Académique Documents

Professionnel Documents

Culture Documents

AniketDubey Macro6 SectionA

Transféré par

Aniket DubeyTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

AniketDubey Macro6 SectionA

Transféré par

Aniket DubeyDroits d'auteur :

Formats disponibles

Macroeconomics – Home Assignment 6 Aniket Dubey | 1901010 | Section A

Question: Make a case for or against the central bank independence by reading the

following resources in addition to the knowledge gained from the text book.

Answer: The answer to this question when making a case may not be binary, i.e. yes or no, but it's

about if the central bank's independence is increased or decreased. I agree that the independence of

the central bank is extremely important in the context of today. There are already some indicators of

central bank independence, such as the rules for appointing and dismissing central bank governors,

the central bank's ability to finance its operations without relying on government, central bank's goal

setting, monetary expansion or contraction, etc.

It was noted that the independence of the central bank is inversely proportional to inflation. This is

the same for developed countries as well as developing countries. By reducing the inflationary

period of the 1980s, the central bank has already proved its worth in. In setting goals and targeting

inflation, the central bank should continue to embrace independence. Otherwise, by reducing

unemployment, politicians tend to loosen monetary policy and increase inflation unexpectedly. In

order to combat increased inflation due to expansionary fiscal policies, central bank independence is

also necessary, a trend that has been noted in recent times. In addition, monetary policy is usually

tried on a medium-term basis, for which fiscal policymakers are not well equipped. Over the past 3

decades, central banks in most developed economies, including the US, have demonstrated their

ability to maintain the low level of inflation on an average. This is the result of their independence.

This should, however, come with greater accountability and transparency. This will help central

banks to avoid intervention by policymakers. In order to maintain this independence, central banks

also need to maintain their credibility, which has deteriorated as a result of crises in 2008 when

Lehman failed to collapse. Furthermore, for most developed and developing countries, the

complementary monetary policy with fiscal policy needs the hour.

But the central bank still faces some challenges because it is independent in its decisions. One of the

challenges facing the central banks is the ongoing political pressure. The dilemma is that due to

expansionary fiscal policies, the central bank should be responsible for financing increased fiscal

deficits. According to the CFM survey, most experts believe that the independence of the central

bank will decline due to political pressures. Increasing populism is also attacking technocratic

institutions to reduce their powers, including central banks.

Therefore, the key in the current scenario is the independence of the central bank with a high level

of accountability and transparency in its operations and setting goals.

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Dr. Reddy's Laboratories Managing Director's Report (FY 2017-18)Document2 pagesDr. Reddy's Laboratories Managing Director's Report (FY 2017-18)Aniket DubeyPas encore d'évaluation

- DR - Reddy'sLaboratoriesDocument2 pagesDR - Reddy'sLaboratoriesAniket DubeyPas encore d'évaluation

- Dr. Reddy's Laboratories Managing Director's Report (FY 2018-19)Document2 pagesDr. Reddy's Laboratories Managing Director's Report (FY 2018-19)Aniket DubeyPas encore d'évaluation

- WorldCom Bond IssuanceDocument9 pagesWorldCom Bond IssuanceAniket DubeyPas encore d'évaluation

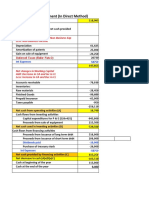

- Cash Flow Statement (In Direct Method) : Add: Non-Cash Charges and Non-Business Exp Less: Non-Business IncomeDocument19 pagesCash Flow Statement (In Direct Method) : Add: Non-Cash Charges and Non-Business Exp Less: Non-Business IncomeAniket DubeyPas encore d'évaluation

- InputDocument2 pagesInputAniket DubeyPas encore d'évaluation

- Sales Less: Excise DutyDocument2 pagesSales Less: Excise DutyAniket DubeyPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- SPECIAL POWER OF ATTORNEY QuintinDocument1 pageSPECIAL POWER OF ATTORNEY QuintinAtty. R. PerezPas encore d'évaluation

- VakalatnamaDocument1 pageVakalatnamavihankaPas encore d'évaluation

- Initial Consultation Agreement: Regulated Canadian Immigration Consultant - R711524Document3 pagesInitial Consultation Agreement: Regulated Canadian Immigration Consultant - R711524Tecnii LaapPas encore d'évaluation

- Oposa Vs Factoran FactsDocument30 pagesOposa Vs Factoran FactsMa. Tiffany T. CabigonPas encore d'évaluation

- LEA 1st Sem 2023 - 2084694338Document21 pagesLEA 1st Sem 2023 - 2084694338Harley BalcitaPas encore d'évaluation

- Schedule E - Saudi Law IKDocument5 pagesSchedule E - Saudi Law IKwangruiPas encore d'évaluation

- Syllabus - ATAP 2nd Semester 2019-2020Document8 pagesSyllabus - ATAP 2nd Semester 2019-2020gongsilog100% (1)

- Alvarez v. IAC - G.R. No. L-68053Document6 pagesAlvarez v. IAC - G.R. No. L-68053Ann ChanPas encore d'évaluation

- October 31, 2022 Pemberton's People, Ungentlemanly Officers & Rogue HeroesDocument3 pagesOctober 31, 2022 Pemberton's People, Ungentlemanly Officers & Rogue HeroesAlan Pemberton - DCSPas encore d'évaluation

- Trump Appeal Advised of Needed DocumentationDocument1 pageTrump Appeal Advised of Needed DocumentationJake DraugelisPas encore d'évaluation

- Mendoza v. CFIDocument2 pagesMendoza v. CFIAndrea JuarezPas encore d'évaluation

- Sample Fellowship Offer LetterDocument2 pagesSample Fellowship Offer Letterditha ayu permata sari0% (1)

- DFA Vs Hon. Falcon GR No 176657 September 1 2010Document26 pagesDFA Vs Hon. Falcon GR No 176657 September 1 2010Marianne Shen PetillaPas encore d'évaluation

- DA1 - Graft and CorruptionDocument8 pagesDA1 - Graft and CorruptionShaneBattierPas encore d'évaluation

- SAN Prop B Enforcement Lawsuit CombinedDocument16 pagesSAN Prop B Enforcement Lawsuit CombinedThe TexanPas encore d'évaluation

- Gerochi vs. Department of EnergyDocument3 pagesGerochi vs. Department of EnergyRoss LynePas encore d'évaluation

- Letter Sent To Owners at Hillview Park Condo ComplexDocument3 pagesLetter Sent To Owners at Hillview Park Condo ComplexAnonymous NbMQ9YmqPas encore d'évaluation

- Sikim Online Gaming (Regulation) Amendment Act, 2009Document6 pagesSikim Online Gaming (Regulation) Amendment Act, 2009Latest Laws Team50% (2)

- 20-Enrico Santos v. NSO G.R. No. 171129 April 6, 2011Document7 pages20-Enrico Santos v. NSO G.R. No. 171129 April 6, 2011Jopan SJPas encore d'évaluation

- Jonathan Paul Wrongful Death SuitDocument8 pagesJonathan Paul Wrongful Death SuitRobert WilonskyPas encore d'évaluation

- United States v. Tony Ray Cole, 67 F.3d 297, 4th Cir. (1995)Document3 pagesUnited States v. Tony Ray Cole, 67 F.3d 297, 4th Cir. (1995)Scribd Government DocsPas encore d'évaluation

- Certificate of Payment of Foreign Death TaxDocument3 pagesCertificate of Payment of Foreign Death Taxdouglas jonesPas encore d'évaluation

- Miscarriage of Justice in Judge Wilhelm's Green County CourtDocument3 pagesMiscarriage of Justice in Judge Wilhelm's Green County CourtSteve HughesPas encore d'évaluation

- ADR Project Sem VIDocument5 pagesADR Project Sem VIShubhankar ThakurPas encore d'évaluation

- Restraint of MarriageDocument9 pagesRestraint of Marriagekirtichourasia14Pas encore d'évaluation

- Exclusion of Mens Rea and Socio-Economic Offences in India - Law TeacherDocument8 pagesExclusion of Mens Rea and Socio-Economic Offences in India - Law TeachergurpreetsomalPas encore d'évaluation

- Windy A. Malapit: Oblicon Case DigestDocument10 pagesWindy A. Malapit: Oblicon Case DigestWindy Awe MalapitPas encore d'évaluation

- Labor Law 2 Reviewer (Villegas)Document62 pagesLabor Law 2 Reviewer (Villegas)bobbyrickyPas encore d'évaluation

- Offer and ObjectionDocument3 pagesOffer and Objectionmarie deniegaPas encore d'évaluation

- AP American Government: Chapter Eleven: CongressDocument9 pagesAP American Government: Chapter Eleven: Congressirregularflowers100% (2)