ CWLP and city leadership held public review and comment

meetings to obtain input and insights into the decision

+ CWLP has prepared a decommissioning plan, which if approved

will be how the units will be shut down,

+ Plan was cteated by a small, cross-functional team from C\WLP and

the City of Springfield

+ CWLP partnored with ScottMaddon, which assisted functional areas

in identifying and thinking through deliverables, timing, and building

the plan

+ The recent forced outage event at Dallman 3 has introduced new

variables, the impact of which has not yet beer fully analyzed.

@ 8

scotmadion

Decommissioning Plan Overview

* This document together with an Excel based implementation plan

represent the proposed high-level decommissioning plan

+ Presents the planning objectives, approach, and guidelines

+ Presents a summary overview of the plan

+ Highlights strategic considerations for planning specific:

decommissioning dates

+ The decommissioning plan was reviewed, revised and approved

by CWLP leadership

+ Plan to be reviewed with input by Aldermen/Alderwomen

+ Final decommissioning approval by the mayor

® clodien

12/11/2019

Project Objectives

+ Prepare a comprehensive technical decommissioning project plan

in two phases

+ Create a formal, sustainable framework to plan and execute

the retirements of Units 31, 32, and 33 at Dallman

+ Identify all supporting tasks, activities, and actions necessary

for decommissioning

+ Provide mechanisms for functional areas to oross-coordinate

activities and to ensure consistency in timing, messaging,

approvals, and implementation

+ Align across all impacted functional areas at CWLP

s determined tht for planning purposes, the final stale

ing plan includ making the unit and

Decommissioning Planning Approach

‘A three phased planning and execution approach Is shown below,

the plan presented is Phase 1

Detailed Plan

+ Retin pan aod or

High Level Plan

repered by smalteam

Delersbies erties

{Plan comentment tee

‘attished

Execution

+ Exeeut the plan

+ hac progress and port

resuts ve: plan

‘pptowal process

+ Prepare more reese

level fat

+ Ingato actos between

funconal ees

12/11/2019

Planning Guidelines

The planning team recognizes the myriad implications to

decommissioning a long: standing Paseload power plant in

Springfield, ang will conduct all glanning efforts using the following

guidelines:

* We wil mantzn planning confidentiality and communicate

professionally with one voice as a project

+ This is organized as a cohesive project and integrated across

Various fuinctions.

+ Employees willbe informed of timelines and their options, and

they will be engaged with CWLP's core values throughout this,

process

All operational, reguatoy,Jegal, and financial requirements

will be met on time and ia ful

+ Planning focus is on decommissioning Daliman Units 34, 32,

and 33 (assuming governance approval), but we wil consider

collaleral impacts and needs of the plant, CWLP, the grid, and

customers

® sete

Project Roles and Accountabilities

Establish project appreach and paco

Dect panning fis

Review al plas or approve

+ Recommend plan components

*Roviow rommendetons wih

Fetal ar Lead

+ Support Piet Core Tes

+ Corie naval coal area

pans

en

Assigned SMES fr oach Funlonat

rea

+ ony al somponente of

‘decommiesering in

+ Propare ihlwe pln Phace 1),

delves, ouners, ere

‘be dates

12/11/2019

V 22/11/2019

Decommissioning Plan Summary

The specific decommissioning plan is Excel based and too large

fe show in this presentation, A summary of the plan is shows

below

* »Bach deliverable has a description 4

Deliverables} 220m, ster date, ang completion date

Identified] # Plans developtdibased on 7 key. 2-4

sMlosthe'dsing

1 qq wctional | “Phase t plan dis version a high eq

lines Toye oin odevelop aime rake °

Deliverables pena |

Per fia i 1 H

Functionat 4 if | i i

Area Mootbaabel bat

YEE E fd

ee eon

© Bern

Decommissioning Plan Summary (cont'd)

J Uiay Milestones drive the decommissioning plan. Once dates for these

events are finalized, the plan will auto-populate

Employes abing Decom Fri

Ampounetments «tution acevo

en ei ‘an ance

aso of he docom flor camming to

ne irae ‘cose

eenten atearg rine “cme

erent “na

Deskion ws mans

‘roemans form toda

cae tpn comets

ar ot soot Sad

aera ‘soso ee

oem Sut

ip ah

seottmarden cir amataeanueicaseiostntinn anus ene!

Next Steps

End of December Decision Date + 1 month

GE provides extent of

ondiion of Uni 29 Announcoments

and Costo Repair

en ial ae

Dec 10-11

January

Plan and drivers Final Decommissioning

Teviewod with Dates Established

Aldermen/Alderwomen

‘and Mayor

® .£

Det

Gene

a

Following

Announcements,

Support locations.

‘and programs

Taunched

12/11/2019

Vous aimerez peut-être aussi

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Investigative Statement No 3-RedactedDocument3 pagesInvestigative Statement No 3-RedactedNewsTeam20Pas encore d'évaluation

- Investigative Statement No 1-RedactedDocument9 pagesInvestigative Statement No 1-RedactedNewsTeam20Pas encore d'évaluation

- Investigative Statement No 1-RedactedDocument9 pagesInvestigative Statement No 1-RedactedNewsTeam20Pas encore d'évaluation

- Investigative Statement No 3-RedactedDocument3 pagesInvestigative Statement No 3-RedactedNewsTeam20Pas encore d'évaluation

- Investigative Statement No 2-RedactedDocument3 pagesInvestigative Statement No 2-RedactedNewsTeam20Pas encore d'évaluation

- Investigative Statement No 2-RedactedDocument3 pagesInvestigative Statement No 2-RedactedNewsTeam20Pas encore d'évaluation

- Ludwig Interview Summary-RedactedDocument8 pagesLudwig Interview Summary-RedactedNewsTeam20Pas encore d'évaluation

- Rowe v. Raoul, 2023 IL 129248Document43 pagesRowe v. Raoul, 2023 IL 129248Todd FeurerPas encore d'évaluation

- Order Denying BailDocument5 pagesOrder Denying BailNewsTeam20Pas encore d'évaluation

- Petition For Denial of Bail - S. Woods 22-CF-1112Document29 pagesPetition For Denial of Bail - S. Woods 22-CF-1112NewsTeam20Pas encore d'évaluation

- Paris FY 21 Audit Findings - NutritionDocument4 pagesParis FY 21 Audit Findings - NutritionNewsTeam20Pas encore d'évaluation

- Indictment - S. Woods 22-CF-1112Document7 pagesIndictment - S. Woods 22-CF-1112NewsTeam20Pas encore d'évaluation

- 2023 01 06 Toole FM Complaint at LawDocument18 pages2023 01 06 Toole FM Complaint at LawNewsTeam20Pas encore d'évaluation

- Reclamite BrochureDocument2 pagesReclamite BrochureNewsTeam20Pas encore d'évaluation

- Facts That Led To Decision To Close SED ProgramDocument1 pageFacts That Led To Decision To Close SED ProgramNewsTeam20Pas encore d'évaluation

- Peoria County Plane CrashDocument3 pagesPeoria County Plane CrashNewsTeam20Pas encore d'évaluation

- Pedestrian OrdinanceDocument4 pagesPedestrian OrdinanceNewsTeam20Pas encore d'évaluation

- WH Biden Covid LetterDocument1 pageWH Biden Covid LetterRema RahmanPas encore d'évaluation

- 4.11.22 Letter To DOI Re Honor Flight FINALDocument6 pages4.11.22 Letter To DOI Re Honor Flight FINALNewsTeam20Pas encore d'évaluation

- 2022 Ethan's Rodeo FlyerDocument1 page2022 Ethan's Rodeo FlyerNewsTeam20Pas encore d'évaluation

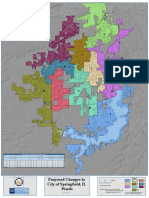

- Springfield Ward Map Draft 3Document1 pageSpringfield Ward Map Draft 3NewsTeam20Pas encore d'évaluation

- 2022 DCFS Child Safety Well Being PerformanceDocument124 pages2022 DCFS Child Safety Well Being PerformanceNewsTeam20100% (1)

- University of Illinois Urbana Champaign Warning Complaint 6-15-22Document7 pagesUniversity of Illinois Urbana Champaign Warning Complaint 6-15-22NewsTeam20Pas encore d'évaluation

- NPS Response To Rep. Roy On Honor FlightsDocument1 pageNPS Response To Rep. Roy On Honor FlightsNewsTeam20Pas encore d'évaluation

- Honor Flight LetterDocument2 pagesHonor Flight LetterNewsTeam20Pas encore d'évaluation

- 22 IA Case Summary Report Final Mike Killen Karen HamptonDocument9 pages22 IA Case Summary Report Final Mike Killen Karen HamptonNewsTeam20Pas encore d'évaluation

- JoAnn Cunningham Post Conviction Petition 2022Document25 pagesJoAnn Cunningham Post Conviction Petition 2022NewsTeam20100% (1)

- Joint Letter On Springfield Police OfficerDocument3 pagesJoint Letter On Springfield Police OfficerNewsTeam20Pas encore d'évaluation

- 04.01.22 DCFS TimelineDocument9 pages04.01.22 DCFS TimelineNewsTeam20100% (1)

- 22 IA Case Summary Report Lexi Cunningham 03-23-22Document4 pages22 IA Case Summary Report Lexi Cunningham 03-23-22NewsTeam20Pas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)