Académique Documents

Professionnel Documents

Culture Documents

Fund Pro

Transféré par

meshachTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Fund Pro

Transféré par

meshachDroits d'auteur :

Formats disponibles

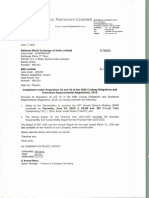

November 2019

Despite the Q2 FY20 GDP growth recently falling to more than a 6-year low, we feel that the growth

may have bo omed out. We expect a gradual recovery in economic growth in H2 FY20, with a pick-up

in pace in FY21.

BEWARE OF SPURIOUS FRAUD PHONE CALLS

IRDAI is not involved in activities like selling insurance policies, announcing bonus or investments of premiums. Public receiving such

phone calls are requested to lodge a police complaint.

Bajaj Allianz House,

Ver: November 2019

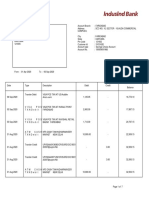

Equity ETF

Large Cap Money Market 7.68%

Instruments

16.07%

7.13% 6.26% 12.67% 11.41% 8.53% 13.19% 06-Jan-10

Equity Shares

76.25%

Money Market

Instruments

13.66%

Ethical Fund

1.99% 1.89% 10.06% 9.15% 8.20% 14.61% 21-Jul-06

Equity Shares

86.34%

Benchmark index: Ni y 50 Index 10.84% 8.59% 13.61% 11.02% 7.01%

Peer Category: Morningstar India Insurance Large-Cap Category* 8.00% 4.49% 10.88% 9.58% 7.08%

Non Conver ble

Debentures

9.01%

Asset Allocation Money Market

Instruments

4.04%

ULIF07205/12/13ASSETALL02116 Equity Shares

Govt Securi es

45.54%

7.85% 5.68% 8.90% 8.72% 8.80% 10.20% 31-Mar-14

41.41%

Benchmark index: CRISIL Balanced Fund - Aggressive Index 11.67% 8.65% 11.33% 10.42% 7.87%

Peer Category: Morningstar India Insurance Dynamic Asset Alloca on Category* 9.58% 6.21% 8.32% 8.55% 6.89%

Mid Cap Money Market

Instruments

4.88%

-0.56% -3.87% 8.39% 9.90% 9.94% 12.46% 06-Jan-10

Equity Shares

95.12%

Benchmark index: NIFTY Midcap 50 Index -1.20% -4.82% 8.00% 8.51% 6.67%

Peer Category: Morningstar India Insurance Mid-Cap Category* -1.36% -5.05% 6.53% 8.21% 8.13%

Money Market

Instruments

Index Linked Nifty Fund 11.52%

Blue Chip Equity Fund

ULIF06026/10/10BLUECHIPEQ116 7.39% 6.64% 11.86% 9.83% 6.03% 7.86% 01-Nov-10

Equity Shares

88.48%

Benchmark index: Ni y 50 Index 10.84% 8.59% 13.61% 11.02% 7.01%

Peer Category: Morningstar India Insurance Large-Cap Category* 8.00% 4.49% 10.88% 9.58% 7.08%

Cash Fund

3.49% 1.26% 2.73% 3.91% 4.77% 7.18% 10-Jul-06

Money Market

Instruments

100.00%

Benchmark index: Crisil Liquid Fund Index 7.03% 7.25% 7.04% 7.19% 7.41%

Peer Category: Morningstar India Insurance Ultra Short Dura on Category* 5.58% 4.83% 5.14% 5.66% 6.11%

Fixed Deposits

2.30%

Debt Fund Non Conver ble

Debentures

34.90%

11.47% 7.53% 5.68% 8.30% 8.37% 8.86% 10-Jul-06

Govt Securi es

Money Market 61.04%

Instruments

1.76%

Benchmark index: Crisil Composite Bond Fund Index 12.36% 7.99% 6.59% 8.63% 8.76%

Peer Category: Morningstar India Insurance Long Dura on Category* 10.49% 6.99% 5.24% 7.69% 7.81%

th

The above information is as on 30 November 2019

*Source: Morningstar. Morningstar India Insurance category return is average return of all ULIP funds in the respective Morningstar Category.

Disclaimer: © 2019 Morningstar. All Rights Reserved. The Morningstar name and logo are registered marks of Morningstar, Inc. The information, data, analyses and opinions (“Information”)

contained herein: (1) include the proprietary information of Morningstar and its content providers; (2) may not be copied or redistributed except as speci cally authorized; (3) do not

constitute investment advice; (4) are provided solely for informational purposes; (5) are not warranted to be complete, accurate or timely; and (6) may be drawn from fund data published on

various dates and procured from various sources. Morningstar, its affiliates, and its officers, directors and employees shall not be liable for any trading decision, damage or any other loss

arising from using the Information. Please verify all of the Information before using it and do not make any investment decision, except upon the advice of a professional nancial adviser. Past

performance is no guarantee of future results. The value and income derived from investments may go down as well as up.

Ver: November 2019

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- World's Largest Banks in 2008 10Document5 pagesWorld's Largest Banks in 2008 10fatmaPas encore d'évaluation

- Application FormDocument5 pagesApplication FormSaurav BansalPas encore d'évaluation

- History of Accounting-WPS OfficeDocument10 pagesHistory of Accounting-WPS OfficeLea PasquinPas encore d'évaluation

- CA Related Syllabus For 2024 - 2025Document4 pagesCA Related Syllabus For 2024 - 2025loganathanPas encore d'évaluation

- Liquidity RatiosDocument2 pagesLiquidity Ratiosabrar mahir SahilPas encore d'évaluation

- Non-Banking Financial Companies (NBFC'S)Document8 pagesNon-Banking Financial Companies (NBFC'S)gag90Pas encore d'évaluation

- Report 20200907194859 PDFDocument7 pagesReport 20200907194859 PDFKeshav SinghPas encore d'évaluation

- Generate StatementDocument3 pagesGenerate StatementBHASKAR SEWA SANSTHANPas encore d'évaluation

- Adjusting Accounts and Preparing Financial Statements: We Have Learned - .Document23 pagesAdjusting Accounts and Preparing Financial Statements: We Have Learned - .Đàm Quang Thanh TúPas encore d'évaluation

- Capital BudgetingDocument2 pagesCapital BudgetingZarmina ZaidPas encore d'évaluation

- Week 11 - Tutorial QuestionsDocument7 pagesWeek 11 - Tutorial QuestionsVuong Bao KhanhPas encore d'évaluation

- 8.31.21 Boa STMNTDocument6 pages8.31.21 Boa STMNTAnthony VinsonPas encore d'évaluation

- Eie G8 SbiDocument32 pagesEie G8 Sbipiruthvi chendurPas encore d'évaluation

- Exam 2 Practice Problems AnswersDocument6 pagesExam 2 Practice Problems Answersoizys131Pas encore d'évaluation

- Ratio Analysis of Kohinoor Textile Mill and Compare With Textile Industry of PakistanDocument17 pagesRatio Analysis of Kohinoor Textile Mill and Compare With Textile Industry of Pakistanshurahbeel75% (4)

- Developing The Philippines's Parametric and Crop Insurance IndustryDocument14 pagesDeveloping The Philippines's Parametric and Crop Insurance IndustryKarloAdrianoPas encore d'évaluation

- ACFrOgBKylWIFKqvQUoX2Yag018eml8V2evCY-xyBCergd9v5HXZoTbU3Q8kgtUcNC 5mafD1Hk933Hbe5goLmzsLjTjnum6IB4inPQsm6vrTPgbDppndlBKfMysfn8Document28 pagesACFrOgBKylWIFKqvQUoX2Yag018eml8V2evCY-xyBCergd9v5HXZoTbU3Q8kgtUcNC 5mafD1Hk933Hbe5goLmzsLjTjnum6IB4inPQsm6vrTPgbDppndlBKfMysfn8rodell pabloPas encore d'évaluation

- 909Document2 pages909Kashif SiddiquiPas encore d'évaluation

- 362 End Term FRA SecDDocument5 pages362 End Term FRA SecDkhushali goharPas encore d'évaluation

- Accounting Equation Class 11thDocument7 pagesAccounting Equation Class 11thAtul Kumar SamalPas encore d'évaluation

- CE Period CloseDocument11 pagesCE Period CloseMd MuzaffarPas encore d'évaluation

- 1ST QUIZ - Simple InterestDocument4 pages1ST QUIZ - Simple InterestYANET MENGISTUPas encore d'évaluation

- PA2 X ESP HW9 G1 Revanza TrivianDocument9 pagesPA2 X ESP HW9 G1 Revanza TrivianRevan KonglomeratPas encore d'évaluation

- 1Z0-960 Exam QuestionsDocument7 pages1Z0-960 Exam QuestionsBill Hopes100% (1)

- Avinash Muthoot Finance ProjectDocument76 pagesAvinash Muthoot Finance ProjectSalman gs100% (1)

- Consumer Client Manual CitibankDocument32 pagesConsumer Client Manual CitibankGuillermo CarranzaPas encore d'évaluation

- Acc3 Intermediate Acctg 1aDocument9 pagesAcc3 Intermediate Acctg 1aKaren UmaliPas encore d'évaluation

- Sundram Fasteners Annual Report 2023Document247 pagesSundram Fasteners Annual Report 2023vijayPas encore d'évaluation

- Time Value of MoneyDocument32 pagesTime Value of MoneyHariom Singh100% (1)

- RBI Lender of Last ResortDocument18 pagesRBI Lender of Last ResortHemantVermaPas encore d'évaluation