Académique Documents

Professionnel Documents

Culture Documents

Bank Reconciliation

Transféré par

alford sery CammayoCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Bank Reconciliation

Transféré par

alford sery CammayoDroits d'auteur :

Formats disponibles

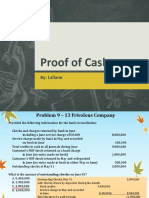

INTERMEDIATE ACCOUNTING 1

Summer class

Quiz

Problem solving

The following information pertains to Park Company at December 31, 2006:

Bank statement balance 1,000,000

Checkbook balance 1,400,000

Deposit in transit 500,000

Outstanding checks 100,000

1. In Park’s December 31, 2006 balance sheet, cash should be reported at

In preparing its August 31, 2006 bank reconciliation, Apex Company has available the following information:

Balance per bank statement 1,805,000

Deposit in transit 325,000

Return of customer’s check for insufficient fund 60,000

Outstanding checks 275,000

Bank service charge for August 10,000

2. At August 31, 2006, Apex’s correct cash balance is

In preparing its bank reconciliation at December 31, 2006, Case Company has made available the following data:

Balance per bank statement 3,800,000

Deposit in transit 520,000

Amounts erroneously credited by bank to Case’s account 40,000

Bank service charge for December 5,000

Outstanding checks 675,000

3. The adjusted cash in bank balance on December 31, 2006 is

In your audit of Mindanao Company as of December 31, 2006, you gathered the following:

Balance per book 1,000,000

Bank charges 3,000

Outstanding checks 235,000

Deposit in transit 300,000

Customer note collected by bank 375,000

Interest on customer note 15,000

Customer check returned NSF 62,000

Depositor’s note charged to account 250,000

4. The correct cash balance amounts to

Core Company provided the following data for the purpose of reconciling the cash balance per book with the

balance per bank statement on December 31, 2006:

Balance per bank statement 2,000,000

Balance per book 850,000

Outstanding checks (including certified check of P100,000) 500,000

Deposit in transit 200,000

December NSF checks (of which P50,000 had been redeposited and

cleared by December 27) 150,000

Erroneous credit to Core’s account, representing proceeds of loan

granted to another company 300,000

Proceeds of note collected by bank for Core, net of service charge of

P20,000 750,000

5. The cash in bank balance to be shown on Core’s December 31, 2006 balance sheet is

Aries Company keeps all its cash in a checking account. An examination of the company’s accounting records

and bank statement for the month ended June 30, 2006 revealed the following information:

The cash balance per book on June 30 is P8,500,000.

A deposit of P1,000,000 that was placed in the bank’s night depository on June 30 does not appear on

the bank statement.

The bank statement shows on June 30, the bank collected note for Aries and credited the proceeds of

P950,000 to the company’s account.

Checks outstanding on June 30 amount to P300,000.

Aries discovered that a check written in June for P200,000 in payment of an account payable, had been

recorded in the company’s records as P20,000.

Included with the June bank statement was NSF check for P250,000 that Aries had received from a

customer on June 26.

The bank statement shows a P20,000 service charge for June.

6. The cash in bank to be shown on the balance sheet on June 30, 2006 is:

On March 3, 2006, Able Company received its bank statement. However, the closing balance of the account

was unreadable. Attempts to contact the bank after hours did not secure the desired information. Thus, you

had to prepare a bank reconciliation from the available information summarized below:

February 28 book balance 1,460,000

Note collected by bank 100,000

Interest earned on note 10,000

NSF check of customer 130,000

Bank service charge on NSF check 2,000

Other bank service charges 3,000

Outstanding checks 202,000

Deposit of February 28 placed in night depository 85,000

Check issued by Axle Company charged to Able’s account 20,000

7. What was the cash balance per bank statement?

Carefree Company’s newly hired assistant prepared the following bank reconciliation on March 31, 2006:

Book balance 1,405,000

Add: March 31 deposit 750,000

Collected of note 2,500,000

Interest on note 150,000 3,400,000

Total 4,805,000

Less: Careless Company’s deposit to account 1,100,000

Bank service charge 45,000 1,145,000

Adjusted book balance 3,660,000

Bank balance 5,630,000

Add: Error on check No. 175 45,000

Total 5,675,000

Less: Preauthorized payments for water bill 205,000

NSF check 220,000

Outstanding check 1,650,000 2,075,000

Adjusted bank balance 3,600,000

Check No. 175 was made for the proper amount of P249,000 in payment of account. However it was entered

in the cash payments journal as P294,000. Carefree authorized the bank to automatically pay its water bills as

submitted directly to the bank.

8. the correct cash in bank balance is

The bookkeeper of Divine Company recently prepared the following bank reconciliation on December 31, 2006:

Balance per bank statement 2,800,000

Add: Deposit in transit 195,000

Checkbook printing charge 5,000

Error made by Divine in recording check No.45

(issued in December) 35,000

NSF check 110,000 345,000

3,145,000

Less: Outstanding check 100,000

Note collected by bank

(includes P15,000 interest) 215,000 315,000

Balance per book 2,830,000

Divine Company has P200,000 cash on hand on December 31, 2006.

9. The amount to be reported by Divine Company as cash on the balance sheet as of December 31, 2006 should

be

While checking the cash account of ABC Company on December 31, 2006, you find the following information:

Balance per book 6,776,000

Balance per bank statement (outstanding checks of P987,000) 6,532,000

Deposit in bank closed by BSP 1,600,000

Deposit in transit 1,234,000

Currency and coins counted 950,000

Petty cash fund (of which P10,000 is in the form of paid vouchers 50,000

Bank charges not yet taken up in the book 6,000

Bond sinking fund cash 1,000,000

Receivables from employees 70,000

Error in recording a check in the books. The correct amount as paid by

the bank is P89,000 instead of P98,000 as recorded in the books, or a

different of 9,000

10. The correct cash in bank balance for ABC on December 31, 2006 is

1. 1 400 000

2. 1 855 000

3. 3605000

4. 1075000

5. 1500000

6. 9000000

7. 1532000

8. 3630000

9. 3095000

10. 6779000

Vous aimerez peut-être aussi

- FINANCIAL ACCOUNTING 1 CASH AND CASH EQUIVALENTSDocument9 pagesFINANCIAL ACCOUNTING 1 CASH AND CASH EQUIVALENTSPau Santos76% (29)

- Accounts ReceivableDocument3 pagesAccounts Receivablealford sery Cammayo0% (1)

- DocxDocument5 pagesDocxLorraine Mae Robrido100% (2)

- Proof of Cash-1Document7 pagesProof of Cash-1Ella MalitPas encore d'évaluation

- Loans ReceivableDocument48 pagesLoans ReceivableJoshua PaliwagPas encore d'évaluation

- 05 Cash Cash EquivalentsDocument54 pages05 Cash Cash EquivalentsFordan Antolino83% (12)

- Lesson 1 - Cash and Cash EquivalentsDocument2 pagesLesson 1 - Cash and Cash EquivalentsPol Moises Gregory Clamor88% (16)

- Proof of Cash: By: LailaneDocument19 pagesProof of Cash: By: LailaneGianJoshuaDayrit100% (1)

- Loans and Receivables - PresentationDocument71 pagesLoans and Receivables - PresentationIvy RosalesPas encore d'évaluation

- Proof of CashDocument7 pagesProof of CashPeachy80% (5)

- Proof of CashDocument2 pagesProof of CashAiden Pats80% (5)

- Cash and Cash EquivalentsDocument16 pagesCash and Cash EquivalentsÇåsäō Ärts67% (3)

- Proof of Cash: Two-Date Bank ReconciliationDocument18 pagesProof of Cash: Two-Date Bank ReconciliationMcrislb0% (1)

- FAR Practical Exercises Proof of CashDocument3 pagesFAR Practical Exercises Proof of CashAB CloydPas encore d'évaluation

- Act 1 Solutions - Cash and Cash EquivalentsDocument3 pagesAct 1 Solutions - Cash and Cash Equivalents이시연100% (1)

- Cash and Cash Equivalents ReportingDocument4 pagesCash and Cash Equivalents ReportingMary Joy Morallon Calagui100% (1)

- Account Statement 1000013254935Document1 pageAccount Statement 1000013254935Ebrahim Maru60% (10)

- Petty Cash Exercises ANSWERSDocument2 pagesPetty Cash Exercises ANSWERSXDragunov Alcroix100% (10)

- Proof of Cash ProblemDocument4 pagesProof of Cash ProblemHtiduj Oretubag50% (4)

- Cash and Cash EquivalentsDocument5 pagesCash and Cash EquivalentsJladySilhoutte100% (3)

- Intermediate Accounting 1 Cash and Cash Equivalents ProblemsDocument7 pagesIntermediate Accounting 1 Cash and Cash Equivalents Problemsleng g50% (2)

- Cash & Cash EquivalentsDocument4 pagesCash & Cash EquivalentsYassi Curtis100% (1)

- 4 Petty Cash FundDocument13 pages4 Petty Cash FundAlyssa Barbara D. Badidles100% (1)

- 4 FAR Handout Notes ReceivableDocument2 pages4 FAR Handout Notes Receivablealford sery CammayoPas encore d'évaluation

- Bank-Reconciliation IADocument10 pagesBank-Reconciliation IAAnaluz Cristine B. CeaPas encore d'évaluation

- Chapter 2 Last PartDocument11 pagesChapter 2 Last PartXENA LOPEZ100% (2)

- Cash and Cash Equivalents Basic ProblemsDocument6 pagesCash and Cash Equivalents Basic ProblemshellokittysaranghaePas encore d'évaluation

- Computer Networks Notes 3 - TutorialsDuniyaDocument146 pagesComputer Networks Notes 3 - TutorialsDuniyaReenaPas encore d'évaluation

- Midterm Exam No. 3Document3 pagesMidterm Exam No. 3Anie MartinezPas encore d'évaluation

- Bank Reconciliation ProblemsDocument2 pagesBank Reconciliation ProblemsCris Jung80% (5)

- Unit 1 - CASH AND CASH EQUIVALENTS PDFDocument9 pagesUnit 1 - CASH AND CASH EQUIVALENTS PDFJeric Lagyaban Astrologio100% (1)

- SolutionsDocument25 pagesSolutionsDante Jr. Dela Cruz100% (1)

- Accounting - 1st Quiz Cash and Cash Equivalent 2011Document2 pagesAccounting - 1st Quiz Cash and Cash Equivalent 2011Louie De La Torre40% (5)

- Intermediate Accounting Vol 1 Chapter 1 Problems Cash EquivalentsDocument4 pagesIntermediate Accounting Vol 1 Chapter 1 Problems Cash EquivalentsAnne Mauricio89% (38)

- 50 Journal EntriesDocument8 pages50 Journal EntriesAshish GuptaPas encore d'évaluation

- ABC's Cash and Cash Equivalents on December 31, 2019Document5 pagesABC's Cash and Cash Equivalents on December 31, 2019Clariz Angelika EscocioPas encore d'évaluation

- FAR QUIZ #3 With AnswerDocument4 pagesFAR QUIZ #3 With AnswerMarriz Bustaliño Tan100% (2)

- Accounts Receivable QuizzerDocument4 pagesAccounts Receivable Quizzerknorrpampapakang67% (3)

- Cash and Cash Equivalents GuideDocument33 pagesCash and Cash Equivalents GuideKaren Estrañero LuzonPas encore d'évaluation

- Project Accounting II ManualDocument136 pagesProject Accounting II ManualSamina InkandellaPas encore d'évaluation

- Cash & Cash EquivalentsDocument4 pagesCash & Cash Equivalentsralphalonzo100% (5)

- Gavial inventory costing and profit calculationDocument5 pagesGavial inventory costing and profit calculationalford sery CammayoPas encore d'évaluation

- ACCTG102 MidtermQ1 CashDocument13 pagesACCTG102 MidtermQ1 CashRose Marie93% (15)

- Module 1 - Cash and Cash EquivalentsDocument16 pagesModule 1 - Cash and Cash EquivalentsJehPoy0% (1)

- Role of A Facilitator in Change ProcessDocument6 pagesRole of A Facilitator in Change ProcessRukhsar BaqirPas encore d'évaluation

- CASH AND CASH EQUIVALENTS QuizDocument6 pagesCASH AND CASH EQUIVALENTS QuizAlvin Yerc0% (1)

- Maharashtra State Electricity Distribution Co. LTDDocument2 pagesMaharashtra State Electricity Distribution Co. LTDsumedhshetyePas encore d'évaluation

- Proof of Cash: Irene Mae C. Guerra, CPADocument17 pagesProof of Cash: Irene Mae C. Guerra, CPAjeams vidalPas encore d'évaluation

- Account ReceivableDocument10 pagesAccount ReceivableHarold B. Lacaba0% (1)

- Paytm Payment Solutions Feb15 PDFDocument30 pagesPaytm Payment Solutions Feb15 PDFRomeo MalikPas encore d'évaluation

- Q4 - Audit of Receivables (Prob - KEY)Document5 pagesQ4 - Audit of Receivables (Prob - KEY)Kenneth Christian Wilbur100% (1)

- Bank Reconciliation MethodsDocument12 pagesBank Reconciliation MethodsKalven Perry Agustin80% (5)

- CPA Review: Cash and Cash Equivalents ProblemsDocument3 pagesCPA Review: Cash and Cash Equivalents ProblemsLui100% (1)

- Cash and Cash EquivalentsDocument14 pagesCash and Cash EquivalentsPatricia Guba100% (1)

- Assets Liabilities + Equity + Income - Expenses: Oct. TransactionsDocument4 pagesAssets Liabilities + Equity + Income - Expenses: Oct. Transactionsalford sery Cammayo0% (1)

- PS 1Document4 pagesPS 1BlackRosePas encore d'évaluation

- FInancial Accounting and Reporting1C6Document19 pagesFInancial Accounting and Reporting1C6Yen YenPas encore d'évaluation

- CASH AND CASH EQUIVALENTS BALANCESDocument8 pagesCASH AND CASH EQUIVALENTS BALANCESRonel CaagbayPas encore d'évaluation

- Proof of Cash: Intermediate Accounting Part 1Document1 pageProof of Cash: Intermediate Accounting Part 1Steffanie Olivar0% (1)

- Accounting Review and Tutorial Services in San Isidro, Nueva EcijaDocument8 pagesAccounting Review and Tutorial Services in San Isidro, Nueva EcijaEiuol Nhoj Arraeugse100% (3)

- Answer Sample Problems Cash1-12Document4 pagesAnswer Sample Problems Cash1-12Anonymous wwLoDau1aPas encore d'évaluation

- 12345Document17 pages12345xjammer0% (3)

- Chapter 2 Bank ReconciliationDocument5 pagesChapter 2 Bank ReconciliationRolando BantayanPas encore d'évaluation

- Loans and Receivables Sample Problems 2Document2 pagesLoans and Receivables Sample Problems 2Bryce Bihag60% (5)

- Bank ReconciliationDocument3 pagesBank Reconciliationlucas lilaPas encore d'évaluation

- Bank Reconciliation Practice SetDocument2 pagesBank Reconciliation Practice SetMirella AlminarPas encore d'évaluation

- Bank ReconciliationDocument12 pagesBank ReconciliationJieniel ShanielPas encore d'évaluation

- 33Document2 pages33yes yesnoPas encore d'évaluation

- 5Document2 pages5yes yesnoPas encore d'évaluation

- Assessment Task 1-1Document10 pagesAssessment Task 1-1hahahahaPas encore d'évaluation

- 112 ReconSeatworkDocument2 pages112 ReconSeatworkGinie Lyn RosalPas encore d'évaluation

- Cash and Cash Equivalents C5 Valix 2006Document5 pagesCash and Cash Equivalents C5 Valix 2006Ghaill CruzPas encore d'évaluation

- Lawquiz PDFDocument6 pagesLawquiz PDFAliya NaseemPas encore d'évaluation

- Transfer Pricing To Be PrintedDocument4 pagesTransfer Pricing To Be Printedalford sery CammayoPas encore d'évaluation

- Accounting For GovernmentalDocument3 pagesAccounting For Governmentalalford sery CammayoPas encore d'évaluation

- Transfer Pricing To Be PrintedDocument4 pagesTransfer Pricing To Be Printedalford sery CammayoPas encore d'évaluation

- Benchmarking Is A Process Used in Management and Particularly Strategic ManagementDocument4 pagesBenchmarking Is A Process Used in Management and Particularly Strategic Managementalford sery CammayoPas encore d'évaluation

- Cable Modem Connectivity Issues With CM ModelDocument3 pagesCable Modem Connectivity Issues With CM ModelHakim QaradaghiPas encore d'évaluation

- Microwave Equipment Technical Proposal: For MTN Sudan Site Build ProjectDocument24 pagesMicrowave Equipment Technical Proposal: For MTN Sudan Site Build ProjectAkomolede GabrielPas encore d'évaluation

- Guide To First Time Adoption of Ind AS 109Document112 pagesGuide To First Time Adoption of Ind AS 109eyindia.pd100% (1)

- Img 20190521 0001 PDFDocument1 pageImg 20190521 0001 PDFMaelyn FavilaPas encore d'évaluation

- Swedish Health Care SystemDocument2 pagesSwedish Health Care SystemHassaan KarimPas encore d'évaluation

- Premium ReceiptDocument1 pagePremium ReceiptVikash VashisthaPas encore d'évaluation

- Banking Question PapersDocument12 pagesBanking Question Papersmohak khinPas encore d'évaluation

- FormatsDocument11 pagesFormatskaarthyPas encore d'évaluation

- InvoiceDocument2 pagesInvoiceReza Andhitya PutraPas encore d'évaluation

- IFRS Red Book - IAS 7 Statement of Cash FlowsDocument37 pagesIFRS Red Book - IAS 7 Statement of Cash FlowsAjmal HusseinPas encore d'évaluation

- Eob RemittanceDocument4 pagesEob RemittanceAndres ChavarrioPas encore d'évaluation

- Quick Guide To Cardholder Activated Terminals CATs PDFDocument10 pagesQuick Guide To Cardholder Activated Terminals CATs PDFhvalolaPas encore d'évaluation

- How To Get Registered As An Investment Adviser With SEBI - CS KrutiDocument19 pagesHow To Get Registered As An Investment Adviser With SEBI - CS Krutifxindia19Pas encore d'évaluation

- DM NotesDocument10 pagesDM NotesAbhishek SinghalPas encore d'évaluation

- GoZiyarah-Umrah-2020 PackagesDocument1 pageGoZiyarah-Umrah-2020 PackagesPlanagement BDPas encore d'évaluation

- P1 Exams Set ADocument10 pagesP1 Exams Set Aerica lamsenPas encore d'évaluation

- Ch2-3 Cash & Cash Equivalent and Bank Recon TablesDocument1 pageCh2-3 Cash & Cash Equivalent and Bank Recon TablesEUNICE NATASHA CABARABAN LIMPas encore d'évaluation

- Eofy 1363807 202307141612Document6 pagesEofy 1363807 202307141612Jeffrey BoucherPas encore d'évaluation

- Encash 24 FormDocument1 pageEncash 24 Formvipin jainPas encore d'évaluation

- Service - Charges of PNBDocument17 pagesService - Charges of PNBfreakyansumanPas encore d'évaluation

- 2015 Anthem Small Group 4-1-2015 Rate Filing PDFDocument40 pages2015 Anthem Small Group 4-1-2015 Rate Filing PDFmoconsumerPas encore d'évaluation

- Universak BankingDocument33 pagesUniversak BankingprashantgorulePas encore d'évaluation

- Cover SheetDocument16 pagesCover SheetRahimahBintiMohdYussofPas encore d'évaluation