Académique Documents

Professionnel Documents

Culture Documents

IS Bajaj 2019

Transféré par

test boCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

IS Bajaj 2019

Transféré par

test boDroits d'auteur :

Formats disponibles

1910508839-BI

Bajaj Allianz Life

Income Assure

A Guaranteed Monthly Income

Life Insurance Plan

Key Features of the plan

Aim of the policy Bajaj Allianz Life Income Assure is a non-linked, participating, limited premium payment, monthly income endowment plan.

Survival Benefit - Provided the life assured is alive at the end of the premium payment term, the Guaranteed Monthly Income (GMI)+

(irrespective of the variant chosen) will be paid every month for 144 months, starting from the end of premium payment term.

In case of death of the life assured during the installment period of the Survival Benefit, the GMI will be stopped immediately. Any GMI paid

during the period from the date of death to the date of intimation will be deducted from the death benefit.

+

The GMI has to be selected at the inception of the policy and is fixed throughout the term of the policy.

Maturity Benefit - Provided the policy is in-force and the life assured is alive, vested bonus plus terminal bonus, if any, will be paid.

Death Benefit – Provided all due premiums are paid, then, in case of unfortunate death of the life assured during the policy term, the death

benefit will be higher of:

• Sum Assured on Death# plus vested bonus plus terminal bonus, if any, or

• 105% of the total premium** paid

Income Assure

• Vested bonus plus terminal bonus, if any, will be paid • Death benefit will be paid as a lump sum

Benefits under immediately

• The policy will terminate on the date of death of the life assured

the policy • The sum assured on death will be paid to the nominee as

monthly income, over the next 144 equated monthly

installments (over the next 12 years), and the first installment

will start from date of death

• The nominee will not have the option of taking the installments

in lump sum

• All risk cover under the policy will cease as on the date of death

of the life assured

• The policy will terminate on payment of the 144th monthly

installment

#

Sum Assured on Death is higher of (i) sum assured (ii) 10 times of Annualised Premium*.

*Annualised Premium is exclusive of extra premium, rider premium, loadings for modal premiums, Goods and Service Tax, if any. **Total

Premium is exclusive of extra premium, rider premium, Goods and Service Tax, if any. Goods and Service Tax will be collected over and above the

premium under the policy.

Premiums at regular intervals are payable for the entire premium payment term as chosen by you. The premium payment term chosen by

Premium payment

you is the basis on which Benefit Illustration has been drawn and shall also be mentioned in the Policy Schedule.

1.Bajaj Allianz Accidental Death Benefit Rider UIN: 116B034V01

2.Bajaj Allianz Accidental Permanent Total/ Partial Disability Benefit Rider UIN: 116B036V01

Riders Available 3.Bajaj Allianz Critical Illness Benefit Rider UIN: 116B035V01

4.Bajaj Allianz Family Income Benefit Rider UIN: 116B037V01

5.Bajaj Allianz Waiver of Premium Benefit Rider UIN: 116B031V01

Please refer to respective product/ rider sales literature or visit Company website or consult your “Insurance Consultant” for more details and

eligibility conditions.

Bajaj Allianz Life Insurance Co. Ltd.,

G.E. Plaza, Airport Road, Yerawada, Pune - 411006. Reg No.: 116. Ver1.1 : English

If at least 2 years’ premium for premium payment term less than 10 years or at least 3 years’ premium for premium payment term of 10

years and above are not paid, then,

• policy will lapse at the expiry of the grace period

• no benefits under the plan will be paid.

If at least 2 years’ premiums for premium payment term less than 10 years or at least 3 years’ premiums for premium payment term of 10

years and above are paid, , then your policy will be converted to a paid-up policy at the expiry of the grace period.

• The Sum Assured and the Sum Assured on Death under the policy will be reduced to the paid-up Sum Assured and paid-up Sum Assured

on Death respectively.

• The vested bonuses as on the paid-up date shall remain attached to the policy. A paid-up policy will not accrue any further bonus.

• The Maturity Benefit under a paid-up policy will be the vested bonuses attached in the policy till the policy became a paid-up policy.

• The Survival Benefit under a paid-up policy will be the paid-up GMI i.e. paid-up Sum Assured divided by 144 months and is payable every

month starting from the end of premium payment term as long as the life assured is alive, till the end of the policy term. If paid-up GMI is

less than ` 400 per month, then, the benefit will be paid annually which will be equal to paid-up Sum Assured in 12 yearly installments

over the next 12 years.

Non- payment • The Death Benefit under a paid-up policy will be the paid-up Sum Assured on Death plus vested bonus plus terminal bonus, if any,

of premium attached in the policy till the policy became a paid-up policy, subject to a minimum of 105% of total premium** paid. The Death Benefit

will be paid as per the life cover variant chosen at inception.

o In case ‘Assure’ variant was chosen at inception, the paid-up sum assured on death plus vested bonuses, if any will be paid to the

nominee as a lump-sum as on date of death.

o In case ‘Income’ variant was chosen at inception, the vested bonus, plus terminal bonus, if any, will be paid immediately and the

paid-up sum assured on death will be paid to the nominee as monthly income, over the next 144 equated monthly installments

(over the next 12 years). The first installment will start from date of death. If the monthly income is less than ` 400 per month, then

the benefit will be paid annually in 12 yearly installments over the next 12 years

o The paid-up GMI paid during the period from the date of death to the date of intimation will be recovered from the monthly

income/s.

• You may revive a lapsed/ paid-up policy during the revival period of 2 years from the due date of first unpaid premium, subject to the

revival conditions mentioned under the plan

Although it is not advisable to surrender your policy unless there is an extreme urgency, you will have the option to surrender your policy

Surrender anytime, provided at least 2 full years’ premiums in full have been paid for premium payment term less than 10 years or at least 3 years’

premiums in full for premium payment term of 10 years and above.

The surrender value shall be higher of the Guaranteed Surrender Value (GSV) and the Special Surrender Value (SSV).

Revival You may revive your lapsed/ paid-up policy during the revival period of 2 years from the due date of first unpaid premium, subject to the

revival conditions under the policy

Termination The policy will terminate on the earlier occurrence of either of the following events:

• on payment of surrender value

• on the maturity date

• on the expiry of the revival period of 2 years from the date of first unpaid premium, in case of a lapsed policy

• on date of death of the life assured in case of ‘Assure’

• on payment of the 144th installment in case of ‘Income’, however the risk cover under the policy will terminate on date of death

You will have the option to review the terms and conditions of the policy and if you disagree to any of the terms & conditions, you will have an

Free Look option to return the policy within 15 days [30 days in case this policy is issued under the provisions of IRDAI Guidelines on Distance Marketing

Cancellation of Insurance Products] stating the reasons for your objections.

Contact us Regd. Office Address: G.E. Plaza, Airport Road, Yerawada, Pune - 411006., IRDAI Reg No.: 116, Visit us: www.bajajallianzlife.com,

BALIC CIN : U66010PN2001PLC015959, Mail us : customercare@bajajallianz.co.in, Call on : Toll free no. 1800 209 7272, Fax No: 020-66026789,

Do’s and Don’ts

• Do fill the proposal form very carefully and personally in CAPITAL letters in blue ink only

• Do provide true and complete information

• Do provide correct contact number, address and email ID, and update in case of any change, so that you can receive

necessary communication

• Do sign on all the documents provided by you (Self Attestation)

Do’s • Do provide your recent passport photograph

• Do draw cheque/ DD, in favour of “Bajaj Allianz Life Insurance Co. Ltd.”

• Do read the policy bond carefully upon receipt of the same.

• Do contact us if you do not receive the policy bond or any other communication from the Company within 30 days.

• Do read the enclosed Benefit Illustration carefully before signing

• Do register for Auto Debit Instructions/ ECS to ensure timely payments of your premium on due dates.

• Do not sign any blank proposal form

• Do not leave any column blank in the proposal form

• Do not conceal any facts as this could lead to dispute at the time of a claim

Don’ts

• Do not miss or delay your premium payment

• Do not rely on any commitments of any additional benefits made by anyone apart from what has been highlighted

herein above.

Disclaimer

This document contains the highlights of the product Bajaj Allianz Life Income Assure UIN: 116N139V01 and is subject to the terms and conditions as contained in

the policy document. The terms and conditions as contained in the policy document shall govern the contractual relationship and shall be binding. For details on

any of the matters highlighted herein above, please refer to policy document upon receipt of the same by you. The standard terms and conditions of the product is

also available on the Company website (at www.bajajallianzlife.com)

Bajaj Allianz Life Insurance Co. Ltd.,

G.E. Plaza, Airport Road, Yerawada, Pune - 411006. Reg No.: 116. Ver1.1 : English

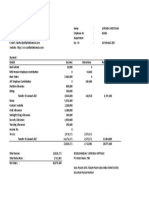

Bajaj Allianz Life Insurance Company Ltd.

BAJAJ ALLIANZ INCOME ASSURE - INCOME

PREMIUM QUOTATION CUM BENEFIT ILLUSTRATION

(All monetary amounts are expressed in Indian Rupees & all Ages & Terms are expressed in Years)

Personal Details

Life Assured Name s s Life Assured Age 31

Gender Male

Policy Details

Mode Yearly Premium Paying Term 12

Pincode 760003 Branch State ODISHA

Sum Assured 720000 Guaranteed Monthly Income 5000

Premium / Benefit Details

TYPE POLICY TERM SUM ASSURED MODAL PREMIUM

INCOME ASSURE Main Benefit Income [UIN: 116N139V01] 24 720000 53481.60

High Sum Assured Rebate (HSAR) Less : 834.00

Base Policy Premium Net of HSAR 52647.60

RIDER COVER COVERAGE TERM RIDER SUM ASSURED MODAL PREMIUM

Accidental Death Benefit [UIN: 116B034V01] 24 720000 568.80

Total Premium before Goods & Service Tax 53216.40

Premium Payable

MODE -> YEARLY MONTHLY

MODAL PREMIUM PAYABLE DURING FIRST POLICY YEAR

Modal Premium before Goods & Service Tax 53216.40 4789.48

Goods & Service Tax @ 4.5 % 2394.74 215.53

Modal Premium (including GST) * 55612 5006

MODAL PREMIUM PAYABLE DURING SECOND & SUBSEQUENT YEARS

Modal Premium before Goods & Service Tax 53216.40 4789.48

Goods & Service Tax @ 2.25 % 1197.36 107.76

Modal Premium (including GST) * 54414 4898

*It includes CGST,SGST/UTGST,IGST & State Cess as applicable. Taxes and tax rates are subject to change

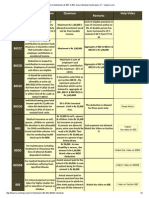

Case: Investment Return 8% # ##

Polic Life Annualized Cumulative Accrued Survival Death Benefit Maturity Maturity Guaranteed Special Surrender

y Assure Premium Premium (Excl Compound Benefit ^! Benefit Benefit Surrender Surrender Value

Year d Age (Excl of GST) of GST) Reversionar Under Paid- Value (GSV) Value (SSV) Receivable

y Bonus Up Policy **

EOY EOY EOY EOT EOY EOY

1 31 53216 53216 22320 0 742320* 0 0 0 0 0

2 32 53216 106433 45332 0 765332* 0 0 0 0 0

3 33 53216 159649 69057 0 789057* 0 69057 58212 86462 87377

4 34 53216 212866 93518 0 813518* 0 93518 121265 121717 122823

5 35 53216 266082 118737 0 838737* 0 118737 153701 160635 161883

6 36 53216 319298 144738 0 864738* 0 144738 187257 203514 204858

7 37 53216 372515 171545 0 891545* 0 171545 222104 250672 252070

8 38 53216 425731 199183 0 919183* 0 199183 258435 302449 303865

9 39 53216 478948 227677 0 947677* 0 227677 296473 359218 360618

10 40 53216 532164 257055 0 977055* 0 257055 336475 421381 422736

11 41 53216 585380 287344 0 1007344* 0 287344 407694 489381 490666

12 42 53216 638597 318572 0 1038572* 0 0 455192 563705 564899

13 43 0 638597 350767 60000 1070767* 0 0 443738 580356 581443

14 44 0 638597 383961 60000 1103961* 0 0 435749 597294 598262

15 45 0 638597 418184 60000 1138184* 0 0 431767 614506 615346

16 46 0 638597 453468 60000 1173468* 0 0 452008 631984 632692

17 47 0 638597 489845 60000 1209845* 0 0 455026 649710 650286

Signature of Policyholder Signature of Sales Representative Company's Seal Date Place

18 48 0 638597 527350 60000 1247350* 0 0 464262 667668 668116

19 49 0 638597 566018 60000 1286018* 0 0 480707 685833 686161

20 50 0 638597 605885 60000 1325885* 0 0 505518 704168 704389

21 51 0 638597 646987 60000 1366987* 0 0 540048 722629 722759

22 52 0 638597 689364 60000 1409364* 0 0 585887 741159 741219

23 53 0 638597 733054 60000 1453054* 0 0 644903 759681 759696

24 54 0 638597 778099 60000 1498099* 778099

Case: Investment Return 4% # ##

Polic Life Annualized Cumulative Accrued Survival Death Benefit Maturity Maturity Guaranteed Special Surrender

y Assure Premium Premium (Excl Compound Benefit ^! Benefit Benefit Surrender Surrender Value

Year d Age (Excl of GST) of GST) Reversionar Under Paid- Value (GSV) Value (SSV) Receivable

y Bonus Up Policy **

EOY EOY EOY EOT EOY EOY

1 31 53216 53216 3600 0 723600* 0 0 0 0 0

2 32 53216 106433 7218 0 727218* 0 0 0 0 0

3 33 53216 159649 10854 0 730854* 0 10854 49085 66257 67171

4 34 53216 212866 14508 0 734508* 0 14508 107773 92883 108879

5 35 53216 266082 18181 0 738181* 0 18181 135000 122060 136248

6 36 53216 319298 21872 0 741872* 0 21872 162373 153973 163716

7 37 53216 372515 25581 0 745581* 0 25581 189909 188819 191307

8 38 53216 425731 29309 0 749309* 0 29309 217631 226802 228218

9 39 53216 478948 33056 0 753056* 0 33056 245561 268149 269549

10 40 53216 532164 36821 0 756821* 0 36821 273729 313100 314455

11 41 53216 585380 40605 0 760605* 0 40605 331120 361920 363205

12 42 53216 638597 44408 0 764408* 0 0 362490 414897 416091

13 43 0 638597 48230 60000 768230* 0 0 332248 407815 408902

14 44 0 638597 52071 60000 772071* 0 0 302396 398388 399355

15 45 0 638597 55932 60000 775932* 0 0 272989 386330 387170

16 46 0 638597 59811 60000 779811* 0 0 263677 371328 372035

17 47 0 638597 63710 60000 783710* 0 0 232354 353026 353602

18 48 0 638597 67629 60000 787629* 0 0 201689 331028 331476

19 49 0 638597 71567 60000 791567* 0 0 171777 304886 305215

20 50 0 638597 75525 60000 795525* 0 0 142725 274092 274313

21 51 0 638597 79502 60000 799502* 0 0 114658 238070 238201

22 52 0 638597 83500 60000 803500* 0 0 87720 196162 196222

23 53 0 638597 87517 60000 807517* 0 0 62078 147612 147628

24 54 0 638597 91555 60000 811555* 91555

EOY: End Of Policy Year

EOT: End Of Policy Term

~ Survival Benefit will be paid in monthly installments (unless each installment is less than Rs.400/-). As such, the displayed values of Income Benefit are the sums

of monthly benefits paid over the course of the corresponding years.

^! In case of Death Benefit, the corresponding number in the 'Policy Year' column should be read as the Year in which Death happens at Year-End.

* In case of Plan-Variant 'INCOME', the vested bonus & terminal bonus, if any, will be paid immediately. The amount of (death benefit minus the vested bonus &

terminal bonus, if any) will be paid in 144 equated monthly installments starting from date of settlement of the death benefit as income to the nominee.

# In case of 'Paid-Up' Benefits, the corresponding number in the 'Policy Year' column should be read as the Number of Completed Years' Premiums Paid.In case

of Paid up, the Survival Benefit will also be payable which is equal to paid up GMI(paid up GMI is GMI multiplied by no. of premiums paid divided by no. of premiums

payable) and will be paid in monthly installments (over the next 12 years). If the paid up GMI (Paid-up SA / 144) is less than Rs. 400 per month, then, the benefit will

be paid annually, which will be equal to paid-up Sum Assured in 12 yearly installments over the next 12 years.

## In case of 'Surrender' Benefits, the corresponding number in the 'Policy Year' column should be read as the Year in which the Policy is Surrendered at Year-End.

** 'Surrender Value Receivable' includes Base Policy Surrender Value and Rider Surrender Value, if any.

Notes & Disclaimers:

1.The above information should be read in conjunction with the Sales Literature.

2.Further clarification can be sought by contacting company's sales representative or by sending an e-mail to life@bajajallianz.co.in.

3.Income Benefit: Starting from the end of PPT, Guaranteed Monthly Income (GMI) shall be receivable every month till either the Life Assured dies, surrenders the

Policy or the Policy matures.

4.The company may declare a rate of Compound Reversionary Bonus. This rate will be expressed as a percentage of the Sum Assured . This percentage will be

applied on the Sum Assured plus already attached reversionary bonuses under the policy to determine the amount of reversionary bonus to be added to the policy at

that year end. An interim bonus may also be declared. Furthermore, if the policy has completed ten (10) years and all due premiums have been paid, the company

may declare a terminal bonus (applied on the guaranteed maturity benefit), if any.

Signature of Policyholder Signature of Sales Representative Company's Seal Date Place

The compound reversionary bonus, interim bonus and terminal bonus may vary with the policy term chosen by the policyholder.

5.The illustrated figures of 'Surrender Value Receivable' include the respective 'Base Policy Surrender Value' and 'Rider Surrender Value'.

6.The investment returns illustrated above are only for the illustrative purpose as mandated by the IRDA and do not in any way indicate the upper and lower limits of

investment return.

7.Goods & Service Tax would be payable as per applicable tax laws.

8.Premiums payable and benefits receivable would be eligible for tax benefits, as per the then existing tax laws.

9.Investment return shown at 8% & 4% are not guaranteed and are for illustrative purpose only.

Insurance is a subject matter of solicitation.

This illustration should be read along with the product brochure for detailed terms and conditions.

I declare that I have read the terms and conditions and understood the above Benefit Illustration.

Signature of Proposer:

Date: Place:

I have explained the benefit illustration to the proposer.

Signature of Sales Representative

Date: Place:

Bajaj Allianz Life Insurance Company Limited

GE Plaza, Airport Road, Yerawada, Pune - 411 006

Tel: (020) 66026777. Fax: (020) 66026789

Email: life@bajajallianz.co.in

www.bajajallianz.com

Signature of Policyholder Signature of Sales Representative Company's Seal Date Place

Vous aimerez peut-être aussi

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Reviewer in NegoDocument7 pagesReviewer in NegoJoan BartolomePas encore d'évaluation

- ListDocument8 pagesListLuis RodríguezPas encore d'évaluation

- CIBC Bank LKRDocument2 pagesCIBC Bank LKRJames HacherPas encore d'évaluation

- Clubbing of IncomeDocument2 pagesClubbing of IncomeNoopur BhandariPas encore d'évaluation

- Lite BillDocument1 pageLite BillTOP 10 MALAD EAST NEWPas encore d'évaluation

- Gentjan Leshaj 59 Park Ridings London N8 0LB United Kingdom: Returns SlipDocument1 pageGentjan Leshaj 59 Park Ridings London N8 0LB United Kingdom: Returns SlipnderimPas encore d'évaluation

- Taxation HandoutsDocument5 pagesTaxation HandoutsTiyon TiyonPas encore d'évaluation

- Income Tax Payment Challan: PSID #: 138638394Document1 pageIncome Tax Payment Challan: PSID #: 138638394naeem1990Pas encore d'évaluation

- Chapter 7-The Regular Output VatDocument7 pagesChapter 7-The Regular Output VatJamaica DavidPas encore d'évaluation

- Payment Processing ProfessionalDocument6 pagesPayment Processing ProfessionalaPas encore d'évaluation

- Aero Suites Price List DT 17.07.2022 (North Block)Document1 pageAero Suites Price List DT 17.07.2022 (North Block)divyans SanuPas encore d'évaluation

- BOB WorldDocument49 pagesBOB WorldSanjeev GuptaPas encore d'évaluation

- BIR VAT Ruling No. 076-99Document3 pagesBIR VAT Ruling No. 076-99Adrian CabanaPas encore d'évaluation

- Aggresive Transportation Inc: Delilah Dixon 130 S Sacramento BLVD, Apt 2 Chicago, IL 60612Document2 pagesAggresive Transportation Inc: Delilah Dixon 130 S Sacramento BLVD, Apt 2 Chicago, IL 60612faxev83733Pas encore d'évaluation

- Easy Chart of Deductions U - S 80C To 80U Every Individual Should Aware of ! - TaxworryDocument2 pagesEasy Chart of Deductions U - S 80C To 80U Every Individual Should Aware of ! - Taxworrytiata777Pas encore d'évaluation

- Mock Test - 2-2Document10 pagesMock Test - 2-2Deepsikha maitiPas encore d'évaluation

- Your Business Fundamentals Checking: Account SummaryDocument14 pagesYour Business Fundamentals Checking: Account Summaryabal67% (3)

- Rentohay Manullang Manajemen Perpajakan - Transfer PricingDocument9 pagesRentohay Manullang Manajemen Perpajakan - Transfer PricingRento ManullangPas encore d'évaluation

- Payslip Airen ObenzaDocument1 pagePayslip Airen Obenzamiss_airenPas encore d'évaluation

- Tax Invoice: SI No. Descriptions of Goods Qty MRP Rate Taxable Value (INR) Igst (INR) Amount (INR)Document1 pageTax Invoice: SI No. Descriptions of Goods Qty MRP Rate Taxable Value (INR) Igst (INR) Amount (INR)Saurabh MehraPas encore d'évaluation

- Shedule of ChargessDocument13 pagesShedule of ChargessalirezaPas encore d'évaluation

- 1b. Cost Calculation Sheet - SINTEX Anaerobic Septic Tank (AST Model)Document1 page1b. Cost Calculation Sheet - SINTEX Anaerobic Septic Tank (AST Model)surajPas encore d'évaluation

- Retirement Withdrawal CalculatorDocument17 pagesRetirement Withdrawal CalculatorSanjeev NehruPas encore d'évaluation

- SCHEDULE OF FEES - FinalDocument1 pageSCHEDULE OF FEES - FinalAbhishek SunaPas encore d'évaluation

- Airway Bill SAMPLEDocument1 pageAirway Bill SAMPLEMildred C. WaltersPas encore d'évaluation

- FNF Settlement Guidelines and Ways To Reach Finance: Computation As Per Input F&F Calculation ParametersDocument1 pageFNF Settlement Guidelines and Ways To Reach Finance: Computation As Per Input F&F Calculation ParametersVivekMedaramitlaPas encore d'évaluation

- Airfast IndonesiaDocument1 pageAirfast Indonesiabovan28Pas encore d'évaluation

- FMCC225 - Financial Accounting 3 Final Examination 1 Sem. S/Y 2020-20221 Name: - Section: - Multiple ChoiceDocument3 pagesFMCC225 - Financial Accounting 3 Final Examination 1 Sem. S/Y 2020-20221 Name: - Section: - Multiple ChoiceChristian QuidipPas encore d'évaluation

- Prepared By: Sikha Sadani Assistant Professor, IITMDocument39 pagesPrepared By: Sikha Sadani Assistant Professor, IITMTANYAPas encore d'évaluation