Académique Documents

Professionnel Documents

Culture Documents

Concept Note 1 Balance Sheet

Transféré par

Preethi PatunkarDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Concept Note 1 Balance Sheet

Transféré par

Preethi PatunkarDroits d'auteur :

Formats disponibles

Concept Note: Finance Domain

Note 1: Definition of 'Balance Sheet'

Definition: Balance Sheet is the financial statement of a company which includes assets,

liabilities, equity capital, total debt, etc. at a point in time. Balance sheet includes assets on

one side, and liabilities on the other. For the balance sheet to reflect the true picture, both

heads (liabilities & assets) should tally

Assets = Liabilities + Equity

Current Assets + Non-current Assets = Current Liabilities + Long-term Liabilities +

Equity

Description: Balance sheet is more like a snapshot of the financial position of a company at

a specified time, usually calculated after every quarter, six months or one year. Balance Sheet

has two main heads –assets and liabilities.

Let’s understand each one of them.

1. What are assets?

Assets are those resources or things which the company owns.

They can be divided into current as well as non-current assets or long term assets.

2. What are liabilities?

Liabilities on are debts or obligations of a company. It is the amount that the

company owes to its creditors.

Liabilities can be divided into current liabilities and long term liabilities.

3. What is shareholder or owner’s equity?

Another important head in the balance sheet is shareholder or owner’s equity. Assets

are equal to total liabilities and owners’ equity.

Owner’s equity is used when the company is a sole proprietorship and shareholders’

equity is used when the company is a corporation.

It is also known as book value of the company.

Example of reporting a transaction in balance sheet format

Let’s understand reporting of a transaction on a balance sheet. If a company XYZ takes a

five-year loan from public sector banks for an amount of Rs 5,00,000, it means that the bank

will pay the money to XYZ Ltd.

The accounts department will increase the cash component by 5,00,000 on the assets front,

and at the same time increase the long term debt account with the same amount, thus

balancing both the sides.

Current Assets + Non-current Assets = Current Liabilities + Long-term Liabilities + Equity

5,00,000 + Non-current Assets = Current Liabilities + 5,00,000 + Equity

Next, if company raises Rs 10,00,000 from investors, then its assets will increase by that

amount, as will its shareholder’s equity.

15,00,000 + Non-current Assets = Current Liabilities + 5,00,000 + 10, 00, 000

How would you record a cash purchase of machinery worth Rs.4, 00, 000? (Hint: Same side

transaction)

Source: Economic Times (Modified version)

Vous aimerez peut-être aussi

- Balance SheetDocument6 pagesBalance Sheetddoc.mimiPas encore d'évaluation

- Engineering EconomicsDocument12 pagesEngineering EconomicsAwais SiddiquePas encore d'évaluation

- Reading and Interpreting Banks Balance SheetDocument8 pagesReading and Interpreting Banks Balance SheetRavalika PathipatiPas encore d'évaluation

- How The Balance Sheet WorksDocument5 pagesHow The Balance Sheet Worksrimpyagarwal100% (1)

- Accounting Fundamantals 2Document13 pagesAccounting Fundamantals 2Viren BansalPas encore d'évaluation

- Sap Fico Balance SheetDocument28 pagesSap Fico Balance Sheetvenkat pulluriPas encore d'évaluation

- Fabm2 PPTG1Document65 pagesFabm2 PPTG1chrisraymund.bermudoPas encore d'évaluation

- Reading The Balance SheetDocument4 pagesReading The Balance Sheetsandipghosh123Pas encore d'évaluation

- Faculty of Businee and EconomicsDocument9 pagesFaculty of Businee and EconomicsEfrem WondalePas encore d'évaluation

- Balance Sheet EquationDocument4 pagesBalance Sheet EquationAmitPas encore d'évaluation

- Acconting NotesDocument27 pagesAcconting NotesparinkhonaPas encore d'évaluation

- Assets and LiabilitiesDocument4 pagesAssets and LiabilitiesmoganPas encore d'évaluation

- A Quick Glance On Balance Sheet: DefinitionDocument2 pagesA Quick Glance On Balance Sheet: DefinitionSanjay kumarPas encore d'évaluation

- FinMan Module 3 FS, Cash Flow and TaxesDocument10 pagesFinMan Module 3 FS, Cash Flow and Taxeserickson hernanPas encore d'évaluation

- Financial Statement AnalysisDocument98 pagesFinancial Statement AnalysisDrRitesh PatelPas encore d'évaluation

- What Is Accounting Users? Give Details Answer:: Internal AssignmentDocument2 pagesWhat Is Accounting Users? Give Details Answer:: Internal Assignmentjitendra.jgec8525Pas encore d'évaluation

- Balance Sheet Assets Liabilities Income StatementDocument4 pagesBalance Sheet Assets Liabilities Income Statementmadhav5544100% (1)

- Static 1Document16 pagesStatic 1Anurag SinghPas encore d'évaluation

- FMM Acct For Business Ch1Document98 pagesFMM Acct For Business Ch1DrKhalid A Chishty100% (1)

- Accounting Ratio AnalysisDocument98 pagesAccounting Ratio AnalysisAmar Vaman100% (1)

- FMM Acct For Business Ch1Document98 pagesFMM Acct For Business Ch1Saugat KarPas encore d'évaluation

- Accounting NotesDocument98 pagesAccounting NotesAnonymous NSNpGa3T93100% (1)

- Balance SheetDocument4 pagesBalance SheetPFEPas encore d'évaluation

- A Balance SheetDocument3 pagesA Balance SheetKarthik ThotaPas encore d'évaluation

- OF Financial Statement: Dr. Quang NguyenDocument56 pagesOF Financial Statement: Dr. Quang NguyenQuang NguyễnPas encore d'évaluation

- Financial Accounting & AnalysisDocument12 pagesFinancial Accounting & Analysisankita mishraPas encore d'évaluation

- Week 10 (Learning Materials)Document8 pagesWeek 10 (Learning Materials)CHOI HunterPas encore d'évaluation

- Statement of Financial Position (SFP) : Lesson 1Document29 pagesStatement of Financial Position (SFP) : Lesson 1Dianne Saragena100% (1)

- Financial Statements AnswersDocument6 pagesFinancial Statements AnswersKrizzia Fatima PiodosPas encore d'évaluation

- A Balance Sheet Is A Financial StatementDocument6 pagesA Balance Sheet Is A Financial StatementNatsu DragneelPas encore d'évaluation

- Acconting Eqn and Types AccntDocument12 pagesAcconting Eqn and Types AccntZaid SiddiquiPas encore d'évaluation

- FABM2 STATEMENT OF FINANCIAL POSITION AbstractionDocument5 pagesFABM2 STATEMENT OF FINANCIAL POSITION AbstractionIrish Shyne IIPas encore d'évaluation

- Session 1: Overview of Financial Accounting and ControlDocument10 pagesSession 1: Overview of Financial Accounting and ControlYamu HiadeenPas encore d'évaluation

- S2 3.analyze - Balance - SheetDocument16 pagesS2 3.analyze - Balance - SheetLimberg IllanesPas encore d'évaluation

- Managerial Accounting Und Erst A DingsDocument98 pagesManagerial Accounting Und Erst A DingsDebasish PadhyPas encore d'évaluation

- Accounting Elements in The Statement of Financial PositionDocument4 pagesAccounting Elements in The Statement of Financial PositionBianca Jane GaayonPas encore d'évaluation

- EL201 Accounting Learning Module Lessons 2Document5 pagesEL201 Accounting Learning Module Lessons 2Code BoredPas encore d'évaluation

- Balance Sheet (Research)Document3 pagesBalance Sheet (Research)Joycel MerdegiaPas encore d'évaluation

- Asset VS LiabilitiesDocument10 pagesAsset VS LiabilitiesSuhas Salehittal100% (1)

- Discuss About Users and Uses of Accounting Information AnswerDocument3 pagesDiscuss About Users and Uses of Accounting Information AnswerJitendraPas encore d'évaluation

- Document 1-Introduction To Financial AnalysisDocument17 pagesDocument 1-Introduction To Financial Analysismathieu652540Pas encore d'évaluation

- Chapter 2Document21 pagesChapter 2Kibrom EmbzaPas encore d'évaluation

- Accounting and FinanceDocument9 pagesAccounting and FinanceHtoo Wai Lin AungPas encore d'évaluation

- Elements of The Statement of Financial PositionDocument4 pagesElements of The Statement of Financial PositionHeaven SyPas encore d'évaluation

- Understanding Assets, Liabilities, Shareholders' Equity, Revenues, Expenses and DividendsDocument9 pagesUnderstanding Assets, Liabilities, Shareholders' Equity, Revenues, Expenses and DividendsHasanAbdullahPas encore d'évaluation

- Chapter 2 HandoutsDocument15 pagesChapter 2 HandoutsBlackpink BtsPas encore d'évaluation

- Statement of Financial PositionDocument11 pagesStatement of Financial Positionshafira100% (1)

- Accounting Review 3Document1 pageAccounting Review 3Scouty TheboyPas encore d'évaluation

- Lesson 3Document19 pagesLesson 3Rizza Joy Comodero Ballesteros100% (1)

- Liabilities 213Document28 pagesLiabilities 213Rajashekar Reddy100% (1)

- Iii. Statement of Financial PositionDocument9 pagesIii. Statement of Financial PositionAnthon Karl AvenidoPas encore d'évaluation

- Fra Notes Unit1&2Document21 pagesFra Notes Unit1&2mohdsahil2438Pas encore d'évaluation

- Fabm 2Document7 pagesFabm 2Akaashi KeijiPas encore d'évaluation

- Corporate Finance 1Document5 pagesCorporate Finance 1kmandeepkumar1994Pas encore d'évaluation

- The Balance SheetDocument7 pagesThe Balance Sheetsevirous valeriaPas encore d'évaluation

- Understanding Financial Statements (Review and Analysis of Straub's Book)D'EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Évaluation : 5 sur 5 étoiles5/5 (5)

- Financial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersD'EverandFinancial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersPas encore d'évaluation

- Disparate Regulatory Schemes For Parallel Activities - HazenDocument75 pagesDisparate Regulatory Schemes For Parallel Activities - HazenCervino InstitutePas encore d'évaluation

- IFT2day OLIVER VALEZ PDFDocument315 pagesIFT2day OLIVER VALEZ PDFMohamedKeynan100% (23)

- Statement of Cash Flows - Lecture NotesDocument6 pagesStatement of Cash Flows - Lecture NotesSteven Sanderson100% (8)

- CH 07Document7 pagesCH 07junaid1626Pas encore d'évaluation

- Technical AnalysisDocument69 pagesTechnical AnalysisNikhil KhandelwalPas encore d'évaluation

- Chapter 1. Introduction of Venture CapitalDocument46 pagesChapter 1. Introduction of Venture CapitalPriyanka satamPas encore d'évaluation

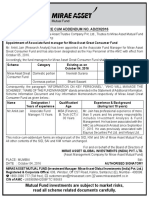

- Notice-Fund Manager (Ankit Jain)Document1 pageNotice-Fund Manager (Ankit Jain)Yagnik KalariyaPas encore d'évaluation

- Financial Management Case StudyDocument7 pagesFinancial Management Case StudynimarPas encore d'évaluation

- Financial MArkets Module 1 NCFMDocument92 pagesFinancial MArkets Module 1 NCFMChetan Sharma100% (21)

- Equity Valuation: Capital and Money Markets AssignmentDocument5 pagesEquity Valuation: Capital and Money Markets AssignmentSudip BainPas encore d'évaluation

- Answer Scheme Group Assignment 1Document8 pagesAnswer Scheme Group Assignment 1NurulAdibahPas encore d'évaluation

- 107 09 IPO Valuation ModelDocument8 pages107 09 IPO Valuation ModelAnirban Bera100% (1)

- Examples of Inherent RiskDocument6 pagesExamples of Inherent Riskselozok1Pas encore d'évaluation

- ACTIVITY 2-Fundamentals of Accounting 1Document1 pageACTIVITY 2-Fundamentals of Accounting 1shelou_domantay100% (1)

- Galena Asset Management BrochureDocument7 pagesGalena Asset Management Brochureabiesaga90Pas encore d'évaluation

- Common Stock and Treasury Stock TutorialDocument3 pagesCommon Stock and Treasury Stock TutorialSalma HazemPas encore d'évaluation

- Account Application Booklet: Please Retu RN Entire Book LETDocument15 pagesAccount Application Booklet: Please Retu RN Entire Book LETibadwonPas encore d'évaluation

- Formula Sheet For Midterm Examination: 0 1 W Acc 2 W Acc 2 N W Acc N N W Acc N N+1 W Acc FCFF FCFF W Acc FCFF NDocument5 pagesFormula Sheet For Midterm Examination: 0 1 W Acc 2 W Acc 2 N W Acc N N W Acc N N+1 W Acc FCFF FCFF W Acc FCFF NrohansahniPas encore d'évaluation

- A Brief Overview of The Classical Linear Regression ModelDocument105 pagesA Brief Overview of The Classical Linear Regression ModelAli Kalem100% (1)

- SQE First Year - Answer KeyDocument4 pagesSQE First Year - Answer KeyNicolaus CopernicusPas encore d'évaluation

- Chapter 14 Portfolio Analysis CbcsDocument17 pagesChapter 14 Portfolio Analysis CbcsShivanshPas encore d'évaluation

- Comprehensive ProblemDocument13 pagesComprehensive ProblemUmair Zoberi100% (8)

- IIM Ranchi - PEVC - Group 9 - Abraaj CapitalDocument5 pagesIIM Ranchi - PEVC - Group 9 - Abraaj CapitalAnjali Maheshwari100% (1)

- The Owner Operator CompanyDocument7 pagesThe Owner Operator CompanyaugustaboundPas encore d'évaluation

- Single Index ModelDocument17 pagesSingle Index ModelWawan Goendoel100% (3)

- Harley-Davidson Financial ValuationDocument51 pagesHarley-Davidson Financial Valuationfebrythiodor100% (1)

- Pulau Carey KenangaDocument17 pagesPulau Carey KenangaAzim FauziPas encore d'évaluation

- 2 Derivatives - Futures & Options SynopsisDocument9 pages2 Derivatives - Futures & Options SynopsisPradeep KumarPas encore d'évaluation

- Practice Problems SolutionsDocument13 pagesPractice Problems SolutionsEMILY100% (1)

- Equicapita Announces Acquisition of A&R Metal Industries Ltd.Document2 pagesEquicapita Announces Acquisition of A&R Metal Industries Ltd.Equicapita Income TrustPas encore d'évaluation